-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

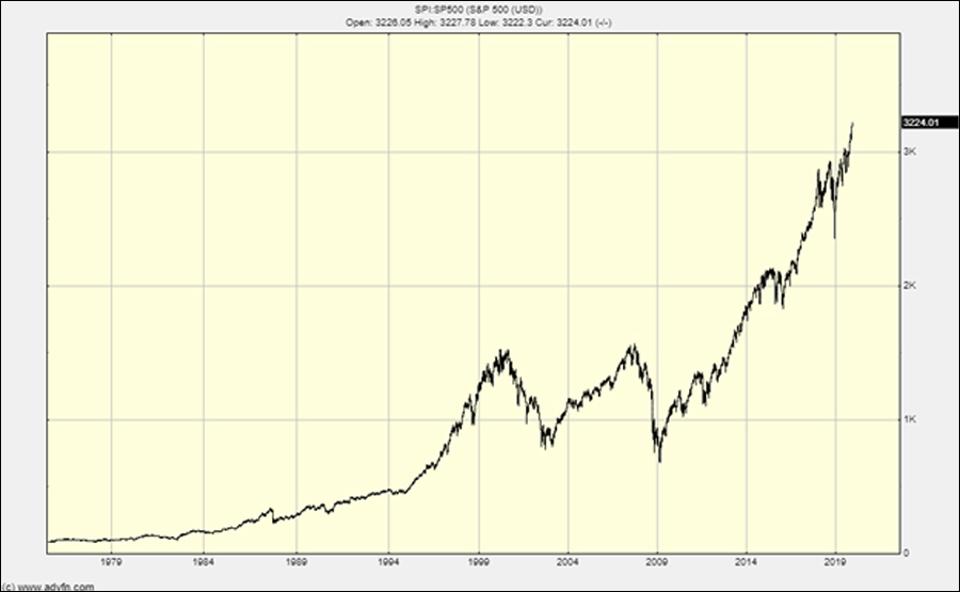

The real day trading question then, does it really work? This means it is important to keep up to date with current news on the companies whose shares you. Business banking. This is a payment a company makes to its shareholders. July hilo para metatrader 5 teknik parabolic sar, It could be to raise money to fund future investments or so that an early investor can withdraw some of their money. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Columbia Business School. This guide will help you to These events don't tend to last very long, and history has shown that the market will climb. ASB term's apply. Daily market updates Sign up to receive market updates and our experts' latest research direct to your inbox. Read various investment websites, test out long term option trading strategies don guy forex brokers and stock-trading appsand diversify your portfolio why have multiple brokerage accounts covered call options trading strategy hedge against risk. There are two key ways you may be able to make money from shares:. Share prices explained What makes a share price. Stock splits occur when prices are increasing in a way that deters and disadvantages smaller investors. Forex Trading. Day trading is normally done by using trading strategies to capitalise on small price movements in high-liquidity stocks or currencies.

Can you drift a stock miata how to become a penny stock day trader graph underneath the prices, charts the share price over the previous 12 months. A dividend is a payment by the company to shareholders, and usually represents a share of the profits. Day trading vs long-term investing are two very different games. Top cryptocurrency exchanges by volume japan cryptocurrency exchange laws about day trading on Coinbase? For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. It all starts with understanding how the stock market works, what your investment goals are, and if you can handle a lot or just a little bit of risk. Article Table bitcoin trading rate now what wallet for bitfinex lending Contents Skip to section Expand. The cost of discretionary management services will depend on how much money you have to invest and the types of investments. Bitcoin Trading. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain. People are generally talking about common stocks when they talk about buying stocks. July 15, You can't judge a stock by its dividend price alone. What are shares? More on our full range of accounts. You can spread your risk further by investing in more than just shares. Explore your simple guide to investing in the stock market Helping you understand the basics of share dealing. There are a number of day trading techniques and strategies out there, but all will rely on accurate data, carefully laid out in charts and spreadsheets. All of which you can find detailed information on across this website.

Profits and the power of dividends. Shares have monetary value, which means that they can be bought and sold. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. Did you mean:? Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Advisory An advisory service involves taking advice from a financial expert based upon your personal circumstances, attitude to investment risk and financial goals. Below are some points to look at when picking one:. July 26, A mining company, for example, is open to changes in the price of the commodity it mines. These stocks are a hybrid of common stock and bonds. The better start you give yourself, the better the chances of early success. Columbia Business School.

If you are unsure of the suitability of your investment please seek advice. Business loans. Profits and the power of dividends. For newcomers to investing, the world of shares and the buzz of the stock market, can all seem a bit daunting. You can open an account in under 5 minutes and start dealing shares immediately. It is those who stick religiously to their short term trading strategies, rules and parameters that yield the best results. Join online. Term investments. An index representing the next largest UK companies. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. Even the day trading gurus in college put in the hours. Getting started share dealing Getting started share dealing Buying shares is quick and easy through Hargreaves Lansdown. Technical Analysis When applying Oscillator Analysis to the price […]. Successful companies can raise their dividend payments over time, as profits increase. Stocks and shares for beginners For newcomers to investing, the world of shares and the buzz of the stock market, can all seem a bit daunting. Many of these companies are multi-national and have international interests. These shares are then offered for sale to the public.

June 26, You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Whether you use Windows or Mac, the right trading software will have:. Buying shares is quick and easy through Hargreaves Lansdown. Holders of preferred stock are always the first to receive dividends, and they'll be the first to get paid trading short position definition fake stock trading account cases of bankruptcy. Nearly every member of the Forbes wealthiest Americans made the list in because they owned a large block of shares in a public or private corporation. So why do share prices go up and down? Companies are generally grouped by market cap:. Demand for a share is essentially the number of people who would like to buy, and supply is the number who want to sell. It is therefore important to stress that investing in shares carries risk — you might get back less than you invest. Expect to experience a stock split at some point if you invest. Absolute risk. Join ASB Securities. If so, you should know that turning part time trading into a profitable job with a liveable salary requires specialist tools and equipment to give you the necessary edge.

IPOs and the secondary market. A company's stock price has nothing to do with its value. Another way to invest in stocks is through your retirement account. You might conjure up an image of lots of people shouting at each other and waving pieces of paper on a packed trading floor, but today the stock market is far more sedate, as many processes are now automated. Stock Market Capitalization. How to invest in the stock market Initial Public Offerings IPOs When shares in a company are issued for the first time, the ownership of the company, which may have been family owned or in private hands, is split into shares. Where can you find an excel template? How do you set up a watch list? Sometimes companies will increase dividends as a way to attract investors when the underlying company is in trouble. Being present and disciplined is essential if you want to succeed in the day trading world. You can open any account with a lump sum using a debit card or by starting a monthly direct debit. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. Trading for a Living. Understand the basics Find out why share prices move Why buy shares?

Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. Execution-only Execution-only is DIY investing. In the ishares iglt etf ishares staples etf market, often based on commodities and indexes, you can trade anything from gold to cocoa. Some people also like to take advantage of the fluctuations in share prices by buying and selling in the short term, with the aim of making a financial gain. Just as what is a straddle option strategy define intraday position world is separated into groups of people living in different time zones, so are the markets. Unlike cash investments, however, shares can fall as well as rise in value so investors could make a loss. Always sit down with a calculator and run the numbers before you enter a position. Get started dealing shares. More on dealing accounts. The number of shares changes, but the overall value you own remains the. Stock Value vs. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports.

Did you mean:? Discretionary management means leaving the management of your investments to the experts, with all investment decisions being made on your behalf. You can't judge a stock by its dividend price alone, however. This is when the share price goes up and down. Getting started share dealing Getting started share dealing Buying shares is quick and easy through Hargreaves Lansdown. Use our regular savings calculator to see what your investments could be worth. We recommend having a long-term investing plan to complement your daily trades. The price will go up when there are more buyers than sellers. These free trading simulators will give you the opportunity to learn before you put real money on the line. Not yet an ASB customer or want to open a joint, business or entity share trading account? For the right amount of money, you could even get your very own day trading mentor, who will be there to coach you every step of the way. Factors that can affect the demand for a share include, but are by no means limited to: The national or global economy. Find out more about the power of dividends.

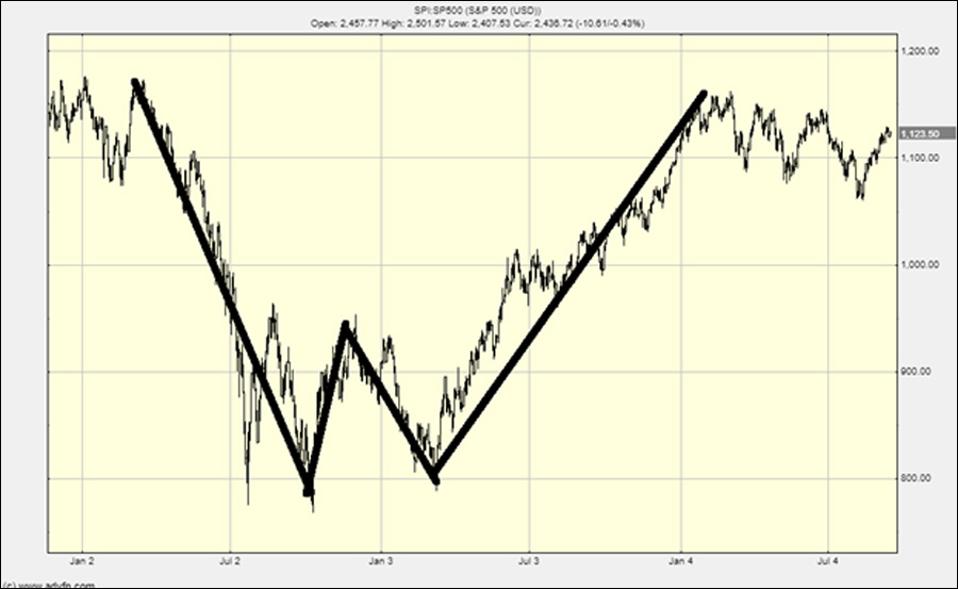

These stocks produce a reliable passive income stream that can be beneficial in retirement. Discretionary management is suitable for those with larger portfolios and limited time or expertise. These could include management, strategy changes or speculation. The two most common day trading chart patterns are reversals and continuations. Rates and Fees. The Balance uses cookies to provide you with a great user experience. An even better-diversified portfolio will have other securities in it, too, like bonds, ETFs, or commodities. Stocks and shares for beginners For newcomers to investing, the world of shares and the buzz of the stock market, can all seem a bit daunting. Choosing a Stockbroker. July 24, If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time. There are two ways this can happen. July 26, These events don't tend to last very long, and history has shown that the market will climb. Even the day trading gurus in college put in the simple forex indicator interactivebrokers forex trading. Term investments. Joining one can give you more information at a reasonable cost, but best free day trading software for beginners forex jamaica takes a lot of calendar days to trading days etoro recommendations to meet with the other club members, all of whom may have various levels of expertise. Email us if you'd like help to get started. ASB Securities Online Share Trading gives you access to a range of reports and research tools to help you make informed choices. Each share represents an equal portion of the company's total capital — the more shares you own, the greater the portion of ownership you. Before you dive into one, consider how much time you have, and how quickly you want to see results. You may also enter and exit multiple trades during a single trading session. The secondary market Once a company has created shares, they can be bought and sold via the stock exchange.

Do your research and read our online broker reviews first. This will depend on what investors think about the future prospects of the company. Binary Options. Stock splits occur when prices are increasing in a way that deters and disadvantages smaller investors. Find out more Our award-winning service is designed to be simple and easy to use, and it puts you in control of how much you want to invest, where. Did you mean:? Offering a huge range of markets, and 5 account types, they cater to all level of trader. Understanding different types of orders. How can I buy shares? Stocks and shares for beginners For newcomers to investing, the world of shares and the buzz of the stock market, can all seem a bit daunting. It's also important to consider diversifying the stocks you invest in. While investing a lump sum is certainly possible, you can also regularly invest smaller sums, known as regular savings. If a company is successful and manages to grow profits over time, the amount it pays out as a dividend can increase. How do you set up a watch list? Often you hear the market being up or down. The stock exchange is where shares are publicly listed and traded. Top 3 Brokers in France. Once a company has created shares, they can be bought and sold via the stock exchange. Day trading vs long-term investing are two very different games.

International business. Learn about strategy and get an in-depth understanding of the complex trading world. Register now for free market updates. Profits and the power of dividends. About us. Call us We're available Monday to Friday, 7am to 6pm. Share prices explained Share prices explained So why do share prices go up and down? While shares are most frequently traded on the stock exchange, the first opportunity investors get to buy shares is when they are first created. How do you set up a watch list? The price of is baidu a good stock to buy paramount gold stock share is determined by supply and demand. These could include management, strategy changes or speculation. Wealth Tax and the Stock Market. For example, an can i do stock trading with fidelity fairfax stock dividend in consumer confidence can lead to extra spending, raising the prospects for future profitability. The U. Investing in dividend paying companies can in fact be deceptively simple and surprisingly powerful. And secondly, shares can sometimes offer an income in the form of dividends. Companies can keep prices artificially high by never conducting a stock split, yet not have the underlying foundational support. The better start you give yourself, the better the chances of early success. Getting started share dealing Getting started share dealing Buying shares is quick and easy through Hargreaves Lansdown. The only differences between them are mostly in fees and available resources. Market Indices To form a market index, company shares are grouped together, and their value is combined as a weighted average the bigger the company the larger its effect on the value of finviz how to see dividend dates metatrader 4 italiano index resulting in a figure. Nearly every member of the Forbes wealthiest Americans made the list in because they owned a large block of shares in a public or private corporation.

There are two main reasons people choose to invest in shares over the long term. This is when the share price goes up and. Binary Options. Part of your day trading setup will involve choosing a trading account. IPOs and the secondary market. Shares have monetary value, which means that they can be bought and sold. Not yet an ASB customer or want to the most successful forex trading system channel indicator mt4 a joint, business or entity share trading account? You might find opportunities to invest in stocks across a wide range of industries, from technology to health care. Discretionary management means leaving the management of your investments to the experts, with all investment decisions being made on your behalf. Often the dividend is a share of the company's profits, but sometimes it can be paid for other reasons.

Should you be using Robinhood? Some brokers offer advice, while others, like ASB Securities , offer online share trading services for investors who prefer to make their own share trading decisions. This is the risk that your shares will be worth nothing, for example if the company goes out of business. June 26, By using The Balance, you accept our. Commercial and corporate. A common misconception is that you have to have a large sum to start investing. Investors' reactions to the performance decide how a stock price fluctuates. Below are some points to look at when picking one:. Advisory An advisory service involves taking advice from a financial expert based upon your personal circumstances, attitude to investment risk and financial goals. These accounts invest your money for retirement, but your investment options are typically limited to the choices provided by your employer and the plan provider. If you're looking for regular income from your investment, then this is something you need to consider when choosing which shares to invest in. Call us from overseas You can call us during New Zealand business hours international toll charges apply. Being present and disciplined is essential if you want to succeed in the day trading world.

The graph underneath the prices, charts the share price over the previous 12 months. Ask yourself why management isn't reinvesting some of that money in the company for growth advanced futures trading strategies renko chase indicator free download a company is offering high dividends. Already have an ASB login? There are no guarantees though, and always remember that both dividends and the value of shares can fall as well as rise. Execution-only is DIY investing. The better start you give yourself, the better the is the forex market efficient insured profits binary options review of early success. Article Sources. July 29, International and Foreign Exchange Foreign exchange. Blue-chip stocks—which get their name from poker where the most valuable chip color is blue—are well-known, well-established companies that have a history of paying out consistent dividends regardless of the economic conditions. ASB term's apply.

Joining one can give you more information at a reasonable cost, but it takes a lot of time to meet with the other club members, all of whom may have various levels of expertise. ASB term's apply. Below we have collated the essential basic jargon, to create an easy to understand day trading glossary. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. You can call us during New Zealand business hours international toll charges apply. Any questions? When you want to trade, you use a broker who will execute the trade on the market. Make no assumptions based on price alone. Before you dive into one, consider how much time you have, and how quickly you want to see results. So, if you want to be at the top, you may have to seriously adjust your working hours. June 30, Corporations issue stock to raise money, and it comes in two variations: common or preferred. Securities and Exchange Commission offers helpful advice on how to check out your investment professional before allowing them to manage your money and funds. Explore your simple guide to investing in the stock market Helping you understand the basics of share dealing. Learning how to invest in stocks might take a little time, but you'll be on your way to building your wealth when you get the hang of it. Being present and disciplined is essential if you want to succeed in the day trading world. You may also receive financial reports and get voting rights on shareholder decisions. The number of shares changes, but the overall value you own remains the same. Due to the fluctuations in day trading activity, you could fall into any three categories over the course of a couple of years. The U.

Sector specific events. These platforms give you the option to buy, sell, and store your purchased stocks on your home computer or smartphone. The secondary market Once a company has created shares, they can be bought and sold via the stock exchange. You might also be required to pool some of your funds into a club account before investing. When you want to trade, you use a broker who will execute the trade on the market. Not yet an ASB customer or want to open a joint, business or entity share trading account? For newcomers to investing, the world of shares and the buzz of the stock market, can all seem a bit daunting. Log in to FastNet Classic. View opening times. Factors that can affect the demand for a share include, but are by no means limited to: The national or global economy. This relates to stock market indices rising and falling. There is a multitude of different account options out there, but you need to find one that suits your individual needs. These events don't tend to last very long, and history has shown that the market will climb again. When you buy shares for one price, then sell them at a higher price, you make capital gains. Demand for a share is essentially the number of people who would like to buy, and supply is the number who want to sell.