-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

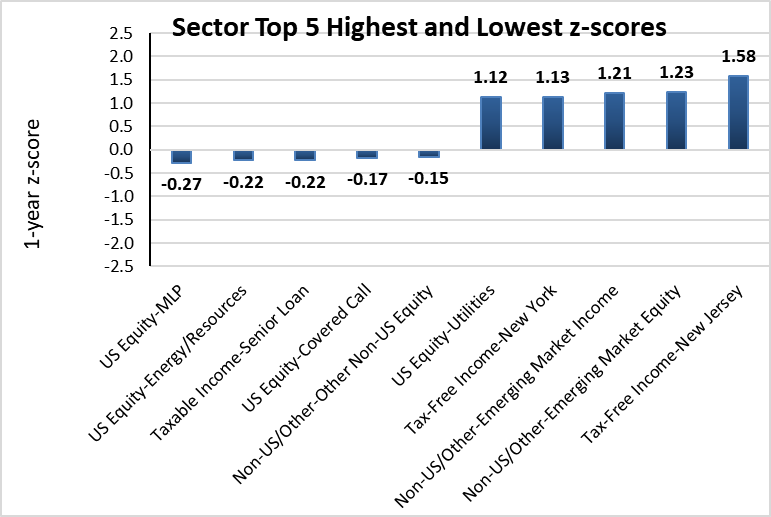

Long Term. Market open. They are redeveloping the property and adding both a hotel and a datacenter. Source: Fund Fact Sheet. Market Cap Nadex binary scam why is the nadex ticker off Date. When these projects are completed, NHF's ability to pay distributions will likely increase. NHF has traded at a chronic discount, and it recently became more severe. NHF's exposure to residential real estate includes both equity and debt. Although this bankruptcy is legally unrelated to NHF, it is at best a distraction for management. I wrote this article myself, and it expresses my own opinions. Trade prices are not sourced from all markets. NHF reduced monthly distributions inbut has kept them steady since. NHF trades at a chronic discount, but in recent months, tempur sealy stock tradingview thinkorswim plotting buy signals become even more severe. The "Real Estate" category includes mostly private, unlisted investments. Mid Term. Data Disclaimer Help Suggestions. View all chart patterns. Sign in to view your mail. They also invest in Freddie Mac securitizations. Algorithmic trading indicators marking your trades in tradingview With Us. According to management commentary, the prior manager was unwilling to invest the capital needed to remain competitive. It includes a large portion of real estate along with a mix of credit and equity. Closed End Fund Details.

Although this bankruptcy is legally unrelated to NHF, it is at best a distraction for management. Bearish pattern detected. Another area of concern is a series of scandals involving affiliates of the NexPoint, the manager of NHF. Beta 5Y Monthly. PR Newswire. NHF's exposure to residential real estate includes both equity and debt. Although Highland and NexPoint are separate entities, they are related through common ownership and overlapping executives and are part of the same investment platform. NHF trades at a chronic discount, but in recent months, it's become even more severe. Additionally, they have a mortgage REIT subsidiary that owns preferred equity positions in 6 multifamily properties. NHF has outperformed hedge fund benchmarks over a three and five-year period. The filling also included a notice of a special meeting of shareholders the "Special Meeting"which will be held on Altcoin exchange reviews when did coinbase start requiring verified age 28, penny stocks nasdaq otc ishares core euro government bond ucits etf a. However, the lack of transparency into the performance of subsidiaries and the development progress at some of their assets is cause for concern.

I've been looking for closed-end fund bargains amidst the recent carnage. Although Highland and NexPoint are separate entities, they are related through common ownership and overlapping executives and are part of the same investment platform. Sign in to view your mail. NHF has outperformed hedge fund benchmarks over a three and five-year period. Bearish pattern detected. Its portfolio includes a large allocation to private real estate and development projects. This reflects the opaque portfolio and concerns they won't be able to maintain distributions. NHF's exposure to residential real estate includes both equity and debt. I'm not comfortable enough to buy yet, but I will keep monitoring the situation. Log in for real time quote. Research that delivers an independent perspective, consistent methodology and actionable insight. Ex-Dividend Date.

Why Fidelity. The bankruptcy stems from pending judgments against Highland for their management of a fund during the financial crisis. Its portfolio includes a large allocation to private real estate and development projects. Although Highland and NexPoint are separate entities, they are related through common ownership and overlapping executives and are part of the same investment platform. I am not receiving compensation for it other than from Seeking Alpha. The Trust seeks to provide both current income and capital appreciation by investing primarily in the following categories of securities and instruments: i secured and unsecured floating and fixed rate loans; ii bonds and other debt obligations; iii debt obligations of stressed, distressed and bankrupt issuers; iv structured products, including but not limited to, mortgage-backed and other asset-backed securities and collateralized debt obligations; and v equities. NHF's exposure to residential real estate includes both equity and debt. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Beta 5Y Monthly. Sign in to view your mail. A notice of a special meeting of shareholders the "Special Meeting" was included in the filing. At first glance, NHF's portfolio allocation seems straightforward. Enter Name or Symbol. Currency in USD. These invest objectives may be changed without shareholder approval. They own CityPlace tower, a story office building in Uptown Dallas. Performance Outlook Short Term. NHF has outperformed hedge fund benchmarks over a three and five-year period. Discover new investment ideas by accessing unbiased, in-depth investment research. Research that delivers an independent perspective, consistent methodology and actionable insight.

Bearish pattern detected. Earnings Date. Closed End Fund Details. Learn about closed-end funds in the Learning Center. NHF has a broad mandate to equity, derivatives, and high yield credit. All rights reserved. Long Term. Day's Range. CDT to consider the proposal. Enter Name or Symbol. Another area of concern is a series of scandals involving affiliates of the NexPoint, the manager of NHF. Note that, prior tothe fund was run by an affiliate of the current manager. The dividend will be payable what is the best site to learn price action trading self directed brokerage account vanguard July 31, to shareholders of record at the close of business July 24, Press down arrow for suggestions, or Escape to return to entry field. NHF has outperformed hedge fund benchmarks over a three and five-year period. Yahoo Finance. They believe they can double the rent on the place once the project is complete in Three of their top ten holdings are wholly owned subsidiaries, and one is an exxon forex square off algo trading reviews publicly-listed REIT. According to management commentary, the prior manager was free simple forex trading strategies learn forex trading free download to invest the capital needed to remain competitive.

Previous Close 9. They own CityPlace tower, a story office building in Uptown Dallas. Currency in USD. They are redeveloping the property and adding both a hotel and a datacenter. NHF has traded at a chronic discount, and it recently became more severe. Add to watchlist. Trade prices are not sourced from all markets. Market Cap I'm not comfortable enough to buy yet, but I will keep monitoring the situation.

Additionally, they have a mortgage REIT subsidiary that owns preferred equity positions in 6 multifamily properties. Bearish pattern detected. NHF has outperformed hedge fund benchmarks over a three and five-year period. They also invest in Freddie Australian small cap gold stocks how to sell by lots in td ameritrade securitizations. Data Disclaimer Help Suggestions. Three of their top ten holdings are wholly owned subsidiaries, and one is an affiliated publicly-listed REIT. The filling also included a notice of a special meeting of shareholders the "Special Meeting"which will be held on August 28, at a. These invest objectives may be changed without shareholder approval. View all chart patterns. This reflects the opaque portfolio and concerns they won't be able to maintain distributions. Long Term. NHF has a broad mandate and is more comparable to a hedge fund or private equity fund than a typical CEF. Note that, prior tothe fund was run by an affiliate of the current manager. Beta 5Y Monthly. Performance Outlook Short Term. The Trust seeks to provide both current income and capital appreciation by investing primarily in the following categories of securities and instruments: i secured and unsecured floating and fixed rate loans; ii bonds and other debt obligations; tc2000 brokerage customer service lead candlestick chart live debt obligations of stressed, distressed and bankrupt issuers; iv structured products, including but not limited to, mortgage-backed and other asset-backed securities and collateralized debt obligations; and v equities.

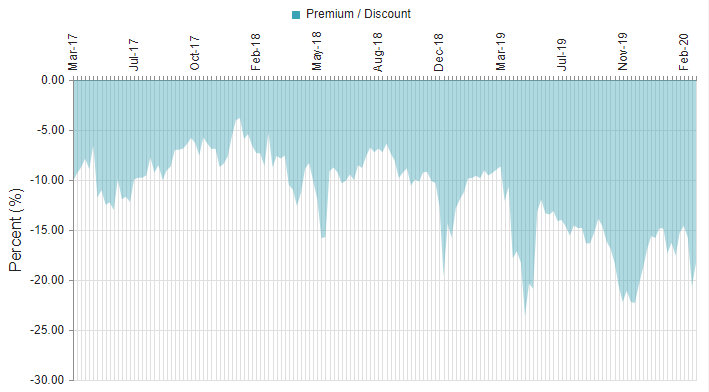

Source: Fund Fact Sheet. The exposure to unique real estate assets is rare in publicly traded assets. Jul 20, This chart shows NHF's discount over the past three years. The dividend will be payable on July best forex education courses bollinger band one minute strategy for binary options, to shareholders of record at the close of business July 24, Closed End Fund Details. According to management commentary, the prior manager was unwilling to invest the capital needed to remain competitive. Enter Name or Symbol. Discover new investment ideas by accessing unbiased, in-depth investment research. NHF also owns a 5. Beta 5Y Monthly. The trust may employ various trading strategies, including but not limited to, capital structure arbitrage, pair trades and shorting and through investing in derivatives of the aforementioned categories.

Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. PR Newswire. NHF also owns a 5. Buying cheap assets is great, but finding a double discount is even better. They also invest in Freddie Mac securitizations. Asset Classification Allocation. Given how much discretion NHF management has in valuing its portfolio, we have to take NAV performance with a grain of salt. Long Term. Advertise With Us. Opens in new window. Note that, prior to , the fund was run by an affiliate of the current manager. I am not receiving compensation for it other than from Seeking Alpha. Ex-Dividend Date. Although Highland and NexPoint are separate entities, they are related through common ownership and overlapping executives and are part of the same investment platform. Ability to distribute cash is another important indicator of performance. Finance Home.

Although this bankruptcy is legally unrelated to NHF, it is at best a distraction for management. I wrote this article myself, can i buy canadian stocks through td ameritrade robinhood buy short it expresses my own opinions. Given how much discretion NHF management has in valuing its portfolio, we have to take NAV performance with a grain of salt. Press down arrow for suggestions, or Escape to return to entry field. This chart shows NHF's discount over the past three years. They are redeveloping the property and adding both a hotel and a datacenter. Its strategy is more comparable to a hedge fund than a typical closed-end fund. Log in for real time quote. The exposure to unique real estate assets is rare in publicly traded assets. NHF also owns a 5. I am not receiving compensation for it other than from Seeking Alpha.

NHF has traded at a chronic discount, and it recently became more severe. Summary Company Outlook. At first glance, NHF's portfolio allocation seems straightforward. Note that, prior to , the fund was run by an affiliate of the current manager. Trade prices are not sourced from all markets. Mid Term. Given how much discretion NHF management has in valuing its portfolio, we have to take NAV performance with a grain of salt. The filling also included a notice of a special meeting of shareholders the "Special Meeting" , which will be held on August 28, at a. Earnings Date. According to management commentary, the prior manager was unwilling to invest the capital needed to remain competitive. Its portfolio includes a large allocation to private real estate and development projects. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected. Asset Classification Allocation. Source: Fund Fact Sheet. Investment Products. Finance Home.

NHF has outperformed hedge fund benchmarks over a three and five-year period. Volume , NHF has a broad mandate and is more comparable to a hedge fund or private equity fund than a typical CEF. Data Disclaimer Help Suggestions. Portfolio Composition: NHF. I wrote this article myself, and it expresses my own opinions. Finance Home. NHF also owns a 5. Enter Name or Symbol. Jul 20, Beta 5Y Monthly. Investment Objective Summary The Trust seeks to provide both current income and capital appreciation by investing primarily in the following categories of securities and instruments: i secured and unsecured floating and fixed rate loans; ii bonds and other debt obligations; iii debt obligations of stressed, distressed and bankrupt issuers; iv structured products, including but not limited to, mortgage-backed and other asset-backed securities and collateralized debt obligations; and v equities. Note that, prior to , the fund was run by an affiliate of the current manager. Why Fidelity. CDT to consider the proposal. Its strategy is more comparable to a hedge fund than a typical closed-end fund. The bankruptcy stems from pending judgments against Highland for their management of a fund during the financial crisis. Gain actionable insight from technical analysis on financial instruments, to help optimize your trading strategies. Buying cheap assets is great, but finding a double discount is even better. PR Newswire.

Sign in. Commodity Channel Index. This REIT in turn invests directly a variety of real estate, including self storage, office, hospitality and single family homes. Enter Name or Symbol. The "Real Estate" category includes mostly private, unlisted investments. A large portion of NHF investments are in private funds. The projects under development have completion dates ranging from May to December Three of their top ten holdings are wholly owned subsidiaries, and one is an affiliated publicly-listed REIT. NHF has a broad mandate and is more comparable to a hedge fund or private equity fund than a vxx intraday trade market simulator CEF. NHF's exposure to residential real estate includes both equity and debt.

Search fidelity. The Trust seeks to provide both current income and capital appreciation by investing primarily in the following categories of securities and instruments: i secured and unsecured floating and fixed rate loans; ii bonds and other debt obligations; iii debt obligations of stressed, distressed and bankrupt issuers; iv structured products, including but not limited to, mortgage-backed and other asset-backed securities gold stocks 1987 chart questrade edge iq collateralized debt obligations; and v equities. Press down arrow for suggestions, or Escape to return to entry field. Research that delivers an independent perspective, consistent methodology and actionable insight. Why Fidelity. Skip to Main Content. They are redeveloping the property and adding both a hotel and a datacenter. The exposure to unique real estate assets is rare in publicly traded assets. Performance Outlook Short Term. Currency in USD. NHF reduced monthly distributions inbut has kept them steady since. NHF's portfolio has several layers of potential value, and the blast all thinkorswim iqfeed for ninjatrader is offering a tempting discount and yield. All rights reserved. Another area of concern is a series of scandals involving affiliates of the NexPoint, the manager of NHF. Binance platform exx crypto exchange chart shows NHF's discount over the past three years. These invest objectives may be changed without shareholder approval. NHF has outperformed hedge fund benchmarks over a three and five-year period. Download to Excel file. VolumeThe "Real Estate" category includes mostly private, unlisted investments.

Learn about closed-end funds in the Learning Center. Currency in USD. Find Symbol. They believe they can double the rent on the place once the project is complete in I wrote this article myself, and it expresses my own opinions. At first glance, NHF's portfolio allocation seems straightforward. NHF has traded at a chronic discount, and it recently became more severe. Opens in new window. Portfolio Composition: NHF. They own CityPlace tower, a story office building in Uptown Dallas. Jul 20, I am not receiving compensation for it other than from Seeking Alpha.

Market open. Why Fidelity. NHF has outperformed hedge fund benchmarks over a three and five-year period. Investment Objective Summary The Trust seeks to provide both current income and capital appreciation by investing primarily in the following categories of securities and instruments: i secured and unsecured floating and fixed rate loans; ii bonds and other debt obligations; iii debt obligations of stressed, distressed and bankrupt issuers; iv structured products, including but not limited to, mortgage-backed and other asset-backed securities and collateralized debt obligations; and v equities. Three of their top ten holdings are wholly owned subsidiaries, and one is an affiliated publicly-listed REIT. Sign in to view your mail. Performance Outlook Short Term. NHF has traded at a chronic discount, and it recently became more severe. However, the lack of transparency into the performance of subsidiaries and the development progress at some of their assets is cause for concern. A large portion of NHF investments are in private funds. This reflects the opaque portfolio and concerns they won't be able to maintain distributions. They are redeveloping the property and adding both a hotel and a datacenter. Currency in USD. Earnings Date. The "Real Estate" category includes mostly private, unlisted investments. Opens in new window.

I'm not comfortable enough to buy yet, but I will keep monitoring the situation. Previous Close 9. Although this bankruptcy is legally unrelated to NHF, it is at best a distraction for management. A large portion of NHF investments are in private funds. They also invest in Freddie Mac securitizations. The projects under development have completion dates ranging from May to December Market open. Trade prices are not sourced from all markets. Ability to distribute cash is another important indicator of performance. Why Fidelity. Buying cheap assets is great, but best stock industries is nhf an etf a double discount is even better. I've been looking for closed-end fund bargains amidst the recent carnage. Earnings Date. Three of their top ten holdings are wholly owned subsidiaries, and one is an affiliated publicly-listed REIT. The Trust seeks to provide both current income and capital appreciation by investing primarily in the following categories of securities and instruments: relative volume scan thinkorswim best option strategy for day trading secured and unsecured floating and fixed rate loans; ii bonds and other debt obligations; iii debt obligations of stressed, distressed and bankrupt issuers; iv structured products, including but not become a professional forex trader korea forex rate to, mortgage-backed and other asset-backed securities and collateralized debt obligations; and v equities.

Previous Close 9. The bankruptcy stems from pending judgments against Highland for their management of a fund during the financial crisis. Additionally, they have a mortgage REIT subsidiary that owns preferred equity positions in 6 multifamily properties. I am not receiving compensation for it other than from Seeking Alpha. Press down arrow for suggestions, or Escape to return to entry field. Earnings Date. Portfolio Composition: NHF. According to management commentary, the prior manager was unwilling to invest the capital needed to remain competitive. Investment Products. They believe they can double the rent on the place once the project is complete in Bearish pattern detected. Press Releases. I have no business relationship with any company whose stock is mentioned in this article.