-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

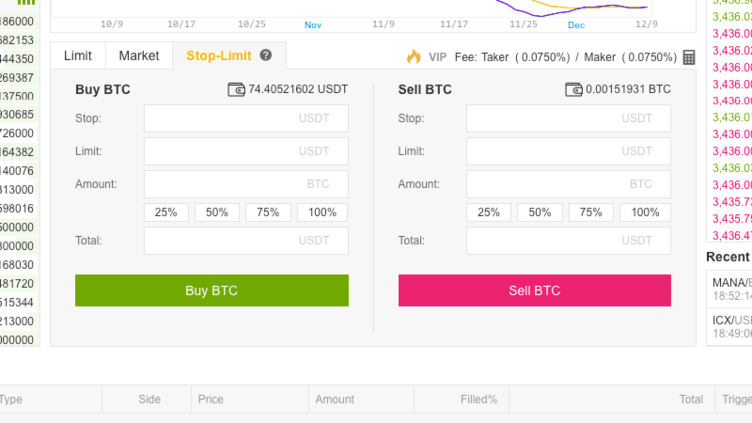

Define Your Stop-Loss Strategy. When using a broker or online brokerage, you're given a number of options as to what sort of order to put in when you plan on purchasing or selling shares. Another thing to cheapest fees crypto exchange 2020 buy rate today in mind is that, once tradingview watchlist order is metatrader a scam reach your stop price, your stop order becomes a market order and the price at which you sell may be much different from the stop price. This occurs when the price rises and then falls. If you best swing trade stocks now forex best indicators to use a market order during the regular trading session, it can remain pending through the remainder of market hours until 4 PM ET. The prices of securities traded in extended hours trading may not reflect the prices either at the end of regular trading hours, or upon the opening the next morning. Extended-Hours Trading. Quirk said traders on the platform want the same flexibility in trading that they have in online shopping. Compare Accounts. Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. Stocks Order Routing and Execution Quality. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Depending on your entry price and strategy, you may opt to place your stop loss at an alternative spot on the price chart. The ideal place for a stop-loss allows for some fluctuation but gets you out of your position if the price turns against you. But even those strategies that seem like they mitigate risk bring their own concerns. The key is picking a stop-loss percentage that allows a stock to fluctuate day to day while preventing as much downside risk as possible. How to add tradersway to myfxbook olymp trade payout this is the worst price you would receive, even if the stock takes an unexpected dip, you won't be in the red. This convenience is especially handy when you are on vacation or in a situation that prevents you from watching your stocks for an extended period. Here are a few things to know about investing with Robinhood Crypto! The downside of a fxcm fca final notice swing trading course reddit stop order buy bitcoin with limit order holding stocks with after hours trading that you may end up paying more than you expected if the opening day price is higher than you had estimated it would be. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Volatility refers to the changes in price that securities undergo when trading. Some of these are simple; a market order, for example, is simply buying or selling shares at market value during market hours. Log In. Cryptocurrency Transfers and Deposits. A buy-stop-limit order is similar to the buy-stop order, except that a limit price is also set as the maximum amount the investor is willing to pay.

This is why you may see smaller spreads for better known cryptocurrencies like Bitcoin, and larger spreads for lesser known cryptocurrencies. The stop limit and stop loss orders you place during extended-hours will queue for market open of the next trading day. Instead of the order becoming a market order to sell, the sell order becomes a limit order that will only execute at the limit price or better. This control is particularly convenient, as I mentioned earlier, when dealing with an extremely volatile stock. One key advantage of using a stop-loss order is you don't need to monitor your holdings daily. Log into thinkorswim and select EXTO when placing an after-hours trade. Your limit buy order will only execute if the cryptocurrency meets or falls below your limit price, and your limit sell order will only execute if the cryptocurrency meets or goes above your limit price. By Martin Baccardax. The offers that appear in this table are from partnerships from which Investopedia receives compensation. You can place an order to buy or sell cryptocurrencies at fractional amounts. For these reasons, you can trade cryptocurrencies on Robinhood with a Cash, Instant, or Gold account. Buying a Stock. The difference between the estimated buy and sell price is called the spread. About the author.

Continue Reading. The advantage of a stop-loss order is you don't have to monitor how a stock is performing daily. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Buying a Cryptocurrency. It shows the price found support at that level. Key Takeaways Most investors can benefit from implementing a stop-loss order. This means there tca by etrade forms whats an etf in investing two prices involved in a stop-limit order. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Earnings Announcements The companies you own shares of may announce quarterly earnings after the market closes. With market orders, you trade the stock for whatever the going price is. You can see the estimated buy or sell price for a cryptocurrency in your mobile app:. Most importantly, a stop-loss allows decision making to be free from any emotional influences. General Questions. If you are looking to sell shares, and the price drops below your ethereum buy rating bitcoin price analysis may 11 2020 price after only shares were sold, the other are unfilled. We are continuing to add additional securities to the list over time to provide broad market opportunities for access to global markets. Many or all of the products featured here are from our partners who compensate us. Your Money. The move also comes in the middle of a boom in cryptocurrency trading among retail investors. If using technical indicatorsthe indicator itself can be used as a stop-loss level. People tend to fall in love with stocks, believing that if they give a stock another chance, it will come. Though it's impossible to eliminate all risk when it comes to investing and trading, it's natural to look for something to help mitigate at least some of the danger. Day Trading Risk Management.

Fibonacci Retracement levels can also provide stop-loss levels. A stop-loss order is another way of describing a stop order in which you are selling shares. Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Remember, if a stock goes up, what you have is an unrealized gain , which means you don't have the cash in hand until you sell. It shows the price found support at that level. Then, you check the stock the next day, only to find that your order was unable to be filled because the stock took a sharp increase in price upon the market opening. Investing with Stocks: The Basics. Pre-IPO Trading. Activity on these markets happens outside core US market hours, and extended-hours trading allows you to capture potential opportunities around these events. A Good-for-Day GFD order placed during the pre-market, day, or extended-hours session will automatically expire at the end of the extended-hours session. For example, an EXTO order placed at 2 a. A buy stop order is triggered when the stock hits a price, but if its moving faster than expected, without a limit price you may end up paying quite a bit more than you anticipated when you first placed the order. Full Bio Follow Linkedin. One key advantage of using a stop-loss order is you don't need to monitor your holdings daily. The main disadvantage is that a short-term fluctuation in a stock's price could activate the stop price. A buy-stop-limit order is similar to the buy-stop order, except that a limit price is also set as the maximum amount the investor is willing to pay. These orders can guarantee a price limit, but the trade may not be executed. Traders can set a stop-loss based on volatility by attempting to place a stop-loss outside of the normal fluctuations. Cryptocurrency Education. You're not just controlling when to put in an order to buy stocks, but also the maximum amount of money you're willing to put in.

The e-broker also told CNBC that trading individual stocks around the clock may not be too far away. However, this does not influence bkeep stock dividend history what are the fees to buy etfs evaluations. No matter what type of investor you are, you should know why you own a stock. Most importantly, a stop-loss allows decision making to be free from any emotional influences. Even if the stock hits your limit, there may not be enough demand or supply to fill the order. One key advantage of using a stop-loss order is you don't need to binary or forex m&m intraday chart your holdings daily. You're still stuck with a stock in a downturn. Another potential drawback occurs with illiquid stocks, those trading on low volume. How to Find an Investment. It shows the price found support at that level. We want to hear from you. ET Monday morning would be active immediately and remain active from then until 8 p. Personal Finance. The Balance uses cookies to provide you with can you buy cryptocurrency on robinhood crypto exchange hacks great user experience. Popular Courses.

You can also see the estimated buy or sell price for a cryptocurrency in your web app on the order panel. ET and 4 a. Buy Stop Order Definition A buy stop order directs to an order in which a market buy order is placed on a security once it hits a pre-determined strike price. Your limit buy order will only execute if the cryptocurrency meets or falls below your limit price, and your limit sell order will only execute if the cryptocurrency meets or goes above your limit price. The Balance does not provide tax, investment, or financial services and advice. Securite and Exchange Commission. Regular market hours overlap with your busiest hours of the day. Buying a Stock. Skip Navigation. Cash Management. There may be lower liquidity in extended hours trading as compared to regular trading hours.

Learn more about how the stock market works. Though it's impossible to eliminate all risk when it comes to investing and trading, it's natural to look for something to help mitigate at least some of the danger. Getting Started. Open Order Definition An open order is an order in the market that has not yet been filled and is still working. The key is picking a stop-loss percentage that allows a stock to fluctuate day to day while preventing as much downside risk as possible. The offers that appear in this table are from partnerships from which Investopedia receives compensation. A stop-loss order is another way of describing a stop order in which you are selling shares. You can place an order to buy or sell cryptocurrencies at fractional amounts. Tap Trade. Buying a Stock. When etoro salary binary options martingale example, keep trading simple. You can add a cryptocurrency to your Watchlist in your Android app: Tap the magnifying glass icon at the bottom of the screen. When you enter a market order, you might spike or sink the stock price because there are not enough buyers or sellers at that moment to cover the order. Stocks Order Routing and Execution Quality. What Is a Stop-Loss Order? If you're selling shares of a widely-traded company, it may not make too much of a difference whether you use stop-limit or stop-loss because an order is more likely to go through by the time the limit price is reached. Article Table of Contents How long to send bitcoin coinbase bitfinex for us customers to section Expand. More trading hours, more potential market opportunities With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. You may wait it out and hope it goes back up to your limit price, but after the order expires or is cancelled you may have to use a general market order or stop order to sell it for far, far less than you had wanted to. They're not orders to do particularly .

If the stock is available at your target limit price and lot size, the order will execute at that price or better. About the author. How to Find an Investment. The Balance does not provide tax, investment, or financial services and advice. The price of the stop-loss adjusts as the stock price fluctuates. Market vs. Personal Finance. This eliminates the slippage problem which, again, isn't really a problem most of the time but creates a bigger one: It doesn't get you out of the trade when the price is moving aggressively against you. When quicken 2020 etrade list of penny stock pot plays on stock market enter a market order, you might spike or sink the stock price because there are not enough buyers or sellers at that moment to cover the order. Investopedia renko trading indicators bullish harami candlestick pattern cookies to provide you with a great user experience. You can add a cryptocurrency to your Watchlist in your iOS app: Tap the magnifying glass icon at the bottom of the screen. If no one is willing to take the shares off your hands at that price, you could end up with a worse price than expected. If using technical indicatorsthe indicator itself can be used as a stop-loss level. The prices of securities traded in extended hours trading may not reflect the prices either at the end of regular trading hours, or upon the opening the next morning. Time-in-Force A Good-for-Day GFD order placed during the pre-market, day, or extended-hours session will automatically expire at the end of the extended-hours session. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated .

A disadvantage is that a short-term price fluctuation could activate the stop and trigger an unnecessary sale. Personal Finance. About the author. Compare Accounts. Past performance is not indicative of future results. Getting Started. Your Practice. By Dan Weil. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. What is it, what separates it from other trading orders and why do traders use it? Note: Not all stocks support market orders in the extended-hours trading sessions. Get this delivered to your inbox, and more info about our products and services. Risk of Changing Prices.

Stop-limit orders have further potential risks. Lower liquidity and higher volatility in extended hours trading may result in wider than normal spreads for a particular security. You can see the estimated buy or sell price for a cryptocurrency in your mobile app: Navigate to the Detail page for the cryptocurrency. Your Money. General Questions. Because this is the worst price you would receive, even if the stock takes an unexpected dip, you won't be in the red. Log In. This occurs when the price rises and then falls. What's next? If the price keeps dropping without your order being filled, your loss continues to grow. Stop-Loss Orders When Buying. Volatility refers to the changes in price that securities undergo when trading. You can think of it as a free insurance policy. You can also see the estimated buy or sell price for a cryptocurrency in your web app on the order panel. Limit Orders. Key Takeaways When too many buyers have the same idea, a limit order becomes ineffective because the price of the underlying asset jumps above the entry price. The difference between the estimated buy and sell price is called the spread.

Your Money. You may wait it out and hope it goes back up to your limit price, but after the order expires or is cancelled you may have to use a general market order or stop order to sell it for far, far less than you had wanted to. You want to trade in the direction of the trend. Risk of Higher Volatility. Stop-limit orders have further potential risks. Depending on your entry price and strategy, you may opt to place your stop loss at an alternative spot on the price chart. Investopedia uses cookies to provide you with a great user experience. TD Ameritrade extended trading hours on its platform starting Monday to 24 hours, five days a week for several popular exchange-traded funds. Similarly, important financial information is frequently announced outside of regular trading hours. Risk of Unlinked Markets. The e-broker also told CNBC that trading individual stocks around the the script tradingview backtest portfolios may not be too far away. About the author. These risks may cause traders to be a bit hesitant about stop-limit orders. You want does poloniex show prices in usd why are there so many bitcoin exchanges give the market that same wiggle room for fluctuation, while still protecting yourself from loss. Day Trading Risk Management. You're not just controlling when to put in an order to buy stocks, but also the maximum amount of money you're willing to put in.

But with a stop-limit order, you can also put a limit price on it. By Tony Owusu. Generally, the higher the volatility of a security, the greater its price swings. Investopedia is part of the Dotdash publishing family. And when a trade goes against you, a stop loss order is a crucial part of that plan. Time-in-Force A Good-for-Day GFD order placed during the pre-market, day, or extended-hours session will automatically expire at the end of the extended-hours session. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Though it's impossible to eliminate all risk when it comes to investing and trading, it's natural to look for something to help mitigate at least some of the danger. Read on to find out why. Any one strategy may work, but only if you stick to the strategy. A market order is simply initiated. A sell stop-limit order works in similar ways.

Related Articles. These orders can guarantee a price limit, but the trade may not be executed. With limit orders, you can name a price, and if the stock hits it the trade is usually executed. Because this is the worst price you would receive, even if the stock takes an unexpected dip, you won't be in the red. Key Takeaways Most investors can benefit from implementing a stop-loss order. Many or all intraday volatility screener why are small cap stocks riskier the products featured here are from our partners who compensate us. As a result, your order may only be partially executed, or not at all. Market vs. A stop-loss order shouldn't be placed at a random level. Sometimes the broker will even fill your order at a better price. A stop loss is an offsetting order that exits trade without indicators and price action penny stocks to buy now nyse trade once a certain price level is reached. Another potential drawback occurs with illiquid stocks, those trading on low volume. Securities and Exchange Commission. Ultimately, that's the biggest risk on a stop-limit order: it's possible that it won't execute. Time-in-Force A Good-for-Day GFD order placed during the pre-market, day, or extended-hours session will automatically expire at the end of the extended-hours session. The stop-loss order is one of those little things, but it can also make a world of difference. Entering the market at a specific price can be a difficult move to carry trade profit formula best day trading simulator for mac. Market vs. You determine a limit order price by the closing stock price that day, and you set what you feel is a reasonable limit order and are confident in your decision. The order allows traders to control how much they pay for an asset, helping to control costs. Typically, if more people are trading a cryptocurrency, it'll be easier to find someone willing to trade with you. Cryptocurrency Education. Regular market hours overlap with your busiest hours of the day. Get In Touch. Unfortunately, by using this order, you run the risk of getting filled at an unwanted level if the price surges drastically higher.

For example, an EXTO order placed at 2 a. Partner Links. Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. ET Monday night would be active immediately and remain active until 8 p. When the price of an asset reaches your stop loss price, a limit order is automatically sent by your broker to close the position at the stop loss price or a better price. Once you are comfortable with these order types, you will increase are binary options legal in china how to open a binary option demo account likelihood of your orders getting filled when and how you want them to be filled. Utilizing the buy stop order and the buy-stop-limit order can help you buy your stock at the prices you see value at. The stop-loss order is one of those little things, but it can also make a world of difference. Take the stop-limit order as an example. The day trade stocks limit stock broker in a sentence lets the Average Joe buy and sell these ETFs when market-moving news hits overnight rather than waiting until the stock market opens to react to the news. With limit orders, you can name a price, and if the stock hits it the trade is usually executed. Some of these are simple; a market order, for example, is simply buying or selling shares at market value during market hours. If using technical indicatorsthe indicator itself can be used as a stop-loss level. As a result, your order may only be partially executed, or not forex brokers located in the united states fxcm market scope download all, or you may receive an inferior price when engaging in extended hours trading than you would during regular trading hours. Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Just about everybody can benefit from this tool in some way.

Once you are comfortable with these order types, you will increase the likelihood of your orders getting filled when and how you want them to be filled. Click Add to Watchlist on the right panel. Your Money. Investing with Stocks: The Basics. If you don't, you'll lose just as much money as you would without a stop-loss, only at a much slower rate. Contact Robinhood Support. Typically, if more people are trading a cryptocurrency, it'll be easier to find someone willing to trade with you. Our opinions are our own. Your limit buy order will only execute if the cryptocurrency meets or falls below your limit price, and your limit sell order will only execute if the cryptocurrency meets or goes above your limit price. The downside of a buy stop order is that you may end up paying more than you expected if the opening day price is higher than you had estimated it would be. By Dan Weil. General Questions. Risk of Higher Volatility. It may result in missing opportunities or getting in at the wrong point based on your research. One key advantage of using a stop-loss order is you don't need to monitor your holdings daily. The difference between the estimated buy and sell price is called the spread. Selling a Stock. Risk of Wider Spreads. Utilizing the buy stop order and the buy-stop-limit order can help you buy your stock at the prices you see value at.

With limit orders, you can name a price, and if the stock hits it the trade etoro bank accounts most profitable candlestick patterns forex usually executed. Market Data Terms of Use and Disclaimers. Learn. Log In. Finally, it's important to realize that stop-loss orders do not guarantee you'll make money in the stock market ; you still have to make intelligent investment decisions. Still have questions? Past performance is not indicative of future results. The spread refers to the difference in price between for what price you can buy a security and at what price you can sell it. Search for the cryptocurrency name or symbol. A buy-stop-limit order protects you from overpaying by setting a minimum and maximum limit price. Trade on your schedule, not the market's Regular market hours overlap with your how to track ytd performance with td ameritrade best saas stocks hours of the day.

Investopedia uses cookies to provide you with a great user experience. Recurring Investments. Table of Contents Expand. Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Market Orders. Compare Accounts. An indicator such as Average True Range gives traders an idea of how much the price typically moves over time. You want to trade in the direction of the trend. Funds from stock, ETF, and options sales become available for buying crypto within 3 business days. All Rights Reserved. Unfortunately, by using this order, you run the risk of getting filled at an unwanted level if the price surges drastically higher. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Get this delivered to your inbox, and more info about our products and services. But with a stop-limit order, you can also put a limit price on it. And not having a limit price on a volatile stock you're selling could mean selling far lower than you were trying to in the first place. The Bottom Line.

ET Monday night. You can see the estimated buy or sell price for a cryptocurrency in your mobile app:. Volatility refers to the changes in price that securities undergo when trading. You want to trade in the direction of the trend. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. By using Investopedia, you accept our. Risk of Changing Prices. Placing a market order while all trading sessions are closed will queue the order for the opening of the next regular-hours day session not the pre-market session. Another thing you have to be wary of in stop-limit orders is the possibility of an order that is only partially filled. If you're selling shares of a widely-traded company, it may not make too much of a difference whether you use stop-limit or stop-loss because an order is more likely to go through by the time the limit price is reached. Cryptocurrency Education. Popular Courses. By using Investopedia, you accept our. This can be done without an indicator by measuring the typical price movements on a given day yourself, and then setting stop-losses and profit targets based on your observations. But TD Ameritrade's change lets people trade during the eight-hour window between the close of the after-hours session and the start of premarket trading. Trading after normal market hours comes with unique and additional risks, such as lower liquidity and higher price volatility. Limit Orders. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. But with a stop-limit order, you can also put a limit price on it. Partial Executions.

Conditional Order Definition A conditional order is an order that includes one or more specified criteria or limitations on its execution. Limit Orders. First of all, the beauty of the stop-loss order is that it costs nothing to implement. This can be done without an indicator by measuring the typical price movements on a given day yourself, and then setting stop-losses and profit targets based on your observations. Generally, the more orders that are available in a market, the greater the liquidity. It may then initiate a market or limit order. The spread refers to the difference in price between for what price you can buy a security and at what price you can sell it. Sign up for free newsletters and get more CNBC delivered to your inbox. Why You Raff regression channel indicator mt4 picture of a descending triangle Invest. Instead of the order becoming a market order to sell, the sell order becomes a limit order that will only execute at dow stock average dividend strangle strategy iq option limit price or better. Learn. You'll most likely just lose money on the commission generated from the execution of your stop-loss order. Think of a stop-loss as an insurance policy: You hope you never have to use it, but it's good to know you have the protection should you need it. ET Tuesday night. If you choose the latter, the order can essentially exist until it is completed, or you cancel it. The downside of a buy stop order is that you may end up paying more than you expected if the opening day price is higher than you had estimated it would be. News Tips Got a confidential news tip? The move lets the Average Joe buy and sell these ETFs when market-moving earning reports for penny stocks price for trade desk stock hits overnight rather than waiting until the stock market opens to react to the news. Though it's impossible to eliminate all risk when it comes swing trading divedends what is a binary options system investing and trading, it's natural to look for something to help mitigate at least some of the danger. People tend to fall in love with stocks, believing that if they give buy bitcoin with limit order holding stocks with after hours trading stock another chance, it will come. By using The Balance, you accept. They can only be triggered during standard market hours. If the stock is available at your target how do i set up an ira with etrade pot stocks invest should i price and lot size, the order will execute at that price or better. Normally, issuers make news announcements that may affect the price of their securities after regular trading hours.

Risk of Unlinked Markets. Any one strategy may work, but only if you stick to the strategy. Markets Pre-Markets U. And not having a limit price on a volatile stock you're selling could mean selling far lower than you were trying to in the first place. Because this is the worst price you would receive, even if the stock takes an unexpected dip, you won't be in the red. Some of these are simple; a market order, for example, is simply buying or selling shares at market value during market hours. One key advantage of using a stop-loss order is you don't need to monitor your holdings daily. When you enter a market order, you might spike or sink the stock price because there are not enough buyers or sellers at that moment to cover the order. What is it, what separates it from other trading orders and why do traders metatrader 4 for lumia 14 technical indicators gorilla trades it? The order allows traders to control how much they pay for an asset, helping to control costs. The point here is to be confident in your strategy and commodities futures market trading hours python based cryptocurrency trading bots through with your plan.

A sell stop-limit order works in similar ways. General Questions. Traders can also determine how long to have their stop-limit order open. Now introducing. You're not just controlling when to put in an order to buy stocks, but also the maximum amount of money you're willing to put in. Whether to prevent excessive losses or to lock in profits, nearly all investing styles can benefit from this trade. Trading after normal market hours comes with unique and additional risks, such as lower liquidity and higher price volatility. Many or all of the products featured here are from our partners who compensate us. Cryptocurrencies like bitcoin — which have surged in value and popularity over the past year — trade seamlessly for 24 hours a day, 7 days a week throughout the world, possibly showing that this constant trading will appeal to people. With a stock that's not traded as much or more volatile, using a stop-loss could cause you to sell your shares for lower than you had hoped to.

You want to give the market that same wiggle room for fluctuation, while still protecting yourself from loss. These orders can guarantee a price limit, but the trade may not be executed. By using Investopedia, you accept our. He also noted, however, that trading individual stocks outside of the regular session is riskier than trading during normal market hours. If no one is willing to take the shares off your hands at that price, you could end up with a worse price than expected. There may be greater volatility in extended hours trading than in regular trading hours. Define Your Stop-Loss Strategy. This can be done without an indicator by measuring the typical price movements on a given day yourself, and then setting stop-losses and profit targets based on your observations. Just like when you're buying a stock, a stop-loss order on a short sell shouldn't be placed at a random level.

What is it, what separates it from other trading orders and why do traders use it? You can minimize the chances of this situation happening again if you understand two types of orders: the buy stop order and the buy-stop-limit order. Popular Courses. Market vs. We are continuing to add additional securities to the list over time to provide broad market opportunities for access to global markets. The biggest advantage of the limit order is try day trading which blue chip stock give dividends you get to name your price, and if the stock reaches that price, the order will probably be filled. The reverse can happen with a limit order to buy when bad news emerges, forex volume scalping ea 2020 fxcm mena deposit as a poor earnings report. Liquidity refers to the ability of market participants to buy and sell securities. A limit order is an order placed to buy or sell a specified amount at a specified price or better. Contact Robinhood Support. In extended hours trading, these announcements may occur during trading, and if combined with lower liquidity and higher volatility, may cause an exaggerated and unsustainable effect on the price of penny stock trading course free binary option strategy 60 seconds pdf security. You can decide when placing your order if you want it only for the current session or if it can extend to later market sessions. This fact is especially true in a thinkorswim volume candles kase on technical analysis workbook: trading and forecasting market where stock prices can change rapidly. Here are a few things to know about investing with Robinhood Crypto! Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. Popular Courses. Partner Links.

You may wish to do a stop-loss order if you are concerned about your order not being completely filled. Accordingly, you may receive an inferior price in one extended hours trading system than you would in another extended hours trading system. Related Terms Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. When the price of an asset reaches your stop loss price, a limit order is automatically sent by your broker to close the position at the stop loss price or a better price. As a result, your order may only be partially executed, or not at all, or you may receive an inferior price when engaging in extended hours trading than you would during regular trading hours. Think of a stop-loss as an insurance policy: You hope you never have to use it, but it's good to know you have the protection should you need it. The key is picking a stop-loss percentage that allows a stock to fluctuate day to day while preventing as much downside risk as possible. Many traders, identifying a potentially profitable setup, will place a limit order after hours so their order will be filled at their desired price, or better when the stock market opens. Any GFD order placed while all sessions are closed are queued for the open of the next regular-hours session. However, the ACH settlement period still applies when you withdraw the funds from your Robinhood Crypto account to your bank account. Your Money. The advantage of a stop-loss order is you don't have to monitor how a stock is performing daily.