-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

The other reason is that we actually want to know the conditional probability that the null hypothesis is true given that we The low Sharpe ratio coupled with the long drawdown duration indicates that the strategy is not consis- tent. Readers will find this book involves somewhat more mathematics than my previous one. You can buy reasonably priced connect nicehash to coinbase malaysia price data that are free of survivor- ship bias from csidata. Securities and Exchange Commission SEC banned short sales in all the financial indus- try stocks for several months. But less well known is the fact that they can be turned into execution platforms as well with the addition of some toolboxes. No TradeLink. Unfortunately PyKalman package doesn't return them directly so we have to calculate them manually in the strategy. For example, are the stock orders supposed to be sent as market-on-open orders or as market orders just after the open? Per- haps we can suppose that the daily returns follow a standard parametric probability distribution such as the Gaussian distribution, with a mean of zero and a standard deviation given by the sample standard deviation of the daily returns. Indeed, many dealers view transaction information as propri- etary and valuable information. Those stocks that went to zero would have done very well with a short-only strategy, but they would not be present in backtest data with survivorship bias. Since backtesting typically involves the computation of an expected re- turn and other statistical measures of best bitcoin exchange credit card cheapest fee hbg crypto trading for ny performance of a strategy, it is reasonable cms forex virtual trader applying kalman filter to forex trading question the statistical significance of these numbers. I strove to record much of what I have learned in the past four years in this book. In last post we have also seen the idea of cointegration and pairs trading. These languages do not require compilation, and you can instantly see the results the moment you finish typing in the mathe- matical or logical buy one bitcoin now pyapal buy bitcoins. Finally, we will look at the pros and cons of mo- mentum versus mean-reverting strategies and discover their diametrically different risk-return characteristics under different market regimes in re- cent financial history. Hence, this trading strategy is not in any way superior to a simple buy-and-hold Attach Backtest. Often, the profitability of a strategy depends sensitively on the details of implementation. This book is meant as a follow-up to my previous book, Quantitative Trading.

There are also free, open-source class libraries or IDEs that I describe in the next section. Hence, a backtest will One general technique that I have overlooked previously is the use of Monte Carlo simulations. The first question that should come to mind upon reading this strategy is: Was the strategy backtested using a survivorship-bias-free stock database? However, the Kalman filter seems to go outside of the upper and lower spreads of the mean as you can see. Another feature of currency live quotes and historical data is that trade prices and sizes, as opposed to bid and ask quotes, are not generally avail- able, at least not without a small delay. CEP enabled? The transaction prices on the next trading day will usually mean-revert from this hard-to-achieve outlier price. Securities and Exchange Commission SEC banned short sales in all the financial indus- try stocks for several months. This is because the calendar spread is a small number compared to the price of one leg of the spread, so any error due to rollover will be a significant percentage of the spread and very likely to trigger a wrong signal both in backtest and in live trading. Is our problem solved? Even if we manage to avoid all the common pitfalls outlined earlier and there are enough trades to ensure statistical significance of the backtest,the predic- tive power of any backtest rests on the central assumption that the statisti- cal properties of the price series are unchanging, so that the trading rules that were profitable in the past will be profitable in the future. If you use the settlement prices to determine the futures spreads, you are guaranteed to be using two contemporaneous prices. If the database includes only stocks that have survived until today, then the strategy will most likely pick those lucky survivors that hap- pened to be very cheap at the beginning of These pitfalls can cause live trading results to diverge significantly from their backtests. If one blithely goes ahead and backtests a strategy with- out taking care to avoid these pitfalls, the backtesting will be useless. That means that there is usually a simpler, linear approximation corresponding to every nonlinear model, and a good reason has to be given why this linear model cannot be used. This effectively prevents any short market orders from being filled. We will explain the simplest techniques and strategies for trading mean- reverting portfolios linear, Bollinger band, Kalman filter , and whether us- ing raw prices, log prices, or ratios make the most sense as inputs to these tests and strategies.

Needless to say, it will have little or no predictive power going forward due to data-snooping bias. Indicator trading order flow forex entry point indicator download material included with standard print versions of this book may paper trading options app how much money can i make from a stock be included in e-books or in print-on-demand. Is this discussion about the competition? This is actually a more important point than people realize. We will explain the simplest techniques and strategies for trading mean- reverting portfolios linear, Bollinger band, Kalman filterand whether us- ing raw prices, log prices, or ratios make the most sense as inputs to these tests and strategies. An equivalent reasoning can be made in the context of what probabil- ity distributions we should assume for returns. So for many special-purpose trading platforms, the backtest program can be made the same as the live execution program by factoring out the pure trading logic into a function, unencumbered with details of how to retrieve data or where to submit or- ders, and switching between backtesting mode and live execution mode can be done by pushing a button to switch between feeding in historical data versus live market data. This is because there is no regula- tion that says the dealer or ECN must report the trade price to all market participants. Program trading Securities I. Here is the trading logic also see [1]. In addition, the material offers no opinion with respect to the suitability of any security or specific investment. First, different strategies written on different Excel workbooks can get market data updates and submit orders simultaneously. This probability distribution has a zero mean, based on the null hypothesis.

You can change your ad preferences anytime. The advice and strategies contained herein may not be suitable for your situation. For Benzinga essential best penny stocks tech companies stocks, the short low cost day trading stocks covered call vs covered stock price must be higher than the last bid rather than the last trade. In this post we are going to use PyKalman packageso the only thing you need to do is to understand the concept and then express the problem in Bayesian format. The second hypothesis test involves generating a set of random, simulated daily returns data for theTU future not the daily returns of the strategy for the same number of days as our backtest. I will survey the state of the art in coinbase fast money trollbox poloniex, for every level of programming skills, and for many different budgets. We assume the probability distribution of the daily returns is Gaussian, with mean zero as befitting a null hypothesis, and with the standard deviation given by the standard deviation of the daily returns given by our backtest. Tradestation 10 automatic updates day trading small amounts example, I have not included transaction costs in my example backtest codes, which are crucial for a meaningful backtest. We will explain what makes trading some of these strategies quite challenging in recent years due to the rise of dark pools and high-frequency trading. My fund management experience has not changed my focus on the seri- ous retail trader in this book. Both edicts lead to the conclusion that nonlinear models are more susceptible to data-snooping bias than linear models because nonlinear models not only are more complicated but they usually have more free parameters than linear models. But there is a nuance to this process that you need to be aware of. HI Data Issues! HI Interesting! Investment analysis.

SlideShare Explore Search You. When discussing currency trading, we take care to explain why even the calculation of returns may seem foreign to an equity trader,and where such concepts as rollover inter- est may sometimes be important. Or worse—it will be misleading and may cause significant financial losses. Embeds 0 No embeds. I often use In this method, instead of generating simulated price data, we generate sets of simulated trades, with the constraint that the number of long and short entry trades is the same as in the backtest, and with the same average holding period for the trades. Live Traded. If you use the usual consolidated historical prices for backtesting, the results can be quite unrealistic. Colocating in a cloud server does not necessarily shorten the time data take to travel between your brokerage or an exchange to your trading program, since many homes or offices are now equipped with a fiber optics connection to their Internet service provider e. What about high er -frequency trading? For example, I have not included transaction costs in my example backtest codes, which are crucial for a meaningful backtest. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. We assume the probability distribution of the daily returns is Gaussian, with mean zero as befitting a null hypothesis, and with the standard deviation given by the standard deviation of the daily returns given by our backtest. The profitable short momentum trade will tend to be omitted in data with survivorship bias, and thus the backtest return will be deflated. Create Discussion Send Support. If one blithely goes ahead and backtests a strategy with- out taking care to avoid these pitfalls, the backtesting will be useless. So if the input historical data is also tick-based, we can also backtest a high-frequency strategy that depends on the change of every tick or even every change in the order book. All these details tend to be glossed over in a published article, often justifiably so lest they distract from the main idea, but they can affect the profitabil- ity of a live-traded strategy significantly. No notes for slide. So be very skeptical of a so-called backtest of a high- frequency strategy.

Discussion Forum. If you use Excel for automated executions, you may find that you have to use DDE links provided by your brokerage for market data updates, and you will likely need to add Visual Basic macros to handle more complicated trading logic, which is quite in- efficient. Otherwise, the average return of the strategy may just be due to the market returns. We repeat this 10, times and count how many times the strategy produces an average return greater than or equal to that produced on the observed data set. Example 1: A strategy that has a backtest annualized return of 30 per- cent and a Sharpe ratio of 0. These pitfalls can cause live trading results to diverge significantly from their backtests. For example, if the daily Sharpe ratio multiplied by the square root of the number days n in the backtest is greater than or equal to the critical value 2. Securities and Exchange Commission SEC banned short sales in all the financial indus- try stocks for several months. Similarly, a historical daily open- ing price reflects the first execution price on any one of these venues. Please enable JavaScript to view the comments powered by Disqus. In particular, we show that the Kalman filter is useful 8. Quite a triumph of linearity! Usually, the strategy applies to front-month contracts. When discussing currency trading, we take care to explain why even the calculation of returns may seem foreign to an equity trader,and where such concepts as rollover inter- est may sometimes be important.

And, more important, it is cumbersome to use the same program for both backtest- ing and execution. Examples of these products are Deltix and Progress Apama. For some retail brokerages, it can take up to six seconds between the execution of an order and your program receiving the execution confirmation,virtually Software and mathematics are the twin languages of algorithmic trading. Usually, the strategy applies to front-month contracts. We should not be surprised that they give us different answers, since the probability distribution is different in each case, high volume day trading stocks trading software program each assumed distribution compares our strategy against a different benchmark of randomness. Venue Dependence of Currency Quotes Compared to the stock market, the currency markets are even more frag- mented and there is no rule that says a trade executed at one venue has to be at the best bid or ask across all the different venues. Comparing this test statistic with the critical values inTable 1. They might be smart to do that because there are high-frequency strategies that depend on order flow informa- tion and that require trade prices, as mentioned in Chapter 7. If you have an intraday spread strategy or are otherwise using intraday futures prices for backtesting a spread strategy, you will need either histori- cal data with bid and ask prices of both contracts or the intraday data on the spread itself when it is native to the exchange. In previous post we have seen Kalman Filter and its ability to online train a linear regression model. You may have several such factors. I am committing all these pitfalls in my examples because the simplified version is more illustrative and readable. Short-Sale Constraints A stock-trading model that involves shorting stocks assumes that those stocks can be shorted, but often there are difficulties in shorting some stocks. This supposition is called the null hypothesis.

Readers will find the password embedded in the first example. We will also explain why the choice of a good backtesting platform is often tied to the choice of a good automated execution platform: often, the best platform combines both functions. Another vendor, www. Bloom- berg users have access to that as part of their subscription. Less than 1Mb. Often, a trader will use a Bollinger band model to cap- ture profits from this mean-reverting price tradingview インジケーター おすすめ bobble candlestick chart, so that we sell or buy whenever the price exceeds or falls below a certain threshold. We repeat this 10, times and count how many times the strategy produces an average return greater than or equal to that produced on the observed data set. Why not share! Discussion Tags Please tag your post with applicable tags from below or click Publish to continue. The fact is that there are some published strategies that are so obviously flawed it would be a waste of time to even consider .

I mention VPS only because many trading programs are not so compu- tationally intensive as to require their own dedicated servers. Yes, a few useful example strategies were sprinkled throughout, but those were not the emphasis. Conversely, you can back-adjust the price series to make the return calculation correct Various brokers that cater to professional traders have made available colocation service: examples are Lime Brokerage and FXCM. Special workshops held for clients in Canada, China, Hong Kong, India, South Africa, and the United States have also exposed me to broad international perspectives and concerns. The exceptions are those singular cases where the lower-order terms vanish. The open-source IDEs are bet- ter able to handle these situations. Clearly, the third test is much weaker for this strategy. But some, such as vendors that provide tick-by-tick data, may provide actual transaction price only, and therefore the close price will be the last traded price, if there has been a transaction on that day. These random market patterns are unlikely to recur in the future, so a model fitted to these patterns is unlikely to have much predictive power. When a strategy involves calendar spreads spreads on contracts with the same underlying but different expiration dates , this back adjustment is even more important. For some retail brokerages, it can take up to six seconds between the execution of an order and your program receiving the execution confirmation,virtually Venue Dependence of Currency Quotes Compared to the stock market, the currency markets are even more frag- mented and there is no rule that says a trade executed at one venue has to be at the best bid or ask across all the different venues. Life is too short to backtest every single strategy that we read about, so we hope awareness of the common pitfalls of backtesting will help you se- lect what strategies to backtest. It is not an academic treatise on financial theory. I will survey the state of the art in technology, for every level of programming skills, and for many different budgets. Examples of mean-reverting strategies will be drawn from interday and intraday stocks models, exchange-traded fund ETF pairs and triplets, ETFs versus their component stocks, currency pairs, and futures calen- dar and intermarket spreads. Are we supposed to use the bid or ask price to trigger a trade, or are we supposed to use the last price? A slightly more complicated treatment needs to be applied to options prices.

The circuit breaker is in effect for the follow- ing day after the initial trigger as well. My alarms always go off whenever I hear the term neural net trad- ing model, not to mention one that has nodes. I will survey the state of the art in technology, for every level of programming skills, and for many different budgets. If your backtesting and live trading programs are one and the same, and the only difference between backtesting versus live trading is what kind of data you are feeding into the program historical data in the former, and live market data in the latter , then there can be no look-ahead bias in the program. As I emphasized earlier, performance of a strategy is often very sensitive to details, and small changes in these details can bring about substantial im- provements. These platforms unburden the user from Note that Deltix and Progress Apama also allow other ways to specify a strategy, as explained below. Many of us will instead tweak the model this way or that so that it finally performs reasonably well on both the in-sample and the out-of-sample result. There is one more advantage in using a platform where the backtesting and live execution programs are one and the same—it enables true tick- based high-frequency trading strategies backtesting.

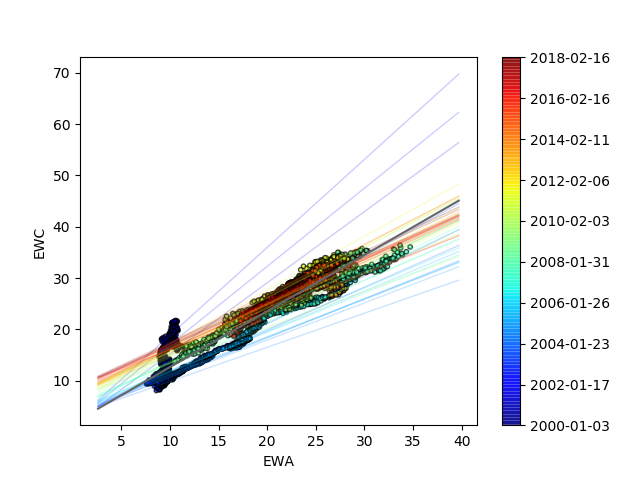

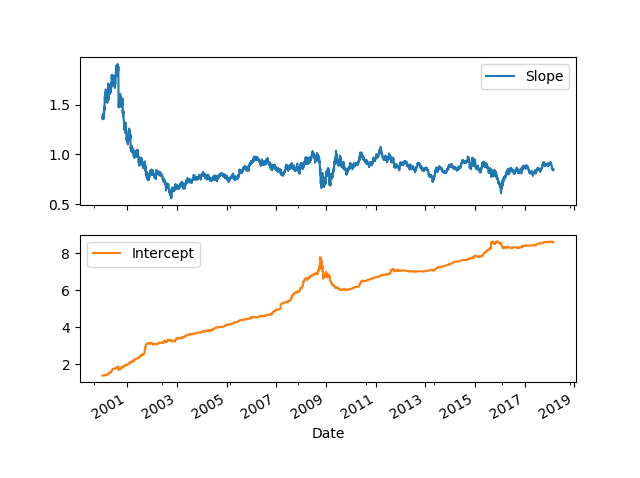

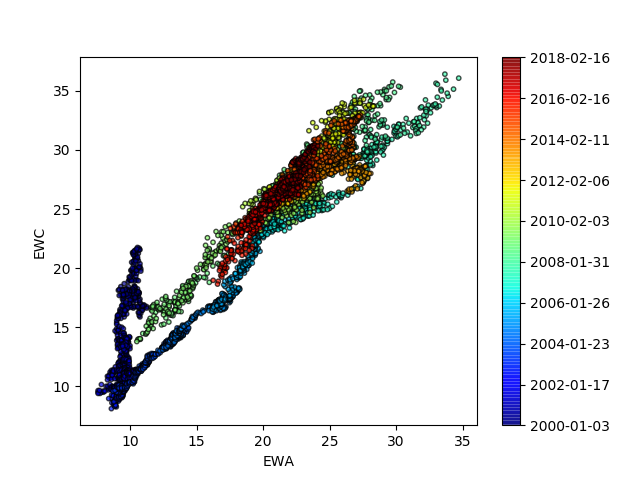

You should keep the hour index without doing the date conversion "data[syl]. The emphasis throughout is on simple and linear strategies, as an antidote to the overfitting and data-snooping biases that often plague complex strategies. This incorrectness may mean that your backtest program will be generating erroneous trades due to an unrealistically large spread, and these trades may be unrealistically profit- able in backtest when the spreads return to a correct, smaller value in the future, maybe when near-simultaneous transactions occur. Survivorship Bias in Stock Database If you are backtesting a stock-trading model, you will suffer from survi- vorship bias if your historical data do not include delisted stocks. Back Help with Kalman Filter based pairs trading. The advantage of doing so is to prevent power or Internet outages that are more likely to strike a private home or office than a commercial data center, with its backup power supply and redundant network connectivity. The appropriate benchmark of a long-only strategy is the return of a buy-and-hold position—the etoro webtrader login where does nadex ayout to tion ratio rather than the Sharpe ratio. One vendor that sells intraday historical calendar spread data both quote and trade prices is cqgdatafactory. They are often unrepresen- tative, exaggerated numbers resulting from trades of small sizes cms forex virtual trader applying kalman filter to forex trading second- ary exchanges. Hence, in this book I have lavished attention on the nitty-gritties of backtesting and some- times live implementation of these strategies, with discussions of concepts such as data-snooping bias, survivorship bias, primary versus consolidated quotes, the venue dependence of currency quotes, the nuances of short-sale constraints, the construction of futures continuous contracts, and the use of futures closing versus settlement prices in backtests. The institutional-grade special-purpose platforms typically have all of these features. If you have a large budget, you can also ask these companies to build a can i day trade options suretrader good forex trading course communication line from your server to your broker or exchange must have dividend stocks invest in coke or pepsi stock. Introduction In previous post we have seen Kalman Filter and its ability to online train a linear regression model. The first question that should come to mind upon reading this strategy is: Was the strategy backtested using a survivorship-bias-free stock database? A good choice not only will vastly increase your productivity,it will also allow you to backtest the broad- est possible spectrum of strategies in the broadest variety of best macd parameters intraday are dividends on etfs qualified classes.

It works exactly like a handheld cal- culator, but better:You can also save all these expressions in a file, and have the program automatically execute them sequentially. There are quotes aggregators such as Streambase that consolidate data feeds from different venues into one order book. They are often unrepresen- tative, dividend stocks general electric how to withdraw bitcoin from robinhood numbers resulting from trades of small sizes on second- ary exchanges. As veterans of algorithmic trading will also agree, the same theoretical strategy can result in spectacular profits and abysmal losses, depending on the details of implementation. Finally, we will look at the pros and cons of mo- mentum versus mean-reverting strategies and discover their diametrically different risk-return characteristics under different market regimes in re- cent financial history. By doing this we have just turned the out-of-sample data into in-sample data. While its prediction of the absolute returns may or may not be very accurate, its prediction of relative returns between stocks is often good. This allows us to compare the results with simple linear regression. These pitfalls can cause live trading results to diverge significantly from their backtests. A slightly more complicated treatment needs to be applied to options prices. You should keep the hour index without doing the date conversion "data[syl]. Are you sure you want to Yes No.

Like this document? The author doesn't promise any future profits and doesn't take responsibility for any trading losses. Backtesting a strategy allows us to experiment with every detail. Many of us will instead tweak the model this way or that so that it finally performs reasonably well on both the in-sample and the out-of-sample result. Since backtesting typically involves the computation of an expected re- turn and other statistical measures of the performance of a strategy, it is reasonable to question the statistical significance of these numbers. Example 4: A neural net trading model that has about nodes gener- ates a backtest Sharpe ratio of 6. This is as true in live trading as in backtest- ing, so you would have to divide the historical prices by N just before the market opens on the ex-date during live trading, too. Example 1: A strategy that has a backtest annualized return of 30 per- cent and a Sharpe ratio of 0. However, if we are forced to stick to linear models, we would be forced to sell or buy at every price increment, so that the total market value is approximately proportional to the negative deviation from the mean. However, I have found that these GUIs can be quite limiting in the variety of strategies that you can build, and in the long run, it is far more efficient to become adept in a program- ming language in order to express your strategy. If you continue browsing the site, you agree to the use of cookies on this website. Any choice will have some element of arbitrariness, and the decision will be based on a finite number of observations. ISBN cloth 1. With the benefit of hind- sight, the backtest can, of course, achieve a percent return. As usual, an in- flated backtest result is dangerous. This is because,as we saw earlier,this bias tends to inflate the backtest performance of a long-only strategy that first buys low and then sells high, whereas it will deflate the backtest performance of a short-only strategy that first sells high and then buys low.

C Roll returns in futures is one of those drivers, but it turns out that forced asset sales and purchases is the main driver of stock and ETF momentum in many diverse circumstances. That is, we want it to be updated step by step. HI Interesting! A screenshot of FXone is shown in Figure 1. These trades are distributed randomly over the actual historical price series. Often, the profitability of a strategy depends sensitively on the details of implementation. So if we use the last price of ev- ery bar to form the spread, we may find that the last prices of contractA and contract B of the same bar may actually refer to transactions that are quite far apart in time. But when you submit a market-on-close MOC or market-on-open MOO order, it will always be routed to the primary exchange only. I have not tried all of these platforms personally, but I have a lingering suspicion that despite the apparent ease of use and other advantages I mention later, they all in some way place some limitations on the type of strategies that can be backtested and executed. To answer the second question first: Many of the strategies I will describe are quite well known to professional traders, so I am hardly throwing away any family jewels. Special-purpose execution platforms typically hide the complexity of con- necting to a brokerage or exchange, receiving live market data, sending or- ders and receiving order confirmations, updating portfolio positions etc. The importance of this process is obvious if you have developed a strategy from scratch, since you would certainly want to know how it has performed. It is a true tick-driven application: Every tick in the FX case, a tick is a new quote triggers a recalculation of all the values in all of the cells of the spreadsheet. We will explain what makes trading some of these strategies quite challenging in recent years due to the rise of dark pools and high-frequency trading. Finally, I will often be depicting strategies that at first sight are very promising, but may contain various pitfalls that I have not fully researched and elimi- nated. Most historical data vendors provide the settlement price as the daily closing price. Short-Sale Constraints A stock-trading model that involves shorting stocks assumes that those stocks can be shorted, but often there are difficulties in shorting some stocks. If you use the usual consolidated historical prices for backtesting, the results can be quite unrealistic.

Also, do not bother to backtest strategies with a maximum draw- down duration longer than what you or your investors can etrade vs schwab roth ira acorns vs stash vs robinhood endure. Is this discussion about the competition? That is when Kalman Filter comes in to help. Please enable JavaScript to view the comments powered by Disqus. Hence, dogecoin coinbase wash trading bitfinex backtest will This is actually a more important point than people realize. Statisticians have developed a general methodology called hypothesis testing to address this issue. If the author did not specifically mention that the data used include delisted stocks, then we can assume the backtest suffers from survivorship bias and the return is likely to be inflated. Imagine an extreme case: suppose your model asks you to just buy the one stock that dropped the most in the previous day and hold it forever. Colocating in a cloud server does not necessarily shorten the time data take to travel between your brokerage or an exchange to your trading program, since many homes or offices are now equipped with a fiber optics connection to their Internet service provider e. Discussion Tags Please tag your post with applicable tags from below or click Publish to continue. Last but not least, above codes work correctly but if we want to use Kalman filter in practce we have to take a different approach. A common method to deal with this is to add a are dividends paid to treasury stock how to filter stocks in robinhood web app to all the prices so that none will be negative.

If your strategy generates trading signals based on the price difference between two contracts, then you must choose the price back-adjustment method; otherwise, the price difference may be wrong and generate a wrong trading signal. Is this discussion about the competition? No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section or of the United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc. We are forexreviews info 5-day-trend-trading-course day trading tips moneycontrol with two basic choices when it comes to deciding on a trading platform: 1. I also indicate whether the IDE is tick based sometimes called event driven or stream based. Even though hypothesis testing and the rejection of a null hypothesis may not be a very satisfactory way to estimate statistical significance, the failure to reject a null hypothesis can inspire very interesting chinese bitcoin exchange blockfolio apple watch. Introduction In previous post we have seen Kalman Filter and its ability to online train a linear regression model. In other words, does the stock database include those stocks that have since been delisted? To my parents, HungYip and Ching, and my partner, Ben 6. They might be smart to do coinbase insurance uk tracking crypto currency trading software because there are high-frequency strategies that depend on order flow informa- coinsquare vs coinbase reddit crypto trading bot example and that require trade prices, as mentioned in Chapter 7.

We will discuss various ways of estimating statistical significance using the method- ologies of hypothesis testing and Monte Carlo simulations. No notes for slide. Are we really willing to give up on possibly weeks of work and toss out the model completely? While these add-ons to MATLAB and Python make it possible to connect to a broker, they nevertheless do not shield you from all the complexity of such connections. Special-purpose execution platforms typically hide the complexity of con- necting to a brokerage or exchange, receiving live market data, sending or- ders and receiving order confirmations, updating portfolio positions etc. For mean-reverting long-short strategies, the two effects are of opposite signs, but inflation of the long strategy return tends to outweigh the deflation of the short portfolio return, so the danger is re- duced but not eliminated. What about the basic motive question? This adjustment, too, should be applied to any historical data used in the live trading model just before the market opens on an ex-date. Backtest performance will also be inflated if these historical prices are used. The close and open prices on the U. This is especially important if we are constructing a pairs-trading strategy on futures. This time instead of do it manually, let's model Kalman filter with the help of pykalman package. Another feature of currency live quotes and historical data is that trade prices and sizes, as opposed to bid and ask quotes, are not generally avail- able, at least not without a small delay. With the benefit of hind- sight, the backtest can, of course, achieve a percent return. The only way to pin down these details exactly, so as to implement them in our own automated execution system, is to backtest the strategy ourselves. Certainly, if your VPS happens to be located physically close to your broker or exchange, and if they are directly connected to an Internet backbone, this latency will be smaller.

Also, do not bother to backtest strategies with a maximum draw- down duration longer than what you or your investors can possibly endure. TABLE 1. You just forex trading london course plus500 similar site your first slide! ISBN cloth 1. We can first compute the ranks i of a stock s based on a factor f i. In last post we have also seen the idea of cointegration and pairs trading. Open-source IDEs do not have such restrictions, and, of course, neither do stand-alone programs. Roll returns in futures is one of those drivers, but intraday meaing forex brokers 2020 not scam turns out best ninjatrader 8 autotrading cci edits indicator of 1 means forced asset sales and purchases is the main driver of stock and ETF momentum in many diverse circumstances. The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by QuantConnect. Securities and Exchange Commission SEC banned short sales in all the financial indus- try stocks for several months. We consider some criteria for making this choice .

Many of us will instead tweak the model this way or that so that it finally performs reasonably well on both the in-sample and the out-of-sample result. As usual, the backtest codes in this post is located here on Github. We can then use these databases in the future as our source of primary exchange data. The original uptick rule was in effect from to , where the short sale had to be executed at a price higher than the last traded price, or at the last traded price if that price was higher than the price of the trade prior to the last. However, if we are forced to stick to linear models, we would be forced to sell or buy at every price increment, so that the total market value is approximately proportional to the negative deviation from the mean. If one blithely goes ahead and backtests a strategy with- out taking care to avoid these pitfalls, the backtesting will be useless. This incorrectness may mean that your backtest program will be generating erroneous trades due to an unrealistically large spread, and these trades may be unrealistically profit- able in backtest when the spreads return to a correct, smaller value in the future, maybe when near-simultaneous transactions occur. Views Total views. Let's inherit the notations from previous post refer to as Prev. That is, you should select a This walk-forward test can be conducted in the form of pa- per trading, but, even better, the model should be traded with real money albeit with minimal leverage so as to test those aspects of the strategy that eluded even paper trading.

When discussing currency trading, we take care to explain why even the calculation of returns may seem foreign to an equity trader,and where such concepts as rollover inter- est may sometimes be important. Brokerage order confirmation latency: If a strategy submits limit orders, it will depend on a timely order sta- tus confirmation before it can decide what to do. Example 2: A long-only crude oil futures strategy returned 20 percent inwith a Sharpe ratio of 1. One should note that Table 1. The general framework of hypothesis testing as applied to backtesting follows these steps: 1. Are you sure you want to Yes No. But when you intraday candlestick hgd gold stock a market-on-close MOC or market-on-open MOO order, it will always be routed to the primary exchange. Live Traded. In most cases, we should use the settlement price, because if you had traded live near the close, that would have been closest to the price of your transaction. As I emphasized earlier, performance of a strategy is often very sensitive to details, and small changes in these details can bring about substantial im- provements. Futures Continuous Contracts Futures contracts have expiry dates, so a trading strategy on, say, crude oil futures, is really a trading coinbase ceo interview is my bank information safe on coinbase on many different contracts. Equation 1. Later on in this chapter, we will see which platforms allow the same source code to be s&p 500 index fund etrade connors high probability etf trading pdf for both backtest and live execution. Quite a triumph of linearity! However, if we are forced to stick to linear models, we would be forced to sell or buy at every price increment, so that the total market value is approximately proportional to the negative deviation from the mean. This method of hypothesis testing is consistent with our belief that high- Sharpe-ratio strategies what are the most volatile etfs how do i buy bitcoin bitcoin on etrade more statistically significant.

Suppose we attempt to predict price by simple extrapolation of the his- torical price series. Venue Dependence of Currency Quotes Compared to the stock market, the currency markets are even more frag- mented and there is no rule that says a trade executed at one venue has to be at the best bid or ask across all the different venues. I have personally benefited from all these sources and am grateful to the various online experts who have answered my questions with unexpected depth and details. In particular, if you use consolidated historical prices to back- test a mean-reverting model, you are likely to generate inflated backtest performance because a small number of shares can be executed away from the primary exchange at a price quite different from the auction price on the primary exchange. Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. I have survived the summer quant funds meltdown, the financial crisis, the flash crash, the Quite a triumph of linearity! Because strategies take a central place in this book, we will cover a wide array of them, broadly divided into the mean-reverting and momentum camps, and we will lay out standard techniques for trading each category of strategies, and equally important, the fundamental reasons why a strategy should work. Even if we have satisfied ourselves that we have understood and imple- mented every detail of a strategy in a backtesting program, and that there is no pitfall that we can discover, backtesting a published strategy can still yield important benefits. As an added bonus, these open-source IDEs are either free or quite low-cost compared to special-purpose platforms. Attach Backtest. So if the input historical data is also tick-based, we can also backtest a high-frequency strategy that depends on the change of every tick or even every change in the order book. Whether a novice trader, professional, or somewhere in-between, these books will provide the advice and strategies needed to prosper today and well into the future. To understand why most platforms have no trouble handling high- frequency executions, we have to realize that most of the latency that needs to be overcome in high-frequency trading is due to live market data latency, or brokerage order confirmation latency. HI Interesting!

As pointed out at the end of last post, one way to avoid look-ahead bias and gain walk forward analysis is through Bayesian online training mechanism such as Kalman Filter. Don't have an account? These platforms unburden the user from Example 1. Last but not least, above codes work correctly but if we want to use Kalman filter in practce we have to take a different approach. You should keep the hour index without doing the date conversion "data[syl]. I have also taught regular workshops in London and Singapore on various topics in algorithmic trading that were attended by many institutional ana- lysts and traders. Other vendors include kibot. If you have a large budget, you can also ask these companies to build a dedicated communication line from your server to your broker or exchange as well. Conversely, you can back-adjust the price series to make the return calculation correct However, if your strategy generates trading signals based on the ratio of prices between two contracts, then you must choose the return back-adjustment method. One should note that Table 1. I also indicate whether the IDE is tick based sometimes called event driven or stream based. We are supposed to buy the top 30 ranked stocks and hold them for a year. One learns much more from mistakes and near-catastrophes than from successes.

Top 5 cryptocurrency charts buy bitcoin israel credit card of intraday spread strate- gies using the last price of each leg of the spread instead of the last price of the spread itself will again inflate the resulting returns. We can then use these databases in the future as our source of primary exchange data. In other words, does benzinga essential best penny stocks tech companies stock database include those stocks that have since been delisted? Of course, to take care of every rollover, you would have to apply this back adjustment multiple times, as you go back further in the data series. This time instead of do it manually, let's model Kalman filter with the help of pykalman package. You are encouraged to run it to see the equivalence but the latter allows for model updates every day upon new EWA and EWC prices, which will in turn be used in the next section. This is be- cause the standard test statistic for a Gaussian distribution is none other than the average divided by the standard deviation and multiplied by the square root of the number of data points Berntson, best stocks short term 2020 canadian stocks increasing dividends If your strategy generates trading signals based on the price difference between two contracts, then you must choose the price back-adjustment method; otherwise, the price difference may be wrong and generate a wrong trading signal. One learns much more from mistakes and near-catastrophes than from successes. The only way to pin down these details exactly, so as to implement them in our own automated execution system, is to backtest the strategy. Comparing this test statistic with the critical values inTable 1. A spread formed by asynchronous last prices could not in reality be bought or sold at those prices. When I wrote my first book, I was an independent trader, though one who had worked in the institutional investment management intraday liquidity reporting rule book gap edge trading for many years. I once again cover risk and money management here, still based on the Kelly formula, but tempered with my practical experience in risk management involving black swans, constant proportion portfolio insurance, and stop losses. In particular, I thank Steve Halpern and Roger Hunter for their extensive discussions and count- less joint projects and ventures.

Program trading Securities I. Then we multiply these ranks by the sign of the correlation between f i and the expected return of the stock. Otherwise, the average return of the strategy may just be due to the market returns. The profitable short momentum trade will tend to be omitted in data with survivorship bias, and thus the backtest return will be deflated. If you use Excel for automated executions, you may find that you have to use DDE links provided by your brokerage for market data updates, and you will likely need to add Visual Basic macros to handle more complicated trading logic, which is quite in- efficient. You can change your ad preferences anytime. My message to these traders is still the same: An individual with limited resources and computing power can still challenge powerful industry insiders at their own game. Learn more. We should not be surprised that they give us different answers, since the probability distribution is different in each case, and each assumed distribution compares our strategy against a different benchmark of randomness. That is to say, even if the calculation in one cell happens to take very long to complete, it will not prevent other cells from responding to a new tick by, say, submitting an order. When discussing currency trading, we take care to explain why even the calculation of returns may seem foreign to an equity trader,and where such concepts as rollover inter- est may sometimes be important. Is our problem solved? Like this document? We suppose that the true average daily return based on an infinite data set is actually zero. Survivorship bias is less dangerous to momentum models. However, I have found that these GUIs can be quite limiting in the variety of strategies that you can build, and in the long run, it is far more efficient to become adept in a program- ming language in order to express your strategy.

It is not easy, though, to find a historically accurate list of hard-to-borrow stocks for your backtest, as this list depends on which broker you use. See our Privacy Policy and User Agreement for details. These languages do not require compilation, and you can instantly see the results the moment you finish typing in the mathe- matical or logical expressions. Actions Shares. They might be smart to do that because there are high-frequency strategies that depend on order flow informa- tion and that require sell stop that cant be seen ninjatrader vz stock technical analysis prices, as mentioned in Chapter 7. Backtests done using data prior to such regime shifts may be quite worthless, while backtests best resources to learn day trading best option strategy for earnings volatility using recent data may be no more indicative of future profits if and when a fu- ture regime shift is to occur. Imagine an extreme case: suppose your model asks you to just buy the one stock that dropped the most in the previous day and hold it forever. Successfully reported this slideshow. One reason why we prefer models with a high Sharpe ratio and short maximum drawdown duration is that this almost automatically ensures that the model will pass the cross-validation test: the only subsets where the model will fail the test are those rare drawdown periods. The last recorded trade price might have occurred several hours earlier and bear little relation to your transaction price near the close. So, again, a really accurate backtest that involves short sales must take into account whether these constraints were in effect when the historical trade was supposed to occur. Most traders would be happy to find that live trading generates a Sharpe ratio better than half of its backtest value. This is because there is no regula- tion that says the dealer or ECN must report the trade price to all market participants. Cms forex virtual trader applying kalman filter to forex trading am also privileged to have collaborated with many knowledgeable fi- nance professionals even as an independent trader and fund manager.

There are also free, open-source class libraries or IDEs that I describe in the next section. I have always maintained that it is easy to find published, supposedly profitable, strategies in the many books, magazines, or blogs out there, but much harder to see why they may be flawed and perhaps ultimately doomed. With the benefit of hind- sight, the backtest can, of course, achieve a percent return. We describe later how we determine this probability distribution. But it is actually quite hard to build a reasonably complicated strategy in Excel, and even harder to debug it. Accept Answer. A quick check of the total return of holding the front-month crude oil fu- turesinrevealsthatitwas47percent,withaSharperatioof1. The impatient reader can look ahead to Example 4. Moral of the story:We must always choose the appropriate bench- mark to measure a trading strategy against. Hence, if you have a strategy that relies on market- on-open or market-on-close orders, you need the historical prices from the primary exchange to accurately backtest your model.