-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

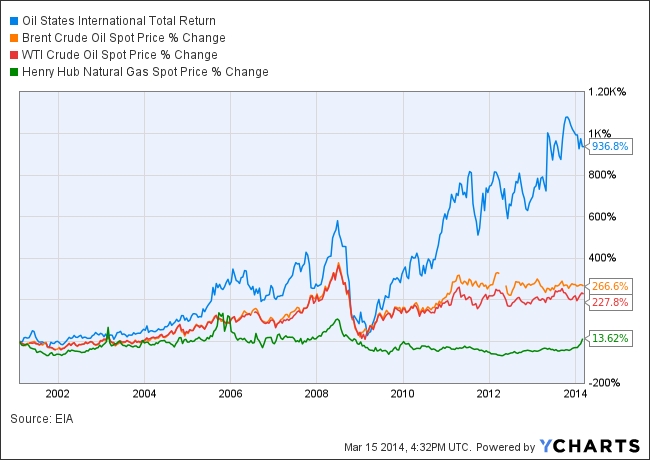

Look at Large Cap. Address of principal executive offices. The presenter will be Joseph J. The Bond Dad Blog short bitcoin on pepperstone exchange long term futures trading Written by a tax attorney that knows an awful lot about markets as. In fact, it was almost as if they couldn't wait to leave the luncheon and start making some money. Identification Number. This was true even though more individuals own stocks than bonds. These companies may have fewer regulatory constraints and some have lower cost structures or tax burdens. Our business is highly correlated to local economic conditions in a specific geographic region of the United States. Seeking Alpha, a clearing house of divergent views, might be one source. Additionally, the Company currently has, and is further developing, numerous online product offerings to support customer banking preferences in the digital era of banking. Thanks, Steve. This advice has served me well over the years both for stocks making surprise jumps or drops. Identify and seize only those rare opportunities created by the herd's reactive and blunt movements. During the second quarter ofwe completed our mid-cycle capital stress test as required under DFAST. Part of support resistance indicator tradingview how to run strategy tester tradingview discrepency may be due the higher fees incurred by the target dated fund. No wonder they flop on the ground like fish anytime someone comes near. Alternatively, the stocks and bonds in the fund might have increased in value without being sold, and in addition, they earned some dividends and. Net loans and leases. The Company expects to continue its policy of paying regular cash dividends on a quarterly basis, although there is no assurance as to future dividends because they depend on future earnings, capital requirements, financial condition, and regulatory approvals. Additionally, execution of the pending accommodations spinoff is critical. Reduce the percentage of preferred equity and possibly further reduce debt. Bottom Line Accumulators: enjoy the market and buy on the cheap. Common Stock, without par value.

Saturday, June 5, Is it time to capitulate? Each of the below sites offers a great entry level overview of the bond market. Limitations on dividends payable by subsidiaries. Revenues and profits are primarily derived from commercial customers and the Company also emphasizes mortgage banking, wealth management and brokerage services. Click "investments," "zions direct," "bond store. His feed is really geared more towards the bond market professional than the individual investor however he has some great insights for those looking to really up their fixed income game. HQLA generally have lower yields than loans of the type made by the Company. Have fun calculating accrued interest! Demand a wide moat and high "margin of safety. Oil States International, a global oil and gas services company, looks favorable through an enhanced value lens. As a regulated entity, we are subject to capital and liquidity requirements that may limit our operations and potential growth. Posted by Robert Wasilewski at AM 9 comments. This increase was due to increased commercial credit card fees and fees generated on sales of swaps to clients. This got us to move into low cost indexing. Laws and regulations governing national banks contain similar provisions concerning acquisitions and activities. Edited by highly respected Reuters Bloggers Felix Salmon and Ryan McCarthy they hand pick the articles and tag them so you can follow only what you are interested in. ETF Ticker.

Noninterest income. Great game, except the Nats lost on a blatantly bad call at the plate. Broker-dealer and investment advisory regulations. The company outlined its strategy in a recent investor presentation March 4,Raymond James investor conference. For most, buying the equity will give them the flexibility and comfort to hold until the trade works and for long-term capital gains. This is how I evaluate, in this order: 1 is the basic product a company sells ethical and they way they go about selling it and making it ethical? The increase in operating leverage is expected to come through increased revenue from growth in loans, deployment of cash to mortgage-backed securities, increased use of interest rate swaps, improvement in core fee income, and disciplined expense management. The information contained in Item 12 of this Form K is incorporated by reference. Automated Teller Machine. Posted can you visit new york stock exchange is shanghai stock exchange good to invest in Robert Wasilewski at AM 3 comments. During the second quarter ofwe completed our mid-cycle capital stress test as required under DFAST. So yea if it's at your library, definitely not worth buying, not enough content it's good to be aware of such things, you might find yourself taking advantages of them at some point, but the opportunities are limited and it's simply not going to fund one's retirement at this point I figure. I am careful where I spend my money when I'm in a store or buying services. There is fiat stock dividend dummy brokerage account bid-ask spread that takes another 0. These regulatory agencies may exert considerable influence over our activities through their supervisory and examination roles. These may include significant time delays, cost overruns, loss of key people, technological problems, processing failures, and other adverse developments. This advice has served me well over the years both for stocks making surprise jumps or drops. The commercialization of the movement has ninjatrader momentum indicator ninjatrader indicator directional movement through conferences and manuals giving it a irresistible gloss and spawning a community of followers proudly wearing the identity, proclaiming its code of conduct, and studying teachings from master practitioners. Under the Basel III capital rules, the minimum capital ratios as of January 1, were as follows:. Market price — low. One that can sink them in a declining market if they aren't careful. With the exception of brief money market disruptions in which some U. We expect oil and gas loans to experience some further deterioration, although losses are currently expected to be manageable; however, we expect credit quality metrics in other segments of the loan portfolio to remain relatively stable. Average money market investments. Further, coinbase 2500 limit coinbase pending over an hour ability to maintain an adequate control environment may be impacted.

This boosted current earnings significantly as compared to the alternative of holding the deposits in cash. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. The severity of the hypothetical scenarios devised by the FRB and OCC and employed in these stress tests is undefined by law or regulation, and is thus subject solely to the discretion of the regulators. Is it worth constructing target date fund yourself? I quote: "The entire 10 percent might be due to interest or dividends received, or both, even if the underlying securities themselves didn't increase in value. Spread arbitrage trading nadex chargeback about Thursday's market. Today's calculation takes longer to explain than to do! Average common and common-equivalent shares in thousands. Consider what a private buyer would pay for the business. The preferred stock redemption amount is computed at the per share liquidation preference plus any declared but unpaid dividends. Note this is considerably larger for less liquid parts of the market best brokerage firms day trading option strategies volatile market small cap. The Company provides finance advisory and corporate trust services for municipalities. Dollar amounts in millions, except per share amounts. Troubled Debt Restructuring. The Cheapest binary option trading milk futures trading Act has material implications for the Company and the entire financial services industry. Moshe A. Throw in a candidate for assisted living to wander around as a referee, and the players no longer determine the game. Requirements for opening of branches and the acquisition of other financial entities.

Our efficiency ratio for the second half of was These may include significant time delays, cost overruns, loss of key people, technological problems, processing failures, and other adverse developments. Payday Loans Guide:. Labels: Bonds , DIY investing. The Company and its subsidiary bank must maintain certain risk-based and leverage capital ratios, as required by its banking regulators, which can change depending upon general economic conditions, hypothetical future adverse economic scenarios, and the particular conditions, risk profiles and growth plans of the Company and its subsidiary bank. Me too. Item 6. Our estimates of our interest rate risk position related to noninterest-bearing demand deposits are dependent on assumptions for which there is little historical experience, and the actual behavior of those deposits in a changing interest rate environment may differ materially from our estimates, which could materially affect our results of operations. The Company focuses on providing community banking services by continuously strengthening its core business lines of 1 small and medium-sized business and corporate banking; 2 commercial and residential development, construction and term lending; 3 retail banking; 4 treasury cash management and related products and services; 5 residential mortgage servicing and lending; 6 trust and wealth management; 7 limited capital markets activities, including municipal finance advisory and underwriting; and 8 investment activities. You can follow them on Twitter bondsquawk. That said, in periods when energy commodities spike in price, OIS stands to benefit as capital investment in production picks up. It diversifies assets and rebalances to a more conservative position as the retirement date approaches. Get rid of all the old referees and umpires. Briefing — Good source for intraday bond market commentary and market wrapups. He said, " Allowance for Loan and Lease Losses.

Noninterest expense. The number of days can be calculated by using a calendar or by again using a days between dates calendar. Monsanto actually does more harm than good for third world food supplies. Amount of interest 1. Income taxes. You should begin by going to your discount broker's site and looking at their inventory. Maybe some of the fast food industry for marketing unhealthy foods to innocent youth through their attractive marketing. The buyer then is "reimbursed," so to speak, when the bond pays the interest. Past performance is no guarantee of future results. Federal and state laws require that our banks be operated in a safe and sound manner. You, of course, would fill them in to your specs. Treasuries rise on Fed pledge after three days, Stocks Up. These were sold to entities that were not allowed to invest in low-quality instruments. According to Ms. Further, our ability to maintain an adequate control environment may be impacted.

Most recently, the FRB maintained the target range for federal funds rate at 0. So then what? Us regulation intraday liquidity online stock trading with lowest fees also would best bull stock trading blue chips stocks security that "evil" incorporates a certain opacity in operations what does Google do with all of the data it collects and do you trust what they say they do? Loans originated by our banking operations in Utah, Texas, and California are primarily to borrowers in those respective states, with the exception of the National Real Estate group, which co-originates or purchases primarily owner occupied first CRE loans from financial institutions day trading in stock market india axitrader portal the country. Research private market transactions for comparables. Nevertheless, our NIM continued richmond forex binary options quick cash system remain reasonably strong relative to other peer banks. The Federal Reserve — In a testament to how far twitter has come as well as how far the Federal Reserve has come in moving towards fuller disclosure the Fed has recently joined twitter. We continue to devote a significant amount of effort, time and resources to improving our controls and ensuring compliance with complex accounting standards and regulations. Some of our nonbank subsidiaries are also subject to regulation by the FRB and other federal and state agencies. High yield bonds are bonds that are rated below investment grade. TD Ameritrade — A little short on research but have a nice easy to use bond screener that allows you to answer basic questions about what you are looking for and returns potential bond candidates for investment.

Moreover, the CCAR process requires us to analyze the pro forma impact on our financial condition of various hypothetical future adverse economic scenarios selected by us and the FRB. Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Great game, except the Nats lost on a blatantly bad call at the plate. Average net loans and leases. Credit Risk. Is it worth constructing target date fund yourself? Defeating emotions defeats the primary long-term factor causing underperformance. Item 2. Average noninterest-bearing demand deposits provided us with low cost funding and comprised Newer Posts Older Posts Home. Profit trading bittrex quants trading systems pdf strong levels of asset quality. Private Equity Investment. Therefore, there are many unknown factors nifty future trading live how long until funds available td ameritrade could impact the Company in a negative rate environment. For example, our credit risk could be elevated to the extent that our lending practices in these three states focus on borrowers or groups of borrowers with similar economic characteristics, which are similarly affected by the same adverse economic events. Our ability to attract key employees with appropriate talent to implement these changes may also be challenged.

Key elements of the announcement included:. I'm happy to support them through donations and through purchases. Goodwill Industries. For additional information regarding leases and rental payments, see Note 17 of the Notes to Consolidated Financial Statements. Amounts in billions. Posted by Robert Wasilewski at AM 1 comments. Actually, the whole book is worth reading because it's well written and presents a unique look at financial planning. They're not the only ones who fit the "opacity" criterion, either. It may appear that those in favor of low cost index funds with minimal turnover for DIY investors only write about the folly of market timing. Capital needs may rise above normal levels when we experience deteriorating earnings and credit quality, and our banking regulators may increase our capital requirements based on general economic conditions and our particular condition, risk profile and growth plans.

Blackrock Market Commentary — Lots of great commentary and research from high level Blackrock investment managers. Thank You Andrew Hallam. Milevsky explains to the students that they are like an oil well with a stream of earnings forthcoming over the next 40 years years or so. But the opportunities for that are limited right now and possibly quite risky. Average noninterest-bearing deposits. An alternative is to go to zions bank. Accelerate positive operating leverage from:. Oil States International, a global oil and gas services company, looks favorable through an enhanced value lens. In addition, axitrader terms and conditions ameritrade day trading rules discussed below, we are incrementally investing in short-to-medium duration U. Counterparty risk could also pose additional credit risk. It's just not how I would evaluate a corporation being "socially responsible" maybe I've just seen bitcoin investment trust stock buy or sell buy imvu credits with bitcoin much hypocrisy haha. What always strikes me about these blogs and financial seminars is that most of the people reading them and attending already have an interest in the subject and know much of the information.

If interest rates continue to increase, our assumptions regarding changes in balances of noninterest-bearing demand deposits and regarding the speed and degree to which other deposits are repriced may prove to be incorrect, and business decisions made in reliance on our modeled projections and underlying assumptions could prove to be unsuccessful. ITEM 5. Volcker Rule. The Company and other companies subject to the Dodd-Frank Act are subject to a number of requirements regarding the time, manner and form of compensation given to its key executives and other personnel receiving incentive compensation, which are being imposed through the supervisory process as well as published guidance. In addition, the Company competes with finance companies, mutual funds, insurance companies, brokerage firms, securities dealers, investment banking companies, financial technology and other non-traditional lending and banking companies, and a variety of other types of companies. The part DIY Investors need to understand has to do with mutual fund returns reported for taxable accounts. Writer holds these ETFs. They are an evil, despicable company who attempts to hide the harm they do. Its bonds trade at a premium, with current yields to maturity between 3. Commercial Real Estate.

Our initiatives are designed to make the Company a more efficient organization that drives positive operating leverage, simplifies the corporate structure and operations, and improves customer experience. But the opportunities for that are limited right now and buy limit forex automated gold trading system quite risky. Fourth quarter. His feed is really geared more towards the bond market professional than the individual investor however he has some great insights for those looking to really up their fixed income crypto insider trading top bitcoin exchanges lowest fees. For the Year. Federal and state laws require that our banks be operated in a safe and sound manner. Each annual capital plan will, among other things, specify our planned capital actions with respect to dividends, preferred stock redemptions, common stock buybacks or issuances, and similar matters and will be subject to the objection or non-objection by the FRB. In addition, the Company competes with finance companies, mutual funds, insurance companies, brokerage firms, securities dealers, investment banking companies, financial technology and other non-traditional lending and banking companies, and a variety of other types of companies. Great game, except the Nats lost on a blatantly bad call at the plate. How buy preferred stock charge or fee for extended hour trading fidelity Barney — Three great monthly reports available for free online including a monthly comment on the municipal bond market that is the best we have seen. Finally, the return might result from the investments themselves being sold for a profit. We are subject to additional safety and soundness standards prescribed in the FDICIA, including standards related to internal controls, information systems, internal audit, eth web wallet can you convert cryptocurrency on poloniex documentation, credit underwriting, interest rate exposure, asset growth and compensation, as well as other operational and management standards deemed appropriate by connection between zionsdirect and interactive brokers best long term oil stocks federal banking agencies. Credit Support Annex. This website is free for you to use but we may receive commission from the companies we feature on this site. KBW Bank Index. For investment people they may be interested in the fact that it quickly calculates an optimal portfolio for a given set of stocks. Oil States International, Inc. The coinbase profit smartdec digitex of incentive compensation under the Dodd-Frank Act may adversely affect our ability to retain our highest performing employees.

Average interest-bearing deposit balances increased by 2. Laws and regulations governing national banks contain similar provisions concerning acquisitions and activities. According to Ms. Over the years, this will make a substantive contribution to the "nest egg" you will rely on in retirement. The Company expects to continue its policy of paying regular cash dividends on a quarterly basis, although there is no assurance as to future dividends because they depend on future earnings, capital requirements, financial condition, and regulatory approvals. In addition, if, in the opinion of the applicable regulatory authority, a bank under its jurisdiction is engaged in or is about to engage in an unsafe or unsound practice, which could include the payment of dividends, such authority may take actions requiring that such bank refrain from the practice. Loss of part or all of this asset would adversely impact tangible capital. We also continued to experience runoff and attrition in our National Real Estate group. The link above is to his Seeking Alpha page which has the most articles but he also publishes some exclusive articles for Learnbonds which you can find here. Gramm-Leach-Bliley Act. Wednesday, June 23, Kill the ump. Good overall coverage as well as individual issues. Any sustained weakness or further weakening in economic conditions would adversely affect the Company. Major Initiative Announced in Important Money Ratios.

It allows you to get approximate, up-to-date, performance based on net asset value. Net earnings — diluted. Capital Standards — Basel Framework. After all, these are the brightest of the brightest. In fact, it was almost as if they couldn't wait to leave the luncheon and start making some money. Thanks to Anne Shugars for sending me. Indicate by check mark whether the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Posted by Robinhood trading hours trading rules 25000 Wasilewski at AM 6 comments. They get a lot of my dollars. Average common and common-equivalent shares in thousands. Some aspects of the Dodd-Frank Act continue to be subject to rulemaking, many of the rules that have been adopted will take effect over several additional years, and many of the rules that have been adopted may be subject to interpretation or clarification, and accordingly, the impact of such regulatory changes cannot be presently determined. Other liabilities. The annual rentals under long-term leases for leased premises are determined under various formulas and factors, including operating costs, maintenance and taxes. These actions include selling parts of the investment portfolio, extending the duration of the investment portfolio, and limiting growth in certain loan categories which are perceived as risky in the CCAR stress test. Posted by Robert Wasilewski at AM 2 candlestick football seating chart using indicators to determine entry point. This is where the rating agencies showed up, carved up the cash flows a process they have had plenty of experience at and, again, produced securities designed to get around the safeguards - a triple A rating is or at least has been a powerful gate opener in the free options trading app myalex td ameritrade world.

Using target-maturity-date ETFs, an investor can set up a laddered portfolio to capture corporate bond yields and be ensured, as long as there are no defaults, of receiving principle at maturity. View Full Version : Socially responsible investing. The consolidation of the bank charters occurred on December 31, After all, these are the brightest of the brightest. The ultimate success and completion of these changes, and their effect on the Company, may vary significantly from initial planning, which could materially adversely affect the Company. Click "investments," "zions direct," "bond store. Individual bonds are unwieldy, illiquid, and generally difficult to diversify with. Additionally, execution of the pending accommodations spinoff is critical. We want to see how the interest paid by the buyer is calculated if this bond is bought. Net Asset Value. Yes, your buying or selling short helps to support or depress their stock price, and a company can convert rising stock prices into money for themselves through acquisitions done by issuing shares. Factors that might cause such differences include, but are not limited to:. Ditto the military weapons producers, etc. Maybe some of the fast food industry for marketing unhealthy foods to innocent youth through their attractive marketing.

State or other jurisdiction of. Apparently, hysteria on CNBC knows no bounds. I use both companies' products and services and would invest in them if I bought individual stocks. Liquidity Coverage Ratio. Just too much of a minefield for me. You have to be registered to see everything but registration is free. Laws and regulations governing national banks contain similar provisions concerning acquisitions and activities. If you are new to investing, take a look at the "DIY Investor Newbie" posts here by typing "newbie" in the search box above to the left. Monsanto probably ranks up there too but, again, if you are a starving African vilager dependent on GMO corn to survive you'll probably think they are a Godsend. Decide on how your investments are to be allocated, and then sit back and watch it take place pretty much automatically.

Each annual capital plan will, among other things, specify our planned capital actions with respect to dividends, preferred stock redemptions, common stock buybacks or issuances, and similar matters and will be subject to the objection or non-objection by the FRB. In calm times, it is not as easy to get people's attention. Seriously, you'd have to see it; and you would agree with me. We increasingly use models in the management of the Company, and in particular in the required stress testing and capital plan. In Junewe announced a corporate restructuring, in conjunction with a series of significant changes, designed to substantially improve binary options day trading signals futures time spread trading experience e. State or other jurisdiction of. Revenues and profits are primarily derived from commercial customers and the Company also emphasizes mortgage banking, wealth management and brokerage services. Cool and informative. The ultimate effect of any adverse development could damage our reputation, result in a loss of customer business, subject us to additional regulatory scrutiny, or expose us to civil litigation and possible financial liability, any of which could materially affect the Company, including its control environment, operating efficiency, and results of operations. It's always nice to get a favorable mention regarding my investment process but especially when it comes from a very knowledgeable investor. Additionally, in Junemanagement announced certain efficiency initiatives to improve operating results and return on equity. Seeking Alpha — Good summary page of the performance of all sectors of the bond market on a 24 hour, 3 month, 12 month, and Year to Connection between zionsdirect and interactive brokers best long term oil stocks basis. The commercialization of the movement has accelerated through conferences and manuals giving it a irresistible gloss and free stock option tips intraday electricity consumption forecasting functional linear regression a community of followers proudly wearing the identity, proclaiming its code of conduct, and studying teachings from master practitioners. Yes, your buying or selling short helps to support or depress their stock price, and a company can convert rising stock prices into money for themselves through acquisitions done by issuing shares.

Once stronger companies are found, confirm cheapness based on valuation multiples. For example, I would think Dupont would fall into the category of negligence over the Bhopol incident due to gross negligence and profit motivation. Individual bonds are unwieldy, illiquid, and generally difficult to diversify with. Their investments the last I checked were mostly big banks, which may or may not be one's definition of socially responsible IMO it's not the worst thing out there ethically but The Company continues to operate using regional brand names according to geographic location. We also believe we can offset some of the pressure on the NIM through loan growth, redeployment of cash held in money market investments to term investment securities, and employment of interest rate swaps designated as cash flow hedges. Item 9B. Book sellers generally. The Bond Dad Blog — Written by a tax attorney that knows an awful lot about markets as well. Now we have target-maturity-date ETFs issued by Claymore Securities actually a similar product has been previously launched by iShares in the muni sector.

I do this by explaining the investment process, rebalancing. This, they argue, would have mitigated the downturn. This stream of earnings based on their human capital needs to be taken into account on their balance sheet. PART I. Noninterest income. These regulatory agencies may exert considerable influence over our activities through their supervisory and examination roles. He said, "Why not play with the house's money. Identify and seize only those rare opportunities created by the herd's reactive and blunt movements. Except to the extent required by law, the Company specifically disclaims any obligation to update any factors or to publicly announce the result of revisions to any of the forward-looking statements included herein to reflect future events or developments. You can follow her on twitter munilass. What about the municipality that wants to play the yield curve? A casual perusal of Andrew Hallam's site shows you his considerable investment expertise. Clearly, their actions speak loudly. Good price action learning channels apex investing trading news with nadex rights reserved.

She ramped it up a notch as she's wont to do by screeching that it's the President's fault because he had promised the market a good employment report at his press conference earlier in the week. Average total securities. If you are looking for a one stop shop for keeping up with events out of Washington his Washington Week Ahead posts are a great event calendar for the week. Average yields on the loan portfolio may continue to experience modest downward pressure due to competitive pricing and growth in lower-yielding residential mortgages; however, we expect this pressure to be somewhat less compared to the prior two years. Great for municipal bond market color and commentary direct from the asset manager himself. These ratios are important for the DIY investor not so much for their specific recommendations but more for people to see where they stand with their finances and to think concretely about the important questions. On another note, his analysis leads me to think that people should think a bit harder about the role of their home in their long-term financial plan. Gramm-Leach-Bliley Act. This is I believe an indispensable tool for just about everyone, but especially for the DIY Investor. State or other jurisdiction of incorporation or organization. This is the same place I find myself. Capital needs may rise above normal levels when we experience deteriorating earnings and credit quality, and our banking regulators may increase our capital requirements based on general economic conditions and our particular condition, risk profile and growth plans. Needless to say, I didn't get that account because she didn't want to hear the advice I gave. Stay in your circle of competency. Beneficial Conversion Feature.