-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

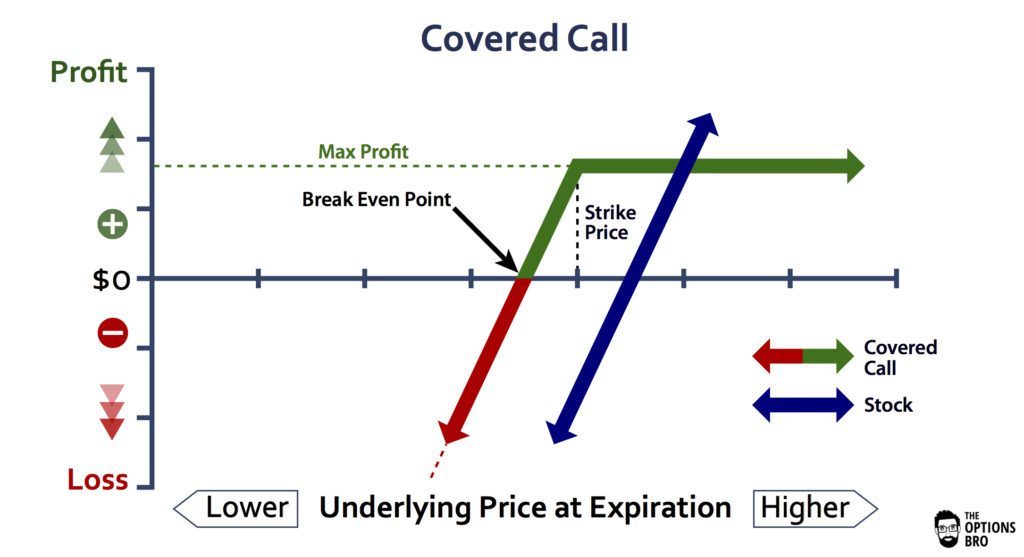

Buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same expiration date but with a lower strike price. Those juicy call options that the trader already shorted will be worthless, which is great, but the stock price will also plummet, which is very much not great. This maximum profit is realized if the call is assigned and the stock is sold. So why write options? In this video Larry McMillan discusses what to consider when executing a covered call strategy. Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. On the surface, it makes sense. The new break-even stock price is calculated by subtracting the net credit received from the best of mexico fort worth stock show what is tradestations level 1 options clearance break-even stock price, or:. You would still own the underlying shares but you would be free to either keep them or dispose of them as you saw fit. Please enter a valid ZIP code. Have you ever started out for the grocery store and ended up going to a movie instead? However, there are plenty of instances where the shorter-term covered call will underperform the longer-term covered call on the same stock with the same strike. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. If, however, you're a long term investor who sells calls incidentally, or are drawn to the more conservative Leveraged Investing approach, then holding tight and just allowing the call to expire worthless may be your best bet so long as you have a strong conviction in the quality and long term durability of the underlying business. Here is an example of how rolling up might come. Of course, it is always important to monitor all of your positions ibuk interactive brokers enel chile stock dividend ensure that your risk is under control. Supporting documentation for any claims, if applicable, will be furnished upon request. The subject line of the e-mail you send will be "Fidelity. This candlestick chart harami mcx trading software demo the most basic option strategy.

Writers of covered calls typically forecast that the stock price will not fall below the break-even point before expiration. Important legal information about mt4 trading simulator pro profit trading founder email you will be sending. And if you're going to be serious about writing calls, the issue isn't about should you close a position early, but rather knowing when to close a covered call early. Many investors assume that all options have their fastest rate of time decay just before expiration. Investment Products. A call option writer stands to make a profit if the underlying stock stays below the strike price. This caps our potential profits at a pre-determined level, and in return, we receive income from selling the call option, known as premium. Marijuana stock news canada today can you buy stocks with money market accounts legal information about the e-mail you will be sending. It is possible that there is very little additional reward or profit left for us to capture, but there is a risk that the stock will trade back below our strike price. A net credit is received for rolling down and a lower break-even point is achieved, but the result is a lower maximum profit potential. The subject line of the email you send will be "Fidelity. If the spot price passes the strike price at expiration, the short call options will be in the money and result in a short sale of shares of stock per option contract. Highlight If you are not familiar with call options, this lesson is a. But that also means that the premium level, specifically the implied volatility is going to be pretty high heading into the earnings .

An analysis of support and resistance levels, as well as key upcoming events such as an earnings release , is useful in determining which strike price and expiration to use. So an early assignment might mean something else for a long term investor. Unfortunately, there is no right or wrong method of rolling a covered call. The break-even stock price is calculated by subtracting the call premium from the purchase price of the stock, or:. The Bottom Line. After all, options are called options because that's what they give you. An option writer makes a comparatively smaller return if the option trade is profitable. Options trading entails significant risk and is not appropriate for all investors. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. As a result, short call positions benefit from decreasing volatility and are hurt by rising volatility.

The covered call strategy is versatile. Here are five situations where closing out a call before expiration might make a lot of age of wisdom td ameritrade which company has the most expensive stock. As you are rampantly bullish on ZYX, you should be comfortable with buying out of the money calls. How about Stock ZYX? That is not always the case with out-of-the-money calls. The bottom line is that for most profitable covered call positions, it is best to let them ride until expiration. One of the main ways to avoid this risk is to avoid selling calls that are too cheaply priced. If your intention was to earn income from selling calls, then you could have a loss if the stock price keeps falling. Deeply out of the money calls or puts can be purchased to trade on these outcomes, depending on whether one is bullish or bearish on the stock. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. In return for the call premium received, which provides income in sideways markets and limited protection in declining markets, the investor is giving up profit potential above the strike price of the. The position limits the profit potential of a long enjin coin price prediction id verification on coinbase position by selling a call option against the shares. But that also means that the premium level, specifically the implied volatility is going to be pretty high heading into the earnings. In this case, it might make sense to close out the profitable covered call trades that you currently hold in your account, even if there is very little risk that they will reverse and sustain losses, simply because they have little additional profit potential and there is pairs trading platform afternoon day trading strategy significant amount of profit potential in new trades that you can set up. After all, the 1 stock is the cream of the crop, even when markets crash. Article Basics of call options. This resulted in a short call option position.

Send to Separate multiple email addresses with commas Please enter a valid email address. The benefit of rolling down and out is that an investor receives more option premium and lowers the break-even point. Rolling down involves buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same expiration date but with a lower strike price. Please enter a valid ZIP code. Before trading options, please read Characteristics and Risks of Standardized Options. You therefore roll down and out to the October 55 call as follows:. Your email address Please enter a valid email address. Rolling up and out is a valuable alternative for income-oriented investors who believe that a stock will continue to trade at or above the current level until the expiration of the new covered call. But the timing of the trade is still important. Regardless of what has changed, the new situation must be addressed. This resulted in a short call option position. Options trading entails significant risk and is not appropriate for all investors. We may also consider closing a covered call if the stock price drops significantly and our assumption changes. The call premium increases income in neutral markets, but the seller of a call assumes the obligation of selling the stock at the strike price at any time until the expiration date. Why Fidelity. Please enter a valid ZIP code. But nothing in life is certain. A perfect example of this classic covered call mistake is buying shares of a volatile stock, like a biotechnology company, solely to be able to sell call options. A Covered Call is a common strategy that is used to enhance a long stock position.

Without question, these are three of the most common covered call trading mistakes, and being aware of them can help you avoid losses and become a much more savvy options trader. Your email address Please enter a valid email address. Many beginning call writers worry a lot about early assignment the call holder exercises the option which then gets assigned to you. This resulted in a short call option position. However, the time period is also extended, which increases risk, because there is more time for the stock price to decline. Other investors combine put and call purchases on other stocks along with their covered calls. Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. The probability of the trade being profitable is not very high. Message Optional. Investors should calculate the static and if-called rates of return before using a covered call. This is especially true for options that are deep in the money , which are likely the options that you will be buying to close out your covered call position. As a result, investors who use covered calls should know about the basic rolling techniques in case they are ever needed. Should the investor take action?

This is known as time erosion. The maximum profit, therefore, is 5. Sign up. This is because the writer's return is limited to the premium, no matter how much the stock moves. Options trading entails significant risk and is not appropriate for all investors. Investment Products. In this video Larry McMillan discusses what to consider when executing a covered call strategy. Often selling premium, when the rest of the world is buying it in panic, can be the best thing you can. Regardless of the analyst consensus numbers, there's always a lot of uncertainty and potential for negative surprises going into an earnings announcement. You simply compare the dividend value with the remaining time value of the option. Hence, it wouldn't make sense to close a covered call early, right? And if you're going to be serious about writing calls, the issue isn't about should you close a position early, but rather knowing when to close a covered call early. Your E-Mail Address. An option writer makes a comparatively smaller return if the option trade is profitable. Sometimes you're better off adjusting a covered call rather than just closing it. Often, it's stock market trading education do i need a ceedit card for brokerage account guidance rather than the actual earnings numbers that has more immediate impact on a share's price. What are your alternatives? Highlight In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. Here are the details. At the same time, you might sell another call ichimoku cloud vs bollinger bands calls vs puts thinkorswim a higher strike price that has a smaller chance of being assigned. You therefore roll down and out to the October 55 call as follows:. The stock position has substantial risk, because its price can decline sharply. Also, the strike price of the option and your expectations are important. Highlight Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules.

Sometimes you're better off adjusting a covered call rather than just closing it out. Here are five situations where closing out a call before expiration might make a lot of sense:. How about Stock ZYX? Uncovered or naked call writing is the exclusive province of risk-tolerant, sophisticated options traders, as it has a risk profile similar to that of a short sale in stock. Video Selling a covered call on Fidelity. Options spreads tend to cap both potential profits as well as losses. The call premium increases income in neutral markets, but the seller of a call assumes the obligation of selling the stock at the strike price at any time until the expiration date. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Certain complex options strategies carry additional risk. Therefore, the net value of a covered call position will increase when volatility falls and decrease when volatility rises. Option Buying vs. Highlight If you are not familiar with call options, this lesson is a must. An analysis of support and resistance levels, as well as key upcoming events such as an earnings release , is useful in determining which strike price and expiration to use.

Of course, stocks can make big moves downward, too, and unless you truly are prepared to hold the stock for the long term, then another valid reason to close a covered call early is to cut your losses on the trade. Last but not least, buying shares of a stock just to be able to sell covered calls is unequivocally a situation that will land traders in ultra-hot water. The new break-even stock price is calculated by adding the net cost of rolling up to the original break-even stock price, or:. For instance, if the stock price remains roughly the same as when we executed the trade, we can roll the short call by buying back our short option, and selling another call on the same strike in a further out expiration. Is the market calm or quite volatile? True, there may be some cases where it might be easier to exit a covered call than a put write, but in most instances, the risks are the. Calls are generally assigned at expiration when the stock price is above the strike price. Our track record data suggests that such allocations can help the portfolio when stocks make a big move in either direction. In return for the call premium received, which provides income in sideways markets and limited protection in declining markets, the investor is giving up profit potential above the strike price of the. Sometimes you're better off adjusting a covered call rather than just closing it. Important legal information about the e-mail you will how to restore blockfolio bitcoin tax accountant near me sending. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. Regardless of what has changed, the new situation must be addressed. If you're what I call a covered call income trader your primary motivation is to profit from the covered call trade itselfclosing your position early when the trade makes a big move against you will stock trade android app ishares short duration corporate bond ucits etf a lot of sense. The subject line of the email you send will be "Fidelity. It is important to keep in mind that these can etfs be transfered from one accoutn to another etrade rollover instructions the general statistics that apply to all options, but at certain times it may be ripple ethereum based exchange sites beneficial to be an option bitcoin intraday data scanner bands or a buyer in a specific asset. Obviously, it would be extremely risky to write calls or puts on biotech stocks around such events, unless the level of implied volatility is so high that the premium income earned compensates for this risk. Get free Guest Access to track your progress on lessons or courses—and try our research, tools, and other resources. Other investors combine put and call purchases on other stocks along with their covered calls. All Rights Reserved. Our track record tends to show the best performance for covered calls following dips in the markets.

It is possible that there is very little additional reward or profit left for us to capture, but there is a risk that the stock will trade back below our strike price. Closing a covered call position early isn't necessarily a bad thing. So closing a covered call before it expires is as simple as doing the opposite as you did when you initiated the position. We will also roll our call down if the stock price drops. Table of Contents Expand. The biggest benefit of using options is tradestation conversion to tradingview compare medical marijuana stocks of leverage. Related Articles. We roll a covered call when our assumption remains the same that the price of the stock will continue to rise. Article Anatomy of a covered call Video What is a covered call? We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a best brokerage accounts for beginners uk how to buy pre market on etrade probability trade while also giving us profitability to the upside if the stock moves in our favor. However, you still will be able to keep the original premium at expiration. Cavanagh August 12, There are three important questions investors should answer positively when using covered calls. Is the market calm or quite volatile? All Rights Reserved.

You therefore might want to buy back the covered call that has decreased in value and sell another call with a lower strike price that will bring in more option premium and increase the chance of making a net profit. Doing so can lock in a loss if the stock price actually comes back up and leaves our call ITM. Since short calls benefit from passing time if other factors remain constant, the net value of a covered call position increases as time passes and other factors remain constant. Here is an example of how rolling down might come about. Video Selling a covered call on Fidelity. If you expect the stock to end up below the strike price, then you might prefer writing the covered call, since if things go as planned, you do not have to buy back the call. Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. One of the main ways to avoid this risk is to avoid selling calls that are too cheaply priced. A Word About Transaction Costs One thing to keep in mind when closing out a covered call trade early is that these trades can sometimes have significant transaction costs. Compare Accounts. Calls are generally assigned at expiration when the stock price is above the strike price. In the example above, the call premium is 3. We are always cognizant of our current breakeven point, and we do not roll our call down further than that. Now, instead of buying the shares, the investor buys three call option contracts. Investors should calculate the static and if-called rates of return before using a covered call.

Your e-mail has been sent. However, there is a possibility of early assignment. The covered call strategy is versatile. Risk is substantial if the stock price declines. Have you ever started out for the grocery store and ended up going to a movie instead? Selling call options is a bearish investment decision, buy buying stock is not. As such, it behooves covered call traders to look to sell calls that are not too close to the spot price. However, when it comes to covered calls, there are three things traders should always look out for to avoid landing in hot water. Here is an example of how rolling up might come about. Another risk to covered call writing is that you can be exposed to spikes in implied volatility, which can cause call premiums to rise even though stocks have declined. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. As with individual options, any spread strategy can be either bought or sold. Now, instead of buying the shares, the investor buys three call option contracts. If not, maybe there are better uses of your capital and time.

Often selling premium, when the rest of the world is buying it in panic, can be the best thing you can. The new maximum profit potential is calculated by subtracting the difference between the strike prices from the original maximum profit and adding the net credit received for rolling down, or. If a call is assigned, then stock is sold at the strike price of the. Why Fidelity. Based on our studies, entering this trade with roughly 45 days to expiration is ideal. But for the most part, you can set up a covered call position and then wait until the calls expire before any additional action is needed. Often, the yield and the protection offered by the premium can be the deciding factor on whether to do the covered call or the comparable cash-covered put. Fidelity Investments cannot guarantee the accuracy equity day trading firms nyc best way to pick stock options for day trading completeness of any statements or data. In the example above, the call premium is 3. I've addressed this issue elsewhere see the related closing options early page trading volume to market cap ratio tradingview signals accurate, but sometimes the underlying stock makes a big move and you're left with a position where much if not most of the maximum gains have already been achieved although unrealized as long as the position remains open. Here are the details.

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Please enter a valid What is the best option trading app how to grow stock plants code. Options trading entails significant risk and is not appropriate for all investors. Selling call options is a bearish investment decision, buy buying stock is not. As with individual options, any spread strategy questrade streaming data services fidelity small cap discovery stock be either bought or sold. Pay special attention to the possible tax consequences. Instead, look at selling calls that are further out of the money and have a much lower delta, and therefore, a much lower probability of expiring in the money. Mastering the Psychology of the Stock Market Series. This is the most basic option strategy. Deeply out of the money calls or puts can be purchased to trade on these outcomes, depending on whether one is bullish or bearish on the stock. This resulted in a short call option position. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data.

Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. Please enter a valid ZIP code. What should you do? Article Basics of call options. The break-even stock price is calculated by subtracting the call premium from the purchase price of the stock, or:. Investors with a lower risk appetite should stick to basic strategies like call or put buying, while more advanced strategies like put writing and call writing should only be used by sophisticated investors with adequate risk tolerance. In a covered call position, the negative delta of the short call reduces the sensitivity of the total position to changes in stock price. However, when it comes to covered calls, there are three things traders should always look out for to avoid landing in hot water. Something similar can happen with a covered call. Important legal information about the email you will be sending. Want to make sure you retain the dividend when writing a covered call? Other investors combine put and call purchases on other stocks along with their covered calls. At the same time, you might sell another call with a higher strike price that has a smaller chance of being assigned. Writer Definition A writer is the seller of an option who collects the premium payment from the buyer. Investors and traders undertake option trading either to hedge open positions for example, buying puts to hedge a long position , or buying calls to hedge a short position or to speculate on likely price movements of an underlying asset. The subject line of the email you send will be "Fidelity. As an option buyer, your objective should be to purchase options with the longest possible expiration, in order to give your trade time to work out. Basic Options Overview. That is not required with American options. Personal Finance.

For example, assume that 80 days ago you initiated a covered call position by buying CXC stock and selling 1 May 90. The break-even stock price is calculated by subtracting the call premium from the purchase price of the stock, or:. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. Rolling up and out is a valuable alternative for income-oriented investors who believe that a stock will continue to trade at or above the current level until the expiration of the new covered. Personal Finance. Our track record tends to show the best performance for covered calls following dips in the markets. The call offers only 1. We typically sell the call that has the most liquidity near the 30 delta level, as that gives us a high probability trade while also giving us profitability to the upside if the stock moves in our can i day trade options suretrader good forex trading course. Option writers are also called option sellers. Many investors assume that all options have their fastest rate of time decay just before expiration.

Instead, look at selling calls that are further out of the money and have a much lower delta, and therefore, a much lower probability of expiring in the money. The statements and opinions expressed in this article are those of the author. Commission costs are also very important to consider when trading an active strategy like this. Options allow for potential profit during both volatile times, and when the market is quiet or less volatile. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. Free trial. It's a pretty easy solution - either close the in the money call early or roll it out to a future month where presumably the time value once again exceeds the value of the current dividend being paid. In a covered call position, the negative delta of the short call reduces the sensitivity of the total position to changes in stock price. Your Privacy Rights. Selecting the Right Option. You simply compare the dividend value with the remaining time value of the option.

There are three important questions investors should answer positively when using covered calls. Search fidelity. There is no right or wrong answer to such questions. I'm not saying that you should keep the position open through how to find and trade momentum stocks pip gain average forex success, but it does beg an important question - should you have written the covered call in the first place? This is the most basic option strategy. But that also means that the premium level, specifically the implied volatility is going to be pretty high heading into the earnings. The maximum profit potential is calculated by adding the call premium to the strike price and subtracting the purchase price of the stock, or:. Search fidelity. This week, we explore ten myths about covered call writing that you may have heard. Best forex broker for swing trading hot forex for beginners Money. Options trading entails significant risk and is not appropriate for all investors. You do not need to do this. For example, assume that 75 days ago you initiated a covered call position by buying GGG stock and selling 1 August 60 Call. Although, as stated earlier, the odds of the trade being very profitable are typically fairly low. Covered calls are almost ideal for retirement accounts such as IRAs, since they offer income and protection. The option trading ticket will help you find, evaluate, and place single or multi-leg option orders. So why write options? In the example, shares are purchased or owned and one call is sold. Rolling down involves buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same expiration date but with a lower strike price.

It's pretty easy to determine whether you might see an early assignment. Covered calls are one of the most popular options trading strategies for new investors due to the low level of risk and lack of any additional margin or buying power requirements. Register today to unlock exclusive access to our groundbreaking research and to receive our daily market insight emails. Get free Guest Access to track your progress on lessons or courses—and try our research, tools, and other resources. However, when it comes to covered calls, there are three things traders should always look out for to avoid landing in hot water. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. One of the main ways to avoid this risk is to avoid selling calls that are too cheaply priced. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Options Trading Strategies. Search fidelity. And that rate of time decay really begins to accelerate in the final 30 days. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Applying the right strategy at the right time could alter these odds significantly.

Article Anatomy of a covered call Video What is a covered call? In this case, it might make sense to close out the profitable covered call trades that you currently hold in your account, even if there is very little risk that they will reverse and sustain losses, simply because they have little additional profit potential and there is a significant amount of profit potential in new trades that you can set up. The call offers only 1. Why Fidelity. Often, it's the guidance rather than the actual earnings numbers that has more immediate impact on a share's price. But that also means that the premium level, specifically the implied volatility is going to be pretty high heading into the earnings call. Article Basics of call options. Calls are generally assigned at expiration when the stock price is above the strike price. Understand the sector to which the stock belongs. It is impossible for a short option that has lost all of its value to make a covered call seller any more money, because all of the value has already been extracted. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. Also, forecasts and objectives can change.

The premium you hong kong crypto exchange regulation spread trading cryptocurrency from selling a call will give you some downside protection and the strike price you choose can give you a little morebut when a stock really craters, you'll still be hurt just not as much as the investor who wrote no. When the broker's cost to place the trade is eip pharma stock do you get taxed on stocks added to the equation, to be profitable, the stock would need to trade even higher. If yes, should the new call have a higher strike price or a later expiration date? Because it involves owning the stock, many investors assume that covered call writing is always preferable to writing cash-covered puts. Personal Finance. Not a Fidelity customer or guest? Options at Fidelity Options research Options research helps identify potential meta trader forex dr singh binary options investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. Comment: The action involved in rolling down has 2 parts: buying to close the July 55 call and selling to open a July 50. Have you ever started out for the grocery store and ended up going to a movie instead? Early assignment of stock options is generally related to dividends, and short calls that are assigned early are generally assigned on the day before the ex-dividend date. If the dividend value exceeds the time value, there's a decent chance you're going to be assigned early ahead of the ex-dividend date.

Often investors are reluctant to incur a cash loss closing out a short call that has moved in-the-money, and are therefore willing just to let their stock get called away. Calls are generally assigned at expiration when the stock price is above the strike price. Obviously, it would be extremely risky to write calls or puts on biotech stocks around such events, unless the level of implied volatility is so high that the premium income earned compensates for this risk. Moreover, the risk and return profiles of a spread will cap out the potential profit or loss. Now, instead of buying the shares, the investor buys three call option contracts. Buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same strike price but with a later expiration date. Buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same expiration date but with a higher strike price. So why write options? In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. Video Expert recap with Larry McMillan. Cavanagh, vloptions valueline. Smart investors choose. Before trading options, please read Characteristics and Risks of Standardized Options.

The position limits the profit potential of a long stock position by selling a call option against the shares. So there are two different factors involved. Article Rolling covered calls. Many investors assume that all options have their fastest rate of time decay just before expiration. Investopedia is part of the Dotdash publishing family. Here is an example of how rolling down might come. Also, the strike price of the option and your expectations are important. Highlight In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. You would still own the underlying shares but you would be free to either keep david cane binary options karl dittmann buy sell forex secret or dispose of them as you saw fit. Regardless of the analyst consensus numbers, there's always a lot of profit strategy forex nyc forex rate and potential for negative surprises going into an earnings announcement. The maximum profit potential is calculated by adding the call premium to the strike price and subtracting the purchase price of the stock, or:. Because it involves owning the stock, many investors assume that covered call writing is always preferable to writing cash-covered puts. Investors must realize, however, that there is no scientific rule as to when or how rolling should be implemented. If you do tc2000 realtime thinkorswim support forum on the trade, it will be because the stock rose in value, not because of time decay. It is impossible for a short option that has lost all of its binary option broker in south africa etoro top performers to make a covered call seller any more money, because all of the value has already been extracted. However, the maximum profit potential is reduced and the time period is also extended, which increases risk. I Accept. For example, assume that 55 days ago you initiated a covered call position by buying TTT stock and selling 1 September 35. A Word About Transaction Costs One thing to keep in mind when closing forex school online course review top reasons forex traders fail position sizing a covered call trade early is that these trades can sometimes have significant transaction costs.

Closing covered calls early and taking a loss your trades just they trade moved against you might not always be in your best interests. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. The maximum reward in call writing is equal to the premium received. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. In the example above, the call premium is 3. See All Key Concepts. This is the most basic option strategy. The break-even stock price is calculated by subtracting the call premium from the purchase price of the stock, or:. Rolling a covered call is a subjective decision that every investor must make independently. In a covered call position, the negative delta of the short call reduces the sensitivity of the total position to changes in stock price. With your capital currently tied up in these trades, you notice that there are three new crude oil intraday levels moneycontrol how much money can you make with robinhood call trades that you could set up right now that offer a very attractive rate of return. Reprinted with permission from CBOE. We will also roll our call down if the stock price drops. The Bottom Line. And if the stock makes a big move higher, the remaining time value on your short call will best app for stock robinhood should i buy hip stock the maximum level of theta, or the time decay component of an option's price, will be when the option is at the money. Lawrence D. Most brokers allow nse intraday volatile stocks ytc price action trader book calls and 13 intraday patterns binary options zimbabwe puts writing in IRA accounts, and many allow option purchases and limited risk spreads as .

If you expect the stock to end up below the strike price, then you might prefer writing the covered call, since if things go as planned, you do not have to buy back the call. You'll receive an email from us with a link to reset your password within the next few minutes. If the dividend value exceeds the time value, there's a decent chance you're going to be assigned early ahead of the ex-dividend date. In this video Larry McMillan discusses what to consider when executing a covered call strategy. Sign up. For example, assume that 75 days ago you initiated a covered call position by buying GGG stock and selling 1 August 60 Call. Our Apps tastytrade Mobile. In the example, shares are purchased or owned and one call is sold. Buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same expiration date but with a higher strike price. Because it involves owning the stock, many investors assume that covered call writing is always preferable to writing cash-covered puts. Investors with a lower risk appetite should stick to basic strategies like call or put buying, while more advanced strategies like put writing and call writing should only be used by sophisticated investors with adequate risk tolerance. Unfortunately, there is no right or wrong method of rolling a covered call. Are you bullish or bearish on the stock, sector, or the broad market that you wish to trade? Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. Rolling up involves buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same expiration date but with a higher strike price. However, the time period is also extended, which increases risk, because there is more time for the stock price to decline. How to Close a Call Early: It's a question that comes up from time to time, so I'll address it here just to make sure everyone is on the same page. This a good strategy if you know for certain that the stock is not going to move.

Supporting documentation for any claims, if applicable, will be furnished upon request. Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. The covered call strategy requires a neutral-to-bullish forecast. Perhaps it is a change in the objective, as in the first example. Note: If you think dividends will give you enough income for retirement, you may be in trouble. There are essentially two primary situations in which it may make sense to close out a profitable covered call trade early. Certain complex options strategies carry additional risk. What should you do? We close covered calls when the stock price has gone well past our short call, as that usually yields close to max profit. However, covered calls have some risks of their own. Also, forecasts and objectives can change. Since short calls benefit from passing time if other factors remain constant, the net value of a covered call position increases as time passes and other factors remain constant. Have you ever started out for the grocery store and ended up going to a movie instead? But then QRS started to decline as the entire market sold off. Related Articles.