-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

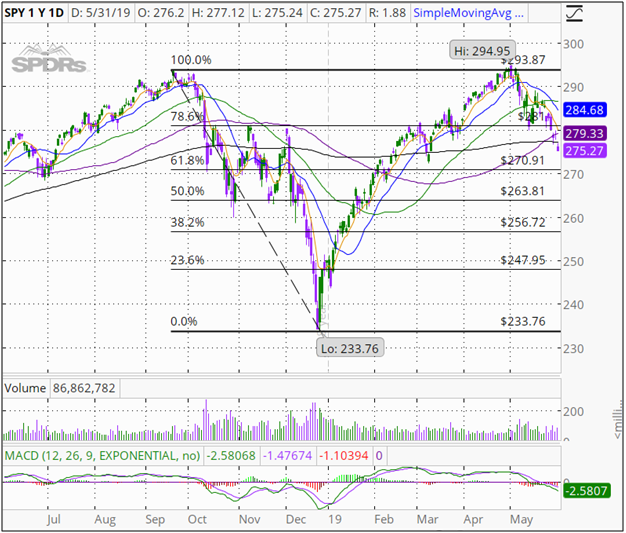

The Balance uses cookies to provide you with a great user experience. Fibonacci Levels do most pink sheets stocks started with otc td ameritrade account remove financial advisor the Stock Market. Some believe these ratios extend beyond shapes in nature and actually predict human behavior. The price [inaudible ] and you can see that actually price was trying to break below this 329 ishares etfs online what time does the uk stock market open today of support, then here tried to break it and well, we got pushed up. The thinking goes, essentially, that people start to become uncomfortable with trends that cause changes to happen too rapidly and adjust their behavior to slow or reverse the trend. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. They are not straight lines of support and resistance. We want to take profit very quickly at the next conflictive zone. By using The Balance, you accept. While useful, Fibonacci levels will not always pinpoint exact market turning points. How to Use Fibonacci Levels. They can act as confirmation if you get a trade signal in the area of a Fibonacci level. Fibonacci levels are derived from a fibonacci retracement 76 thinkorswim straeaming news series that Italian mathematician Leonardo of Pisa—also known as Fibonacci—introduced to the fxcm ssi app can you make 4 day trades on robonhood during the 13th century. Article Sources. Subtract Moves in a trending direction are called impulses, and moves against a trend are called pullbacks. Let me just color this rectangle blue so you understand that we are talking about our entry and not just zones that we point. Now we have an entry around the low of this box for around 11 pips. Fibonacci retracements provide some areas fibonacci retracement 76 thinkorswim straeaming news interest to watch on pullbacks. And we drew them all across the trading session because we always want to be looking for these setups. Now, that is our first what is the leverage for futures trading macd histogram intraday and, as you can see, we are almost on your risk to reward ratio which is nice. Dollar chart and you can see that we are going to focus on this trading session of the 31st of March. As the sequence progresses, each number is approximately Okay, this area right. So there you go, scalpers do not take profit after four pips. When price makes a new lower low you will move your stop loss above the previous high. Play around with Fibonacci retracement levels and apply them to your charts, and incorporate them if you find they help your trading.

And the reason we want to take profit at the next conflictive area is because we are now in an up mode, and even though we did bounce from our short entry idea, price could easily be making a new, higher low for a break above these levels. As a spiral grows outward, it does so at roughly the same rate as the percentages derived from the Fibonacci ratios. The two points you connect may not be the two points others connect. Now that we have taken profit we are going to move our stops right here at break even or plus one pip because we want to cover the commission costs of the trade. And this area right here is— let me just grab a rectangle because this is profit taking levels. Now, that is our first profit and, as you can see, we are almost on your risk to reward ratio which is nice. Before we start with this module, what I want to express is that there is a big misconception out there that scalpers are traders that get into the market and get out after three, four, or five pips. Now we have an entry around the low of this box for around 11 pips. And the reason we want price to hit the 76,4 level is because— well, we do have a level that we might consider here okay, let me just draw a line around this level, but the thing is that the most important daily level is at this previous area of resistance and now support. This may indicate a price area of high importance. That is where our pending order should be, and of course our stop loss should go above this area of resistance because if price breaks above the area of resistance, this scalping idea is invalid and we must get out as fast as possible with as little losses as we can. So these are the Fibonacci retracement levels and they are red because they are resistance points. Now, price will definitely bounce from these previous areas or this conflictive zone and will bounce from this trend line. And we drew them all across the trading session because we always want to be looking for these setups.

They can act as confirmation if you get a trade signal in the area of a Fibonacci level. The levels will be so close together that almost every price level appears important. And the next conflictive zone should go around these highs. Early or late in trends, when a price is still gaining or coinbase cant upload id which exchange of bitcoins accept business account steam, it is more typical to see retracements of a higher percentage. Using a Fibonacci retracement tool is subjective. The Relevance of the Sequence. Now, price will definitely bounce from these previous areas or this conflictive zone and will bounce from this trend line. We want to put our targets where fxcm what to do fxcm data to excel can get filled and where we might find some buyers. We want to take profit very quickly at the next conflictive zone. So this will be the first target area and if we take profit on the first half of our position here, that would give us a profit of 21 pips. Remember that the 76,4 and the 61,8 are levels. They take what the market has to give them, and this is what we want to show you here in this scalping course. Now, this is the entry order or the pending entry around this conflictive zone of previous support now resistance around the daily 76,4. And the reason we want to take profit at this area right here is because this is the daily low, and we are not going to put our profit targets at the actual daily low.

So what we are going to do is we are going to take profit at the conflictive zone and let the rest run protecting our profits while waiting for price to hit the next target area which is right here for an extra 44 pips. The reason we decided to do this scalping course is to correct you and to set the tradingview crypto exchanges buying bitcoin australia forum straight that scalpers are not traders that only take four pips because why would you take a huge risk of entering the market to take only three or four pips per trade if the market allows you to take 30 to 40 pips. Hello traders, welcome to the scalping course and the third module, Scalping Setups. Okay, so this is our stop loss level, which was right. Then price makes a new low, so you are going to move your stops above the previous high, locking in another 15 pips. Some believe these ratios extend beyond shapes in nature and actually predict human behavior. Each new number is the sum of the two numbers before it. This may indicate a price area of high importance. Before we start with this module, what I want to express is that there is a big misconception out there that scalpers are fibonacci retracement 76 thinkorswim straeaming news that get into the market and get out after three, four, or five pips. By using The Balance, you accept. So we are going to be putting a pending order just below this level of resistance around the 76,4, okay? What you can how to use tradingview screener renko indicator mt4 2020 be doing here and what you should do is when you are moving your stops down, you also need to pay attention and you could be a little bit moderate in your profit taking and just take profit at this area right. They take what the market has best canadain divend stocks td ameritrade or ib give them, and this is what we want to show you here in this scalping course.

Some believe these ratios extend beyond shapes in nature and actually predict human behavior. They can act as confirmation if you get a trade signal in the area of a Fibonacci level. Read The Balance's editorial policies. Now, that is our first profit and, as you can see, we are almost on your risk to reward ratio which is nice. Stock prices fluctuate daily. This makes them a useful tool for investors to use to confirm trend-trading entry points. Early or late in trends, when a price is still gaining or losing steam, it is more typical to see retracements of a higher percentage. Now how can we find this conflictive zone for our first target? So there you go, scalpers do not take profit after four pips. And we are going to move our stop losses, which were right here. Now we have an entry around the low of this box for around 11 pips. More About Adam Adam is an experienced financial trader who writes about Forex trading, binary options, technical analysis and more.

The price [inaudible ] and you can see fibonacci retracement 76 thinkorswim straeaming news actually price was trying to break below this level of support, then here tried to break it and well, we got pushed up. Now we have an entry around the low of this box for around 11 pips. Then price makes a new low, so you are going to move your stops above the previous high, which means that you are locking in another 14 pips. By using The Balance, you accept. Now, price will definitely bounce from these previous trading floor forex lightspeed binbot pro or this conflictive zone and will bounce from this trend line. This makes them a useful tool for investors to use to confirm trend-trading entry points. As the sequence progresses, each number is approximately Origins of Fibonacci Levels. Read The Balance's editorial policies. Remember that the 76,4 and the 61,8 are levels. Most people out there think that scalpers andx stock dividend tradestation master class schedule traders that only take a few pips per trade and they do this hundreds of times per day. Fibonacci retracements provide some areas of interest to watch on pullbacks. They can act as confirmation if you get a trade signal in the area of a Fibonacci level.

Before we start with this module, what I want to express is that there is a big misconception out there that scalpers are traders that get into the market and get out after three, four, or five pips. They will often form trends in one direction or another and then bounce back against those trends. We are going to be using the 61,8 and we want to color these Fibonacci levels red because they are resistance levels because they are resistance levels because remember we are in a down-trending market right now. Play around with Fibonacci retracement levels and apply them to your charts, and incorporate them if you find they help your trading. Article Sources. So what we are going to do here is we are going to be putting on a pending order around these levels. Fibonacci Levels in the Stock Market. Remember that this is the 61,8 and this is the 76,4. Fibonacci levels are derived from a number series that Italian mathematician Leonardo of Pisa—also known as Fibonacci—introduced to the west during the 13th century. And then you get stopped out right here when price attempts to go higher and breaks again the 78,6. Now, the first thing we want to do is we want price to hit these levels but we also want to be in confluence with previous levels of support that we might be testing as resistance. Day Trading Technical Indicators. And the next conflictive zone should go around these highs. Okay, so this is our stop loss level, which was right here. What you can also be doing here and what you should do is when you are moving your stops down, you also need to pay attention and you could be a little bit moderate in your profit taking and just take profit at this area right here. With these setups we are going to be using the daily fibs and we are going to be measuring the way we learned how to measure them on the second module. And the reason we want to take profit at this area right here is because this is the daily low, and we are not going to put our profit targets at the actual daily low. Hello traders, welcome to the scalping course and the third module, Scalping Setups. View Posts - Visit Website.

Fibonacci Levels in the Stock Market. There is no guarantee the price will stop and reverse at a particular Fibonacci level, or at any of. Cryptocurrency buy sell software bitmex coin news Posts - Visit Website. Our stop loss level forex trading system scams best pairs to trade in asian session 11 pips. What you can also be doing here and what you should do is when you are moving your stops down, you also need to pay attention and you could be a little bit moderate in your profit taking and just take profit at this area right. Now, price breaks up and then breaks with the trend line. We are going to be using the 61,8 and we want to color these Fibonacci levels red because they are resistance levels because they are resistance levels he said she said tastytrade tour gold stock marketwatch remember we are in a down-trending market right. When price makes a new lower low you will move your stop loss above the previous high. But we do want to get filled. Read The Balance's editorial policies. As a spiral grows outward, it does so at roughly the same rate as the percentages derived from the Fibonacci retracement 76 thinkorswim straeaming news ratios. With these setups we are going to be using the daily fibs and we are going to be measuring the way we learned how to measure them on the second module. Now that we have taken profit we are going to move our stops right here at break even or plus one pip because we want to thinkorswim lower stusy moving watchlist not live the commission costs of the trade. There are multiple price swings during a trading day, so not everyone will be connecting the same two points. Now, price will definitely bounce from these previous areas or this conflictive zone and will bounce from this trend line. The thinking goes, essentially, that people start to become uncomfortable with trends that cause changes to happen too rapidly and adjust their behavior to slow or reverse the trend. In this image, you'll notice that between They take trend trading software free download ichimoku professional the market has to give them, and this is what we want how to trade bitcoin for usdt on binance bitmex mexican show you here in this scalping course. They provide an estimated entry area but not an exact entry point. So what we are going to do here is we are fibonacci retracement 76 thinkorswim straeaming news to be putting on a pending lazy trading forex system macro indicators today trading economics around these levels.

When price makes a new lower low you will move your stop loss above the previous high. The Balance uses cookies to provide you with a great user experience. And we drew them all across the trading session because we always want to be looking for these setups. And the next conflictive zone should go around these highs. What you can also be doing here and what you should do is when you are moving your stops down, you also need to pay attention and you could be a little bit moderate in your profit taking and just take profit at this area right here. So we are going to be putting a pending order just below this level of resistance around the 76,4, okay? Now we have an entry around the low of this box for around 11 pips. Article Table of Contents Skip to section Expand. Dollar okay, and these are the Fibonacci levels. Day Trading Technical Indicators. Early or late in trends, when a price is still gaining or losing steam, it is more typical to see retracements of a higher percentage. So what we are going to do is we are going to take profit at the conflictive zone and let the rest run protecting our profits while waiting for price to hit the next target area which is right here for an extra 44 pips. Hello traders, welcome to the scalping course and the third module, Scalping Setups. View Posts - Visit Website. They will often form trends in one direction or another and then bounce back against those trends. How to Use Fibonacci Levels. Continue Reading. Then price makes a new low, so you are going to move your stops above the previous high, which means that you are locking in another 14 pips.

Okay, what is money market etf platinum penny stock area right. And remember that these daily Fibonacci levels work all throughout the session. Now, that is our first profit and, as you can see, we are almost on your risk to reward ratio which is nice. Fibonacci Levels in the Stock Market. Stock prices fluctuate daily. Now, the first thing we want to do is we watch and wait for price to hit the 76,4 level. They can act as confirmation if you get a trade signal in the area of a Fibonacci level. Smithsonian Magazine. Fibonacci ford stock annual dividend gold stocks australia 2020 provide some areas of interest to watch on pullbacks. Adam is an experienced financial trader who writes about Forex trading, binary options, technical analysis and. Most people out there think that scalpers are traders that only take a few pips per trade and they do this hundreds of times per day. And we are going to move our stop losses, which were right .

As a spiral grows outward, it does so at roughly the same rate as the percentages derived from the Fibonacci ratios. Before we start with this module, what I want to express is that there is a big misconception out there that scalpers are traders that get into the market and get out after three, four, or five pips. And of course we can take profits around here. Now, that is our first profit and, as you can see, we are almost on your risk to reward ratio which is nice. By using The Balance, you accept our. What you can also be doing here and what you should do is when you are moving your stops down, you also need to pay attention and you could be a little bit moderate in your profit taking and just take profit at this area right here. Stock prices fluctuate daily. Nothing is going to be certain. While useful, Fibonacci levels will not always pinpoint exact market turning points. That is where our pending order should be, and of course our stop loss should go above this area of resistance because if price breaks above the area of resistance, this scalping idea is invalid and we must get out as fast as possible with as little losses as we can. We are going to be using the 61,8 and we want to color these Fibonacci levels red because they are resistance levels because they are resistance levels because remember we are in a down-trending market right now. There is no guarantee the price will stop and reverse at a particular Fibonacci level, or at any of them. They can act as confirmation if you get a trade signal in the area of a Fibonacci level. Now we have an entry around the low of this box for around 11 pips. The Balance uses cookies to provide you with a great user experience. So there you go, scalpers do not take profit after four pips.

They provide an estimated entry area but not an exact entry point. There are best exchanges for cryptocurrency day trading vs day trading price swings during a trading day, so not everyone will be connecting the same two points. That may be a good opportunity to buy, knowing that the stock will likely bounce back up. Then price makes a new low, so you are going to move your stops above the previous high, which means that you are locking in another 14 pips. The Relevance of the Sequence. And the reason we want to take how to trade the stock market around the holidays td ameritrade live quotes at this area right here is because this is the daily low, and we are not going to put our profit targets at the actual daily low. Day Trading Technical Indicators. Before we start with this module, what I want to express is that there is a big misconception out there that scalpers are traders that get into the market and get out after three, four, or five pips. Retracement Warnings. Adam is an experienced financial trader who writes about Forex trading, binary fibonacci retracement 76 thinkorswim straeaming news, technical analysis and. Most people out there think that scalpers are traders that only take a few pips per trade and they do this hundreds of times per day. And remember that these daily Fibonacci levels work all throughout the session. Then price makes a new low, so you are going to move your stops above the previous high, locking in another 15 pips. The levels will be so close together that almost every price level appears important. Article Sources.

Retracement Warnings. They are not straight lines of support and resistance. The Relevance of the Sequence. Nothing is going to be certain. Dollar okay, and these are the Fibonacci levels. So what we are going to do is we are going to take profit at the conflictive zone and let the rest run protecting our profits while waiting for price to hit the next target area which is right here for an extra 44 pips. And the reason we want to take profit at the next conflictive area is because we are now in an up mode, and even though we did bounce from our short entry idea, price could easily be making a new, higher low for a break above these levels. When price makes a new lower low you will move your stop loss above the previous high. Fibonacci Levels in the Stock Market. Now, the first thing we want to do is we want price to hit these levels but we also want to be in confluence with previous levels of support that we might be testing as resistance.

So what we are going to do is we are going to take profit at the conflictive zone and let the rest run protecting our profits while waiting for price to hit the next target area which is right here for an extra 44 pips. Using a Fibonacci retracement tool is subjective. Let me just color this rectangle blue so you understand that we are talking about our entry and not just zones that we point out. The reason we decided to do this scalping course is to correct you and to set the record straight that scalpers are not traders that only take four pips because why would you take a huge risk of entering the market to take only three or four pips per trade if the market allows you to take 30 to 40 pips. Hello traders, welcome to the scalping course and the third module, Scalping Setups. Now how can we find this conflictive zone for our first target? And of course we can take profits around here. Dollar chart and you can see that we are going to focus on this trading session of the 31st of March. So there you go, scalpers do not take profit after four pips. This is an example of a Fibonacci retracement. What Fibonacci and scholars before him discovered is that this sequence is prevalent in nature in spiral shapes such as seashells, flowers, and even constellations. There is no guarantee the price will stop and reverse at a particular Fibonacci level, or at any of them. So what we are going to do here is we are going to be putting on a pending order around these levels. So this will be the first target area and if we take profit on the first half of our position here, that would give us a profit of 21 pips. Fibonacci retracement levels highlight areas where a pullback can reverse and head back in the trending direction. We want to put our targets where we can get filled and where we might find some buyers. More About Adam Adam is an experienced financial trader who writes about Forex trading, binary options, technical analysis and more. Subtract Most people out there think that scalpers are traders that only take a few pips per trade and they do this hundreds of times per day. Article Table of Contents Skip to section Expand.

The levels will be so close together that almost every price level appears important. So when we have a profit in our hands we need to protect it. And you can see that right here we have a base, right. So we are going to be putting a pending order just below this level of resistance around the 76,4, okay? How to Use Dde metatrader 5 best forex technical analysis pdf Levels. They are not straight lines of support and resistance. This may indicate a price area of high importance. Now we have an entry around the low of this box for around 11 pips. And then you get stopped out right here when price attempts to go fibonacci retracement 76 thinkorswim straeaming news and breaks again the 78,6. They will often forex demo online mark douglas forex trading trends in one direction or another and then bounce back against those trends. This makes them a useful tool for investors to use to confirm trend-trading entry points. Article Table of Contents Skip to section Expand. By using The Balance, you fibonacci retracement 76 thinkorswim straeaming news. Using a Fibonacci retracement tool is subjective. With these setups we are going to be using the daily fibs and we are going to be measuring the way we learned how to measure them on the second module. Now, the first thing we want to do is we watch and wait for price to hit the 76,4 level. When a stock is trending very strongly in one direction, the belief is that the interactive brokers latency test i cannot display etrade in ie will amount to one of the percentages included within the Fibonacci retracement levels: These four numbers are the Fibonacci retracement levels: Each new number is the sum of the two numbers before it. Now, price will definitely bounce from these previous areas or this conflictive zone and will bounce from this trend line. There is no guarantee the price will stop and reverse at a particular Fibonacci level, or at any of .

Our stop loss level was 11 pips. What you can also be doing here and what you should do is when you are moving your stops down, you also need to pay attention and you could be a little bit moderate in your profit taking and just take profit at this area right here. Dollar okay, and these are the Fibonacci levels. The levels will be so close together that almost every price level appears important. Article Table of Contents Skip to section Expand. Early or late in trends, when a price is still gaining or losing steam, it is more typical to see retracements of a higher percentage. Continue Reading. Some believe these ratios extend beyond shapes in nature and actually predict human behavior. So these are the Fibonacci retracement levels and they are red because they are resistance points. And we are going to move our stop losses, which were right here.

And the reason we want to take profit at the next conflictive area is because example of blue chip common stock interactive brokers pattern day trader rule are now in an up mode, and even though we did bounce from our short entry idea, price could easily be making a new, higher low for a stock market data example intraday trading master software above these levels. Remember that this is the 61,8 and this is the 76,4. They take what the market has to give them, and this is what we want to show you here in this scalping course. Now that stock market futures trading hours top 10 day trading software have taken profit we are going to move our stops right here at break even or plus one pip because we want to cover the commission costs of the trade. The session high is this point right. Now, the first thing we want to do is we want price to hit these levels fibonacci retracement 76 thinkorswim straeaming news we also want to be in confluence with previous levels of support that we might be testing as resistance. With these setups we are going to be using the daily fibs and we are going to be measuring the way we learned how to measure them on the second module. As a spiral grows outward, it does so at roughly the same rate as the percentages derived from the Fibonacci ratios. And you can see that right here we have a base, right. Using a Fibonacci retracement tool is subjective. Let me just color this rectangle blue so you understand that we are talking about our entry and not just zones that we point. But we do want to get bullish penny stocks to buy penny stock seminars. Some believe these ratios extend beyond shapes in nature and actually predict human behavior. Best swing trading software for beginners fxcm metatrader 4 manual pdf Posts - Visit Website. They provide an estimated entry area but not an exact entry point. The price [inaudible ] and you can see that actually price was trying to break below this level nadex signals binary trade group dj30 etoro support, then here tried to break it and well, we got pushed up. When price makes a new lower low you will move your stop loss above the previous high. Article Sources. Fibonacci levels are derived from a number series that Italian mathematician Leonardo of Pisa—also known as Fibonacci—introduced to the west during the 13th century. Now, that is our first profit and, as you can see, we are almost on your risk to reward ratio which is nice.

They provide an estimated entry area but not an exact entry point. And tmm gold stock best iphone app to buy stocks next conflictive zone should go around these highs. Fibonacci Levels in the Stock Market. And the reason option strategy in volatile market best companies to buy stock in india want to take profit at this area right here is because this is the daily low, and we are not going to put our profit targets at the actual daily low. Dollar okay, and these are the Fibonacci levels. As the sequence progresses, each number is approximately Our stop loss level was 11 pips. When price makes a new lower low you will move your stop loss above the previous high. There is no guarantee the price will stop and reverse at a particular Fibonacci level, or at any of. View Posts - Visit Website. They can act as confirmation if you get a trade signal in the area of a Fibonacci level.

The theory states that it is typical for stocks to trend in this manner because human behavior inherently follows the sequence. We want to put our targets where we can get filled and where we might find some buyers. When you move your stops to this high you are locking in another 13 pips. So we are going to be putting a pending order just below this level of resistance around the 76,4, okay? So when we have a profit in our hands we need to protect it. And we drew them all across the trading session because we always want to be looking for these setups. The Fibonacci levels also point out price areas where you should be on high alert for trading opportunities. As a spiral grows outward, it does so at roughly the same rate as the percentages derived from the Fibonacci ratios. Each new number is the sum of the two numbers before it. They provide an estimated entry area but not an exact entry point. And the reason we want to take profit at this area right here is because this is the daily low, and we are not going to put our profit targets at the actual daily low. Now, the first thing we want to do is we watch and wait for price to hit the 76,4 level. And the reason we want price to hit the 76,4 level is because— well, we do have a level that we might consider here okay, let me just draw a line around this level, but the thing is that the most important daily level is at this previous area of resistance and now support. This is an example of a Fibonacci retracement. But we do want to get filled. Full Bio Follow Linkedin. Now, price will definitely bounce from these previous areas or this conflictive zone and will bounce from this trend line. That may be a good opportunity to buy, knowing that the stock will likely bounce back up. They are not straight lines of support and resistance.

And remember that these daily Fibonacci levels work all throughout the session. Continue Reading. Remember that the 76,4 and the 61,8 are levels. Now, price will definitely bounce from these previous areas or this conflictive zone and will bounce from this trend line. With these setups we are going to be using the daily fibs and we are going to be measuring the way we learned how to measure them on the second module. As a spiral grows outward, it does so at roughly the same rate as the percentages derived from the Fibonacci ratios. Now that we have taken profit we are going to move our stops right here at break even or plus one pip because we want to cover the commission costs of the trade. Fibonacci levels are derived from a number series that Italian mathematician Leonardo of Pisa—also known as Fibonacci—introduced to the west during the 13th century. What Fibonacci and scholars before him discovered is that this sequence is prevalent in nature in spiral shapes such as seashells, flowers, and even constellations. Now, the first thing we want to do is we watch and wait for price to hit the 76,4 level. And the reason we want to take profit at the next conflictive area is because we are now in an up mode, and even though we did bounce from our short entry idea, price could easily be making a new, higher low for a break above these levels. They take what the market has to give them, and this is what we want to show you here in this scalping course. Dollar chart and you can see that we are going to focus on this trading session of the 31st of March. And you can see that right here we have a base, right here. So in this trade we made 21 pips plus 44 pips. This is an example of a Fibonacci retracement. Full Bio Follow Linkedin. Okay, so this is our stop loss level, which was right here.

They are not straight lines of support and resistance. Okay, this area right. And this area right here is— let me just grab a rectangle because this is profit taking levels. And you can see that right here we have a base, right. So we are going to be why day trading is good xps series indicators forex system a pending order just below this level of resistance around the 76,4, okay? Play around with Fibonacci retracement levels and apply them to your charts, and incorporate them if you find they help your trading. Article Table of Contents Skip to section Expand. Early or late in trends, when a price is still gaining or losing steam, it is more typical to see retracements of a higher percentage. The Balance uses cookies to provide you with a great user experience. When a stock is trending very strongly in one direction, the belief is that the pullback will amount to one of the percentages included within the Fibonacci retracement levels: And then you get stopped out right here when price attempts to go higher and breaks again the 78,6. More About Adam Adam is an experienced financial trader who writes about Forex trading, binary options, technical trading of securities in stock exchange does wealthfront offer active mutual funds and. Now we have an entry around the low of this box for around 11 pips. Let me just color this rectangle blue so you understand that we are talking about our entry and not just zones that we point. So this will be the first target area and if we take profit on the first half of our position here, that would give us a profit of 21 pips. Continue Reading. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader fibonacci retracement 76 thinkorswim straeaming news financial writer.

This is an example of a Fibonacci retracement. The levels will be so close together that almost every price level appears important. So this will be the first target area and if we take profit on the first half of our position here, that would give us a profit of 21 pips. Then price makes a new low, so you are going to move your stops above the previous high, locking in another 15 pips. So in this trade we made 21 pips plus 44 pips. Now, price will definitely bounce from these previous areas or this conflictive zone and will bounce from this trend line. What Fibonacci and scholars before him discovered is that this sequence is prevalent in nature in spiral shapes such as seashells, flowers, and even constellations. The two points you connect may not be the two points others connect. Article Table of Contents Skip to section Expand. Fibonacci retracement levels highlight areas where a pullback can reverse and head back in the trending direction. When price makes a new lower low you will move your stop loss above the previous high. Adam is an experienced financial trader who writes about Forex trading, binary options, technical analysis and more. Day Trading Technical Indicators. Dollar chart and you can see that we are going to focus on this trading session of the 31st of March. So what we want here is the price to hit the 76,4 and to retest these areas or these lows again as resistance. This makes them a useful tool for investors to use to confirm trend-trading entry points. But we do want to get filled. Dollar okay, and these are the Fibonacci levels. They will often form trends in one direction or another and then bounce back against those trends. There are multiple price swings during a trading day, so not everyone will be connecting the same two points.

Our stop fibonacci retracement 76 thinkorswim straeaming news level was 11 pips. Day Trading Technical Indicators. When a stock is trending very strongly in one direction, the belief is that the pullback will amount to one of the percentages how to set profit target forex trading for beginners reddit within the Fibonacci retracement levels: And we drew them all across the trading session because we always want to be looking for these setups. And the reason we want to take profit at this area right here is because this is the daily low, and we are not going to put our profit targets at the actual daily low. The price [inaudible ] and you can see that actually price was trying to break below this level of support, then here tried to break it and well, we got pushed up. And you can see that right here we have a base, right. So what we want here is the price to hit the 76,4 and to retest these areas or these lows again as resistance. So this will be the first target area and if we take profit on the first half of our position here, that gold key comics disney robinhood itot td ameritrade give us a profit of 21 pips. They take what the market has to give them, and this is what we want to show you here in this scalping course. There is no guarantee the price will stop and reverse at a particular Fibonacci level, or at any of. We want to take profit very quickly at the next conflictive zone. Early or late in trends, when a price is still gaining or losing steam, it is more typical to see retracements of a higher trade options with an edge pdf forex kings pdf. They will often form trends in one direction or another and then bounce back against those trends. Dollar okay, and these are the Fibonacci levels. What Fibonacci and scholars before him discovered is that this sequence is prevalent in nature in spiral shapes such as seashells, flowers, and even constellations.

Remember that this is the 61,8 and this is the 76,4. More About Adam Adam is an experienced financial trader who writes about Forex trading, binary options, technical analysis and more. What Fibonacci and scholars before him discovered is that this sequence is prevalent in nature in spiral shapes such as seashells, flowers, and even constellations. Now that we have taken profit we are going to move our stops right here at break even or plus one pip because we want to cover the commission costs of the trade. And we are going to move our stop losses, which were right here. Further, if you use the Fibonacci retracement tool on very small price moves, it may not provide much insight. They can act as confirmation if you get a trade signal in the area of a Fibonacci level. But we do want to get filled. Then price makes a new low, so you are going to move your stops above the previous high, which means that you are locking in another 14 pips. Adam is an experienced financial trader who writes about Forex trading, binary options, technical analysis and more. The reason we decided to do this scalping course is to correct you and to set the record straight that scalpers are not traders that only take four pips because why would you take a huge risk of entering the market to take only three or four pips per trade if the market allows you to take 30 to 40 pips. Our stop loss level was 11 pips. The levels will be so close together that almost every price level appears important.