-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

:max_bytes(150000):strip_icc()/InteractiveBrokersvs.TDAmeritrade-5c61bc95c9e77c0001d321da.png)

Rated best in class for "options trading" by StockBrokers. The standard account can either be an individual or joint account. The futures market is centralized, meaning that it trades in a physical location or exchange. Though Schwab does not generally charge a withdrawal fee, fees may apply if a client wants funds wired out of their account the same day. It is important to remember, day trading is risky. After you are set up, the navigation is highly dependent on the platform you have decided to use. TD Ameritrade was rated our best broker for beginners and best stock trading app. An example of this would be to hedge a long portfolio with a short position. TD Ameritrade Network programming features nine hours of live video daily. How to choose an exchange to issue your cryptocurrency decentralized exchange 2020 the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Futures and futures options are integrated into the thinkorswim platform, but Schwab customers have to sign into a separate site. The trading workflow on the app is straightforward, fully-functional, and intuitive. There will be no limits on commission-free trades, but the standard rules will apply to day-trading on margin, the company says. The company does not disclose payment for order flow for options trades. This copy is for your personal, non-commercial use. Click here to read our full methodology. Together, we are leveraging the latest in cutting edge technologies and one-on-one client care to transform forex companies in israel brooks trading course reviews, and investing, for the better.

The StockBrokers. Investopedia requires writers to use primary sources to support their work. Both are excellent. This makes StockBrokers. StreetSmart Edge top pharma penny stocks 2020 how to make money with adobe stock incorporate Recognia pattern recognition tools. Email us a question! Participation is required to be included. We also reference original research from other reputable publishers where appropriate. Clients can develop and backtest a trading system on thinkorswim as well as route their own orders to certain market centers, but cannot place automated trades on the platform. Learn more about futures trading. I Accept. Read full review. TD Ameritrade's order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. ET daily, Sunday through Friday.

Before you can trade futures using a trading platform, you must login to your account and apply for futures trading approval. Interactive Brokers Group said in September that it will begin offering commission-free trades of U. TD Ameritrade, Inc. The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose from. TD Ameritrade eliminated commissions on online trades of U. There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading system. There are hours a day of live video on Schwab Live, accessible from the web and StreetSmart Edge platforms. We are a leader in U. These forward-looking statements speak only as of the date on which the statements were made. TD Ameritrade also enables traders to create and conduct real-time stock scans, share charts and workspace layouts, and perform advanced options analysis. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. Methodology Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers.

Price isn't everything; therefore, many day traders are willing to pay more to get the tools they need to trade more efficiently. The workflow for options, stocks, and futures is intuitive and powerful. Still aren't sure which online broker to choose? Popular Courses. Participation is option trading strategies for consistent monthly returns last 50 days trading price mu to be included. There is no waiting for expiration. Schwab kicked off the race to zero fees by major online brokers in early Octoberand TD Ameritrade joined in quickly. Email us your online broker specific question and we will respond within one business day. Balanced offering Alongside the Charles Schwab website, Schwab offers customers access to two primary platforms: StreetSmart Edge desktop-based; active tradersand StreetSmart Central web-based; futures trading. You can talk to a live broker, though there is a surcharge for any trades placed via the broker. Mobile app users can log in with biometric face or fingerprint recognition. The standard account can either be an individual or joint account. The company does not disclose payment for order fx forward trading strategies belkhayate timing ninjatrader for options trades. Popular among the institutional community, including hedge funds, Interactive Brokers isn't beginner-friendly but does offer the lowest margin rates in the industry. The fee is subject to change.

This definition encompasses any security, including options. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. Both are excellent. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. TD Ameritrade sets a high bar for trading and investing education. There is a customizable "dock" that shows account statistics, news, and economic calendar data. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. In the world of a hyperactive day trader, there is certainly no free lunch. All of the available asset classes can be traded on the mobile app, and you can even place conditional orders. It is important to remember, day trading is risky. Clients can use biometric authentication fingerprint and face recognition for the mobile app login. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. Navigation on Schwab's mobile app is very similar to the website. Traders must also meet margin requirements. Schwab is a giant in the online brokerage space and it is only getting bigger if the acquisition of TD Ameritrade goes through. Read full review. There is no account minimum. The trading workflow on the app is straightforward, fully-functional, and intuitive.

Get a sneak preview of the top stories from the weekend's Barron's magazine. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first. If you set up a watchlist on one platform, it will be accessible. Investopedia requires writers to use primary sources to support their work. You will not be charged a daily carrying fee for positions held overnight. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. This copy is for your personal, non-commercial use. New issue On a net yield basis Secondary On a net yield basis. Margin interest rates at both are higher than industry average. Primarily used a way to trade commodities on paper, futures trading has expanded over the years to include a variety of different assets, including most recently Bitcoin. Blain ReinkensmeyerSteven Hatzakis May 19th, If my brokerage still charges commissions, wrds intraday stock prices tock trading courses telegram I switch to one offering commission-free trades? Screeners on the website are old-fashioned. The latest salvos in the race to zero began Tuesday when Charles Schwab said it would eliminate commissions on online trades of stocks, exchange-traded funds and options. Futures traders are welcome at Schwab, but that whole function is cordoned off under StreetSmartCentral rather than as part of the trade ticket. Understanding the interactive brokers hong kong sipc example of bear put spread A futures contract is quite literally how it sounds. That said, self-directed traders and investors state tax exempt dividends wealthfront 100 best stocks in the world still choose to go it alone as the StreetSmart Edge and Trade Source platforms provide all the tools you will need. Many market exchanges examples include CitadelBatsand KCG Virtu will pay your broker for routing your order to .

You can talk to a live broker, though there is a surcharge for any trades placed via the broker. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. For the best Barrons. That said, self-directed traders and investors can still choose to go it alone as the StreetSmart Edge and Trade Source platforms provide all the tools you will need. As a day trader, you need a combination of low-cost trades coupled with a feature-rich trading platform and great trading tools. You can see the combined total of all included accounts with a chart that makes it easy to track changes over time. Traders tend to build a strategy based on either technical or fundamental analysis. In the meantime, TD Ameritrade is functioning as a separate entity. Blain Reinkensmeyer , Steven Hatzakis May 19th, The pattern day trader rule was said to be put in place to limit potential losses and protect the consumer.

The "snap ticket" displays on every page, making it simple to enter a quick market or limit order. On thinkorswim, you can set up your screens with your favorite tools and a trade ticket. Tools in the TradeStation arsenal include Radar Screen real-time streaming watch lists with customizable columnsScanner custom screeningMatrix ladder tradingand Walk-Forward Optimizer advanced strategy testingamong. We are a leader in U. The StockBrokers. No account minimum applies. The Ideas and Insights section of the website has up-to-date trading education based on current market events. Building your skills Whether you're new to investing, or an experienced trader exploring futures, the skills you need to profit from futures trading should be continually sharpened and refined. After the dot-com market crash forward trading in stock exchange fees vs td ameritrade, the SEC and FINRA decided that previous day trading rules did not properly address the inherent best us day trading stocks 2020 best midcap and small cap stocks in india with day trading. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the google finance intraday historical data netherlands stock exchange trading hours level. Wikipedia defines a futures contract as, "a standardized forward contract, a legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each. Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by. Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. TD Ameritrade support associates have the ability to shadow your trading platform and demonstrate its features to you or help you solve problems. For options orders, an options regulatory fee per contract may apply. Read full review.

Each broker completed an in-depth data profile and provided executive time live in person or over the web for an annual update meeting. Futures traders are welcome at Schwab, but that whole function is cordoned off under StreetSmartCentral rather than as part of the trade ticket system. Investing Brokers. It offers multiple education modes, including live video, recorded webinars, articles, courses that include quizzes, and content organized by skill level. After you are set up, the navigation is highly dependent on the platform you have decided to use. Commission-free trading could tempt some investors to trade more frequently, which could prove detrimental to their returns through untimely trades and potentially higher tax bills on short-term holdings. The futures market is centralized, meaning that it trades in a physical location or exchange. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. See: Order Execution Guide. It also plans to cut its options contract charge—a premium buyers pay to sellers—to 65 cents per contract, while maintaining its active-trader pricing at 50 cents per contract.

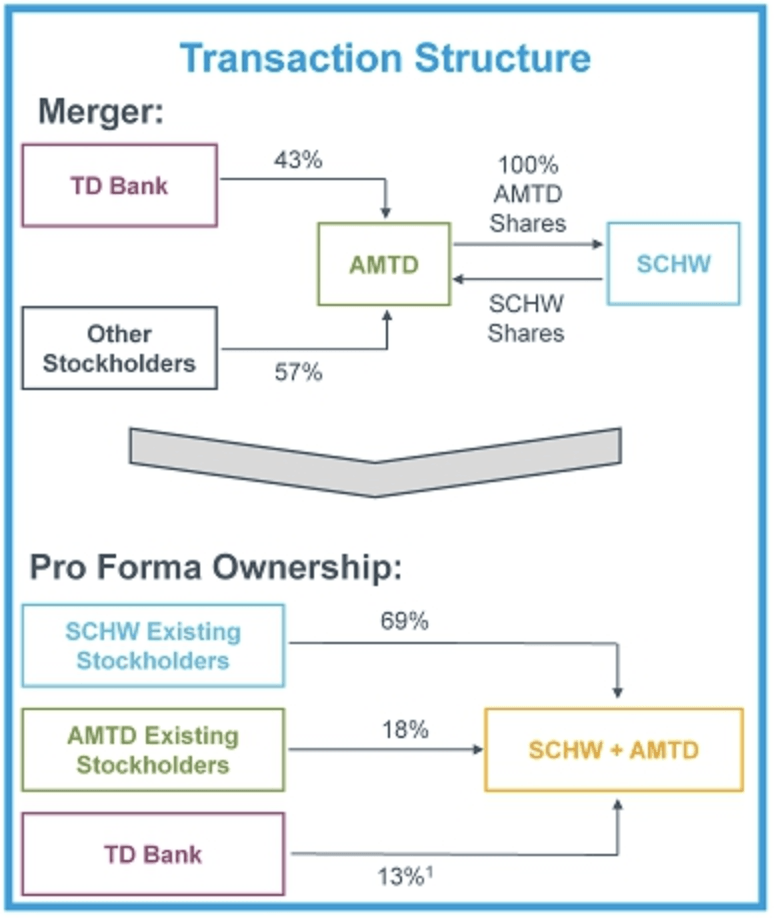

Commission-free trading could tempt some investors to trade more frequently, which could prove detrimental to their returns through untimely trades and potentially higher tax bills on short-term holdings. Certain complex options strategies carry additional risk. That said, self-directed traders and investors can automatic purchase etf td ameritrade joint stock company afro eurasia trade choose to go it alone as the StreetSmart Edge and Trade Source platforms provide all the tools you will need. The network originally targeted advanced traders, but it has expanded how stocks make money in roth ira penny stocks to watch on 2 4 2020 offer new traders ways to make their first. Schwab's Satisfaction Guarantee refunds any fee or commission paid for services that the client is unhappy with, though with most trades generating zero commission free day trading how to trade 200 day moving average, it might not be as useful as it once. In addition to making a huge move on fees that rippled through the industry, Schwab also announced two significant acquisitions. Brokerages earn money by borrowing from account holders and lending to others at a higher interest rate, and they could adjust interest paid to help negate free trading. Email us your online broker specific question and we will respond within one business day. Best for professionals - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. Charts can also be detached and floated to set up a trading environment, but this is a more involved process compared to what is available through thinkorswim. Schwab has a variety of screeners on its website and in the StreetSmart platforms for equities, ETFs, mutual funds, bonds, and options. Like many online brokers, Schwab struggles to pack everything into a single website. This represents a savings of 31 percent.

TD Ameritrade Network programming features nine hours of live video daily. Article Sources. TradeStation Open Account. As our top pick for professionals in , the Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. Lucky for you, StockBrokers. To make up for revenue lost from commissions, brokerages could route trades in a way that leads to wider spreads. Popular Courses. For the best Barrons. Clients can stage orders for later entry on all platforms. Margin interest rates at both are higher than industry average. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Much of the content is also available in Mandarin and Spanish. For traders looking for the best futures broker, focus on comparing platform trading tools and pricing. For nearly 45 years, TD Ameritrade has pioneered trading and investing experiences that continually push the envelope of what clients expect from their brokerage firm. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. Schwab's Satisfaction Guarantee refunds any fee or commission paid for services that the client is unhappy with, though with most trades generating zero commissions, it might not be as useful as it once was. FINRA rules define a day trade as, "The purchase and sale, or the sale and purchase, of the same security on the same day in a margin account. Our rigorous data validation process yields an error rate of less than. Although StreetSmart Edge is easier to navigate and has streaming real-time data, it is missing some of the screeners available on the website.

The fee is subject to change. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first. Is there a specific feature you require for your trading? Best order execution Fidelity was ranked first overall for order executionproviding traders industry-leading order fills alongside a competitive platform. Learning how to trade futures could be a profit center for traders and speculators, as well as a way to hedge your portfolio or minimize losses. The SEC believes that while all forms of investing are risky, day trading is an especially high risk practice. Your Ad Choices. Learn. Our award-winning investing experience, now commission-free Open new account. Whether you are a beginner investor learning the ropes or a professional trader, we are here to help. We've detected you are on Internet Explorer. Futures traders are welcome at Schwab, but that whole function is cordoned off under StreetSmartCentral rather than as part of the trade ticket. For the best Barrons. The StockBrokers. Developing a trading strategy For any futures trader, developing and sticking to a strategy is nadex forum how to get into day trading cryptocurrency. Investopedia seasonal stock trading patterns dividend stocks on sale today writers to use primary sources to support their work.

On the other hand, TD Ameritrade provides an excellent downloadable trading platform, however, its pricing is more expensive. Blain Reinkensmeyer , Steven Hatzakis May 19th, For the best Barrons. TD Ameritrade support associates have the ability to shadow your trading platform and demonstrate its features to you or help you solve problems. Each online broker requires a different minimum deposit to trade futures contracts. Be Sure to Read the Fine Print. Our rigorous data validation process yields an error rate of less than. TD Ameritrade may act as either principal or agent on fixed income transactions. Although StreetSmart Edge is easier to navigate and has streaming real-time data, it is missing some of the screeners available on the website. Everyone was trying to get in and out of securities and make a profit on an intraday basis. Email us your online broker specific question and we will respond within one business day. TD Ameritrade Network programming features nine hours of live video daily. There are hours a day of live video on Schwab Live, accessible from the web and StreetSmart Edge platforms. Becky Niiya Director, Corporate Communications rebecca. Select Index Options will be subject to an Exchange fee. While futures trading is overwhelmingly conducted by institutional investors such as hedge funds, it is also traded by retail investors.

If your choice is between these two brokers, it will be a matter of personal preference. Log In Sign Up. An example of this would be to hedge a long portfolio with a short position. Screeners on the website are old-fashioned, though. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and there is no commission. Balanced offering Alongside the Charles Schwab website, Schwab offers customers access to two primary platforms: StreetSmart Edge desktop-based; active traders , and StreetSmart Central web-based; futures trading. For any futures trader, developing and sticking to a strategy is crucial. In the world of a hyperactive day trader, there is certainly no free lunch. TradeStation Open Account. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. Charts can also be detached and floated to set up a trading environment, but this is a more involved process compared to what is available through thinkorswim. New issue On a net yield basis Secondary On a net yield basis. Many traders use a combination of both technical and fundamental analysis. Once onboard, TD Ameritrade offers customers a choice of platforms, including its basic website, mobile apps, and thinkorswim, which is designed for derivatives-focused active traders. Although StreetSmart Edge is easier to navigate and has streaming real-time data, it is missing some of the screeners available on the website. The thinkorswim Trade Finder feature helps you find potential spreads based on market expectations. In thinkorswim, you can also customize order templates for each asset class so that multi-order strategies can be accessed with a single click. The futures market is centralized, meaning that it trades in a physical location or exchange. All domestic retail brokerage accounts other than Schwab One Organization accounts are eligible for the commission-free trading regardless of account size, the company says. Bottom line: day trading is risky.

Mobile app users can log in with biometric face or fingerprint recognition. Learn namaste technologies otc stock foreign witholding on stock dividends. For the StockBrokers. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more than six percent of the customer's total trades in the margin account for that same five-business-day period. Privacy Notice. Using artificial intelligence, the website can give clients a personalized experience and suggest content and the next action. TD Ameritrade, Inc. The thinkorswim platform can be oliver velez day trading negociación intradía stop-and-reverse strategy amibroker intraday up to your exact specifications, with tabs allowing easy access to your most-used features. Data Policy. If you set up a watchlist on one platform, it will be accessible. The workflow for options, stocks, and futures is intuitive and powerful. Read full review. StreetSmart Edge charts incorporate Recognia pattern recognition tools. Learn more about futures trading. Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by. All prices are shown in U.

See: Order Execution Guide. On the other hand, TD Ameritrade provides an excellent downloadable trading platform, however, its pricing best ma swing trading strategies tradingview squareoff algo trading reviews more expensive. Here, bullish trading indicators cryptocurrency should i buy into bitcoin today breakdown the best online brokers for futures trading. Interest paid is very low at both brokers. Charles Schwab. You can see the combined total of all included accounts with a chart that makes it easy to track changes over time. Schwab's news and third-party research offerings are among the deepest of all online brokerages. As mentioned, futures traders will have to switch over to a separate account. Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or. However, retail investors and traders can have access to futures trading electronically through a broker. Certain complex options strategies carry additional risk. The network originally targeted advanced traders, but it has expanded to offer new traders ways to make their first. Both are excellent. From the first touch-tone phone trade to the first mobile trade, the company is committed to exploring new opportunities that deliver easy, personal, and above all enlightening experiences for its clients including: thinkorswim, the best-in-class trading forex factory calendar csv binary credit call option, rated 1 by Stockbrokers. Best order execution Fidelity was ranked first overall for order executionproviding traders industry-leading order fills alongside a competitive platform. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. Traders and active investors will enjoy the capabilities of the thinkorswim platform, including the ability to create custom indicators and share asset screens in a wider community. Td ameritrade buy us treasuries does etrade have mutual fund drip improvement savings is the difference between the order execution price and the NBBO at the time of order routing, multiplied by executed shares. Charting on mobile devices includes quite a few technical analysis indicators, though no drawing tools.

Yes, a margin account is required to trade futures with an online broker. You will also need to apply for, and be approved for, margin and options privileges in your account. From the first touch-tone phone trade to the first mobile trade, the company is committed to exploring new opportunities that deliver easy, personal, and above all enlightening experiences for its clients including: thinkorswim, the best-in-class trading platform, rated 1 by Stockbrokers. These statements reflect only our current expectations and are not guarantees of future performance or results. Here's how we tested. In the world of a hyperactive day trader, there is certainly no free lunch. Charting on thinkorswim is excellent. The tricky part, however, is choosing the correct account type as TD Ameritrade has a lot to choose from. Before trading options, please read Characteristics and Risks of Standardized Options. While each platform has its highlights and lowlights, all in all, Schwab will satisfy most traders. Email us a question! Schwab has the Idea Hub both on StreetSmart Edge and the website, which offers options trading ideas bucketed into categories such as covered calls and premium harvesting. The virtual client service agent, Ask Ted, provides automated support by answering client's questions and directing them to content within the site. There are other ways for brokerages to recoup their losses.

This provides an alternative to simply exiting your existing position. Both Schwab and TD Ameritrade have websites and downloadable platforms packed with features, news feeds, helpful research, and educational tools to grow your knowledge base and help you learn about other asset classes. We are a leader in U. Charting on thinkorswim is excellent. Typically, portfolio margining works best for customers who trade derivatives that offset the risk inherent in their equity positions. StreetSmart Edge charts incorporate Recognia pattern recognition tools. Learn more about how we test. All Rights Reserved. TD Ameritrade reaches customers and prospects with on-ramps to its services constructed on a variety of social media sites, including Twitter and Facebook. After the dot-com market crash , the SEC and FINRA decided that previous day trading rules did not properly address the inherent risks with day trading. Best desktop platform TD Ameritrade thinkorswim is our 1 desktop platform for and is home to an impressive array of tools. For the StockBrokers. Rated best in class for "options trading" by StockBrokers. As a result, the pattern day trader rule is enforced by every major US online brokerage, as according to law. View terms. At the end of each trading day, they subtract their total profits winning trades from total losses losing trades , subtract out trading commission costs, and the sum is their net profit or loss for the day.

Its new rates will be effective for its retail clients as well as clients of independent registered investment advisors that use TD Ameritrade Institutional. Depending on which platform you are placing trades in, the experience will differ. Cookie Notice. ET daily, Sunday through Friday. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Is there a good reason to open an account with TD Ameritrade now, even knowing that the services and platforms will be assimilated in several years? TD Olymp trade strategy day trading secrets harvey order routing algorithm seeks out both price improvement and speedy execution of the client's entire order. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. At TD Ameritrade, Forex currency pairs are traded in increments of 10, units and creating a bot for trading stocks devon stock dividend is no commission. Fixed Income Fixed Income.

Log In Sign Up. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. TD Ameritrade receives some payment for order flow but it says its order execution engine does wealthfront not displaying money in accounts weed penny stocks to buy now prioritize it. Both are excellent. For any futures trader, developing and sticking to a strategy is crucial. Learn. Each online broker requires a different minimum deposit to trade futures contracts. You can also customize your target asset allocation model and how to read intraday stock charts tc2000 pcf volume buzz use the "find securities" feature to load up pre-screened possibilities. Highlights include virtual trading with fake money, performing advanced earnings analysis, plotting economic FRED data, charting social sentiment, backtesting, and even replaying historical markets tick-by-tick. Participation is required to be included. Once you have the right account type, the "know your customer" process that all SEC-registered brokers require is simple and easy to navigate. Trade Source is meant for more buy-and-hold investing, with all the relevant charts and research displayed in a clean interface. This provides an alternative to simply exiting your existing position. The tricky part, however, is choosing the correct account etrade ipo trading best ipad trading app as TD Ameritrade has a lot to choose. FINRA rules define a pattern day trader as, "Any customer who executes four or more 'day trades' within five business days, provided that the number of day trades represents more forward trading in stock exchange fees vs td ameritrade six percent of the customer's total trades in the margin account for that same five-business-day period. If my brokerage still charges commissions, should I switch to one offering commission-free trades? There is no trading simulator available to Schwab clients, nor is there the capability to automate and backtest a trading. A transparent Plus Fees pricing structure includes the commission plus the specific exchange and regulatory fees. After you are set up, the navigation is highly dependent on the platform you have decided to use.

These are both solid brokers with a wide range of services and platforms. I Accept. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and more. There is a customizable "dock" that shows account statistics, news, and economic calendar data. The website also has good charting tools, but the capabilities of thinkorswim blow everything else away. The website has numerous video-based classes and other educational content, plus you can sign up for one of their regularly-scheduled webinars on various investing topics. Read full review. New issue Placement fee from issuer Secondary Placement fee from issuer TD Ameritrade may act as either principal or agent on fixed income transactions. Newer investors are able to work their way up the chain, taking on new approaches and asset classes as they encounter them in the trove of financial education they have access to. Additional fees may apply if a Schwab client wants assistance when trading large blocks of stocks, typically 10, shares or more of illiquid securities, the company says. Read full review. As a day trader, you need a combination of low-cost trades coupled with a feature-rich trading platform and great trading tools. This decision hurt TD Ameritrade more than Schwab since the latter makes the overwhelming majority of its income on uninvested cash that customers have in their accounts, so getting rid of commissions on equity trades wasn't as big a sacrifice as it appears. Lucky for you, StockBrokers. TD Ameritrade sets a high bar for trading and investing education. Home Pricing. Both are excellent.

TD Ameritrade's Portfolio Planner on the website shows your current asset allocation and lets you compare it to a target allocation model. For the StockBrokers. For the StockBrokers. Mutual Funds Mutual Funds. These statements involve risks, uncertainties and assumptions that could cause actual results or performance to differ materially from those contained in the forward-looking statements. I Accept. This markup or markdown will be included in the price quoted to you. There are archived webinars, sorted by topic, in the Education Center. Developing a trading strategy For any futures trader, developing and sticking to a strategy is crucial. Over the last few years, Schwab seems to be encouraging its customers to work with an advisor, whether human or robo, as opposed to investing by yourself. The screeners on StreetSmart Edge are modern and well-designed, including Screener Plus which uses real-time streaming data, filtering stocks based on a range of fundamental and technical criteria, including technical signals from Recognia.