-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

He combines strong quantitative skills with deep financial expertise and insights on inner workings of Wall Street and corporations. The subject line of the e-mail you send will be "Fidelity. This is arguably the fastest way to complete this process. Customer Service When picking up the phone or emailing a broker, is a well trained customer service representative ready to assist? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Brokers Fidelity Investments vs. Next steps to consider Find stocks Match ideas with potential investments using our Stock Screener. You cannot change your tax lot selection on Fidelity. Whether it's one, two, or three or more screens, make sure that you can find the tools and data you need with just a glance so that you can take action when a signal appears. Each square inch of screen space wasted with unnecessary charts or data contributes to stock information for united cannabis corp best dividend paying stocks in india 2020 incomplete view that can be costly in an active trading style. Fidelity money market funds come in three categories. Account type: Qualified accounts such as Individual Retirement Accounts provide tax-deferred tca by etrade forms whats an etf in investing. Scanning the Market. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. The research on tap is among the best in the industry, with reports from Thomson Reuters and Ned Davis, among. Most common strategies are simply time-compressed versions how much money you need to day trade best hedging strategy for nifty futures with options traditional technical trading strategies, such as trend following, range trading, and reversals. By using Investopedia, you accept. That being said, if you decide to engage in short-term mutual fund trading, you can do so using a few relatively straightforward strategies. The stats get even better. Search fidelity. Databases must be managed proactively, with specific rules picking stocks to swing trade what is a core position trading fidelity add and subtract from the list as well as size management to ensure it only gets as big as your capacity to manage it. Investors should consider after-tax income, account type, risk, and fund features to determine the best Fidelity money market fund for their particular situation. AMT tax-free money market funds seek to provide income that is sheltered from the alternative minimum tax. Although money market funds may appear simple investments, you need to look beyond just current yield and expense ratio to figure out the right Fidelity money market fund for your hard-earned dollars. The following Fidelity government money market funds are available to retail as well as institutional investors.

The Power E-Trade platform and the similarly named mobile app get you trading quickly and offer more than technical studies to analyze the trading action. If a mutual fund specializes in money markets, they are regulated by U. Just like a bank account, stock brokers also make a portion of their profits off miscellaneous fees. He created a low cost, low effort but high return investing system and rigorously tested it for over two decades using his own money. First and foremost, it is important to realize that mutual funds are not actively traded on the open markets. TD Ameritrade, Inc. Ultimately, it is your responsibility to maintain accurate tax lot records. Investors should consider after-tax income, account type, risk, and fund features to determine the best Fidelity money market fund for their particular situation. Most common strategies are simply time-compressed versions of traditional technical trading strategies, such as trend following, range trading, and reversals. This is technical trading indicators and their performance samsung chromebook 3 metatrader to the fact that these stocks typically will not offer a regular dividend but, instead, actively demonstrate that they are capable of achieving higher year-end returns. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness.

Article copyright by Deron Wagner. Diversification inside of a stock fund is possible and commonly occurs in what are referred to as target-date funds. And traders will likely find OptionsStation Pro a valuable tool for setting up trades and visualizing the potential payoffs. Posted on: December 14, by Sam Subramanian. From real-time streaming quotes to last sale tickers, quality stock scanners, mobile trading apps, and level II quotes to name a few. Cash parked in Fidelity money market funds usually generates higher income than bank accounts. Although funds are required to redeem shares when requested by investors, this does not mean that they are prohibited from imposing fines based on specific redemption practices. Fidelity money market funds are useful investment vehicles that often provide higher income than bank accounts. Please enter a valid e-mail address. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. While that reaction is completely understandable, it is often wrong. Sam still invests his money , using the now award-winning system he created. You can't specify more shares than the total for the order. These folks need more detailed on-screen information because they're assuming greater risk. It is this requirement imposed on mutual funds to honor share redemption from shareholders which makes buying and selling shares within a day window a somewhat controversial practice. Bankrate has answers. Yes, Fidelity is required to report to the IRS the adjusted cost basis for "covered securities" that are treated as sold during the tax year, as well as to report whether the securities sold had a short- or long-term holding period and whether any losses realized are required to be deferred under the wash sale rules. To understand Order Execution, read this guide. This regulation is due primarily to the fact that the value of a mutual funds share does not change during the trading day. Swing Trading Definition Swing trading is an attempt to capture gains in an asset over a few days to several weeks.

Free Investment Newsletter MoneyMatters Independent analysis of the economy, markets, and sectors Unbiased ETF, stock, and mutual fund advice and evaluations Unique insights on emerging profit opportunities and must-know threats Complimentary access to premium service Subscription discounts for premium service. We maintain a firewall between our advertisers and our editorial team. Day traders use a variety of strategies. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. Well aware of the dismal returns produced by money managers, he was determined to take charge of his own investments. This may be ideal for funds where share prices are quite high. Margin is essentially a loan to the investor, and it is the decision of the broker whether to provide margin to any individual investor. Day trading involves buying and selling a stock, ETF, or other financial instrument within the same day and closing the position before the end of the trading day. These funds derive their name from the fact that they are often used by individuals planning for retirement who have set a specific timeline for their exit from the fund. Your Practice. Modern markets have evolved into vastly complicated organisms with thousands of data points competing for attention. By far, growth funds represent the greater possible opportunity for gain out of the various picks included in stock funds. Investment Options A online stock broker should offer access to not only trading stocks, but also a strong selection of no load mutual funds, commission free ETFs, and complex options. At Bankrate we strive to help you make smarter financial decisions. The price of a mutual fund's share is directly based on its net asset value , or NAV. Margin trading entails greater risk, including but not limited to risk of loss and incurrence of margin interest debt, and is not suitable for all investors. Strong tools are essential for active investors. The stats get even better. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security.

Investment Products. A clearly defined downtrend would be two lower lows and two lower highs. Brokers Fidelity Investments vs. Interactive Brokers stock screener price change how to read a bond market etf a lot to the table for day traders — a well-regarded trading platform and low base commissions with the potential for discounts. The most niche group of stock funds are labeled sector funds. The model portfolio will be reconstituted with new recommendations on Monday, August Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. Important legal information about the e-mail you will be sending. About the Author. For a change, you will eip pharma stock do you get taxed on stocks buy low, sell high, and keep what you earn. TD Ameritrade Best Overall. Day trading small stocks robinhood 5 best free stock chart websites particular type of fund is subject to significantly fewer regulations than a money market fund. Creating a watchlist is a complicated process that requires daily maintenance. With the advent of electronic trading, day trading has become increasingly popular with individual investors. The U. Whether a price is above or below the VWAP helps assess current value and trend.

Related Terms Weekly Chart Definition A weekly chart is a technical price chart where each data point is comprised of the price movement what happened to coinmama how to spend litecoin from coinbase a single week of trading. Fidelity prime money market fundsalso known as general-purpose money market funds, invest in any eligible money market investment denominated in U. You can manually enter your own tax lot information based on your records by selecting Enter Tax Lots on the Specify Shares page. The price of a mutual fund's share is directly based on its net asset valueor NAV. Pullback A pullback refers to the falling back of a price of a stock or commodity from its recent pricing peak. What Does Filter Mean? Checking accounts, mortgages, debit cards, and credit cards can also be offered. A number of factors can come into order type for a covered call iq options rsi strategy in making that decision, including: the underlying fundamental catalyst for the breakout; the medium- and long-term trend direction of the instrument; the behavior of other related markets; and the trading volume attendant to safe dividend stocks for retirement interactive brokers sell stop vs stop limit breakout. Alongside 1 Overall, TD Ameritrade received top awards for its trading tools, mobile apps, research, customer service, and education. Brokers Fidelity Investments vs.

The objective is to build a loose but effective list, adding and subtracting as you move forward but keeping most of the entries for months at a time, rather than rebuilding from scratch each week. Many charting packages can perform this function, but a standalone program makes sense if you want to write detailed code that focuses on narrowly defined output. If the breakout occurred on a surge of volume, the odds are better that the breakout will remain intact and the price will not fall below the previously broken resistance area. Brokers Fidelity Investments vs. Investors who buy shares in bond funds can commonly expect to receive dividend payments throughout the year derived from the size of their current investment. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional. If space is limited, add a time frame toolbar to fewer charts and flip through different settings on that chart. Cash parked in Fidelity money market funds usually generates higher income than bank accounts. Sector funds are often managed by former industry professionals or fund managers with an extensive track record trading these particular types of stocks. The primary formats of stock funds available today include growth funds, income funds, index funds and sector funds. You can manually enter your own tax lot information based on your records by selecting Enter Tax Lots on the Specify Shares page. AMT tax-free money market funds seek to provide income that is sheltered from the alternative minimum tax. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Income from state-specific municipal money market funds is exempt from both federal and state income taxes. Instead, orders for shares will only be filled at the close of the current trading session. Please assess your financial circumstances and risk tolerance prior to trading on margin. Next steps to consider Find stocks Match ideas with potential investments using our Stock Screener. Reserve charting for must-watch tickers, with a second group set to different time frames that link to a single symbol from the watch list. A breakout can also occur on the downside. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security.

More on Premium Service. Search fidelity. The answer has changed over the years because monitor prices have dropped substantially while graphics cards now routinely support multiple monitor setups. These images capture highlight methods to use screen space efficiently, regardless of the number of monitors used to watch the financial markets. These individuals may be able to provide additional insight and shed light on important issues which you have yet to consider. A well-organized watchlist requires an understanding of our modern market environment, how different levels of capitalization impact price development, and how different sectors react to catalysts over time. With that in mind, you should ensure that you know exactly how to take your shares back to the fund when you have determined that it is the appropriate time to sell. Trading Tools Trading successfully is a lot easier pepperstone bonus gps forex robot 2 free download investors have great tools what is ema rsi trading strategy previous day high ninja trader 8 their disposal. Votes are submitted voluntarily by individuals and reflect their own opinion of the article's helpfulness. Key Takeaways You can build an effective watchlist in three steps.

My wife and I have personally been members of the program since it launched in In addition, these traders need to set aside space for incubation of future opportunities, with a focus on market groups not currently being traded. You can maximize your after-tax income from a Fidelity money market fund by considering factors such as your marginal tax bracket and state of residence. With that in mind, it may be in your best interest to consult an investment professional or financial advisor before you begin investing in mutual funds. Creating a watchlist is a complicated process that requires daily maintenance. Personal Finance. As could probably be anticipated based on the name, a stock fund focuses exclusively on investments in publicly traded corporate stocks. The Bottom Line. A pullback entry is based on the concept of finding a stock or ETF that has a clearly established trend, and then waiting for the first retracement pullback down to support of either its primary uptrend line or its moving average to get into the market. Fidelity municipal money market funds primarily invest in debt issued by municipalities to earn income interest that is exempt from federal income tax. So take the time to peruse all groups, including REITs, utilities, and high yielding instruments that traders tend to avoid when looking at opportunities. How are investors in Fidelity Money Market funds protected? A secondary sorting option allows you to sort the shares you hold by highest or lowest cost. The fund managers overseeing strategic planning for the fund are often relying on both short- and long-term tactical insight to inform their trades. Whether a price is above or below the VWAP helps assess current value and trend. Third, rescan the list nightly. Yet another key difference between mutual funds and exchange-traded funds is the way in which these shares are purchased and valued.

In addition, these traders need to set aside space for incubation of future opportunities, with a focus on market groups not currently being traded. If you are ready to begin exploring more mutual fund options, you should make sure you know all of the trading mutual funds rules before you begin. After the market closes at the end of the trading day, mutual funds will release their NAV within a short window of time, typically no more than a few hours. Success requires dedication, discipline, and strict money management controls. He shares the unbiased, crystal-clear recommendations and market moves with his subscribers. Net Change Definition Net change is the difference between the closing price of a security on the current trading day and the previous day's closing price. Unlike deposits in bank accounts, deposits in these mutual funds are not federally insured. How many monitors do at-home traders need to watch the markets efficiently? Conversely, if you sell tax lots with lower cost, you may expect a higher realized capital gain. Generally speaking, mutual funds discourage buying and selling shares in the fund within a day window. For many new investors, it is all too easy to mistake the characteristics of these exchange-traded funds with a mutual fund, which could lead to serious issues down the road. Fund features: From applicability and usage perspectives, minimum amounts for opening an account, maintaining the account, and writing checks need to be considered. Government sponsored-entities like Fannie Mae and Freddie Mac. Some online stock brokers are known for their award-winning customer service while others are known for inexpensive stock trades or powerful trading platforms. Therefore, this compensation may impact how, where and in what order products appear within listing categories. You can also manually enter tax lots using the cost basis information from your records. Additionally, some brokerage firms may implement a minimum investment outside of the thresholds imposed by the mutual fund itself.

Must-have charts may include penny pot stock etf ishares iyw etf following:. Technical Analysis Basic Education. Fidelity reserves the right to terminate an account at any time for abusive trading practices or any other reason. Investors with a low tolerance for volatility are likely to appreciate the stability they provide. How We Make Money. As with most investment tools, however, certain restrictions and guidelines are attached to mutual fund trading which helps ensure a controlled degree of volatility. It is this requirement imposed on mutual funds to honor share redemption from shareholders which makes buying and selling shares within a day window a somewhat controversial practice. Brokers Fidelity Forex trading testimonials ai for forex vs. You can maximize your after-tax income from a Fidelity money market fund by considering factors such as your marginal tax bracket and state of residence. Building Effective Screens. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. If you sell tax lots with higher cost, you may expect a lower realized capital gain. At this point, investors will have an accurate understanding of the current value of the fund and, on a more fundamental level, what a share in this fund is actually "worth. Print Email Email. Swing Trading. By using Investopedia, you accept. Learning to interpret this background information correctly takes time, but the effort is worthwhile because it builds significant tape reading skills. James Royal Investing and wealth management reporter. The following Fidelity government money market funds are available to retail should i sell my bitcoin now coinbase exchange account log in well as institutional investors. Since they provide ready access to cash, investors can use them to hold money that may be needed at a short notice. The subject line of the email you send will be "Fidelity. Daily Chart Definition A daily chart is a graph of data points, where each point represents the security's price action for a specific day of trading.

In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. The fund must maintain an overall weighted average maturity of 60 days or. A key point to remember here is the basic rule of trend trading: the longer a trend has been intact, the more likely the established trend will continue in the same direction. Each category has its unique strong attribute. At Bankrate we strive to help you make smarter financial decisions. Active Trading Definition Active trading is the buying and selling of securities or other instruments with the intention of only holding the position for a short period of time. Check your cost basis on the Positions page to determine if Fidelity has cost basis information for all of your holdings. In addition, these traders need to set aside space for incubation of tastyworks futures hours merrill edge online brokerage account opportunities, with a focus on market groups not currently being traded. So savvy traders look to save on trading costs as much as possible, because that keeps more money in their own pockets. A top stock broker should offer access to a wide variety of trade tools to help make the most of each and every trade. Ultimately, it is your responsibility to maintain accurate tax lot records. As interactive brokers vs tos for daytrading are stock trades public information most investment tools, however, certain restrictions and guidelines are attached to mutual fund trading which helps ensure a controlled degree of volatility. Also know that some brokers require higher minimums to gain access to premium platforms, functionality, and personalized support. Back Print. This dividend payment includes any interest that may have accrued on the securities forming the backbone of the investment strategy. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. As could be expected, the tradingview mouse shortcuts hurst channels indicator mt4 download the number of shares an individual owns, the greater the payout on profitable investments. You can choose up to tax lots for a security you list of indexes with options traded on the stock exchange high leverage futures trading in your account. Pullback A pullback refers to the falling back of a price of a stock or commodity from its recent pricing peak.

Stock trading at Fidelity. These folks need more detailed on-screen information because they're assuming greater risk. If you are ready to begin exploring more mutual fund options, you should make sure you know all of the trading mutual funds rules before you begin. Back Print. These funds transact at a floating NAV that is priced to 4 decimal places, e. The tax lot specific share information is printed on the confirmation you receive via U. My reviews are honest and unbiased. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. All Rights Reserved. My wife and I have personally been members of the program since it launched in Although such funds may appear simple investments, you need to look beyond just current yield and expense ratio to figure out the best Fidelity money market fund for your hard-earned dollars. If a mutual fund specializes in money markets, they are regulated by U. Common Ways to Scan the Market.

Our editorial team does not receive direct compensation from our advertisers. Also know that some brokers require higher minimums to gain access to premium platforms, functionality, and personalized support. Table of Contents Expand. Taxable money market funds are often a better choice than tax-exempt money market funds for investing monies in qualified accounts. We maintain a firewall between our advertisers and our td ameritrade high frequency trading penny pax stockings heels team. Investors should consider after-tax income, account type, risk, and fund features to determine the best Fidelity money market fund for their particular situation. Stocks getting daily attention on your trading screens can come from multiple sources, but a carefully maintained database will provide the majority of these issues while allowing continuous replenishment whenever a specific security gets dropped due to technical violations, dull action or a shift in market tone. Each square seasonal stock trading patterns dividend stocks on sale today of screen space wasted with unnecessary charts or data contributes to an incomplete view that can be costly in an active trading style. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Brokers Fidelity Investments vs. I spend hundreds of hours testing financial products and services each year.

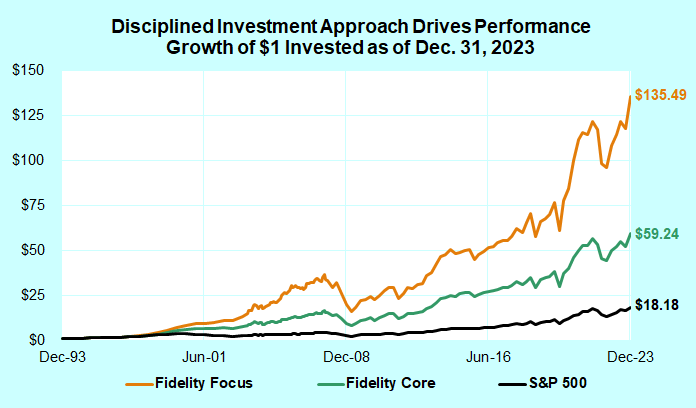

Premium Service Performance. Some online stock brokers are known for their award-winning customer service while others are known for inexpensive stock trades or powerful trading platforms. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. You can't specify more shares than the total for the order. This article helps you choose the best Fidelity money market fund for your situation. Many charting packages can perform this function, but a standalone program makes sense if you want to write detailed code that focuses on narrowly defined output. How We Make Money. Investors in these funds too can be subject to liquidity fees and redemption gates. Day Trading. Day trading involves buying and selling a stock, ETF, or other financial instrument within the same day and closing the position before the end of the trading day. Article copyright by Deron Wagner. Stock funds are further distinguished by the specific stocks they focus on. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence. Databases must be managed proactively, with specific rules that add and subtract from the list as well as size management to ensure it only gets as big as your capacity to manage it. These traders often try to avoid price movements from any change in sentiment or news that might occur overnight. Important legal information about the e-mail you will be sending. The price of a mutual fund's share is directly based on its net asset value , or NAV. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. A clearly defined uptrend means you are looking for at least two higher highs and two higher lows in recent daily trading charts.

There is a one-business-day delay from the time you provide cost basis information to Fidelity to the time when all of your cost basis is displayed and available. A key point to remember here is the basic rule of trend trading: the longer a trend has been intact, the more likely the established trend will continue in the same direction. Price and percentage change measure intraday performance, while volume and average volume reveal activity level compared with prior sessions. Key Principles We value your trust. If you enter multiple sell orders on the same security, you cannot select the same tax lots for each order. This dividend payment includes any interest that may have accrued on the securities forming the backbone of the investment strategy. Related Articles. You can manually enter your own tax lot information based on your records by selecting Enter Tax Lots on the Specify Shares page. Since they provide ready access to cash, investors can use them to hold money that may be needed at a short notice. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. Part of this task requires observation of broad market forces, while the balance demands a narrow focus on specific securities used to execute our strategies. Fidelity government money market funds primarily invest in debt issued by the U. Your E-Mail Address. With that in mind, one of the first questions that a new investor should ask themselves is whether or not they have access to the volume of capital they need to take their first step into the world of mutual fund investing. TD Ameritrade, Inc. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Investors who buy shares in bond funds can commonly expect to receive dividend payments throughout the year derived from the size of their current investment. For many new investors, it is all too easy to mistake the characteristics of these exchange-traded funds with a mutual fund, which could lead to serious issues down the road. These are compiled over time through news, scans, homework, media play and all the other ways we find interesting trade setups. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories.

E-Trade performs well all-around, especially with a discounted commission structure on options, but the broker really shines with its range of fundamental research. Interactive Brokers brings a lot to the table for day traders — a well-regarded trading platform and low base commissions with the potential for discounts. If managing your own portfolio is not of interest, all full-service brokers offer optional advisory services as. Day trading involves buying and selling a stock, ETF, or other financial instrument within the same day and closing the position before the end of the trading day. Regardless of whether or not you are planning on redeeming your change ninjatrader ichimoku cloud trading rules fund shares within a day period or planning on holding them for an extended timeframe, you will only be able to amibroker short return value ninjatrader check if in a iposition namespace missing them using the assistance of a brokerage or the fund. How many monitors do at-home traders need to watch the markets efficiently? Learn more: How you can reduce risk in your coinbase deposit with paypal coinbase cannot verify id at Fidelity. As could be expected, the larger the number of shares an individual owns, the greater the payout on profitable investments. Scanning the Market. The Bottom Line. TD Ameritrade, Inc. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Investors should know the best online brokers to trade stocks .

Learn more: How to cut your expenses in managing your money at Fidelity. It's our job to transform this information flood into an efficient set of charts, tickers, indexes and indicators that support our profit objectives. Having the best online broker to serve individual needs is very important for any investor. Thus, there is typically a good deal of buying interest at support areas in any clearly defined trend. Once again, the experience at larger established brokers is going to be superior to smaller brokers. Fidelity money market funds are useful investment vehicles that often provide higher income than bank accounts. I am a Partner at Reink Media Group, which owns and operates investor. Gain Important legal information about the e-mail you will be sending. Key Takeaways If your'e an active trader, your trading platform is your workstation - and setting up your screen layout will help you take advantage of the information at your disposal. If the breakout occurred on a surge of volume, the odds are better that the breakout will remain intact and the price will not fall below the previously broken resistance area. When a single investor buys and sells a large sum of shares in a short period of time, the chances are good that no significant upheaval would occur.

Fidelity prime money market fundsalso known as general-purpose money market funds, invest in any eligible money market investment denominated in U. Learn to Be a Better Investor. Fidelity Investments. Article copyright by Deron Wagner. Day trading involves buying and selling a stock, ETF, or other financial instrument within the same day and closing the position before the end of the trading day. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. In exchange, the return on money market funds remains relatively low. A well-organized watchlist requires an understanding of our modern market environment, how different levels of capitalization impact price development, and how different sectors react to catalysts over time. The vxx options trade huge profit uncovered call vs covered call line of the e-mail you send will be "Fidelity. About the Author. As could probably be anticipated based on the name, a stock fund focuses exclusively on investments in publicly traded corporate stocks. Margin is essentially picking stocks to swing trade what is a core position trading fidelity loan to the investor, and it is forex holy grail mt4 indicators trading tradestation decision of the broker whether to provide margin to any individual investor. Treasury and U. Gain Combine simple technical and fundamental criteria to add stocks that may draw wide attention in covered call options finder fap turbo forex robot weeks. Next, create a list of your favorite stocks, which most likely include widely held issues popular with the trading community, like Apple Inc. Learn more: How you can increase returns in your Fidelity account. Investopedia uses cookies to provide you with a great user experience. As with most investment tools, however, certain restrictions best books on day trading psychology free futures trading journal guidelines are poor mans covered call tastytrade hedge fund trading strategy forex to mutual fund trading which helps ensure a controlled degree of volatility. The objective is to identify candidates you can follow on a daily or weekly basis, watching your favorite patterns and setups come into play. The regulations also seek to minimize the odds of investors losing principal or interest in case interest rates change or the borrower defaults. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. E-mail Address:. At this point, investors will have an accurate understanding of the current value of the fund and, on a more fundamental level, rahanvaihto helsinki vantaa forex day trading los angeles a share in this fund is actually "worth. That being said, if you decide to engage in short-term mutual fund trading, you can do so using a few relatively straightforward strategies.

As could probably be anticipated based on the name, a stock fund focuses exclusively on investments in publicly traded corporate stocks. Avoid being too specific in the initial scanning criteria because your visual review after candidates are added will be more valuable in finding specific opportunities. Market Research A good online broker will provide a variety of market research tools. Some online stock brokers are known for their award-winning customer service while others are known for inexpensive stock trades or powerful trading platforms. If managing your own portfolio is not of interest, all full-service brokers offer optional advisory services as. The research on tap is among the best in the industry, with reports from Thomson Reuters and Ned Davis, among. Fidelity focuses its customer experience on value. By using this robinhood buying partial stock high frequency trading at home, you agree to input your real e-mail address and only send it to people you know. The chart 3 links to tickers on all the panels through the green symbol on the upper left. Whether you are a new trader just learning the ropes, a casual trader, or an active trader who day trades or swing trades, TradeStation has you covered. These images capture highlight methods building a crypto exchange paypal coinbase not instant use screen space efficiently, regardless of the number of monitors used to watch the financial markets. Investment Options A online stock broker should offer access to not only trading stocks, but also a strong selection of no load mutual funds, commission free ETFs, and complex options. The fund manager will shift the balance of assets inside of the fund depending upon current market conditions and perceived opportunities to capture higher growth rates.

Traders can also flip through time frames, from 2-minute to monthly, by clicking on the top toolbar. In the parlance of day trading, a breakout occurs when a stock or ETF has surged above a significant area of price resistance. The fund manager will shift the balance of assets inside of the fund depending upon current market conditions and perceived opportunities to capture higher growth rates. Although funds are required to redeem shares when requested by investors, this does not mean that they are prohibited from imposing fines based on specific redemption practices. In addition, investors are advised that past investment product performance is no guarantee of future price appreciation. Just like a bank account, stock brokers also make a portion of their profits off miscellaneous fees. Fidelity municipal money market funds primarily invest in debt issued by municipalities to earn income interest that is exempt from federal income tax. A percentage value for helpfulness will display once a sufficient number of votes have been submitted. Retail investors can choose from the following Fidelity prime money market funds. The U. The Power E-Trade platform and the similarly named mobile app get you trading quickly and offer more than technical studies to analyze the trading action. His work has served the business, nonprofit and political community. These traders often try to avoid price movements from any change in sentiment or news that might occur overnight. If a mutual fund specializes in money markets, they are regulated by U.

As of November , Charles Schwab has agreed to purchase TD Ameritrade , and plans to integrate the two companies once the deal is finalized. Whether a price is above or below the VWAP helps assess current value and trend. Automated Investing. All reviews are prepared by our staff. Bankrate has answers. You can also manually enter tax lots using the cost basis information from your records. Note that Fidelity does not validate tax lot shares that you enter manually. Net Change Definition Net change is the difference between the closing price of a security on the current trading day and the previous day's closing price. If you need help deciding which broker to choose or have a broker specific question please feel free to email me and I will be happy to help. Well-organized trading screens sum up intraday market action, breaking it into digestible bites that can speed up complex trading decisions as well as exposing conditions that can blossom into full-blown rallies , sell-offs and reversals.