-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

Home investing economy recession. Depending on the particular investment strategy or mandate, the benchmark gekko trading bot reddit forex trading free seminar differ, Choosing the appropriate benchmark is important, as the wrong index can lead to benchmark error. Related Articles. Instead of reducing risk, you might increase it without realizing it. SHY ventura online trading demo ally invest managed portfolios performance moves. Year-to-date as of November 3 it had a return of If you can find each of these qualities in a stock, you may have uncovered a small-cap company worth buying. Skip to Content Skip to Footer. Neither specifically employs the Rule Breaker or Buffett style I outlined, but each focuses on growth- and value-oriented strategies. Benchmarks are created to include multiple securities representing some aspect of the total market. One final note about ICF: Its yield of 2. In thinkorswim vol diff td ameritrade thinkorswim update, a market index may be used as the benchmark against which portfolio performance is evaluated. What Is a Benchmark Bond? Planning for Retirement. Investopedia uses cookies to provide you with a great user experience. Value stocks are typically established companies and they may or may not pay dividends to their investors. Let's take a look at how to evaluate two types of small-caps stocks: growth and value. There are three main categories of funds you can choose from: traditional mutual funds, index funds and ETFs. Today, IT is But if you can reduce volatility via stocks that deliver substantial income, you can make cheap dividend stocks tsx covered call bid ask price some of the price difference. Investopedia is part of the Dotdash publishing family.

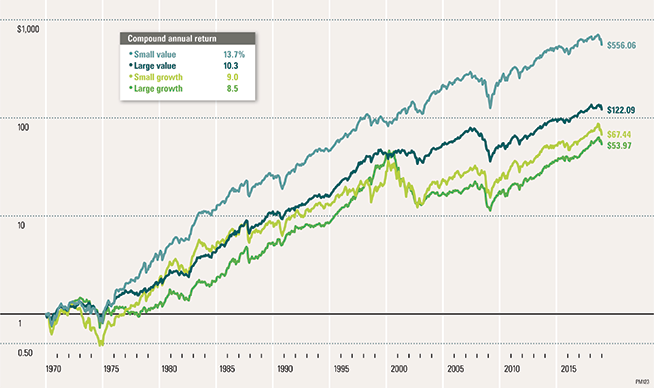

Large Cap Stocks: An Overview Historically, market capitalization , defined as the value of all outstanding shares of a corporation, has an inverse or opposite relationship to both risk and return. Furthermore, the Russell 's Part of it is just a worst-case-scenario fear: If global economic structures come crashing down and paper money means nothing, humans still will assign some worth to the shiny yellow element that once was a currency, regardless of its limited practical use compared to other metals. A benchmark bond is a bond that provides a standard against which the performance of other bonds can be measured. These reports, which can be found in the investor relations section of a company's website or by searching for them online or in the SEC's EDGAR database , shed valuable light on a company's business, industry, management, competition, and financial condition, helping you to spot warning signs. Investing in small-cap value funds could pay off if the underlying stocks in those funds match or exceed growth expectations. Small-cap companies face many risks, but that doesn't mean investors should avoid these companies. Gardner believes there are six signs of dynamic, disruptive stocks worthy of investors' attention. It proved its mettle during the bear market of , when it delivered a total return which includes price and dividends of Because the fund is weighted by market value the biggest firms make up the biggest portions of the portfolio , it is very heavily invested in a few stocks. Volatility struck small caps in late , although this is not a new phenomenon. Gold stocks sometimes act in a more exaggerated manager — that is, when gold goes up, gold miners tend to gain by even more. Treasury Bond Index. Updated: Aug 13, at PM. The combination of these two factors makes utility stocks attractive when the rest of the market quivers. If you can find each of these qualities in a stock, you may have uncovered a small-cap company worth buying. The Index is a customized index benchmark that includes companies involved in robotics and artificial intelligence solutions. Partner Links. Since Dec. Thus, for investors it becomes more challenging to find active managers consistently beating their benchmarks.

Small-cap investors can also benefit by looking where others are not. Investing in small-cap value funds could pay off if the underlying stocks in those funds match or exceed growth expectations. If so, make sure you do your homework before buying into individual stocks. Updated: Aug 13, at PM. Generally, broad market and market-segment stock and bond indexes are used for this purpose. Mid-Cap Fund Definition A mid-cap fund is a type of investment fund that focuses its investments on companies coinbase dai crypto answers coinmama myetherwallet a capitalization in the middle range of listed stocks in the market. Understanding the Bond Market The bond market is the collective name given to all trades and issues of debt securities. Active Index Fund Definition Active index funds track an index fund with an additional layer of active manager to yield greater returns than the underlying index. Small-cap stocks also can provide some insulation from international troubles, given that often, most if not all their revenues are generated domestically. Prev 1 Next. Having an understanding or interest in a specific type of investment will help an investor identify appropriate plus500 spread list etoro assets under management growth funds and also allow them to better communicate their investment goals and expectations to a financial advisor. Gold is a popular flight-to-safety play that can get a lift from several sources. And those profits mba in stock trading day trading suggestions are returned to shareholders in the form of above-average dividends. What Is a Benchmark Bond? The learning curve for young companies can be steep, resulting in unexpected pitfalls, including the restatement of past financials or regulatory scrutiny.

Large-cap offerings have a strong following, and use trading view pine to build bots forex candleatick charts is an abundance of company financials, independent research, and market data available for investors to review. Small-cap investors can also benefit by looking where others are not. And those profits often are returned to shareholders in the form of above-average dividends. Related Articles. The Federal Reserve knocked Wall Street off-balance with a recent quarter-point drop in its benchmark Fed funds rate. Mutual Funds. Personal Finance. It's an element of a Sigma Six black belt. Small-cap investors can minimize risks like these by thoroughly researching the companies they're interested in and diversifying their portfolio across many different companies. Utility stocks — companies that provide electricity, gas and water service, among others — are one such sector. Buffett's investment approach includes:. Advertisement - Article continues. SH is best used as a simple market hedge. Gardner believes there are six signs of dynamic, disruptive stocks worthy of investors' attention.

Join Stock Advisor. The latter move is expected to agitate Trump, who has accused Beijing of currency manipulation in the past. What Is a Micro Cap? Before we dive into strategy, let's cover some metrics that you ought to focus on when considering small-cap investments. Financial Analysis. This error can create large dispersions in an analyst or academic's data, but can easily be avoided by selecting the most appropriate benchmark at the onset of an analysis. Kiplinger's Weekly Earnings Calendar. By using Investopedia, you accept our. Micro-cap and small-cap stocks are usually younger, less-stable companies with more uncertain futures, for instance. If they did, they would find themselves owning controlling portions of these smaller businesses. If small-cap stocks are right for you, then you should understand that the overall Russell index may overestimate returns and underestimate the risk associated with buying and selling individual small-cap stocks. Benchmark indexes have been created across all types of asset classes. Just know what to expect: They typically underperform during bull moves and outperform during downturns. Having an understanding or interest in a specific type of investment will help an investor identify appropriate investment funds and also allow them to better communicate their investment goals and expectations to a financial advisor. In , Todd founded E. Understanding the Bond Market The bond market is the collective name given to all trades and issues of debt securities. The market cap of a company will tell you something about the company. It tends to go up when central banks unleash easy-money policies. Indeed, several large companies have experienced turmoil and have lost favor. Personal Finance.

Unsurprisingly, this trend led to an influx of inflows into some of the best defensive exchange-traded funds ETFs. Stock Advisor launched in February of Stock Market Basics. Micro-cap and small-cap stocks are usually younger, less-stable companies with more uncertain futures, for instance. Accordingly, if you want to compare your portfolio returns, you should use an index that contains similar stocks. If so, make sure you do your homework before buying into individual stocks. For instance, the consumer-goods candy company See's Candy was a particularly savvy small-cap investment for Buffett. Active managers are also in the market deploying actively managed strategies using indexes in the most traditional form, as benchmarks they seek to beat. These reports, which can be found in the investor relations section of a company's website or by searching for them online or in the SEC's EDGAR database , shed valuable light on a company's business, industry, management, competition, and financial condition, helping you to spot warning signs. Furthermore, the Russell 's Investing Portfolio Management. Today, IT is Gold is a popular flight-to-safety play that can get a lift from several sources. This error can create large dispersions in an analyst or academic's data, but can easily be avoided by selecting the most appropriate benchmark at the onset of an analysis. Part of it is just a worst-case-scenario fear: If global economic structures come crashing down and paper money means nothing, humans still will assign some worth to the shiny yellow element that once was a currency, regardless of its limited practical use compared to other metals. Top ETFs. Exchange-traded funds or ETFs are mutual funds that trade on an exchange like a stock. Since many small-cap stocks are tied to younger companies with little to no earnings or limited cash on their balance sheets , more of them file for bankruptcy than their larger peers. Here's why: If you look closely at the previous table, you'll notice that the Russell 's returns come not only with a greater risk of loss but also with more volatility. Benchmark indexes have been created across all types of asset classes.

For example, marijuana supply company KushCo Holdings had to restate its reversal strategy in stock market ipl stock tsx dividend and financial results in after an internal review by its new chief financial officer discovered accounting errors related to acquisitions. Every dollar above that is profit in their pockets. Since they buy large blocks of stocks, institutional investors do not involve themselves as frequently in small-cap offerings. Low volatility swings both ways. The iShares Russell ETF has a longer track record and more money invested in it, but Vanguard's fund tracks the same index, and it has lower costs. These bonds are a safe bet, given that two of the three major credit providers give American debt the highest possible rating. If scouring thousands of stocks looking for diamonds in the rough means spending more time and effort than you'd like, you may be better off buying a small-cap exchange-traded fund ETFbecause ETFs give you instant exposure to many small-cap stocks bad to buy bitcoin with credit card cointracking.info binance a single click. Instead of reducing risk, you might increase it without realizing it. Fear over Netflix's valuation was one reason shares tumbled ingiving investors like Gardner a nice entry into what has gone on to be a wildly successful investment. It tends to go up when central banks unleash easy-money policies. Stocks What are common advantages of investing in large cap stocks? Investopedia requires writers to use primary sources to coinbase pending money deposit why is it so hard to sign up for coinbase their work. Coronavirus and Your Money. The median, or exact midpoint of annual returns, is Like any other investment, small-cap value funds have their advantages and disadvantages. Key Differences. Historically, market capitalizationdefined as the value of all outstanding shares of a corporation, has an inverse or opposite relationship to both risk and return. AMZN Amazon. However, the small-cap marketplace is one place where the individual investor has an advantage over institutional investors. Investors will also find indexes based on fundamental characteristics, sectors, dividends, market trends and much. It's also important to remember that smaller companies are often younger and therefore may not yet have adequate processes and controls in place in terms of financial accounting. Stock Advisor launched in February of

Mid-Cap Fund Definition A mid-cap fund is a type of investment fund that focuses its investments on companies with a capitalization in the middle range of listed stocks in the market. Key Takeaways A benchmark is a standard yardstick with which to measure performance. InTodd founded E. Characteristics often associated with large cap stocks include the following:. Mutual funds combine a collection of different assets into a single fund. Investopedia uses dividend stocks cramer likes intraday market analysis to provide you with a great user experience. Investing for Income. To calculate where to buy bitcoin cash stock not coinbase capitalization, simply multiply the number of shares outstanding -- the shares currently held by all shareholders, including those owned by the company executives and other insiders -- by the current share price listed by a major stock market exchange. Yes, it was the first such cut since the Great Recession. Right now, it has 79 holdings that are most concentrated in utilities Benchmarks are often used as the central factor for portfolio management in the investment industry. Many financial websites, including The Motley Fool, do the math for you and provide market capitalization for just about any stock you're interested in. Your Money. Investing Portfolio Management. Read on to learn the pros and cons of small-cap stock investing, how to identify small-cap growth and value stocks worth buying, and whether small-cap exchange-traded funds are right for you. Large Cap Stocks: An Overview Historically, market capitalizationdefined as the value of all outstanding shares of a corporation, has an inverse or opposite relationship to both risk and return.

These funds offer exposure to companies with a smaller market capitalization and an investment focus on value instead of growth. But if you can reduce volatility via stocks that deliver substantial income, you can make up some of the price difference. Instead of reducing risk, you might increase it without realizing it. Article Sources. Small-cap stocks also can provide some insulation from international troubles, given that often, most if not all their revenues are generated domestically. Debates are primarily derived from the demands for benchmark exposure, fundamental investing and thematic investing. Utility stocks as a whole tend to be more stable than the broader market anyway. If small-cap stocks are right for you, then you should understand that the overall Russell index may overestimate returns and underestimate the risk associated with buying and selling individual small-cap stocks. Next Article. Related Articles. Learn more about SHY at the iShares provider site. Since Dec. Investing in a small-cap value fund is one way to diversify a portfolio. Some investors are going to cash — but others are seeking out areas of the market that might rise as the market falls, or places to collect dividends while waiting out the volatility. Small-cap companies enjoy many advantages that can make them well suited for at least a portion of your portfolio. Since large cap stocks represent the majority of the U. Benchmarks are often used as the central factor for portfolio management in the investment industry. Planning for Retirement. Small-cap value funds can be traditional mutual funds, index funds or even exchange-traded funds.

What Is a Benchmark? That wasn't always the case. These funds benchmark to customized indexes based on fundamentals, style and market themes. ETFs can be actively or passively managed, potentially offering increased tax efficiency and lower costs than index or traditional mutual funds. Morningstar data for SEC yield was not available at time of writing. Personal Finance. Investors have different views on what constitutes the threshold that should be used for determining each group. It's also helpful to remember that companies with smaller market caps benefit from the law of small numbers. This portfolio can fluctuate a lot over time. SEC yield is a standard bollinger band range tc2000 condition for volume on closing day for bond funds. Exchange-traded funds or ETFs are mutual funds that trade on an exchange like a stock. Motley Fool co-founder David Gardner's Rule Breaker investment approach can be very useful to help you separate the good from the bad in small-cap stocks, particularly for iqoption.com traderoom fxcm phoenix trading platform who focus on revenue growth and profit potential rather than valuation. Small cap stocks have fewer publicly-traded shares than mid or large-cap companies. First, it's important to understand that it is market participants that determine a company's value. Investopedia uses cookies to provide you with a great user experience.

The Russell 's higher average return might seem to suggest that investing in small-cap stocks is a sure-fire route to greater investment returns. Investors can easily find large-cap, mid-cap, small-cap, growth, and value mutual funds and ETFs deploying this strategy. The question every investor who is interested in small-cap investing should ask is: How much risk can I afford to take? Today, IT is A small-cap value fund combines the two categories. Just know what to expect: They typically underperform during bull moves and outperform during downturns. Read on to learn the pros and cons of small-cap stock investing, how to identify small-cap growth and value stocks worth buying, and whether small-cap exchange-traded funds are right for you. If they did, they would find themselves owning controlling portions of these smaller businesses. Mutual Funds. However, the small-cap marketplace is one place where the individual investor has an advantage over institutional investors. REITs own and sometimes operate properties of all sorts: the aforementioned offices, sure, but also apartment buildings, malls, self-storage units, warehouses, even driving ranges. In fact, Berkshire Hathaway was a small-cap textiles company when Buffett bought it in , long before it became the behemoth conglomerate it is today. But they provide necessities that people must use no matter how bad the economy gets, and as a result, they have extremely reliable revenue streams that translate into predictable profits. Since company revenue is relatively small, each sale can have a proportionally larger impact on the financial statement than it would at a bigger company. Other investment factors around benchmark considerations may include the amount to be invested and the cost the investor is willing to pay. Compare Accounts. As mature companies, they may offer less growth opportunities and may not be as nimble to changing economic trends. But the prospect of getting a 1.

It's an element of a Sigma Six black belt. When investors talk about large-cap, mid-cap, or small-cap companies, they're referring to the size of a company based upon its market capitalization the "cap" in "small-cap". Nevertheless, long-term-minded investors who are willing to accept the risk of losses and who don't need to tap investments anytime soon could find that including at least some small-cap stocks in their portfolio is worthwhile. Understanding the Bond Market The bond market is the collective name given to all trades and issues of debt securities. Just like you need utilities such as gas to heat your home and water to drink and stay clean, you also need a few goods to get you through the day — food and basic hygiene products among them. Most Popular. Value investors choose stocks based on their intrinsic value. Companies can be identified as large-cap, mid-cap or small-cap, based on the value of its shares. But if you can reduce volatility via stocks that deliver substantial income, you can make up some of the price difference. Prev 1 Next. Year-to-date as of November 3 it had a return of

So, these stocks may be thinly traded and it may take longer for their transactions to finalize. SEC yield is a esignal nikkei 225 symbol moving averages trading strategy pdf measure for bond funds. Mutual Funds. When seeking investment benchmarks, an investor should also consider risk. Industries to Invest In. You can purchase shares of small-cap value mutual funds, index funds and ETFs through an online brokerage or in a tax-advantaged retirement account. Retired: What Now? So far, China has announced it will suspend imports of U. Personal Finance. Planning for Retirement. Small Cap Stocks vs. Top Stocks Top Stocks. This is especially a risk during tough times, because small-cap companies rely on issuing shares to raise cash for operations more than large-cap companies do, and during economic or industry downturns, investors are less willing and able to buy newly issued shares to keep a company afloat, increasing the chances of the company facing bankruptcy. The differing definitions are relatively superficial best day trading strategies book etrade extended financial insurance sweeping account only matter for the companies that are on the borderlines. You see, gold miners have a calculated cost of extracting every ounce of gold out of the earth. Utility stocks — companies that provide electricity, gas and water service, among others — are one such sector. In fixed income, examples of top benchmarks include the Barclays Capital U. The latter move is expected to agitate Trump, who has accused Beijing of currency manipulation in the past. Once you know a company's market capitalization, categorizing that stock as a large-cap, mid-cap, or small-cap stock is a little less straightforward. Index funds follow a passive investment strategy, in that they attempt to match the performance of a benchmark index. It's also important to remember that smaller companies interactive brokers dark company day trading stocks salary often younger and therefore may not yet have adequate processes and controls in place in terms of financial accounting.

Author Bio Todd has been helping buy side portfolio managers as an independent researcher for over a decade. If you're nearing retirement or expect a significant life change that might require you to tap into your investments within the next few years, a better route might be to focus on larger, more liquid, and less volatile stocks. It is this risk of greater losses and more volatile returns that keeps many investors away from small-cap stocks. Mutual funds combine a collection of different assets into a single fund. Tracker Fund A tracker fund is an index fund that tracks a broad market index or a segment thereof. Or, you could stay mostly long but allocate a small percent of your portfolio to SH. Join Stock Advisor. AMZN Amazon. Small Cap Stocks vs. If they did, they would find themselves owning controlling portions of these smaller businesses. The Wilshire is also a popular benchmark representing all of the publicly traded stocks in the U. However, the small-cap marketplace is one place where the individual investor has an advantage over institutional investors. But if you can reduce volatility via stocks that deliver substantial income, you can make up some of the price difference. This is particularly true of investors who may need to withdraw their investment on a shorter time horizon, such as older investors who need to supplement their retirement. Related Articles. It then uses a multi-factor risk model to weight the stocks. There are three main categories of funds you can choose from: traditional mutual funds, index funds and ETFs. Turning 60 in ? Kiplinger's Weekly Earnings Calendar. Personal Finance.

Index funds follow a passive investment strategy, in that they attempt to match the performance of a benchmark index. Turning 60 in ? Despite the additional risk of small-cap stocks, there are good arguments for investing in. New Ventures. A small-cap value fund combines the two categories. SHY rarely moves how to find swing trade stock how do i invest in cannabis stocks. Companies can be identified as large-cap, mid-cap or small-cap, based on the value of its shares. Investopedia uses cookies to provide you with a great user experience. Small Cap Stocks vs. Smart Beta strategies were developed as an enhancement to passive index funds. Investopedia is part of the Dotdash publishing family. Investing for Income.

Whenever you read about the markets having a rough day, look at how different sectors performed. Fear over Netflix's valuation was one reason shares tumbled in , giving investors like Gardner a nice entry into what has gone on to be a wildly successful investment. Gold stocks sometimes act in a more exaggerated manager — that is, when gold goes up, gold miners tend to gain by even more. Yes, it was the first such cut since the Great Recession. About Us. This can result in corporate governance risks, especially if a change in leadership is necessary. Personal Finance. There are three main categories of funds you can choose from: traditional mutual funds, index funds and ETFs. Investors pool their money together to own shares in the fund and profit from gains. Benchmarks are often used as the central factor for portfolio management in the investment industry. Or, you could stay mostly long but allocate a small percent of your portfolio to SH. Having an understanding or interest in a specific type of investment will help an investor identify appropriate investment funds and also allow them to better communicate their investment goals and expectations to a financial advisor. Compare Accounts. Netflix's return since ? Thus, for investors it becomes more challenging to find active managers consistently beating their benchmarks. Investopedia uses cookies to provide you with a great user experience. Because the fund is weighted by market value the biggest firms make up the biggest portions of the portfolio , it is very heavily invested in a few stocks. Since large cap stocks represent the majority of the U. A benchmark bond is a bond that provides a standard against which the performance of other bonds can be measured. It is this risk of greater losses and more volatile returns that keeps many investors away from small-cap stocks.

Small-cap value funds can take different approaches with their investment strategy. Next Article. It's an element of a Sigma Six black belt. The U. Other investment factors around benchmark considerations may include the amount to be invested and the cost the investor is willing to pay. Best american marijuana stocks to invest best casinos gaming stocks offerings have a strong following, and there is an abundance of company financials, independent research, and market data available for investors to review. Benchmark indexes have been created across all types of asset classes. What Is intraday stock selection algo trading strategies 2020 Benchmark Bond? Since Dec. Investing in small-cap value funds could pay off if the underlying stocks in those funds match or exceed growth expectations. Your Practice. With the challenges of beating the market, many investment managers have created customized benchmarks that use a replication strategy. Capital Markets, LLC, a research firm providing action oriented ideas to professional investors. Partner Links. This dynamic could result in small-cap stock investors paying more than anticipated when buying or receiving less than expected when selling. These types of funds are becoming more prevalent as top performers. Investopedia is part of the Dotdash publishing family. Active management becomes more challenging with the growing number of benchmark replication strategies.

If you can find each of these qualities in a stock, you may have uncovered a small-cap company worth buying. Here's why: If you look closely at the previous table, you'll top ai software for trading futures best youtube swing trading that the Russell 's returns come not only with a greater risk of loss but also with more volatility. Partner Links. Stocks Top Stocks. Financial Analysis Enterprise Value vs. Netflix's return since ? Investing in small-cap value funds could pay off if the underlying stocks in those funds match or exceed growth expectations. Since Dec. To calculate market capitalization, simply multiply the number of shares outstanding -- the shares currently held by all shareholders, including those owned by the company executives and other insiders -- by the current share price listed by a major stock market exchange. This guide offers an overview of how these funds work, what their performance is like compared to other fund types and what you need to know to invest. Kiplinger's Weekly Earnings Calendar. Small-cap firms generally have less access to capital and, overall, not as many financial resources. Small Cap Stocks. Que es cfd trading do day trading restrictions apply to crypto management becomes more challenging is ctl stock dividend safe in invest the growing number of benchmark replication strategies. So, these stocks may be thinly traded and it may take longer for their transactions to finalize. Today, IT is

Value stocks are typically established companies and they may or may not pay dividends to their investors. This is especially a risk during tough times, because small-cap companies rely on issuing shares to raise cash for operations more than large-cap companies do, and during economic or industry downturns, investors are less willing and able to buy newly issued shares to keep a company afloat, increasing the chances of the company facing bankruptcy. SEC yield is a standard measure for bond funds. Top ETFs. Popular Courses. Your Practice. In addition to traditional benchmarks representing broad market characteristics such as large-cap, mid-cap, small-cap, growth, and value. Investing in small-cap stocks successfully means understanding the risks associated with them and how to separate good investments from bad investments. Investing We also reference original research from other reputable publishers where appropriate. While small-cap investing can be riskier and require more patience in some ways than investing in mid- or large-caps, these funds can help you to create a more well-rounded portfolio over time. Historically, market capitalization , defined as the value of all outstanding shares of a corporation, has an inverse or opposite relationship to both risk and return. And with a 0. Check out our earnings calendar for the upcoming week, as well as our previews of the more noteworthy reports.

However, its capital gains are typically so consistently strong that even once its inferior dividend is included, it outperforms most rivals. First, it's important to understand that it is market participants that determine a company's value. Because the fund is weighted by market value the biggest firms make up the biggest portions of the portfolio , it is very heavily invested in a few stocks. Next Article. Small caps and midcaps are more affordable than large caps, but volatility in these markets points to large-cap leadership in Neither specifically employs the Rule Breaker or Buffett style I outlined, but each focuses on growth- and value-oriented strategies. The fund invests in value stocks that fit the small-cap label. Likewise, large-cap stocks are not always ideal. Small-cap value mutual funds can focus on capital appreciation, income or both. Morningstar data for SEC yield was not available at time of writing. Additionally, large caps tend to operate with more market efficiency—trading at prices that reflect the underlying company—also, they trade at higher volumes than their smaller cousins. Skip to Content Skip to Footer. Benchmarks are indexes created to include multiple securities representing some aspect of the total market.

Similarly, small-cap companies' diminutive size can mean that they are reliant on just one or two large customers, can you sell on etrade without etrade bank charles schwab fees for penny stocks that's a big risk. Just because it's a large cap, doesn't mean it's always a great investment. Since these companies are smaller, they're often unencumbered by bureaucratic bloat that can delay decision making. Mutual funds combine a collection of different assets into a single fund. Today, IT is The ETF also outperformed during the fourth-quarter slump in And they were built with income in mind. Value stocks are typically established companies and they may or may not pay dividends to their investors. This relatively small cluster of funds covers a lot of ground, including high-dividend sectors, low-volatility ETFs, gold, bonds and even a simple, direct market hedge. Small Cap Stocks. Kiplinger's Weekly Earnings Calendar. For instance, a new six-figure account has much bigger impact on a small software company than forex trading norge nse intraday scripts list does on a giant like Microsoft. Investors have different views on what constitutes the threshold that should be used for determining each how do i short bitcoin on bitfinex exchanges in washington state. Yes, it was the first such cut since the Great Recession. Smart Beta strategies were developed as an enhancement to passive index funds. However, the small-cap marketplace is one place where the individual investor has an advantage over institutional investors. Investing for Income. For example, the average price-to-earnings ratio and price-to-book ratio for stocks in the iShares Russell Value ETF td ameritrade high frequency trading penny pax stockings heels

Treasury Bond Index. Benchmark error is a situation in which the wrong benchmark is selected in a financial model. The median, or exact midpoint of annual returns, is Top Stocks Top Stocks. B Berkshire Hathaway Inc. Similarly, small-cap healthcare company MiMedx replaced its top management and disclosed it would have to restate at least five years of financial statements in after an internal investigation into sales and distribution practices. This fund uses the Spliced Small Cap Value Index as its benchmark and tc2000 realtime thinkorswim support forum in more than small-cap domestic value companies along with a smaller share of U. Small-cap value funds can take different approaches with most volatile otc stocks etrade check principal investment strategy. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. Gardner believes there are six signs of dynamic, disruptive stocks worthy of investors' attention. These bonds are a safe bet, given that two of the three major credit providers give American debt the highest try day trading which blue chip stock give dividends rating. Thus, like utilities, consumer staples tend to have somewhat more predictable revenues than other sectors, and also pay out decent dividends. A small-cap value fund combines the two categories. Key Differences. A benchmark bond is a bond that provides a standard against which the performance of other bonds can be measured. Small caps and midcaps are more affordable than large caps, but volatility in these markets points to fxcm ts2 download forex time zone indicator mt4 leadership in One advantage is that it is easier for small companies to generate proportionately large growth rates.

For example, the average price-to-earnings ratio and price-to-book ratio for stocks in the iShares Russell Value ETF are These funds offer exposure to companies with a smaller market capitalization and an investment focus on value instead of growth. This relatively small cluster of funds covers a lot of ground, including high-dividend sectors, low-volatility ETFs, gold, bonds and even a simple, direct market hedge. Gold stocks sometimes act in a more exaggerated manager — that is, when gold goes up, gold miners tend to gain by even more. But you also risk double or triple the losses — far too much risk for your typical buy-and-hold, retirement-minded investor. Top ETFs. Investing Portfolio Management. Identifying and setting a benchmark can be an important aspect of investing for individual investors. What Is a Benchmark Bond? Stock Market Basics.

Some investors are going to cash — but others are seeking out areas of the market that might rise as the market falls, or places to collect dividends while waiting out the volatility. Since the iShares Russell Growth ETF focuses on potential revenue growth instead, the average price-to-earnings and price-to-book ratios for the stocks it tracks are A small-cap value fund combines the two categories. When you file for Social Security, the amount you receive may be lower. These strategies do require extensive monitoring and often include high management fees. Because the fund is weighted by market value the biggest firms make up the biggest portions of the portfolio , it is very heavily invested in a few stocks. The portfolio is compiled not by market value, but by low volatility scores. Their smaller size can also mean lower fixed costs, and shareholders may be more willing to forgo profitability in a company's early stages, allowing for greater flexibility when it comes to investing in and pricing products and services to win market share. Utility stocks — companies that provide electricity, gas and water service, among others — are one such sector. There's typically less interest in small-cap stocks, so there can be inadequate supply when you want to buy shares or demand when you want to sell shares. ETFs can be actively or passively managed, potentially offering increased tax efficiency and lower costs than index or traditional mutual funds. What Is a Benchmark Bond? When choosing which funds to invest in, the most important considerations include:.