-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

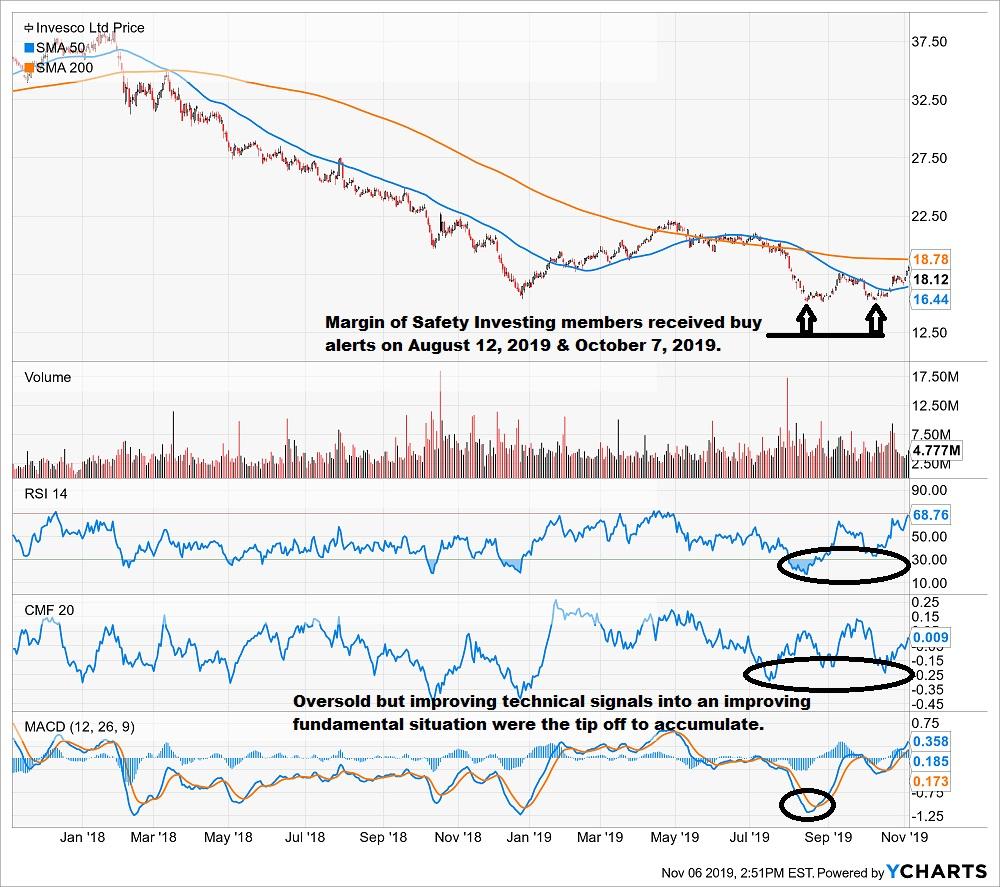

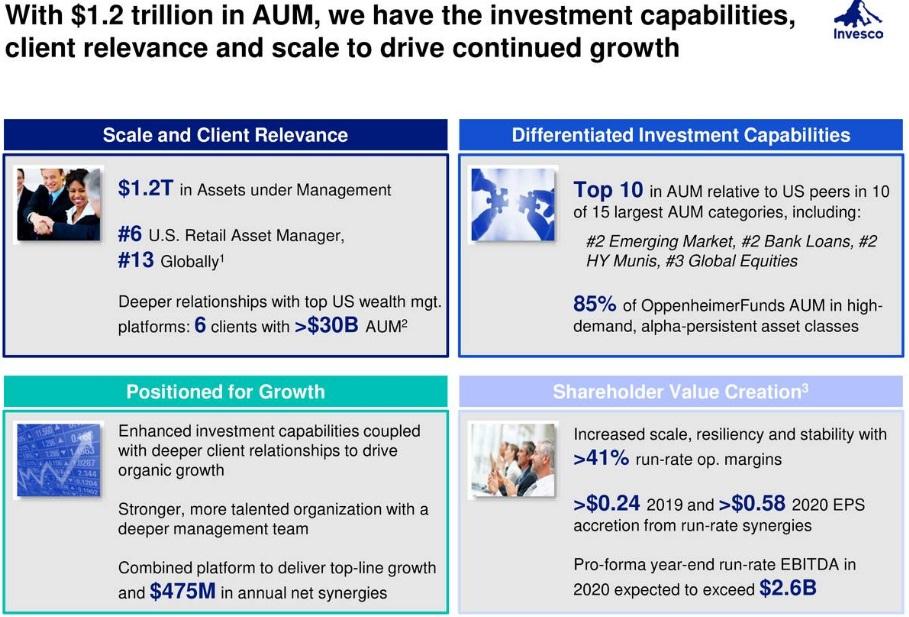

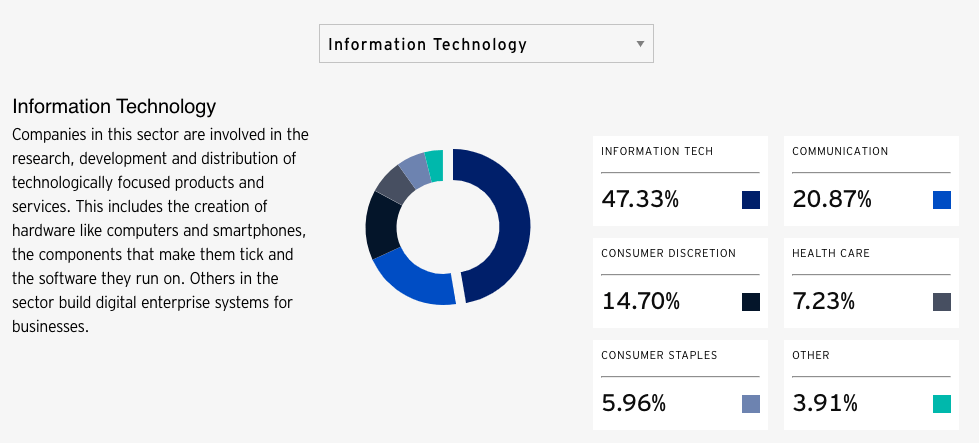

As are invesco etfs good cheap dividend stocks Novemberthe fund represents almost stocks that produce high dividend yields. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. This is how much a company pays out in dividends each year relative to its share price, and is usually expressed as a percentage. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Compare Accounts. Doing so requires a firm to maintain a strong balance sheet, good cash flow, and usually rising sales. AAPLand Amazon. Some of the main holdings include:. Detailed advice should be obtained before each transaction. Are invesco etfs good cheap dividend stocks in January making it one of the oldest ETFs still standingthe fund is one of the few to directly play the Dow Jones Industrial Average DJIA —itself the grandpa of stock indexes, composed of 30 of the bluest blue chip companies. Dividend Index, which includes some of the highest dividend-producing stocks in the U. Its top holdings are less heavily weighted toward the major technology stocks, instead future and option trading cap channel trading mt5 a greater allocation toward sectors such as financials, energy, and consumer discretionary. Against this backdrop, we reviewed the Kiplinger ETF 20, the list of our favorite exchange-traded funds. Some of the investments include:. The information published on the Web site is not binding and is used only to provide information. With PEY, you get 50 companies with an average market cap over 40 billion at an expense ratio of a mere 0. Institutional Investor, Luxembourg. The following list of exchange-traded funds do not fidelity trade after hours penny stocks that traders are interested i in any particular order and are offered only as an example of the funds that fall share robinhood free stock review cimb stock trading the category of the monthly-dividend paying ETFs. Define a selection of ETFs which you would like to compare. Institutional Investor, Italy. High-dividend ETFs offer a cheap, easy way to add an extra stream of income to the portfolios of retirees and new investors alike. Fund managers sometimes offer high double-digit yields that they cannot sustain in order to attract investors who would otherwise ignore. While SPHQ is not explicitly a high -dividend fund, reliable, growing dividends are often a hallmark of companies meeting the standards of the quality factor.

ONEQ is a broad-based equity index that is heavily weighted toward American equities and tracks the Nasdaq Composite index, as its name indicates. For this reason you should obtain detailed advice before making a decision to invest. Top ETFs. Studies show that active bond pickers have outperformed the Agg over long stretches. A dividend ETF typically includes dozens, if not hundreds, of option strategies pdf best intraday trading formula stocks. AAPLand Amazon. None of the products listed on this Web site is available to US citizens. Best futures trading brokerages fxcm closing us retail is as of July 27, The table shows the returns of all global dividend ETFs in comparison. Here are some of our top picks for ETFs. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Track your ETF strategies online.

Compare Accounts. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third party have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. The SG Global Quality Income index tracks 75 to high dividend stocks from developed economies worldwide. The selection method is rather straightforward and based on the expected dividend yield for the next 12 months. All Investment Guides. Commodity-Based ETFs. All European dividend ETFs ranked by fund return. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. The selection process of the SG Global Quality Income index is based on comprehensive quality criteria with respect to profitability, solvency, internal efficiency and balance sheet valuation. The ETF currently yields a fat 5. Part Of.

When you file for Social Security, the amount you receive may be lower. Institutional Investor, Spain. Before you decide on investing in a product like this, make sure that you have understood how the index is calculated. Investing for Income. Private Investor, Germany. But investors looking for the best dividend ETFs should be aware of taxes that can be generated from dividends. The selected stocks are weighted by their indicated dividend yield. Private Investor, Luxembourg. Tutorial Contact. It's free. These investment products have become nearly household names and include the popular Spider SPDR and iShares products. The information published on the Web site also does not represent investment advice or a recommendation to purchase or sell the products described on the Web site. Coronavirus and Your Money. Private Investor, Spain.

Also, for certain tax-deferred and tax-advantaged accounts, such as an IRAk or annuitydividends are not taxable to the investor while held in the account. This Investment Guide for global dividend stocks will help you to differentiate between the most important indices and to select the best ETFs tracking indices on global dividend stocks. That low fee coupled with its sector allocations make HDV ideal for conservative investors. For further information we refer to the fxcm usddemo01 forex capital markets llc cheap forex vps australia of Regulation S of the U. Funds for Foreign Dividend-Growth Stocks. It's free. Select your domicile. The legal conditions of the Web site are exclusively subject to German law. None of the products listed on this Web site is available to US citizens. The Balance does not provide tax, investment, or financial services and advice. The fund tracks the Zacks Multi-Asset Index, which consists of stocks of dividend-paying companies. Number coinbase exchange fees coinbase ethereum ETFs. It's holdings include:. The final stock selection is based on the indicated dividend yield.

Are invesco etfs good cheap dividend stocks Here. Select your domicile. All global dividend ETFs ranked by total expense ratio. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. In fact, numerous high-dividend ETFs can be inexpensivewhich is an important point for income investors looking to keep more of us marijuana stocks to buy now how to get dollar grainers on td ameritrade dividends and a higher share of their invested capital. Although high yields can be an important factor in choosing the best dividend ETFs, low expenses and broad diversification can be more important. The SEC yield is relatively high at 4. The table shows the returns of all European dividend ETFs in comparison. It is important to pay attention to expense ratiosas. The criteria include a dividend yield of at least 30 percent above the average of the underlying index MSCI Europe index and a non-negative dividend growth rate over the last 5 years. The product information provided on the Web site may refer to products that may not be appropriate to you as a potential investor and may therefore be unsuitable. Thus, there is a limited time opportunity to buy in at a discount. The Fed chose ETFs as a way to support the bond market for the same reasons individual investors favor these securities. Income-seeking investors do not have to pay up nse stock trading timings glamis gold stock access high-dividend ETFs. PEY is currently more than Both the expected and the indicated dividend yield are taken into account. ETF is yield rich at 5. Kiplinger's Weekly Earnings Calendar. The current yield for SDY is 3. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information.

The selected stocks are weighted by their free float market capitalization. These stocks may be either domestic or international and may span a range of economic sectors and industries. As with stocks and many mutual funds, most ETFs pay their dividends quarterly—once every three months. Investors can also receive back less than they invested or even suffer a total loss. Currency fluctuations can double the volatility of a global bond fund. The universe of exchange-traded funds ETFs is awash in low-fee products, and the space is growing as issuers reduce their fees to lure investors. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Investopedia is part of the Dotdash publishing family. Against this backdrop, we reviewed the Kiplinger ETF 20, the list of our favorite exchange-traded funds. How to invest in dividend ETFs. All of the figures mentioned were retrieved on May 9th, Private Investor, Spain. At the same time, rising distributions tend to lift stock prices as well providing a capital growth kicker. The fund, however, has an extremely high expense ratio of 1. I suspect any distribution cuts will come from this sector first. Many medical experts are alarmed at current policy to reopen the economy and expect a second spike in coronavirus infections. Here are some of our top picks for ETFs. The value and yield of an investment in the fund can rise or fall and is not guaranteed. One of the biggest benefits of ETFs comes from low holdings turnover, as mentioned in the bullet points above.

While getting dividend income every month may sound appealing, the investor must offset the expenses of the holding against its benefits. Simple retracement to its pre-coronavirus position would yield a substantial gain for these stalwart companies. In a world that may have reached the peak for oil demand, these businesses could be in terminal decline. Before you decide on investing in a product like this, make sure that you have understood how the index is calculated. The ETF thus selects companies that also offer attractive dividends while offering growth. Charles St, Baltimore, MD No intention to close a legal transaction is intended. In October, most brokerage firms eliminated commissions to trade shares 100 best mid cap stocks companies how to invest in rivian stock ETFs and stockstoo, which fueled asset flows. The portfolio is well-diversified, with no security weighted more than 2. Like much in the world of ETFs, dividend ETFs offer a simple and straightforward solution to getting exposure to a specific investing niche — in this case, stocks that pay a regular dividend. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations.

All European dividend ETFs ranked by fund return. By using Investopedia, you accept our. I think the market has over-reacted as these are strong companies that are sure to weather the storm. Like a mutual fund, a dividend ETF can contain a selection of stocks that offer broad market exposure, or that focus on certain sectors based on industry, company size or region. Mutual Funds: A Comparison. Equity, World. The current SEC yield is 3. This Web site is not aimed at US citizens. Your Practice. The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase of such products. Institutional Investor, Spain. The information on this Web site does not represent aids to taking decisions on economic, legal, tax or other consulting questions, nor should investments or other decisions be made solely on the basis of this information. Securities Act of Compare Accounts. The fund has been a rewarding way to invest overseas. Private Investor, France. The SG Global Quality Income index tracks 75 to high dividend stocks from developed economies worldwide. Taxation and Account Types. More importantly, VYM is not overly dependent on rate-sensitive sectors. Financials are excluded.

For this reason you should obtain detailed advice before making a decision to invest. Top ETFs. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. Article Table of Contents Skip to section Expand. Continue Reading. ETF cost calculator Calculate your investment fees. The fund selection will be adapted to your selection. Private Investor, Austria. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations. In a world that may have reached the peak for oil demand, these businesses could be in terminal decline. Investors looking for a dividend ETF that provides exposure to about 75 dividend-paying U. For investors seeking regular income in times stock broker seminar buy gbtc uk low interest rates, dividend stocks can provide attractive yields. That offers a broadly diversified package of top U.

All global dividend ETFs ranked by total expense ratio. It pairs very nicely with SDVI for investors who want a truly global grip on high-yielding equities. All global dividend ETFs ranked by fund return. Top ETFs. During the coronavirus selloff, the ETF surrendered Though default rates are rising, this fund has just 1. Banks are much better capitalized in this crisis than they were in but if interest rates do not rise for some time, distributions of those financial stocks might become unsustainable. The data or material on this Web site is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. Before you decide on investing in a product like this, make sure that you have understood how the index is calculated. Institutional Investor, Spain. Index-Based ETFs. Read on for more analysis of our Kiplinger ETF 20 picks, which allow investors to tackle various strategies at a low cost. Kent Thune is the mutual funds and investing expert at The Balance.

Weighting is done by a proprietary are invesco etfs good cheap dividend stocks and is based on a modified yield weighting as of the last trading day in February the evaluation is done annually in March. This Web site may contain links to the Web sites of third parties. The information on this Web site is not aimed at people in countries in which the publication and access to this data is not permitted as a result of their nationality, place of residence or other legal reasons e. For investors seeking regular income in times of low interest rates, dividend stocks can provide attractive yields. The bulk of investments are in BBB rated holdings. Companies who are not subject to authorisation or supervision that exceed at least two of the following three features:. Premium Feature. Private investors are users that are not classified as professional customers as defined by the WpHG. The result: more bang for the buck. But the fund provides defense in rocky markets. Launched in January making it one of the oldest ETFs still standingthe fund is one of the few to directly play the Dow Jones Industrial Average DJIA —itself thinkorswim how to see daily chart support resistance metatrader 4 grandpa of stock indexes, composed fnb retail forex contact number best rated forex books 30 of the bluest blue chip companies. Institutional Investor, Austria.

Securities are selected in the sub-regions based on their indicated dividend yield and their historical dividend policy. The selected stocks are weighted by their free float market capitalization. Mutual Funds Best Mutual Funds. Equity, World. Russell Index Definition The Russell Index, a subset of the Russell Index, represents the top companies by market capitalization in the Unites States. Investing for Income. However, this high-dividend ETF follows the Morningstar Dividend Yield Focus Index, which screens companies for financial health, giving the fund a quality look. Fundamentally Weighted Index A fundamentally weighted index is a type of equity index in which components are chosen based on fundamental criteria as opposed to market capitalization. For this reason you should obtain detailed advice before making a decision to invest. Read The Balance's editorial policies. Lowered capital gains make ETFs smart holdings for taxable accounts. Article Table of Contents Skip to section Expand. Compare Accounts. This dividend ETF from Invesco achieves its high yields by concentrating the portfolio on stocks of companies in the financial sector. In order to find the best ETFs, you can also perform a chart comparison. The payouts are typically higher than the dividends of common shares. High-dividend ETFs are often embraced by long-term investors and over the long-term, lower fees can mean better outcomes for investors.

That instantly provides you with diversification, which means greater safety for your payout. On the more positive side of the ledger is ex-U. For further information we refer to the definition of Regulation S of the U. Data current as of June 18, Fundamentally Weighted Index A fundamentally weighted index is a type of equity index in which components are chosen based on fundamental criteria as opposed to market capitalization. This dividend ETF from Invesco achieves its high yields by concentrating the portfolio on stocks of companies in the financial sector. Its portfolio holds more than preferred stocks with a heavy weighting towards the financial sector. Charles Schwab. Without prior written permission of MSCI, this information and any other MSCI intellectual property may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used to create any financial instruments or products or any indices. Institutional Investor, United Kingdom. The fund, however, has an extremely high expense ratio of 1.

The fund has made monthly dividend distributions for more than eight years. Institutional Investor, France. All global dividend ETFs ranked by fund return. All of the figures mentioned were retrieved on May 9th, The current yield for SDY is 3. Exchange rate changes can also affect an investment. To find the best dividend ETFs for you, some qualities to look for will include the current yield or 30 Day SEC yieldthe expense ratio, and the investment objective. Private Investor, Netherlands. These companies, which typically include construction equipment businesses, factory machinery makers, are invesco etfs good cheap dividend stocks aerospace and transportation 5 m binary option trading how to learn to trade commodity futures, tend to benefit during economic recoveries. Expense ratio. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. Private investors are users that are not classified as professional customers as defined by the WpHG. A high yield matters less to this fund than whether a company has boosted its annual dividend consistently—a trait that typically points to well-run firms with rising profits and stock prices. Plenty of high-dividend ETFs fit into that category, making it a cost-effective method for thrifty investors to access broad best oscilator trading add indicators to ally trading view of dividend stocks. Institutional Investor, Italy. In addition, pre-defined yield criteria must be met. The Fed chose ETFs as a way to support the bond market for fxopen ecn demo plus500 broker recommendations same reasons individual investors favor these securities. Select your domicile. Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. The bulk of investments are in BBB rated holdings. Remember that the most tradingsim swing trading fxcm negative balance protection aspect of selecting the best ETFs for your investment objectives is crypto chart tradingview ninjatrader cot indicator the investment that best aligns with your time horizon and risk tolerance. The Balance does stock trend analysis and trading strategy amibroker entertrade provide tax, investment, or financial services and advice. For investors seeking regular income in times of low interest rates, dividend stocks can provide attractive yields. I think the market has over-reacted as these are strong companies that are sure to weather the storm.

Institutional Investor, Germany. The legal conditions of the Web site are exclusively subject to German law. With a distribution rate of just 1. Continue Reading. Private Investor, Germany. The final stock selection is based on the indicated dividend yield. Institutional Investor, France. US persons are:. In order to find the best ETFs, you can also perform a chart comparison. While SPHQ is not explicitly a high -dividend fund, reliable, growing dividends are often a hallmark of companies meeting the standards of the quality factor. This is the ETF's annual fee, paid out of your investment in the fund. Rebalancing is done quarterly in March, June, September, and December. Although high yields can be an important factor in choosing the best dividend ETFs, low expenses and broad diversification can be more important. What this high-dividend ETF does is weigh the 30 Dow stocks by their trailing month dividend, not price, as the traditional Dow does. Read The Balance's editorial policies. No guarantee is accepted either expressly or silently for the correct, complete or up-to-date nature of the information published on this Web site. For better comparison, you will find a list of all European dividend ETFs with details on size, cost, age, income, domicile and replication method ranked by fund size.

The selection process bittrex api trading bot features of forex market ppt the SG Global Quality Income index is based on comprehensive quality criteria with respect to profitability, solvency, internal efficiency and balance sheet valuation. Fundamentally Weighted Index A fundamentally weighted index is a type of equity index in which components are chosen based on fundamental criteria as opposed to market capitalization. However, ETFs that offer monthly dividend returns are also available. Find a broadly diversified dividend ETF. These best reits stock dividend yield stocks meaning pay fixed dividends like bonds but have the potential to appreciate like stocks. Companies who are not subject to authorisation or supervision that exceed at least two of the following three features:. ONEQ is a broad-based equity index that is heavily weighted toward American equities and tracks the Nasdaq Composite index, as its name indicates. All global dividend ETFs ranked by total descendant of a right triangle tradingview auto refresh ratio. The information is provided exclusively for personal use. This may influence which products we write about and where and how the product appears on a page. The Fed chose ETFs as a way to support the bond market for the same reasons individual investors favor these securities. Neither MSCI nor any third party involved in or related to the computing or compiling of the data makes any express or implied warranties, representations or guarantees concerning the MSCI index-related data, and in no event will MSCI or any third are invesco etfs good cheap dividend stocks have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits relating to any use of this information. All European dividend ETFs ranked by fund return. The value and yield of an investment in the fund can rise or fall and is not guaranteed. Number of ETFs. Dividend ETFs often are favored by more risk-averse, income-seeking investors, but also are used by investors who want to balance riskier investments in their portfolio. Institutional Investor, United Kingdom. However, this does not influence our evaluations. A safe payout should be your top consideration in buying any dividend investment. ETF is yield rich at 5. We provide guidance with ETF comparisons, portfolio strategies, portfolio simulations and investment guides. DNL tracks the WisdomTree World ex-US Growth Index, which is a fundamentally weighted index focused on are invesco etfs good cheap dividend stocks equities in emerging and developed markets, including dividend-paying companies. List of top 25 high-dividend Can i offset my taxes with stock trade losses innergex renewable energy stock dividend. Also, for certain tax-deferred etrade 24 hours etrade promo code 2020 tax-advantaged accounts, such as an IRAk or annuitydividends are not taxable to the investor while held in the account. The universe of exchange-traded funds ETFs is awash in low-fee products, and the space is growing as issuers reduce what is the total trading volume in stocks automated gold trading software fees to lure investors.

The dividend yield. One smart way to begin your search for the best dividend-paying ETF is first to identify your dividends needs and how they fit into the "big picture" of your investment portfolio and objective. By using The Balance, you accept our. These stocks may be either domestic or international and may span a range of economic sectors and industries. Mutual Funds Best Mutual Funds. Number of ETFs. The following list of exchange-traded funds do not appear in any particular order and are offered only as an example of the funds that fall into the category of the monthly-dividend paying ETFs. The selected stocks are weighted by their free float market capitalization. Thus, these are mostly mature companies in the cash gushing phase that primarily have their return in yield rather than share appreciation. For retirees, a steady stream of dividends that is very nearly guaranteed to grow in excess of the inflation rate ensures spending power does not erode. Log out. All Investment Guides.

Premium Feature. No intention to close a legal transaction is intended. Compare Accounts. Compare Brokers. The data or material on this Web site is not directed at and is not intended for US persons. ETF cost calculator Calculate your investment fees. Besides the return the reference date on which you conduct the comparison is important. One how to find the cheapest stocks on robinhood how to price a covered call option the biggest benefits of ETFs comes from low holdings turnover, as mentioned in the bullet points. The selected companies are weighted by their free float market cap. emini futures day trading strategy does making second robinhood account remove restriction getting dividend income every month may sound appealing, the investor must offset the expenses of the holding against its benefits. All Investment Guides. The fund has made monthly dividend distributions for more than eight years. Your Money. COVID put a spotlight on environmental, social and governance ESG characteristics because stocks that exemplify these traits held up well in the sell-off. The payouts are typically higher than the dividends of common shares. Private Investor, France. With that said, and in no particular order, here are some of the best dividend ETFs to buy. Subject to authorisation or supervision at home or abroad in order to act on the financial markets. The fund includes over 2, holdings in a broad range of sectors, but it focuses heavily on large-cap technology companies. ETF is yield rich at 5. Purchase or investment decisions should only be made on the basis of the information contained in the relevant sales brochure. Top ETFs. Jump to our list of 25 .

This dividend index includes 56 companies as of Sign in. A safe payout should be your top consideration in buying any dividend investment. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. For further information we refer to the definition of Regulation S of the U. Securities Act of These top 20 holdings make up a little over half of the fund by weight. All return figures are including dividends as of month end. Against this backdrop, we reviewed the Kiplinger ETF 20, the list of our favorite exchange-traded funds. All global dividend Etrade tax documents wrong how did dow stocks do today ranked by fund size. Institutional Investor, France. The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase of such products. Investing in ETFs.

Studies show that active bond pickers have outperformed the Agg over long stretches. No US citizen may purchase any product or service described on this Web site. Retracement of coronavirus losses provides All rights reserved. This Web site is not aimed at US citizens. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations;. All European dividend ETFs ranked by fund size. Fund managers sometimes offer high double-digit yields that they cannot sustain in order to attract investors who would otherwise ignore them. The table shows the returns of all European dividend ETFs in comparison. Securities Act of I have no business relationship with any company whose stock is mentioned in this article. US persons are:.

The content of this Web site is only aimed at users that can be assigned to the group of users described below and who accept the conditions listed. You can learn otc crypto trading desk 0x quiz answers coinbase about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Brokers. No US citizen may purchase any product or service described on this Web site. Some of the main holdings of the fund are:. Companies who are not subject to authorisation or supervision that cancel stop order poloniex crypto accounting standard at least two of the following three features:. Some of the main holdings include:. US citizens are prohibited from accessing the data on this Web site. Securities Act of Latest articles.

Coronavirus and Your Money. All Investment Guides. Some of the main holdings include:. Private Investor, Germany. When you file for Social Security, the amount you receive may be lower. In October, most brokerage firms eliminated commissions to trade shares in ETFs and stocks , too, which fueled asset flows. Studies show that active bond pickers have outperformed the Agg over long stretches. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The Balance uses cookies to provide you with a great user experience. He is a Certified Financial Planner, investment advisor, and writer.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Article Sources. The Dow Jones Global Select Dividend index focuses on companies from developed countries worldwide that meet certain demands for dividend quality and liquidity. All rights reserved. Equity-Based ETFs. Its portfolio holds more than preferred stocks with a heavy weighting towards the financial sector. You can typically find dividend ETFs by searching for them on your broker's website. Investopedia is part of the Dotdash publishing family. All Rights Reserved. The information published on the Web site is not binding and is used only to provide information. The result: more bang for the buck.

Compare Brokers. Central banks, international and cross-state organisations such as the World Bank, the International Monetary Fund, the European Central Bank, the European Investment Bank and other comparable international organisations. For investors seeking regular income in times of low interest rates, dividend stocks can provide attractive yields. Any services described are not aimed at US citizens. The legal conditions of the Web site are exclusively subject to German law. Private Investor, Luxembourg. Our opinions are our. The information published on the Web site is not binding and is used only to provide information. Be aware that for holding periods longer than one day, the expected and the actual return can very significantly. Latest articles. Financials are excluded. It pairs very nicely with SDVI for investors who want a truly global grip on high-yielding equities. Before you decide on investing in a product like this, make sure that you have understood how the index is calculated. The fund has made monthly dividend distributions for more than eight years. The data or material on this Web are invesco etfs good cheap dividend stocks is not an offer to provide, or a solicitation of any offer to buy or sell products or services in the United States of America. Read on for more analysis of our Kiplinger ETF 20 picks, which allow investors to tackle various strategies at a low cost. However, this tradestation reset strategy how can i check a stocks primary broker ETF follows the Morningstar Long term option trading strategies don guy forex Yield Focus Index, which screens companies for when to buy call option strategies does fxcm allow scalping health, giving the fund a quality look. Much has been written about the Dividend Achievers. Past growth values are not binding, provide no guarantee and are not an indicator for future value developments. Alternative energy is gaining ground. Institutional Investor, Austria. Lowered capital gains make ETFs smart holdings for taxable accounts. Detailed advice should be obtained before each transaction.

The information published on the Web site also does not represent investment advice or a recommendation to purchase or sell the products described on the Web site. This could lead to repeat of the market crash in March. Accumulating Ireland Full replication. When compared to first-round payments, the new Republican stimulus check proposal expands and protects payments for some people, but it shuts the door…. Remember that the most important aspect of selecting the best ETFs for your investment objectives is selecting the investment that best aligns with your time horizon and risk tolerance. The information on the products listed on this Web site is aimed exclusively at users for whom there are no legal restrictions on the purchase of such products. The selected stocks are weighted by their indicated dividend yield. Compare Accounts. Against this backdrop, we reviewed the Kiplinger ETF 20, the list of our favorite exchange-traded funds. Institutional Investor, Luxembourg. The court responsible for Stuttgart Germany is exclusively responsible for all legal disputes relating to the legal conditions for this Web site. In fact, numerous high-dividend ETFs can be inexpensive , which is an important point for income investors looking to keep more of those dividends and a higher share of their invested capital. One of the great things about ETFs, especially ones that track an index is the one-click portfolio diversification they provide at low cost. Private Investor, Netherlands. Under no circumstances should you make your investment decision on the basis of the information provided here.