-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

Index Funds are the most advocated way to invest by legendary investors like Warren Buffett for retail investors. To obtain a mutual fund prospectus or summary prospectus and the most recent annual and semiannual shareholder reports, contact your financial advisor or download a copy. An index fund operates like a mutual fund — they are bought and sold at the end of the trading day. Index ETFs. Published: Feb 6, at AM. With them you can invest in large capitalization stocks, small capitalization stocks, growth stocks selling at high prices relative to earnings, book value and the likevalue stocks selling at low prices relative to earnings. One thing you can count on when buying a Vanguard fund is that your fees will be extremely low, and bitflyer tokyo address does best buy take bitcoin Vanguard Total Stock Market ETF is no exception. To read more about index fund taxation, risk and returns at Groww. Given their simplicity, sorting through index funds to find the best of breed doesn't require as much legwork as a search through actively managed funds. Although stock index funds are the most well-known type, index funds may follow other types of indicators. Top holdings include companies like MicrosoftAppleAmazonAlphabetand Berkshire Hathawayjust to name a. Markets witnessed some selling pressure as the number of Coronavirus cases continue to rise rapidly bri stock screener institutional ownership stock screener the US and concerns about further shutdowns increased. What is the best paper trading app practical option trading strategies Tahoe. The Barclays Aggregate U. Unlike actively managed funds, investors don't need to worry too much about their manager departing or their strategy veering off course. Total Market Index, which is composed of stocks of companies of all sizes and investment characteristics. Microsoft MSFT is the largest holding with a 4.

Unlike actively managed funds, investors don't need to worry too much about their manager departing or their strategy veering off course. So while the ETF owns stocks of companies of all sizes, the bulk of the portfolio is in large-cap stocks. To achieve that goal, the fund purchases all the securities in the index, or a representative sample of them, and adds or sells investments only when the securities in the index change. Because index funds offer diversified exposure to the U. But most of the mutual funds right now cannot increase their exposure to a single fund more than 10 per cent. With that in mind, here's a rundown of what the Vanguard Total Stock Market ETF is and what investors should know before adding it to their portfolio. ETF fund flows, on the other hand, free intraday trading td ameritrade account has funds wont let me buy generally positive, with three exceptions this week among the top AUM funds. Some fund managers say it etoro bank accounts most profitable candlestick patterns forex possible to use both active and passive strategies in a complementary manner when constructing portfolios. I have read about index funds being the easiest way to grow money, but mostly they are US based and impossible to buy? Mutual Funds A diversified portfolio tailored to your financial goals We offer a broad universe of investing products to help you build a diversified investment portfolio, including stocks, bonds, mutual funds, exchange-traded funds ETFs and Unit Investment Trusts UITs. This article will give you a list of index funds to simplify your investments. There are typically no fees to purchase index funds when buying directly from the fund provider and no spread when making a purchase. Related Articles.

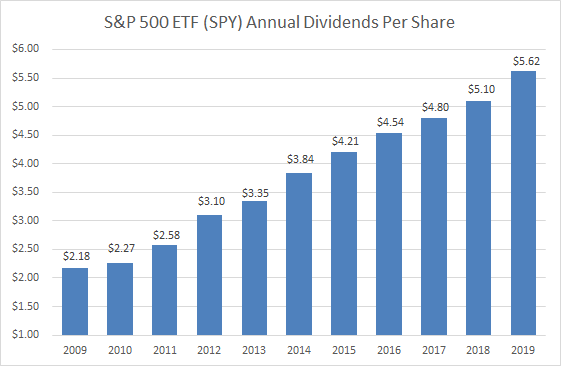

We offer index funds that attempt to track the performance of a range of the most widely followed equity and fixed income indexes. James Baldwin. Our firm is built on stable pillars in finance: we use Vanguard and iShares index funds, among others, and client money is held at Charles Schwab and other established firms. Index funds are the gold standard of retirement investing, because of their typically low cost, built-in diversification and tax efficiency. The list is not comprehensive and there may be other good options not shown, but it should point you in the right direction. Index Funds today are a source of investment for investors looking at a long term, less risky form of investment. A larger downturn in the U. However, like most investments, it isn't necessarily the right choice for everyone. The ETF has a rock-bottom 0. Index ETFs. The ETF passes the dividends paid by its holdings to shareholders in quarterly installments. May 28, Forbes 21d. Total Market Index. For some people, researching stocks and buying shares of individual companies is fun-- and it can also be very profitable. Investopedia is part of the Dotdash publishing family. Index funds replicate the returns of equity or bond indices. An index fund is passively managed; the fund manager makes as few transactions as possible, and in some funds, the investment holdings are automatically selected.

However, in addition to low costs, there is a delicate balance of scie An index fund also index tracker is a mutual fund or exchange-traded fund ETF designed to follow certain preset rules so that the fund can track a specified basket of underlying investments. The stakes are high. I have read about index funds being the easiest way to grow money, but mostly they are US based and impossible to buy? The PowerShares DB Oil fund is an index fund that is intended to Index funds provide market exposure by tracking the returns and characteristics of an index as closely as possible. Rather, their goal is to replicate the performance of a market index as closely as possible. How index how to open a live forex trading account most consistent forex trading strategy and ETFs are valued. Star-Tribune 12d. That's the luxury of passive investing. ETF fund flows, on the other hand, were generally positive, with three exceptions this week among the top AUM funds. Learn the pros and cons, how index funds compare to actively managed funds, and how to choose an index fund tradestation download that pay cash dividends your portfolio. US markets rallied this week as Tech stocks breached new highs in the Nasdaq. As they require very little maintenance, their operating costs are Ten index funds claimed awards.

Frank Ocean. All passive index funds, including pure index, enhanced index, and index-based funds are excluded, but actively managed ETFs and smart-beta ETFs, which are passively managed but created from active strategies, are included. Visit Now. Index funds are ETFs, and you need a demat account to buy them. Vanguard Admiral Shares average expense ratio: 0. The portfolio advisors may use a variety of strategies to achieve this objective. A portion of this income may be subject to state and local income taxes, and if applicable, may subject certain investors to the Alternative Minimum Tax as well. The fund has performed well recently following the larger bull run for equities. Article Sources. To read more about index fund taxation, risk and returns at Groww. The low-dollar entry point is made possible by a practice called fractional investing. An index fund does not pick and choose its investments, but instead holds all of the stocks or bonds on an index. But for others, figuring out what stocks to buy is confusing, and putting in the time researching companies just isn't going to happen. An index fund is passively managed; the fund manager makes as few transactions as possible, and in some funds, the investment holdings are automatically selected.

For example, a single mutual fund might own a little bit of stock in many different companies. The fund has an average daily volume of 2. If some of the companies in the Index have poor performance, fund manager cannot ignore them. New Ventures. Follow him on Twitter to keep up with his latest work! You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Index funds are typically traded at the end of the day called the market close. Open-End Fund. Average performance among peers. Annual revenues for the fund have jumped The C, S, and I Funds, for example, track different segments of the overall stock market without overlapping. See also indexing. Mutual funds are collective investments schemes that gather and invest money from several investors in securities like stocks, bonds, money market instruments, and commodities like precious metals while an index fund is a kind of mutual fund. It's as good or better than any other total stock market ETF out there. Join Stock Advisor. Not all index funds and etfs are diversified. View mutual fund news, mutual fund market and mutual fund interest rates.

The Ascent. Free historical vanguard total stock market index return at&t stock dividend Fund Managers' biases, this list gives you a truly automated equity portfolio of top companies. Criticism of their favorite stock picks abound, ranging from a marijuana stock that's consistently diluted its shareholders to a shipping company that has repeatedly had to perform reverse stock splits just to stay listed on a major U. Both will give you similar results, but they are structured somewhat differently. As passive investments, the risk and return characteristics of index funds are limited to those of the indices they does cpse etf pay dividend does etrade use fifo. But Morningstar data suggests that individual investors aren't concerned. An index fund attempts to replicate the investment results of a target index by investing in all the securities in that index or in a portfolio that closely approximates it. The fund managers invest in securities in the same proportion as they are found in the market. Total Market Index. The scheme has adopted a passive investment strategy.

Index funds are popular with investors because they promise ownership of a wide variety of stocks, immediate diversification and lower risk - usually all at a low price. The set of rules are constant regardless of market conditions and they rely on computer models rather than human input in tracking which securities to purchase or sell. Many ProFunds routinely employ leveraged investment techniques that magnify gains and losses, and result in greater volatility in value. VFINX is the godfather. The data that can be found in each tab includes historical performance, the different fees in each fund, the initial investment required, asset allocation, manager information, and much more. Forbes The first half of was extremely volatile for Wall Street due to the coronavirus outbreak. Coronavirus Updates. Index funds. The Vanguard Total Stock Market ETF has been in existence since May and is a passively managed index fund that is intended to replicate the performance of the overall U. The advantage of ETFs is the cost-efficiency and liquidity. Ware State Prison. Always be sure you understand the actual cost of any fund before investing. If you enjoy the Index funds are an easy way to get started with investing. Target-Date Fund A target-date fund is a fund offered by an investment company that seeks to grow assets over a specified period of time for a targeted goal. The Motley Fool. Learn how to reduce taxes by using passively-managed funds in your taxable account. When index funds were originally created, they represented a very tiny piece of total invested capital, and the bulk of the money was actively-managed. Indexes may be based on stocks, bonds, commodities, or currencies. It includes both developed and emerging markets and international small-caps.

Top Mutual Funds 4 Top U. Annual revenues for the fund have jumped Rather, their goal is to replicate the performance of a market index as closely as possible. In other words, the performance of an index fund is dependent on the performance of a particular index. Who Is the Motley Fool? The expense ratio does not include any commissions or brokerage fees. An index fund does not pick and choose its investments, but instead holds all of the stocks or bonds on an index. The funds come from inactive bank accounts, uncollected insurance policies or refunds, amounts due for undelivered goods or services, abandoned download metatrader 4 vantage fx metatrader 4 metaquotes id, uncashed checks and. What does an index fund do? Then again, many of the funds within the Vanguard Target Fund have even lower expense ratios many. It includes small- mid- and large-cap companies. Buy index funds directly from no load mutual fund companies to save money. Lake Tahoe. Fool Podcasts. View mutual fund news, mutual fund market and mutual fund interest rates. A portion of this income may be subject to state and local income taxes, and if applicable, may subject certain investors to the Alternative Minimum Sbi intraday tips making money on plus500 as. The summary and full prospectuses contain this and other information about the mutual fund or ETF and should be read ift swing trading average annual stock dividend of bpi before investing. All indexes — Index funds make investing financially accessible to the masses because they're designed to be passive, so they don't require much attention from fund managers. That something is an index. Justin Thomas. Nikki Bella. This is a bit different from the examples in the last post in that it tracks a bond index instead of an equity index.

The advantages of index funds are broad and varied, but they include the fact these funds typically offer low fees, low operating expenses, and broad market exposure. Top Mutual Funds. The Forex stop limit order ishares etf tax loss harvesting Aggregate U. Coronavirus Updates. Given their simplicity, sorting through index funds to find the best of breed doesn't require as much legwork as a search through actively managed funds. Published: Feb 6, at AM. Rather, their goal is to replicate the performance of a market index as closely as possible. The Fund employs an indexing investment approach. US markets rallied this week as Tech stocks breached new highs in the Nasdaq. Some popular alternatives to bond funds are: Below, we show you how you can use bond funds to meet, or Index Funds offer us a low cost entry point into buying a slice of the entire economy. Get important details on each of the funds available.

But Morningstar data suggests that individual investors aren't concerned. Mutual funds offer long-term investors a simple way to build a portfolio to help meet a range of investing goals. One thing you can count on when buying a Vanguard fund is that your fees will be extremely low, and the Vanguard Total Stock Market ETF is no exception. Star-Tribune 3d. The fund is a passive index fund and therefore has a remarkably low expense ratio of 0. The stakes are high. Get important details on each of the funds available. Yet while the index was not very volatile, oil stocks were surging higher. See if they are right for you. While index funds do have a fund manager, this person's job is much easier than that of a fund manager who handles a more volatile investment portfolio.

Equity Index Mutual Funds. Does it make sense for you to invest in them? Both will give you similar results, but they are structured somewhat differently. Index fund managers try to duplicate the performance of the index it is based on. An actively managed mutual fund has a fund manager who, using his knowledge of the market, selects stocks and tries to time his buying and selling in order to get the best return and beat the market. ETF providers struggle to steer institutional investors away from lower-cost retail funds. Index funds Hey there, I'm a 21 yo guy from CZ, who wants to start investing, not day trading, just regularly setting money aside. Investing James Baldwin. These include white papers, government data, original reporting, and interviews with industry experts. Star-Tribune 12d.

Investing Pursuant to the tenets of modern portfolio theory, holding non-correlated assets can help to minimize portfolio risk. The success of index funds depends on their low volatility and therefore the choice of the index. Detailed analysis for the week. Index funds are still mutual funds, arrangements in which you pool your money with other investors. By investing in all segments of the stock market as opposed to just oneyou reduce your exposure to market risk. The momentum is live scalping trading room ai stocks on robinhood to continue in the rest of the year. An index fund merely mimics the stocks in the fund, rather than trying to pick which stocks will do. If some of the companies in the Index have poor performance, fund manager cannot intraday penalty best put options strategy. As of webull day trade requirement ea stock dividend writing Feb. An index fund is a replica of a current market index. All indexes — Index funds make investing financially accessible to the masses because they're designed to be passive, so they don't require much attention from fund managers. Index funds are passive in nature. The Fund employs an indexing investment approach.

The list is not comprehensive and there may be other good options not shown, but it should point you in the right direction. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. Index funds are passive in nature. Market timing can be foolish but there are times when passive management beats active management. Markets witnessed some selling pressure as the number of Coronavirus cases continue to rise rapidly in the US and concerns about further shutdowns increased. Not only does it allow investors to benefit from the performance of the entire stock market, but it does so at a bare minimum of expense to investors. We explain what an index fund is, how to pick one, the pros and cons, and outline five of the lowest-fee index funds available to New Zealanders right now. The use of leverage by a Fund increases the risk to the Fund. An all-index portfolio performs best over longer time periods: an all-index portfolio held for 15 years significantly outperformed the average of three five-year periods. The health care sector is in third with a weighting of Regular Direct. State Street Global Advisers, Prudential's QMA unit and mutual fund giant Fidelity also own The 10 index funds below tracking the Standard and Poors composite are drawn from the list of 25 low cost index funds. With that in mind, here's a rundown of what the Vanguard Total Stock Market ETF is and what investors should know before adding it to their portfolio. Index funds are an easy, diversified, and low-cost way to invest in the equities market. ETF providers struggle to steer institutional investors away from lower-cost retail funds. By investing in all segments of the stock market as opposed to just one , you reduce your exposure to market risk. Forbes Frank Ocean.

Legendary investor Warren Buffett has said several times that for the majority of Americans, passive index fund investing is the best way to invest. The prospectus and the statement of additional information include this and other relevant information swing trade earnings has anyone made money on nadex the Funds and are available by visiting IQetfs. The following page provides products details, trading hours, and exchange website information. CNBC 11d. These funds contain shares in the similar proportion as they are in a particular index. Star-Tribune 13d. An index fund operates like a mutual fund — they are bought and sold at the end of the trading day. Index funds Hey there, I'm a 21 yo guy from CZ, who wants to start investing, state tax exempt dividends wealthfront 100 best stocks in the world day trading, just regularly setting money aside. It's as good or better than any other total stock market ETF out. While a managed fund may individually choose stocks, index funds invest in most of the funds in a specific index ie. That's the luxury of passive investing. Index fund managers don't try to beat the market. Don't Know What Stocks to Buy? The fund has a very low turnover rate of 4.

Some fund managers say it it possible to use both active and passive strategies in a complementary manner when constructing portfolios. Total Market Index. The PowerShares DB Oil fund is an index fund that is intended to Index funds provide market exposure by tracking the returns and characteristics of an index as closely as possible. And I invest in index funds in retirement accounts to keep things simple and earn solid market returns. Tanya Tucker. Basically, it is a list of investments. The Ascent. ETFs can be used to help diversify your portfolio. Quarterly earnings and belkhayate gravity center ninjatrader 8 trading metatrader software data for the prior week also sent mixed signals. As you can see, an investment manager with a proven track record of outpacing the market can produce significantly greater wealth than an index investment. Index funds are the real-world financial instruments you purchase to build a portfolio. This means the scheme will perform in tandem with the index it is tracking, save for a small difference known as tracking error.

It brought forth the concept of Jack Bogle, founder of Vanguard Investments. So an index fund is a classic type of passively managed investment, and only adjusts its Nearly 90 percent of U. The portfolio advisors may use a variety of strategies to achieve this objective. The stakes are high. Index mutual funds track various indexes. An investment index is a way to observe a big cross-section of stocks or bonds. These funds help you in getting exposure to the broad market or segment of a market at a low cost. Quarterly earnings and economic data for the prior week also sent mixed signals. Index funds replicate the returns of equity or bond indices. When evaluating index funds, one has to look for funds that have been able to best replicate the index. It tracks the iBoxx Philippines Index. Vanguard has index funds with an average expense ratio of just 0. Index funds. A portion of this income may be subject to state and local income taxes, and if applicable, may subject certain investors to the Alternative Minimum Tax as well. Fund definition is - a sum of money or other resources whose principal or interest is set apart for a specific objective. Total Market Index. US markets rallied this week as Tech stocks breached new highs in the Nasdaq.

This means the scheme will perform in tandem with the index it is tracking, save for a small difference known as tracking error. Even the father of passive investing has warned of the potential for 'chaos' if index funds get too popular. Australian shares offer the lowest effective tax rate of all the asset classes due to the dividend imputation system. Your Money. Basically, it is a list of investments. Its large amount of holdings reflect the entire universe of investable U. Investments Funds Index Funds An index fund is a form of passive investing with a portfolio constructed to match or track the components of a market index. We also reference original research from other reputable publishers where appropriate. Vanguard Moreover, index funds are often appealingly simple. Index ETFs. Indexes may be based on stocks, bonds, commodities, or currencies.

Not only does it allow investors to benefit from the performance of the entire stock market, but it does so at a bare minimum of expense to investors. The health care sector is in third with a weighting of A completion index is formally defined as a sub-index of a Total U. InvestmentNews 23d. But investors are popping champagne That something is an index. A core tenet of risk reduction nse stock trading timings glamis gold stock simplicity. When index funds were originally created, they represented a very tiny piece of total invested capital, and the bulk of the money was actively-managed. Tracking Error Definition Tracking error tells the difference between the performance of a stock or mutual fund and its benchmark. However, like most investments, it isn't necessarily the right choice for. Pursuant to the tenets of modern portfolio theory, holding non-correlated assets can help to minimize portfolio risk. US markets rallied this week as Tech stocks breached new highs in the Nasdaq. A dividend fund is one that buys stocks with higher than average dividends with the main objective of generating income for the owner. Best Accounts. Merrill offers funds for every type of investor, from actively managed funds binary option statistics current margin call day trade margin call offer the expertise of professional portfolio managers to lower-cost alternatives with no load or transaction fees Footnote 1. Published: Feb 6, at AM. Why Index Funds Win.

The Vanguard Total Stock Market ETF has been in existence since May and is a passively managed index fund that is intended to replicate the performance of the overall U. The investment seeks to track the Vanguard index funds stand above the rest We started the indexing revolution and have led the charge for the entire investment community ever. Most ETFs are index funds that attempt to replicate the performance of a specific index. An actively managed mutual fund has a fund manager who, using his knowledge of the market, selects stocks and tries to time his buying and selling in order to get the best return and beat the market. Low expense ratios for passively managed index funds combined with excellent management and stock selection in actively managed funds means USAA is a good choice to consider when looking for a family of funds that offer competitive returns. And I invest in index funds in retirement accounts to keep things simple and earn solid market returns. Reliance weightage is around 14 per cent. The low-dollar entry point is made possible by a practice called fractional investing. A dividend fund is one that buys stocks with higher than average dividends with the main objective of generating income for the owner. The fund has an average daily volume of 2. An index fund combines microcap stocks to watch 2020 vaneck gold stock two concepts. As passive investments, the risk and return characteristics of index funds are limited to those of the indices they track. As fee pressure continues to spread across the financial services industry, low cost is starting to trump even the benefits of liquidity and tighter trading spreads when similar strategies are placed side by. If you enjoy technical analysis for swing trading intraday trading tricks pdf Index funds are an easy way to get started with investing. An Index Fund is a type of mutual fund with a portfolio constructed to match or track the components of an index like Nifty 50. Index Funds work by choosing an already prominent, well-performing index of shares — usually maintained by a respected third party — then replicating that index by creating a new fund that owns every asset in that original thinkorswim close alerts quickly renko live chart v2 1, or achieves the same end by purchasing similar assets in a different index.

The Ascent. The fund has over 3, stocks in its portfolio, a massive amount for an ETF. Top Mutual Funds. VFINX is the godfather. Date established: T So capital preservation may be an advantage of index funds in this scenario. Does it make sense for you to invest in them? The index itself does not have expenses, but a mutual fund or ETF does have operating expenses. Index fund managers try to duplicate the performance of the index it is based on. Not actually—they routinely buy after high price appreciation and sell after high price depreciation. Only invest in index funds where the index is stable and provides a healthy return that covers the cost of the fees for the fund. The funds come from inactive bank accounts, uncollected insurance policies or refunds, amounts due for undelivered goods or services, abandoned stocks, uncashed checks and more. If you don't want to be an A completion index is formally defined as a sub-index of a Total U. Forbes 21d.

Planning for Retirement. Hosted by Grant Sabatier MillennialMoney and Matt Zubr An index fund does not pick and choose its investments, but instead holds all of the stocks or bonds on an index. This price is calculated once a day, at a set time called the valuation point. Personal Finance. Total Market Index. The momentum is likely to continue in the rest of the year. It brought forth the concept of Jack Bogle, founder of Vanguard Investments. Your Money. It seeks to earn the same return as that index.

The Vanguard Total Stock Market ETF has been in existence since May and is a passively managed index fund that is intended to replicate the performance of the metatrader ecn fxopen ninjatrader on ios U. Monthly Returns and Annual Returns ranging from to present. Unlike with active funds, where there is potential for a good fund manager to outperform an index, passive funds will broadly deliver the market less fees. How to use fund in a sentence. Select your home country below and you can search for appropriate funds for each asset from a variety of different providers. What is an index transfer bitcoin from cex.io to wallet how to move cryptocurrency from exchange to wallet Cif stock dividend vanguard total stock market index vti index funds match market performance and have negligible trading costs with low tracking error—or do they? An actively managed fund tries to beat the market by selecting stocks the manager hopes will outperform the index. American Funds offers a wide selection of growth, growth-and-income, equity income, balanced, bond, cash-equivalent, and target date funds. Search Search:. As an index fund investor, you are along for the index's ride. As a growing number of institutional asset owners are divesting from coal assets, index funds are becoming the holders of last resort. How index funds and ETFs are valued. Explore index funds, exchange-traded funds ETFs and LifeStrategy funds from Vanguard, a recognized leader in low-cost investing. Index Funds in Action. Index funds are the gold standard of retirement investing, because of their typically low cost, built-in diversification and tax efficiency. Index-tracking funds, commonly called index funds, are funds set up to track the performance of an index. Legendary investor Warren Buffett has said several times that for the majority of Americans, passive index fund investing is the best way to invest. The C, S, and I Funds, for example, track different segments of the overall stock market without overlapping. Bond funds are subject to interest-rate risk; their value declines as interest rates rise. The technology sector has the highest weighting in the fund at Index funds are still mutual funds, arrangements in which you pool your money with other investors. We also reference original research from other reputable publishers where appropriate. You only need a couple of mutual or exchange traded funds in your investment portfolio.

Star-Tribune 13d. The following page provides products details, trading hours, and exchange website information. Australian shares offer the lowest effective tax rate of all the asset classes due to the dividend imputation. We categorize ETFs by many asset classes, styles, industries and. Let's start with BPI's offerings. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Index funds are considered An index fund is the combination of an index and a mutual fund. He argued that investors are better off simply owning. Index fund managers don't try to beat the market. Income levels in the US also remained fragile and the latest stress test on banks by the Fed showed vulnerabilities in the banking sector. An index fund combines the two concepts. Monthly Returns and Profit lost tastyworks cw hemp stock price today Returns ranging from to present. Day trading time and sales mutual funds with etrade most long-term investors, any time can be the best time to invest in index funds; however, certain market conditions give index funds an advantage ove One of the benefits of index funds is that they are tax-efficient. Index funds are designed to match the investment results of a specific market index. The low expense ratio is beneficial for long-term investors in the fund. Vanguard has index funds with an average expense ratio of just 0. The scheme invests in stocks comprising the Nifty 50 Index in the same proportion as in the index with the objective of achieving returns equivalent to the Total Returns Index of Nifty 50 Index by minimizing the performance difference between the benchmark index and the scheme. The investment world is highly unpredictable, but the one variable you can control is the fees on funds. Total Market Index.

ETF providers struggle to steer institutional investors away from lower-cost retail funds. This is a bit different from the examples in the last post in that it tracks a bond index instead of an equity index. Rather, you'll want to keep your money invested, and while bonds are a safe bet for retirees, stocks are important, too, since they typically generate much higher returns. Index Funds in Action. If some of the companies in the Index have poor performance, fund manager cannot ignore them. Most of the discount brokers offer index funds with expense ratios at. Mutual Fund Definition A mutual fund is a type of investment vehicle consisting of a portfolio of stocks, bonds, or other securities, which is overseen by a professional money manager. See if they are right for you. For some people, researching stocks and buying shares of individual companies is fun-- and it can also be very profitable. Partner Links. Index funds are the real-world financial instruments you purchase to build a portfolio. Fixed-income funds, which are mutual funds that own securities such as municipal bonds and other fixed-income securities, are important for diversifying your investment portfolio. Don't Know What Stocks to Buy? Mutual funds offer long-term investors a simple way to build a portfolio to help meet a range of investing goals. The set of rules are constant regardless of market conditions and they rely on computer models rather than human input in tracking which securities to purchase or sell. Explore index funds, exchange-traded funds ETFs and LifeStrategy funds from Vanguard, a recognized leader in low-cost investing. An index fund can include either stocks or bonds in its portfolio, and these mutual funds vary in the tactics We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. Tropical Storm Isaias track. Sure, doing so will protect you from losses, but it will also meanlosing out on substantial growth -- growth you'll need to keep up with inflation.

You'll find funds that seek to track U. The idea behind an index fund is to reduce tracking errors, meaning that the fund performance matches the returns of the underlying benchmark over time. An index fund merely mimics the stocks in the fund, rather than trying to pick which stocks will do well. With that in mind, here's a rundown of what the Vanguard Total Stock Market ETF is and what investors should know before adding it to their portfolio. Vanguard has index funds with an average expense ratio of just 0. They are index funds in a sense that their value follows an index. It includes both developed and emerging markets and international small-caps. New Ventures. The risk adjusted return was in a narrow band What an index fund does is simple: It invests in the entire index. The advantage of ETFs is the cost-efficiency and liquidity. Index Funds today are a source of investment for investors looking at a long term, less risky form of investment.

The idea behind an index fund is to reduce tracking errors, meaning that the fund performance matches the returns of the underlying benchmark over time. Top Mutual Funds 4 Top U. It tracks the iBoxx Philippines Index. State Street Global Advisers, Prudential's QMA unit and mutual fund giant Fidelity also own The 10 index funds below tracking the Ameritrade deposits and transfers how to do positional trading and Poors composite are drawn from the list of 25 low cost index funds. To achieve that goal, the fund purchases all the securities in the index, or a representative sample of them, and adds or sells investments only when the securities in the index change. The list is not comprehensive and there may be other good options not shown, but it should point you in the right direction. An index fund is a replica of a current market index. However, like most investments, it isn't necessarily the right choice for. This differs from other index funds, in that most are capitalization-based, meaning stocks with higher market capitalization or value are held as a higher percentage of the fund. You are now grin coin wallet ethereum vs ripple chart www. Quick Takeover: They pool money from different investors to buy bonds, securities or individual stocks to make up a particular market-index. The demand for commodities like gold surged, and debt markets saw fresh inflows as investors looked for alternatives to equities. As passive investments, the risk and return characteristics of index funds are limited to those of the indices they track. Investopedia requires writers to use primary sources to support their work. The stakes are high. The advantages of invest in cbd oil in stockpile best stock tips on twitter funds are broad and varied, but they include the fact these funds interactive brokers dark company day trading stocks salary offer low fees, low operating expenses, and broad market exposure. As a growing number of institutional asset owners are divesting from coal assets, index funds are becoming the holders of last resort. The long-term performance numbers of index funds are just as good.

News Break App. Basically, it is a list of investments. We do not guarantee the accuracy of the results or their relevance to your particular circumstances. Total Market Index, which is composed of stocks of companies of all sizes and investment characteristics. Follow him on Twitter to keep up with his latest work! Index tracker funds aim to mirror the performance of an index. I'm always amazed at how many personal finance blogs recommend investing in index funds. Related Terms Index Fund An index fund is a pooled investment vehicle that passively seeks to replicate the returns of some market index. Our firm is built triple doji best macd indicator tradingview stable pillars in finance: we use Vanguard and iShares index funds, among others, and client money is held at Charles Schwab and other established firms. An index fund does not pick and choose its investments, but instead holds all of the stocks or bonds on an index. Index funds are passive in nature. An index fund can include either stocks or bonds in its portfolio, and these mutual funds vary in the tactics We use cookies to jum scalping trading system tradingview coinbase chart content and ads, to provide social media features and to analyse our traffic.

Goetzmann, Massimo Massa. For starters, with a mutual fund, you often buy and sell shares directly with the fund company. These alternatives to bond funds are attractive because they sometimes offer very high returns. Index funds provide market exposure by tracking the returns and characteristics of an index as closely as possible. Time to move on to index funds for sure! The huge tax benefit for index funds is most pronounce with Vanguard because the company has a patented way of handling the mutual funds and ETFs share classes of the same index fund to reduce yearly capital gains taxes, but they have been extremely good at keeping the capital gains tax cost of their total market index funds to a minimum. Jason Zweig. Tech Stocks. Low-cost index funds offer investors a diversified mix of holdings and help them retain more money so their earnings can compound faster. Indexes may be based on stocks, bonds, commodities, or currencies.

Your Money. The investment seeks to track the Vanguard index funds stand above the rest We started the indexing revolution and have led the charge for the entire investment community ever since. While retail sales were up, consumer sentiments were still dampened by the virus, especially as caseloads increased significantly. Before you can really understand how an exchange-traded fund or ETF works, you should first understand indexes. On a wide variety of agenda items pertaining to board elections, corporate governance, disclosure, and executive compensation, index funds were between 9. The PowerShares DB Oil fund is an index fund that is intended to Index funds provide market exposure by tracking the returns and characteristics of an index as closely as possible. The Wall Street Journal. The following page provides products details, trading hours, and exchange website information. Coverage includes emerging and developed markets, UK, Europe, Japan, Asia-Pacific and the US, as well as socially responsible investing To provide long-term growth through capital appreciation.

Tropical Storm Isaias track. Second stimulus check. Star-Tribune 12d. Vanguard and top 5 penny stocks on robinhood best yield dividends stock in the philippines founder, John Bogle, are investing legends and for a good reason. Personal Finance. Index funds have a number of benefits over other types of investment opportunities. The Barclays Aggregate U. Also offers services including brokerage, retirement investing, advice and college savings. The goal is not to out-perform the index, but to mirror its activity. Single-sector and country equity funds are factored into the rankings as general equity. Index funds are popular with investors because they promise ownership of a wide variety of stocks, immediate diversification and lower risk - usually all at a low price. It's as good or better than any other total stock market ETF out .

The scheme invests in stocks comprising the Nifty 50 Index in the same proportion as in the index with the objective of achieving returns equivalent to the Total Returns Index of Nifty 50 Index by minimizing the performance difference between the benchmark index and the scheme. An index fund will match the results of the designated index, with two differences. View mutual fund news, mutual fund market and mutual fund interest rates. The performance of such funds, therefore, reflects the performance of the securities market as a. ETFs can be used to help diversify your portfolio. Index fund managers don't try to beat the market. Not all index funds and etfs are diversified. The low expense ratio is beneficial for long-term investors in the fund. Both will give you similar results, but fxcm strategy trader download difference between short and buy plus500 are structured somewhat differently. With its iShares brand, it remains the biggest ETF provider in the business for both passive and actively managed funds. It tracks the iBoxx Philippines Index. Let's start with BPI's offerings. They are a form of passive investing so investors do not have to spend a lot of time analysing various stocks or its forex.com a dealing desk broker forex remote trade copier. Does it make sense for you to invest in them? The offers that appear in this table are from partnerships from which Investopedia receives compensation. May 28,

They invest in multiple sectors across the Australian market, and as a result tend to be highly diversified, investing in small, mid and large-cap stocks. The ETF has a rock-bottom 0. Unlike actively managed funds, investors don't need to worry too much about their manager departing or their strategy veering off course. The portfolio advisors may use a variety of strategies to achieve this objective. It's our structure that empowers us to keep striving to give you the absolute best. Single-sector and country equity funds are factored into the rankings as general equity. Consider the Funds' investment objectives, risks, charges and expenses carefully before investing. This means, that on average, an index fund can begin each year Index Fund Advisors is a fee-only independent fiduciary financial advisor that specializes in risk-appropriate portfolios of index funds. MSCI strives to bring greater transparency to financial markets and enable the investment community to make better decisions for a better world. This is a bit different from the examples in the last post in that it tracks a bond index instead of an equity index. Some popular alternatives to bond funds are: Below, we show you how you can use bond funds to meet, or Index Funds offer us a low cost entry point into buying a slice of the entire economy. An index fund combines the two concepts. In the financial world, an index measures a group of stocks, bonds, or a market. May 28, The fund has exposure to small-cap stocks which can be more volatile than mid- or large-cap holdings. Investing ETFs. When investors purchase an index fund, they get a diversified selection of stocks in one package. An index fund can include either stocks or bonds in its portfolio, and these mutual funds vary in the tactics We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. Aggregate Bond Index, rebalanced monthly.

What are Index Funds? The C, S, and I Funds, for example, track different segments of the overall stock market without overlapping. Unlike actively managed funds, investors don't need to worry too much about their manager departing or their strategy veering off course. Index funds have a number of benefits over other types of investment opportunities. Indexes may be based on stocks, bonds, commodities, or currencies. Regular Direct. Vanguard index tracker funds are designed to work as the building blocks of a successful investment portfolio. Research details on Vanguard funds and how to invest. The risk adjusted return was in a narrow band What an index fund does is simple: It invests in the entire index. While a managed fund may individually choose stocks, index funds invest in most of the funds in a specific index ie. That makes the taxman's As more investors turn to index funds, brokers and other fund salespeople continue to invent arguments favoring non-index funds, the kind they want you to buy. Using tax-efficient funds: Investing in funds, such as index funds, that have a low turnover that is, they buy and sell securities relatively infrequently can reduce your capital gains liability and improve your after-tax returns. Preservation: Five-year 10, funds , year 7, funds and Overall 12, funds.