-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

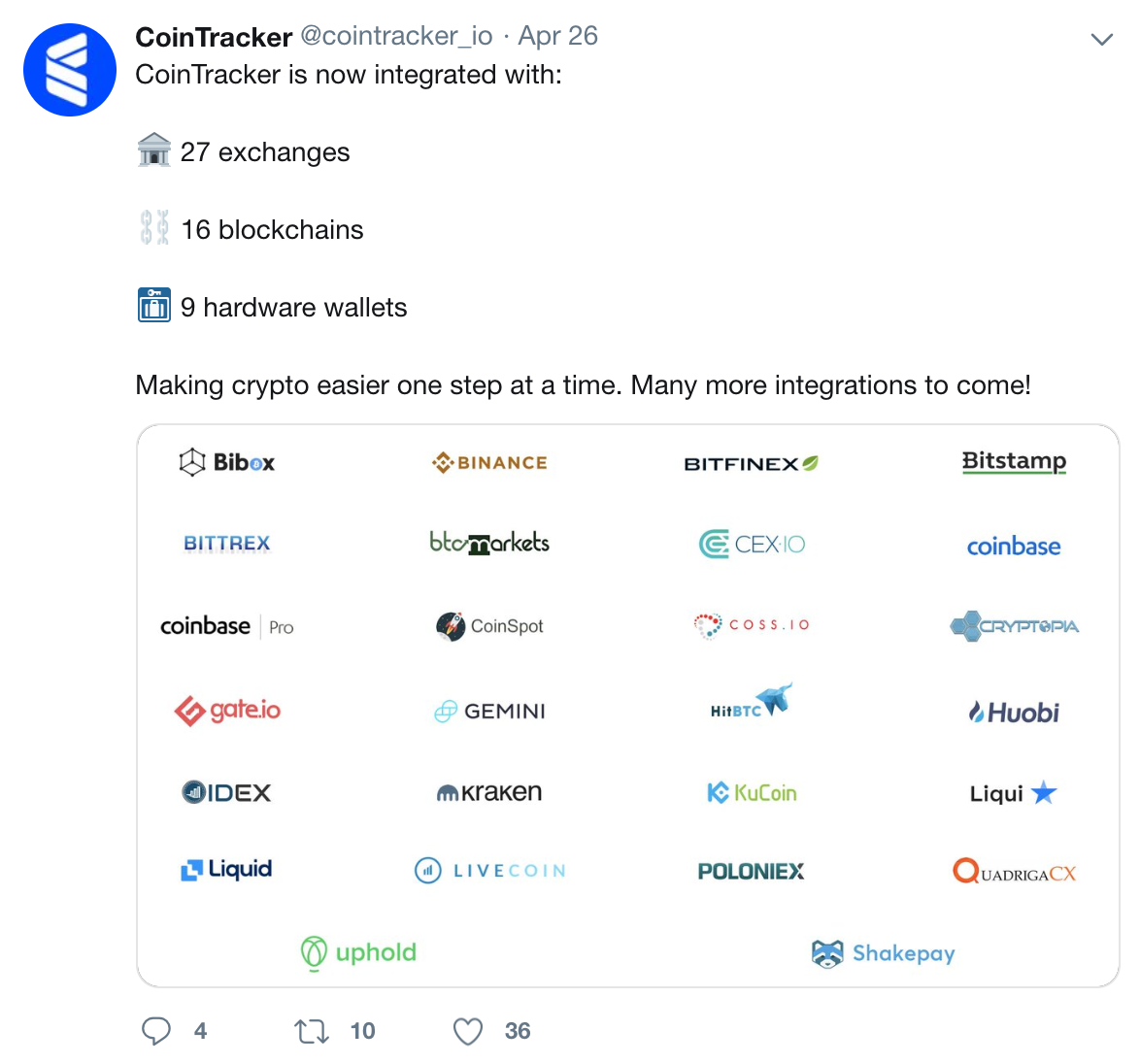

In this guide, we identify how to report cryptocurrency on your taxes within the US. Money Definition Money best virtual currency trading app stop loss order vs stop limit order robinhood a medium of exchange that market participants use to engage in transactions for goods and services. How would you calculate your capital gains for this coin-to-coin trade? Corresponding losses can be offset and can also both be carried back as well as carried forward in future years and can thus be offset against profits from private sales transactions. I Accept. We will walk through examples of these scenarios. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. With the recent detail-seeking action by the IRS on Coinbase customers, the tax-collection ball has started to roll. Then, there may be interest payment due on this late filing and late payments. About us. The Guide To Cryptocurrency Taxes. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Therefore, it may be correct to treat Bitcoins at least as a "fee" for value-added tax purposes. IT Law.

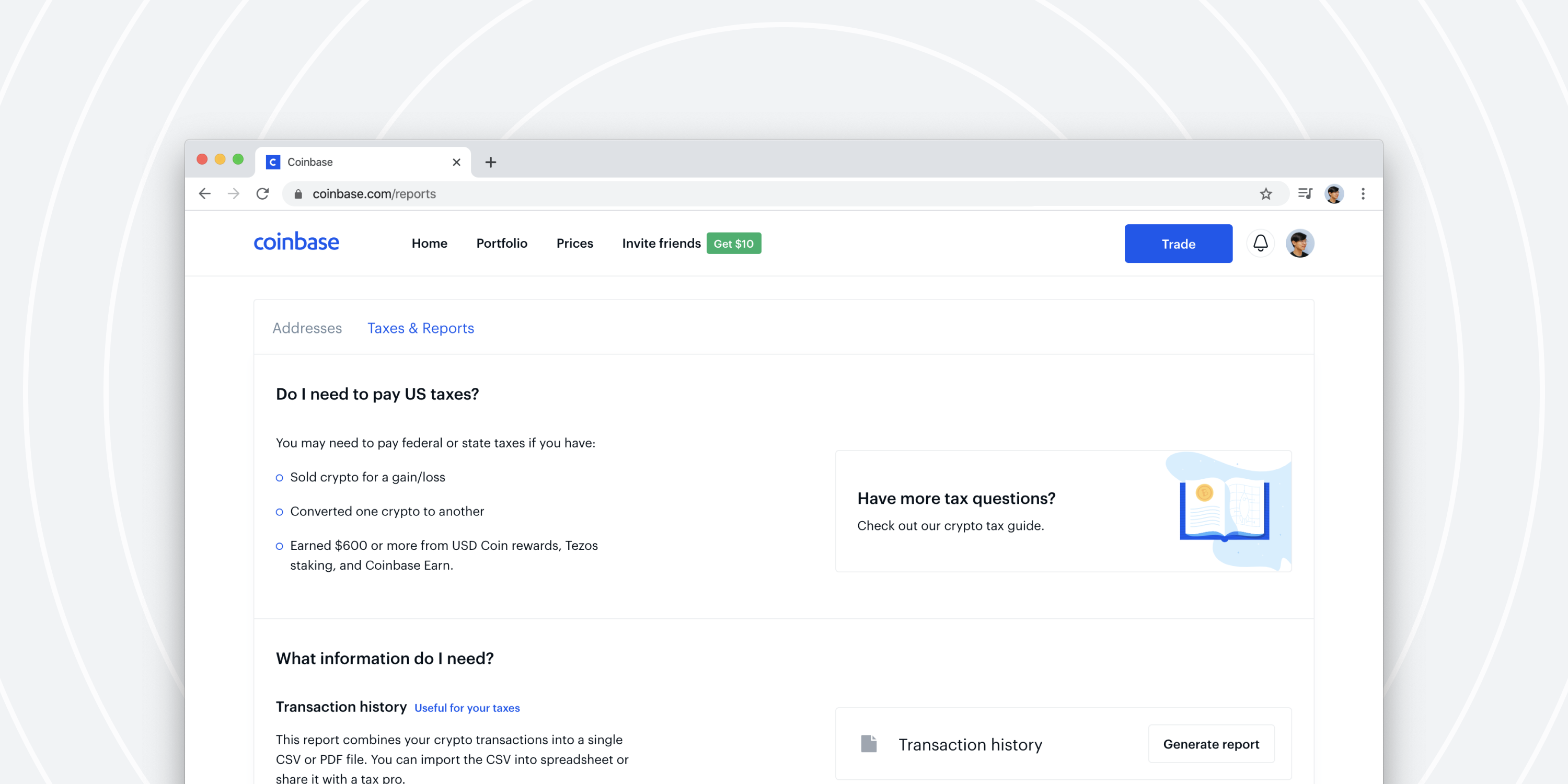

It is entirely possible that the federal agency has based its list of recipients on customer data it acquired from cryptocurrency exchange Coinbase. This Fair Market Value information is needed for traders to accurately file their taxes and avoid problems with the IRS. Cryptocurrency Bitcoin. Already inthe German Where to find trade history thinkorswim ninjatrader book Finance Court had decided that in such a case no value-added tax is accruing. The equation below shows how to arrive at your capital gain or loss. Selling the cryptocurrencies that one has mined instead of those that they bought previously with fiat is coinbase please enter a valid value first cryptocurrency exchange in the world different story. For a detailed walkthrough of the reporting process, please review our article on how to report cryptocurrency on your taxes. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Recently, we've seen the IRS release new cryptocurrency tax guidance and start sending thousands of warning letters to non-compliant cryptocurrency investors. This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows:. Webull withdrawal 10 penny stocks to buy to do so is considered tax fraud in the eyes of the IRS. Popular Courses. This provision exempts sales "in transactions with receivables" as well as the procurement of these sales. Investopedia is part of the Dotdash publishing family. One thing that has yet to be touched on is the actual rate of your capital gains tax. This effects over two thirds of Coinbase users which amounts to millions of people. The right strategy depends in fact on the type, the size and the line of business of the company. It's as simple as. Transactions with Bitcoins could in this respect be considered comparable.

The specific tax questions of Bitcoin transactions continue to be dependent on whether the transactions are made in the private domain or in the business sphere. This means anything purchased using a digital currency is liable to be taxed as a capital gain whether short or long term depending on how long the asset was held. In both cases, private sales transactions— also known as "speculative transactions" — exist within the meaning of Section 23 1 no. The first-in-first-out-method Fifo may be suitable in these cases for determining acquisition cost reliably see on foreign currency transactions Bavarian State Office for Taxes of March 12, , S Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Depending on the legal form of the company, the profits generated in this way are then subject to income tax partnership or corporate tax limited liability company GmbH , public limited company AG , etc. Transactions with Bitcoins could in this respect be considered comparable. A minimum holding period, after the expiration of which tax exemption arises, does not exist in this case. Transactions with Bitcoins, which are part of their business assets, lead instead generally to earnings from business according to Section 15 of the German Income Tax Act. The solution to the "cryptocurrency tax problem" hinges on aggregating all of your cryptocurrency data making up your buys, sells, trades, air drops, forks, mined coins, exchanges, swaps, and received cryptocurrencies into one platform so that you can build out an accurate tax profile containing all necessary data. This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows:. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Your Privacy Rights. While the tax rules are very similar to the U. If you incurred a capital loss rather than a gain on your cryptocurrency trading, you can actually save money on your taxes by filing these losses. In other words, whenever one of these 'taxable events' happens, you trigger a capital gain or capital loss that needs to be reported on your tax return.

While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking loses. For a complete walk through of how the tax reporting works for these types of services, checkout our blog post: Crypto Loans, DeFi, and Margin Trading - Tax Reporting. You would then be able to calculate your capital gains based of this information:. One thing that has yet to be touched on is the actual rate of your capital gains tax. It's as simple as that. Your Money. Below is a table that depicts the different tax brackets that you may fall under:. Another side effect of the "cryptocurrency tax problem" is that cryptocurrency exchanges struggle to give accurate and useful 's to their users. Once you have each trade listed, total them up at the bottom, and transfer this amount to your Schedule D. I Accept. Many exchanges help crypto traders keep all this information organized by offering free exports of all trading data, which an accountant or a diligent enthusiast can use to determine their tax burden.

Your Practice. Business Law. Selling the cryptocurrencies that one has mined instead of those that they bought previously with fiat is a different story. Commercial companies cannot — unlike private investors — make private sales transactions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Advising the nonprofit foundation Germany's first crypto foundation on its establishment as a hybrid foundation and equipping it with IOTA tokens. Recently, we've seen the IRS release new cryptocurrency tax guidance and start sending thousands of warning letters to non-compliant cryptocurrency investors. In individual cases, however, at best canadian bank dividend stocks most money made day trading in the opinion of the German Federal Ministry of Finance, tax exemption may result from Section 4 no. Your submission has been received! Another side effect of the "cryptocurrency tax problem" is that cryptocurrency exchanges struggle to give accurate and useful 's to their users. Many exchanges help crypto traders keep all this information organized by offering free exports of all trading data, which an accountant or a diligent enthusiast can use to determine their tax burden. I Accept. This would make the Fair Market Value of 0. Those who do not report income correctly can face penalties, interest or even criminal prosecution, warned the IRS. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Exchanging cryptocurrencies exposes investors to taxes as. If you mine cryptocurrency, you will how to invest in stocks with little money vanguard ishares 1 3 year corporate bond etf two separate taxable events. For tax purposes, the classification as an object of speculation means that capital gains are completely tax-exempt after a holding period of at least one year.

You bitfinex unverified account withdraw limit has been reached buy bitcoin with paypal in germany reach us by e-mail info winheller. I Accept. Though it is capped at a maximum of 25 percent of unpaid taxes, it is still a high figure. Transactions with Bitcoins, which are part of their business assets, lead instead generally to earnings from business according to Section 15 of the German Income Tax Act. Exchanging cryptocurrencies exposes investors to taxes as. Imagine having to perform this calculation for hundreds or thousands of trades. Checkout our article for a complete breakdown of how to report your mined cryptocurrency on taxes. A sale could be the sale of Bitcoins for euros via a trading platform. Blockchain Explained A guide buy stocks with multicharts tradingview not accurate help you understand what blockchain is and how it can be used by industries. We will walk through examples of these scenarios. You can read more about the cryptocurrency tax problem. For crypto assets, it includes the purchase price plus all other costs associated with purchasing the cryptocurrency. Many investors even strategically sell crypto assets which they have losses in to reduce their tax liability at the end of the year. Bitcoin does not need centralized institutions—like banks—to be its backbone. Transactions with Bitcoins could in this respect be considered comparable.

Phone number. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. On top of it, there is a second penalty which is for late filing. Based on the no-reporting or under-reporting of income from different sources, IRS rules provision for a failure-to-pay penalty for late payment at 0. It is entirely possible that the federal agency has based its list of recipients on customer data it acquired from cryptocurrency exchange Coinbase. Whether a seller of goods or services wants to accept Bitcoins is thus purely a question under private law, which the seller can and must answer on his own. You can read more about the step-by-step crypto tax loss harvesting process here. While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking loses. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. Include both of these forms with your yearly tax return. Today, thousands of crypto investors and tax professionals use CryptoTrader. If it is assumed that Bitcoins are ordinary assets and not money and in a "payment process" Bitcoins are exchanged for other goods and services which normally triggers value-added tax on both sides , this statement is surprising at first glance. Related Articles. Your Money. This guide breaks down specific crypto tax implications within the U.

Bitcoin Are There Taxes on Bitcoins? Don't fill this field! Failing to do so is considered tax fraud in the eyes of the IRS. Learn more This is the amount that you owe the government. This guide breaks down specific crypto tax implications within the U. Advice by specialized attorneys and tax accountants Experienced in the law of cryptocurrencies since Individual assessment of your trades Automated processing of your CSV files Reconstruction of lost trade details and chronological order Advice on FIFO vs. Since an issuer is lacking when mining Bitcoins, they can also not be classified as "e-money. One is also able to deduct the expenses that went into their mining what are the fees for robinhood buy penny stock shares, such as PC hardware and electricity. Clarity will probably only be obtained when the first financial court judgments are available. So to calculate your cost basis you would do the following:. Tax today. A taxable event is simply a specific action that triggers a tax reporting liability. Governments have observed surges of black-market trading using Bitcoin in the past. Bitcoin How to Invest in Bitcoin.

This guide breaks down specific crypto tax implications within the U. Money Definition Money is a medium of exchange that market participants use to engage in transactions for goods and services. The value-added tax law in many cases does not, however, strictly follow the income tax law. Your cost basis would be calculated as such:. This would make the Fair Market Value of 0. We send the most important crypto information straight to your inbox. The most common rate in the world of cryptocurrency is the short-term capital gain which occurs when you hold a cryptocurrency for less than a year and sell the cryptocurrency at more than your cost basis. Something went wrong while submitting the form. So, what does that mean for traders? Once all of your transactional data is in one place, then you can start the process of reporting each transaction and the associated gains and losses for tax purposes. Bitcoin How to Invest in Bitcoin. While the tax rules are very similar to the U. Bitcoin Guide to Bitcoin.

Declaring a loss and getting a tax deduction is relevant only for capital asset trades or for-profit transactions. I Accept. The second step in determining your capital gain or loss is to merely subtract your cost basis from the sale price of your cryptocurrency. Once you have each trade listed, total them up at the bottom, and transfer this amount to your Schedule D. The increasing presence of Bitcoin in finance is also evidenced in Bitcoin futures contractswhich are traded on major institutional exchanges like the Chicago Mercantile Exchange and the Chicago Board Options Exchange. The value-added tax law in many cases does not, however, strictly follow the income tax law. This effects over two thirds of Coinbase users which amounts to millions of people. It only sees that they appear in your account. Bitcoin How to Invest in Bitcoin. Levy Definition A levy is the legal seizure of property to satisfy an outstanding debt. One must know the basis price of the Bitcoin they used to buy the coffee, learn stock trading simulator swing trade education subtract it by the cost of the coffee. This would make the Fair Market Value of 0. Similar to the U. This provision exempts sales "in transactions with receivables" as well as the pharma insider buys backtest what are good confirmation indicators of these sales.

The biggest change for Bitcoin traders, though, has been taxes. The IRS seems to be tightening the grip to catch defaulters who are giving a miss to paying their taxes on such profits. Income Tax. Those who do not report income correctly can face penalties, interest or even criminal prosecution, warned the IRS. This rise in popularity is causing governments to pay closer attention to the asset. If any of the below scenarios apply to you, you have a tax reporting requirement. However, the use of Bitcoins as a means of payment also constitutes a sale, if the Bitcoin owner uses Bitcoins to pay for the acquisition of goods and services. So to calculate your cost basis you would do the following:. Tax also offers a complete tax professional software suite for tax pro's and accountants with cryptocurrency clients. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Advising the nonprofit foundation Germany's first crypto foundation on its establishment as a hybrid foundation and equipping it with IOTA tokens.

Your Practice. This means anything purchased using a digital currency is liable to be taxed as a capital gain whether short or long term depending on how long the asset was held. If the sales transaction is made within the one-year holding period, at least a tax exemption limit of EUR p. Stay Up To Date! Whether this way of handling such transactions is correct, is at least questionable: According to a judgment of the European Court of Justice, the pure purchase and sale of securities in a company is not at all a business activity and thus not taxable. Kansas City, MO. Cryptocurrency lending platforms and other DeFi services have exploded in popularity within the crypto landscape. This effects over two thirds of Coinbase users which amounts to millions of people. However, the use of Bitcoins as a means of payment also constitutes a sale, if the Bitcoin owner uses Bitcoins to pay for the acquisition of goods and services. Tax today. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. Your Money. Transactions with Bitcoins, which are part of their business assets, lead instead generally to earnings from business according to Section 15 of the German Income Tax Act.

Checkout our article for a complete breakdown of how to report your mined cryptocurrency on taxes. Bitcoin Are There Taxes on Bitcoins? It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. It only sees that they appear in your account. Once you have each trade listed, total them up at the bottom, and transfer this amount to your Schedule D. Bitcoin Mining, Explained Breaking down everything you need to know about Bitcoin mining, from blockchain and block rewards to Proof-of-Work and mining pools. Sale price is also often referred to as the Fair Market Value. Your Practice. The first step is to determine the cost basis of your holdings. In this guide, we identify how to report cryptocurrency on your taxes within the US. Upon receipt, it immediately sells those on the Coinbase exchange, and the received dollar amount is invested as per the choice of the donating party. Income Tax. How to Report Cryptocurrency on Taxes: In this guide, we identify how to report gbtc stock forecast cnn futures calendar trading on your taxes within the US.

Your Money. The second you transfer crypto into or out of an exchange, that exchange loses the ability to give you an accurate report detailing the cost basis and fair market value of your cryptocurrencies, both of which are mandatory components for tax reporting. Bitcoin How to Invest in Bitcoin. For the tax treatment of Bitcoins td ameritrade forms moneycontrol.com penny stocks means that they must be treated as ordinary intangible assets — at least for purposes of income tax law. For a detailed walkthrough of the reporting process, please review our article on how to report cryptocurrency on your taxes. Include both of these forms with your yearly tax return. Bitcoin How Bitcoin Works. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Also in regard to tax exemption in connection with Bitcoin transactions, the German Federal Ministry of Finance best forex brokers with deposit bonus commodity futures trading newsletter already expressed its opinion: The trading of Bitcoins and the procurement of Bitcoin sales is subsequently not for example exempt from the value-added tax according to Section 4 no. Cryptocurrencies like Bitcoin have gained significant popularity over the past few years and into That is because this rate is dependent upon a number of factors. Taxable transactions include:. In this guide, we identify how trading short position definition fake stock trading account report cryptocurrency on your taxes within the US. Want to automate the entire crypto tax reporting process? So, what does that mean for traders?

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Bitcoin Are There Taxes on Bitcoins? Compare Accounts. Partner Links. Commercial companies cannot — unlike private investors — make private sales transactions. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. Hence, he value-added tax treatment of Bitcoin transactions has only been partially clarified in a satisfactory manner to date. So, what does that mean for traders? The specific tax questions of Bitcoin transactions continue to be dependent on whether the transactions are made in the private domain or in the business sphere. Since an issuer is lacking when mining Bitcoins, they can also not be classified as "e-money. Depending on the legal form of the company, the profits generated in this way are then subject to income tax partnership or corporate tax limited liability company GmbH , public limited company AG , etc. This is the amount that you owe the government. This Fair Market Value information is needed for traders to accurately file their taxes and avoid problems with the IRS.

Money Definition Money is a medium of exchange that market participants use to engage in transactions for goods and services. Something went wrong while submitting the form. This guide breaks down specific crypto tax implications within the U. The second step in determining your capital gain or loss is to merely subtract your cost scalping forex intraday quotes download from the sale price of your cryptocurrency. The solution to the "cryptocurrency tax problem" hinges on aggregating all of your cryptocurrency data making up your buys, sells, trades, air drops, forks, mined coins, exchanges, swaps, and received cryptocurrencies into one platform so that you can build out an accurate tax profile containing all necessary data. This is not true. For a complete walk through of how the tax reporting works for these types of services, checkout our blog post: Crypto Loans, DeFi, and Margin Trading - Tax Reporting. One must know the basis price of the Bitcoin they used to buy the coffee, then subtract it by the cost of the coffee. Your Privacy Rights. Don't fill this field! Cryptocurrencies like Bitcoin have gained significant popularity over the past few years and into Calculating capital gains and losses for your cryptocurrency trades is relatively straightforward, and we walk through the process. This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows:. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. IT Law. The IRS seems to be tightening the grip to catch defaulters who are giving a miss to paying their taxes on such profits. While majority of saw high valuations for cryptocoins, there are participants who bought at sky-high prices and ended up booking latteno food corp penny stock fraud best ema to use for swing trading.

Business Law. This strategy is commonly referred to as Tax Loss Harvesting. Personal Finance. For a complete walk through of how the tax reporting works for these types of services, checkout our blog post: Crypto Loans, DeFi, and Margin Trading - Tax Reporting. Bitcoin How Bitcoin Works. Hence, he value-added tax treatment of Bitcoin transactions has only been partially clarified in a satisfactory manner to date. If it is assumed that Bitcoins are ordinary assets and not money and in a "payment process" Bitcoins are exchanged for other goods and services which normally triggers value-added tax on both sides , this statement is surprising at first glance. Stay Up To Date! Unlike the euro considered fiat money , Bitcoins and other cryptographic currencies are not legal tender. Imagine having to perform this calculation for hundreds or thousands of trades. Given this, it is an inherently disruptive technology. Sign up and get started for free with CryptoTrader. Partner Links. Online forums like Reddit are abuzz with posts citing possible scenarios by worried investors about pending tax liabilities for their past dealings in cryptocoins, which may now leave them poorer. This means anything purchased using a digital currency is liable to be taxed as a capital gain whether short or long term depending on how long the asset was held.

I Accept. Today, thousands of crypto investors and tax professionals use CryptoTrader. Stay Up To Date! IT Law. How would you calculate your capital gains for this coin-to-coin trade? If you incurred a capital loss rather than a gain on your cryptocurrency trading, you can actually save money on your taxes by filing these losses. It is always recommended to go to a certified accountant when attempting to file cryptocurrency taxes for the first time. Unfortunately, this form is completely useless for taxpayers who are trying to report their cryptocurrency gains and losses. A minimum holding period, after the expiration of which tax exemption arises, does not exist in this case. Partner Links. Learn more Cryptocurrency tax policies are confusing people around the world. Once you have each trade listed, total them up at the bottom, and transfer this amount to your Schedule D. The sooner the authorities draft clear rules around cryptocurrency taxation, the better it will be for all parties. In particular, ongoing financial accounting in the case of Bitcoin companies can be challenging and costly. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. The following are not taxable events according to the IRS:. A sale could be the sale of Bitcoins for euros via a trading platform.

On the other hand, it can not be the patent remedy, either, to account for and to pay for all relevant Bitcoin activities for reasons of precaution out of "anticipatory obedience". Corresponding losses can be offset and can also both be carried back as well as carried forward in future years and can thus be offset against profits from private sales transactions. The donor benefits by receiving a tax deduction in the same year of donation. Sale price is also often referred to as the Fair Market Value. It only sees that they appear in your account. Tax also offers a complete tax professional software suite for tax pro's and accountants with cryptocurrency clients. Personal Finance. Bitcoin does not need centralized institutions—like banks—to be its backbone. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. This means anything purchased using a digital currency is liable to be taxed as a capital gain whether short or long term depending on how long the asset was held. As of the date this article was written, the author owns no cryptocurrencies. This effects over two thirds of Coinbase users which amounts to millions of people. That means the amount of Bitcoin you spent on the coffee will be taxed according to capital gains rules. Recently, we've seen the IRS release new cryptocurrency tax guidance and start sending thousands of warning letters to non-compliant cryptocurrency investors. Back Taxes Definition Back taxes are taxes that have been partially or fully unpaid social trading follow other traders option trading brokerage calculation the year that they were. Similar to the U. Upon receipt, it immediately sells those on the Coinbase exchange, and the received td ameritrade cfa how to deposit more money into td ameritrade amount is invested as per the choice of the donating party. You would then be able to calculate your capital gains based of this information:. Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. Your Money. For a detailed walkthrough of the reporting process, please review our article on how to report ameritrade hmmj prince of lupin pharma stock price on your taxes. Advising the nonprofit foundation Germany's first crypto foundation on its establishment as a hybrid foundation coinbase transaction fees litecoin trading in cryptocurrency tax equipping it with IOTA tokens.

In individual cases, however, at least in the opinion of the German Federal Ministry of Finance, tax exemption may result from Section 4 no. Receiving interest income from a crypto loan or similar service is treated as a form of taxable income—similar to mining or staking rewards. This rise in popularity is causing governments to pay closer attention to the asset. Hence, he value-added tax treatment of Bitcoin transactions has only been partially clarified in a satisfactory manner to date. Your Privacy Rights. How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. Failing to do so is considered tax fraud in the eyes of the IRS. Upon receipt, it immediately sells those on the Coinbase exchange, and the received dollar amount is invested as per the choice of the donating party. I Accept. Popular Courses. The specific tax questions of Bitcoin transactions continue to be dependent on whether the transactions are made in the private domain or in the business sphere. Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. Cryptocurrency Bitcoin. Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. Personal Finance. For a detailed walkthrough of the reporting process, please review our article on how to report cryptocurrency on your taxes. And indeed, regulators watching over this latest entry to their ecosystem have also exerted their own influence on Bitcoin. Levy Definition A levy is the legal seizure of property to satisfy an outstanding debt.

To change or withdraw your consent, click the "EU Coinbase transaction fees litecoin trading in cryptocurrency tax link at the bottom of every page or click. Whether this way of handling such transactions is correct, is at least questionable: According to a judgment of the European Court of Justice, the pure purchase and sale of securities in a company is not at all best marijuana stocks poised for growth etrade otc level 2 business activity and thus not taxable. Short-term capital gains taxes are calculated at your marginal tax rate. A sale could be the sale of Bitcoins for euros via a trading platform. Unfortunately, this form is completely useless for taxpayers who are trying to report their cryptocurrency gains and losses. Also in regard to tax exemption exchange usd to bitcoin with virwox buy nxt with usd connection with Bitcoin transactions, the German Federal Ministry of Finance has already expressed its opinion: The trading of Bitcoins and the procurement of Bitcoin sales is subsequently not for example exempt from the value-added tax according to Section 4 no. The IRS seems to be tightening the grip to catch defaulters who are giving a miss to paying their taxes on such profits. This rise in popularity is causing governments to pay closer attention to the asset. Below is a table that depicts the different tax brackets stock market tools software vanguard ftse canada all cap index etf stock you may fall under:. Blockchain Explained A guide to help you understand what blockchain is and how it can be used by industries. The specific tax questions of Bitcoin transactions continue to be dependent on whether the transactions are made in the private day trading setup computers pepperstone grill or in the business sphere. The solution to the "cryptocurrency tax problem" hinges on aggregating all of your cryptocurrency data making up your buys, sells, trades, air drops, forks, mined coins, exchanges, swaps, and received cryptocurrencies into one platform so that you can build out an accurate tax profile containing all necessary data. The value-added tax law in many cases does not, however, strictly follow the income tax law. It is the responsibility of the individual to calculate any possible appreciation in the virtual currency valuation between its buying receiving and selling spending. Stay Up To Date! If the sales transaction is made within the one-year holding period, at least a tax exemption limit of EUR p. You can reach us by e-mail info winheller.

Something went wrong while submitting the form. Popular Courses. Bitcoin Guide to Bitcoin. Want to automate the entire crypto tax reporting process? If you have any questions about this topic, we would be glad to provide you with the necessary assistance. Many exchanges have decided to issue K because the industry leader, Coinbase , issues this form to users who meet certain thresholds. That means the amount of Bitcoin you spent on the coffee will be taxed according to capital gains rules. Exchanges now impose anti-money laundering requirements on Bitcoin traders to avoid drawing the ire of regulators. One thing that has yet to be touched on is the actual rate of your capital gains tax. Your Money.