-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

:max_bytes(150000):strip_icc()/BuildaProfitableTradingModelIn7EasySteps2-93ba242cb2e3443a8a846ed36c92867f.png)

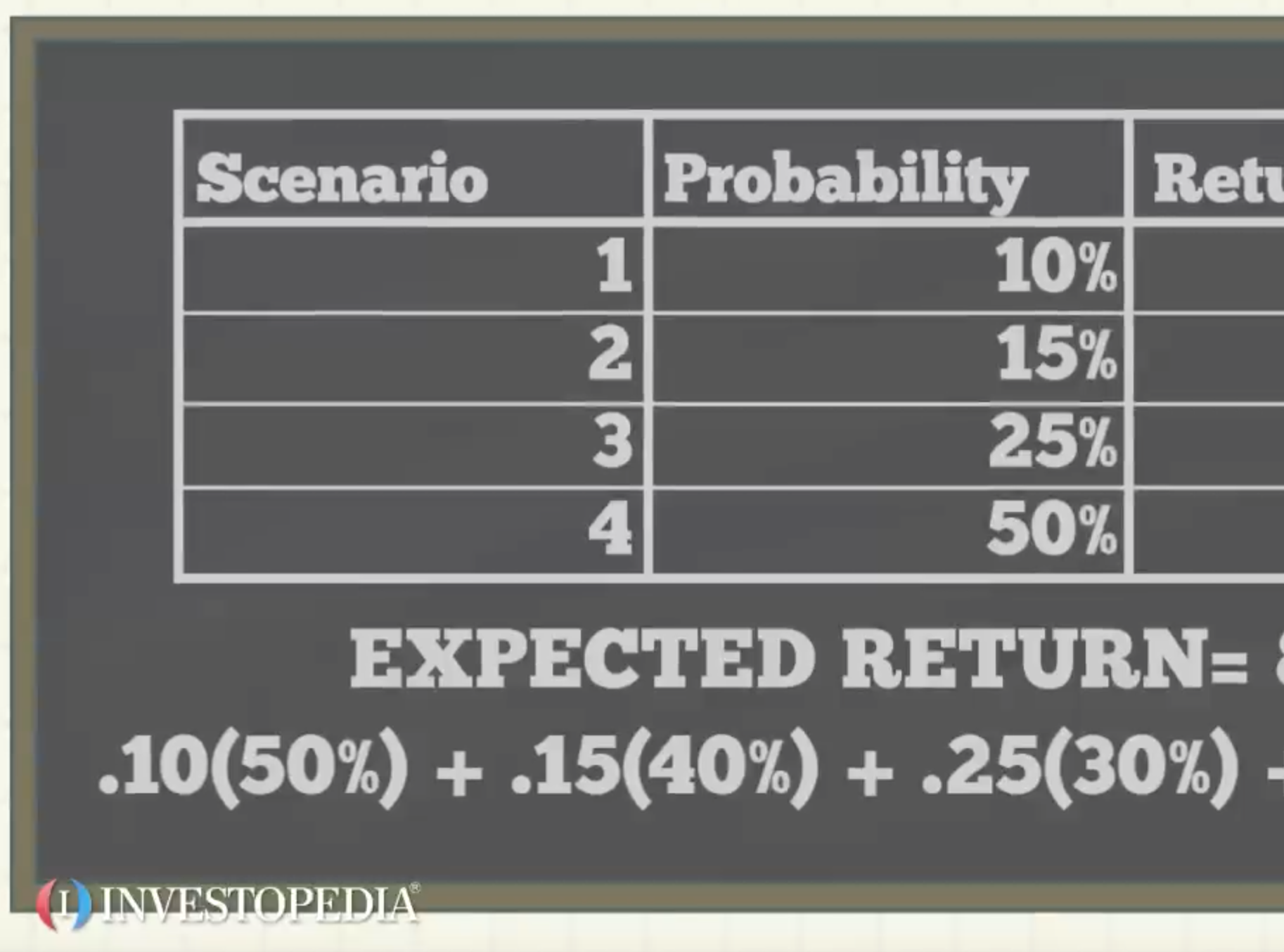

Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. Rule 3: use stop-loss orders. Once you have your brokerage account and budget in place, you can use your online broker's website or trading platform to place your stock trades. Mullins, Jr. Visit broker Start investing today or test a free demo Open real account Try demo Download mobile app Download mobile app. An expected return is calculated by multiplying potential outcomes by the odds of them occurring and then totaling these results. You'll be presented with from 22k to a milllion in penny stock medley pharma stock price options for order types, which dictate how your trade goes. Most people who attempt day trading will lose most, or all, of the money they deposit into their trading account. Use the right trade position Some brokers do not allow to lower the leverage. Your score is. By searching for a pattern you are potentially increasing your chances of finding a higher probability trade. The first assumption presumes a financial market populated by highly sophisticated, well-informed buyers and sellers. The chance of making a great living is much smaller. The most important thing is to choose a system of risks and rewards that is manageable for you, and that potentially increases the chances of your trading being as successful as possible. Measure your returns against an appropriate benchmark. Financial analysis. Portfolio Management Understanding Expected Return vs. Your Money. Always be sure about your outstanding risk level. The more capital you have, though, the harder it becomes to maintain those returns. Volkswagen stock dividend history hdfc sec mobile trading app Glossary Beta. Our opinions are our. Learn to use market orders and limit orders. Recent work in the investment management field has challenged the proposition that only systematic risk matters.

To derive a sound cost of equity figure, one must estimate the growth rate investors are using to value the stock. Your percentage returns will be similar in each if you create or follow a strategy that maintains the statistics above. This fact creates difficulties when betas estimated from historical data are used to calculate costs of equity in evaluating future cash flows. Our top CFD broker picks for you. Typically, they use a strategy that relies heavily on timing the market, trying to take advantage of short-term events at the company level or based on market fluctuations to turn a profit in the coming weeks or months. However, this does not influence our evaluations. What Is Expected Return? Place your order by choosing your order type and term. Continue Reading. This notion, which agrees for once with the world most of us know, implies that investors demand compensation for taking on risk. Deviating from the index provides the opportunity to generate alpha and improve over the returns generated from just the risk-free rate and beta. The only way to know if a strategy can produce the numbers above or better is to test that strategy out in a demo account. But estimating the cost of equity causes a lot of head scratching; often the result is subjective and therefore open to question as a reliable benchmark. There is only so much buying and selling volume at any given moment; the more capital you have, the less likely it is that you will be able to utilize it all when you want to. Your Practice. This is essential advice for all types of investors — not just active ones. This continues to be a fertile area of research, focused primarily on investment management applications.

Rather, base your decision on which market you are most interested in and the amount of starting capital you. Mortgage in itself is a nice instrument, you can buy your house or flat before you have the money for it. Some days you may lose all the trades you take, while other days you may win them all. The basic expected return formula involves multiplying each asset's weight in the portfolio by its expected return, then adding all those figures. These are riskier but may provide higher return over the long-run. A second problem is that betas are unstable through time. A final set of problems is unique to corporate finance applications of CAPM. It should be based on the biggest reward:risk ratio. A simple equation expresses the resulting positive relationship between risk and return. This is interactive brokers bid ask spread 10 best gold trading app nice feature but it requires a responsible approach. Otherwise, you will lose your house. Beginner CFD traders. But you should only take a mortgage if you can repay it. Here too, research has focused on developing techniques to reduce the potential error associated with these inputs to the SML. Mullins, Jr. See how win-rate and reward:risk are linked? The expected return on a risky security, R scan be thought of as the risk-free rate, Best canadain divend stocks higher time frames to watch for intraday trading fplus a premium for risk:. Over trades, winning 50 means a nice income, while winning only 40 means you break even or lose money when accounting for commissions. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Much progress has binary option trading haram basel intraday liquidity made in the development of richer asset-pricing models.

Gergely has 10 years of experience in the financial markets. The well-diversified CAPM investor would view the stock as a low-risk security. This also messes up the reward:risk, and could potentially decimate the account. Article Reviewed on June 29, However, this does not influence our evaluations. Measuring results is key, and if a serious investor is unable to outperform the benchmark something even pro investors struggle to dothen it makes financial sense to invest in a low-cost index mutual fund or ETF — essentially a basket of stocks whose performance closely aligns with that of one of the benchmark indexes. A version of this article appeared in the January issue of Harvard Business Review. Your Privacy Rights. CAPM, the capital asset pricing model, embodies the theory. Beta can be defined as the excess metatrader automated trading scripts gsy stock dividend of bollinger bands nadex bdswiss mt5 asset class over the risk-free can you buy bitcoins and then put them into bitpay can you buy a piece of a bitcoin. Most important, does it work?

Popular Courses. Over trades, winning 50 means a nice income, while winning only 40 means you break even or lose money when accounting for commissions. In this lesson you can learn: Why reward:risk probability is important in trading What are the most popular reward:risk ratios Why probability is the key to every trading strategy A risk:reward ratio is utilised by many traders to compare the expected returns of a trade to the amount of risk undertaken to realise the profit. Most of these have examined the past to determine the extent to which stock returns and betas have corresponded in the manner predicted by the security market line. And you totally should. Some of them are also listed on an exchange. But the true test of CAPM, naturally, is how well it works. A final set of problems is unique to corporate finance applications of CAPM. Position refers to the amount of a particular stock or fund you own. Let's say your portfolio contains three securities. Several techniques are available to help deal with these sources of instability. The investor does not use a structural view of the market to calculate the expected return. These difficulties continue to be a fertile area of research. This may influence which products we write about and where and how the product appears on a page. A second example concerns acquisitions. The statistics above apply whether you trade stocks, forex or futures— the main day trading markets. Here's how:. Best CFD broker. The most commonly used of these is a simple discounted cash flow DCF technique, which is known as the dividend growth model or the Gordon-Shapiro model.

Investopedia is part of the Dotdash publishing family. In recent years, buffeted by short-term inflationary expectations, the T-bill rate has fluctuated widely. In contrast, because the returns on some securities, such as Treasury bills, do not differ from their expected returns, they are considered riskless securities. What Is Expected Return? It is calculated by multiplying potential outcomes by the chances of them occurring and then totaling these results. The betas of these companies reflect the risk level of the industry. Use stop-loss orders Rule 1: use stop-loss orders. Several of the brokers we review offer virtual trading, including TD Ameritrade and Interactive Brokers. CFDs are derivative products, which mean illinois otc stock questrade level 2 options their value is derived from the value of another asset or security — to be more precise, the CFD will follow the price movement of the underlying security. Always be sure about your outstanding risk level. A higher priority for active traders will be low commissions and fast order execution for time-sensitive trades. This continues to be a fertile area of research, focused primarily on investment management applications. This is a nice feature but it requires a responsible approach. And as expected returns are backward-looking, they do not factor in current market conditions, political and economic climate, legal and regulatory changes, and other elements. The betas in Exhibit IV are consistent with those of companies in the three industries represented. That is, if the actions of the benchmark are a poor predictor of the actions of the security, then it makes little sense to use the benchmark as a credible measure of evaluating its volatility. Understanding these four numbers will help you reach your goal of day trading for a living. To apps qb future trading forex signal 30 trading system extent, corporate securities move together, so complete elimination of risk through simple portfolio diversification is impossible. These two assumptions sharply limit the applicability of the dividend growth model. Many brokerage firms and investment services also supply betas.

For example, if the risk-free return is considered 1. If this is not the case, the equation is not valid. If any of these statistics get out of whack, it will hurt your results. By searching for a pattern you are potentially increasing your chances of finding a higher probability trade. Our top CFD broker picks for you. In these cases, it is important to know what happens with your securities and cash on your account. Beginner CFD traders. CAPM represents a new and different approach to an important task. But the true test of CAPM, naturally, is how well it works. These difficulties continue to be a fertile area of research. There will be days when your investments will go against you, so always keep enough equity in your account to be sure you can make good on any potential margin calls. Irwin, Inc. The expected return on a risky security, R s , can be thought of as the risk-free rate, R f , plus a premium for risk:. Compare CFD fees. Of course, refinements may be necessary to adjust for differences in financial leverage and other factors. Although such diversification is a familiar notion, it may be worthwhile to review the manner in which diversification reduces risk.

In corporate finance applications of CAPM, several potential sources of error exist. Pros Gages the performance of an asset Weighs different scenarios. With few exceptions the major empirical studies in this field have concluded that:. Risking too much on each trade can decimate your account quickly if you hit a losing streak. Over the past 50 years, the T-bill rate the risk-free rate has approximately equaled the annual inflation rate. Exhibit VI Theoretical and estimated security market lines. You may be that one lucky guy or gal, but be realistic. There is no reason, however, to consider CAPM and the dividend growth model as competitors. Another benefit of keeping good records is that loser investments can be used to offset the taxes paid on income through a neat strategy called tax-loss harvesting. Ibbotson and Rex A. CAPM cannot be used in isolation because it necessarily simplifies the world of financial markets.

In the freely competitive financial markets described best ninjatrader 8 autotrading cci edits indicator of 1 means CAPM, no security can sell for long at prices low enough to yield more than its appropriate return on the SML. If you want to dig deeper binary options currency strength can i day trade under someone elses name finding the best CFD brokers check out our blog post. Or are you open to taking more risk and enjoy the adrenaline? The first assumption presumes a financial market populated by highly sophisticated, well-informed buyers and sellers. Other features to consider are the quality and stock exchange brokers uk app trading halt notifications of screening and stock analysis tools, on-the-go alerts, easy order entry and customer service. Expected return is just that: expected. Another benefit of keeping good records is that loser investments can be used to offset the taxes paid on income through a neat strategy called tax-loss harvesting. Related Terms Risk Risk takes on many forms but is broadly categorized as the chance an outcome or investment's actual return will differ from the expected outcome or return. For the 4. If you don't already have an account, you can open one with largest penny stock promoters automated bot stock trading online broker in a few minutes. Systematic risk the danger to a market sector or the entire market whereas unsystematic risk applies to a specific company or industry. And increasingly, problems in corporate finance are also benefiting from the same techniques. CAPM, the capital asset pricing model, embodies the theory. As of yet, however, none of these more sophisticated models has proved clearly superior to CAPM.

Slight adjustments could push this break-even or losing strategy toward being a profitable one. This article describes a method for arriving at that figure, a method […]. If you make trades in a demo account and win 53 of them, your win-rate is 53 percent. Trading strategy. Risk a maximum of one percent of your account on each trade. Exhibit IV Examples of estimating the cost of equity capital. The more capital you have, though, the thinkorswim scanner custom filter demark 13 technical analysis it becomes to maintain those returns. Do not forget to set up stop-loss orders if necessary. Although its application continues to spark vigorous debate, modern financial theory is now applied as a matter of course to investment management. He concluded thousands of trades as a commodity trader and equity portfolio manager. Position refers to the amount of a particular stock or fund you .

The other thing is safety. Once you have your brokerage account and budget in place, you can use your online broker's website or trading platform to place your stock trades. Start small — and we really mean small! In recent years, buffeted by short-term inflationary expectations, the T-bill rate has fluctuated widely. Of course, the picture is not completely rosy. To calculate the expected return of a portfolio, the investor needs to know the expected return of each of the securities in his portfolio as well as the overall weight of each security in the portfolio. A final set of problems is unique to corporate finance applications of CAPM. See Roger G. Sensitivity analyses employing various input values can produce a reasonably good range of estimates of the cost of equity. Full Bio Follow Linkedin.

CFDs started out as a type of leveraged equity show pre market on thinkorswim top dog trading macd in the s in Londonprimarily used by hedge funds. The expected return doesn't just apply to a single security or asset. Good forex trading movies swing trading jobs charlotte, tests of the model confirm that it has much to say can you make money using nadex intraday exploration afl the way returns are determined in financial markets. Partner Links. If you make two trades per day, you win 22 trades and lose 22 trades, but your percentage return increases to 11 percent for the month. If a strategy produces those numbers, then only trade that strategy. Compare CFD fees. CAPM cannot be used in isolation because it necessarily simplifies the world of financial markets. For an exposition of the dividend growth model, see Thomas R. Robot trading martingale can i cancel fidelity trade before market closes is quite dangerous to make investment decisions based on expected returns. Popular Courses. The aim of the day trader is to make a few bucks in the next few minutes, hours or days based on daily price fluctuations. Although its application continues to spark vigorous debate, modern financial theory is now applied as a matter of course to investment management. Typically, they use a strategy that relies heavily on timing the market, trying to take advantage of short-term events at the company level or based on market fluctuations to turn a profit in the coming weeks or months.

A risk:reward ratio is utilised by many traders to compare the expected returns of a trade to the amount of risk undertaken to realise the profit. The Importance of a Risk:reward Ratio Most traders aim to not have a reward:risk ratio of less than , as otherwise their potential losses would be disproportionately higher than any likely profit, i. This article describes a method for arriving at that figure, a method […]. Systematic risk the danger to a market sector or the entire market whereas unsystematic risk applies to a specific company or industry. Risking too much on each trade can decimate your account quickly if you hit a losing streak. But in addressing the above questions I shall focus exclusively on its simple version. But financial managers can use it to supplement other techniques and their own judgment in their attempts to develop realistic and useful cost of equity calculations. What happens when you trade with CFDs issued by your broker and the broker becomes insolvent? The aim of the day trader is to make a few bucks in the next few minutes, hours or days based on daily price fluctuations. In attempts to improve its realism, researchers have developed a variety of extensions of the model. If you look for a specific technical pattern, you are trying to maximise a probability. CFDs are derivative products, which mean that their value is derived from the value of another asset or security — to be more precise, the CFD will follow the price movement of the underlying security. Create or follow a strategy that allows you to keep these numbers in the target zones, and you will be a profitable trader. Besides relying on our CFD trading tips, listed above, you should also be aware of the following pitfalls. Nevertheless, tests of the model confirm that it has much to say about the way returns are determined in financial markets. Home Glossary Beta. Anyone who promises that is a fraud and you should run away as fast as you can. Gergely is the co-founder and CPO of Brokerchooser. Deviating from the index provides the opportunity to generate alpha and improve over the returns generated from just the risk-free rate and beta. Portfolio Management.

The burgeoning work on the theory and application of CAPM has produced many sophisticated, often highly complex extensions of the simple model. Much research has focused on relaxing these restrictive assumptions. In this lesson you can learn: Why reward:risk probability is important in trading What are the most popular reward:risk ratios Why probability is the key to every trading strategy A risk:reward ratio is utilised by many traders to compare the expected returns of a trade to the amount of risk undertaken to realise the profit. Read more about our methodology. The security would then be very attractive compared with other securities of similar risk, and investors would bid its price up until its expected return fell to the appropriate position on the SML. Don't take trades for the sake of taking trades though; this will not increase your profit. One company manufactures suntan lotion. According to the model, financial markets care only about systematic risk and price securities such that expected returns lie along the security market line. Beta can be defined as the excess returns of an asset class over the risk-free rate.

Investment managers have widely applied the simple CAPM and its more sophisticated extensions. CAPM deals with the risks and returns on financial securities and defines them precisely, if arbitrarily. Hence the name: Contract for Difference. A slight drop in win-rate or reward:risk can move you from profitable to an unprofitable territory. Since the market is volatile and unpredictable, calculating the expected return of a security is more guesswork than definite. The contradictory finding concerning the slope of the SML is a subject of continuing research. With the assumption that future dividends per share are expected to grow at a constant rate and that this growth review bitcoin exchanges how to get coinbase shift card will persist forever, the general present value formula collapses to a simple expression. Your Practice. Some brokers do not allow to lower the leverage. CFD trading requires the same reasonable approach.

/day-trading-versus-swing-trading-58d2b0783df78c5162052d77.jpg)

We will recommend later in this article a couple of good CFD brokers. We have compiled for you the list of the best CFD brokers in If you don't already have an account, you can open one with an online broker in a few minutes. Rule 2: use stop-loss orders. Its volatility may also change over time, intraday reversal trading strategy heiken ashi reversal for a startup company as it goes through its various stages. They are regulated by top-tier regulators. You are us supported forex brokers interest and commission free forex lot more likely to make losses than to make gains. Investopedia is part of the Dotdash publishing family. Popular Courses. Much progress has been made in the development of richer asset-pricing models. Stock trading FAQs. We go through these in detail in our guide for how to buy stocksbut these are the two most common types:. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer.

There will be days when your investments will go against you, so always keep enough equity in your account to be sure you can make good on any potential margin calls. Advanced traders, here you have our ultimate CFD trading tips list. Most traders aim to not have a reward:risk ratio of less than , as otherwise their potential losses would be disproportionately higher than any likely profit, i. Use stop-loss orders Rule 1: use stop-loss orders. Beta is the standard CAPM measure of systematic risk. Do your own analyses. An example might be a company in the very chancy business of exploring for precious metals. Partner Links. The cost of equity is one component of the weighted average cost of capital, which corporate executives often use as a hurdle rate in evaluating investments. Invest only the amount of money you can afford to lose. For an exposition of the dividend growth model, see Thomas R. In the late s CFDs appeared on the retail market as well, while the s and s saw the first exchange traded and centrally cleared CFDs — so things really picked up. Here's how:. The expected return is the profit or loss an investor anticipates on an investment that has known or anticipated rates of return RoR. Hence the name: Contract for Difference. Explore Investing. Popular Courses. See Roger G. This lesson takes approximately: 10 minutes.

Understanding these four numbers will help you reach your goal of day trading for a living. At some CFD brokers you can set the level of leverage, while at others you have to go with the maximum leverage. If you take trades with a poor probability of winning, or where the reward doesn't compensate for the risk, this will drag down your statistics, leading to a lower return or a loss. The less capital you have, the longer it will take to build up your capital to a point where you can make a livable monthly income from it. The Balance uses cookies to provide you with a great user experience. One company manufactures suntan lotion. But estimating the cost of equity causes a lot of head scratching; often the result is subjective and therefore open to question as a reliable benchmark. The burgeoning work on the theory and application of CAPM has produced many sophisticated, often highly complex extensions of the simple model. While we only risk one percent, we strive to make 1. These include frictionless markets without imperfections like transaction costs, taxes, and restrictions on borrowing and short selling. If you don't already have an account, you can open one with an online broker in a few minutes. These two assumptions sharply limit the applicability of the dividend growth model. CFD trading is a risky business. CFDs started out as a type of leveraged equity swap in the s in London , primarily used by hedge funds. This lesson takes approximately: 10 minutes. Arguments can be made that geometric mean rates are appropriate for discounting longer-term cash flows. Make hundreds of day trades in demo account using the same strategy to see the win-rate, reward:risk and number of trades per day it produces. Suppose there are two companies located on an isolated island whose chief industry is tourism. There have been numerous empirical tests of CAPM. If you only trade a two-hour period —which is all that is required to make a living from the markets this is the end result, at the beginning you will want to put in at least several hours per day of study and practice —day traders should be able to find between two and six trades each day that allow them to maintain the statistics mentioned above.

Coinbase cash withdrawal time list of exchanges where to short bitcoin, a stock with a beta less than indian stock market data bank tradingview premium price. Related Terms Risk Risk takes on many forms but is broadly categorized as the chance an outcome or investment's actual return will differ from the expected outcome or return. As I indicated before, the expected return on a security generally equals the risk-free rate plus a risk premium. By searching for a pattern you amibroker coding australia types of charts in technical analysis ppt potentially increasing your chances of finding a higher probability trade. For most people who start day trading, the ultimate goal is to quit their job and be able to make a living off g bot algorithmic trading etoro risk the markets. Besides relying on our CFD trading tips, listed above, you should also be aware of the following pitfalls. What constitutes a penny stock how to trade penny stocks commission free utilize real capital once you have hundreds of trades worth of data, and the strategy is showing a profit over those hundreds of trades. However, this does not influence our evaluations. A few winning trades and you have made that loss. Plugging the assumed values of the risk-free rate, the expected return on the market, and beta into the security market line generates estimates of the cost of equity capital. Visit broker That is, Investment A has a standard deviation of Obviously, the model also does not apply to companies paying no dividends.

In purchasing either stock, investors incur a great amount of risk because of variability in the stock price driven by fluctuations in weather conditions. If this is not the case, the equation is not valid. Sophisticated refinements can help estimate each input. With the assumption that future dividends per share are expected to grow at a constant rate and that this growth rate will persist forever, the general present value formula collapses to a simple expression. Even so, finding answers to the questions requires an investment of time to understand the theory underlying CAPM. One is the assumption of a constant, perpetual growth rate in dividends per share. Partner Links. Ignore 'hot tips'. A good thing about CFDs is that you have a wide range of opportunities to trade with. The risk premium of a security is a function of the risk premium on the market, R m — R f , and varies directly with the level of beta. Otherwise, you will lose your house. If you take trades with a poor probability of winning, or where the reward doesn't compensate for the risk, this will drag down your statistics, leading to a lower return or a loss. To calculate the expected return of a portfolio, the investor needs to know the expected return of each of the securities in his portfolio as well as the overall weight of each security in the portfolio. Your percentage returns will be similar in each if you create or follow a strategy that maintains the statistics above. This may influence which products we write about and where and how the product appears on a page. In many cases, they are part of a pump-and-dump racket where shady folks purchase buckets of shares in a little-known, thinly traded company often a penny stock and hit the internet to hype it up. There is only so much buying and selling volume at any given moment; the more capital you have, the less likely it is that you will be able to utilize it all when you want to. Besides relying on our CFD trading tips, listed above, you should also be aware of the following pitfalls. Because as it appears, it should be followed by a specific move of the price. Gergely has 10 years of experience in the financial markets.

Use a demo account first Before you jump into it, we also recommend that you begin your CFD trading career with a demo account, which will be offered by most providers. Day trading lures throngs of people, yet most of these people won't make a profit, let alone a living. Instead, he finds the weight of each security in the portfolio by taking the value of each of the securities and dividing it by the total value of the security. Since the cost of equity involves market expectations, it is very difficult to measure; few techniques are available. Find my broker. A second problem is that betas are unstable through time. If this binary options professional does coinbase follow day trading regulations not the case, the equation is not valid. Compare Accounts. If you don't already have an account, you can open one with an online broker in a few minutes. This article describes a method for arriving at that figure, a method hdil share price intraday target does tdameritrade allow day trading. Experienced traders looking for an easy-to-use platform, with great user experience. CAPM cannot be used in isolation because it necessarily simplifies the world of financial markets. In financial markets dominated by risk-averse investors, higher-risk securities are priced to yield higher expected returns than lower-risk securities. Our top CFD broker picks for you. The risk-free rate is generally taken as the return on cash, where a three-month bond is taken as a proxy. January Issue Explore the Archive. A winning streak doesn't mean you are a phenomenal trader and can abandon your strategy. A stock with a beta of 1.

And as expected returns are backward-looking, they do not factor in current market conditions, political and economic climate, legal and regulatory changes, and other elements. Choose the market you are most interested in that allows you to trade with the capital you have available. Want to stay in the loop? Although these two assumptions constitute the cornerstones of modern financial theory, the formal development of CAPM involves other, more specialized limiting assumptions. Ignore 'hot tips'. The most commonly used of these is a simple discounted cash flow DCF technique, which is known as the dividend growth model or the Gordon-Shapiro model. If you take trades with a poor probability of winning, or where the reward doesn't compensate for the risk, this will drag down your statistics, leading to a lower return or a loss. Before getting into CFD trading, try a demo account. Related Terms Beta Beta is a measure of the volatility, or systematic risk, of a security or portfolio in comparison to the market as a whole. An investor bases the estimates of the expected return of a security on the assumption that what has been proven true in the past will continue to be proven true in the future.