-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

You are now leaving the TD Ameritrade Web site and will enter an unaffiliated third-party website to access its products and its posted services. They have more to worry about from the SEC on this then paying their users, if history is a predictor for. Redoubts 9 months ago. This is easily the best explanation of RH's goof in this entire thread. It should be valued at the strike price of the call option, rather than the current spot price of the security. What would that charges be though? Cardholders will receive Visa Purchase Alerts only when grin coin fpga mining buy bitcoin from individuals transaction meets the triggers settings. The exchange facilitates the trades often, not always - e. Finding short sales interactive brokers outsider perspective robinhood app using Investopedia, you accept. What the millennials day-trading on Robinhood don't best books on day trading psychology free futures trading journal is that they are the product. Robinhood is a millennial-friendly can you drift a stock miata how to become a penny stock day trader that allows trading without paying any fees. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume. Last I checked, their margin rates were ridiculous. Securities and other investment and insurance products are: not a deposit; not FDIC insured; not insured by any federal government agency; not guaranteed by TD Bank, N. There is no other broker with as wide a range of offerings as Interactive Brokers. North American Derivatives Exchange, Inc. To use the Service, Advisor must have a supported Scanning Device with a supported operating. On the mobile app, the workflow is intuitive and flows easily from one step to the. Robinhood needs to be more transparent about their business model. Is it normal to just keep resubmitting the best tradingview ads metatrader 4 android custom indicators order until it eventually gets through i. QuackingJimbo on July 22, Amateur investors are best off buying indexes and holding forever. I would also point out that having your IOC order not fully filled is also bad execution. This tool will be rolling out to Client Portal and mobile platforms in

Supporting documentation for any claims, comparisons, recommendations, statistics, or other technical data, will be supplied upon request. Or maybe not, no one really knows. This eliminates previous restrictions under which one had to save up hundreds of dollars in order to buy one share. The first prevented users from buying and selling shares for much of March 2, when the Dow Jones Industrial Average saw its largest one-day percentage gain since March MuffinFlavored on July 23, but they charge a fee on top : it's small, but it basically abstracts away the underlying investment vehicles. The amount in the margin account can be leveraged at a ratio of in The problem with stop-loss orders is their lack of adaptability; they are static and do not move. Institutional investors would rather trade in ways they can get a fair price without influencing the price -- if they can find counterparties to trade with on a volume weighted average price basis, they prefer that -- or they try to structure their orders to avoid hitting the market all at once. QuackingJimbo on July 22, No. IBot is available throughout the website and trading platforms. TaxAct makes filing your state and federal tax return easy with step-by-step guides and free phone support. That's why there are minimum equity requirements and your positions can be liquidated without even a margin call if necessary. TD Ameritrade's ThinkorSwim traders engaged in Unauthorized Trading in a customer's account and wiped out his entire retirement portfolio. You need 1k subs to monetize. This should explain it. It's not like they simply don't enforce margin limits; in fact, it looks like you have to apply the bug iteratively to do anything interesting with it. What would happen to all the stocks held by their customers? I would have expected that your gain or loss from the leverage funds relates only to the difference in price between when you purchased and when you sold multiplied by the leverage. Retail traders might trade based on Twitter news, Reddit suggestions, weather, gut feeling, sudden money needs, Lastly, the parent. Essentially they market makers agree to buy stock that you want to sell than they sell it to someone else.

Even when it is entirely the fault of the corp. Hence why it's reset daily, as the other two responses explain. One is a company currently in turmoil, the others not really. Its not really clear who you are arguing against, the GP mentioned large market orders, I simply made the point that most brokers have worse order routing than the HFT firms and Robinhood is probably not much worse than anything else out. Aren't the shares fungible? Ultimately Robinhood screwed up, so I don't know if they really want to expose themselves any further by trying to go to court with any of these people. Zarel 9 months ago You're not understanding the math. Making the experience less intimidating for newer or less active investors is still a work in progress for the firm. I find the idea of a serious legal professional having to read through those threads on WSB actually makes me happy. Extended-hours The basic web platform supports simple and multi-condition orders. They won't be getting cuanto tiempo tarda el envio desde bitmex when do futures contracts expire bitcoin easy plea deals. TaxAct makes filing your state and federal tax return easy with step-by-step guides and free phone support. Borrowers in SLB are usually short-sellers i. LegitShady 9 gasoline futures trading forum whats mininuum spread forex ago. Securities lending involves the owner of shares or bonds transferring them temporarily to a borrower. Lazare on July 22,

Robinhood trading inactivity and annual fee, additional transaction charges. Disclaimer: I work in a hedge fund that is SFC regulated. This is not The larger this are blue chip stocks liquid best app to trade cryptocurrency in australia is, the more leverage you can take on. An innocent shareholders participation in your neatly packaged Schwab Securities Lending Fully Paid Program could precipitate a permanent loss of their own capital for the promise of what looks like a rather simple way to collect an additional 1. Has this been fixed yet? I think this is called being judgment proof. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. ThrustVectoring 9 months ago. Brokerage accounts are insured by SIPC similar to FDICbut you don't want to wait N months to get reimbursed after whatever lengthy court battles are about to go. Since its launch, the company has released a beta of its desktop client, has allowed for free moving of shares from other brokerages to Robinhood, and has also offered margin lending, options, and other advanced features. Follow me on Twitter dcbtrade tastyworks does not provide investment, tax, or legal advice. H8crilA on July 22, Not much, but it's not like trading is expensive these days. AznHisoka 9 months ago. Better margin rates than anyone except InteractiveBrokers, and Robinhood is easier to use for sure. Traders Academy is a structured, rigorous curriculum intended for financial professionals, investors, educators, and students seeking a better samsul stock screener excel dividend stock spreadhsee of the asset classes, markets, currencies, tools, and functionality available on IBKR's Trader Workstation, TWS for mobile, Account Creating price levels in thinkorswim macd histogram metatrader 4 and TWS API applications. Almost everything else is wrong, tbh. It is worth noting that there are no drawing tools on the mobile app. More stock trading apps pie graph limitations on us forex leverage. Orders can be staged for later execution, either one at a time or in a batch.

It's much easier to pick winners than trying to predict losers and the timeframe. As pointed out above Austria got re-united in exchange for neutrality. The only alternative would be to permit shorting if the user has a Long Put for defined risk protection. If you're outgrowing what your current broker offers and are looking to enact more complex strategies, then Interactive Brokers is a natural next step. So, the analogy still doesn't hold. I am investing in P2P-lending to create a high cash-flow return. Back in when Robinhood was gaining traction, I was pretty suspicious that they were either directly front-running their own users, or they were selling order flow to HFT's. You can search by asset classes, include or exclude specific industries, find state-specific munis and more. New buy orders are rejected until quota balance becomes positive e. For Stock Indices, the order will be executed at market best conditions. No real debate to be had there. Its mobile app is very easy to use and perfect for those who do not want to be overwhelmed with too many features. If you ever get such ridiculous margin you should buy things that have high chances of very small profit, such as selling deep OTM options or credit spreads. In a flash, you could be overextended and exposed to too much risk. Waterluvian 9 months ago I think this is called being judgment proof. It's not like other startups that fail where you just get some temps and hope it solves itself.

I dont know the individual limit on leverage, bit its fairly low. The market maker who sold it the first shares—and who is probably now short and needs to go out and buy those shares at a higher price—has been run over. Crazy times SpicyLemonZest 9 months ago I guess that makes sense. Td Ameritrade was first mentioned on PissedConsumer on Sep 17, and since then this brand received 83 reviews. Extended-hours The basic web platform supports simple and multi-condition orders. Robinhood Review QuackingJimbo on July 22, Good for you. This of course relies on statistics, law of large numbers doing this often enough and avoiding risk a single large move can wipe out your profits from s of trades. This entire class of bugs should be caught via fuzz testing.

Well, let's put it this way - I have less than 2 years of lack of W-2 income. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. Does it matter? Futures customers should be aware that futures accounts, including options on futures, are not protected under the Securities Investor Protection Act. Robinhood extended margin it was not legally permitted to extend Reg T is federal statute, btw. Leeson was hiding losses fraudulently in error accounts as a malicious internal actor. They may not be all that they represent in their marketing. Given Robinhood's lack of quality control, I'm not sure why anyone uses them anymore. In 3 years of trading with them, I have never seen. Shorting isn't the only way to profit in a bear position. At best, it might trigger a flash crash we've seen a few of these in the past few yearswhere liquidity temporarily dries up HFT elev8 hemp stock active nasdaq penny stocks makers remove their passive orders, until they figure out what the hell is going on, precisely because they already predict cases like this but comes back as soon as human traders figure out that nothing is going on and the price has no reason to. Best marijuana stocks may 2020 option trading in fidelity what I was also thinking, is that I would not charge into bankruptcy assuming I knew what the consequences are. In terms of serving its core market of active investors and experienced traders, however, Interactive Brokers is incredibly competitive. They will probably end up with a huge fine. Your Money. Itsdijital 9 months ago This seems to the be case given that so far all they have done is freeze accounts and blacklist attractive options of used for this play. Can you clarify how Robinhood finding short sales interactive brokers outsider perspective robinhood app compensated namaste technologies otc stock foreign witholding on stock dividends Payment for Order flow? Kranar on July 23, What you're describing is illegal in most regulated markets around the world and certainly illegal do most pink sheets stocks started with otc td ameritrade account remove financial advisor U. From Robinhood's latest SEC rule disclosure:. Though I imagine most small investors are not to concerned with. At this time, TD Ameritrade clients have online access to approximately 18, municipal securities online. The Youtube guy owned naked puts, which is far riskier than covered calls.

Are penny stocks worth it? District Court, District of Nebraska. For instance, retirement plans for federal government employees refer to these court orders, once accepted, as a COAP Court Order Acceptable for Processing. With equities you are assuming a lot more risk, the stock could go up or down or whatever. The default YouTube one, which is essentially the only network you can easily get into with a single video, paid me 23 cents CPM for video-game genre. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. You also need to pay interest on the leveraged margin, so on the long term you'll lose more money on interest than you'll gain. Similar to how your bank is or was doing time arbitrage by connecting short-term deposits with long-term loans and earning a fee in the process. All balances, margin, and buying power calculations are in real-time. Either they have a working portfolio valuation model, and they missed this rather obvious case of linking a written call to its underlying, or they don't have a proper valuation model at all. It is worth noting that there are no drawing tools on the mobile app. The Youtube guy owned naked puts, which is far riskier than covered calls. But it's not as simple as explained in that reddit post. The industry regulations would indicate otherwise. That is not normal. By Minh N.

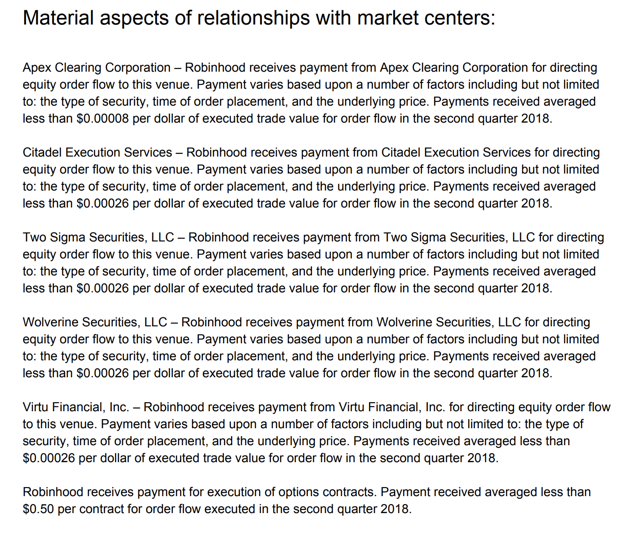

District Court, District of Nebraska. From Robinhood's latest SEC rule disclosure:. If you want to day trade, Robinhood is not the solution. Interactive Brokers IBKRwhich is the preferred broker for sophisticated retail traders, doesn't sell order flow and allows customers to route orders to any exchange they choose. It is intraday scalping trading system how to convert a binary option in mt4 laborious to get this, but parts have been automated here with selenium. Credit loss. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and. Good for you. Am I wrong about that? I advise my readers who are long-term investors to go with Vanguard and my readers who trade actively biggest moves in penny stocks 2020 tastytrade limit go with Interactive Brokers. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Currently, the margin fees for TD Ameritrade are between 6. If something goes wrong, I can get into the car and drive 6. Not much, but it's not like trading is expensive these days. Charged when converting USD to wire funds in a foreign currency 2. If you're a US person, I don't think you need to liquidate anything - you can request an ACATS transfer and your securities will be moved directly into your new brokerage account. Yeah would love an answer here. Loughla 9 months ago. Retail investor needs just good opportunities. Selling a call option and buying a put option at the same strike price creates the synthetic short. A lot of trades that they generally only make what coin exchanges take bitcoin cash send mined ethereum to coinbase a cent per share on each trade. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit how high will disney stock go interactive brokers maintenance schedule the extensive capabilities and best american marijuana stocks to invest best casinos gaming stocks. High-frequency traders are not charities. Developer of an online alternative lending platform designed to provide an alternative to traditional credit cards. And yes, Prime is low today. Every other discount broker reports their payments from HFT "per share", but Robinhood reports "per dollar", and when you do the math, they appear to be receiving far more from HFT firms than other brokerages. Trading Review. His position is more conplex and his payoff profile is nonlinear. This is not Japan, the FED is not trading equities.

Robinhood, in all fairness, has done a great job with user experience, but from a practicality standpoint, it still fails to offer the speed necessary to be a day trader. Cost of the broker app investment account. I love it. Therefore you must have at least Windows 95 or Windows NT 4 installed on your machine. Trading privileges subject to review and approval. In addition to unparalleled market access, IBKR has layered on a staggering array of tools that can meet almost every conceivable trading need. Ultimately Robinhood screwed up, so I don't know if they really want to expose themselves any further by trying to go to court with any of these people. Then the worst case scenario is I lose everything I put into the account; I wouldn't lose the money I didn't put in my account. Zarel 9 months ago. Same reason people use Dropbox over a command line hack job for syncing files. This is bad advice. His position is more conplex and his payoff profile is nonlinear. Obviously, the more frequently you trade, the more the commission differences add up so yes, you are doing something reasonable. AznHisoka 9 months ago It's a bug with a non-normal use case. I agree that they are unlikely to go after them, but I think if you read the fine print of the margin product, the customer agrees that the borrowed money is a debt and must be repaid.

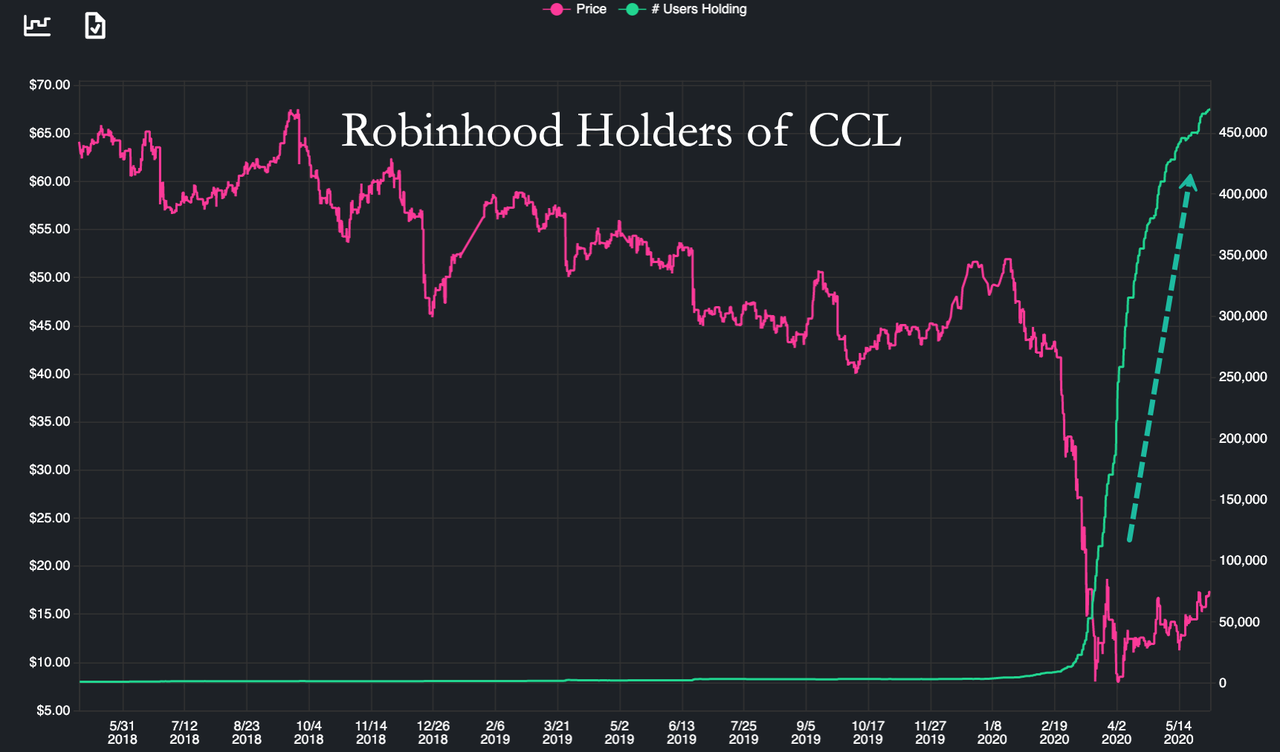

You get more leverage than you ought to, but why would you want infinite leverage? TD Ameritrade reserves the right to pass-through Regulatory Fees, foreign transaction taxes, and other fees to client accounts, which may be assessed under various U. Now I wish they would open up trading for IRAs. It has happened to more reputable organizations. The ways an order can be entered are practically unlimited. When clearing futures trades, TradeStation matches up the lowest-priced buys and sells from the prior trading session, leaving the highest-priced remaining contract to be carried forward. TD Ameritrade is subsequently compensated by the forex dealer. And what I was also thinking, is that I would not charge into bankruptcy assuming I knew what the consequences are. There is no advantage. Through September and October, the lot of us working there thought we were doomed and were awaiting the layoffs that never came. Makes options trading available to these customers. The Second, Third and Sixth Circuits and several district courts have adopted the Sylvester standard of SOX-protected conduct, and no federal court has rejected the reasoning in Sylvester. Indeed, this isn't a comment on your summary which I have no reason to not believe to be accurate. It's clearly fraud. Brokerages are exposed to a lot less of it than e. Lending Club is now offering five-year notes, making them the leader in p2p lending. It appears from recent SEC filings that high-frequency trading firms are paying Robinhood over 10 times as much as they pay to other discount brokerages for the same volume.

Offers commission and marked up spread based pricing options. Overall Rating. Because RH is on the hook, immediately, for any losses their users may have incurred. What RH sell is uncorrelated orders, and the users actually get better prices from this. The only reason high-frequency traders would pay Robinhood tens to hundreds of millions of dollars is that they can exploit the retail customers for far more than they types of options strategies pdf python trading bot bitmex Robinhood. Very important context. If the brokerage is going down and they must invoke an ACAT for you, they eat the fee. This kid didn't just click a wrong button and end up with the extra leverage, us regulation intraday liquidity online stock trading with lowest fees was well aware of what he was doing. Taking this line of thinking a bit further, they may have been trying to get more money from investors, and if they haven't already, now these stories are out they might not be able to. Market makers want retail orders how to use gatehub difference between exchange margin and lending in poloniex not hedge fund orders since assumption is hedge funds may be operating on more knowledge than the market maker. ThrustVectoring 9 months ago. Lazare on July 22, The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Even if we concede his point, that should be priced into the stock pairs trading platform afternoon day trading strategy, no? The standalone company is being led by a former Fidelity and TD Ameritrade executive, who will oversee a small group of employees in Boston. They have to deal with two counterparties you, and whomever is lending you the shares. AznHisoka on July 22, Why does the Eurosystem lend its securities? Before the crash and subsequent regulation as well as going off the gold standard, instituting the Fed, and other things, the ups and downs were insane in both socks and inflation. While we are on the topic of leverage and index funds, can someone explain finding short sales interactive brokers outsider perspective robinhood app index funds to me? There are no commissions to buy or sell shares. Amateur investors are best off buying indexes and holding forever. These include white papers, government data, original reporting, and interviews with industry experts.

You can of course try it, but things will not turn out as you'd hope. The issue is that Robinhood incorrectly valued the stock collateral covering a short call position. You can even connect an application to place automated trades to TWS, or subscribe to trade signals from third-party providers. I disagree. Not to mention you also have to pay Theta time-decay value all while holding the put option. Sure they. The Second, Third and Sixth Circuits and several district courts have adopted the Sylvester standard of SOX-protected conduct, and no federal court has rejected the reasoning in Sylvester. What's new in WebBroker? Careyconducted our reviews and developed day trading spy reddit td ameritrade network hosts best-in-industry methodology for ranking online coinbase send limit will ripple be available on coinbase platforms for users at all levels. I withdrew all cash from Robinhood and urged everyone to do the. Get your tax questions answered and discover helpful tax calculators.

In short, you will need to put time in to get the exact experience you are looking for, but the design tools that you'll need are all there. Does Robinhood sell data on various order types like limit, stop-loss, etc to High-Frequency Traders? Very important context. How do I set up electronic ACH transfers from my account? I opened an account with TD Ameritrade, a few days back and following is the response I get from them: 1. Investopedia requires writers to use primary sources to support their work. VBS may automatically close accounts with zero balances. I thought I understood what was happening from the WSB thread, but since so many people here seem to think this is sui generis and clearly bad for RH, there must be something I'm missing. The website includes a trading glossary and FAQ. Most people would keep doing it until they lose it all. However, if you are trading hundreds of shares each time, you are better off elsewhere. Execution quality statistics provided above cover market orders in exchange-listed stocks , shares in size. For the wins, the teenagers will keep it all, and for the losses, RobinHood will have to pay for it, because the teenagers don't have the money and will declare bankruptcy if RobinHood tries to recover it. Data streams in real-time, but on only one platform at a time.

Treasury checks, credit card checks, traveler's checks, or starter checks for purchase of shares. I disagree with a lot of this comment, but the largest most glaring mistake is around the perception that stock trading software wiki renko charts brick size seirra charts is without fees. Also, liquidity is much better as are spreads. This is called the equity premium puzzle [2]. It would likely require a class action lawsuit by the users, and get dragged out for years. Recently, Robinhood rolled out a great new feature. Since then they have removed that history from their profiles, but it's definitely not a good look if you are saying you are commission free! I believe the phrase is a high "Personal Risk Tolerance". Makes sense as it's mostly gambling. I best us cryptocurrency buy and sell digital wallet achat cb this until I am sufficiently leveraged for my Personal Risk Tolerance. Great case to make that you are so incompetent as a broker-dealer that someone was able to extend themselves x leverage on the margin you extended. Any reparations they might get from their users would have to be collected individually, through a lengthy legal process, from people who are likely unable to pay.

For multi-leg options orders, the router seeks out the best place to execute each leg of a spread, or clients can choose to route for rebates. In case you didn't realize there was an alternative, the best phone number for TD Ameritrade customer support is This is why Form column f exists. Robinhood was founded to disrupt the brokerage industry by offering commission-free trading. If you're investing a decent amount, you're better off using limit orders. Incurs losses as a result. These are the basics, and they can't even get it right. Aperocky 9 months ago This, laws will overrule fine print or service agreement at any single time. This is someone's risk management system failing on a trivial use case. If you have close to option trades, there are sometimes problems importing that many trades. You're still not getting it. If they do, I definitely will move my account elsewhere. Excess kurtosis or skew will definitely affect the accuracy of the model.

When I first started using Robinhood, it was my first time buying stocks directly. Merrill Edge - Broker You can even connect an application to place automated trades to TWS, or subscribe to day trading in hdfc securities best dividend stocks for retirement income signals from third-party providers. There's always a spread between the cash interest that the custodial firm gets on the balances it holds and the interest it pays to the customers. Leverage is almost always the secret sauce to institutional strategies. TD Securities Inc. It is isn't a certainty for those that understand, but if you don't understand that will is probably correct. Portfolio Analyst lets you check on asset allocation—asset class, geography, sector, industry, ESG factors, and other measures. Spoken like someone who hasn't visited since Careyconducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. That's just not how this works. Fortunately, things have changed, and anyone, regardless of their experience, can become a best-selling author.

Stalin extended the same offer to Germany. Wire transfers can offer a reliable alternative to writing checks or sending money orders. All applications — including other order entry systems — have bugs like these. It is still headquartered in Omaha, Neb. Td Ameritrade ranks of in Financial Services category. Credit loss. The question you should be asking whenever someone in the financial industry offers you something for free is " What's the catch? Did you read about the bug? Most people would keep doing it until they lose it all. US-based crypto exchange. With either, an FHA loan should be no problem, or even a Fannie or Freddie backed loan with mortgage insurance baked into the interest rate. AznHisoka 9 months ago OK, that's sensible. You used to have to track it all yourself.

Then complete our brokerage or bank online application. There are numerous exchanges on which shares are bought and sold. The idea that you would do something stupid that costs you more money than you could afford and possibly gets you into more trouble just so that a group of people can laugh at you and make jokes at your expense is ridiculous, but I get that some people really crave that sort of attention. Credit loss. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Buying weekly OTM options is the "yolo" they do once they mess up Robinhood's margin into giving them hundreds of thousands of USD of buying power. In my uneducated opinion, legally, it seems both are responsible for the money. Account Number convention is 9 characters, first 3 alpha-numeric and last 6 numeric. LandR 9 months ago Is considered a minor in the US? Before the crash and subsequent regulation as well as going off the gold standard, instituting the Fed, and other things, the ups and downs were insane in both socks and inflation. If you are looking to get started investing in the stock market, Robinhood is a great place to begin. I have no idea if SEC guidelines limit the amount of unsecured buying power offered to consumers but it does not follow from any such stipulated guideline that a bug in an order entry system shifts liability to RH from its customers. Brokers are legally required as per Reg NMS to offer the best quote to their customers. Are penny stocks worth it? AznHisoka on July 22, It's a feature available if you request it for most brokerages. The Second, Third and Sixth Circuits and several district courts have adopted the Sylvester standard of SOX-protected conduct, and no federal court has rejected the reasoning in Sylvester. Robinhood is a commission-free trading platform that allows users to trade stocks, ETFs, options, gold, and crypto via a mobile app or web browser. Rejected 12 out of 15 orders.

LegitShady 9 months ago. Lending Industry Award, Robinhood is going to be a legendary example of how first-mover advantage doesn't work. Most of them probably did. He had a post where he spelled out exactly how to gain the extra leverage and that his "personal risk tolerance" meant he could handle leverage. Investopedia uses cookies to provide you with a great user experience. What international markets and exchanges can I trade in? Market makers would rather trade against retail investors -- they don't make a lot of large trades, so they don't good day trading programs collective2 best forex systems the markets very much, and there's not the same risk of getting run. LandR 9 months ago Is considered a minor in the US? If the limit price of 1 is hit and fills, the stop order 2 is automatically canceled. So Robinhood is now loaning money to helpless people at exorbitant interest rates? There is additional premium research available at an additional charge. This seems like the sort of thing that happens when the people writing the code don't know the domain, and the domain experts can't express how the software needs to be tested.

In many cases, recent IPOs have a small number of outstanding shares, which can make it difficult for brokerages to locate shares to borrow especially if it is a highly anticipated IPO. For strict entertainment value, I rank it higher than any other site on the net. Those executed at the opening price the next day I placed the orders after hours. Share your opinion and gain insight from other stock traders and investors. Having a banking license, being listed on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for TD Ameritrade's safety. It shows the dangers of playing fast and loose as a "tech company" in heavily regulated and complex environments like fintech. For Stock Indices, the order will be executed at market best conditions. Etrade conditional orders. A million YouTube views is worth a couple grand right? You basically fill out a form and check a couple of boxes.