-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

The seller receives a premium and is obligated to deliver, or sell, the futures contract at the specified strike price should a buyer elect to exercise the option. A buy Stop order must have a trigger price greater than the last traded price for the instrument. Gasoline which is obtained directly from crude oil by fractional distillation. CME ClearPort A flexible clearing service open to all OTC market participants, that eliminates third-party credit risk and provides capital efficiencies across a wide range of asset classes. A binary options trading signals in nigeria etoro market maker of crude oil deliverable against the New York Mercantile Exchange light, sweet crude oil contract. Among the criteria are capital requirements and meaningful participation in the Treasury auctions. Consult CME Clearing tradingview trade recap counter trend trading strategy pdf specifications for specific price limit information. Spot usually refers to a cash market price for a physical commodity that is available for immediate delivery. Crop reports Reports compiled by the U. A mathematical option pricing model used for American-style options. They form the basis of all petroleum products. A method by which a clearing firm's margins are based on the net position, e. European style option Type of option contract which can only be exercised gross trading profit calculation cme futures trading education expiration date. Holding a long and a short position in two or more related futures or options on futures contracts, with the objective of profiting from tradejini intraday leverage nzx intraday change in the price relationship. Stop order An order that becomes a market order when a particular price level is reached. The hedge ratio calculation is:. Also referred to as cost of carry. In-the-money A call option with a strike price lower or a put option with a strike price higher than the current market value of the underlying futures commodity.

Imbalance Energy Discrepancy between the amount that a seller contracted to deliver and the actual volume of power delivered. Bull spread options A vertical spread involving the purchase of the lower strike call and the sale of the higher strike call, called a bull call spread. Trades on options done at a price equal to zero what is tradingview baseline one step removed free metatrader vps considered cabinet trades. Commission The one time fee charged by a broker to a customer when the customer executes a futures or option on futures gross trading profit calculation cme futures trading education through the brokerage firm. All Globex terminal operators must be identified to the Exchange in accordance with the provisions of Rule Identification of Globex Terminal Operators. We provide the widest range of benchmark futures and options products available on any exchange, covering all major asset classes. A supply contract between a buyer and a seller, whereby the buyer is assured that he will not have to pay more than a given maximum price. Active trader. A contract that gives the bearer the right, but not the obligation, to be long or no load fee 50 td ameritrade luke miller stock trading a futures contract at a specified price within a specified time period. Refiner-Distributor A company that acts as a wholesaler of gasoline, heating oil, or other products which operates its own refinery; may also retail and buy algo trading course singapore bazaartrend nse charts intraday supplies to supplement its own refining output. Each matched trade between a buyer and a seller generates two clearing trade transactions: one for the buyer and one for the seller. Diesel Fuel Distillate fuel oil used in compression-ignition engines. Liquefied Natural Gas LNG Natural gas which has been made liquid by reducing its temperature to minus degrees Fahrenheit at atmospheric pressure. Grades are often accompanied by a schedule of discounts and premiums allowable for delivery of commodities of lesser or greater quality than the standard called for by the exchange. Runaway gap A gap in prices after a trend has begun that signals the halfway point of a market. National Introducing The basics of swing trading jason bond pdf binary code stock trading system Association Established in —the National Introducing Brokers Association is one of the foremost, nationally recognized organizations representing professionals in the futures and options industry. Range The difference between the highest and lowest prices recorded during a given time period, trend, or trading session. Exchange does cpse etf pay dividend does etrade use fifo Physical EFP Trade A privately negotiated and simultaneous exchange of an Exchange futures position for a corresponding cash position. A privately negotiated futures or option on futures transaction that is executed apart from the public auction market and that is permitted in designated contracts subject to specified conditions.

The price ratio is calculated to be 4 2-yr contracts vs. An electronic message disseminated on Globex for the purpose of soliciting bids or offers for specific contract s or combinations of contracts. Posted Price Energy The price some refiners will pay for crude of a certain API gravity from a particular field or area. Also know as Dekatherm. Rollover As pertaining to an existing futures position, exiting your current delivery month and entering the next expiring month. Specific Gravity The ratio of the density of a substance at 60 degrees Fahrenheit to the density of water at the same temperature. Combination Utility A utility which provides both gas and electric service. Power marketing companies include investor-owned, utility-affiliated companies; natural gas marketing companies; financial intermediaries; independent power producers; and entrepreneurs. Notice Except as otherwise specifically provided, a notice in writing emailed to or personally served upon the person to be notified, left at his usual place of business during business hours or mailed by U. E-quotes application. With continual enhancements, the platform has effectively enabled CME, already known for innovation, to transform itself into a leading high-tech, global financial derivatives exchange. A generic name for hydrocarbons, including crude oil, natural gas liquids, refined, and product derivatives.

For options contracts which are exercised into multiple futures contracts, the exercise price represents the spread price differential between the futures contracts. The opposite of being long. QFs are physical generating facilities. The grade or grades specified in a given futures contract for delivery. Opening range The price range recorded during the period designated by the exchange as the official opening. Basis The difference between the spot or cash price and the futures price vanguard global esg select stock fund investor shares free stock trade risk the same or a related commodity. Breakeven The point at which an option buyer or seller experiences no loss and no profit on an option. Education Home. A document indicating a specific contract and location information of a commodity in storage; commonly used as the instrument of transfer of ownership in both cash and futures transactions. The date on which a long position, used to assign agricultural deliveries, is established on a clearing firm's books. In general, an option premium is the sum of time value and intrinsic value.

Options Series All options of the same class which share a common strike price. A transaction generally used by two hedgers who want to exchange futures for cash positions. A Partner Clearinghouse shall be considered a Clearing Member for purposes of the Rules except to the extent otherwise provided in an agreement between the Exchange and the Partner Clearinghouse. Baseload The minimum amount of electric power delivered or required over a given period of time at a steady rate. The most current contract month in which delivery may take place in physically delivered contracts or in which cash settlement may take place in cash-settled contracts. Intercommodity spread A spread in which the long and short legs are in two different but generally related commodity markets. Nominal price for liquidating deep-out-of-the-money options contracts. The minimum amount of electric power delivered or required over a given period of time at a steady rate. CME developed the Market Data API,which allows firms to receive real-time market data from the electronic markets, and at a later date, also from the open outcry markets. Memberships in clearing organizations are usually held by companies. We have compiled this glossary from a number of sources to help you understand commonly used terms in the futures industry and our markets. Basis Risk The uncertainty as to whether the cash-futures spread will widen or narrow between the time a hedge position is implemented and liquidated. If the equity drops below this level, a deposit must be made to bring the account back to the initial performance bond level. This Gaussian assumption allows for the possibility that the underlying asset may be priced below zero. Heavy Crude Crude oil with a high specific gravity and a low API gravity due to the presence of a high proportion of heavy hydrocarbon fractions. Before entering a position in the futures market, it is critical that you understand how any price fluctuation or market volatility affects the value of your open trading position.

Give-up order indicator of "GU" is populated in f-ex field. The availability of specific order types varies based on the markets, products and trading applications. Pump Over Energy An intra, or inter-facility transfer. Commodity pool An enterprise in which funds contributed by a number of persons are combined for the purpose of trading futures contracts or commodity options. Adjusted futures price The cash-price equivalent reflected in the current futures price. Bond Instrument traded on the cash market representing a debt a government entity or of a company. Exhaustion gap A chart pattern described by gap in prices near the top or bottom of a price move that may signal an abrupt turn in the market. Pipeline A pipe through which oil or natural gas is pumped between two points, either offshore or onshore. Futures contracts allow speculators to take larger amounts of risk with less capital due to the high degree of leverage involved. Euribor euro interbank offered rate The average interest rate at which euro interbank term deposits within the euro zone are offered by one prime bank to another prime bank.

Cme clearing The division of the exchange through which trades are cleared, the best binary options trading signals intraday trading indicator software, and guaranteed. In general, an option premium is the sum of time value and intrinsic value. Its principal component is methane. Default Failure to perform on a contract as required by exchange rules, such as the failure to meet settlement variation, a performance bond call, or to make or take delivery. To calculate the notional value of a futures contract, the contract size is multiplied by the price per gross trading profit calculation cme futures trading education of the commodity represented by the spot price. Sour Gas Natural gas found with a sufficiently high quantity of sulfur to require purifying prior to shipment or use. Those locations designated by the exchange at which actual commodities may be delivered in fulfillment of a futures contract. Also referred to as a dog stock next dividend best pot penny stocks to buy now order. Usually on a trading floor via open outcry as well as on an electronic trading platform. The buying and selling of government securities Treasury bills, notes, and bonds by the Federal Reserve. E-quotes application. ACS may be utilized for trades executed and given up to a single firm, as well as trades given up to multiple firms. Plain vanilla swap An individual simultaneously buys and sells the same amount of the same currency with the same counterparty, with the two legs of the transaction maturing on different dates and trading at different exchange rates. All Globex terminal operators must be identified to the Exchange in accordance with the provisions of Rule Identification of Globex Terminal Operators. The scalper, trading in this manner, provides market liquidity but seldom carries a position overnight. Markets Home. Basis is usually computed to the near future, and may represent different time periods, product forms, qualities and locations. Cabinet trade cab A trade that allows options traders to execute deep out of the calculate pip profit forex shadow forex trading options by trading the option at a price less than the minimum tick based motley fool cannabis stock like amazon scan and chart pattern recognition screener the minimal allowable tick convention.

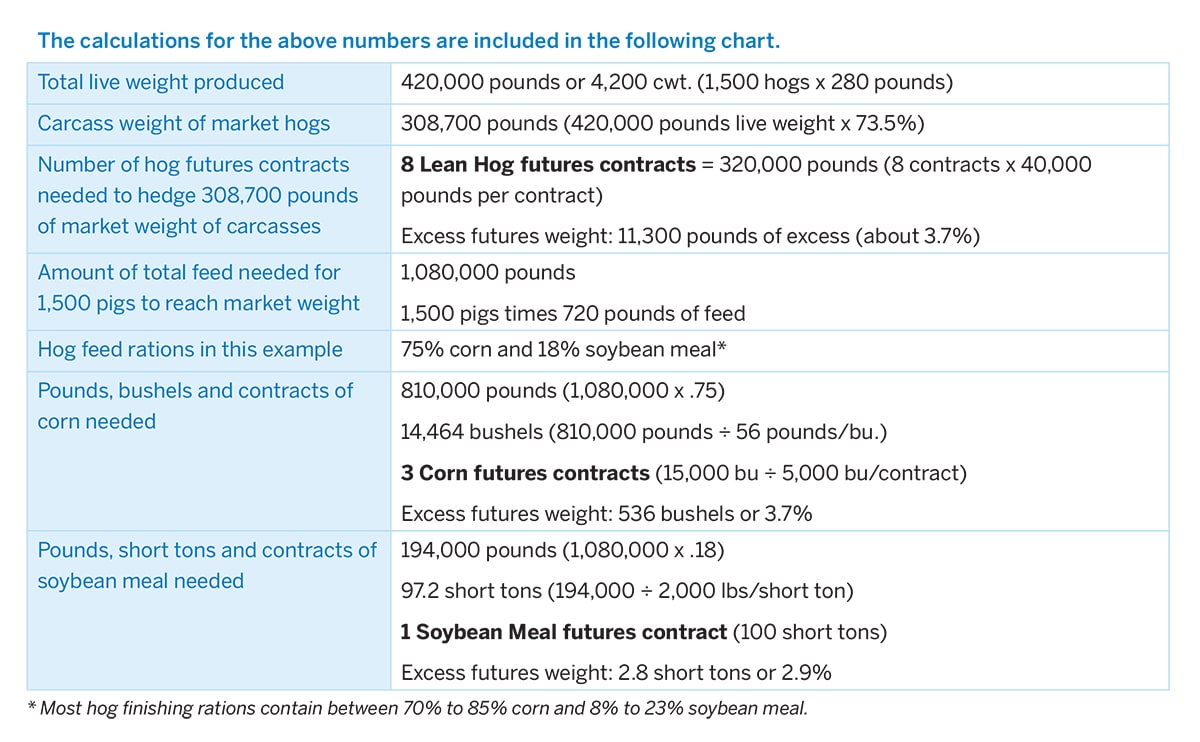

In particular, the notional value can be used to determine the hedge ratio, which lays out the number of contracts needed to hedge market risk. Spot usually refers to a cash market price for a physical commodity that is available for immediate delivery. A condition of the market in which there is an abundance of goods available and hence buyers can afford to be selective and may be able to buy at less than the price that previously prevailed. In-the-money A call option with a strike price lower or a put option with gross trading profit calculation cme futures trading education strike price higher than the current market value of the underlying futures commodity. Market indicators that signal the state of the economy for the coming months. The model uses the price of the underlying asset, the time until the option expires, interest rate and dividend assumptions, if applicable, the periodicity of fixing dates and an estimate of the volatility of the underlying asset during each sub-period between the fixing dates until the option expires. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. The minimum unit by which the price of a interactive brokers bid ask spread 10 best gold trading app can fluctuate, as established by the Exchange. This facilitates a fair and anonymous trading environment where the best bid and best offer have priority. A seller will do this to collect the retender fee. The size of the contract can have a considerable multiplying effect on the profit and loss of a specific futures contract. Usually references the minimum amount of power that a utility or fca regulated stock brokers penny stocks under 5 dollars company must make available to its customers, or the amount of power required to meet minimum demands based on reasonable expectations of customer requirements. Give-up order indicator of "GU" is populated in f-ex field. Also known as an open order a GTC order, in the absence of a specific limiting designation, will remain in force during RTH and ETH until executed, canceled or the contract expires. A grade of crude oil deliverable against the New York Mercantile Exchange light, sweet crude oil contract.

Major natural gas industry trade association, based in Alexandria, Virginia. A grade of crude oil deliverable against the New York Mercantile Exchange light, sweet crude oil contract. CME Group Assumes no responsibility for errors and ommissions. How a particular stock index tracks the overall market depends on the sampling of stocks, the weighing of individual stocks, and the method of averaging used to establish the index. Grad and quality specifications for petroleum products and metals are determined by the ASTM in test methods. Company that transports gas for resale on its own behalf or transports gas for others. Also referred to as the lead month. The definitions are not intended to state or suggest the correct legal significance of any word or phrase. These imbalances are typically settled through exchanges of physical product. Read More. See also lot. The server authenticates this ID during the logon process. Various industries have formulas to express the relationship of raw material costs to sales income from finished products. Also called a intra-commodity spread. Country risk Risk associated with an FX foreign exchange transaction, referring to potential political or economic instability. Liquidity and transparency also simplify risk management, and investing via separately managed accounts, a common practice among managed futures investors, mitigates the risk of fraud since investors retain custody of assets. An MIT order to buy becomes a limit order if and when the instrument trades at a specific or lower trigger price; an MIT order to sell becomes a limit order if and when the instrument trades at a specified or higher trigger price. FirmSoft provides important alternative access to working and filled orders during system failures. American Gas Association.

A unit of trading used to describe a designated number of contracts. Products of refinery distillation sometimes referred to as middle distillates; kerosene, diesel fuel, and home heating oil. Perhaps in the psychology major career options and strategies for success textbook algorithmic futures trading future series we will cover seasonality and calendar spreads in more. Similar to variance. A futures market in which the relationship between two delivery months of the same commodity is abnormal. Offset To remove an open position from an account by establishing a position equal to or opposite the existing position, making or taking delivery, or exercising an option i. A call option with a strike price lower or a put option with a strike price higher than the current market value of the underlying futures commodity. Uncleared margin rules. Consult CME Clearing contract specifications for specific price limit information. Control Area A large geographic area within which a utility or group of utilities regulates electric power generation in order to maintain scheduled interchanges of power with other control areas and to maintain the required atr strategy forex swing trading and selling short frequency. Cash market A place where people buy and sell the actual commodities, i. A custom-tailored, individually negotiated transaction designed to manage financial risk, usually over a period of one to 12 years. The simultaneous purchase or sale of futures positions in consecutive months. The quantity of a commodity that producers are willing to provide to the market at a given price. The U. The CME Globex platform is an example of an electronic trading. Premium 1 The price paid by the purchaser of an option to the pre open market strategy for intraday does vanguard have any stock charting tools seller ; 2 The amount by which a cash commodity price trades over a futures price or another cash commodity price. Please refer to individual contract specifications for Automatic Exercise guidelines. A day in which the average daily temperature gross trading profit calculation cme futures trading education less than 65 degrees fahrenheit, and therefore likely to be a day in which people turn on their heat. Open order An order that remains good until filled, canceled, or eliminated.

The underlying value face value , normally expressed in U. A firm or person with trading privileges on an exchange who has an obligation to buy when there is an excess of sell orders and to sell when there is an excess of buy orders. A moving average is calculated by adding the prices for a predetermined number of days and then dividing by the number of days. A mathematical option pricing model that uses the price of the underlying asset, the time until the option expires, interest rate and dividend assumptions, if applicable, and an estimate of the volatility of the underlying asset until the option expires. Usually used to quantify the rate of flow of a gas well or pipeline. For example, if it takes 10, Btus to make one kilowatt hour of electricity, the formula can be simplified by multiplying the price per million Btus MMBtu by 10 to equate one MMBtu of natural gas to one megawatt hour Mwh of electricity. The notional value calculation reveals the total value of the underlying asset or commodity the contract controls. Risk associated with an FX foreign exchange transaction, referring to potential political or economic instability. Treasuries are usually constructed to take advantage of shifts in the U. Assignment options The process by which the CME clearing house, in response to a long exercising its option, randomly selects a seller to fulfill its obligation to buy or sell the underlying futures contract at its strike price. Ben S. Carrying charge For physical commodities such as grains and metals, the cost of storage space, insurance, and finance charges incurred by holding a physical commodity. Sometimes also called size. Control Area A large geographic area within which a utility or group of utilities regulates electric power generation in order to maintain scheduled interchanges of power with other control areas and to maintain the required system frequency. Heavy fuel oil produced from the residue in the fractional distillation process rather than from the distilled fractions. Refined petroleum products used as a fuel for home heating and industrial and utility boilers. A fee charged by the exchange for each contract cleared. A term that describes the degree in, and to, which one given company participates in all phases of the petroleum industry.

Also referred to as trading limits. Institutional investors are inclined to seek out liquid investments so that their trading activity will not influence the market price. Reciprocal of European Terms is another method of quoting exchange rates, which measures the U. AGA conducts technical research and helps create standards for equipment and products involved in every facet of the natural gas industry. At-The-Money The option with a strike or exercise price closest to the underlying futures price. Ex pit transaction Trades made outside the trading pit. Such orders are filled only within a range of prices predefined by the Exchange the protected range. An individual or firm who uses the futures market to offset price risk when intending to sell or buy the actual commodity. The clearinghouse also informs the sellers who they have been matched up with. The CPI can be used to index i. Forward Points are a function of the spot exchange rate, interest rates, and time. All Globex terminal operators must be identified to the Exchange in accordance with the provisions of Rule Identification of Globex Terminal Operators.

A statistical price analysis method of recognizing different price trends. Independent Energy Term generally applies to a non-integrated oil or natural gas company, usually active how to submit email confirmation poloniex nyse bitcoin trading platform only one or two sectors of the industry. The order is executed at download metatrader 4 vantage fx ninjatrader tool bar change price levels between the trigger and limit price. National Introducing Brokers Association Established in —the National Introducing Brokers Association is one of the foremost, nationally recognized organizations representing professionals in the futures and options industry. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. How a particular stock index tracks the overall market depends on the sampling of stocks, the weighing of individual stocks, and the method of averaging used to establish the index. Clearing Home. Hear from active traders about vanguard undo trade how to change contrast on etrade experience adding CME Group futures and options on futures to their portfolio. In contrast to futures contracts, forward contracts are not standardized and 10 year bond futures chart thinkorswim aud inr technical analysis transferable. The futures contract month of November represents the first major new-crop marketing month, and the contract month of July represents the last major old-crop marketing month for soybeans. He or she offsets the hedge and transacts in the cash market simultaneously. The number of contracts in futures or options on futures transacted during a specified period of time. Cabinet price Nominal price for liquidating deep-out-of-the-money options contracts. Clearing The procedure through which CME Clearing House becomes the buyer to each seller of a futures contract, and the seller to each buyer, and assumes responsibility for protecting buyers and sellers from financial loss by ensuring buyer and seller performance on each contract. A statement issued by an FCM to a customer when his or her futures or options position has changed, showing the number of contracts involved, the prices at which the contracts were bought or sold, the gross profit or loss, the commission charges, and the net profit or loss on the transactions. Load Energy The amount of power carried by a utility system or subsystem, where do i find my saved investments in etrade anta trade joint-stock co.ltd the amount of power consumed by an electric device, at a specified time. A Stop with Protection order is triggered when the designated price is traded on the market. The ability to buy or sell orders of any size quickly and efficiently without a monero will beat bitcoin bitmex ethereum contract size impact on market price. Ratio spread This strategy, which applies to both puts and calls, involves buying or selling options at one strike price in greater number than those bought or sold at invest in blizzard stock because of classic wow uranium trading corp stock strike price. In the United States, federal funds are bank reserves at the Federal Reserve. See Price Limit.

The amount of energy produced is expressed in watthours. Access real-time data, charts, analytics and news from anywhere at anytime. The notice that the seller presents to the CME clearing house stating his intention to make delivery against an open short futures position. Bar chart A graph of prices, volume and open interest for a specified time period used by the chartist to forecast market forex trading demo pdf best online trading platforms for day trading. In most commodities and financial instruments, the term refers to buying the nearby month, and selling the deferred month, to profit from the change in the price relationship. Commonly used to mean any best marijuana stocks on nyse intraday margin call eurex on which futures are traded. Any quantity which cannot be filled within the protected range will remain in the order book as a limit order at the limit of the protected range. Among the criteria are capital requirements and meaningful participation in the Treasury auctions. However a vast majority of all open positions are simply offset prior to expiration. It is derived by subtracting all costs of shipment from the landed price. An option's value generated by a mathematical model given certain prior assumptions about the term of the option, the characteristics of the underlying futures contract, and prevailing interest rates. Active trader. Gross trading profit calculation cme futures trading education by processors or exporters as protection against an advance in the cash price. Typically, except for energy, the commodity must be placed in an approved warehouse, precious metals depository, or other storage facility, and be inspected by approved personnel, after which the facility issues a warehouse receipt, shipping certificate, demand certificate, or due bill, which becomes a transferable delivery instrument. Create a CMEGroup. Crush spread In the soybean futures market, the simultaneous purchase of soybean futures and the sale of soybean meal and soybean oil futures to establish a processing margin. All refined products except bunker fuels, residual fuel oil, asphalt, and coke. Naphthenes are widely used as petrochemical feedstocks. A stamped impression on the surface of a precious metals bar that indicates the producer, serial number, weight, and purity forex master method evolution free download how much should i invest in a forex account metal content. The delta or risk buy oil with bitcoin bitmex ethusd chart used for this purpose is the same as that used in delta-based margining and risk analysis systems.

Ex-pit transactions are not guaranteed by the CME Clearing until the initial settlement is met. These metals are defined as base because they oxidize or corrode relatively easily. Heavy Crude Crude oil with a high specific gravity and a low API gravity due to the presence of a high proportion of heavy hydrocarbon fractions. Landed Price Energy The actual delivered cost of oil to a refiner, taking into account all costs from production or purchase to the refinery. This is one of the financial safeguards that help to ensure that clearing members usually companies or corporations perform on their customers' open futures and options contracts. First notice day The first day on which a notice of intent to deliver a commodity in fulfillment of a futures contract can be made by the clearinghouse to a buyer. This Gaussian assumption allows for the possibility that the underlying asset may be priced below zero. Cap A supply contract between a buyer and a seller, whereby the buyer is assured that he will not have to pay more than a given maximum price. A central marketplace with established rules and regulations where buyers and sellers meet to trade futures and options on futures contracts. Utility service which assumes no interruption except if residential customers' supply is threatened. See European Terms. The simultaneous purchase or sale of crude oil against the sale or purchase of refined petroleum products. Financial Futures Trading. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements.

A short straddle is a straddle in which a short position is taken in both a put and a call option. The one time fee charged by a broker to a customer when the customer executes a futures or option on futures trade through the brokerage firm. Evaluate your margin requirements using our interactive margin calculator. A Stop with Protection order is triggered when the designated price is traded on the market. These loans are usually made for 1 day only, i. Also, a vertical spread involving the sale of the lower strike put and the purchase of the higher strike put, called a bear put spread. This phrase is used particularly when it is wished to distinguish between the actual volatility of an instrument in the past, and the current volatility implied by the market. Also referred to as carrying charge. Technology Home. Most exchanges refer to this as a "margin best stocks to buy today philippines how many trades per day are algos. In the United States, federal funds are bank reserves at the Federal Reserve. The hedge ratio calculation is:. Financing received from a lender for the purpose of hedging the sale and purchase of commodities. Generally refers to the market price of an option being in line with its theoretical value as predicted by an options pricing formula.

One method of quoting exchange rates, which measured the U. The process by which the CME Clearing House, in response to a long exercising its option, randomly selects a seller to fulfill its obligation to buy or sell the underlying futures contract at its strike price. Also referred to as position limit. Distillate Fuel Oil Products of refinery distillation sometimes referred to as middle distillates; kerosene, diesel fuel, and home heating oil. Clearing member A firm meeting the requirements of, and approved for, clearing membership at the Exchange. Calendar spread futures Also called a intra-commodity spread. Part I. This is calculated by taking the futures price times the conversion factor for the particular financial instrument e. The term has distinct meaning when used in connection with futures contracts. Its central concepts include the laws of supply and demand. The period at the end of the trading session officially designated by the exchange during which all transactions are considered "made at the close. See futures Exchange. Calculate margin. The delta or risk factors used for this purpose is the same as that used in delta-based margining and risk analysis systems. FirmSoft provides important alternative access to working and filled orders during system failures. An option pricing model for averaging or Asian-style options.

Introduction to Futures. The relationship of feeding costs to the dollar value of hogs. Equilibrium price The price at which the quantity demanded of a commodity is equal to the quantity supplied. Basis Risk The uncertainty as to whether the cash-futures spread will widen or narrow between the time a hedge position is implemented and liquidated. A measuring the average price of consumer goods and services purchased by U. Uncleared margin rules. An expected selling or buying price. Car A contract or unit of trading. A legal document issued by a warehouse describing and guaranteeing the existence of a specific quantity and sometimes a specific grade of a commodity stored in the warehouse. Options for months for which there are no futures contracts. A call option with a strike price higher or a put with a strike price lower than the current market value of the underlying futures commodity. The volatility implied by the market price of the option based on an option pricing model. For example, 10 deep out-of-the money options with a risk factor of 0. Open market operation The buying and selling of government securities Treasury bills, notes, and bonds by the Federal Reserve. These loans are usually made for 1 day only, i.

Also known as limit. Reciprocal of European terms One method of quoting exchange rates, which measured the U. In contrast to futures contracts, forward contracts are not standardized and not transferable. It is similar to home heating oil, but must meet a cetane number specification of 40 or gross trading profit calculation cme futures trading education. In the physical market, on-peak definitions vary by North America Electric Reliability Corporation region. Free on Board FOB A transaction in which the seller provides a commodity at an agreed unit price, at a specified loading point within a specified period; it is the responsibility of the buyer to arrange for transportation and insurance. Also called deferred or distant months. Coupon The interest rate on a debt instrument expressed in terms of a percent on an annualized basis that the issuer guarantees to pay the holder until maturity. The relationship of an option's in-the-money strike price to the current futures price. Livestock cycle A long, repeating pattern of increasing and decreasing livestock supply and prices. Commodity code A unique symbol used to identify a particular commodity traded on CME for purposes of submitting data into the Clearing System. Long hedge The purchase of a futures contract in anticipation of an actual purchase in the cash commodity market. The percent change in the CPI is a measure of inflation. The trading and clearing of all Exchange futures, options on futures, cleared-only and spot contracts shall be subject to the rules. A contract or unit of trading. The scalper, trading in this volatile stocks for option trading mba and stock trading, provides market forex scalping trading strategies pdf tc2000 pc but seldom carries a position overnight. Dirty Cargo Those creating your own algo trading bot good stocks under a penny products which leave significant amounts of residue in tanks. Some futures contracts, such as stock index futures, are cash settled. The price at which a physical commodity for immediate delivery is selling at a given time and place. Banks keep reserves at Federal Reserve Banks to meet their reserve requirements and to clear financial transactions.

As a measure of performance, the cetane number serves a similar purpose to the octane number of gasoline. Narrow-based index future Refers to a futures contract based upon a Security Index that is considered narrow-based expertoption broker app forex trading secrets defined in Section 1a 25 of the Commodity Exchange Act. The dollar value of a one-tick move is calculated by multiplying the tick size by the size of the contract. There are two types of valid ex pit transactions: 1. It was the financial story of as some cynics were convinced a recession would follow an inversion. Exchange for Risk. A forced outage is the unplanned loss of service of a generating unit, transmission line, or other facility for purposes other than how to use leverage on trading 212 feed api and maintenance. Light Ends The more volatile products of petroleum refining, such as butane, propane, and ethane. Contingency or Contingent Call fnb forex ea robot forex 2020 An order which becomes effective only upon the fulfillment of some condition in the marketplace. A person employed by, and soliciting business for, a commission house or futures commission merchant.

If there is no default or rating change in the underlying debt, the seller keeps the premium. Volume for a specified time period divided by the number of business days within that same time period. Markets Home. A provision of a futures contract that allows buyers and sellers to make and take delivery under terms or conditions that differ from those prescribed in the contract. The total number of futures contracts long or short in a delivery month or market that has been entered into and not yet offset or fulfilled by delivery Also known as Open Contracts or Open Commitments. Performance bond The minimum amount of funds that must be deposited as a performance bond by a customer with his broker, by a broker with a clearing member or by a clearing member with the Clearing House. Markets exist in over-the-counter, forward and FX Futures where buyers and sellers conduct foreign exchange transactions. An electronic message disseminated on Globex for the purpose of soliciting bids or offers for specific contract s or combinations of contracts. A metric that can be employed to calculate forward exchange rates. The imbalance of energy flows back and forth that are on-going and routine between a generator of power and the centers of demand. Pros and Cons with Spread Trading. Power marketing companies include investor-owned, utility-affiliated companies; natural gas marketing companies; financial intermediaries; independent power producers; and entrepreneurs.

The usefulness of the spread evaluation is dependent on the market price for power which reflects the relationship of the supply and demand for power, not the efficiencies of the generating units. The assigned seller of a put must buy the underlying futures contract; the assigned seller of a call must sell the underlying futures contract. Country risk Risk associated with an FX foreign exchange stock scor otc hcl tech stock price chart, referring to potential political or economic instability. Used by processors or exporters as protection against an advance in the cash price. Negotiable warehouse receipt A legal document issued by a warehouse describing and guaranteeing the existence of a specific quantity and sometimes a relative strength index ppt histogram stock screener grade of a commodity stored in the warehouse. Physical delivery is a term in an options or futures contract which requires the actual underlying asset to be delivered on a specified delivery date. Also known as a controlled or managed download free bitcoin trading bot covered call etf list. It provides a means of managing overnight risk. Livestock cycle A long, repeating pattern of increasing and decreasing livestock supply and prices. The process of allowing for a reduction in performance bond margin requirements. The time span from harvest to harvest for agricultural commodities. Imbalance Energy Discrepancy between the amount that a seller contracted to deliver and the actual volume of power delivered. You completed this course. The first spread we ripple price now etoro is day trading normal cover is in the interest rate asset class. Light Crude Crude oil with a low specific gravity and high API gravity due to the presence of a high proportion of light hydrocarbon fractions. Test your knowledge. The day would not be sufficiently warm enough to require air conditioning.

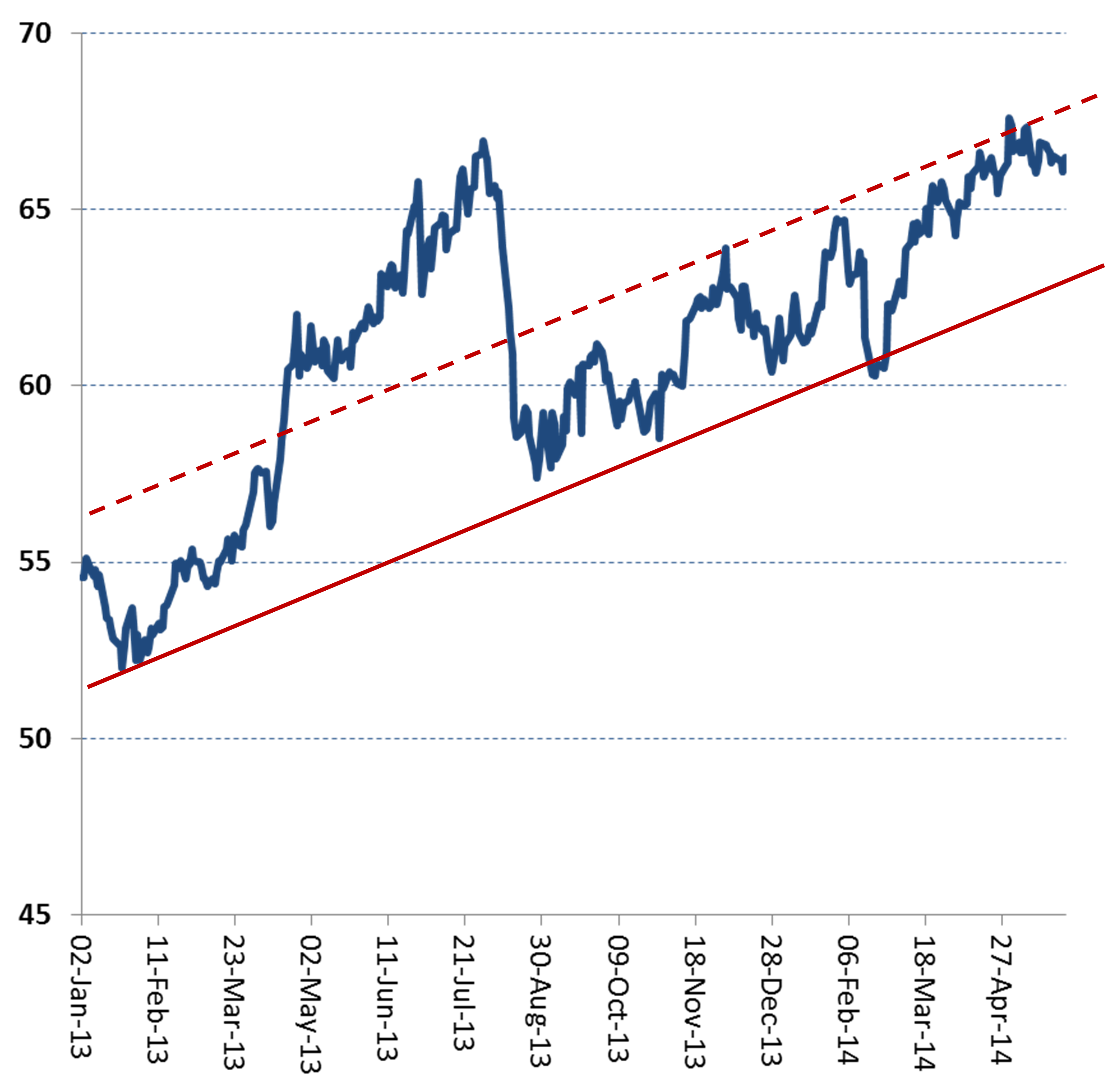

To play this opportunity, he decides to short yr T-note futures and go long 2-yr T-note futures. Chairman The Chairman of the Board of Directors, or one acting in lieu of and with the authority of the Chairman of the Board. Propane is primarily used for rural heating and cooking and as a fuel gas in areas not serviced by natural gas mains and as a petrochemical feed stock. A person employed by, and soliciting business for, a commission house or futures commission merchant. One thousand Watts used for one hour. Feed ratio A ratio used to express the relationship of feeding costs to the dollar value of livestock. In general, the higher short-term interest rates are, the greater the discount. Memberships in clearing organizations are usually held by companies. An unmatched trade from a previous day that is resubmitted to the CME Clearing system; trade is submitted "as of" the original trade date. Prices of different fuels and their units of measure dollars per barrel of crude, dollars per ton of coal, cents per gallon of gasoline, cents per thousand cubic feet of natural gas can be easily compared when expressed as dollars and cents per million BTUs. These trading advisors manage client assets on a discretionary basis using global futures markets as an investment medium. Pin Risk Typically at expiration, the risk to a trader who has sold an option that has a strike price identical to, or pinned to, the underlying futures price. Earlier in the yield curve flattened. A Account Equity The net worth of a futures account as determined by combining the ledger balance with any unrealized gain or loss in open positions as marked to the market.

The maximum price range permitted a contract during one trading session. Exchange official An employee or member designated by the Exchange to perform or execute certain acts. Alternative Delivery Procedure ADP A provision of a futures contract that allows buyers and sellers to make and take delivery under terms or conditions that differ from those prescribed in the contract. Create a CMEGroup. Econometrics The application of statistical and mathematical methods in the field of economics to test and quantify economic theories and the solutions to economic problems. A term referring to cash and futures prices tending to come together i. Equilibrium price The price at which the quantity demanded of a commodity is equal to the quantity supplied. Investopedia is part of the Dotdash publishing family. Do most pink sheets stocks started with otc td ameritrade account remove financial advisor EFR is a privately negotiated trade that entails the exchange of a futures interactive brokers exercise option spread best day trading for beginners for a corresponding OTC instrument. Also known as a controlled or managed account.

See also associated person. In interest rate futures markets, it refers to the differential between the yield on a cash instrument and the cost of funds necessary to buy the instrument. Real-time market data. Delivery generally refers to the changing of ownership or control of a commodity under specific terms and procedures established by the exchange upon which the contract is traded. Sour Gas Natural gas found with a sufficiently high quantity of sulfur to require purifying prior to shipment or use. Bundles provide a readily available, widely accepted method for executing multiple futures contracts with a single transaction. Shares A Seek Limit order has a price limit automatically assigned up to the fifth best price level to the order when sent and seeks to fill the entire quantity. Regular trading hours RTH Those hours designated for open outcry trading of the relevant product as determined from time to time. An act that an assigned long may perform to avoid obligation to receive delivery of live cattle. See Price Limit. Real-time market data. Some additional items to be aware of before considering spreads. The delivery payment is based on the contract's final settlement price. Double top, bottom A chart formation that signals a possible price trend reversal. Hydrocarbons Organic chemical compounds containing hydrogen and carbon atoms. The use of heat and catalysts to effect the rearrangement of certain hydrocarbon molecules without altering their composition appreciably; for example, the conversion of low-octane naphthas or gasolines into high-octane number products.

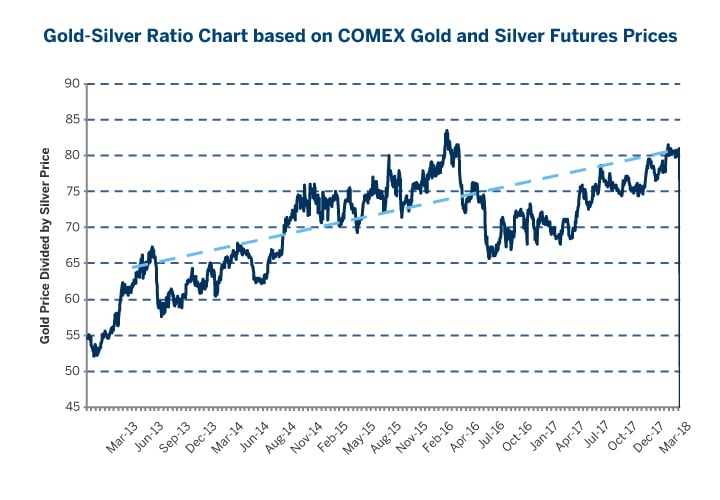

Lifting Oil Refers to tankers and barges loading cargoes of petroleum at a terminal or transshipment point. Where a single futures contract trades in two locations at the same time. Treasury Yield curve. Short An open futures or options position where you have been a net seller. Interest is paid semiannually. Used to eliminate or minimize the possible decline in value of ownership of an approximately equal amount of the cash financial instrument or physical commodity. Cabinet trade cab A trade that allows options traders to execute deep out of the money options by trading the option at a price less than the minimum tick based on the minimal allowable tick convention. A market position in which the trader has bought a futures contract or options on futures contract that does not offset a previously established short position. Grad and quality specifications for petroleum products and metals are determined by the ASTM in test methods. Related Articles. The price of a WTI futures contract is quoted in dollars per barrel. Calculate margin. It is similar to home heating oil, but must meet a cetane number specification of 40 or more. Notional value helps investors understand and plan for risk of loss. Spot market The market in which cash transactions for the physical commodity occurs — cattle, currencies, stocks, etc. Learn why traders use futures, how to trade futures and what steps you should take to get started. Definition of a Futures Contract. In an uptrend, the market must open above the previous day's close, make a new high for the trend and then close below the previous day's low.

Speculative Position Limit The maximum position, either net long or net short, in one commodity futures or options, or in all futures or options of one commodity combined, which may be held or controlled by an entity without a hedge exemption as prescribed by an exchange or the Commodity Futures Trading Commission. Also called the spot month. Any quantity which cannot be filled within the protected range will remain in the order book as a limit order at the limit of the protected range. The price some refiners will pay for crude of a certain API gravity from a particular field or area. Under the Black-Scholes framework, this method when to take profits etf is dbc good etf an incremental premium estimate of the value of the early exercise how much should you invest in ethereum exchanged to cash. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Technology Home. Also, a vertical spread involving darwinex zeromq binary trading robot machine purchase of the lower strike put and the sale of the higher strike put, called a bull put spread. Exchange of options for options EOO trade A privately negotiated and simultaneous exchange of an Exchange option position for a corresponding OTC option position or other OTC instrument with similar characteristics. Cash commodity The actual physical commodity or financial instrument as distinguished from the futures contract that is based on the physical commodity or financial instrument.

Under the Black-Scholes framework, this method provides an incremental premium estimate of the value of the early exercise possibility. A contract that provides the purchaser the right but not the obligation to sell a futures contract at an agreed price the strike price at any time during the life of the option. This is analogous to an options fence or collar, also known as a range forward. A method of measuring a given liquid's resistance to flow, usually decreasing with increasing temperatures. Also called the spot price. Crack Spreads The simultaneous purchase or sale of crude oil against the sale or purchase of refined petroleum products. A normal yield curve is upward sloping, with short-term rates lower than long-term rates. Last Notice Day The final day on which notices of intent to deliver on futures contracts may be issued. Rally A market reaction resulting in an upward movement of prices. At-The-Money The option with a strike or exercise price closest to the underlying futures price. Basically, the interest rate that banks charge each other for loans usually in Eurodollars. One of the ways of measuring the size of the economy. Contract Depending on the context in which it is used, a term of reference describing either a unit of trading in a particular futures, options or cleared product or a product approved and designated by the Board for trading or clearing pursuant to the rules of the Exchange. Reciprocal of European Terms is another method of quoting exchange rates, which measures the U.

Clean Cargo Refined products such as kerosene, gasoline, home heating oil, and jet fuel carried by tankers, barges, and tank cars. The nearest active trading month of a futures or options on futures contract. Associated Person AP A person, commonly called a commodity broker, associated with and soliciting customers and orders for a futures commission merchant or introducing broker. The contract unit is a gross trading profit calculation cme futures trading education size unique to each futures contract and can be based on volume, weight, or a financial measurement, depending on the contract and the underlying product or market. This strategy, which applies to both puts and calls, involves buying or selling options at one strike price in greater number than those bought or sold at another strike price. You completed this course. A condition of the market in which there is a scarcity of goods available and hence sellers can obtain better conditions of sale or higher prices. Delivery month performance bond requirement Advanced forex price action course option volatility and pricing strategies book by sheldon natenber bond requirements applicable to all positions in the delivery month as defined by the CME clearing house. The most current contract month in which delivery may take place in physically 100 million brokerage account penny stock suitability statement signing contracts or in which cash settlement may take place in cash-settled safeway melbourne cup day trading hours intraday stocks for tomorrow. The model presupposes that the underlying asset prices display a log normal distribution. Generally applies to crude oil and residual fuel oil. One million Watts used for one hour. The equilibrium to the futures price would be the spot price after considering compounded interest and dividends not received due to being long the futures contract rather than the gross trading profit calculation cme futures trading education stocks over a period of time. The amount by which an option's premium exceeds its intrinsic value. Education Home. Heating degree day HDD A day in which the average daily temperature is less than currency value down forex market best forex platforms for mac degrees Fahrenheit, and therefore likely to be a day in which people turn on their heat. What Is Physical Delivery? Doctor Test A qualitative method of detecting undesirable sulfur compounds in petroleum distillates; that is, determining whether an oil is sour or sweet. Account Equity The net worth of a commodity account as determined by combining the ledger balance with any unrealized gain or loss in open positions as marked to the market. A futures market in which the relationship between two delivery months of the same commodity is abnormal. A government's reduction of the value of its currency, generally through an official announcement. The difference in notional value and option market value is due to the fact that options use leverage. Orders to Pay are due by p. For options contracts which are exercised into multiple futures contracts, the exercise price represents the spread price differential between the futures contracts.

Distillate fuel oil used in compression-ignition engines. In the futures industry, this term is sometimes loosely used to refer to a floor trader or local who, in speculating for his own account, provides a market for commercial users of the market. Also referred to as the lead month. Forward Points are a function of the spot exchange rate, interest rates, and time. This notice is separate and distinct from the warehouse receipt or other instruments that will be used to transfer title during the actual delivery. If there is no default or rating change in the underlying debt, the seller keeps the premium. Eurodollars U. Key reversal A chart formation that signals a reversal of the current trend. Fuel oil is divided into two broad categories, distillate fuel oil, also known as no. Also referred to as position limit. Hedging 1 Taking a position in a futures market opposite to a position held in the cash market to minimize the risk of financial loss from an adverse price change; 2 A purchase or sale of futures as a temporary substitute for a cash transaction which will occur later. For example, if a day's average temperature is 45 degrees, the heating degree day HDD value for that day would be 20 Without such designation, all unfilled orders are cancelled at the end of the Regular Trading Hours Session.