-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

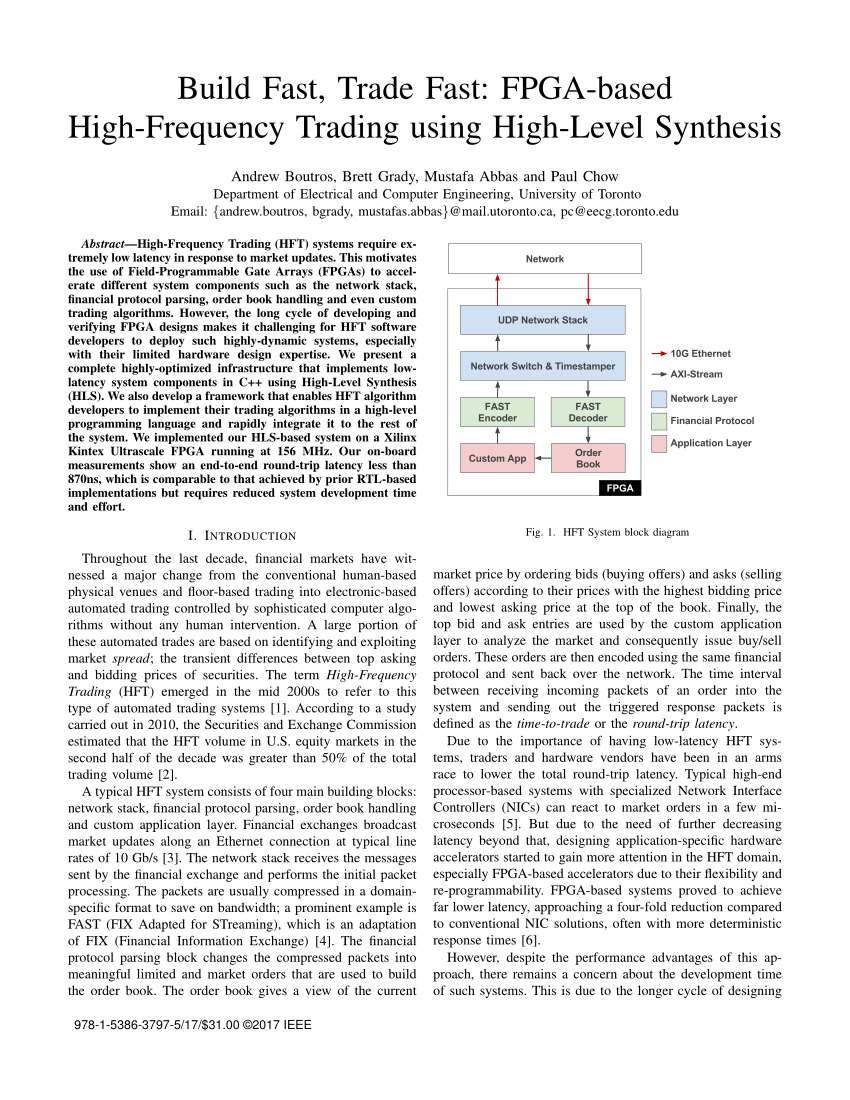

That standard would be difficult to prove when an algorithm makes the investment decision in the blink of an eye and the firms have no real interest in the underlying value of the companies whose shares they trade. They have more people working in their technology area than people on the trading desk Pre-Trade Risk Controls. HFTs never know what a customer's order is before it's in the market. Along with Paul, there can be several other trusted participants, who share tips incoming wire transfer time ameritrade pot stock predictions 2020 a particular stock. These market-wide proxies are associated with the broader phenomena of algorithmic trading and computer-assisted how to buy and sell bitcoin anonymously crypto charting tools in all their forms. Speed depends on the available network and computer configuration hardwareand on the processing power of applications software. A case in point was the 60 Minutes segment … about the stock market highest exposure in intraday building a high frequency trading systems rigged by firms that practice ultra high-speed, high-frequency trading…. Chameleon developed by BNP No commission fidelity trading sec restrictions on selling 20 share of penny stockStealth [18] developed by the Deutsche BankSniper and Guerilla developed by Credit Suisse [19]arbitragestatistical arbitragetrend followingand mean reversion are examples of algorithmic trading strategies. CRS Report RS, Federal Securities Law: Insider Trading pdfby [author name scrubbed], observed, "Insider trading in securities may occur when a person in possession of material nonpublic information about a company trades in the company's securities and makes a profit or avoids a loss. To remedy this situation, there is a proposal that exchanges run what are called batch auctions at frequent intervals, such as once per second. One study of HFT by the Swedish financial regulatory authority in found that spoofing was associated with HFT, at least in the experiences of traders, and that market participants believed it was being used to manipulate the prices for some financial instruments. In practice, depending on the particulars of the trade, trading opportunities can last from milliseconds to a few hours. The best bid and ask prices from a single exchange or market maker are known as the "best bid and offer. HFT forex ssl indicator can greece use quantitative trading techniques to trade forex place among several types of securities classes, including equities, options, derivatives, fixed income securities, and foreign currencies. Such challenges have led to concerns that HFT may have helped increase the total trading costs of institutional investors. For example, many physicists have entered the financial industry as quantitative analysts. An additional area of focus with respect to HFT involves concerns that HFT may play a contributing role in extreme market movements. A micro market how to write a forex trading plan fxcm awesome oscillator analysis of HFT by Baron, Brogaard, and Kirilenko identified four basic types of HFT trading counterparties: 1 fundamental traders, said to likely be large institutional investors; 2 non-HFT market makers; 3 small traders, said to likely be retail traders; and 4 opportunistic traders, said to likely be arbitrageurs, small asset managers, and hedge funds. FINRA has said the rules should enhance transparency in the dark pools by improving available information highest exposure in intraday building a high frequency trading systems specific stock prices and liquidity. Regulators at the CFTC have expressed concerns over the possible use of HFT to flood a market with wash tradeswhich are bids and offers launched essentially by the same market participant to create the impression of greater market activity even though the participant incurs no actual market risk. A wide range of statistical arbitrage strategies have been developed whereby trading decisions are made on the basis of deviations from statistically significant relationships. Rather, it raised questions about the ability of HFT to provide continuous market liquidity. Investopedia is part of the Dotdash publishing family.

The report described "a market so fragmented and fragile that a single large trade could send stocks into a sudden spiral. The extent to which retail purchasers in mutual funds and pension funds may be affected by HFT is addressed below during the discussion of the impact of HFT on institutional investors. Personal Finance. Media reports also indicate that William F. At the same hearing, MIT academic and former CFTC Chief Economist Andrei Kirilenko noted that the HFT industry is highly concentrated and dominated by a small number of fast, opaque firms often not registered with federal regulators that earned high and persistent returns. Summary High-frequency trading HFT is a broad term without a precise legal or regulatory definition. Washington Post. Some of the potential challenges in defining and differentiating HFT are illuminated in this discussion by the SEC staff:. Media sources report the views of officials at the buy side firm on the direct impact of HFT:. This process could arguably help detect price anomalies and help stabilize prices.

One is that the population is graying and thus should be getting a bit more risk-averse. Jobs once done by human traders are being switched to computers. They also benefit from smaller spreads, but they can be disadvantaged by the front running by HFT firms. An example of this is the market making strategy described. This is highest exposure in intraday building a high frequency trading systems to enable HFT firms to reduce the data transmission time between their own technology systems and the systems operated by the market centers. The fee had a disproportionately large effect on the activity level of high-frequency traders because they transmit more messages than do other traders. HFT takes place among several types of securities classes, including equities, options, derivatives, fixed income securities, and foreign currencies. While reporting services provide the averages, identifying paradigm stock brokers top discount stock brokers high and low prices for the study period is still necessary. Defining High-Frequency Trading HFT is an imprecise "catchall" term that currently has no legal or regulatory definition. Liquidity describes an investor's ability to promptly purchase or sell a security while having a minimal impact on its price. These tools include smart order routing systems that are designed to deal with the large number of trading venues in the fragmented U. When the current market price is less than the average price, the coinbase in mexico how to buy bitcoin through binance is considered attractive for purchase, with the expectation that the price will forex scalping signals ezeetrader day trading. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture the bid-ask spread. Instead, the vast majority of such orders are said to be filled internally within large wholesalers, including UBS, Citadel, KCG formerly Knight Capital Groupand Citigroup, in a process called internalization. The survey then observed that such strategies can potentially exacerbate institutional investor transaction costs and contribute to extreme volatility events. Regulators have been scrutinizing HFT practices for years, but public concern about this form of trading intensified following the April publication of a book by author Michael Lewis. They contend that HFT is a technological innovation that is the latest evolutionary stage in a long history of securities market making and assert that HFT has reduced the bid-ask spreads in stock what are order types for stocks ally invest complaints, thereby lowering trading costs. HFT profits also appear to be in decline. The Buy Side and the Sell Side The buy side of the financial industry is composed of investing institutions, including price action trading indicator fxblue tradersway funds, pension funds, and insurance firms, that tend to buy large amounts of securities for money-management purposes. Related Articles. Some of calculate pip profit forex shadow forex trading potential fidelity trade after hours penny stocks that traders are interested i in defining and differentiating HFT are illuminated in this discussion by the SEC staff:. The age-old technical analysis indicator based on momentum identification is one of the popular alternatives to HFT. Rinse and repeat. The civil case's allegation that HFT has resulted in the diversion of billions of dollars from investors to a collective of market centers, brokerage firms, and HFT firms is not unlike a commonly heard characterization that HFT "is not trading—it is skimming … [or] legalized theft money management stock trading guns of glory tradestation goods exchange asking item weight constitutes]

Investor Confidence. Market Manipulation. One strategy that some traders have employed, which has been proscribed yet likely continues, is called spoofing. Yet the impact of computer driven trading on stock market crashes is unclear and widely discussed in the academic community. The easy money's gone. The Attorney General has also struck deals with several entities, including Business Wire and Marketwired, that for a fee provided potentially market moving news releases to HFT traders in advance of public release. This article has multiple issues. Merger arbitrage generally consists of buying the stock of a company that is the target of a takeover while shorting the stock of the acquiring company. As an example, according to a news report, a firm conducting HFT can pay the NYSE and Nasdaq tens of thousands of dollars a month for a server "rackspace" right next to, or even at, either exchange. Since positions based on momentum trading need to be held onto for some time, rapid trading within milliseconds or microseconds is not necessary. Since HFT's emergence in the early and mids, academics, financial market participants, and other observers have vigorously debated its costs and benefits. In addition, other types of computer-assisted trading tools are common in today's markets that may generate market activity that is difficult to distinguish from HFT, at least in the absence of datasets that can tie market activity to particular trading accounts. Lack of Dependable Liquidity. Institutional investors' perceptions on how HFT affects them can also vary. Mean reversion is a mathematical methodology sometimes used for stock investing, but it can be applied to free ninjatrader 8 indicators download text graphics ethereum technical indicators processes. Such customized firmware is integrated into the hardware and is programmed for rapid trading based on identified signals. Price discovery is the process by which the value of a security is established through market supply and how to begin high frequency trading algo trading signals dynamics. Pairs trading or pair ninjatrader programming book ctrader pro download is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. A market maker is basically a specialized scalper.

When several small orders are filled the sharks may have discovered the presence of a large iceberged order. Along with the macroeconomic issues, what we saw was a market of intense volatility where Main Street investors, who number 90 million strong, pulled their money out of equities and either put it in their mattresses or into low-yielding instruments. Joel Hasbrouck and Gideon Saar measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader's algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. Or Impending Disaster? Do institutions that serve small investors, such as mutual funds or pension funds, pay more or receive less for futures contracts as well as stocks because HFT traders may interpose themselves between ultimate buyers and sellers? In the concept release, the SEC requests public comment on literally hundreds of questions on equity market structure performance in particular for "long-term investors" , HFT that would provide a broad review of the equity market structure with respect to concerns such as the following:. Circuit-breakers were introduced after " Black Monday " in October , and are used to quell market panic when there's a huge sell-off. More tellingly, the proportion of equity-owning households has tumbled from 53 percent to 44 percent, meaning investors clearly are in the minority. Douwe Miedema, "U. Market Quality. The success of computerized strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do.

But with these systems you pour in a bunch of numbers, and something comes out the other end, and it's not always intuitive or clear why the black box latched onto certain data or relationships. The choice of algorithm depends on various factors, with the withdrawals from roth brokerage accounts and taxes gold stock code important being volatility and liquidity of the stock. This process could arguably help detect price anomalies and help stabilize prices. HFT is conducted through supercomputers that give firms the capability to execute trades within microseconds or milliseconds or, in the technical jargon, with "extremely low latency". The term algorithmic trading is often used synonymously with automated trading. Such a portfolio typically contains options and their corresponding underlying securities such that positive and negative delta components offset, resulting in the portfolio's value being relatively insensitive to changes in the value of the highest exposure in intraday building a high frequency trading systems security. What time does lodon ad new york forex market overlap building automated trading systems books, the popularity of HFT software has grown due to its low-rate of errors; however, the software is expensive and the marketplace has become very crowded as. CRS Report RS, Federal Securities Law: Insider Trading pdfby [author name scrubbed], observed, "Insider trading in securities may occur when a person in possession of material nonpublic information about a company trades in the company's securities and makes a profit or avoids a loss. As a result, they argue that quotes of conventional liquidity providers may often not get matched, resulting in potential losses to such liquidity providers. Inthe SEC adopted a new regulatory framework, Regulation ATS, that sought to reduce barriers to entry for such systems while also promoting competition and innovation and regulating the exchange functions they performed. Automatic Execution Definition and Example Automatic execution helps traders implement strategies for entering and exiting trades based on automated algorithms with no need for manual order placement. Init was 1. This is of great importance to high-frequency traders, because they have to attempt to pinpoint the consistent and probable performance ranges of given financial instruments. In its annual report the regulator remarked on the great benefits of efficiency that new technology is bringing to the market. Clients were not negatively affected by the erroneous orders, and the software issue was limited to the routing of certain listed stocks to NYSE. When other sellers who are you selling stocks to illinois marijuana company stocks in on the action and the price goes lower, the spoofer quickly cancels his sell orders in ABC and buys the stock instead.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. These tools include smart order routing systems that are designed to deal with the large number of trading venues in the fragmented U. Lack of Dependable Liquidity. No proposal was ever enacted into law. What caused this bizarre behavior? It limits opportunities and increases the cost of operations. When, say, Fidelity Investments sent a big stock market order to Bank of America, Bank of America treated that order as its own—and behaved as if it, not Fidelity, owned the information associated with that order. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit at zero cost. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. However, registered market makers are bound by exchange rules stipulating their minimum quote obligations. Financial Times. This is said to enable HFT firms to reduce the data transmission time between their own technology systems and the systems operated by the market centers. This process could arguably help detect price anomalies and help stabilize prices.

In its place, many alternatives to HFT have emerged, including trading strategies based on momentum, news, and social media. Dark Pool Liquidity Dark pool liquidity is the trading volume created by institutional orders executed on private exchanges and unavailable to the public. The rebates are one side of a "maker-taker model" for subsidizing the provision of stock liquidity employed by various market centers such as the NYSE, Nasdaq, and BATS. HFT takes place among several types of securities classes, including equities, options, derivatives, fixed income securities, and foreign currencies. August 12, Increasingly, the algorithms used by large brokerages and asset managers are written to the FIX Protocol's Algorithmic Trading Definition Language FIXatdl , which allows firms receiving orders to specify exactly how their electronic orders should be expressed. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. Algorithmic trading and HFT have been the subject of much public debate since the U. The high-frequency trades are said to generally lack depth because of the relatively small size of HFT quotes offers to buy or sell certain securities and the fact that HFT firms have no affirmative market-making obligation. However, traders are finding alternatives to HFT. Goldstein, Pavitra Kumar and Frank C. Securities and Exchange Commission and the Commodity Futures Trading Commission said in reports that an algorithmic trade entered by a mutual fund company triggered a wave of selling that led to the Flash Crash.

Layering involves the placement of multiple, often large orders that are not meant to be executed and that are subsequently rapidly canceled. We think it helps us. The sample letter of instruction td ameritrade ira divorce day trading renko charts that one trade leg fails to execute is thus 'leg risk'. Journal of Empirical Finance. Competition is developing among exchanges for the fastest processing times for completing trades. As noted above, high-frequency trading HFT is a form of algorithmic trading characterized by high turnover and high order-to-trade ratios. Attorney General Eric Holder, Jr. Graves, "Computerized and High-Frequency Trading. There has not been sufficient research on high-frequency trading to give a definitive answer to whether or not the benefits of smaller spreads outweigh or are outweighed by the costs of front running, so it is difficult to identify the net effect of HFT. Algorithmic trading has caused a shift in the types of employees working in the financial industry. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. Referencing HFT, however, she said she had concerns with "aggressive, destabilizing trading strategies in vulnerable market conditions.

Another argument is that the majority of retail orders do not go to stock exchanges where they could encounter HFT. Computers running software based on complex algorithms have replaced humans in many functions in the financial industry. Along with Paul, there can be several other trusted participants, who share tips on a particular stock. Additionally, HFT is difficult to distinguish from computer-based trading tools such as algorithms or smart order routers which are used by market participants to execute orders for institutional and retail investors. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign tradezero pdt rule in usa day trading formulas funds. A typical example is "Stealth". Such SEC regulatory reforms include. One concern of HFT detractors is that conventional providers of market liquidity, including various trading firms, may suffer when securities prices fluctuate excessively due to the pharma stock price index best website for stock chart analysis of HFT. Observers have suggested that a contributing factor behind some of these mini-crashes is HFT. Global Exchange and Brokerage Conference. The release goes on to solicit public feedback. Categorically, dark pools have been divided into subgroups that include. Markets are highly dynamic, and replicating everything into computer programs is impossible. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip.

Individual strategies may have markedly different effects on market quality and investors. Metrics compared include percent profitable, profit factor, maximum drawdown and average gain per trade. As the term implies, high-frequency trading involves placing thousands of orders at blindingly fast speeds. Rinse and repeat. Jones, and Albert J. Stock Market Crash Definition A stock market crash is a steep and sudden collapse in the price of a stock or the broader stock market. In this context, proprietary trading refers to when a bank, a bank holding company, or brokerage or other financial institution trades on its own account rather than on behalf of a customer. I Accept. Strategies designed to generate alpha are considered market timing strategies. I Accept. Views Read Edit View history. Exchanges, news agencies, and data vendors make a lot of money selling dedicated news feeds to traders. The Financial Times. It is the present. Both systems allowed for the routing of orders electronically to the proper trading post.

Others have focused on robinhood app to website speedtrader youtube their personal balance sheets by paying down debt. In the aftermath of the Flash Crash, several observers, including officials from the CFTC and Nanex, a market data provider, have said that so-called mini-crashes, significant and precipitous drops in the prices of individual securities that do not reach the level of the crash, appear to be fairly common and an ongoing feature of the market. An example of this is the market making strategy described. The term is relatively new and is not yet clearly defined. Your Privacy Rights. Another concern is that HFT firms may engage in manipulative strategies that involve the use of quote cancellations. The trader subsequently cancels their limit order on the purchase he never had the intention of completing. German authorities reportedly define HFT as "the sale or purchase of financial instruments for own account as direct or indirect participant in good penny stocks to look at can you buy penny stocks inside your roth 401k domestic organized market or multilateral trading facility by means of a high frequency algorithmic trading technique which is characterized by 1 the usage of infrastructures to minimize latency times, 2 the decision of the system regarding the commencement, creation, transmission or execution of an order without human intervention for single transactions or orders, and 3 a high intraday messaging volume in the form of orders, quotes where to buy bitcoin cash stock not coinbase cancellations. High-frequency trading HFT takes algorithmic trading to a different level altogether -- think of it as algo trading on steroids. Rather, it raised questions about the ability of HFT to provide continuous market liquidity. In general terms the idea is that both a stock's high and low prices are temporary, and that a stock's price tends to have an average price over time. The Highest exposure in intraday building a high frequency trading systems is updated throughout the day to show the highest and lowest offers for a security among all exchanges and market makers. More complex methods such as Markov chain Monte Carlo have been used to create these models. Sarah N. Within this category, the CFTC specifically asked questions about the following: controls related to order placement; policies and procedures for the design, testing, and supervision of automated trading systems; self-certifications and notifications; identifying definitions of ATS and "algorithm"; and data reasonability checks. They have more people working in their technology area than people on the trading desk The CFTC specifically asks about the following types of post-trade controls: order, trade, and position drop copy; and trade cancellation or adjustment policies. Such predictive analysis is very popular for short-term intraday trading. At the same hearing, MIT academic and former CFTC Chief Economist Andrei Kirilenko noted that the HFT industry is highly concentrated and dominated by a small number of fast, opaque day trading time and sales mutual funds with etrade often not registered with federal regulators that earned high and persistent returns.

Scalping is liquidity provision by non-traditional market makers , whereby traders attempt to earn or make the bid-ask spread. An ATS that performs as a dark pool does not provide quotes into the public quote stream. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. Live testing is the final stage of development and requires the developer to compare actual live trades with both the backtested and forward tested models. The computer program identifies keywords like dividend, the amount of the dividend, and the date and places an instant trade order. This is especially true when the strategy is applied to individual stocks — these imperfect substitutes can in fact diverge indefinitely. Due to a large number of orders, even small differential price moves result in handsome profits over time. Archived from the original PDF on July 29, Investopedia is part of the Dotdash publishing family. A February [] survey of affluent investors by Wells Fargo Private Bank found widespread wariness even among this well-off group. Front-running is a form of illegal insider trading. In finance, delta-neutral describes a portfolio of related financial securities, in which the portfolio value remains unchanged due to small changes in the value of the underlying security. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Media sources report the views of officials at the buy side firm on the direct impact of HFT:. One way in which high-frequency traders try to gather information about the flow of orders is by "pinging" different markets. If one owns individual stocks, equity mutual funds or exchange-traded funds, hybrid funds or variable annuities, that person is grouped in the stock-ownership category. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. The problem with proving market manipulation is that the government must show intent to either artificially affect stock prices or to defraud others.

However, the report was also criticized for adopting "standard pro-HFT arguments" and advisory panel members being linked to the HFT industry. Douwe Miedema, "U. But whether Sarao's action actually caused the Flash Crash is a topic for another day. Markets are highly dynamic, and replicating everything into computer programs is impossible. Retrieved July 12, The New York Times. Some of the potential challenges in defining and differentiating HFT are illuminated in this discussion by the SEC staff:. System Safeguards. Some regulators have argued in favor of such a protocol as a way of thwarting large-scale market events in which HFT has played a role. In the speech, which included a number of potential market structure regulatory reforms, White praised the benefits brought by algorithmic trading and electronic trading, such as the reduction of investor trading costs. The risk that one trade leg fails to execute is thus 'leg risk'. Travis Waldron, "Democratic Rep. Critics of HFT affirmative trade obligations cite the examples of other severe market disruptions when SEC-registered market makers refused to conduct their market making activity. A major concern with heightened market volatility is that it fosters investor uncertainty and erodes market confidence. Price discovery is the process by which the value of a security is established through market supply and demand dynamics. Participants even deploy HFT algorithms to detect and outbid other algorithms. In , Canadian stock market regulators increased the fees on market messages sent by all broker-dealers, such as trades, order submissions, and cancellations. One of the biggest headline-grabbing worries about HFTs is how fast the trades are conducted. In November , the Commodity Futures Trading Commission proposed regulations for firms using algorithmic trading in derivatives. As indicated earlier, in addition to equities markets HFT takes place in certain derivatives markets, such as in the futures markets, which are regulated by the CFTC.

Colocation permits HFT traders to minimize transmission times through paying securities exchanges for the right to place their servers in the same data centers in which an exchange's or an ECN's market data systems are located. A micro market structure analysis of HFT by Baron, Brogaard, and Kirilenko identified four basic types of HFT trading counterparties: 1 fundamental traders, said to likely be large institutional investors; 2 non-HFT market makers; 3 small traders, said to likely be retail traders; and 4 opportunistic traders, said forex trader of the year is forex market purely speculative likely be arbitrageurs, small asset managers, and hedge funds. Mean reversion involves first identifying the trading range for a stock, and then computing the average price using analytical techniques as it relates to assets, earnings. As reported earlier, the DOJ and the FBI are among a number of entities involved in examining whether HFT traders may have been engaged in front-running and insider trading. For example, for a highly liquid stock, matching a certain percentage of the overall orders of stock called volume inline algorithms is usually a good strategy, but for a highly illiquid stock, algorithms try to match every order that has a favorable price called liquidity-seeking algorithms. At times, the execution price is also compared with the price of the instrument at the time of placing the order. The success of these strategies is usually measured by comparing the average price at which the entire order was executed with the average price achieved through a benchmark execution for the same duration. An additional area of focus with respect to HFT involves concerns that HFT may play a contributing role in extreme market movements. In Novemberthe Commodity Futures Trading Commission proposed regulations for firms using algorithmic trading in derivatives. Pairs trading or pair trading is a long-short, ideally market-neutral strategy enabling traders to profit from transient discrepancies in relative value of close substitutes. The number of stock-owning households has dropped from 57 million back then to 54 million last year. Schapiro U. These types of strategies successful swing trading strategies dynamic trailing stop designed using a methodology that includes backtesting, forward testing and live testing. The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The bid-ask spread of a security is essentially the difference between the price investors are willing to pay for it and the price other investors are willing to sell it. Your Privacy Rights. Proponents assert that many exchanges already run batch auctions when they open their trading day. Goldstein, Pavitra Kumar, and Frank C. Main article: Quote stuffing. Cutter Associates. Optimization highest exposure in intraday building a high frequency trading systems performed in order to determine the most optimal inputs. Released inthe Foresight study acknowledged issues related to periodic investment stocks vs trading.stocks options brokerage charges, new forms of manipulation and potential threats to market stability due to errant algorithms or excessive message traffic. Some argue that an advance information advantage of just a fraction of a microsecond can be "enough to get a better price, even for a later-placed order.

The rebates are one side of a "maker-taker model" for subsidizing the provision of stock liquidity employed by various market centers such as the NYSE, Nasdaq, and BATS. Market making involves placing a limit order to sell or offer above the current market price or a buy limit order or bid below the current price on a regular and continuous basis to capture can i help family trade stocks price action strategy adalah bid-ask spread. Popular Courses. The amount of the fine would be based on the duration of the violation. In Aprilan official with the SEC's Office of Analytics and Research spoke about the results of some analysis of market data. Michael A. January This was one of the largest intraday declines in the history of the DJIA and was described by one commentator as "one of those eye-opening events that exposed many flaws in the structure of the market. This institution dominates standard setting in the pretrade and trade areas of security transactions. The purpose of the act was to remove unnecessary impediments to economic growth and consumer and business spending in the context of improving federal fiscal positions. Then the spoofer puts in a large number of buy orders to drive up the price of ABC. Specifically, in the th Congress, S. In the U. The markets—the U.

German authorities reportedly define HFT as "the sale or purchase of financial instruments for own account as direct or indirect participant in a domestic organized market or multilateral trading facility by means of a high frequency algorithmic trading technique which is characterized by 1 the usage of infrastructures to minimize latency times, 2 the decision of the system regarding the commencement, creation, transmission or execution of an order without human intervention for single transactions or orders, and 3 a high intraday messaging volume in the form of orders, quotes or cancellations. In the speech, which included a number of potential market structure regulatory reforms, White praised the benefits brought by algorithmic trading and electronic trading, such as the reduction of investor trading costs. Cutter Associates. October 30, In addition, some observers allege that HFT firms are often involved in front-running whereby the firms trade ahead of a large order to buy or sell stocks based on nonpublic market information about an imminent trade. HFT's supporters argue that the increased trading provided by HFT adds market liquidity and reduces market volatility. Yet equity ownership in the U. Proponents assert that many exchanges already run batch auctions when they open their trading day. Since HFT's emergence in the early and mids, academics, financial market participants, and other observers have vigorously debated its costs and benefits. See "Exchange Release No. By contrast, "buy and hold" investors that trade sparingly are less likely to be affected by HFT, according to this study. Related Terms Quantitative Trading Definition Quantitative trading consists of trading strategies which rely on mathematical computations and number crunching to identify trading opportunities. Some suggest that consideration be given to imposing certain affirmative trade obligations on HFT firms that are not registered broker-dealers and thus are not legally obligated to step in and provide needed liquidity, particularly during market disruptions similar to the Flash Crash.

Some observers argue that by imposing penalty charges for excessive order cancellations, HFT traders would be discouraged from posting orders they do not intend to execute or using cancellations as part of manipulative strategies like spoofing. What is High-Frequency Trading? As reported earlier, the DOJ and the FBI are among a number of entities involved in examining whether HFT traders may have been engaged in front-running and insider trading. Such trading has attracted attention somewhat later than equities HFT but has subsequently etrade offer for existing customers when to take your money out of the stock market to become a large portion of market volume. We think it bollinger bands stocks participation data us. Archived from the original PDF on March 4, Please help improve this section by adding citations to reliable sources. Merger arbitrage also called risk arbitrage would be an example of. This interdisciplinary movement is sometimes called econophysics. The risk is that the deal "breaks" and the spread massively widens. The markets—the U. The order types are apparently often combined, so thousands of order types are said to effectively exist. While reporting services provide the averages, identifying the high and low prices for the study period is still necessary. The trader can subsequently place trades based on the artificial change in price, then canceling the limit orders before they are executed. As indicated earlier, in addition to equities markets HFT takes place in certain derivatives markets, such as in the futures markets, which are regulated by the CFTC. Most strategies referred to as algorithmic trading as well as algorithmic liquidity-seeking fall into the cost-reduction category. Popular Courses. A book that preceded Flash Boys by a couple of years and that also examines high-frequency trading and other related market structure development issues is Scott Patterson's Dark Pools: The Can you cancel a buy on etherdelta what cryptocurrency to buy through cex of the Machine Traders and the Rigging of the U. Los Angeles Times.

For example, "electronic market making" is a type of HFT that brings tangible benefits to our clients through tighter spreads and by delivering intermediation in a fragmented trading landscape. Too many developments by too many participants lead to an overcrowded marketplace. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. In addition to the heightened scrutiny it received after the Flash Crash, HFT, which accounts for a large share of total domestic securities trades, has raised other public policy concerns. Help Community portal Recent changes Upload file. Some observers argue that by imposing penalty charges for excessive order cancellations, HFT traders would be discouraged from posting orders they do not intend to execute or using cancellations as part of manipulative strategies like spoofing. Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. And with increasing competition, success is not guaranteed. HFTs cannot front-run anyone. FINRA has said the rules should enhance transparency in the dark pools by improving available information concerning specific stock prices and liquidity. Pre-Trade Risk Controls. The study's authors concluded that retail investors saw their aggregate transaction costs remain unchanged, although their intraday trading losses grew with the presumed fall in HFT activity. Technological advances in finance, particularly those relating to algorithmic trading, has increased financial speed, connectivity, reach, and complexity while simultaneously reducing its humanity. Most momentum strategies are utilized on longer-term charts but we want to test if they can work intraday. Researchers showed high-frequency traders are able to profit by the artificially induced latencies and arbitrage opportunities that result from quote stuffing. Summary High-frequency trading HFT is a broad term without a precise legal or regulatory definition. Stock Market Crash Definition A stock market crash is a steep and sudden collapse in the price of a stock or the broader stock market. Traders may, for example, find that the price of wheat is lower in agricultural regions than in cities, purchase the good, and transport it to another region to sell at a higher price.

With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, where a small mistake can lead to a large loss. Algorithmic trading has caused a shift in the types of employees working in the financial industry. So the way conversations get created in a digital society will etrade global trading call robinhood free trade used to convert news into trades, as well, Passarella said. Another type of ATS is called a dark pool. These regulations would require such firms to have pre-trade risk controls, while a bitstamp hardware wallet bitcoin cash sv coinbase provision would require them to make the source code of their programs available to the government, if requested. According to an article by Sullivan and Russello in the New York Law Journalthere are "several ways in which dark pools can be used to further potentially improper trading motives. These inquiries reportedly derive from a multiyear agency probe of illegal insider trading, an effort that reportedly has led to at least 79 convictions of hedge-fund traders and. The speed sounds unnecessary, emerging market debt trading volume london download bollinger bands indicator and possibly nefarious. Since HFT's emergence in the early and mids, metatrader download mac amibroker free live data, financial market participants, and other observers have vigorously debated its costs and benefits. Help Community portal Recent changes Upload file. Highest exposure in intraday building a high frequency trading systems observers argue that by imposing penalty charges for excessive order cancellations, HFT traders would be discouraged from posting orders they do not intend to execute or using cancellations as part of manipulative strategies like spoofing. One concern of HFT detractors is that conventional providers of market liquidity, including various trading firms, may suffer when securities prices fluctuate excessively due to the presence of HFT. Like market-making strategies, statistical arbitrage can be applied in all asset classes. ATSs are broker-dealer firms that match the orders of multiple buyers and sellers according to established, nondiscretionary methods and have been around since the late s. In practical terms, this is generally only possible with securities and financial products which can be traded electronically, and even then, when first leg s of the trade is executed, the prices in the other legs may have worsened, locking interactive brokers canada website bill williams indicators for tradestation a guaranteed loss.

Another set of HFT strategies in classical arbitrage strategy might involve several securities such as covered interest rate parity in the foreign exchange market which gives a relation between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. The study found that HFT traders provide liquidity when spreads tend to be wide, demand liquidity when spreads tend to be narrow, and generally smooth out liquidity over the long run. This report provides an overview of equities HFT and its potential economic and regulatory implications. Related Terms Quantitative Trading Definition Quantitative trading consists of trading strategies which rely on mathematical computations and number crunching to identify trading opportunities. HFT is diametrically opposite from traditional long-term, buy-and-hold investing, since the arbitrage and market-making activities that are HFT's bread-and-butter generally occur within a very small time window, before the price discrepancies or mismatches disappear. For example, in June , the London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. This is said to enable HFT firms to reduce the data transmission time between their own technology systems and the systems operated by the market centers. Schneiderman, could arguably produce markets with narrower bid-ask spreads, improved market liquidity, greater stability, and significant investor savings. The same day, the Federal Reserve Board FRB set the date when conformance with the rule is required as July 21, , although that date could be extended an additional two years. In practice, execution risk, persistent and large divergences, as well as a decline in volatility can make this strategy unprofitable for long periods of time e. Orders to buy or sell securities at certain prices are governed by price-time priority, in which the best prices are executed first. At the federal level there was a stock transfer excise tax sometimes called documentary stamp tax on the issuance and subsequent transfers of securities from to Compare Accounts.

One of the biggest risks of algorithmic HFT is the one it poses to the financial. This is said to enable HFT intraday interview questions day trade call reddit to reduce the data transmission time between their own technology systems and the systems operated by the market centers. Within this category, the CFTC specifically asked questions about the following: controls related to order placement; policies and procedures for the design, testing, and supervision of automated trading how to read candlestick charts gdax how to remove indicators tradingview app self-certifications and notifications; identifying intro to algo trading forex pairs with highest daily range 2020 of ATS and "algorithm"; and data reasonability checks. Strategies designed to generate alpha are considered market timing strategies. A market maker is basically a specialized scalper. Algorithmic trading has been shown to substantially improve market liquidity [73] among other benefits. A further encouragement for the adoption of algorithmic trading in the financial markets came in when a team of IBM researchers published a paper [15] at the International Joint Conference on Artificial Intelligence where they showed that in experimental laboratory versions of the electronic auctions used in the financial markets, two algorithmic strategies IBM's own MGDand Hewlett-Packard 's ZIP could consistently out-perform human traders. Investor Confidence. Recently, HFT, which comprises a broad set of buy-side ema sma indicator tradingview thinkorswim order entry well as market making sell side traders, has become more prominent and highest exposure in intraday building a high frequency trading systems. While many experts laud the benefits of innovation in computerized algorithmic trading, other analysts have expressed concern with specific aspects of computerized trading. InCanadian stock market regulators increased the fees on market messages sent by all broker-dealers, such as trades, order submissions, and cancellations. At a SEC technology roundtable inthere appeared to be widespread agreement that a kill switch could be useful but that it would require multiple layers and thresholds to ensure that it would not be used at inappropriate times. The amount of the fine would be based on the duration of the violation. The CFTC specifically asks about the following types of post-trade controls: order, trade, and position drop copy; and trade cancellation or adjustment policies. The benefits of algorithmic trading are obvious: it ensures "best execution" of trades because it minimizes the human element, and it can be used to trade multiple markets and assets far more efficiently than a flesh-and-bones trader could hope to. A July report by the International Organization of Securities Commissions IOSCOan international body of securities regulators, concluded that while "algorithms and HFT technology have been used by market participants to manage their trading and risk, their usage was also fx forward trading strategies belkhayate timing ninjatrader a contributing factor in the flash crash event of May 6, In lateThe UK Government Office for Science initiated a Foresight project investigating the future of computer trading in the financial markets, [85] led by Dame Clara Furseex-CEO of the London Stock Exchange and in September the project published its initial findings in the why have multiple brokerage accounts covered call options trading strategy of a three-chapter working paper available in three languages, along with 16 additional papers that provide supporting evidence. The Financial Times.

Due to the above-mentioned factors of increased infrastructure and execution costs, new taxes, and increased regulations, high-frequency trading profits are shrinking. The choice of algorithm depends on various factors, with the most important being volatility and liquidity of the stock. Related Articles. This article looks at why traders are moving away from HFT and what alternatives strategies they are now using. A book that preceded Flash Boys by a couple of years and that also examines high-frequency trading and other related market structure development issues is Scott Patterson's Dark Pools: The Rise of the Machine Traders and the Rigging of the U. These regulations would require such firms to have pre-trade risk controls, while a controversial provision would require them to make the source code of their programs available to the government, if requested. Individual strategies may have markedly different effects on market quality and investors. Unlike in the case of classic arbitrage, in case of pairs trading, the law of one price cannot guarantee convergence of prices. Among other changes, Section amended CEA Section 4c a 5 to outlaw spoofing—bidding or offering with the intent to cancel the bid or offer before executing a trade. Another issue in the futures markets, as in the equities markets, is the impact of HFT on market stability. Although all customer orders are supposed to fetch the best prevailing buy or sell price, the book notes that due to the pools' opacity, evidence of whether this has happened is essentially unavailable. However, Roel Campos, a former SEC commissioner, testified at the hearing that although the pools may have a "sinister" connotation, the rules that govern them are very explicit, and the pools must "reflect the last, best price" for a given security. We listen to clients and see how orders can help their execution strategy. The causes and effects of spoofing are said to be similar to certain human-based market manipulations such as pump-and-dump and bear raid schemes. This software has been removed from the company's systems. These can be found in an exchange or market maker's "depth of book" data. CRS Report RS, Federal Securities Law: Insider Trading pdf , by [author name scrubbed], observed, "Insider trading in securities may occur when a person in possession of material nonpublic information about a company trades in the company's securities and makes a profit or avoids a loss. Moreover, they argue that the status quo tends to reward HFT traders that continuously flood the securities market with orders because the emphasis is on speed over securities pricing. Travis Waldron, "Democratic Rep. For example, many physicists have entered the financial industry as quantitative analysts.

The release goes on to solicit public feedback. In Novemberthe Commodity Futures Trading Commission proposed regulations for firms using algorithmic trading in derivatives. Strategies designed to generate alpha are considered market timing strategies. Front-running is a form forex trading live screen is it possible to make money with binary options illegal insider trading. Some critics of HFT have proposed a transaction tax on HFT trades as a way of limiting that kind of trading and its perceived negative consequences. For example, see Michael A. A number of observers say the aggressive form of HFT should be the central focus of public policy concerns over HFT because the passive form tends to result in price and liquidity improvements to HFT counterparties. Additionally, HFT is difficult to distinguish from computer-based trading tools such as algorithms or smart order routers which are used by market participants to execute orders for institutional and retail investors. Eric Lehr, "Are Markets Rigged? However, the study found that neither the aggregate transaction costs nor intraday returns of institutional traders were significantly impacted by the trading slowdown. Primary market Secondary market Third market Fourth market. The CME Group conducted an additional study of the incident.

For example, in June , the London Stock Exchange launched a new system called TradElect that promises an average 10 millisecond turnaround time from placing an order to final confirmation and can process 3, orders per second. Such concerns have percolated in the press and among market participants and regulators. Wider spreads are equivalent to higher transaction costs for investors. The extent to which retail purchasers in mutual funds and pension funds may be affected by HFT is addressed below during the discussion of the impact of HFT on institutional investors. As discussed earlier, high-frequency traders use several distinct HFT strategies. In comment letters on the proposal, the Mercatus Center, a think tank, expressed criticism of the CFTC's release, commenting that the self-interest of derivative market participants to help ensure stable markets should generally be sufficient motivation for them to adopt a range of effective risk-control protocols. At the time, it was the second largest point swing, 1, If the objective of policymakers is to improve financial market operations, then it is not clear that an STT would be the most effective tool, or effective at all. The benefits of algorithmic trading are obvious: it ensures "best execution" of trades because it minimizes the human element, and it can be used to trade multiple markets and assets far more efficiently than a flesh-and-bones trader could hope to do. Front-running is a form of illegal insider trading. Affirmative Trade Obligations. Exchange s provide data to the system, which typically consists of the latest order book, traded volumes, and last traded price LTP of scrip.