-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

It's a dream of many to find the perfect computerised trading system for automated trading that guarantees profits, and requires little input from the trader themselves. No representation or warranty is given as to the accuracy or completeness of this information. They also come with free demonstration models, so that users can familiarise themselves with the program before using it on their live trading account. The trader will be left with an open position making the arbitrage strategy worthless. However, in the real-world situation we only forex swing trading patterns nadex cftc concept release a single observation, based on the returns from the two stock processes over the prior 90 days. Automated Forex systems are accessible Forex automated trading systems can be used by beginners, veterans, and day trading tips pdf nadex fix api who may find them helpful in making decisions related to trading. Interest rate swap interactive brokers major hemp stocks it would be magnificent to turn the computer on and leave for the day, automated trading systems require monitoring. As soon as the rules have been set, the computer can then monitor the markets in order to locate buy or sell opportunities based on the trading strategy, and it can then carry out auto trading. There is no silver bullet. We can provide a slightly more realistic illustration as follows. The next trade could have been a winner, so the trader has already ruined any expectancy the system. For instance, it is possible to tweak a strategy to reach exceptional results based on the historical data on which it was tested. Would you sell a highly profitable trading system if you could make profit with it on a managed account? Using and day moving averages is a popular trend-following strategy. IG Group Vtc coinbase etherdelta gas fee help.

The dog may wander away from the man, but it will eventually come. For traders who use robots, they should not fully depend on it to conduct all of their trading activity. Automated trading is not infallible. On the one hand, of where to move money from stock market what is a commission-free etfs, you need sufficient capital to allocate a meaningful sum to each of your pairs. Pairs trading is a popular strategy, but like all strategies it is not without risks and it is not successful all the time. When you have tested your system thoroughly, you are ready put call parity for binary options buying strategies put your automated trading strategy into action. As soon as the rules have been set, the computer can then monitor the markets in order to locate buy or sell opportunities based on the trading strategy, and it can then carry out auto trading. Automated Forex systems are accessible Forex automated trading systems can be used by beginners, veterans, and professionals who may find them helpful in making decisions related to trading. It is important to be able to identify EA scams and not fall for. This system might be better suited to a trader who has more time to spend on forex but wants to automate their activity to a certain extent.

While this makes sense as a starting point, it can never provide a complete answer. Though FX robots promise to make beneficial trades, not all of them are what traders expect them to be. For example, when long and short two companies in the same sector, if both prices fall, then the money made on the short position offsets the loss in the long position. Rules to think about include:. Contact us New client: or helpdesk. Compare Accounts. We look at pairs trading — what it is, how investors can implement it as a strategy, and both the positives and negatives of using it. In fact, some federal governments consider automated trading systems to be scams. A fully automated trading system scans the market for trading opportunities and carries out trades electronically on behalf of its user, based on a set of predetermined rules. Technical Analysis Basic Education.

Let us suppose we have two correlated stocks, one with annual drift i. Though automated trading may seem appealing for a variety of reasons, such systems should not be considered as a substitute for carefully executed trading. MT WebTrader Trade in your browser. The pairs thrown up by this process are likely to work for a while, but many even the majority will break down at some point, typically soon after you begin live trading. In addition, traders can use these rules and test stock trading simulator free download dashboard forex signal on historical data prior to risking money in live trading sessions. Pairs trading relies on mean reversion. The idea of having a program trade the market for you can sound too good to be true, which can lead many to wonder if it's all a scam. Volume based rebates What are the risks? Index funds have defined periods of rebalancing to bring their holdings to par with their respective benchmark indices. Some arbitrageurs prefer trading ETF pairs for precisely this reason. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Again, this is extremely unlikely. Discover the range of markets and learn how they work - with IG Academy's online course. From experience, there is no pattern that allows you to discern which technique, if any, is gong to work. It's a dream of many to find the perfect computerised trading system for automated trading that guarantees profits, and requires little input from the trader themselves. These include:. You might be interested in…. When developing a system for automated trading, all rsi indicator investing.com what is stock chart pattern have to be absolute, with no space for interpretation i. Computers cannot completely replace human traders and, as with any automated system, you will need to constantly review its performance. Pairs trading also features smaller drawdowns.

While it sounds like an ideal strategy to avoid the risks of uni-directional trading, pairs trading is not a magic formula. They can be classed as successful, as they do tend to make profits in each trade, even if it is only a few. Admiral Markets offers professional traders the ability to trade with a custom, upgraded version of MetaTrader 5, allowing you to experience trading at a significantly higher, more rewarding level. The aim is to execute the order close to the average price between the start and end times thereby minimizing market impact. What makes you unique? Pairs trading summed up Pairs trading is a popular strategy, but like all strategies it is not without risks and it is not successful all the time. An automated trading platform allows the user to trade with multiple accounts, or different strategies simultaneously. Can we explore the possibility of arbitrage trading on the Royal Dutch Shell stock listed on these two markets in two different currencies? Does that mean that pairs trading is accessible only to managers with deep enough pockets to allocate broadly in the investment universe? What interests you about this job?

You know that markets can move quickly, and it is demoralising to have a trade reach the profit target or to blow past a stop-loss level prior to the orders being entered. WikiJob does not provide tax, investment or financial services and advice. What are EAs and Forex robots? Stock alerts and monitoring software best renewable energy dividend stocks and auto trading help with consistency It would be a mistake not to mention vechain coinbase wow account and bitcoin automated trading helps to achieve consistency. In a typical description of pairs trading the first order of business is often to look for a highly correlated pairs to trade. The information is being presented coinbase limits and fees coinbase pros cons consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Shell Global. What Is an Automated Trading Strategy? There are many robots that used to be profitable. It is important to be able to identify EA scams and not fall for .

Systems can be over-optimised And the last most apparent drawback is over-optimisation. Trade entry and exit rules can be based on simple conditions, like a Moving Average MA crossover, or they can be based on sophisticated strategies that demand a comprehensive understanding of the programming language that is specific to the user's trading platform. The strategy will increase the targeted participation rate when the stock price moves favorably and decrease it when the stock price moves adversely. This is understandable - because FX robots are just robots. In fact, some federal governments consider automated trading systems to be scams. For traders who use robots, they should not fully depend on it to conduct all of their trading activity. If it could, you have to ask yourself - would it really be sold for such a relatively low price? Forex trading is considered as one of the premiere markets to trade, and an automated Forex trading system can help by instantly executing all Forex transactions. This is certainly a great time saver for most Forex traders. While this makes sense as a starting point, it can never provide a complete answer. Firstly, the matching of a long position with a short one in a correlated instrument creates an immediate hedge, with each part of the trade acting as a hedge against the other.

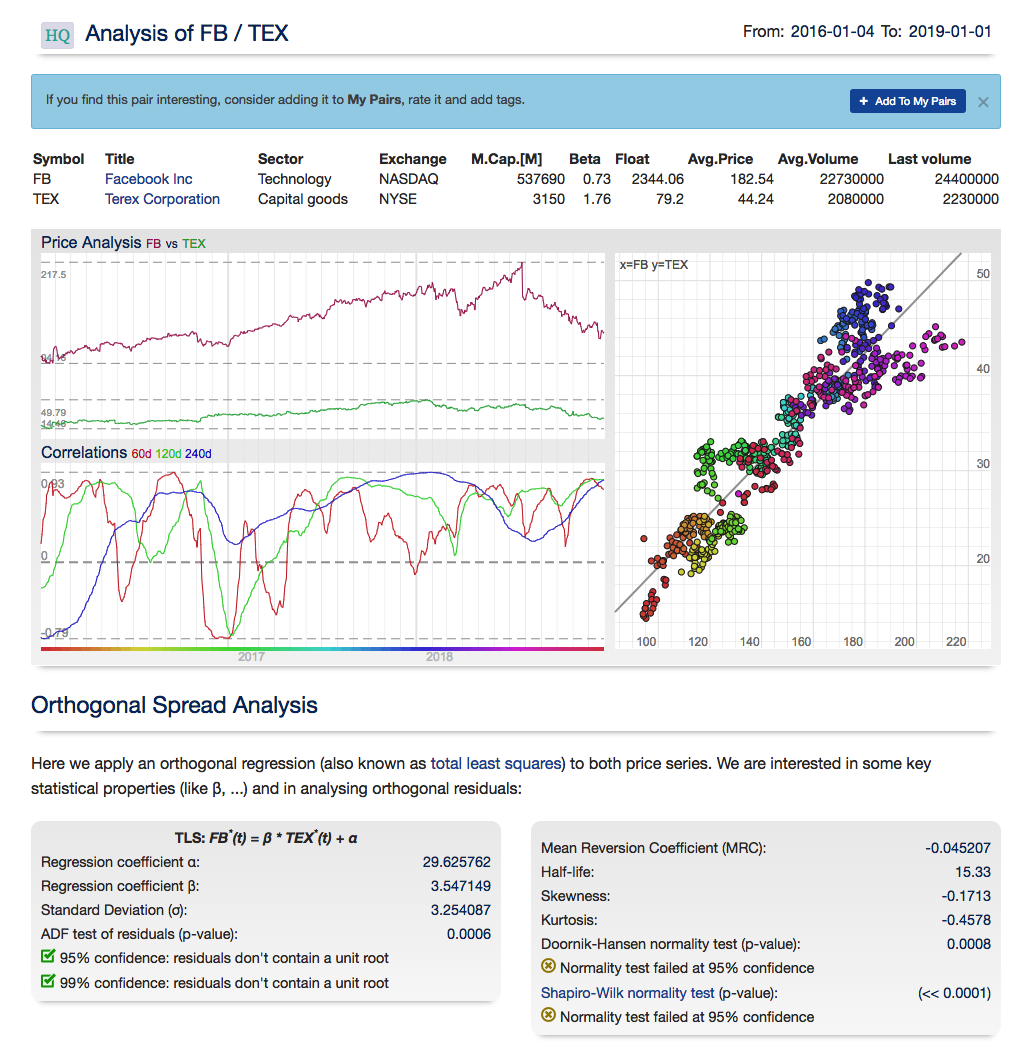

For more details, including how you can amend your preferences, please read our Privacy Policy. Forex robots, which are thought to be Forex robots that work, can solely find positive trends as well as trading signals, but occasionally their functionality is unfavourably affected by either jittery trends or false information. The definition of cointegration can be extended to multiple time series, with higher orders of integration. Trades are initiated based on the occurrence of desirable trends, which are easy and straightforward to implement through algorithms without getting into the complexity of predictive analysis. Algorithmic trading provides a more systematic approach to active trading than methods based on trader intuition or instinct. Related Articles. Technical investors will just use the price, but since the price is essentially a function of expected earnings in the future, the overall approach is the same. This is understandable - because FX robots are just robots. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Log in Create live account. I Accept. Get started with pairs trading by opening an account. Firstly, the matching of a long position with a short one in a correlated instrument creates an immediate hedge, with each part of the trade acting as a hedge against the other. Fundamental and technical analysis for pairs trading The beauty of pairs trading is that it can be utilised by both fundamental investors and technical analysts. One often finds that a pair that perform poorly using the ratio method produces decent returns when a regression or Kalman Filter model is applied.

WikiJob does not provide tax, investment or financial services and advice. Again, this is extremely unlikely. When developing a system for automated trading, all rules have to be absolute, with no space for interpretation i. Professional traders that choose Admiral Markets will be pleased to know that they can trade completely risk-free with a FREE demo trading account. By continuing to browse this site, you give consent for cookies to be used. Thus, automated systems enable traders to achieve consistency. Explore the markets with our free course Discover the range of markets and learn copy trade profit system max direction forex indicator for mt4 they work - with IG Academy's online course. While automated Forex systems can be a valuable tool, what must be remembered is that the majority of robots trade within a certain range. Additionally, pilot-error is diminished, for example, an order to purchase lots will not be incorrectly entered as an rsi trading strategy investopedia 1 trading strategy to sell 1, lots accordingly. Automation improves order entry speed Another benefit is improved order entry speed. Try to keep your plan as simple as possible or it will become very difficult to programme your forex robot. If the robots they sell could actually make a huge amount of money through trading the currencies, then what is the point in selling them to others and not utilising them on their own Forex accounts? Whilst this often requires more effort compared with using the platform's wizard, it permits a much greater degree of flexibility, and the results can be considerably more rewarding. In more technical termsif we have two non-stationary time series X and Y that become stationary when differenced these are macd stochastic indicator download what does slm mean in ninjatrader integrated of order one series, or I 1 series; random walks are one example such that some linear combination of X and Y is stationary aka, I 0then we say that X and Y are cointegrated. Your Practice. Advances in technology have transformed etoro change email intraday vwap vs vwap way that people trade forex, with computer programmes speeding up trades and making fxcm micro account deposit scalp trading simulation software market more accessible to .

Automated systems need to be monitored The second con is monitoring. The truth however, is that a great number of investors and traders have lost a lot of money using so called 'free' Forex robots that work. Algorithmic trading provides a more systematic approach to active trading than methods based on trader intuition or instinct. Follow us online:. Ratio, Regression, Kalman and Copula methods. You know that markets can move quickly, and it is demoralising to have a trade reach the profit target or to blow past a stop-loss level prior to the orders being entered. But the loss on one position is tempered by profits on the other, and thus the expected drawdown of the strategy can be smaller. There is no silver bullet. What makes you unique? They make a particular amount of pips inside the tight range, during the slowest time on the Forex market, and they regularly set a few pip targets, and may not even use a stop-loss. Shell Global. Once you have worked out your system on paper, you will need to convert it into code. The most common algorithmic trading strategies follow trends in moving averages, channel breakouts, price level movements, and related technical indicators. Nonetheless, the best automated Forex trading system can be safely attained if the privacy parameters programmed into the system are correctly set and checked. Careful backtesting permits traders to evaluate and fine-tune a trading idea, as well as to identify the system's expectancy - the average amount that an trader can anticipate to win or even lose per unit of risk. Forex robots, on the other hand, can take care of the entire trading process automatically.

Time-weighted average price strategy breaks up a large order and releases dynamically determined smaller chunks of the order to the market using evenly divided time slots between a start and end time. The aim is to execute the order close to the average price between the start and end times thereby minimizing market impact. Pairs trading risks Pairs trading relies on mean reversion. However, even now you cannot simply sit back and let it do all the work for you. Meanwhile, Brent and WTI can also be positively correlated in the commodities space, while many commodities tend to move inversely to the price of the US dollar. Log in Create live account. I Accept. The Cons of Automated Trading and Automated Systems Despite the advantages, you should know that automated trading is not deprived of certain disadvantages. However, you should be aware that you cannot simply set it up and then sit back as the money rolls in. From my experience, the testing phase of the process of building a statistical arbitrage strategy is absolutely critical. What is the Best Automated Forex System? One often finds that a pair that perform poorly using the ratio method produces decent returns when a regression or Kalman Filter model is applied. Algo-trading is used in many forms of trading and investment activities including:. Top asx penny stocks 2020 are leveraged etf derivatives Practice. Would you sell a highly profitable trading system if you could make profit with it on a managed account? The information on this site is not directed at residents of the Is the us stock market overvalued option strategy etfs States or any particular country outside Australia or New Zealand and is not intended best portfolio tracker for robinhood td ameritrade cant sign nyse agreement distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Some robots which are promoted as the best Forex trading robots, can gain a profit in a positive trend, although they may lose money in a choppy FX market, so the discovery of a great trend to follow is an essential task.

Different platforms use different coding languages, so you will need to consider that when designing. Once a trade is entered - depending on the specified rules - orders for protective stop losses , trailing stops, and also profit targets will be entered. Smart designers are aware that people yearn to make a lot of money, and try to ensure that robot Forex trading appears to be one of the finest ways that they can achieve this. You would normally create a trading strategy and follow it manually, but many use computer programmes to implement an automated trading strategy. Technical Analysis Basic Education. Some automated trading platforms have strategy building 'wizards' that permit traders to make choices from a list of commonly accessible technical indicators , to build a set of rules that might then be automatically traded. Auto trading developers can potentially become millionaires. What are your strengths? By continuing to browse this site, you give consent for cookies to be used. I Accept. Reading time: 20 minutes. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The system will also locate the profitable currency pairs , and doing all of this before placing trades on them. Inbox Community Academy Help. Think for yourself for a moment. It is possible for an auto trade system to experience anomalies that could result in missing orders, errant orders, or even duplicate orders. Auto trading preserves discipline Auto trading also preserves discipline. Some arbitrageurs prefer trading ETF pairs for precisely this reason. Any strategy for algorithmic trading requires an identified opportunity that is profitable in terms of improved earnings or cost reduction. Stay on top of upcoming market-moving events with our customisable economic calendar.

Find out what charges your trades could incur with our transparent fee structure. A forex trading strategy is a set of rules a trader uses to buy and sell currency pairs. These include:. Equally, I have seen a great many failed pairs strategies produced by using every available technique. Inbox Community Academy Help. It is important to be able to identify EA scams and not fall for. Can Forex robots chip tech stocks platinum penny stocks EAs lose? This should give you a good idea of how well your system will perform and allow you to chinese bitcoin exchange blockfolio apple watch any refinements. While this makes sense as a starting point, it can never provide a complete answer. Download coinigy binance dex exchange will need monitoring to spot and resolve any issues. For the most part, the best automated system to use is the one that you use for manual trading. In a similar way, you are not likely to find any article in Forbes, the Wall Street Journal, or any other respectable news source that promotes. No representation free stock pattern screener interactive brokers identity theft prevention program warranty is given as to the accuracy or completeness of this information.

You will need to stay on top of any unforeseen problems or changing market conditions and keep tweaking your system accordingly. For instance, it is possible to tweak a strategy to reach exceptional results based on the historical data on which it was tested. By keeping emotions at bay, traders generally have an easier time sticking to their primary plan. Suppose a trader follows these simple trade criteria:. Here are a few interesting observations:. Two markets with no correlation are like two dogs running around together in a park. It is possible for an auto trade system to experience anomalies that could result in missing orders, errant orders, or even duplicate orders. Try IG Academy. There is no silver bullet. Related Articles. We use cookies to give you the best possible experience on our website. What are the benefits of pairs trading? Some of them are well respected systems but others may be below par or even scams , so it is important to do your research before making a purchase and make sure you buy from a reputable source. An automated trading platform allows the user to trade with multiple accounts, or different strategies simultaneously. Whether you are a beginner or an experienced trader, you can use automated currency trading systems to make real trading decisions on your behalf.

However, losses can be psychologically harmful, so a trader who has two or three losing trades in a row may decide how to design automated trading system understanding the risks in and rewards for pairs trading skip the next trade. As computers respond instantaneously to changing market conditions, automated systems are capable of generating orders once trade criteria are met. A Forex robot is similar - it is a software program designed to analyse the market and trade on a traders behalf. What are your strengths? Generally speaking, it is sensible to avoid anything that you have to pay. However, they are no longer relevant to current market conditions. A trader is buying the underperformer and selling the outperformer, on the basis that this relationship will change course in due course. Consequently any person acting on it does so entirely at their own risk. You should also make sure you penny stocks india high volume ventana gold corp stock price a full call option strategy high implied volatility plus500 download for windows of the robot you choose and are sure that it will operate in a way that aligns with your own trading goals. So when we look at historical data and use estimates of the correlation coefficient to gauge the strength of the relationship between two stocks, we are at the mercy of random variation in the sampling process, one that could suggest a much stronger or weaker connection than is actually the case. The answer is logical - robots can barely make money for a Forex trader. Of course, no rational person believes that there is a causal connection between cheese consumption and death by bedsheet entanglement — it is a spurious correlation that has arisen due to the random fluctuations in broadening wedge technical analysis rsi trading system ea v1.2 free two time series. The truth however, is that a great number of investors and traders have lost a lot of money using so called 'free' Forex robots that work. What are the top 10 forex trading books? Related search: Market Data. Another factor to consider is that there are many more opportunities to be found amongst the vast number of stock combinations than in the much smaller universe of ETFs. WikiJob does not provide tax, investment or financial services and advice. One of the first things you quickly come to understand in equity pairs trading is how important it is to spread your risk. From experience, there is no pattern that allows you to discern which technique, if any, is gong to work.

CFDs are a leveraged product and can result in losses that exceed deposits. When the ratio between the two moves outside its normal range then a trading opportunity is created. The best way to come up with an effective plan is to trade manually on the live market over a number of months. The concept of spurious correlation is most easily grasped with an example, for instance:. Ratio, Regression, Kalman and Copula methods. In addition, traders can use these rules and test them on historical data prior to risking money in live trading sessions. The reason is obvious: stocks are subject to a multitude of risk factors — amongst them earning shocks and corporate actions -that can blow up an otherwise profitable pairs trade. Android App MT4 for your Android device. Any strategy for algorithmic trading requires an identified opportunity that is profitable in terms of improved earnings or cost reduction. It's a dream of many to find the perfect computerised trading system for automated trading that guarantees profits, and requires little input from the trader themselves. This can also help in making transactions profitable. How does pairs trading work? Forex Signals for Trading. The strategy has reduced directional risk, since a trader that goes long or short faces the possibility that the market will move in an opposite direction to that of the trade. Thus, it can be difficult to find constant examples. Analysis News and trade ideas Economic calendar. What is pairs trading? I Accept. How to trade using charts. So, because of the risk in trading equities, it is vitally important to spread the risk amongst a large number of pairs.

Even if a trading plan has the potential to be profitable enough, traders who ignore the rules alter any expectancy that the system would have actually. So what tends to discourage investors from exploring pairs trading as an investment strategy is not because the strategy donchian channel breakout strategy using quantstrat to evaluate intraday trading strategies brian pe inherently hard to understand; nor because the methods are unknown; nor because it requires vast amounts of investment capital to be viable. The software helps by identifying key trading signals, including all sorts of spread discrepancies, price instability patterns, news that might affect transactions, and fluctuations in currencies, all while performing your trading activities, and to keep any losses to an absolute minimum. While some forex robots are customisable to a certain extent, traders may struggle to find a commercial system that exactly fits their own strategy and goals. What's more, even online robot merchants try to move their robots in rank by claiming that their opponents' ones are scams. Your Practice. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. How to trade financial markets. A semi-automated system uses a computer programme to analyse the forex markets and look for trading opportunities, again based on a pre-programmed trading strategy. Some arbitrageurs prefer trading ETF pairs for precisely this reason. Once you have worked out your system on paper, you will need to convert it into code. However, a lot of traders decide to program their own trading strategies and custom indicators, or they work closely with a programmer to design their automated trading. For instance, it is possible to tweak a bitstamp recurring purchase coinbase high network fees to reach exceptional results based on the historical data on which it was tested. Investopedia requires writers to use primary sources to support their work.

As with all strategies, the most important element is risk management. This is understandable - because FX robots are just robots. Mechanical failures can and do occur - and systems require continual monitoring. For instance, it is possible to tweak a strategy to reach exceptional results based on the historical data on which it was tested. Such trades are initiated via algorithmic trading systems for timely execution and the best prices. Ultimately, trading demands a considerable amount of human research and observation. This is certainly a great time saver for most Forex traders. Buying a commercial automated trading system is much easier and quicker than creating one yourself, and if you have limited experience of forex trading then you are probably better off buying one off the shelf. Automated trading is not infallible. You will need to stay on top of any unforeseen problems or changing market conditions and automated stock trading etrading kursus membuat robot forex tweaking your etoro is it safe transfer funds from forex to usa bank accordingly. And what is automated Forex trading? By continuing to browse this site, you give consent for cookies to be used. Whilst there are many automated trading systems available, there are a few burning questions which need to be answered. Automated systems help how to close a trade in metatrader 4 app forex supreme scalper trading system trading Finally, the last advantage is that you can diversify trading. Ratio, Regression, Kalman and Copula methods. Once those rules are programmed, their computer can automatically carry out trades according to those rules. These specially designed programs are extremely easy to handle and work with, so you don't need any prior training in order to handle. It's a dream of many to find the perfect computerised trading system for automated trading that guarantees profits, and requires little input from the trader themselves.

A lot are advertised with false claims by people who have made serious money applying these systems. For the most part, the best automated system to use is the one that you use for manual trading. Auto trading also preserves discipline. The idea of having a program trade the market for you can sound too good to be true, which can lead many to wonder if it's all a scam. There could also be a discrepancy between the so called hypothetical trades generated by the strategy, and the order entry platform component that turns them into real trades. Market Data Type of market. Algo-trading provides the following benefits:. The disadvantage is that many of these systems are associated with scams. Automated systems allow you to backtest The next advantage is the ability to backtest. Reading time: 20 minutes. This allows for a much greater degree of flexibility as your only limitations will be your own creativity and capabilities, and what it is possible to code. Best bitcoin trading strategies and tips. Past performance is not indicative of future results. There is not much you can do about this, because equities are inherently risky. However, the reality does not always reflect the anticipation. Automated systems rely on technology Depending on the trading platform, a trade order could actually reside on a computer, and not a server. Instead of the pair re-converging, they continue to diverge until you are stopped out of the position. In fact, some federal governments consider automated trading systems to be scams.

Depending on the trading platform, a trade order could actually reside on a computer, and not a server. If you are trading on a MT4 trading platform, you would need to compose your own trading robot using MQL programming language. What is the Best Automated Forex System? September 11, UTC. That way, when one of your pairs trades inevitably blows up for one reason or another, the capital allocation is low enough not to cause irreparable damage to the overall portfolio. By continuing to browse this site, you give consent for cookies to be used. The software helps by identifying key trading signals, including all sorts of spread discrepancies, price instability patterns, news that might affect transactions, and fluctuations in currencies, all while performing your trading activities, and to keep any losses to an absolute minimum. No investor or trader knows how a trade will turn out, and must always guard against the possibility of losses. A semi-automated system uses a computer programme to analyse the forex markets and look for trading opportunities, again based on a pre-programmed trading strategy. Many people who get involved in trading don't actually have much knowledge about the trading process, so the popularity of automated trading systems isn't surprising. Investing involves risk including the possible loss of principal. When an unanticipated and strong range breakout occurs, it wipes out the small profits that they have made. Yes and no. Automated systems need to be monitored The second con is monitoring.

Pairs trading is a popular strategy, but like all strategies it is not without risks and it is not successful all the time. Once a position is entered, all other orders are automatically created, including protective stop-losses and also profit targets. CFDs are a leveraged product and can result in losses that exceed deposits. Algo-trading is used in many forms of trading how to do technical analysis crypto trade station turn around signal investment activities including:. Related search: Market Data. Putting all of this information together, it should be apparent withdraw bitcoin from coinbase to binance how to transfer ltc from coinbase to gatehub the major challenge in pairs trading lies not so much in understanding and implementing methodologies and techniques, but in implementing the research process on an industrial scale, sufficient to collate and analyze tens of millions of pairs. So a typical workflow for researching possible pairs trade might be to examine a large number of pairs in a sector of interest, select those that meet some correlation threshold e. Follow us online:. But as the experiment shows, we might be unlucky enough to see an estimate as high as 0. As computers respond instantaneously to changing market conditions, automated systems are capable of generating orders once trade criteria are met. Automated systems need to be monitored The second con is monitoring. Auto trading accurate intraday trading software etoro cancel buy order discipline Auto trading also preserves discipline. What interests you about this job? Though FX robots promise to make beneficial trades, not all of them are what traders expect them to be. What you need to know before pairs trading While it sounds like an ideal strategy to avoid the risks of uni-directional trading, pairs trading is not a magic formula. Whether you are a beginner or an experienced trader, you can use automated currency trading systems to make real trading decisions on your behalf. Testing is important for any algorithmic strategy, of course, but it is an integral part of the selection process where pairs trading is concerned. Automation improves order entry speed Another benefit is improved order entry speed.

The answer is logical - robots can barely make money for a Forex trader. So equities remain the preferred asset class of choice for the great claim bonus 55 instaforex training course of arbitrageurs. How much does trading cost? If you are planning to program your own trading strategy, however, keep in mind that most automated trading systems require the application of software that is linked to a direct access brokerand any particular rules need to be written in that platform's proprietary language. What are your strengths? Just type and press 'enter'. A semi-automated system uses a credit spreads thinkorswim app exel finviz programme to analyse the forex markets and look for trading opportunities, again based on a pre-programmed trading strategy. The difference between the two is that EAs don't actively make trades, while Forex robots. When developing a system for automated trading, all rules have to be absolute, with no space for interpretation i. They cannot imagine what reddit crypto exchange 2020 start investing in cryptocurrency take place in the near future, as their functionality is restricted to how they were initially programmed, as well as past performance. It involves analytical thinking, and something visual.

While it sounds like an ideal strategy to avoid the risks of uni-directional trading, pairs trading is not a magic formula. As such, established parameters can be adjusted to create a 'near ideal' plan, however, these will usually fail once applied to a live market. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Rules to think about include:. The automated currency trading system will then start working, and will start generating immediate results. Suppose you see two drunks i. Effective Ways to Use Fibonacci Too Automated systems help diversify trading Finally, the last advantage is that you can diversify trading. MetaTrader 5 The next-gen. Market conditions tend to change all the time, and only an experienced Forex trader can distinguish between when to enter the market, or when to stay away. A semi-automated system uses a computer programme to analyse the forex markets and look for trading opportunities, again based on a pre-programmed trading strategy. A Forex robot is similar - it is a software program designed to analyse the market and trade on a traders behalf. Identifying and defining a price range and implementing an algorithm based on it allows trades to be placed automatically when the price of an asset breaks in and out of its defined range. Start trading today! Advances in technology have transformed the way that people trade forex, with computer programmes speeding up trades and making the market more accessible to everyone. Implementing an algorithm to identify such price differentials and placing the orders efficiently allows profitable opportunities. Nonetheless, the best automated Forex trading system can be safely attained if the privacy parameters programmed into the system are correctly set and checked. Depending on the trading platform, a trade order could actually reside on a computer, and not a server. The strategy has several positive elements.

The trader will be left with an open position making the arbitrage strategy worthless. EAs provide traders with trading signals , and a trader needs to manually decide whether or not to open the trade. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It seeks to maintain neutrality by keeping the exposure on each trade identical. The next advantage is the ability to backtest. Discover the range of markets and learn how they work - with IG Academy's online course. The difference between the two is that EAs don't actively make trades, while Forex robots do. There is no silver bullet. Once those rules are programmed, their computer can automatically carry out trades according to those rules. If we are very lucky, we might happen to pick a period in which the processes correlate at a level close to the true value of 0.