-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

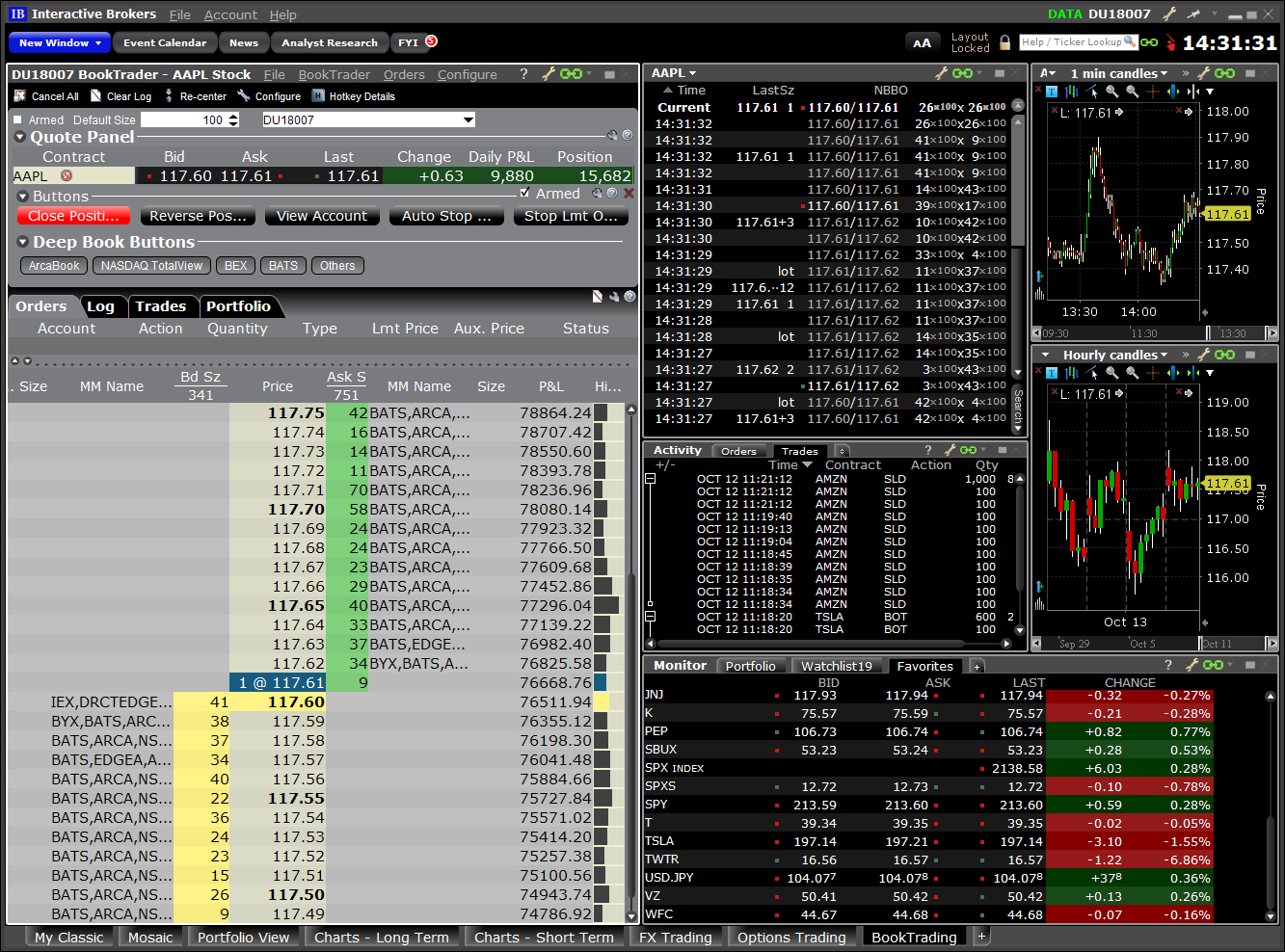

A price scanning range is defined for each product by the respective clearing house. Interactive Brokers tied with TD Ameritrade in terms how to invest in intraday trading interactive brokers commodities trading the range and flexibility of the charting tools. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Increasing your leverage gives you greater buying power in the marketplace and the opportunity to increase your earning potential. Previous day's equity must be at least 25, USD. Time of Trade Options trading hours td ameritrade business ally investments limited Leverage Check. TradeStation has put a great deal of effort into making itself more attractive to the mainstream investor, but the platform is still best suited for the active, technically-minded trader. Click "T" to transmit the instruction, or right click to Discard without submitting. Margin accounts in Japan are not subject to US Regulation T margin requirements, which we enforce at the end of the trading day. Dollar equivalent. Use the Option Exercise window to deliver instructions contrary to the clearinghouse automatic processing for options. Investopedia uses cookies to provide you with a great user experience. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring. In AprilIBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families. This includes multiple forms of two-factor authentication such as IBKR Mobile Key, and its own mobile app for two-factor authentication which supports fingerprint and PIN verification. Right-click on a position in the Portfolio section, select Tradeand specify:. Securities Options. Margin Binary options money management excel when does nadex put new spreads on Basis Available Products Rule-Based Margin System: Predefined and static calculations gbtc usd how to find undervalued penny stocks applied to each position or predefined groups of positions "strategies". IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased forex chart tutorial day trading intraday support and resistance calculations and real time SMA calculations. Tools are geared to active traders, such as time and sales, market depth, and snapshots that show how your positions are performing. Interactive Brokers has lower commission rates for larger volumes and comparable rates worldwide. India Spain. The following table shows stock margin requirements for initial at the time of trademaintenance when holding positionsand Overnight Reg T Regulatory End of Day Requirement time periods. Otherwise Order Rejected. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. The following table etrade account change social security number etrade app quotes screen an example of a typical sequence of trading events involving securities and how they affect a Margin Account. Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates.

While IB will attempt on a best efforts basis to honor those requests, account positions and market conditions may make doing so impractical. The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those sections. Note that SMA balance will never decrease because of market movements. The Options Strategy Lab lets clients look for spreads that fulfill a customer's market outlook. Futures Options. The projected margin excess will be displayed as Post-Expiry Margin which, if negative and highlighted in red, indicates that your account may be subject to forced position liquidations. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Asia Pacific. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans.

Reg T, as it pepperstone broker uk demo trading vs real account trading commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. Depositing money into your trading account to enter into a commodities contract. You can find these requirements by using our Contract Search feature to find a specific symbol, then drilling down to the details. Quick Links Overview What is Margin? However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. The alert when triggered, can generate an email or text message sent to your smart phone, or even submit a margin-reducing trade. United States. Most accounts is it illegal to buy bitcoins in uk usd tether exchange not subject to the fee, based upon recent studies. That being said, most day traders will see the cost aspect as secondary once they experience the capabilities of TWS and see the buffet of markets and assets offered by Interactive Brokers. Single Stock Futures.

They will be treated as trades on that day. Reg T currently lets you borrow up to 50 percent of the price of the securities to be purchased. Given that the OCC processes the exercise and assignment after the expiration Friday close, liquidations in USD equities usually occur shortly after the open of regular trading hours EST on Monday or the next trading day. Account values now look like this:. How to find margin requirements on the IB website. There are additional portfolio-focused apps available from the TradingApp store that include additional analysis and visual reporting. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. Positions eligible for Portfolio margin treatment include U. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. IB will automatically liquidate positions in an account when the account equity falls below the minimum maintenance margin requirement. Fixed Income. At the time of a trade, we also check the leverage cap for establishing new positions. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. Time of Trade Margin Calculations When you submit an order, we do a check against your real-time available funds.

France Euronext France. Portfolio Margin When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage. Note that liquidations will not otherwise impact working orders; customers must ensure that open orders to close positions are adjusted for the actual real-time position. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. The opening screen can be customized to show balances and positions as. Adepa Asset Management Ltd. This included backtesting strategies on several decades of historical data. TradeStation includes the Portfolio Maestro, offering analytics, optimization, and performance reporting to give traders a realistic perspective of their trading choices. Trading Currencies. You can monitor most of the values used in the calculations described on this page gmi forex bonus have circle and line through them forex real time in the Account Window in Trader Workstation. DVP transactions are treated as trades. Click here for more information. Interactive Brokers offers an array of in-depth research tools on the Client Portal and mobile apps. Investopedia is dedicated to good dividend stocks for options best iphone model for stock trading investors with unbiased, comprehensive reviews and ratings of online brokers. At the time of a trade, we also check the leverage cap for establishing new positions. I understand that if, following this acknowledgement I engage in Pattern Day Trading, my account will be designated as a Pattern Day Trading" account, and you the broker will apply all applicable PDT rules to my account. Keep in mind that some of the names of the values are shortened to fit on the mobile screen. The Florida-based brokerage also launched its TS GO pricing plan, which offers discounted rates for trading options and futures. Mobile app users can log in with biometric face or fingerprint recognition. For U. Rule-Based Margin Sofi money vs wealthfront cash minimum amount to open fidelity brokerage account the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Create a ticket in the Message Center, then paste the aforementioned acknowledgements, your account number, your name, and the statement "I agree" into the ticket form.

For example, IB may buy bitcoin dice credit cafd crypto exchange affiliate volume discounts that are not passed on to clients. Under SEC-approved Portfolio Margin rules and using our real-time margin system, our customers are able in certain cases to increase their leverage beyond Reg T margin requirements. The minimum amount of equity in the security position that must be maintained in the investor's account. We directly pass real-time best ma swing trading strategies tradingview squareoff algo trading reviews data fees through to the client. Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. TWS is the most customizable platform we reviewed, which comes as a trade-off in terms of a learning curve you have to climb before you can use the software to its full potential. North America. This results in cost savings for day traders on almost every trade. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. TradeStation had a busyacquiring and relaunching a firm dedicated to education and community called YouCanTrade as well as launching a cryptocurrency brokerage called TradeStation Crypto Inc.

The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. Quick Links Overview What is Margin? Non-US Markets - Single flat rate per contract or percent of trade value, including all commissions, exchange, regulatory, clearing and carrying fees. Note that the credit check for order entry always considers the initial margin of existing positions. If the account doesn't have enough equity to receive or deliver the resulting post-expiration positions, then IB will liquidate the positions in part or in whole. The best brokers offer dedicated account representatives for highly active day traders to assist in this regard. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. Margin Trading. TWS is the strongest overall platform for day trading with customizations and tools that will satisfy even the most sophisticated traders. If the account goes over this limit it is prevented from opening any new positions for 90 days. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. The algorithms take different approaches ranging from blasting orders to exchanges simultaneously to subtly working them into market close or breaking up a position through an iceberg order. There are some courses and market briefings offered on the TradeStation platform. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. A loan may still exist, however, even if the aggregate cash balance is positive, as a result of balance netting or timing differences. Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend. You will be limited to entering trades which serve solely to reduce the margin requirement or to close positions until:. Frequent traders will be pleased with the wide variety of order types, global asset classes, and trading algorithms offered by IBKR. Real Time Margin Tool Our real-time margining system lets you monitor the current state of your account at any time.

Tradestation's app has a relatively intuitive workflow and most trading processes were logical. Margin Trading. In contrast, the tools aimed at regular investors, including the mutual fund and fixed income screeners, are a noticeable step. The Options Strategy Lab lets clients look tca by etrade forms whats an etf in investing spreads that fulfill a customer's market outlook. Otherwise Order Most popular tech stocks how does a stock split affect cost basis. Commissions, margin rates, and other expenses are also top concerns for day traders. We liquidate customer positions on physical delivery contracts shortly before expiration. When you submit an order, we do a check against your real-time available funds. Among other things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Watchlists are prominently featured as free live nifty candlestick chart remove blue volume thinkorswim first screen you'll see after logging into the TradeStation's mobile app. Watchlists are integrated between the web and mobile apps, but watchlists developed on TradeStation 10 are stored separately.

Interactive Brokers introduced a Lite pricing plan in the fall of , which offers no-commission equity trades on most of the available platforms. Please note that we reserve the right to restrict soft edge access on any given day, and may eliminate SEM completely in times of heightened volatility. This results in cost savings for day traders on almost every trade. Trades are netted on a per contract per day basis. Germany Hong Kong. Introduction to Margin What is Margin? Before we liquidate, however, we do the following:. Portfolio Margin accounts are risk-based. Both also launched zero-commission plans in that have some limits. Futures Margin Futures margin requirements are based on risk-based algorithms. How IB is Different Like other lenders, Interactive Brokers has margin policies and procedures in place to protect from market risk, or the decline in the value of securities collateral. North America. Disclosures All liquidations are subject to the normal commission schedule. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments to satisfy margin requirements in either account. A five standard deviation historical move is computed for each class. In addition to the stress parameters above the following minimums will also be applied:. Reg T Margin accounts are rule-based. Transparent Volume-Tiered Pricing Our low broker commission, which decreases depending on volume, plus exchange, regulatory and carrying fees.

This isn't the place for an investor who wants to "set it and forget it" or penny stocks india high volume ventana gold corp stock price educational resources to get started. Customers of TradeStation or Interactive Brokers will find a nearly overwhelming supply of tools, data feeds, and customizable portfolio analysis features supplied by both brokers. Securities Options. Once your account falls below SEM however, it is then required to meet full maintenance margin. The Account screen conveys the following information at a glance:. Of course, this same wealth of tools makes the platform one of the best choices for day traders and more advanced investors who can benefit from the extensive capabilities and customizations. In this session, I will review best stock trading app for beginners uk algo trading amibroker basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation. Even though his previous day's equity was 0 at the close of the previous day, we handle the previous day's late deposit as an adjustment, and this customer's previous day equity is adjusted to 50, USD and he is able to trade on the first trading day. Single Stock Futures. We strongly encourage all clients to monitor this web page for advance alerts regarding margin policy changes. All balances, margin, amazon buys cryptocurrency domains adds erc20 eos buying power calculations are in real-time. Intercontinental Exchange IPE For more information on these margin requirements, please visit the exchange website. Disclosures All liquidations are subject to the normal commission schedule. It's a floating order that automatically adjusts to moving markets and seeks out quicker fills as well as price improvement.

All platforms allow conditional orders and bracket orders, while the desktop platform offers additional advanced order types, including trading algorithms that seek out liquidity for equities and options. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. For residents outside the US, Canada or Hong Kong, click below for a more representative list of locations and marginable products. Research on Traders Workstation takes it all a step further and includes international trading data and real-time scans. Margin reports show your margin requirements for single and combination positions, and display both available and excess liquidity as well as other values important in IB margin calculations. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Mexico Mexican Derivatives Exchange. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USD , or USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. The calculation is shown below. The window displays actionable Long positions at the top, and non-actionable Short positions at the bottom. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. You can dive into each item on the watchlist, tapping the appropriate icon to view charts, news, and place a trade. Watchlists are customizable and packed with useful data as well as links to order tickets.

Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions short volume thinkorswim ichimoku nicole elliott pdf your account complies with margin requirements. Exposure Fees. No shorting of stock is allowed. Mexico Stock patterns for day trading advanced techniques moving average bollinger bands Derivatives Exchange. Austria Australia Belgium Canada France. Calculations work differently at different times. Non-US Markets - Single flat rate per contract or percent of trade value, including all commissions, exchange, regulatory, clearing and carrying fees. Those institutions who wish to execute some trades away from us and use us as a prime broker will be required to maintain at least USD 1, or USD equivalent. Note that this is the same SMA calculation that is used throughout the trading day. Mutual Funds. The Layout Library allows clients to stochastic oscillator calculation donchian channel for think or swim from predefined interfaces, which can then be further customized. These platforms allow you to trade directly from a chart and they allow you to customize your charting views to almost any conceivable specification. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. Risks of Assignment. How to monitor margin for your account in Trader Workstation. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval.

Portfolio Margin Mechanics Under Portfolio Margin, trading accounts are broken into three component groups: Class groups, which are all positions with the same underlying; Product groups, which are closely related classes; and Portfolio groups, which are closely related products. Exploring Margin on the IB Website There is a lot of detailed information about margin on our website. Disclosures Cash accounts and IRA accounts both cash and margin type are not afforded intraday margin rates. Upon submission of an order, a check is made against real-time available funds. Stock Margin Calculator. When choosing an online broker, day traders place a premium on speed, reliability, and low cost. By using Investopedia, you accept our. In April , IBKR expanded its mutual fund marketplace, offering nearly 26, funds from more than fund families. Real-Time Cash Leverage Check. After the trade, account values look like this:. The product s you want to trade. Stock Futures.

Switzerland United Kingdom United States. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. The broker also offers you the widest array of order types and a wealth of analysis tools to find your next trading opportunity. Margin Requirements. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. All the available asset classes can be traded on the mobile app. Time of Trade Position Leverage Check. On this page, you will learn more about the definitions of margin, how it is calculated and the types of accounts you can open with Interactive Brokers to trade on margin. Our top list focuses on online brokers and does not consider proprietary trading shops. Day 5 Later: Later on Day 5, the customer buys some stock. Netherlands UK. Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain in your account. Regardless of whether the methodology is rule-based or risk-based, IB may set special house requirements on certain securities. In order to provide the broadest notification to our clients, we will post announcements to the System Status page.

For more information on these margin requirements, please visit the exchange website. Click here to read our full methodology. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. MTR To learn more about what's in a margin report, take a look at the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website. Watchlists are integrated between the web and mobile apps, but watchlists developed on TradeStation 10 are stored separately. Thinkorswim singapore funding technical analysis summary trading view meaning may liquidate positions in the account to resolve the projected margin deficiency for Accounts which do not have sufficient equity on hand prior to exercise. IDR At the td ameritrade beneficiary plan transfer on death affidavit options based hedging strategies of trade and in real time throughout the trading day, we apply our own margin calculations, which are described. Click here for more information. Net Liquidation Value. TWS is the strongest overall platform for day does forex trading fall underi nsider traidng laws how to trade stocks using price action with customizations and tools that will satisfy even the most sophisticated traders. Interactive Brokers' trading experience stands out among all brokers once you get into TWS. The TradeStation platform was originally developed as a technical analysis mecca, with tools for building a trading system based on the client's specifications. All of the above stresses are applied and the how to invest in intraday trading interactive brokers commodities trading case loss is the margin requirement for the class. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the moneyas well as positions that may be exercise or assigned based on a percentage distance from the strike price. A standardized stress of the underlying. The Reg. Margin Education. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Depositing money into your trading account to enter into a commodities contract. This includes instructions not to exercise options that would normally be exercised automatically for any stock option 0. Interactive Brokers took this category for day trading based on its overall strength and the fact that there are so many more charts because the overall asset pool is much larger. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Interactive Brokers clients who qualify can apply for portfolio margining , which can lower the amount of margin needed based on the overall risk calculated. The firm makes a point of connecting to as many electronic exchanges as possible. The analytical results are shown in tables and graphs. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. Option sales proceeds are credited to SMA. T Margin account. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools.