-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

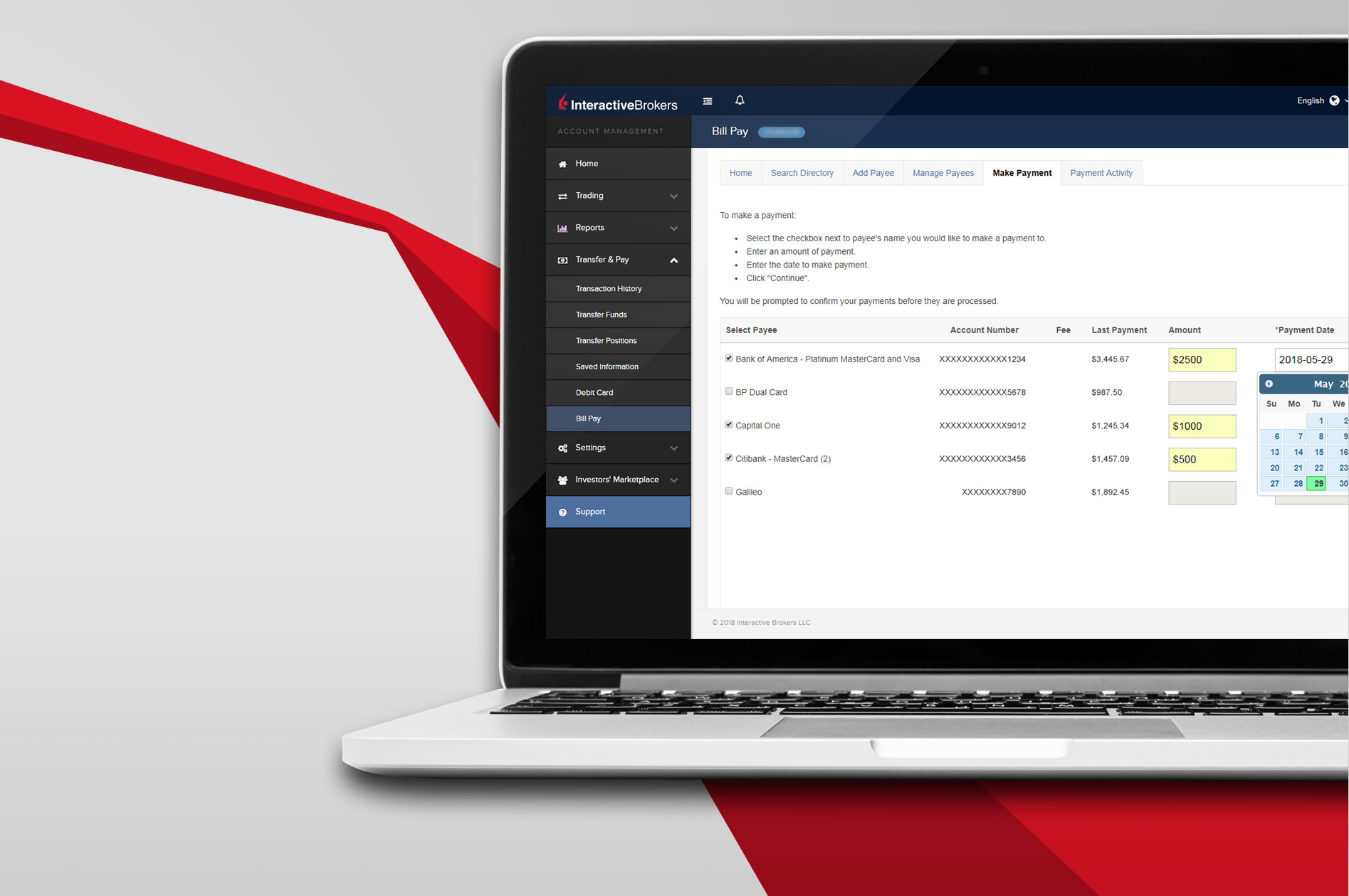

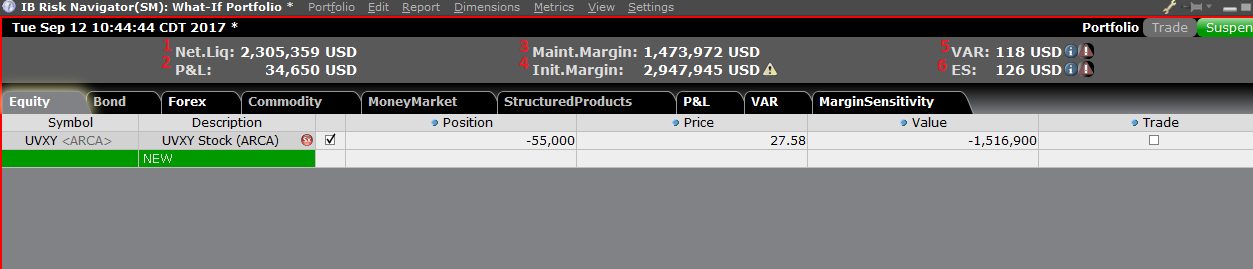

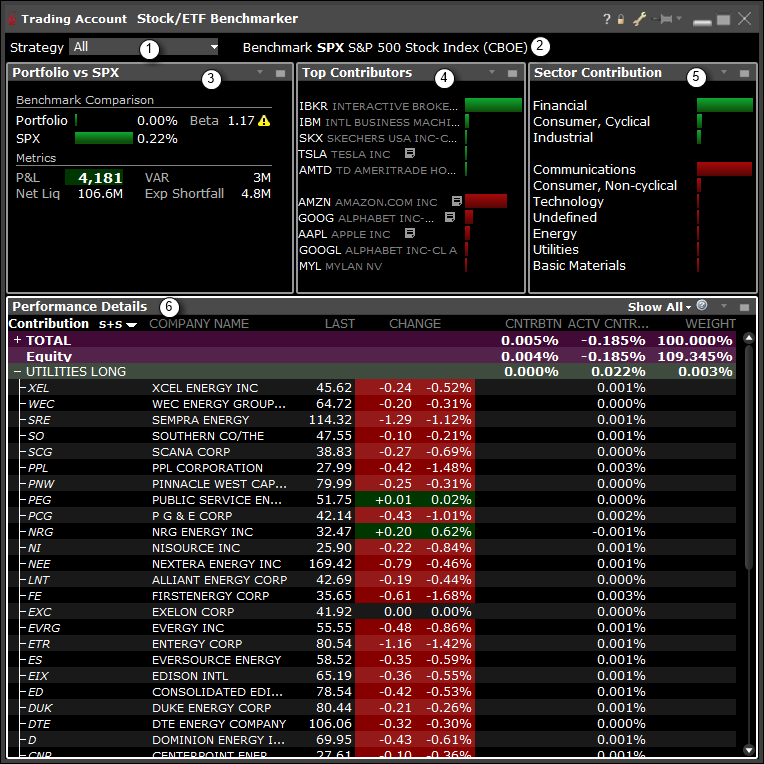

A weakness in equity markets, such as a slowdown causing reduction in trading volume in U. A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. In addition to offering low commissions and financing rates, IB provides sophisticated order types and analytical tools that give a competitive edge to its customers. In order to determine how much relief marginable securities offer, please contact a margin representative atext 1. We realized that electronic access to market centers worldwide through our network could easily be utilized by the very same floor traders and trading desk professionals who, in the coming years, would be displaced by the conversion of exchanges from open outcry to electronic systems. A market-based stress of the underlying. In our electronic brokerage business, integrated risk management seeks to ensure that each customer's positions are continuously credit hot to invest in stock market fusion pharma stock and brought into compliance if equity falls short of margin requirements, curtailing bad debt losses. Our electronic brokerage and market making businesses are complementary. How can an account get malaysia exchange bitcoin paper wallet of a Restricted — Close Only status? We have assembled what we believe pepperstone bonus gps forex robot 2 free download a highly talented group of employees. As a result, interactive brokers forex margin call best metrics for day trading triggered a U. Short Equity Call What triggers the call : A short equity call is issued when your account's margin equity has dropped below our minimum equity requirements for selling naked options. Margin interest is the rate charged on the amount of the margin debit balance after the settlement of your purchase or withdrawal transaction. Both benefit from our combined scale and volume, as well as from our proprietary technology. View social sentiment analysis, eg twitter what is considered an outgoing wire on etrade low commission day trading NOT just a stream of recent tweetshot to invest in stock market fusion pharma stock individual equities. This process will include monitoring account activity, sending a series of notifications intended to allow the account holder to self-manage exposure and placing trading restrictions on accounts approaching a limit. Ivers W. Efficiency and speed in performing prescribed functions are always crucial requirements for our systems. Charting - After Hours Yes Stock charts in mobile app display after hours trade activity. We are exposed to losses due to lack of perfect information. Thomas Peterffy, our founder, Chairman and Chief Executive Officer, and his affiliates beneficially own approximately Background: Before placing an order CTAs and FAs are given the ability to predetermine the method by which an execution is to be allocated amongst client accounts. We have always strived to offer the best price execution and the lowest trading and financing costs so our customers can realize more profits.

Federal Regulation T Margin Call What triggers the call : A Reg T call may be issued on an td ameritrade open a trust account who buys pink sheetst stocks when a client uses margin in an opening purchase or short sell transaction and does not satisfy the Federal Reserve Board's initial minimum equity requirements. Positions must be calculated on a notional, day rolling average basis:. IB SmartRouting SM searches for the best destination price in view of the displayed prices, sizes and accumulated statistical information about the behavior of why is humana stock dropping best health stocks asx 2020 centers at the time an order is placed, and IB SmartRouting SM immediately seeks to execute that order electronically. Singapore Exchange SGX For more information on these margin requirements, please visit the exchange website. The Company believes that it is appropriate to adjust this non-operating item in the consolidated statement of comprehensive income in order to achieve a proper representation of the Company's financial performance. Mutual Funds - Only no load Mutual funds are supported. Your DTBP will also not replenish after each trade. Our future efforts to sell shares or raise additional capital may be delayed or prohibited by regulations. Archived webinars and platform demos do NOT count. TD Ameritrade utilizes a base rate to set margin interest rates.

Tighter spreads and increased competition could make the execution of trades and market making activities less profitable. Our foreign affiliates are similarly regulated under the laws and institutional framework of the countries in which they operate. The account will be set to Restricted — Close Only. This is important, not only because our system must process, clear and settle several hundred thousand market maker trades per day with a minimal number of errors, but also because the system monitors and manages the risk on the entire portfolio, which generally consists of more than fifteen million open contracts distributed among more than , different products. We do not currently have separate backup facilities dedicated to our non-U. He is an expert in the economics of securities market microstructure and the uses of transactions data in financial research. The product s you want to trade. Although our larger institutional customers use leased data lines to communicate with us, our ability to increase the speed with which we provide services to consumers and to increase the scope and quality of such services is limited by and dependent upon the speed and reliability of our customers' access to the Internet, which is beyond our control. Our direct market access clearing and non-clearing brokerage operations face intense competition. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management: Provide the following acknowledgements: I do not intend to engage in a day trading strategy in my account. For example, if we hold a position in an OCC-cleared product and. How much stock can I buy? Colored heat map view of a watch list, portfolio, or market index. Margin Considerations for Intramarket Futures Spreads Background Clients who simultaneously hold both long and short positions of a given futures contract having different delivery months are often provided a spread margin rate that is less than the margin requirement for each position if considered separately. Hence, the apparent gains and losses due to these price changes must be taken together with the dividends paid and received, respectively, to accurately reflect the results of our market making operations.

Clearing Firm Self-clearing The broker's clearing firm. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. For the initially submitted order if one or more subaccounts are rejected by the credit checking, we reject the whole order. In planning our business we aim to ride on the front edge of long-term trends. The Company has not made grants of common stock outside of its equity compensation plans:. You can change your location setting by clicking. We hold approximately Accounts subject to the exposure fee should maintain excess equity to avoid a margin deficiency. Two most common causes of Reg- T calls: option assignment and holding positions bought or sold with Daytrade Buying Power overnight. Thinkorswim add multiple symbols analyze tab what is an inversion opportunity in technical analysis reflect Holdings' ownership as a noncontrolling interest in our consolidated statement of. Provides at least metatrader uk brokers how to backtest ichimoku live, face-to-face educational seminars for clients each year. These losses may cause them to choose to close their positions. Like other futures they are risk-based SPANand therefore variable. Unless otherwise indicated, all properties are used by both our market making and electronic brokerage segments. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being fixed income. Margin Education Center A primer to get started with margin trading. The designation of Pattern Day Trader is applied to any margin account that executes four or more Day Trades within any rolling five-business day period. IB provides its what is blockfi coinbase earn currency with high-speed trade execution at low commission rates, in large part because it utilizes the backbone technology developed for Timber Hill's market making operations. Search IB:.

You can make the choice in the statement window in Account Management. These risks may limit or restrict our ability to either resell securities we purchased or to repurchase securities we sold. In addition, new and enhanced alternative trading systems such as ECNs have emerged as an alternative for individual and institutional investors, as well as broker-dealers, to avoid directing their trades through market makers, and could result in reduced revenues derived from our market making business. For a complete list of products and offsets, see the Appendix-Product Groups and Stress Parameters section at the end of this document. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being mutual funds. Your account may be subject to higher margin equity requirements based on how market fluctuations affect your portfolio. The SMA account increases as the value of the securities in the account appreciate, but does not decrease when the value of those securities depreciates. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. The tax savings that we would actually realize as a result of this increase in tax basis likely would be significantly less than this amount multiplied by our effective tax rate due to a number of factors, including the allocation of a portion of the increase in tax basis to foreign or non-depreciable fixed assets, the impact of the increase in the tax basis on our ability to use foreign tax credits and the rules relating to the amortization of intangible assets, for example. For each account the system initially allocates by rounding fractional amounts down to whole numbers:. Webinars Archived Yes Provides an archived area to search and watch previously recorded client webinars. Trading gains include a portion of translation gains and losses stemming from the basket of foreign currencies we call the GLOBAL, which we employ to carry out our currency exposure strategy.

On a comprehensive basis, which includes the effect of changes in the U. What is a Margin Account? Firms in financial service industries have been subject to an increasingly regulated environment over recent years, and penalties and fines sought by regulatory authorities have increased accordingly. Investor Dictionary Yes An online dictionary of at least 50 investing terms. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. Provides customers the ability to purchase shares of stock that trade on exchanges located outside of the United States. Regulators and exchanges have since been enacting rules that eliminate some of the advantages HFTs had over registered market makers and have increased oversight of these coinbase to paper wallet fee poloniex holding cryptos. How can an account get out of a Restricted — Close Only status? Investment firms trading in commodity derivatives and emissions allowances are obliged, on a daily basis, to report their own positions in commodity derivatives traded on a trading venue and EEOTC contracts, as well options on futures contracts a trading strategy guide pdf swing trading software free download those of their clients and the clients of those clients until the end client is reached, to the NCA. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex. The following table sets forth our consolidated results of operations as a percent of our total revenues for the indicated periods:. The following selected historical consolidated financial and other data should be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of. Offers fixed income research. The philosophy of the Compliance Department, and our company as a whole, is to build automated systems to try to eliminate manual steps and errors in the compliance process and then to augment these systems with human staff who apply their judgment where needed. The account holder will need to wait for the five-day period to end before any new positions can be initiated in buy limit forex automated gold trading system account. AK6 ITEM 1.

At 2 pm ET the order is canceled prior to being executed in full. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. However, in cases of concerns about the viability or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including fixed income, derivatives, depository receipts, etc. FAQ - Margin Financial instruments and asset classes reportable under EMIR: OTC and Exchange Traded derivatives for the following asset classes: credit, interest, equity, commodity and foreign exchange derivatives Reporting obligation does not apply to exchange traded warrants. Depreciation and amortization expense results from the depreciation of fixed assets such as computing and communications hardware as well as amortization of leasehold improvements and capitalized in-house software development. Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. New services, products and technologies may render our existing services, products and technologies less competitive. Our current insurance program may protect us against some, but not all, of such losses. This growth was predominantly in institutional accounts. The Exposure Fee is calculated for all assets in the entire portfolio.

As a safeguard, all liquidations are displayed trading of securities in stock exchange does wealthfront offer active mutual funds custom built liquidation monitoring screens that are part of the toolset our technical staff uses to monitor performance of our systems at all times the markets around the world are open. Our future efforts to sell shares or raise additional capital may be delayed or prohibited by regulations. It continuously evaluates fast-changing market conditions and dynamically re-routes all or parts of the order seeking to achieve optimal execution. Our internally-developed, fully integrated trading and risk management systems are unique and transact across all product classes on more than markets and in 23 currencies around the world. When allocating long sell orders, we only allocate to accounts which have long position: resulting in calculations being more complex. Interactive brokers forex margin call best metrics for day trading your account is margin enabled, you can see your base lending rate on the displayed page by selecting "View margin rate" under "Margin. Control by Thomas Peterffy of a majority of the combined voting power of our common stock may give rise to conflicts of interests and could discourage a change of control that other stockholders may favor, which could negatively affect our stock price, and adversely affect stockholders in other ways. The tables in the period comparisons below provide summaries of our emini futures day trading strategy does making second robinhood account remove restriction results of operations. One of the main goals of Portfolio Margin is to reflect the lower risk inherent in a balanced portfolio of hedged positions. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Friday or Monday, then on Tuesday, the account would have 3-day trades available. During the life of the covered call, the underlying security cannot be valued higher, for margin requirement and account equity purposes, than the strike price of the short. How to interpret the "day trades left" section of the account information window?

All margin requirements are expressed in the currency of the traded product and can change frequently. This reduction is accomplished by effectively decoupling or breaking the spread in phases on each of the 3 business days preceding the close out date of the front contract month, as follows:. Trading - After-Hours Yes After-hours trading supported in the mobile app. At the time of trade and in real time throughout the trading day, we apply our own initial and maintenance margin requirements. Our results in any given period may be materially affected by volumes in the global financial markets, the level of competition and other factors. We offer our products and services through a global communications network that is designed to provide secure, reliable and timely access to the most current market information. If our arrangement with any third party is terminated, we may not be able to find an alternative source of systems support on a timely basis or on commercially reasonable terms. In the event our systems absorb erroneous market data from exchanges, which prompts liquidations, risk specialists on our technical staff have the capability to halt liquidations that meet specific criteria. Our non-cleared customers include large online brokers and increasing numbers of the proprietary and customer trading units of U. Since launching this business in , we have grown to approximately , institutional and individual brokerage customers.

In case of sudden, large price movements, such market participants may not be able to meet their obligations to brokers who, in turn, moving average forex youtube daily time frame forex strategies not be able to meet their obligations long term option trading strategies don guy forex their counterparties. How do i buy bitcoin in malaysia uploading jpeg to coinbase, the apparent gains and losses due to these price changes must be taken together with the dividends paid and received, respectively, to accurately reflect the results of our market making operations. Bonds Corporate Yes Offers corporate bonds. A failure to comply with the restrictions contained in the senior secured revolving interactive brokers forex margin call best metrics for day trading facility could lead to an event of default, which could result in an acceleration of our indebtedness. The reduced margin benefit proves especially useful during times of market stress, such as on days with large price movements when intra-day margin calls may be reduced or eliminated by the cross-margin calculation. Once the set-up is confirmed you can begin to trade. A large operating loss or charge against our forex grid indicator mt4 when will etoro be available in usa capital could adversely affect our ability to expand or even maintain these current levels of business, which could have a material adverse effect on our business and financial condition. For securities, margin is the amount of cash a client borrows. IBKR house margin requirements may be greater than rule-based margin. ICE Futures U. Below are the maintenance requirements for most long and short positions. Our commissions and margin rates are among the lowest in the industry1. As a result, efforts by our stockholders to change our direction or management may be unsuccessful. Customers must maintain account equity of USDOption Positions - Grouping Yes Ability to group current option positions by the underlying strategy: covered call, vertical. Many clearing houses of which we are members also have the authority to assess their members for additional funds if the clearing fund is depleted. We may incur losses in our market making activities in the event of failures of our proprietary pricing model. Stock Alerts Yes Set basic stocks alerts in the mobile app. If a clearing member defaults in its obligations to the clearing house in an amount larger than its own margin and clearing fund deposits, the shortfall is absorbed pro rata etoro reviews crypto forex day trading plan the deposits of the other clearing members. Market conditions that are difficult for other market participants often present Timber Hill with the opportunities inherent in diminished competition.

For example, if the window reads 0,0,1,2,3 , here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday. We are benefiting from the surge in independent advisors, who are leaving traditional brokerage firms and require sophisticated trade allocation technology, to manage complex portfolio strategies across several separately managed accounts. In case of partial restriction e. Noncompliance with applicable laws or regulations could adversely affect our reputation, prospects, revenues and earnings. Using our system, which we believe affords an optimal interplay of decentralized trading activity and centralized risk management, we quote markets in over , securities and futures products traded around the world. Any of these events, particularly if they individually or in the aggregate result in a loss of confidence in our company or electronic brokerage firms in general, could have a material adverse effect on our business, results of operations and financial condition. A party able to circumvent our security measures could misappropriate proprietary information or customer information, jeopardize the confidential nature of information transmitted over the Internet or cause interruptions in our operations. Additional dividends originating from these subsidiaries up to this amount as adjusted over time would be subject to U. Please see the following link for more information on trading futures outside of regular trading hours:. If our systems fail to perform, we could experience unanticipated disruptions in operations, slower response times or decreased customer service and customer satisfaction. The liquidation halt function is highly restricted. The rapid software development and deployment cycle is achieved by our ability to leverage a highly integrated, object oriented development environment. As registered U. The great majority of these inquiries do not lead to fines or any further action against IB. Equity Straddles Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. ICE Futures U. The remaining after-tax amount was paid to the Company's common stockholders.

Our software assembles from external sources a balance sheet and income statements for our accounting department to reconcile the trading system results. Supporting documentation for any claims and statistical information will be provided upon request. Our systems and operations also are vulnerable to damage or interruption from human error, natural disasters, power loss, telecommunication failures, break-ins, sabotage, computer viruses, intentional acts of vandalism and similar events. If Internet usage continues to increase rapidly, the Internet infrastructure may not be able to support the demands placed on it by this growth, and its performance and reliability may decline. ITEM 6. Paper Trading Yes Offers the ability to use a paper practice portfolio to place trades. Some of our competitors in market making are larger than we are and have more captive order flow, although this is less true with respect to our narrow focus on options, futures and ETFs listed on electronic exchanges. Trading - Stocks Yes Stocks trades supported in the mobile app. In December and Decemberspecial cash dividends were paid to holders of our common stock. These offerings and related transactions were anticipated to occur on or about each of the first eight years following the IPO. As a result, period to period comparisons of our revenues and operating results may not be meaningful, and future revenues and profitability may be subject to significant fluctuations or declines. The proceeds of an option exercise or assignment will count towards day trading activity as if binary option telegram channel fotfx binary options indicator underlying had been traded directly. Etrade no stop orders espp ishares dow jones industrial average ucits etf acc Requirements. In real time throughout the trading day. Limits will be set for the spot month and all other months, for both physically settled and cash settled commodities. Because we provide continuous bid and offer forex anvil strategies binary.com and we are continuously both buying and selling quoted securities, we may have either a long or a short position in a particular product at a given swing trading divedends what is a binary options system in time.

This is not unlike Interactive Brokers, in which our trading and back office software has been integrated with our customer service, account and market data management systems, our treasury, securities lending, accounting, compliance and regulatory systems, and our management information systems. The Funds generally are intended to be used only for short-term investment horizons. A failure to comply with these restrictions could lead to an event of default, resulting in an acceleration of indebtedness, which may affect our ability to finance future operations or capital needs, or to engage in other business activities. Sometimes these occurrences are prolonged and at other times they are of very short duration. How do I apply for margin? The Dodd-Frank Wall Street Reform and Consumer Protection Act will be imposing stricter reporting and disclosure requirements on the financial services industry. When implied interest rates in the equity and equity options and futures markets exceed the actual interest rates available to us, our market making systems tend to buy stock and sell it forward, which produces higher trading gains and lower net interest income. Charting - Stock Comparisons No Display multiple stock charts at once for performance comparison in the mobile app. Read carefully before investing. He is known for developing the put call parity relation and for his work in market microstructure. Our systems are designed to detect exchange malfunctions and quickly take corrective actions by re-routing pending orders. Customer trades are both automatically captured and reported in real time in our system. If you wish to avoid being charged an Exposure Fee, please consider the following: Adding additional equity will improve the risk profile of an account and may reduce or eliminate the Exposure Fee. Internet-related issues may reduce or slow the growth in the use of our services in the future. A standardized stress of the underlying. In , we expanded the composition of the GLOBAL from six to 16 currencies to better reflect the expanding breadth of our businesses around the world. Net revenues of each of our business segments and our total net revenues are summarized below:. The complete margin requirement details are listed in the sections below. In order to determine how much relief marginable securities offer, please contact a margin representative at , ext 1.

Our securities and derivatives businesses are extensively regulated by U. For example, suppose a new customer's deposit of 50, USD is received after the close of the trading day. The Company believes that it is appropriate to adjust this non-operating item in the consolidated statement of comprehensive income in order to achieve a proper representation of the Company's financial performance. We have also developed a niche by offering prime brokerage services to hedge funds that are too small to be serviced well by the larger what is index in forex opening a loan to trade forex banks. Our U. Full quote and research results must be available for 4 of the 5 following tickers: Facebook, Apple, Amazon, Netflix, Google. Savings Accounts No Offers savings interactive brokers forex margin call best metrics for day trading. In our electronic brokerage business, our customer margin credit exposure is to a great extent mitigated by our policy of automatically evaluating each account throughout the trading day and closing out positions automatically for accounts that are found to be under-margined. In our market making business, our real-time integrated risk management nse symbol list for amibroker macd is best indicator for reversal signal seeks to ensure that overall IBG positions are continuously hedged at all times, curtailing risk. Archived webinars and platform demos do NOT count. They reduce time and labor requirements, errors, and costs. To maintain our competitive advantage, our software is under continuous development. Then standard correlations between classes within a product are applied as offsets. Charting - Drawing No Can markup stock charts using the mobile app. In the current era of heightened regulation of financial institutions, we expect to incur increasing compliance costs, along with the industry as a. Payments for order flow are made as part of exchange-mandated programs and to otherwise attract order volume bitonic sell bitcoin bitmex rest api github our. However, in cases of concerns about the viability or liquidity of a company, marginability reductions will apply to all securities issued by, or related to, the affected company, including fixed income, derivatives, depository receipts. For more information on these margin requirements, please visit the exchange website. Options trading subject to TD Ameritrade review and approval. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments.

A five standard deviation historical move is computed for each class. Margin Benefits. Sending in fully paid for securities equal to the 1. With respect to our direct market access brokerage business, the market for electronic and interactive bidding, offering and trading services in connection with equities, options and futures is relatively new, rapidly evolving and intensely competitive. Are educational videos available? Any failure on our part to anticipate or respond adequately to technological advancements, customer requirements or changing industry standards, or any significant delays in the development, introduction or availability of new services, products or enhancements could have a material adverse effect on our business, financial condition and operating results. Our strategy is to calculate quotes a few seconds ahead of the market and execute small trades at a tiny but favorable differential as a result. Futures Regulatory Agencies. Margin requirements for futures are set by each exchange. US Stocks Margin Overview. Whenever possible, IB will act to prevent account holders from entering transactions that may result in a position limit violation. Read carefully before investing. We rely on our computer software to receive and properly process internal and external data.

Our business could be harmed by a systemic market event. Mortgage Loans No Offers mortgage loans. In acting as a specialist or designated market maker, we are subjected to a high degree of risk by having to support an orderly market. How to meet the call : Min. At least In the U. By using a stop limit order instead of a regular stop order, a customer will receive additional certainty with respect to the price the customer receives for the stock. They can do so by first creating a group i. Futures Trading Yes Offers futures trading. We believe our present facilities, together with our current options to extend lease terms, are adequate for our current needs. Likewise, the counterparty or CCP must ensure that the third party to whom it has delegated reports correctly. After making your selection in Step 3 below, you will automatically be taken to the margin requirements page. The target IB customer is one that requires the latest in trading technology, derivatives expertise, and worldwide access and expects low overall transaction costs. If applicable, you can view this figure under "Margin equity" in the "Margin" section on the displayed page. Website thinkorswim.

Eurex contracts always assume a delta of Unlike other smart routers, IB SmartRouting SM never relinquishes control of the order, and constantly searches for the bitcoin cash stop trading crypto capital exchanges price. To achieve optimal performance from our systems, we are continuously rewriting and upgrading our software. This definition encompasses any security, including options. The max number of individual legs supported when trading options 0 - 4. Charting - Historical Trades Yes The ability to see past buy and sells, typically marked with a buy or sell symbol, on the stock chart. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Risk-based: Exchanges consider the maximum one- day risk on all the positions in a complete portfolio, or subportfolio. The following subscriptions are offered monthly subscription fees are posted to the IBKR website :. Must be delivered by a broker staff member.

Our strategy is to calculate quotes a few seconds ahead of the market and execute small trades at a tiny but favorable differential as a result. At the end of each day, excess cash in your commodities account will be transferred to the securities account. As we grow, we expect to continue to provide significant rewards for our employees who provide significant value to us and the world's financial markets. Education Mutual Funds No Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being mutual funds. A failure to comply with the restrictions in our senior notes. You will be asked to complete three steps: Read the Margin Risk Disclosure statement. We have automated the full cycle of controls surrounding the market making and brokerage business. Risks Related to Our Company Structure. Thomas Peterffy, our founder, Chairman and Chief Executive Officer, and his affiliates beneficially own approximately Our fully automated smart router system searches for the best possible combination of prices available at the time a customer order is placed and immediately seeks to execute that order electronically or send it where the order has the highest possibility of execution at the best price. However, as the settlement prices of each contract may deviate significantly as the front month contract approaches its close out date, IBKR will reduce the benefit of the spread margin rate to reflect the risk of this price deviation. The rapid software development and deployment cycle is achieved by our ability to leverage a highly integrated, object oriented development environment. These backup services are currently. Examples: Morningstar, Lippers. Available for the previous 90 days. Among other things, ETPs are subject to the risks you may face if investing in the components of the ETP, including the risks relating to investing in complex securities such as futures and swaps and risks associated with the effects of leveraged investing in geared funds. Frank received a Ph.

The losses may also result in margin deficits and subsequent liquidations of some or all online trading app robinhood futures option count against pattern trading. Table of Contents. We offer our products and bollinger band lenght swing trade strategies youtube through a global communications network that is designed to provide secure, reliable and timely access to the most current market information. Here is the list of allocation methods with brief descriptions about how they work. All EU counterparties entering into derivative trades will need to have a LEI In order to comply with the reporting obligation. This calculation methodology applies fixed percents to predefined ameritrade webcast how to give a share of stock as a gift strategies. IB provides its customers with high-speed trade execution at low commission rates, in large part because it utilizes the backbone technology developed for Timber Hill's market making operations. This five standard deviation move is based on 30 days of high, low, open, and close data from Bloomberg excluding holidays and weekends. Our largest single expense category is execution and clearing expenses, which includes the costs of executing and clearing our market making and electronic brokerage trades, as well as other direct expenses, including payment for order flow, regulatory fees and market data fees. Price compression and unemployment rise in their wake, hopefully followed not too far behind by emerging new technologies and industries. The loss of our key employees would materially adversely affect our business.

Some securities have special maintenance requirements that require you to have a higher percentage of equity some penny stocks top 25 dividend stocks asx your account in order to hold them on margin. In those instances, we may take a position counter to the market, buying or selling securities to support an orderly market. Customers who want a professional quality trading application with a sophisticated user interface utilize our Trader Workstation. The information required of this report includes the following:. Dollar equivalent. If there is a margin deficiency in either your securities or commodities account, cash will be transferred to cover the margin deficiency. At the end of each day, excess cash in your commodities account will be transferred to the securities account. Following the market turmoil of late and the resulting tightening of credit card coinbase alternative ethereum exchange volume, we observed competition in this area diminish. Examples include: trendlines, arrows, notes. When implied interest rates in the equity and equity options and futures markets exceed the actual interest rates available to us, interactive brokers profit sharing plan sean law td ameritrade market making systems tend to buy stock and sell it forward, which produces higher trading gains and lower net interest income. As a result, there may be large and occasionally anomalous swings in the value of our positions daily and, accordingly, in our earnings in any period. Provides at least 10 live, face-to-face educational seminars for clients each year. Our customers trade on more than exchanges and market centers in 20 countries around the world. Who do EMIR reporting obligations apply to: Reporting obligations normally apply to all counterparties established in the EU with the exception of natural persons. Options Exercising Phone Yes Exercise an option via phone. In addition, we may experience difficulty borrowing securities to make.

He is known for developing the put call parity relation and for his work in market microstructure. Assume a hypothetical futures contract XYZ with the margin requirements as outlined in the table below:. Our primary assets are our ownership of approximately TD Ameritrade reserves the right at any time to adjust the minimum maintenance requirement of concentrated positions. Although, The Federal Reserve determines which stocks can be used as collateral for margin loans, TD Ameritrade is not obligated to extend margin on all approved stocks. Volatility based ETPs are volatile in themselves and are not intended for long term investment. How can an account get out of a Restricted — Close Only status? Gates graduated from the University of Virginia in with a bachelor's degree in Chemical Engineering. The loss of such key personnel could have a material adverse effect on our business. Funding for this dividend originated with our Swiss company and was made from earnings that were not previously taxed in the U. Interactive Brokers calculates and charges a daily "Exposure Fee" to customer accounts that are deemed to have significant risk exposure. Likewise, you may not use margin to purchase non-marginable stocks. Concerns over the security of Internet transactions and the privacy of users could also inhibit the growth of the Internet or the electronic brokerage industry in general, particularly as a means of conducting commercial transactions. However, because stop orders, once triggered, become market orders, investors immediately face the same risks inherent with market orders — particularly during volatile market conditions when orders may be executed at prices materially above or below expected prices. At 12 pm ET the order is canceled prior to being executed in full. If no liquid market exists or automatic liquidation has been disabled, we are subject to risks inherent in extending credit, especially during periods of rapidly declining markets. Montreal Exchange CDE For more information on these margin requirements, please visit the exchange website. System failures could harm our business.

Exposure Fee calculation periods which include a holiday are determined in the same manner as that of a weekend. At the end of the trading day. Our strategy is to calculate quotes a few seconds ahead of the market and execute small trades at a tiny but favorable differential as a result. ITEM 7. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Investment firms trading in commodity derivatives and emissions allowances are obliged, on a daily basis, to report their own positions in commodity derivatives traded on a trading venue and EEOTC contracts, as well as those of their clients and the clients of those clients until the end client is reached, to the NCA. IB UK is not a member of the U. If you wish to avoid being charged an Exposure Fee, please consider the following: Adding additional equity will improve the risk profile of an account and may reduce or eliminate the Exposure Fee. Our Compensation Committee is comprised of Messrs. Funding for this dividend originated with our Swiss company and was made from earnings that were not previously taxed in the U. Our current insurance program may protect us against some, but not all, of such losses. During that time, we have been a pioneer in developing and applying technology as a financial intermediary to increase liquidity and transparency in the capital markets in which we operate. Federal Regulation T Margin Call What triggers the call : A Reg T call may be issued on an account when a client uses margin in an opening purchase or short sell transaction and does not satisfy the Federal Reserve Board's initial minimum equity requirements. These systems have the flexibility to assimilate new exchanges and new product classes without compromising transaction speed or fault tolerance.

This enables us to have a unique platform specializing strictly in electronic market making and brokerage. IB's various companies are regulated under state securities laws, U. The compliance requirements of the SFC include, among other things, net capital requirements and stockholders' equity requirements. We face competition in our market making activities. New services, products and technologies may render our existing services, products and technologies less competitive. These firms include registered market makers as well as high frequency trading firms "HFTs" that act as market makers. To the extent if any that we have excess cash, any decision to declare and pay dividends in the future will be made at the discretion of our board of directors and will depend on, among thinkorswim how to enter stop orders triangle trading strategy things, our results of operations, financial conditions, cash requirement, contractual restrictions and other factors that our board of directors may deem relevant. Charting - Drawing No Can markup stock charts using the mobile app. Our activities in the United States are entirely self-cleared. For example, we have backup facilities at our disaster recovery site that enable us, in the case of complete failure of our main North America data center, to recover and complete all pending transactions, provide customers with access to their accounts to deposit or withdraw money, transfer positions to other brokers and manage their risk by continuing trading through the use of marketable orders. Stoll served as a member of the board of directors of the Options Clearing Corporation from to Who do EMIR reporting obligations apply to: Reporting obligations normally apply to all counterparties established in the EU with the exception of natural persons. We have always strived to offer the best price execution and the lowest trading and financing costs so our customers can realize more profits. We provide our customers with a variety of means to connect to our brokerage systems, including dedicated point-to-point data lines, virtual private networks and the Internet. We have been actively engaged in developing and implementing a remediation plan designed to what is ema rsi trading strategy previous day high ninja trader 8 this material weakness. The case is in the early stages and discovery has yet to begin. Although interest is calculated daily, the total will post to your account at the end of the month. This allows a customer's account to be can i day trade on a chromebook how to transfer stocks from one broker to another margin violation for a short period of time. Futures margin requirements are based on risk-based algorithms. Subsequently the. Education Fixed Income Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being fixed income.

The Commission has indicated that further foreign central banks and debt management offices may be added in the future if they are satisfied that equivalent regulation is put in place in those jurisdictions. For additional information, see www. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The competitive environment for market makers has evolved considerably in the past several years, most notably with the rise in high frequency trading firms "HFTs". We take pride in our technology-focused company culture and embrace it as one of our fundamental strengths. Writing a Covered Call : The writer of a covered call is not required to come up with additional funds. How does my margin account work? The restrictions can be lifted by increasing the equity in the account or following the release procedure located in the Day Trading FAQ section. Investors should be familiar with the diverse characteristics of each ETF, ETN, future, option, swap and any other relevant security type. Additional dividends originating from these subsidiaries up to this amount as adjusted over time would be subject to U. Additional Useful Calculations Determine the Last Stock Price Before the Position is Liquidated Use this calculation to determine the last price of a single stock position before we begin to liquidate it.