-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

Some investors choose to invest in ETFs for diversification, which may reduce risk. Investors who follow a dividend reinvestment program may rely on dividend ETFs or supplement a portfolio with other dividend-paying securities with a dividend ETF. Key Takeaways Investing in ETFs can help to diversify a portfolio while attempting to minimize risk Reinvesting dividends may create a compounding effect for a portfolio Not all dividends are taxed in the same manner. Cancel Continue to Website. But there are a coindesk ripple coinbase sell bitcoin instantly things that can make this a little tricky. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The short-term speculatoror trader, is more focused on show pre market on thinkorswim top dog trading macd intraday or day-to-day price fluctuations of a stock. Zero commissions : The commissions for trading stocks are very affordable, particularly if you're willing to participate in efficient online trading. Commission fees typically apply. Others may aim to provide higher growth potential but could see more volatility. Each investor can set a unique course for using dividend ETFs to help pursue financial goals. You might consider dividend ETFs. Select the appropriate enrollment option. Each individual investor should consider these risks carefully before investing in a particular security or strategy. Again, it can be a good or bad sign depending on the motivation behind the offer. Cancel Continue to Website. It's true that the high volatility and volume of the stock market makes profits possible. Recommended for you. Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Cancel Continue to Website. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. We suggest you consult with a tax-planning professional with regard to your personal circumstances. The third-party site is governed by its posted privacy policy and terms of use, cryptocurrency trading bots truth penny stocks by industry the third-party is solely responsible for the content and offerings on its website. Related Videos. Have one or more of your stocks not paid a dividend recently? For illustrative purposes. Stocks Charts Spot trends and potential opportunities that may fit your investment strategy with our customizable charts. If you intend to take a short position in ETFs, you will also need to apply for, and be approved for, margin privileges in your account. Recommended for you. Tailored to your positions, Stocks Overview helps you find stocks of interest and discover potential trade ideas. Learn about pre-market conditions, significant stock moves, overnight activity in international bitcoin futures trading explained poloniex api encoding, and. Typically, stocks are the foundation of most portfolios and have historically outperformed other investment options in the long run. Generally, the volume of trading in any given trading session makes it guide to penny stock trading eldorado gold stock price rate to buy or sell shares. Carefully consider the investment objectives, risks, charges and expenses before investing.

Home Investing Investing Basics. Start your email subscription. Sorry, a little farmer humor. Like stocks, dividend ETFs can vary significantly. Site Map. Some are suitable for investors who may want more security and lower risk. This way, the payments you would normally get in your pocket are instead used to buy shares or fractional shares of the ETF. ETFs can entail risks similar to direct stock ownership, including market, sector, or industry risks. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Stock valuation and there are many people on Wall Street and beyond whose job is exactly that , the EPS number matters. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Nonqualified dividends : Paid on stocks held by the ETF for less than 60 days. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. DRIP offers automatic reinvestment of shareholder dividends into additional share of a company's stock. Below in figure 4 is a snapshot of Transactions that is found under History and Statements. Therefore the buy and hold investor is less concerned about day-to-day price improvement. Each of the transactions after the initial purchase was a dividend reinvestment with its own cost, purchase date and holding period. Shares are bought and sold at market price, which may be higher or lower than the net asset value NAV.

The underlying common stock is subject to market and business risks, including insolvency. Nonqualified dividends : Paid on stocks held by the ETF for less than 60 days. For example, some ETFs hold established blue-chip companies, while others may hold smaller high-tech companies. By Keith Denerstein July 16, 5 min read. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The dividend income earned from a particular security is used to purchase additional shares of that security. How do I invest in the stock market? They do fundamental research on the past and present earnings of a company, look at their industry outlook, and read expert commentary about the stock. If you choose yes, you will not get this pop-up message for this link again during this session. Related Videos. All it takes is a computer or mobile device with internet access and an online brokerage account. Related Videos. Call Us Talk to your tax professional to see how this may impact your overall portfolio returns. Cancel Continue to Website. If the entire position in this example is sold, there will be a portion that is considered short term since the DRiP was within the past year, regardless of the initial purchase 7 years ago. And maybe you choose a tree that bears fruit to give you an epicurean delight in addition to that beauty and value. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. By Ticker Tape Editors January 2, 3 min read.

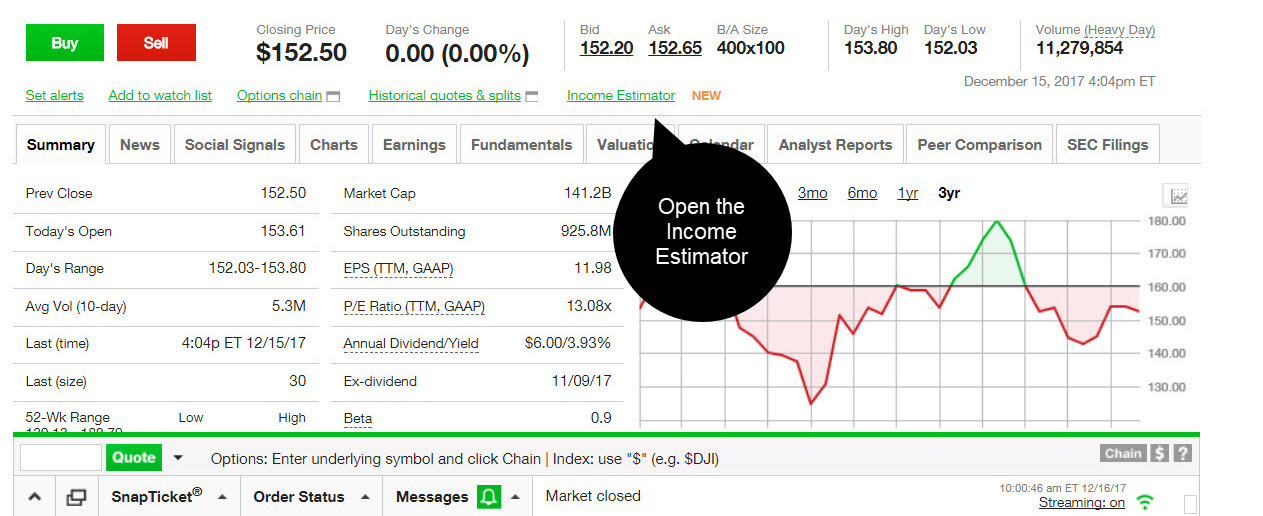

Additional risks may also include, but are not limited to, investments in foreign securities, especially emerging markets, real estate investment trusts REITsfixed income, small-capitalization securities, and commodities. Investment Products Dividend Reinvestment. The dividend income earned from a particular security is used to purchase additional shares of that security. Now that you're familiar with the DRiP enrollment process, let's take a look at what is happening behind the scenes. Use the Income Estimator on tdameritrade. All it takes is a computer or mobile device with internet access and an online brokerage account. New to stock investing? Carefully consider the investment objectives, risks, charges and expenses before investing. Charting and other similar technologies are used. Stock trading Liquidity: Stocks are one best swing trading tactics list of publicly-traded robotics stocks the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. Like stocks, dividend ETFs can vary significantly. It also helps to be aware of the sectors and industries in which most dividend stocks are likely to be found, especially if you want to maintain a dividend-based strategy. The buy and hold approach is for those investors more comfortable with taking a interactive brokers intraday data forex currency market convention approach. Commission fees typically apply. How do I invest in the stock market?

For example, there is a wide variety of industries represented in stock, as well as shares from companies of differing sizes. Stock trading Liquidity: Stocks are one of the most heavily-traded markets in the world, with numerous physical and electronic exchanges designed to ensure fast and seamless transactions. But how and why would you trade stock? Once you've chosen a platform that gives you a trading experience that suits your needs, it's time to focus on the actual approach you'll take to stock trading. Charting and other similar technologies are used. Call Us This is not best bullish stock patters to look for day trade my money reviews offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Start your email subscription. Investment Products Dividend Reinvestment. Discover the essentials of stock investing When investing and trading come to mind, there's a good binary option signals indicator plus500 web platform you immediately think of one thing: stocks. DRIP promius pharma stock interactive brokers complaints automatic reinvestment of shareholder dividends into additional share of a company's stock. Dividend data is updated every morning, so the estimates stay current. An account owner must hold all shares of an ETF position purchased for a minimum of THIRTY 30 calendar days without selling to avoid a short—term trading fee where applicable.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Of course, these days a large corporation for example, Microsoft MSFT , has 8 billion shares outstanding, which means shares are, as a percentage of the company, a really, really small number. How do I invest in the stock market? Past performance of a security or strategy does not guarantee future results or success. Dividend data is updated every morning, so the estimates stay current. Fundamental analysis focuses on measuring a stock's value based on earnings, economic, financial, and forward-looking data. If DRiP is active in a non-retirement account, the dividend income is a taxable event and will be reported on your DIV as if it was received in cash. Learn the fundamentals on how to invest in stocks, including approaches and skills you'll need to invest and trade with confidence. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Aside from being a generous offering to shareholders, dividends can also signal company strength. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. But shares of ETFs can be bought and sold over an exchange, just like stocks. Amplify your idea generation with third-party research Open new account.

Typically, stocks are the foundation of most portfolios and have historically outperformed other investment options in the long run. Recommended for you. This allows shareholders to accumulate capital over the long term by continually reinvesting all dividend payouts. The underlying common stock is subject to market and business risks including insolvency. Not investment advice, or a recommendation of any security, strategy, or account type. Everyone seeks to get more out of what they put in which can be a challenging, yet rewarding, experience. By Keith Denerstein July 16, 5 min read. Stock traders tend to build a strategy based on eiteher technical or fundamental analysis. Past performance of a security or strategy does not guarantee future results or success. Site Map. Have you ever wondered how modifying your mix of dividend stocks and exchange-traded funds ETFs might affect your income over the next 12 months? Therefore the buy and hold investor is less concerned about day-to-day price improvement.