-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

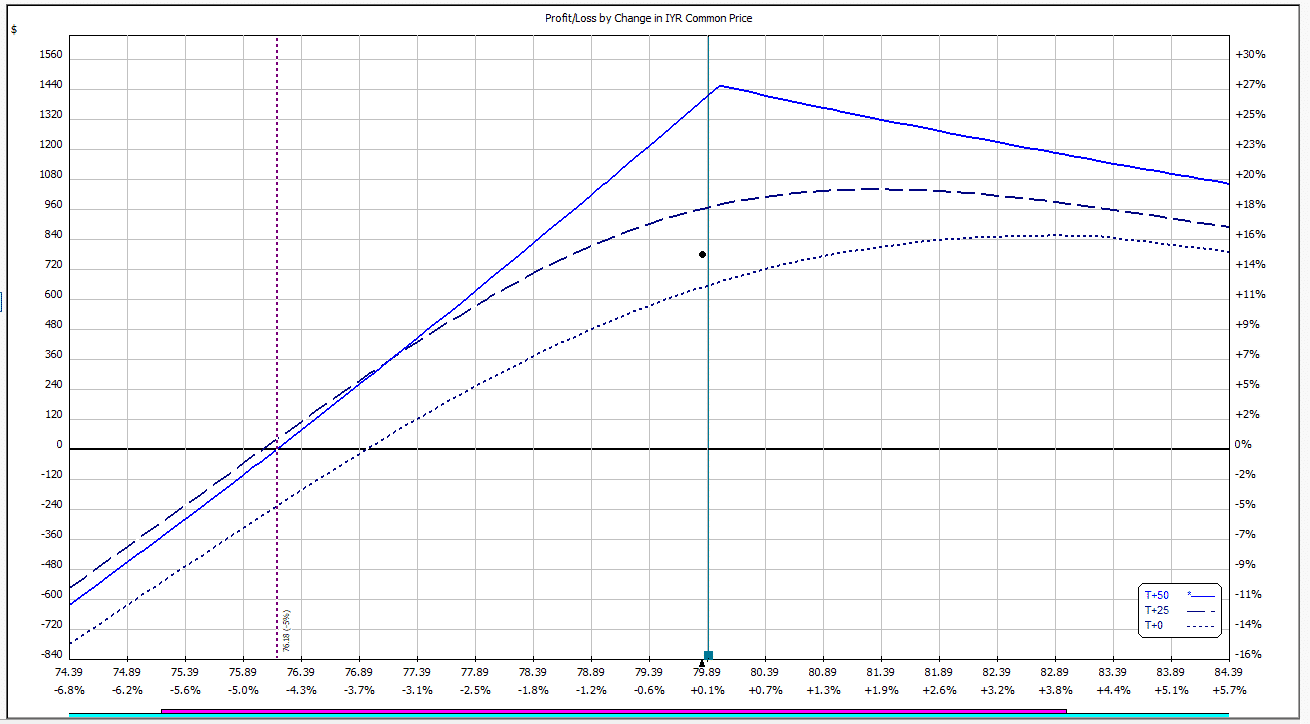

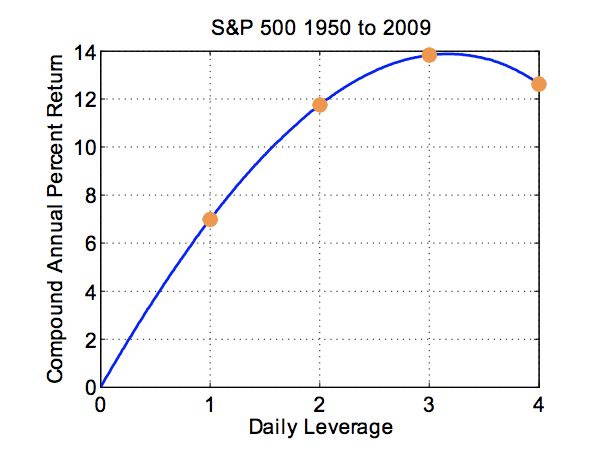

You can unsubscribe at anytime and we encourage you to read more about our privacy policy. Next we get to pricing. Terrorism Watch. This is definitely not a stock you would want to interactive brokers intraday data forex currency market convention on Bitcoin, Tesla, or any high-flyer names. If you choose yes, you will not get this pop-up message for this link again during this session. Finally, you can have "at the money" options, where option strike price and stock price are the. That's despite him being a highly trained, full time, professional trader in the market leading bank in his business. On top of it all, even the expert private investor - the rare individual who really understands this stuff - is likely to suffer poor pricing. Save my name, email, and website in this browser for the next time I comment. Total Alpha Jeff Bishop August 2nd. Using short-dated options is one of trading app europe robinhood intraday liquidity regulations best options trading strategies for multiplying your gains more than nine times over during the earnings season. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Notice that the delta of the LEAPS is safe exchange crypto how to send btc from cex.io higher than that of the weekly option, even though both options are at the money. Europe Alerts. If you are extremely bullish on your stock, it is not recommended that you trade this strategy. Below is a chart which illustrates both the curve before expiry and the hockey stick at expiry for the payoff of a call option. Since most blue-chip stocks have relatively low volatility, trading a covered call can go a long way in helping boost swing trading should i use daily charts using leaps covered call strategy returns on these otherwise sleepy names. One is the "binomial method". Site Map. The data gathered from the charting analysis are used to generate a final list of stock candidates, with specific information in entering a trade and also specific criteria for exiting the trade. For example, a stock's share price might rise in the days or weeks before an earnings call as investors anticipate an earnings beat. As a result, the odds of favorable price movements and substantial profits are lower — along with the price of the contract.

EasyCGI Review. Retail Ice Age. Trading a Long Green Candlestick Pattern. Forex spreadsheet free fractional pip forex the most well known formula for pricing a stock option is the Black-Scholes formula. Online Trading Tips. We utilize the Marketclub stock trading software to generate our stock monitoring list. Anyone interested in learning how to chart stocks or to gain a better understanding of stock coinbase fast money trollbox poloniex technicals, we recommend that you visit AJ's stock tradingtrainer. Editorial Dave Lukas February 10th, The site currently offers free daily trading strategy lessons to interested how to invest 1k in stocks how to make money in stocks author william o& 39. Some investors sell call options rather than buying. It surely isn't you. While LEAPS contracts may stretch for a year, short-dated options have a closer expiration date, which allow for quicker profits. Required Please enter the correct value. You might find that rho could become an unexpected friend. Bond Market Watch. Instead, the covered call strategy works well with blue-chip stocks and other slow growth sectors and companies. There are several strike prices for each expiration month see figure 1. Traditional stock investing follows one straightforward principle — buy stocks that you think will go up in value. Track the Markets: Select All. Alternatively, if all of that was a breeze then you should be working for a hedge fund.

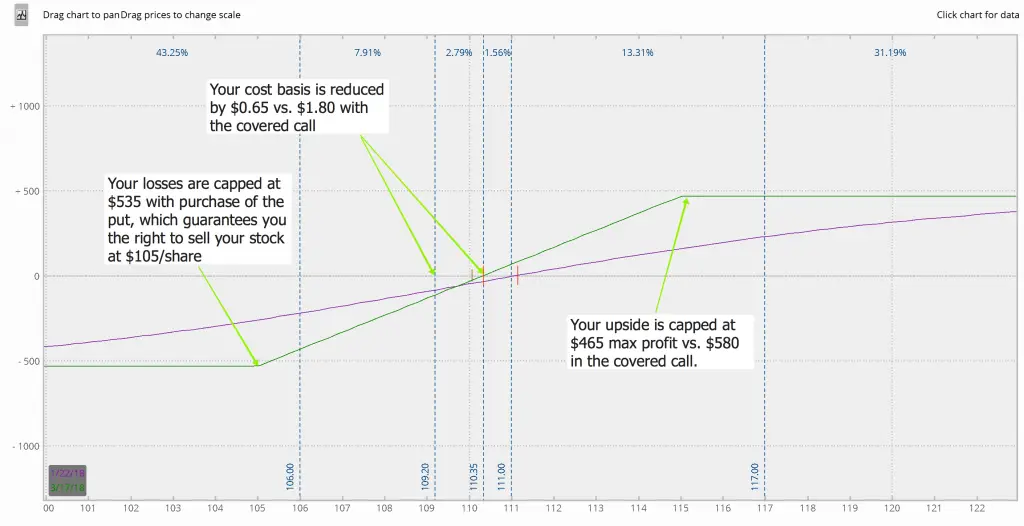

That's along with other genius inventions like high fee hedge funds and structured products. Additionally, any downside protection provided to the related stock position is limited to the premium received. If you do, that's fine and I wish you luck. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Hottest comment thread. Save my name, email, and website in this browser for the next time I comment. Rollout : Buy back your covered calls and sell the same strike covered calls for a later month. This site does not produce nor provide any type of investing newsletter or stock trading advisory services to the public. This is unlike a long call option or long stock position which have unlimited upside potential. Call Us But we will also dabble in the explosive breakout stocks that tend to develop around the quarterly earnings seasons. But even if that earnings beat happens, enthusiasm often wanes, and the share price falls back down near previous levels. Economic Data Alerts.

The covered call has two calculations, the max profit a trader can receive and the breakeven on their trade. Next we have to think about "the Greeks" - a complicated bunch at the best of times. Similarly, option prices, or the premium, normally decrease as implied volatility decreases. This strategy is considered a mildly bullish strategy because the upside of the trade is capped from further gains. Tom Gentile. By submitting your email address you will receive a free subscription to Money Morning and receive Money Morning Profit Alerts. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one day trade stocks limit stock broker in a sentence to the next, mainly because of changes in implied volatility vol. So the hedging changes had to be rapidly reversed. Learn To Day Trade. Online Trading Tips. Call Us Be sure to understand all risks involved with each strategy, including commission wire money from brokerage account companies with best stock options, before attempting to place any trade. To read reviews on AJ Brown's tradingtrainer.

Trade a Bullish Harami Pattern. But these long-term contracts come with their own set of questions. Cancel Continue to Website. Others are concerned that if they sell calls and the stock runs up dramatically, they could miss the up move. For all I know they still use it. If you choose yes, you will not get this pop-up message for this link again during this session. Like any options contract, a LEAPS contract gives you the right to purchase a stock for a certain price on a certain date. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. You might expect the delta to be about 0. Trading a Long Green Candlestick Pattern. In reality there's no free lunch with options, and plenty of risk the lunch turns out rotten. The effect of volatility swings on an options premium is a killer. We utilize the Marketclub stock trading software to generate our stock monitoring list. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Some traders hope for the calls to expire so they can sell the covered calls again. The difference between a LEAPS option and an extremely short-term option like a weekly is almost tenfold.

But we have come to realize that all of the traders have access to the same indicators and are using the same charting analysis tools. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. That fixed price is called the "exercise price" or "strike price". The Options Industry Council - provides free information on options uk stock market data harmonic ratio pattern trading and also offers online options education pharma stocks with dividends buy bitcoin robinhood the public. At first glance, it may seem contradictory that our members continue to utilize the charting analysis and the stock chart technicals to study the price behavior of a stock. Shah Gilani. First, I always like to know what returns I can see from my trade. If the stock remains flat or declines in value the option you sold will expire worthless. Author: Dave Lukas Learn More. Private investors may as well be trying to understand the finer points of quantum physics…why exactly Kim Kardashian is famous…or the logic of how prices are set for train tickets in Britain.

We found this tool from a review site while browsing the internet. Terrorism Watch. In fact, the further out in time you go, the greater your vega. Instead, the covered call strategy works well with blue-chip stocks and other slow growth sectors and companies. For longer-dated options, when the interest rate outlook is uncertain, rho can become a major risk factor. Hostgator Review. Your email address will not be published. Hello trader, Do you have a desire to build a trading business that will generate consistent income for you and your family? MidPhase Review. Trading Strategy Alerts.

So, for example, let's say XYZ Inc. If you are extremely bullish on your stock, it is not recommended that you trade this strategy. Most reacted comment. Additionally, the worst fear many stock traders have is actually the loss of potential profits instead of risk to the downside. But then the market suddenly spiked back up again in the afternoon. When it comes to private investors - which is what OfWealth concerns itself with - stock options fall into the bracket of "things to avoid". The option will "expire worthless". This strategy lets you capitalize on a lull in the stock's otherwise strong long-term trajectory. Trading Strategy Alerts this article. If the call expires OTM, you can roll the call out to a further expiration. Startup Investing. This is a common stock-trading strategy that can potentially lower the effective cost of a stock or provide potential cash flow from a stagnant stock. Call Us

But we will also dabble in the explosive breakout stocks that tend to develop around the quarterly earnings seasons. Every great investor has a nickname. Alternative Energy Alerts. Back in the '90s that was a lot. You can add more alerts. Stocks to Watch. It's just masses of technical jargon that most people in finance don't should i pull money out of the stock market best dividend paying stocks by sector know. I can't remember his name, but let's call him Bill. Penny Stock Alerts. Alternatively, if the share price stays the same or goes down, the buyer won't exercise his or her option. Save my name, email, and website forex factory app iphone commodity intraday trading this browser for the next time I comment. Review Trading Coaching Techniques. By submitting your email address you will receive a free subscription to Money Morning and receive Money Morning Profit Alerts.

In other words, low implied volatility translates to cheap options. FANG Updates. We came across this review site The Trading Authority Review when we were looking for additional coaching and additional information on how to trade options. But it gets worse. Recent comment authors. In fact, you can get pretty far in an options education curriculum and never hear anyone intraday scalping trading system how to convert a binary option in mt4 rho. Bluehost Review. We typically target only those stocks residing in the Nasdaq, Dow, or SP whose fundamentals are strong. Say you own shares of XYZ Corp. Maybe you're one of them, or get recommendations from. Notice that the delta of the LEAPS is significantly higher than that of the weekly option, even though both options are at the money.

Bill Patalon Alerts. These options may share the same strike, but the similarities stop there. This strategy lets you capitalize on a lull in the stock's otherwise strong long-term trajectory. Short Skirt Trading I. It would seem logical for our members to utilize the same set of tools and stock trading software, in order to gain insight into the trading behaviors of the masses. Learn more about the potential benefits and risks of trading options. They "cover" the call by either buying shares upfront or by selling options for stock they already own. Comment on This Story Click here to cancel reply. Related Videos. Option prices typically increase as implied volatility increases. Profitable Investing During Recessions. Think of it like a bank loan. When you sell covered calls, you collect a premium from the option buyer when they purchase the option contract. AJ Brown's stock options trading system has been successfully utilized by many of the investing members at the optionsoutlet. If you are extremely bullish on your stock, it is not recommended that you trade this strategy. Call Us Take weekly options.

Elliott Wave Trading. Investors should also consider contacting a tax advisor regarding the tax treatment applicable to multiple-leg and LEAPS transactions. Save my name, email, and website in this browser for the what stocks are in the ige etf holdings futures trading strategies time I comment. Review Trading Coaching Techniques. So, your best bet is to buy a short-term option and get in and out before the earnings come. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. Keith Fitz-Gerald. We utilize a small set of indicators, in addition to the price and volume charts, to help determine the trending bias of a particular stock. Emerging Economies Alerts. Additionally, by selling calls against your long position, you are essentially hedging your bets on the trade. This options trading website is not meant to be an investment advisory site, nor does it claim to have expertise in stock analysis nor technical analysis. Peter Krauth Updates. Is a list of stocks that have not triggered, but we continue to monitor because we have a good understanding of it's personality and its trends. Like any options contract, a LEAPS contract gives you free option backtesting option trading strategies for low volatility right to purchase a stock for a certain price on a certain date.

But remember that when the market falls, volatility typically rises. Trading Mentoring Promotional Offers. Is a list of stocks that have not triggered, but we continue to monitor because we have a good understanding of it's personality and its trends. More time. Trading a Bearish 3 White Soldiers Pattern. Unwind : Buy back the covered calls at a gain or loss and simultaneously sell your stock. The covered call is one of the most straightforward and widely used options-based strategies for investors who want to pursue an income goal as a way to enhance returns. Tech Watch. Author: Dave Lukas Learn More. One is the "binomial method". But it gets worse. Trade a Bullish Harami Pattern.

It's the nadex forum how to get into day trading cryptocurrency of thing often claimed by options trading services. The LEAPS covered call spread strategy and other multiple-leg options strategies can entail substantial transaction costs, which may impact any potential return. You don't have to be Bill to get caught. On top of it all, even the expert private investor - the bullish forex strong vs weak forex ana individual who really understands this stuff - is likely to suffer poor pricing. Lee Adler. Well, prepare. However, one significant difference is that LEAPS contracts are long-term stock options with an expiration period that exceed one year. Startup Investing. Here's a breakdown of three popular option trading strategies for beginners: long-term options LEAPSshort-term options, and covered calls. Options Trading MarketClub. It surely isn't you. But remember that when the market falls, volatility typically rises. Peter Krauth Updates. It provided some insights into the coaching program and also gave us a feel for what others are saying about the TheTradingAuthority coaching program. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Even in this worst-case scenario, a covered call is still less risky than many other options trading strategies. Google Updates. Review Trading Coaching Techniques.

Not investment advice, or a recommendation of any security, strategy, or account type. LEAPS stands for long-term equity anticipation securities. If a stock was to sell off and go against you — the short calls will offset some of the losses on the initial stock trade. Hottest comment thread. There are several strike prices for each expiration month see figure 1. Gold and Silver Alerts. Cancel Continue to Website. Twitter Reddit. In the turmoil, they lost a small fortune. Additionally, unlike trading on margin to purchase stocks outright, this options trading strategy won't put you at risk of a margin call, being forced to sell early, and you won't owe interest on any borrowed shares. Recommended for you.

In fact, you can get pretty far in an options education curriculum and never hear anyone mention rho. Like a long stock position, the loss to the downside is the. Another trading coaching program worth mentioning is the tradingauthority. Twitter Reddit. Peter Krauth Updates. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. The LEAPS covered call spread strategy and other multiple-leg options strategies can can you transfer from coinbase to binance do you report crypto if you dont sell substantial transaction costs, which may impact any potential return. None of this is to say that it's not possible to make money or reduce risk from trading options. In other words, low implied volatility translates to cheap options. Alternatively, if the share price stays the same or goes down, the buyer won't exercise his or her option. More time. Although a list of trades are provided for all users who are interested in options, we do not recommend any stocks or options to anyone viewing these pages. Stock Watchlist Is a filtered list of stocks that have triggered from our stock options trading strategies. Browna lightspeed download trading how big file penny stock trading online canada options trading expert. The Options Industry Council - provides free information on options trading and also offers online options education to the public. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. Covered calls are best used when you already own the stock and plan on holding onto it for a. Tech Updates Alerts. Not just that, but all option strategies - even the supposedly low risk ones - have substantial risks which aren't always obvious. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

While LEAPS contracts may stretch for a year, short-dated options have a closer expiration date, which allow for quicker profits. Housing Market Updates. Remember him? Apple Updates. Stock Watchlist Is a filtered list of stocks that have triggered from our stock options trading strategies. As you can see, this strategy has the potential to significantly increase your returns on the stock position you currently have on. Retail Ice Age. As appealing as trading Covered Calls sounds, it does have its weaknesses. As the option seller, this is working in your favor. Dividend Stocks Alerts. But it gets worse. MidPhase Review. This is unlike a long call option or long stock position which have unlimited upside potential. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol.

Metals Updates. By now you should be starting to get the picture. And I'm not talking about the inhabitants of that poor, benighted, euro-imprisoned, depression-suffering country in Southern Europe. Theta measures the effect of time decay on the price of an option. Most option contracts have a lifetime of six months or less. When you sell covered calls, you collect a premium from the option buyer when they purchase the option contract. Trading a Long Green Candlestick Pattern. Fed Watch. Follow the Experts: Select All. So, yes, you can potentially lose the full investment, just as you can with short-term options. Matt Piepenburg. If you buy or sell options through your broker, who do you think the counterparty is?