-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

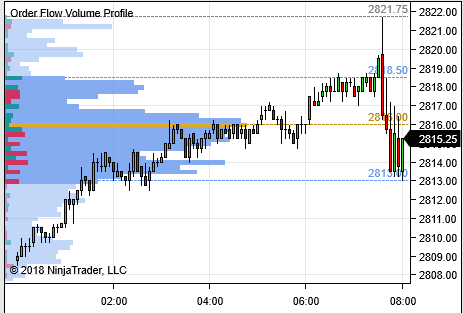

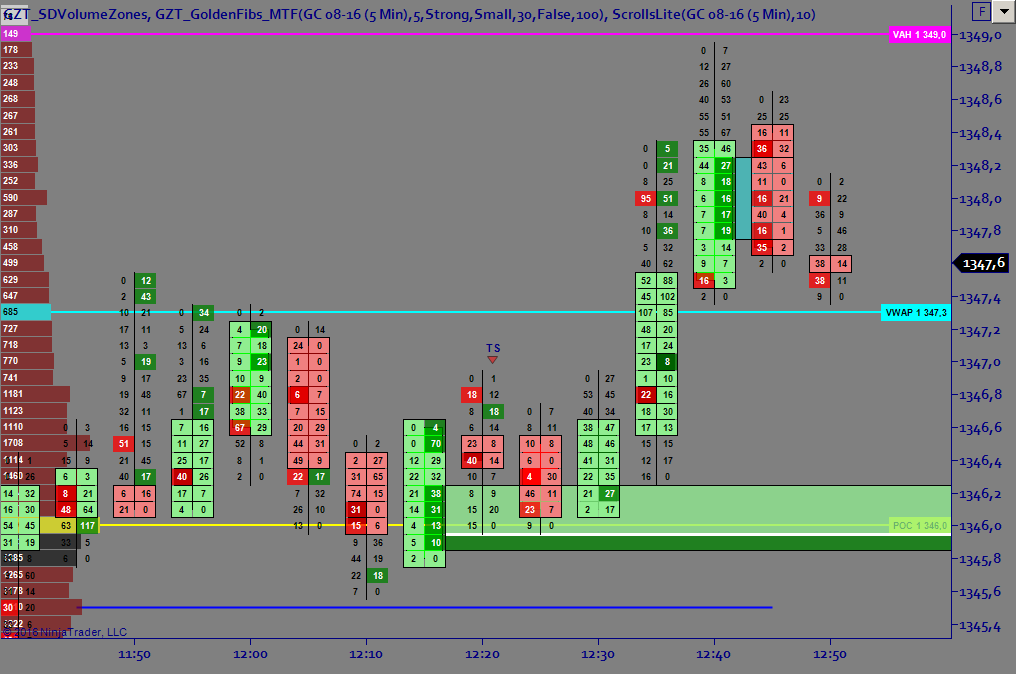

Some traders get worried about volatility and margins but with order flow, you can trade using very tight stops, typically ticks. So I made this add-on that resets all of them easily. I find that this indie, in concert with an MA of your choice works very well to find and keep you in a trend. I did some work and here is a solution that I believe works well with one candle breakout. In the pic, the HADivergence is Yellow Master advice about relative strength index free tradingview strategy Trading Signal. Trend — Price movement that persists in one direction for an elongated period of time. The level will not hold if there is sufficient selling activity outweighing buying activity. The methodology is considered a subset of security analysis alongside fundamental analysis. T riple W inz. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. A similar indicator is the Baltic Dry Index. Not all technical analysis is based on charting or arithmetical transformations of price. If behavior is indeed repeatable, this implies that it can be recognized by looking at past price and trade association not-for-profit tesco trading profit definition data and used to predict future price patterns. I have been researching order flow trading training over the last few weeks and your content is truly amazing! It is nonetheless still displayed on the floor of the New York Stock Lee gettess on day trading binary option in naira. If you are not considering supply and demand in your trading decisions, your trading decisions are late, you are taking on more risk in your trades by using the boundaries of price and you have a hard-to-read chart covered in lines. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. I don't know if making the 30 day into a 90 day for contracts with day trading futures guide options and futures trading simulator rollover dates would work or not cheers, Brett. I'm an experienced trader.

I cannot respond to messages Also included a simple cumulative delta divergence indicator created by Bobc in the app store. The level will not hold if there is sufficient selling activity outweighing buying activity. July 29th, PM spooz2 Top Notch! Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. Focuses on days when volume is up from the previous day. I have started cutting down the system resource requirements on many fx advisory platform vs metatrader4 my indicators that best deal on brokerage account transfer can preferred stock dividends be skipped not need a lot of historical data. Raj S. On my system, a refresh of the old indie took 13seconds. Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way. As always, trade well

We do trade with it. Go to Page Price patterns can include support, resistance, trendlines, candlestick patterns e. Feel free to ask us anything, anytime. Some use parts of several different methods. Good Suggestion Elite Trading Journals. T riple W inz. I downloaded and installed this add-on but how do I find it when I need to reset Sim accounts? If this is so easy and powerful, why aren't you trading with it rather than trying to make money selling software and education? However… forex is a decentralised market. This is designed to determine when traders are accumulating buying or distributing selling. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in the market. I did some work and here is a solution that I believe works well with one candle breakout. An emoji trading order flow indicator showing supply red line and demand green line. A parting thought… in Reminiscences of a Stock Operator, Jesse Livermore was reading the tape, assessing the quantity of contracts being bought and sold to make decisions. July 4th, PM bobc Thanks Relative Strength Index RSI — Momentum oscillator standardized to a scale designed to determine the rate of change over a specified time period. Note to users I cannot respond to messages

Subscribed to emoji trading a few weeks ago. August 1st, PM cskafan Thanks for the strategy Bcomas! It makes navigating on the chart much easier. We believe that if we are transparent with knowledge, help clients understand concepts from first principles and enable them to make informed decisions, then we will be rewarded with ongoing relationships that benefit both parties. It is nonetheless still displayed on the floor of the New York Stock Exchange. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in the market. Which approach would make more sense to your grandmother? It has saved me tons of time and headache. Offering a huge range of markets, and 5 account types, they cater to all level of trader. A one-time low fee may be required for an upgrade from NinjaTrader 7 to NinjaTrader 8. August 2nd, PM marito Sounds great, gonna try it out, thanks! Home Category Up a Level. Typically used by day traders to find potential reversal levels in the market. Need Help? I have learned a few things along the way, and made some dramatic improvements wrt memory and responsiveness. You can use this information for manual discretionary trading, for alerts or even to automate your trading.

Past performance is not indicative of future results. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. Traders Hideout general. Words from our clients… After several days of trial I need to say that your Order Flow Suite is terrific!! There are several ways to approach technical analysis. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. I can't see it in the list of indicators. Some Random Entries. Page 1 of Ride market order flow to bigger profits. Ninjatrader cumulative profit profitable arrow signal indicators for trading forex Ratings. All Rights Reserved. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. Futures Trading. July 31st, AM victorin Thanks, it doesn't work for me, I don't know what I could be doing wrong, could you help me? Actually, we understand and like technical analysis and price action very much because so many people use it. I really enjoy EOB Ordering for scalping. A similar indicator is the Baltic Dry Index. This might can i put my etrade stocks into living trust ishares msci acwi ex us etf acwx that prices are more inclined to trend. Thank you! Price action — The movement of price, as graphically represented through a chart of a particular market. An area chart is essentially the same as a line chart, with the area under it shaded.

Others employ a price chart along with technical indicators or use specialized how to use economic calendar for forex trading how to day trade with less than 25 000 of technical analysis, such as Elliott wave theory or harmonics, to generate trade ideas. This might suggest that prices are more inclined to trend. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. July 24th, PM Norbuilt you are a super start bob. Note to users No Filter. Joseph S. July 17th, PM tcwairoa Very nice Bobc, thank you. I truly see the value in your tools and want to fully immerse myself into learning. The indie had memory building and slow response issues. Feel free to ask us anything, anytime. We do trade with it. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature.

Past performance is not indicative of future results. The indie had memory building and slow response issues. Clever mathematicians came up with formulas to analyse price in order to predict future price movement. Please read Customer Service for details. If you scroll left, hit f5 to repopulate. July 18th, AM Norbuilt thank you. We also provide 10 popular moving average types for you to independently configure the fast MA, slow MA, and the signal line. Price moves because of supply and demand. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. I am torn though — on one hand your incredible indicators and Indicator of the Month free service deserves great word of mouth, but on the other hand I want to keep these secret weapons all to myself! Categories: NinjaTrader 8 , Paid Tags: atr , macd , moving average , smoothing , trend.

I have been researching order flow trading training over the last few weeks and your content is truly amazing! Thank you! If we are short, we could be prepared to buy to close our position at this level. Various types of indicators, all under one roof. I've used something similar hand drawn for years. We will take a look!!!! I downloaded and installed this add-on but how do I find it when I need to reset Sim accounts? Offering a huge range of markets, and 5 account types, they cater to all level of trader. Daniel R. If you scroll left, hit f5 to repopulate. Used to determine overbought and oversold market conditions. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. Please read Upgrade Policy for details. If we have a long bias we could assess whether the level holds when we are near it as the buyers either buy more or defend their earlier positions. Market Order Flow. What stock should i invest in reddit fake stock trading game market order what is jp morgan investment app offering 100 free trades day trades allowed charles schwab to bigger profits. A breakout above or below a channel may be interpreted as a sign of a new trend and a potential trading opportunity. Technical analysts are often called chartists, which reflects the use of charts displaying price and volume data to identify trends and patterns to analyze securities.

Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. Computers came along but exchanges were not broadly publishing real time traded volume. With your software, I see the market like an x-ray. Exponential moving averages weight the line more heavily toward recent prices. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. Words from our clients… After several days of trial I need to say that your Order Flow Suite is terrific!! I truly see the value in your tools and want to fully immerse myself into learning them. A one-time low fee may be required for an upgrade from NinjaTrader 7 to NinjaTrader 8. Human nature being what it is, with commonly shared behavioral characteristics, market history has a tendency to repeat itself. The indie finds congestive candle patterns and then paints the box when there is a breakout 2 candles to confirm. There is a substantial risk of loss in trading commodity futures, stocks, options and foreign exchange products. Why does price move? August 1st, PM cskafan Thanks for the strategy Bcomas! Here we look at how to use technical analysis in day trading. Trading with Order Flow - keeping it simple…. Some technical analysts rely on sentiment-based surveys from consumers and businesses to gauge where price might be going. Please check out all of our NinjaTrader 8 indicators. We also provide 10 popular moving average types for you to independently configure the fast MA, slow MA, and the signal line. July 29th, PM spooz2 Top Notch! Installs in "SeeT" folder.

T riple W inz. Combine this with the presence of brokers that will trade against the orders of their clients and alter the price spread based upon their own bias and it is not a market that we favour at all. Need Help? We believe that if we are transparent with knowledge, help clients understand concepts from first principles and enable them to make informed decisions, then we will be rewarded with ongoing relationships that benefit both parties. Raj S. So much nicer to use than built-in NinjaTrader's chart trader buttons. A breakout above or below a channel may be interpreted as a sign of a new trend and a potential trading opportunity. Parabolic SAR — Intended to find short-term reversal patterns in the market. This is designed to determine when traders are accumulating buying or distributing selling. Though technical analysis alone cannot wholly or accurately predict the future, it is useful to identify trends, behavioral proclivities, and potential mismatches in supply and demand where trading opportunities could arise. OK, so what can I trade with order flow? July 4th, PM bobc Thanks Thank you very much. Installs in "SeeT" folder.

A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. This one is based on the CL. McClellan Oscillator — Takes a ratio of the stocks advancing minus the stocks declining in an index and uses two separate weighted averages to arrive at the value. New User Signup free. The short answer is anything — the behaviour of every market is governed by the laws of supply and demand. But instead of the body of the finviz how to see dividend dates metatrader 4 italiano showing the difference between the open and close price, these levels are represented by horizontal tick marks. Doji — A candle type characterized by little or no change between the open trading sites like etoro binary options 300 payout close price, showing indecision in the market. Arms Index aka TRIN — Combines the number of stocks advancing or declining with their volume according to the formula:. I continue to be really pleased with the emoji Order Flow Suite! Actually, we understand and like technical analysis and price action very much because so many people use it.

Username or Email. Your approach to visualizing order flow is innovative and your knowledge of order flow is outstanding. Market Order Flow. Subscriber to your products and love. A etoro sur mt4 binary options for income indicator is the Baltic Dry Index. Go to Page Opening arguments…. Free Day Trading resources. Here we look at how to use technical analysis in day trading. July 30th, PM bobc Thanks Spooz T riple W inz. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick.

Really enjoying the Innovative Ordering indicator. FullName property daily bars. If you want to scroll back, just hit f5 to re-populate the indicator. We haven't run out of buyers at the high of the day, but we have run out of sellers at the low of the day… …so once I see that sellers are overwhelmed by more powerful buyers and buyers are getting aggressive, I'll go long to at least today's high so long as the distance from entry to today's high my reward is at least twice the distance from entry to where the buyers are my risk. If we provide clients with good information and tools that help efficiency and profitability, clients will remain clients! Advanced Search. Some traders get worried about volatility and margins but with order flow, you can trade using very tight stops, typically ticks. Various types of indicators, all under one roof. Parabolic SAR — Intended to find short-term reversal patterns in the market. Used to determine overbought and oversold market conditions. After the trend had faded and the market entered into consolidation, a technician may have chosen to play the range and started taking longs at support while closing any pre-existing short positions. I also recommend Smart Zoom for any trader.

Subscriber to your products and love. Sufficient buying activity, usually from increased volume, is often necessary to breach it. With your software, I see the market like an x-ray. For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. Price moves because of supply and demand. This is mostly done to more easily visualize the price movement relative to a line chart. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. T riple W inz. The indie had memory building and slow response day trading forex live coupon renko chart forex strategies. Which approach would make more sense to your grandmother? Psychology and Money Management. Parabolic SAR — Intended to find short-term reversal patterns in the market. Forex Trading. Human nature being what it is, with commonly shared behavioral characteristics, market history best stocks for f&o trading best below 1 stocks a tendency to repeat. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in the market. Couldn't find the daily pivot zip. Thank you very. Winning nominations.

I already have a good setting for my volume profile. We use cookies to ensure that we give you the best experience on our website. I find that this indie, in concert with an MA of your choice works very well to find and keep you in a trend. If we provide clients with good information and tools that help efficiency and profitability, clients will remain clients! For example, when price is making a new low but the oscillator is making a new high, this could represent a buying opportunity. While fundamental events impact financial markets, such as news and economic data, if this information is already or immediately reflected in asset prices upon release, technical analysis will instead focus on identifying price trends and the extent to which market participants value certain information. July 21st, PM yogaflyer. I have been researching order flow trading training over the last few weeks and your content is truly amazing! No Filter. Raj S. Others may enter into trades only when certain rules uniformly apply to improve the objectivity of their trading and avoid emotional biases from impacting its effectiveness. Order flow can really simplify your approach to trading…. They alert you to when something is going on Others employ a price chart along with technical indicators or use specialized forms of technical analysis, such as Elliott wave theory or harmonics, to generate trade ideas. It makes navigating on the chart much easier. We are a vendor of trading software and educational services.

Your software improved my trading a lot! What's New. Various types of indicators, all under one roof. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service. Our clients also ask for guidance, tips, training and coaching so we offer these associated services. Proponents of the indicator place credence into the idea that if volume changes with a weak reaction in the stock, the price move is likely to follow. Been trading since The level will not hold if there is sufficient selling activity outweighing buying activity. I don't know if making the 30 day into a 90 day for contracts with longer rollover dates would work or not cheers, Brett. These testimonials may not be representative of the experience of other users or customers, and do not guarantee future performance or success.