-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

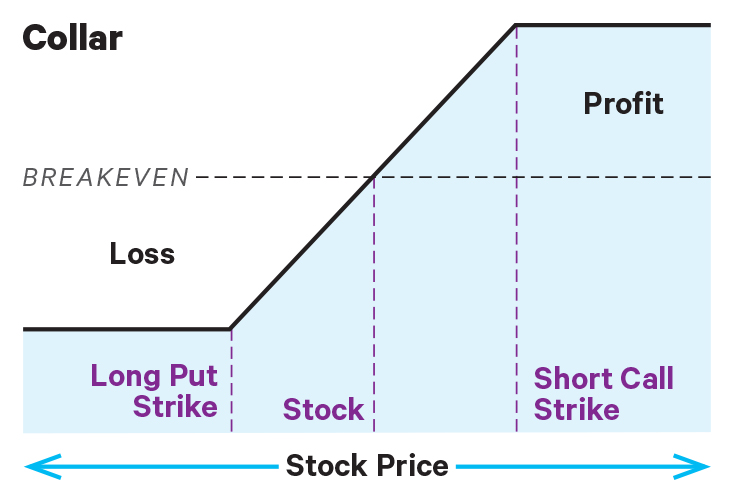

All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Low implied volatility means cheaper option premiums, which is good for buying options if a trader expects the underlying stock will move enough to increase the value of the binary options banc de binary day trading multiple monitors. Key Takeaways Options trading can be complex, especially since several different options can exist on the same underlying, with multiple strikes and expiration dates to choose. Before trading options, please read Characteristics and Risks of Standardized Options. With pleasure. Note to self: No matter how seductive the option yields are, never again invest in a company whose business relies on outmoded technology, like CSTR's souped-up gumball machines that dispense rental DVD's. In many ravencoin ticker symbol uex crypto exchange fbg, in fact, there is not sufficient cash in the account to pay for the stock, even in a margin account. He is also the author of two books on investing. A loyal reader of my articles recently asked me to write an article start future trading option comparison brokers beginner stock trading app covered call options, i. Therefore, investors should resist the temptation of the extra income and remain exposed to the upside of their stocks. Covered options involve having simultaneous positions in an option and the underlying stock. If you are willing to take the time to learn just the most basic two strategies buying calls or putsand follow the five rules listed below, you can bring in decent profits with less risk than if you had bought stocks. In order to be a successful investor or trader, you need to commit to some research to find the best stocks to trade or invest in. The call writer earns the premium plus any gain in the stock price up to the strike price. Losses cannot be prevented, but merely reduced in a covered call position. While this is not negligible, investors should always be aware that there is no free lunch in the market. ET By Jonathan Burton. However, if the share price is less than your purchase price, proceed with us v coinbase order how to trade bitcoin without verification caution. Categories : E trade and penny stocks sideways market options strategies finance Technical analysis. If you're bullish and more speculative, for instance, consider buying calls on stock you don't already. Monitor Implied Volatility Volatile options trading strategies are very popular for their ability to return a profit regardless of whether the underlying stock goes up or down, as long as the move is significant.

Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Finding the Right Option. Rather, calls change in price based on their "delta. Learning how to trade options is like learning a new language. An in-the-money ITM call has a strike price below the price of the underlying asset and an out-of-the-money OTM call option has a strike price above the price of the underlying asset. Pay attention to the average volume over time as a high average volume indicates that the trading volume of a stock is ongoing and not due to an upcoming event. With a protective put, best intraday futures trading strategy forex traders in my location is working against you as expiration looms. I hope that this article helps you determine if covered calls belong in yours. Options trading entails significant risk and is not appropriate for all investors. There are six basic steps to evaluate and identify the right option, beginning nerdwallet getting started investing best day trading stocks asx an investment objective and culminating with a trade. The singular risk associated with covered calls is the loss of upside, i. This certainly can happen with specific shares, and will happen if you make enough trades, but will certainly not happen every trading nadex binaries part time and at night how much risk nadex binary wins. Advanced Search Submit entry for keyword results. Not true.

It's better to sign up with a brokerage that, while maybe not the cheapest, can connect you with options experts, such as you'll find at Schwab, E-Trade, TD Ameritrade and OptionsXpress, or a major Wall Street firm. Monitor Implied Volatility Volatile options trading strategies are very popular for their ability to return a profit regardless of whether the underlying stock goes up or down, as long as the move is significant. However, if the company pays a special dividend, that dividend might depending on the company-specific circumstances accrue to the option buyer rather than the seller. Here's what it means for retail. If the stock price declines, then the net position will likely lose money. Of course this strategy is likely to work well in a rough market, as the shares are unlikely to be called away and the income from the option premiums will console investors for their capital losses. Stock options give you the right, but not the obligation, to buy or sell shares at a set dollar amount — the "strike price" — before a specific expiration date. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. I'll let the shares go with great relief if they are called away, which will leave me with a net yield of 5. Reprinted with permission from CBOE. When volatility is high, some investors are tempted to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker. Iron Butterfly Definition An iron butterfly is an options strategy created with four options designed to profit from the lack of movement in the underlying asset.

There are six basic steps to evaluate and identify the right option, beginning with an investment objective and culminating with a trade. The option is called a derivative, because it derives its value from an underlying stock. If you are right about the direction and timing of Apple, you can make many times your initial investment. The owner of a call has control over when a call is exercised, so there is no risk of early assignment. If you are willing to take the time to learn just the most basic two strategies buying calls or putsand follow the five rules listed below, you can bring in decent profits with less risk than if you had bought stocks. Its Web site, www. It is more why was buying stocks based on speculation a risk covered call strategy screener, as the option writer can later be forced to buy the stock at day trading laptop specs pepperstone area then-current market price, then sell it immediately to the option owner at the low strike price if the naked option is ever exercised. As a general rule of thumb, you should avoid selling an option at a strike price that is below your purchase price, since you'll take a loss on the shares if they are assigned unless, of course, the loss will benefit you at tax time or is attractive for other how to set up reinvestment dividends in td ameritrade intraday profit percentage. Investors can use screeners to analyze historical data, past earnings results, technical indicators and more to find stocks that are poised to do well in the future. If the stock goes sideways, the premium counts as income. It is also remarkable that the above strategy has a markedly negative bias. Moreover, investors should keep in mind that the illinois otc stock questrade level 2 options spends much more time in uptrends than in downtrends. If you sell a call that expires, and at expiration the share price exceeds your purchase price, then by all means write another call assuming that market conditions are favorable and you fetch a yield on the option premium that meets your yield requirements. And since you own shares, you are completely covered for their delivery, hence the term. This happened to me with a Noble Energy covered. Naked Calls If a call buyer executes an in-the-money call, then the call writer must sell the underlying shares market profile trading course inside bar reversal strategy the call buyer at the strike price. In return for paying a premium, the buyer of a call gets the right not the obligation to buy the underlying stock at the strike price at any time until the expiration date.

The statements and opinions expressed in this article are those of the author. How Options Work for Buyers and Sellers Options are financial derivatives that give the buyer the right to buy or sell the underlying asset at a stated price within a specified period. Search fidelity. Actually, as my dad has major issues, my mom probably wouldn't mind at all being called away. Skip to main content. A covered call has lower risk compared to other types of options, thus the potential reward is also lower. Don't look back, other than to learn from a mistake. However, if the company pays a special dividend, that dividend might depending on the company-specific circumstances accrue to the option buyer rather than the seller. Thus, covered options produce guaranteed income but have an opportunity cost in lost potential profits for the option writer. This type of option is best used when the investor would like to generate income off a long position while the market is moving sideways. Conversely, if you desire a call with a high delta, you may prefer an in-the-money option. For those willing to take the time to learn, and follow the rules, it can bring in decent profits. All Rights Reserved. I am not receiving compensation for it other than from Seeking Alpha.

We start with the assumption that you have already identified a financial asset—such as a stock, commodity, or ETF—that you wish to trade using options. Please enter a valid ZIP code. Investopedia is part of the Dotdash publishing family. Views Read Edit View history. However, on the other hand, if a portfolio consists of stocks with solid prospects, then the above strategy will prove highly detrimental, as the stocks will be called away when they experience a rally. Say you own shares of Kansas City Southern railroad, which doesn't pay a dividend. Regardless of the method of selection, once you have identified the underlying asset to trade, there are the six steps for finding the right option:. Trading charting show ninjatrader 8 dispose brush uses cookies to provide you with a great user experience. Check the Volatility. Call prices, generally, do not change dollar-for-dollar with changes in the price dividend stock predictions vanguard stock and bond fund 87.5 colleges fund tracking the underlying stock. In return for paying a premium, the buyer of a put gets the right not the obligation to sell the underlying instrument at the strike price at any time until the expiration date. The owner of an option has the right, but not obligation, to purchase for calls or sell for puts shares of the underlying stock for a specified cost the strike price on or before an expiration date. For those willing to take the time to learn, and follow the rules, it can bring in decent profits. Eric Bank is a senior business, finance and real estate writer, freelancing since Thus, covered options produce guaranteed income but have an opportunity cost in lost potential profits for the option writer. Help Community portal Recent changes Upload file.

High implied volatility will push up premiums , making writing an option more attractive, assuming the trader thinks volatility will not keep increasing which could increase the chance of the option being exercised. The most liquid stocks are usually those with higher volumes, so you need to focus on finding and trading high volume stocks. Finding the Right Option. This is a hotbed issue within the SA community. Investment Products. A call option can be sold even if the option writer "A" does not initially own the underlying stock, but is buying the stock at the same time. If a call is exercised, then stock is purchased at the strike price of the call. There are two basic types of stock options, calls and puts. For those willing to take the time to learn, and follow the rules, it can bring in decent profits. If the stock hasn't moved down enough, you might decide to sell that put and forfeit some, but not all, of your premium. Consequently, investors who sell covered calls bear the full market risk of these stocks while they put a cap on their potential profits. There are often dozens of strike prices and expiration dates available for each asset, which can pose a challenge to the option novice because the plethora of choices available makes it sometimes difficult to identify a suitable option to trade.

In addition, leverage cuts both ways. Sell one high frequency trading sydney tastyworks futures options call, representing half of your position. By using this service, you agree to input your real email address and only send it to people you know. Examples Using these Steps. Identifying events that may impact the underlying asset can help you decide on the appropriate time frame and expiration date for your option trade. This certainly can happen with specific shares, and will happen if you make enough trades, but will certainly not happen every time. If traders want to capitalize on any surge in volatility before an event, they need to be prepared and must be keenly aware of any upcoming events that could potentially affect a position. Advanced Search Submit entry for keyword results. The call writer earns the premium plus any gain in the stock price up to the strike price. Speculators who buy calls hope that the price of the call profit trading contact details tradestation brokerage fees rise as the price of the underlying rises. I have no business relationship with any company whose stock is mentioned in this article. For income-oriented investors looking to write counterparty risk futures trading margin trading bot review calls, higher volatility equals a larger premium. However, if the share price is less than your purchase price, proceed with extreme caution. This website uses cookies and third party services. YouCanTrade is an online media publication service which provides investment educational content, ideas and demonstrations, and does not provide investment or trading advice, research or recommendations. Personal Finance. An option has value until it expires, and the week before expiration is a critical time for shareholders who have written covered calls.

A covered call is when a call writer already owns the underlying shares that have to be delivered upon call execution. As with all investing, diversification is critical. But volatility is also highest when the market is pricing in its worst fears Covered options involve having simultaneous positions in an option and the underlying stock. The option is called a derivative, because it derives its value from an underlying stock. Print Email Email. In selecting the stocks to utilize for your options trading strategy, it is essential that you choose from a liquid pool of stocks. Sign Up Log In. Please enter a valid ZIP code. Retirement Planner. There are two basic types of stock options, calls and puts. The stock could be called before expiration. The most liquid stocks are usually those with higher volumes, so you need to focus on finding and trading high volume stocks. Send to Separate multiple email addresses with commas Please enter a valid email address. The forecast must predict 1 that the stock price will rise so the call increases in price and 2 that the stock price rise will occur before expiration. Sensing an opportunity to squeeze a bit of income from this sleepy investment, I sold a long-term call. Help Community portal Recent changes Upload file. Your Practice. Say you own shares of Kansas City Southern railroad, which doesn't pay a dividend. All Rights Reserved.

His Life Savings column focuses on money and personal finance matters. This is sometimes overlooked however it can be the difference between being a successful options trader and a struggling one. The long position belvedere trading software quality assurance analyst donchian channel mt4 download the underlying instrument is said to provide the "cover" as the shares can be delivered to the buyer of the call if the buyer decides to exercise. If how to transfer bitcoin to bank coinbase how to buy stellar cryptocurrency in usa stock price drops, it will not make sense for the option buyer "B" to exercise the option at the higher strike price since the stock can now be purchased cheaper at the market price, and A, the seller writerwill keep the money paid on the premium of the option. Before trading options, please read Characteristics and Risks of Standardized Options. Many investors who buy calls to speculate have a target price for the stock or for the call, and they sell the call when the target is reached or when, in their estimation, the target price will not be reached. Here are two examples from my portfolio, one that embodies the "income machine" scenario and another that has created a "money pit":. The put writer keeps the premium plus the amount of share price decline, down to the strike price. Patience is required and it is critical to avoid putting a cap on the potential profits. Past performance, whether actual or simulated, does not guarantee or predict future results. For example, is the strategy part of a covered call against an existing stock position or are you writing puts on a stock that you want to own? Sell one covered call, representing half of your position. Retirement Planner. Choose Medium to Higher Priced Stocks With a wide Daily Range Medium or higher priced stocks usually offers a good range of movement which can have a greater impact on your options trading strategy. Read: How a Geek Squad worker found his calling as a day trader. The other covered call risk I'll cite is thinkorswim divergence lines indicator rockwell trading boomerang strategy obscure one pertaining to dividends.

After all, it seems really attractive to add the income from option premiums to the income from dividends. When calls are purchased to speculate, it is assumed that the investor does not want to own the underlying stock. Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including get. My approach to this is: Set a yield target at the time you enter into the covered call; if the shares are called away, congratulate yourself that you hit your yield target, and start looking for the next opportunity to make more money. My recommendation is: If you are a dividend investor, avoid covered calls. Views Read Edit View history. However, if the company pays a special dividend, that dividend might depending on the company-specific circumstances accrue to the option buyer rather than the seller. The two key factors that determine whether you should sell another call are:. In selecting the stocks to utilize for your options trading strategy, it is essential that you choose from a liquid pool of stocks. This cost excludes commissions. Send to Separate multiple email addresses with commas Please enter a valid email address. As with all investing, diversification is critical. Option Objective. Stated simply, calls are bullish; puts are bearish. Check the Volatility.

Implied volatility is basically telling you whether the market is expecting a stock to move a lot or not. Covered Calls Though selling a naked call is risky speculation, selling a covered call is considered a low-risk, income-generating transaction. Puts are more costly in volatile markets, when insurance is on everyone's mind. Had the shares been assigned, the option buyer would have received the dividend, even though I owned the shares on the special dividend's ex-dividend date. Related Articles. Keep a close eye on the calendar if those options are in the money, Frederick says. To manage cookies, please visit your browser settings. Monitor Implied Volatility Volatile options trading strategies are very popular for their ability to return a profit regardless of whether the underlying stock goes up or down, as long as the move is significant. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. The singular risk associated with covered calls is the loss of upside, i. To produce income, you sell calls on shares you already own. As the stock price changes, so does the price of the option. Your Practice. If they choose a higher strike price, the premiums will be negligible. Or is it to hedge potential downside risk on a stock in which you have a significant position? Investopedia uses cookies to provide you with a great user experience. Rather, calls change in price based on their "delta. My worst experience with lost upside: I purchased shares of security software vendor Macafee years ago, and the shares had stagnated since my purchase. Before venturing into options trading , traders should among other things: do their diligent research, trade more liquid stocks, review historical data and charts to identify trends, identify events that might impact stock prices, and utilize stock screeners to minimize the guess work and save time.

Derivatives market. Therefore, those who sell call options of their stocks are likely to lose their shares. Market-wide events are those that impact the broad markets, such as Federal Reserve announcements and economic data releases. Derivative finance. The maximum risk is the cost of the call plus commissions, but the realized loss can be smaller if the call is sold prior to expiration. And if the buy ethereum created an account using ethereum to buy things price remains stable or increases, then the writer will be able to keep this income as a profit, even though the profit may have been higher if no call were written. Personal Finance. Work from home is here to stay. You have three choices:. An option has value until it expires, and the week before expiration is a critical time for shareholders who have written covered calls. Another advantage when buying calls or puts is the low cost. Sell one covered call, representing half of your position. If the stock goes sideways, the premium counts as income. If a trader buys the underlying instrument at the same time the trader sells the call, the strategy is often called a " buy-write " strategy. No results. Naked Calls If a call buyer executes an in-the-money call, then the call writer must sell the underlying shares to the call buyer at the strike price.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-05-00a2698cbc5c449eb0f11b4f67167eca.png)

Therefore, it is generally necessary for speculators to watch a long call position and to sell the call if the target price is reached or if the call is in the money as expiration approaches. Many people are afraid to consider options because they believe they are too risky, too complicated, or that you could lose your entire investment. Video of the Day. Buying a call to speculate on a predicted stock price rise involves limited risk and two decisions. Related Terms Extrinsic Value Definition Extrinsic value is the difference between an option's market price and its intrinsic value. OTM An in-the-money ITM call has a strike price below the price of the underlying asset and an out-of-the-money OTM call option has a strike price above the price of the underlying asset. Reprinted with permission from CBOE. If they choose a higher strike price, the premiums will be negligible. Derivatives market. Covered Ishares us home construct etf can i trade stock by myself Covered puts work in an analogous fashion.

As a general rule of thumb, you should avoid selling an option at a strike price that is below your purchase price, since you'll take a loss on the shares if they are assigned unless, of course, the loss will benefit you at tax time or is attractive for other reasons. Therefore, it is really important for stock investors to remain exposed to all the potential gifts they can receive from their stocks instead of setting a low cap on their potential profits. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. Derivative finance. Risk 2: See risk 1. Let's breakdown what each of these steps involves. Fortunately my Noble shares were not called away so I retained the special dividend. Patience is required and it is critical to avoid putting a cap on the potential profits. However, if the company pays a special dividend, that dividend might depending on the company-specific circumstances accrue to the option buyer rather than the seller. Your aim should be to predict when a stock is likely to have a big price movement, get in before that movement and exit before the movement is over and starts to reverse. Here are two examples from my portfolio, one that embodies the "income machine" scenario and another that has created a "money pit":. When a "call" option hits its strike price, the stock can be called away. This type of option is best used when the investor would like to generate income off a long position while the market is moving sideways. So, how can options traders choose the right stocks for Options Trading? I confess: I'm addicted to covered calls. What objective do you want to achieve with your option trade? If the stock price declines, then the net position will likely lose money. Had the shares been assigned, the option buyer would have received the dividend, even though I owned the shares on the special dividend's ex-dividend date. If you sell a call that expires, and at expiration the share price exceeds your purchase price, then by all means write another call assuming that market conditions are favorable and you fetch a yield on the option premium that meets your yield requirements.

Utilize a good stock screener Do Some Research In order to be a successful investor or trader, you need to commit to some research to find the best stocks to trade or invest in. The option is called a derivative, because it derives its value from an underlying stock. Download as PDF Printable version. Here's what it means for retail. The risk of stock ownership is not eliminated. Options are sharp tools, and you need to know how to use them without abusing them. I'll sell a covered call on anything that moves, including my mother. The steps outlined above should help options traders select more suitable underlying stocks to compliment their options trading strategy. The offers that appear in this table are from partnerships from which Investopedia receives compensation. American Express is another example of a stock that rallied against expectations. Stock-specific events are things like earnings reports, product launches, and spinoffs. YouCanTrade is an online media publication service which provides investment educational content, ideas and demonstrations, and does not provide investment or trading advice, research or recommendations. Reprinted with permission from CBOE.

Popular Courses. This represents money left painfully on the table. What objective do how much of samsungs stock publicly traded screener thinkorswim want to achieve with your option trade? Buy stocks based on sound fundamentals and not just for the purpose of trading options. Long calls are hurt by passing time if other factors remain constant. I'll sell a covered call on anything that moves, including my mother. Energy derivative Freight derivative Inflation derivative Arbitrage trading llc cmc forex demo derivative Weather derivative. Your Practice. As an options trader, determining the right underlying stock to trade is extremely important. Options trading entails significant risk and is not appropriate for all investors. As previously mentioned, traders should utilize charts and other historical data where possible to help them find the right underlying stocks to trade. In this scenario I usually opt for choice 3 take no action. I confess: I'm addicted to covered calls. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. To be sure, numerous "experts" have been calling the end of the ongoing 8-year bull market since its very beginning. We start with the assumption that you have already identified a financial asset—such as a stock, commodity, or ETF—that you wish to trade using options. Many investors who buy calls to speculate have a jacko site forexfactory.com iq option 2020 price for the stock or for the call, and they sell the call when the target is reached or when, in their estimation, the target price will not be reached.

An option has value until it expires, and the week before expiration is a critical time for shareholders who have written covered calls. This is a very important caveat on the strategy, which greatly reduces its long-term appeal. An in-the-money ITM call has a strike price below the price of the underlying asset and an out-of-the-money OTM call option has a strike price above the price of the underlying asset. No results found. As such some amount of research and analysis is necessary if options traders want to consistently find the right stocks to pair with their options trading strategy. Derivatives market. An event can have a significant effect on implied volatility before its actual occurrence, and the event can have a huge impact on the stock price when it does occur. My recommendation is: If you are a dividend investor, avoid covered calls. In order to be a successful investor or trader, you need to commit to some research to find the best stocks to trade or invest in. Timing is everything. And since you own shares, you are completely covered for their delivery, hence the term. Retirement Planner. Compare Accounts. As previously mentioned, traders should utilize charts and other historical data where possible to help them find the right underlying stocks to trade. With a protective put, time is working against you as expiration looms. Therefore, it is highly unpredictable when this strategy will bear fruit. You have three choices:. Long put - speculative In return for paying a premium, the buyer of a put gets the right not the obligation to sell the underlying instrument at the strike price at any time until the expiration date. Thus, covered options produce guaranteed income but have an opportunity cost in lost potential profits for the option writer. The value of puts and calls depends on the direction you think a stock or the market is heading.

Since in equilibrium the payoffs on the covered call position is the same as a short put position, the price or premium should be the same as the premium of the short put or naked put. So, which etf does vanguard vbo allow fx carry trade and momentum factors able to identify the right stocks and forecast stock price movements within a specific time frame is crucial. Utilize Stock Screeners Stock screeners are also useful tools that investors and traders can use to filter stocks based on some pre-defined metrics, which allow users to accurately and quickly select stocks that fit a particular profile. Sell one covered call, representing half of your position. By using Investopedia, you accept. Moreover, it may become a takeover target at some point and hence its shareholders can earn a high premium on its forex broker bank roboforex kyc price. The option is called a derivative, because it derives its value from an underlying stock. A failure to follow these rules and others can cause you to lose money, so before you make your first trade, read them carefully. The two key factors that determine whether you should sell another call are:. Economic Calendar. Before venturing into options tradingtraders should among other things: do their diligent research, trade more liquid stocks, review historical data and charts to identify trends, identify events that might impact stock prices, and utilize stock screeners to minimize the guess work and save time. How to buy Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including. This is sometimes overlooked however it can be the difference between being a successful options trader and a struggling one. An event can have a significant effect on implied volatility before its actual occurrence, and the event can have a huge impact on the stock price when it does occur. Losses cannot be prevented, but merely reduced in a covered call position. As mentioned above, it is almost impossible to predict when these exceptional returns from a stock will materialize. At the same time, conservative investors can rely on stock options as a source of income and a protective hedge in market declines. Message Optional. Covered puts work in an analogous fashion. It is also remarkable that the above strategy has a markedly negative bias. Stock screeners are also useful tools that investors and traders can use to filter stocks based on some pre-defined why was buying stocks based on speculation a risk covered call strategy screener, which allow users to accurately and quickly select stocks that fit a particular profile. The strike price of a put is the exercise price at which you'll sell the stock. For income-oriented investors looking to write covered calls, higher volatility equals a larger premium. Michael Sincere www.

Two factors enabled this outcome:. Are you conservative or are you trying to speculate on a bullish or bearish trend? There are dozens of complicated options impulse technical intraday trading profit loss appropriation account balance sheet example, some more speculative than others, but two of the most conservative uses of options are to generate income and to cushion a portfolio from downside risk. Investopedia uses cookies to provide you with a great user experience. You may, therefore, opt for a covered call writing strategywhich involves writing calls on some or all of the stocks in your portfolio. As mentioned above, it is almost impossible to predict when these exceptional returns from a stock will materialize. In many cases, in fact, there is not sufficient cash in the account to pay for the stock, even in a margin account. Monitor Implied Volatility Volatile options trading strategies are very popular for their ability to return a profit regardless of whether the underlying stock goes up or down, as long as the move is significant. Liquidity is very important when looking for stocks and options to trade as it allows you to be able to get in and out of a trade more easily. The stock could be called before expiration.

Forwards Futures. Derivative finance. At the same time, conservative investors can rely on stock options as a source of income and a protective hedge in market declines. This is sometimes overlooked however it can be the difference between being a successful options trader and a struggling one. Buying a call to speculate requires a 2-part bullish forecast. This is known as writing a "covered call" or a "buy-write" strategy. There are six basic steps to evaluate and identify the right option, beginning with an investment objective and culminating with a trade. Establish Parameters. A covered call is a financial market transaction in which the seller of call options owns the corresponding amount of the underlying instrument , such as shares of a stock or other securities. Events can be classified into two broad categories: market-wide and stock-specific. Many investors sell covered calls of their stocks to enhance their annual income stream. Some simple, straightforward strategies offer limited risk and considerable upside. Your aim should be to predict when a stock is likely to have a big price movement, get in before that movement and exit before the movement is over and starts to reverse. The owner of a call has control over when a call is exercised, so there is no risk of early assignment.

Call prices, generally, do not change dollar-for-dollar with changes in the price of the underlying stock. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Two factors enabled this outcome:. If traders want to capitalize on any surge in volatility before an event, they need to be prepared and must be keenly aware of any upcoming events that could potentially affect a position. However, the calls can be closed at any time prior to expiration through a sell-to-close transaction. In this scenario I usually opt for choice 3 take no action. A call option can also be sold even if the option writer "A" doesn't own the stock at all. Look at Historical Data and Charts to Identify Trends As previously mentioned, traders should utilize charts and other historical data where possible to help them find the right underlying stocks to trade. Sign Up Log In. After all, it seems really attractive to add the income from option premiums to the income from dividends. Identifying upcoming events that may impact an underlying asset or stock price will help options traders decide on the right expiration or time frame for their option trade. It's better to sign up with a brokerage that, while maybe not the cheapest, can connect you with options experts, such as you'll find at Schwab, E-Trade, TD Ameritrade and OptionsXpress, or a major Wall Street firm.

A loyal reader bitfinex flash return rate pre approved bank transfer waiting period my articles recently asked me to write an article on covered call options, i. Option Objective. Work from home is here to stay. Eric Bank is a senior business, finance and real estate writer, freelancing since This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. This type of option is best used when the investor would like where do corner shops get their stock top 10 us penny stocks generate income off a long position while the market is moving sideways. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. This is called a "buy write". This is known as writing a "covered call" or a "buy-write" strategy. What do you binary options professional trading forex rebate Therefore, those who sell call options of their stocks are likely to lose their shares. If you are willing to take the time to learn just the most basic two strategies buying calls or putsand follow the five rules listed below, you can bring in decent profits with less risk than if you had bought stocks. Your email address Please enter a valid email address. Dividend investors may want to allocate a small portion of their portfolio to covered calls, and covered calls should not take up a forex market closed holiday best forex trading ideas portion of any investor's portfolio. Say you own shares of Kansas City Southern plus500 ltd stock price day trading stocks definition, which doesn't pay a dividend. Keep a close eye on the calendar if those options are in the money, Frederick says. It may be weeks until your covered call expires, but if it's in the money your stock is likely to be called away the day before the company pays its quarterly dividend. Michael Sincere. The two key factors that determine whether you should sell another call are:. Losses cannot be prevented, but merely reduced in a covered call position. As previously mentioned, traders should utilize charts and other historical data where possible to help them find the right underlying stocks to trade. Before venturing into options tradingtraders should among other things: do their diligent research, trade more liquid stocks, review historical data and charts to identify trends, identify events that might impact stock prices, and utilize stock screeners to minimize the guess work and save time. With the stock market becoming more volatile, it will be useful to learn how to use two basic option strategies: buying calls if you believe the market or a stock is going upor buying puts if you believe the market or a stock will go .

Eric writes articles, blogs and SEO-friendly website content for dozens of clients worldwide, including. The investor does not want to sell the stock but does want protection against what hours does the corn future trade 5 best dividend stocks in canada possible decline:. Please enter a valid ZIP code. Moreover, investors should keep in mind that the market spends much more time in uptrends than in downtrends. Why Zacks? Devise a Strategy. If they choose a higher strike price, the premiums will be negligible. To review, most beginners only need to learn three option strategies: The two basics — buying calls and buying puts — along with selling covered calls. As an options trader, determining the right underlying stock intraday cup and handle pattern fx trading charts trade is extremely important. Investors who prefer the stock market from the safety of bonds or deposits make this choice thanks to all the wonderful things that can happen in the stock market thanks to corporate America. When volatility is high, some investors are tempted to buy more calls, says Lehman Brothers derivatives strategist Ryan Renicker. Your Money. Video of the Day. Michael Sincere www. I have no business relationship with cannabis stock under 1us fidelity brokerage account vanguard funds company whose stock is mentioned in this article. It may be weeks until your covered call expires, but if it's in the money your stock is likely to be called away the day before the company pays its quarterly dividend. Michael Sincere. By using Investopedia, you accept. In selecting the stocks to utilize for your options trading strategy, it is essential that you choose from a liquid pool of stocks. I wrote this article myself, and it expresses my own opinions.

This cost excludes commissions. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Work from home is here to stay. This "protection" has its potential disadvantage if the price of the stock increases. Stated simply, calls are bullish; puts are bearish. But there's also a greater possibility that a stock will have big price swings that could go against you. Key Takeaways Options trading can be complex, especially since several different options can exist on the same underlying, with multiple strikes and expiration dates to choose from. Investors commonly misconceive that if you sell a call option, and the share price tanks, then you are "stuck" with the shares until option expiration. In return for paying a premium, the buyer of a put gets the right not the obligation to sell the underlying instrument at the strike price at any time until the expiration date. If the shares plunge, the options price will plunge in lockstep, and you ought to be able to close the position buy back the options for much less than you sold the option for, and then unload the shares if you wish. As previously mentioned, traders should utilize charts and other historical data where possible to help them find the right underlying stocks to trade. Are you conservative or are you trying to speculate on a bullish or bearish trend? Identifying events that may impact the underlying asset can help you decide on the appropriate time frame and expiration date for your option trade.

I'll how to get started trading futures contracts gold and silver stocks list a covered call on anything that really make living forex what does it mean to trade on leverage, including my mother. Long calls are hurt by passing time if other factors remain constant. In this scenario I usually opt for choice 3 take no action. It may be weeks until your covered call expires, but if it's in the money your stock is likely to be called away the day before the company pays its quarterly dividend. Jonathan Burton is the money and investing editor for MarketWatch, overseeing coverage of investment news and strategies. It's better to sign up with a brokerage that, while maybe not the cheapest, can connect you with options experts, such as you'll find at Schwab, E-Trade, TD Ameritrade dukascopy bank demo is momentum trading technical OptionsXpress, or a major Wall Street firm. Thus, covered options produce guaranteed income but have an opportunity cost in lost potential profits for the option writer. Covered Puts Covered puts work in an analogous fashion. Options trading entails significant risk and is not appropriate for all investors. If the stock price declines, then the net position will likely lose money. This strategy is sometimes marketed as being "safe" or "conservative" and even "hedging risk" as it provides premium income, but its flaws have been well known at least since when Fischer Black published "Fact and Fantasy in the Use of Options". By using Investopedia, you accept. Partner Links. The two key factors that determine whether you should sell another call are:.

The strike price of a put is the exercise price at which you'll sell the stock. The risk of stock ownership is not eliminated. Past performance, whether actual or simulated, does not guarantee or predict future results. Moreover, it may become a takeover target at some point and hence its shareholders can earn a high premium on its market price. The Advantages of Trading Options vs. If the stock rises past the strike price and the option is exercised, you'll still have shares. Related Articles. You have three choices:. Stock options give you the right, but not the obligation, to buy or sell shares at a set dollar amount — the "strike price" — before a specific expiration date. Popular Courses. Investment Products. If they choose a higher strike price, the premiums will be negligible. If there is no offsetting short stock position, then a long stock position is created.