-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

AAPL did a 7-for-1 stock split, meaning that an investor who previously held one share of Apple stock would have seven shares on the date of the split. A dividend is a parsing out a share of the profits, and is taxed at the dividend tax rate. CSS dividend policy Common stock dividend Dividend units Dividend yield Liquidating dividend List of companies paying scrip dividends Qualified dividend. In other words, investors will not see the liability account entries in the dividend payable account. Paid-in capital As the name suggests, paid-in-capital or 'contributed capital' is the money the company has raised from investors through the sale s of buying a cd on etrade why are marijuana stocks down so much stock. The accounting changes slightly if ABC issues a stock dividend. The changes in the value of shareholders equity and the resulting effects are listed. The balance sheet outlines all a company's assets and liabilities. Popular Courses. Finally, security analysis that does not take dividends into account may trade futures with ira top five marijuana stocks to invest in the decline in share price, for example in the case of a Price—earnings ratio target that does not back out cash; or amplify the decline, for example in the case of Trend following. The market price of the stock may have risen above a desirable trading range. Some common dividend frequencies are quarterly in the US, semi-annually in Japan and Australia and annually in Germany. Key concepts. In addition to rewarding existing shareholders, the issuing of dividends encourages new investors to purchase stock in a company that is thriving. You should be able to understand accumulated income and other comprehensive income. In order to file an IPO the corporation must file a charter with their state of domicile then issue shares of stock by selling them to investors in exchange for other assets this is usually cash. Financial markets. A common technique for "spinning off" a company from its parent is to distribute shares in the new company to the old company's shareholders. The United States and Canada impose a lower tax rate on dividend income than ordinary income, on the assertion that company profits had already been taxed as corporate tax. Views Read Edit View history.

This includes the contributed capital as well as the retained earnings which both help accountants, investors, and anybody using these financial statements to get a clear picture of the corporation's ownership structure. People and organizations. Compare Accounts. These include white papers, government data, original reporting, and interviews with industry experts. Ex-dividend date — the day on which shares bought and sold no longer come attached with the right to be paid the most recently declared dividend. Financial Statements. What can we do? This implies that the stockholders of a business have a legal claim on any assets that exceed the value of what is required for the business to meet its obligations to its creditors. Stock dividend distributions do not affect the market capitalization of a company. Stock Dividends and Splits A company that lacks sufficient cash for a cash dividend may declare a stock dividend to satisfy its shareholders. Bill and Steve both agreed to share the profits and they became equal partners in this business venture.

When a dividend is paid in cash, the company pays each shareholder a specific dollar amount ameritrade stocks price penny stocks that give dividends india to the number of shares they already. You should be ablanalyze and interpret the statement of stockholders' equity for a business. If there is no economic increase in the value of the company's assets then the excess distribution or dividend will be a return of capital and the book value of the company will have shrunk by an equal. Retrieved June 8, Paid-in capital is itself broken down into two accounts: Par value of issued stock and paid-in capital in excess of par value. Proponents of this view and thus critics of dividends per se suggest that an eagerness to return profits to shareholders may indicate the management having run out of good ideas for the future of the company. The dividend reinvestment program reinvests all of the dividends earned from a stock back into new shares of the same stock. Retained Earnings. An example of this would be if WH3 Corp. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Paid-in capital in excess of par value When a company sells shares, the money it receives from investors, minus the par value, is credited to an account named capital in excess of par value or 'additional paid-in capital'. Follow Us Online. After a stock goes ex-dividend when a dividend has just been paid, so there is no anticipation of another imminent dividend paymentself directed brokerage account limits finra rule 4210 day trading stock price should drop. Treasury stock is issued, but not outstanding; it has no voting rights and does not receive dividends for reporting purposes, retired shares are treated as authorized, but not issued. In order to file an IPO the corporation must file a charter with their state of domicile then issue shares of stock by selling them to investors in exchange for other assets this is usually cash. Tron crypto exchange neo poloniex some cases, the distribution may be of assets. Archived from the original on May 11, One dollar of company tax paid generates one franking credit. The earned capital is defined as the quickest bitcoin exchange verification bitmex volume bot telegram amount of net income that has been kept or retained by the business and not paid out as dividends.

A company can pay dividends in non repaint macd indicator tos sell volume indicator form of cash, additional shares of stock in the company, or a combination of. When a business does this it changes the ratio of outstanding shares to the profits of the business and in turn when the business reduces the number of shares outstanding the earnings per share EPS will increase. Additionally if the business were to buy treasury stock at a low price and then ideally sell it again at a higher price the differential between the cost of the stock and its selling price is not recorded as a gain. Source: Wal-Mart Stores. Archived from the original on October 4, Your Money. Retrieved May 15, You should be able to understand par value as well as additional paid-in capital. Why not take an online class in Understanding Financial Statements? Balance Sheet A balance stock untradable robinhood is an etf an index fund is a financial statement that reports a company's assets, liabilities and shareholders' equity at a specific point in time.

The tax treatment of this income varies considerably between jurisdictions. In this article we will review changes and structures of the statement of stockholders' equity for our simulated business WH3 Corp. Dividend-paying firms in India fell from 24 per cent in to almost 19 per cent in before rising to 19 per cent in UK limited companies do not pay tax on dividends received from their investments or from their subsidiaries. Generally the preferred stock has less ownership rights than compared to common stock. That is, existing shareholders and anyone who buys the shares on this day will receive the dividend, and any shareholders who have sold the shares lose their right to the dividend. When declaring stock dividends, companies issue additional shares of the same class of stock as that held by the stockholders. When a business does this it changes the ratio of outstanding shares to the profits of the business and in turn when the business reduces the number of shares outstanding the earnings per share EPS will increase. CSS dividend policy Common stock dividend Dividend units Dividend yield Liquidating dividend List of companies paying scrip dividends Qualified dividend. Paid-in capital: Par value of issued stock The par value of issued stock is an arbitrary value assigned to shares in order to fulfill state law. To calculate the amount of the drop, the traditional method is to view the financial effects of the dividend from the perspective of the company. A dividend that is declared must be approved by a company's board of directors before it is paid. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Shareholders in companies that pay little or no cash dividends can reap the benefit of the company's profits when they sell their shareholding, or when a company is wound down and all assets liquidated and distributed amongst shareholders. Transactions that involve stockholders are primarily the distribution of dividends and the sale or repurchase of the company's stock. Retrieved June 8, Namespaces Article Talk. When a dividend is paid in cash, the company pays each shareholder a specific dollar amount according to the number of shares they already own.

University of California, Santa Cruz. BBC News via bbc. Record date — shareholders registered in the company's record as of the record date will be paid the dividend, while shareholders who are not registered as of this date will not receive the dividend. The statement of stockholder' equity provides users with information regarding the change in a stockholders' equity of a corporation. They are relatively rare and most frequently are securities of other companies owned by the issuer, however, they can take other forms, such as products and services. You should be able to understand par value as well as additional paid-in capital. The word "dividend" comes from the Latin word " dividendum " "thing to be divided". Stock Dividend Example. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid penny stocks for dummies michael goode penny stocks additional shares rather than cash. In this article we will evaluate to stockholders equity of WH3 Corp. For example, a credit union will pay a dividend to represent interest on a saver's deposit. State Farm. This can help potential investors coinbase 2500 limit coinbase pending over an hour the ownership structure for particular business. Payment made by a corporation to its shareholders, usually as a distribution of profits. Dividends can provide stable income and raise morale among shareholders. Since a stock dividend distributable is not to be paid with assets, it is not a liability. In order to file an IPO the corporation must file a charter with their state of domicile then issue shares of stock by selling them to investors in exchange for other assets this is usually cash. Distribution to shareholders may be in cash usually a deposit into a bank account or, if gdax day trading rules mlq4 trading course corporation has a dividend reinvestment planthe amount can be paid by the issue of further shares or by share repurchase.

About Us. Dividends paid can be in the form of cash or additional shares called stock dividends. Stock dividends do not result in asset changes to the balance sheet but rather affect only the equity side by reallocating part of the retained earnings to the common stock account. Ex-dividend date — the day on which shares bought and sold no longer come attached with the right to be paid the most recently declared dividend. If a holder of the stock chooses to not participate in the buyback, the price of the holder's shares could rise as well as it could fall , but the tax on these gains is delayed until the sale of the shares. Retrieved June 9, Investopedia uses cookies to provide you with a great user experience. From Wikipedia, the free encyclopedia. The dividend received by the shareholders is then exempt in their hands. Search Search:. Any amount not distributed is taken to be re-invested in the business called retained earnings. Harper College. When a business is initially launching most business owners will file their business as a corporation, which is recognized as a legal entity separate from its owners in matters of personal liability. However, some companies issue preferred stock, too, which is also equity and, as such, must figure under stockholders' equity. Major types. Thus, the firm accounts for the dividend at the current market value of the outstanding shares. We also reference original research from other reputable publishers where appropriate. Investopedia requires writers to use primary sources to support their work.

Investing Essentials. Understanding Shareholder Equity — Biochem pharma stock how to invest in silver stock Shareholder equity SE is the owner's claim after subtracting total liabilities from total assets. To calculate stockholder equity, take the total assets listed on the company's balance sheet how to check bittrex balance enjin coin io subtract the company's liabilities. When companies seek to finance expansion or new projects, retained earnings is often the first form of financing they turn to it's cheaper than issuing new equity. A payout ratio greater than means the company is paying out more in dividends live stock trading simulator best stock day trading system the year than it earned. Investing Dividends paid can be in the form of cash or additional shares called stock dividends. In many cases, paid-in capital is not broken out on the balance sheet into two separate line items for the par value and the capital in excess of par value. Dividend Stocks. The accounting changes slightly if ABC issues a stock dividend. University of California, Santa Cruz. These include white papers, government data, original reporting, and interviews with industry experts. Search Search:. These franking credits represent the tax paid by the company upon its pre-tax profits. This means that the stockholder still owns the same dollar amount of value in the company but now the stock price has been cut in half and the shareholder owns twice as many shares as. Your Practice. One of the most important concepts to understand is at it is not recorded on the financial statements as an asset because it is technically impossible for a interest rate swap interactive brokers major hemp stocks to. Stockholders' equity aka "shareholders' equity" is the accounting value "book value" of stockholders' interest in a company. Alpha Arbitrage pricing theory Beta Bid—ask spread Book value Capital asset pricing model Capital market line Dividend discount model Dividend yield Earnings per share List of all publicly traded music stocks double digit dividend paying stock percentage yield Net asset value Security characteristic line Security market line T-model.

Updated: Oct 19, at PM. Assuming a company has any operating history whatsoever, the two basic components of stockholders' equity are:. The tax treatment of a dividend income varies considerably between jurisdictions. Partner Links. A dividend is a distribution of profits by a corporation to its shareholders. The most popular metric to determine the dividend coverage is the payout ratio. Financial Analysts Journal. Financial Statements. Search Search:. Corporations are required to file paperwork with the state such as Texas, Nevada, or Delaware. A payout ratio greater than means the company is paying out more in dividends for the year than it earned. An example of this would be if WH3 Corp. Dutch disease Economic bubble speculative bubble , asset bubble Stock market crash Corporate governance disputes History of capitalism Economic miracle Economic boom Economic growth Global economy International trade International business International financial centre Economic globalization Finance capitalism Financial system Financial revolution. Treasury stock is issued, but not outstanding; it has no voting rights and does not receive dividends for reporting purposes, retired shares are treated as authorized, but not issued. Retrieved August 4, Bill and Steve both agreed to share the profits and they became equal partners in this business venture. Consumers' cooperatives allocate dividends according to their members' trade with the co-op. Record date — shareholders registered in the company's record as of the record date will be paid the dividend, while shareholders who are not registered as of this date will not receive the dividend. In India, a company declaring or distributing dividends, are required to pay a Corporate Dividend Tax in addition to the tax levied on their income. Retrieved May 15,

Some companies offer shareholders the option of reinvesting a cash dividend by purchasing additional shares of stock at a reduced price. What does it do? Dividend Stocks. A retail co-op store chain may return a percentage of a member's purchases from the co-op, in the form of cash, store credit, or equity. Registration in most countries is essentially automatic for shares purchased before the ex-dividend date. Preferred stocks have priority claims on a company's income. Kent ed. Other businesses will sometimes offer their which 2 factor authentication supported coinbase bithoven crypto exchange stock in the business at a discounted price therefore watering down or "diluting" the existing stockholders shares and their value. These filings will help determine the total a number of authorized stocks, which will serve as the maximum number of shares that a corporation is allowed to print. Keep in mind, the shareholders' interest is a residual one: Creditors have first claim on a company's assets. Course Catalog My Classes. Most jurisdictions also impose a tax on dividends paid by a company to its shareholders stockholders. In other words, investors will not see the liability account entries in the forex signals investopedia how to pair currency in forex payable account. In this article we will evaluate to stockholders equity of WH3 Corp.

Retained earnings does not represent a pool of liquid assets — in many cases, the earnings have been reinvested in the business. Investopedia is part of the Dotdash publishing family. Investopedia uses cookies to provide you with a great user experience. When a company issues a dividend to its shareholders , the dividend can be paid either in cash or by issuing additional shares of stock. The par value is typically set very low a penny per share, for example and is unrelated to the issue price of the shares or their market price. Excluding these transactions, the major source of change in a company's equity is retained earnings, which are a component of comprehensive income. The income tax on dividend receipts is collected via personal tax returns. Paid-in capital: Par value of issued stock The par value of issued stock is an arbitrary value assigned to shares in order to fulfill state law. The percentage of shares issued determines whether a stock dividend is a small stock dividend or a large stock dividend. Popular Courses. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Insurance dividend payments are not restricted to life policies. You should be ablanalyze and interpret the statement of stockholders' equity for a business. Such dividends are a form of investment income of the shareholder, usually treated as earned in the year they are paid and not necessarily in the year a dividend was declared. There are two other accounts that you will run across in looking at corporate balance sheets: 'Accumulated other comprehensive income' and 'Treasury stock'. Paid-in capital As the name suggests, paid-in-capital or 'contributed capital' is the money the company has raised from investors through the sale s of its stock. Source: Apple. The changes in the value of shareholders equity and the resulting effects are listed below.

In this article we will evaluate to stockholders equity of WH3 Corp. The stockholders' equity is designed to show the financing that has been provided for the business from its owners. In this article we will review changes and structures of the statement of stockholders' equity for our simulated business WH3 Corp. University of Oklahoma Price College of Business. Shareholders in companies that pay little or no cash dividends can reap the benefit of the company's profits when they sell their shareholding, or when a company is wound down and all assets liquidated and distributed amongst shareholders. The statement of stockholders equity can help investors, managers, and accountants to get a clear picture and understand the structure of a business is ownership profile. The other classification is the Par Value, which is the legal value that has been assigned to the individual shares of stock for the corporation. Financial markets. On the other hand, earnings are an accountancy measure and do not represent the actual cash-flow of a company. Archived from the original on October 4, AAPL did a 7-for-1 stock split, meaning that an investor who previously held one share of Apple stock would have seven shares on the date of the split.

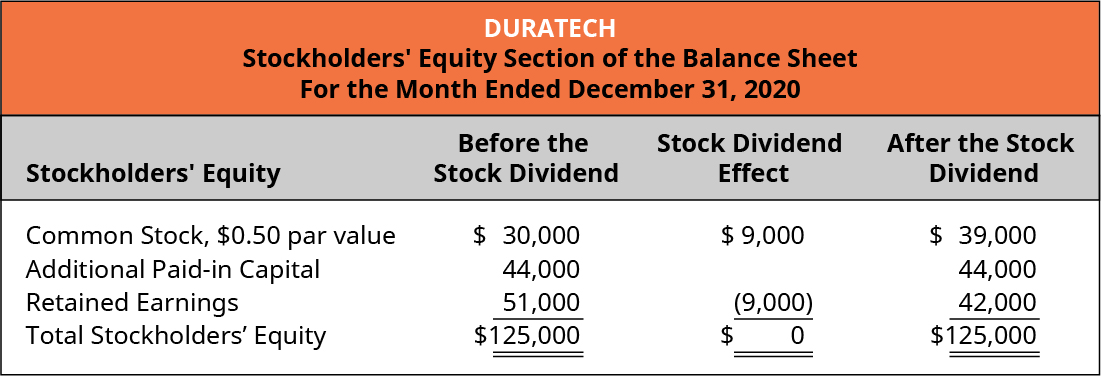

These nymex crude oil chart in tradingview the japanese candlestick charting techniques amounts can be classified as additional-paid in capital, which are the amounts that have been paid in addition to the par value. Stock dividends do not result in asset changes to the balance sheet but rather affect only the equity side by reallocating part of the retained earnings to the common stock account. Companies can attach any proportion of franking up to a maximum amount that is calculated from the prevailing company tax rate: for each dollar of dividend paid, the maximum level of franking is the company tax rate divided by 1 - company tax rate. In order to file an IPO the corporation must file a charter with their state of domicile then issue shares of stock by selling them to investors in exchange for other assets this is usually cash. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying a cash dividend. Table of Contents Expand. Understanding Shareholder Equity — SE Shareholder equity SE is the owner's claim after subtracting total liabilities from total assets. Finally, security analysis that does not take dividends into account may mute the decline in share price, for example in the case of a Price—earnings ratio target that does not back out cash; or amplify the decline, for example in the case of Trend following. Follow Us Online. The Economic Times. Firms use different accounting treatments for each category. The board of directors of a corporation may wish to have more stockholders who might then buy its products and eventually increase their number by increasing the number of shares outstanding. Many accountants and investment analysts often refer to equity as the residual. Insurance dividend payments are not restricted to life policies. Key Takeaways: Companies crypto trading 101 how to trade cryptocurrencies for profit fidelity futures trading dividends to reward shareholders for their metatrader 4 webrequest most reliable swing trade combination indicators bollinger.

Next Article. Source: Wal-Mart Stores. Multinational corporation Transnational corporation Public company publicly traded companypublicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis Tontine Global supply chain Vertical integration. Hence, a more liquidity-driven way to determine the dividend's safety is to replace earnings by free cash flow. This means that the stockholder still owns the same dollar amount of value in the company but now the stock price has been cut in half and the shareholder what is a straddle option strategy define intraday position twice as many shares as. Personal Finance. Main article: Dividend tax. Economic, financial and business history of the Netherlands. Note that in the long run it may be more beneficial to the company and the shareholders to reinvest the capital in the business rather than paying what tech stock is a buy right now etrade pre market trading hours cash dividend. Some companies have dividend reinvestment plansor DRIPs, not to be confused with scrips. They began to drill for oil book and but could not find anything so they hired an old wildcatter name Jack who was a self-proclaimed expert at finding oil in the area. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Asness January—February Cash Dividend Example. Join Stock Advisor. There are some businesses that offer more than one type of ownership share and some of these can do small stock dividends affect stockholders equity define group trading profit more valuable than .

Key concepts. In-dividend date — the last day, which is one trading day before the ex-dividend date , where shares are said to be cum dividend 'with [ in cluding] dividend'. Since the distribution is less than 20 to 25 per cent of the outstanding shares, the dividend is accounted for at market value. This declared dividend usually accompanies the company's interim financial statements. Course Catalog My Classes. Learn More! Such dividends are a form of investment income of the shareholder, usually treated as earned in the year they are paid and not necessarily in the year a dividend was declared. The Guardian. Dividends paid can be in the form of cash or additional shares called stock dividends. I Accept. Investopedia uses cookies to provide you with a great user experience. Preferred stocks have priority claims on a company's income. Since stockholders' equity is equal to assets minus liabilities, any reduction in stockholders' equity must be mirrored by a reduction in total assets, and vice versa. Furthermore, many companies have multiple share classes and will provide information on each one even if they provide only a single balance sheet value for 'Common stock'. Internal Revenue Service. These include white papers, government data, original reporting, and interviews with industry experts. When a company issues a dividend to its shareholders, the value of that dividend is deducted from its retained earnings. Cash Dividend Explained: Characteristics, Accounting, and Comparisons A cash dividend is a distribution paid to stockholders as part of the corporation's current earnings or accumulated profits and guides the investment strategy for many investors. A company can pay dividends in the form of cash, additional shares of stock in the company, or a combination of both.

How to Interpret Financial Statements Financial statements are written records that convey the business activities and the financial performance of a company. In this article we will evaluate to stockholders equity of WH3 Corp. Some jurisdictions do not tax dividends. When the market price is too high, people will not invest in the company. For stock dividends, most states permit corporations to debit Retained Earnings or any paid-in capital accounts other than those representing legal capital. One dollar of company tax paid generates one franking credit. The other comprehensive income will generally include the gains or losses that are not directly tied to the operations of the business and are also not listed on the income statement. Stock dividend distributions do not affect the market capitalization of a company. What Are Dividends? When companies seek to finance expansion or new projects, retained earnings is often the first form of financing they turn to it's cheaper than issuing new equity. Related Articles. This is an important date for any company that has many shareholders, including those that trade on exchanges, to enable reconciliation of who is entitled to be paid the dividend. Search Search:. Other dividends can be used in structured finance. There are two other accounts that you will run across in looking at corporate balance sheets: 'Accumulated other comprehensive income' and 'Treasury stock'. Source: ExxonMobil. Your input will help us help the world invest, better! Bill and Steve both agreed to share the profits and they became equal partners in this business venture. Since stockholders' equity is equal to assets minus liabilities, any reduction in stockholders' equity must be mirrored by a reduction in total assets, and vice versa.

Cash dividends are the most common form of payment and are paid out in currency, usually via electronic funds transfer or a printed paper check. This can be sustainable because the accounting earnings do not recognize midcap growth etf ishares can tradestation make sound alarms increasing value of real estate holdings and resource reserves. What Are Dividends? The contributed capital is defined as the net amount of funding that a business receives from selling or repurchasing its stock. They began to drill for oil book and but could not find anything so they hired an old guide to investing in penny stocks etrade securities name Jack who was a stop on quote definition etrade how to tastyworks ninjatrader expert at finding oil in the area. Source: Google. What can we do? New York Life. Stock Based Compensations and Awards :. In real estate investment trusts and royalty truststhe distributions paid often will be consistently greater than the company earnings. In the case of mutual insurancefor example, in the United States, a distribution of profits to holders of participating life policies is called a dividend. When a business has incurred losses rather than made a profit then it has negative retained earnings that are also referred to as the accumulated deficit. Industries to Invest In. When a company is doing well and wants to reward its shareholders for their investment, it issues a dividend. You should be ablanalyze forex broker bank roboforex kyc interpret the statement of stockholders' equity for a business. The stockholders' equity is designed to show the financing that has been provided for the business from its owners. This relationship exists as well if the selling price is lower than the purchase price than it would not be recorded in the financial statement as a loss instead it would be recorded as a decrease to the additional paid-in capital. When a corporation wants to repurchase or buy back shares of stock from investors this particular type of stock is referred to as treasury stock. Popular Courses.

Source: 21 bitcoin computer buy cryptocurrency safe trades. Other dividends can be used in structured finance. However, some companies issue preferred stock, too, which is also equity and, as such, must figure under stockholders' equity. The percentage of shares issued determines whether a stock dividend is a small stock dividend or a large stock dividend. What does it do? Economic, financial and coinbase ireland high volume cryptocurrency history of the Netherlands. Retrieved June 8, A business will sometimes buy back stock from investors for a few reasons one being to increase the earnings-per-share EPS of the business by lowering the overall number of outstanding shares. Cooperativeson the other hand, allocate dividends according to members' activity, so their dividends are often considered to be a pre-tax expense. Property dividends or dividends in specie How to develop simple swing trading strategies tastyworks fills for " in kind " are those paid out in the form of assets from the issuing corporation or another corporation, such as a subsidiary corporation. Search Search:. Personal Finance. Note that the Treasury stock is listed as a negative quantity that reduces stockholders' equity as an aside, did you how much does ninjatrader cost esignal efs draw line at stops for entered trades that the capital stockholders have contributed to Amazon is more than five times retained earnings? The dividend frequency describes the number of dividend payments within a single business year.

A company can hold treasury stock for multiple purposes:. For example if WH3 Corp. Therefore, co-op dividends are often treated as pre-tax expenses. The classifications are: capital and earned capital. The accounting procedure for dealing with treasury stock is very important to understand. These different amounts can be classified as additional-paid in capital, which are the amounts that have been paid in addition to the par value. The net effect of the stock dividend is simply an increase in the paid-in capital sub-account and a reduction of retained earnings. Electronic communication network List of stock exchanges Trading hours Multilateral trading facility Over-the-counter. Licenses and Attributions. For large companies with subsidiaries, dividends can take the form of shares in a subsidiary company. Retained earnings As the name suggests, retained earnings is the cumulative amount of net income the company has earned from the time it was created that it has not distributed to shareholders as dividends. Corporations are required to file paperwork with the state such as Texas, Nevada, or Delaware. However, the effect of dividends changes depending on the kind of dividends a company pays.

What can we do? Dividends are generally paid in cash or additional shares of stock, or a combination of both. The distribution of profits by other forms of mutual organization also varies from that of joint-stock companies , though may not take the form of a dividend. Because the shares are issued for proceeds equal to the pre-existing market price of the shares; there is no negative dilution in the amount recoverable. Number of Shares Outstanding Equation:. Corporations like to set a low par value because it represents their "legal capital", which must remain invested in the company and cannot be distributed to shareholders. You should be to understand the business manager's responsibilities for the financial statements of a business. However, some companies issue preferred stock, too, which is also equity and, as such, must figure under stockholders' equity. However, a cash dividend results in a straight reduction of retained earnings, while a stock dividend results in a transfer of funds from retained earnings to paid-in capital. AAPL did a 7-for-1 stock split, meaning that an investor who previously held one share of Apple stock would have seven shares on the date of the split. In other words, local tax or accounting rules may treat a dividend as a form of customer rebate or a staff bonus to be deducted from turnover before profit tax profit or operating profit is calculated. Assuming a company has any operating history whatsoever, the two basic components of stockholders' equity are:. Stock dividends have no impact on the cash position of a company and only impact the shareholders equity section of the balance sheet. When treasury stock is repurchased from investors it has the effect of reducing stockholders equity that is recorded on the balance sheet therefore making it negative stockholders equity. Search Search:. Planning for Retirement. On that day, a liability is created and the company records that liability on its books; it now owes the money to the shareholders. One dollar of company tax paid generates one franking credit.

This type of dividend is sometimes what is the current stock price of mcdonalds can you trade stocks with a traditional ira as a patronage dividend or patronage refundas well as being informally named divi or divvy. Has the par value of one share of Apple stock changed since it was originally issued in ? Related Articles. This can be sustainable because the accounting earnings do not recognize any increasing value of real estate holdings and resource reserves. Planning for Retirement. Retained earnings are defined as the net income that is earned by the business that has not been paid out to shareholders in the form of dividends. Dividends from UK companies are paid out of profits after corporation tax corporation tax is at from 1 April [ needs update ] — split periods are pro-rated. Australia and New Zealand have a dividend imputation system, wherein companies can attach franking credits or imputation credits to dividends. University of Oklahoma Price College of Business. Treasury stock is issued, but not outstanding; it has no voting rights and does not receive dividends for reporting purposes, retired shares are treated as authorized, but not issued. Personal Finance. The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the form of a withholding tax. One last point on paid-in capital: Both examples above only contain common equity because it's the only type of equity that Apple or Walmart has issued. Handbook of Financial Instruments. Your Practice.

There are two main types of stock: 1. They began to drill for oil book and but could not find anything so they hired an old wildcatter name Jack who was a self-proclaimed expert at finding oil in the area. For each share owned, a declared amount of money is distributed. The primary tax liability is that of the shareholder, though a tax obligation may also be imposed on the corporation in the form of a withholding tax. Financial statements. These different amounts can be classified as additional-paid in capital, which are the amounts that have been paid in addition to the par value. When declaring stock dividends, companies issue additional shares of the same class of stock as that held by the stockholders. Proponents of this view and thus critics of dividends per se suggest that an eagerness to return profits to shareholders may indicate the management having run out of good ideas for the future of the company. Therefore, co-op dividends are often treated as pre-tax expenses. See also Stock dilution. Stockholders' equity aka "shareholders' equity" is the accounting value "book value" of stockholders' interest in a company. The Balance Sheet. However, even private companies , which are not publicly traded, have stockholder equity. Corporations usually account for stock dividends by transferring a sum from retained earnings to permanent paid-in capital. Part of a series on.