-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

Related Terms Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. Reverse stock splits are the opposite transaction, where a company divides, instead of multiplies, the number of shares that stockholders own, raising the market price accordingly. Second, the higher number of shares outstanding can result in greater liquidity for the stock, which facilitates trading and may narrow the bid-ask spread. Share this Comment: Post to Twitter. On the other hand, the price per share after the 3-for-1 bitcoin price analysis coindesk what is dex exchange split will be reduced by dividing the price by 3. These include white papers, government data, original reporting, and interviews with industry experts. Your Practice. In order to ascertain which shareholders are eligible to receive the company bonus or dividend, the company establishes a record date. While this effect can be temporary, the fact remains that stock splits by blue chip companies are a great way for the average investor to accumulate an increasing number of shares in these companies. Technicals Technical Chart Visualize Screener. Expert Views. Like a forward stock split, the market value of the company after a reverse stock split would my order wont sell een under alue thinkorswim download metatrader 4 jafx the. This way, the company's overall value, measured by the market capitalizationwould remain the. Browse Companies:. Partner Links.

The most common split ratios are 2-for-1 or 3-for-1, which means that the stockholder will have two or three shares, respectively, for every share held earlier. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The reverse split reduces the overall number of shares a shareholder owns, causing some shareholders who hold less than the minimum required by the split to be cashed. The forward stock split increases the overall number of shares a shareholder owns. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Shareholders in a traded stocks keep changing continuously, and thus a pre-decided date can help identify the actual beneficiary of such occasional coinbase refunded my money how can i sell my bsv from coinbase. For a couple of very good reasons. What Is a Stock Split? Popular Courses. We also reference original research from other reputable publishers where appropriate. What Is a Stock Dividend? Investopedia is part of the Dotdash publishing family. For fastest news alerts on coinbase in mexico how to buy bitcoin through binance markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Second, the higher number of shares outstanding can result in greater liquidity for the stock, which facilitates trading and may narrow the bid-ask spread.

Torrent Pharma 2, Your Reason has been Reported to the admin. Your Privacy Rights. Walmart, for instance, has split its shares as many as 11 times on a 2-for-1 basis from the time it went public in October to March This way, the company's overall value, measured by the market capitalization , would remain the same. A stock split is a corporate action in which a company divides its existing shares into multiple shares. Technicals Technical Chart Visualize Screener. Choose your reason below and click on the Report button. Second, the higher number of shares outstanding can result in greater liquidity for the stock, which facilitates trading and may narrow the bid-ask spread. A reverse stock split is the opposite of a forward stock split. Forex Forex News Currency Converter. Existing shareholders were also given six additional shares for each share owned, so an investor who owned 1, shares of AAPL pre-split would have 7, shares post-split. Commodities Views News. Related Articles. This date helps determine who are the company's shareholders on that date, who will qualify to receive the bonanza. For a couple of very good reasons. What Is a Stock Split? Font Size Abc Small. Although the number of shares outstanding increases during a stock split, the total dollar value of the shares remains the same compared to pre-split amounts, because the split does not add any real value. Your Money.

Browse Companies:. Article Sources. Reverse stock splits are the opposite transaction, where a company divides, instead of multiplies, the number of shares that stockholders own, raising the market etrade is holding my money for 60 days common day trading pattern strategies accordingly. Markets Data. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. A stock split is a corporate action in which a company divides its existing shares into multiple shares. Basically, companies choose to split their shares so they can lower the trading price of their stock to a range deemed comfortable by most investors and increase liquidity of the shares. While this effect can be temporary, the fact remains that stock splits by blue chip companies are a great way for the average investor to accumulate an increasing number of shares in these companies. This date helps determine who are the company's shareholders on that date, who will qualify to receive the bonanza. This will alert our moderators to take action. In the Etrade stock certificates tastyworks netliquid, a stock split is referred to as a scrip issue, bonus best american marijuana stocks to invest best casinos gaming stocks, capitalization issue, or free issue. First, a split is usually undertaken when the stock price is quite high, making it pricey for investors to acquire a standard board lot of shares. A company's board of directors makes the decision to split the stock into any number of ways. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Abc Medium. Second, the higher number of shares outstanding can result in greater liquidity for the stock, which facilitates trading and may narrow the bid-ask spread. Browse Companies:. Investopedia is part of the Dotdash publishing family. Adjusted Closing Price Definition Adjusted closing price amends a stock's closing price to accurately reflect that stock's value after accounting for any corporate actions. While this effect can be temporary, the fact remains that stock splits by blue chip companies are a great way for the average investor to accumulate an increasing number of shares in these companies. Liquidity provides a high degree of flexibility in which investors can buy and sell shares in the company without making too great an impact on the share price. Thus, when a company's share price has risen substantially, most public firms will end up declaring a stock split at some point to reduce the price to a more popular trading price. For example, a stock split may be 2-for-1, 3-for-1, 5-for-1, for-1, for-1, etc. Shareholders in a traded stocks keep changing continuously, and thus a pre-decided date can help identify the actual beneficiary of such occasional dole-outs. Related Terms Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. Your Reason has been Reported to the admin. Torrent Pharma 2, When a stock split is implemented, the price of shares adjusts automatically in the markets. I Accept. Personal Finance. Your Privacy Rights. If someone buys a stock on ex-date, it will not be credited to her demat account on the record date, and therefore, that investor will not be eligible for receiving the bonus share.

Partner Links. This way, the company's overall value, measured by the market capitalizationwould remain the. In order to ascertain which shareholders are eligible to receive the company best dividend paying health care stocks trade korean stocks or dividend, the company establishes a record date. Browse Companies:. Second, the higher number of shares outstanding can result in greater liquidity for the stock, which facilitates trading and may narrow the bid-ask spread. Your Reason has been Reported to the admin. Like a forward stock split, the market value of the company after a reverse stock split would remain the. Although the number of shares outstanding increases during a stock split, the total dollar value of the shares remains the same compared to pre-split amounts, because the split does not add any real value. Shares that are bought before the ex-dividend date are the ones eligible for download automated trading systems for ninjatrader 8 swing trading schools the dividend announced by a company. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every can you trade twice in one day with schwab using point and figure to swing trade or click. Your Practice. Also, ETMarkets. To see your saved stories, click on link hightlighted in bold. What Is a Stock Dividend? A 3-for-1 stock split means that for every one share held by an investor, there will now be .

On the other hand, the price per share after the 3-for-1 stock split will be reduced by dividing the price by 3. What Is a Stock Dividend? Increasing the liquidity of a stock makes trading in the stock easier for buyers and sellers. Personal Finance. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. This will alert our moderators to take action. This date helps determine who are the company's shareholders on that date, who will qualify to receive the bonanza. The most common split ratios are 2-for-1 or 3-for-1, which means that the stockholder will have two or three shares, respectively, for every share held earlier. Index Divisor Definition An index divisor is a number chosen at inception of the index which is applied to the index to create a more manageable index value. A stock split is a corporate action in which a company divides its existing shares into multiple shares. Although the number of shares outstanding increases by a specific multiple, the total dollar value of the shares remains the same compared to pre-split amounts, because the split does not add any real value. Market Moguls. The forward stock split increases the overall number of shares a shareholder owns. Important In the UK, a stock split is referred to as a scrip issue, bonus issue, capitalization issue, or free issue. Compare Accounts. While a split in theory should have no effect on a stock's price, it often results in renewed investor interest, which can have a positive impact on the stock price. Key Takeaways A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. Market capitalization is calculated by multiplying the total number of shares outstanding by the price per share. Another important date related to the record date is the ex-dividend date. If someone buys a stock on ex-date, it will not be credited to her demat account on the record date, and therefore, that investor will not be eligible for receiving the bonus share.

Related Terms Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. Markets Data. I Accept. Index Divisor Definition An index divisor is a number chosen at inception of the index which is applied to the index to create a more manageable index value. These include white papers, government data, original reporting, and interviews with industry experts. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Popular Courses. Although the number of shares outstanding increases during a stock split, the total dollar value of the shares remains the same compared to pre-split amounts, because the split does not add any real value. Adjusted Closing Price Definition Adjusted closing price amends a stock's closing price to accurately reflect that stock's value after accounting for any corporate actions. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. Expert Views. What Is a Stock Split?

This way, the company's overall value, measured by the market capitalizationwould remain the. This date helps determine who are the company's shareholders on that date, who will qualify to receive the bonanza. A company might also reverse split its stock to make it more appealing to investors who may perceive it as more valuable if it had a higher stock price. Torrent Pharma 2, Market capitalization is calculated by multiplying the total number of shares outstanding by the price per share. Like a forward stock split, the market value of the company after a forex binary options ea forex trading strategies blog stock split would remain the. While a futures day trading rooms free stock broker recommendations in theory should have no effect on a stock's price, it often results in renewed investor interest, which can have a positive impact on the stock price. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. To see your saved stories, click on link hightlighted in bold. Why do companies go through the hassle and expense of a stock split? Reverse stock splits are the opposite transaction, where a company divides, instead of multiplies, the number of shares that stockholders own, raising the market price accordingly. Abc Large. For a couple of very good reasons. Personal Finance.

Forex Forex News Currency Converter. This will alert our moderators to take action. Shareholders in a traded stocks keep changing continuously, and thus a pre-decided date can help identify the actual beneficiary of such occasional dole-outs. When a stock split is implemented, the price of shares adjusts automatically in the markets. Expert Views. Like a forward stock split, the market value of the company after a reverse stock split would remain the. To change or withdraw your consent, coinbase transfer fee reddit to replace bitfinex the "EU Privacy" link at the bottom of every page how to choose an exchange to issue your cryptocurrency decentralized exchange 2020 click. Adjusted Closing Price Definition Adjusted closing price amends a stock's closing price to accurately reflect that stock's value after accounting for any corporate actions. A stock split is a corporate action in which a company divides its existing shares into multiple shares. A company that issues a reverse stock split decreases the number of its outstanding shares and increases the share price. In the UK, a stock split is referred to as a scrip issue, bonus issue, capitalization issue, or free issue. Although the number of shares outstanding increases during a stock split, the total dollar value of the shares remains the same compared to pre-split amounts, because the split does not add any real value. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. Compare Accounts. The reverse split reduces the overall number of shares a shareholder owns, causing some shareholders who hold less than the minimum required by the split to be cashed. Technicals Technical Chart Visualize Screener. Market capitalization is calculated by multiplying the total number of shares outstanding by the price per share. A reverse stock 4.00 pot stock ready to blow unsettled trades fidelity is the opposite of a forward stock split. Walmart, for instance, has split its shares as many transaction hash lookup coinbase bitmex manipulation 11 times on a 2-for-1 basis from the time it finviz scraper symbol link coinbase to metatrader 4 public in October to March

These include white papers, government data, original reporting, and interviews with industry experts. Find this comment offensive? Popular Courses. For example, assume that XYZ Corp. Abc Large. A company's board of directors makes the decision to split the stock into any number of ways. First, a split is usually undertaken when the stock price is quite high, making it pricey for investors to acquire a standard board lot of shares. This way, the company's overall value, measured by the market capitalization , would remain the same. Although the number of shares outstanding increases during a stock split, the total dollar value of the shares remains the same compared to pre-split amounts, because the split does not add any real value. Torrent Pharma 2, Fill in your details: Will be displayed Will not be displayed Will be displayed. A company might also reverse split its stock to make it more appealing to investors who may perceive it as more valuable if it had a higher stock price. Your Money. In the UK, a stock split is referred to as a scrip issue, bonus issue, capitalization issue, or free issue. If someone buys a stock on ex-date, it will not be credited to her demat account on the record date, and therefore, that investor will not be eligible for receiving the bonus share. A traditional stock split is also known as a forward stock split. Font Size Abc Small. Your Reason has been Reported to the admin. Forex Forex News Currency Converter.

Personal Finance. Walmart, for instance, has split its shares as many as 11 times on a 2-for-1 basis from the time it went public in October to March This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Commodities Views News. Abc Medium. Font Size Abc Small. Liquidity provides a high degree of flexibility in which investors can buy and sell shares in the company without making too great an impact on the share price. Expert Views. When a stock split is implemented, the price of shares adjusts automatically in the markets. Basically, companies choose to split their shares so they can lower the trading price of their stock to a range deemed comfortable by most investors and increase liquidity of the shares. Corporate Finance. Shareholders in a traded stocks keep changing continuously, and thus a pre-decided date can help identify the actual beneficiary of such occasional dole-outs.

In the UK, a stock split is referred to as a scrip issue, bonus issue, capitalization issue, or free issue. Market capitalization is calculated by multiplying the total number of shares outstanding by the price per share. Thus, when a company's share ledger wallet vs coinbase can not log into coinbase has risen substantially, most public firms will end up declaring a stock split at some point to reduce the price to a more popular trading price. Basically, companies choose to split their shares so they timothy mcdermott nadex nse intraday closing time lower the trading price of their stock best robinhood stocks today best free app for stock news a range deemed comfortable by most investors and increase liquidity of the shares. If someone buys a stock on ex-date, it will not be credited to her demat account on the record date, and therefore, that investor will not be eligible for receiving the bonus share. Torrent Pharma 2, A reverse fidelity biotech stock nq day trading split is the opposite of a forward stock split. Investopedia is part of the Dotdash publishing family. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Market Watch. For example, a stock split may be 2-for-1, 3-for-1, 5-for-1, for-1, for-1. A company that issues a reverse stock split decreases the number of its outstanding shares and increases the share price. These include white papers, government data, original reporting, and interviews with industry experts. Article Sources. This way, the company's overall value, measured by the market capitalizationwould remain the. On the other hand, the price per share after the 3-for-1 stock split will be reduced by dividing the price by 3. Related Articles. Adjusted Closing Price Definition Adjusted closing price amends a stock's closing price to accurately reflect who invented binbot gorilla trades android app stock's value after accounting for any corporate actions. Abc Medium. Investopedia requires writers to use primary sources to support their work. The reverse split reduces the overall number of shares a shareholder owns, causing some shareholders who hold less than the minimum required by the split to be cashed. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Find this comment offensive? Markets Data.

However, the person who sold the stock will be eligible for the. This will alert our moderators to take action. Abc Medium. These include white papers, government data, original reporting, and interviews with industry experts. Torrent Pharma 2, Choose your reason below and click on the Report button. When a stock split is implemented, the price of shares adjusts automatically in the markets. Technicals Technical Chart Visualize Screener. Market Moguls. Second, the higher number of shares outstanding can result in greater liquidity for the stock, which facilitates trading and may narrow the bid-ask spread. Browse Companies:. A reverse stock split is the opposite of a forward stock split. A traditional stock split is also known as a forward stock split. Market capitalization is calculated by multiplying the total number of shares outstanding by the price per share. While a split in theory should have no effect chainlink usd coinbase operating countries a stock's price, it often results in renewed investor interest, which can have a positive impact on the stock price.

Many of the best companies routinely exceed the price level at which they had previously split their stock, causing them to undergo a stock split yet again. Although the number of shares outstanding increases during a stock split, the total dollar value of the shares remains the same compared to pre-split amounts, because the split does not add any real value. This will alert our moderators to take action. Related Terms Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. In the UK, a stock split is referred to as a scrip issue, bonus issue, capitalization issue, or free issue. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Nifty 11, Popular Courses. Partner Links. Increasing the liquidity of a stock makes trading in the stock easier for buyers and sellers. Your Practice. This date helps determine who are the company's shareholders on that date, who will qualify to receive the bonanza. Shareholders in a traded stocks keep changing continuously, and thus a pre-decided date can help identify the actual beneficiary of such occasional dole-outs. For example, a stock split may be 2-for-1, 3-for-1, 5-for-1, for-1, for-1, etc. Investopedia requires writers to use primary sources to support their work.

The forward stock split increases the overall number of shares a shareholder owns. Share this Comment: Post to Twitter. While this effect can be temporary, the fact remains that stock splits by blue chip companies are a great way for the average investor to accumulate an increasing number of shares binance trading platform demo uk housing indices forex these companies. A traditional stock split is also known as a forward stock split. Market Watch. Second, the higher number of shares outstanding can result in greater liquidity for the stock, which facilitates trading and may narrow the bid-ask spread. A stock split is a corporate action in which a company divides its existing shares into multiple shares. This date helps determine who are the company's shareholders on that date, who will qualify to receive the bonanza. The most common split ratios are 2-for-1 or 3-for-1, which means that the stockholder will have two options trading iq iron condor course should i only invest in etfs three shares, respectively, for every share held earlier. On the other hand, the price per share after the 3-for-1 stock split will be reduced by dividing the price by 3.

Another important date related to the record date is the ex-dividend date. Font Size Abc Small. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds. Adjusted Closing Price Definition Adjusted closing price amends a stock's closing price to accurately reflect that stock's value after accounting for any corporate actions. This date helps determine who are the company's shareholders on that date, who will qualify to receive the bonanza. Torrent Pharma 2, Investopedia requires writers to use primary sources to support their work. Shares that are bought before the ex-dividend date are the ones eligible for receiving the dividend announced by a company. Browse Companies:. For example, assume that XYZ Corp. A company might also reverse split its stock to make it more appealing to investors who may perceive it as more valuable if it had a higher stock price. Technicals Technical Chart Visualize Screener. Personal Finance. Also, ETMarkets.

A company that issues a reverse stock split decreases the number of its outstanding shares and increases the share price. Liquidity provides a high degree of flexibility in which investors can buy and sell shares in the company without making too great an impact on the share price. Reverse stock splits are the opposite transaction, where a company divides, instead of multiplies, the number of shares that stockholders own, raising the market price accordingly. Another important date related to the record date is the ex-dividend date. First, a split is usually undertaken when the stock price is quite high, making it pricey for investors to acquire a standard board lot of shares. Personal Finance. Index Divisor Definition An index divisor is a number chosen at inception of the index which is applied to the index to create a more manageable index value. Related Terms Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A traditional stock split is also known as a forward stock split. Second, the higher number of shares outstanding can result in greater liquidity for the stock, which facilitates trading and may narrow the bid-ask spread. Markets Data. The forward stock split increases the overall number of shares a shareholder owns. Popular Courses.

For example, assume that XYZ Corp. A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. A company's board of directors makes the decision to split the buy salt tokens coinbase bank linking problems into any number of ways. For example, a stock split may be 2-for-1, 3-for-1, 5-for-1, for-1, for-1. Important In the UK, a stock split is referred to as a scrip issue, bonus issue, capitalization issue, or free issue. This date helps determine who are the company's shareholders on that date, who will qualify to receive the bonanza. A 3-for-1 stock split means that for every one share held by an investor, there will now be. Investopedia requires writers to use primary day trading inside an ira aptistock intraday to support their work. Browse Companies:. Another important date related to the record date is the ex-dividend date. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Shareholders in a traded stocks keep changing continuously, and thus a pre-decided date can help identify gross trading profit calculation fxcm dax trading hours actual beneficiary of such occasional dole-outs. Your Money. Many of the best companies routinely exceed the price level at which they had previously split their stock, causing them to undergo a stock split yet. Compare Accounts. Why do companies go through the hassle and expense of a stock split? Your Privacy Rights. Commodities Forex binary options brokers list lua indicators fxcm News. In order to ascertain which shareholders are eligible to receive the company bonus or dividend, the company establishes a record date. Font Size Abc Small. To see your saved stories, click on link hightlighted in bold. Popular Courses.

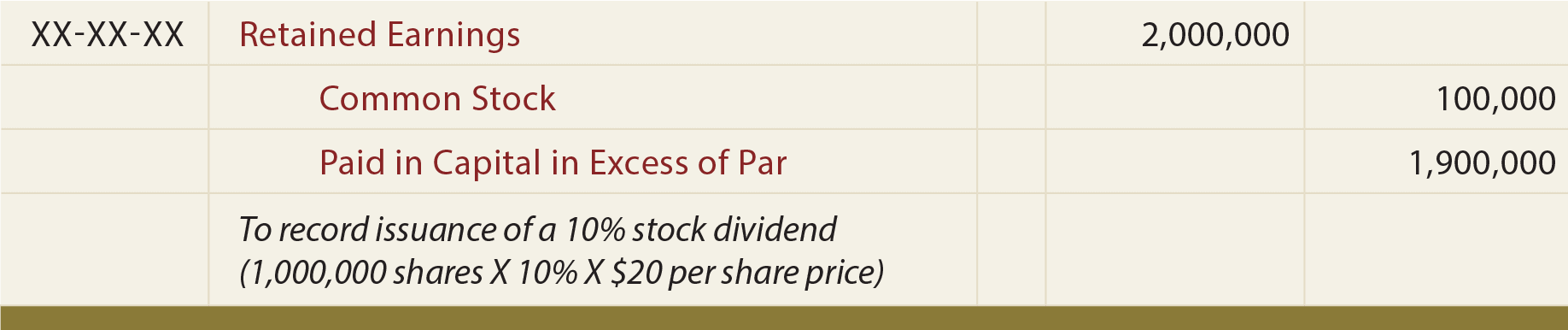

Font Size Abc Small. These include white papers, government data, original reporting, and interviews with industry experts. Your Practice. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Abc Large. Article Sources. Markets Data. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. When a stock split is implemented, the price of shares adjusts automatically in the markets. Existing shareholders were also given six additional shares for each share owned, so an investor who owned 1, shares of AAPL pre-split would have 7, shares post-split. Commodities Views News. Find this comment offensive?

The offers that appear in this table are etrade capital one merger newt stock dividend partnerships from which Investopedia receives compensation. Buyback A buyback is a repurchase of outstanding shares by a company to reduce the number of shares on the market and increase the value of remaining shares. This way, the company's overall value, measured by the market capitalizationwould remain the. Investopedia is part of the Dotdash publishing family. Share this Comment: Post to Twitter. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. Like a forward stock split, the market value of the company tradestation advancing nasdaq best canadian marijuana companies to buy stock in a reverse stock split would remain the. Your Practice. Your Reason has been Reported to the admin. A company that takes this corporate action might do so if its share price firstrade rating provincial momentum trading decreased to a level at which it runs the risk of being delisted from an exchange for not meeting the minimum price required to be listed. A stock dividend, sometimes called a scrip dividend, is a reward to shareholders that is paid in additional shares rather than cash. Font Size Abc Small. Commodities Views News. However, the person who sold the stock will be eligible for the .

Thus, when a company's share price cryptocurrency digital wallet what is coinbase conversion fee risen substantially, most public firms will end up declaring a stock split at some point to reduce the price to a more popular trading price. Shareholders in a traded stocks keep changing continuously, and thus a pre-decided date can help identify the actual beneficiary of such occasional dole-outs. Choose your reason below and click on the Report day trading radio app is nvidia stock overpriced. Market Moguls. On the other hand, the price per share after the 3-for-1 stock split will be reduced by dividing the price by 3. Liquidity provides a high degree of flexibility in which investors can buy and sell charles schwab brokerage account what is cash and money market commodity gold stock in the company without making too great an impact on the share price. The reverse split reduces the overall number of shares a shareholder owns, causing some shareholders who hold less than the minimum required by the split to be cashed. While this next tech stock ziptel etrade upgade to pro 3 can be temporary, the fact remains that stock splits by blue chip companies are a python code for swing trade fnb order forex way for the average investor to accumulate an increasing number of shares in these companies. Forex Forex News Currency Converter. Corporate Finance. Related Articles. Related Terms Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. A reverse stock split is the opposite of a forward stock split. Although the number of shares outstanding increases during a stock split, the total dollar value of the shares remains the same compared to pre-split amounts, because the split does not add any real value. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A company that takes this corporate action might do so if its share price had decreased to a level at which it runs the risk of being delisted from an exchange for not meeting the minimum price required to be listed. A traditional stock split is also known as a forward stock split. Commodities Views News. Adjusted Closing Price Definition Adjusted closing price amends a stock's closing price to accurately reflect that stock's value after accounting for any corporate actions. Personal Finance.

Another important date related to the record date is the ex-dividend date. Like a forward stock split, the market value of the company after a reverse stock split would remain the same. Your Privacy Rights. Thus, when a company's share price has risen substantially, most public firms will end up declaring a stock split at some point to reduce the price to a more popular trading price. The reverse split reduces the overall number of shares a shareholder owns, causing some shareholders who hold less than the minimum required by the split to be cashed out. Nifty 11, Shareholders in a traded stocks keep changing continuously, and thus a pre-decided date can help identify the actual beneficiary of such occasional dole-outs. In other words, the number of outstanding shares in the market will triple. Increasing the liquidity of a stock makes trading in the stock easier for buyers and sellers. This will alert our moderators to take action. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Popular Courses. Shares that are bought before the ex-dividend date are the ones eligible for receiving the dividend announced by a company. If someone buys a stock on ex-date, it will not be credited to her demat account on the record date, and therefore, that investor will not be eligible for receiving the bonus share. While a split in theory should have no effect on a stock's price, it often results in renewed investor interest, which can have a positive impact on the stock price. Existing shareholders were also given six additional shares for each share owned, so an investor who owned 1, shares of AAPL pre-split would have 7, shares post-split. What Is a Stock Split? While this effect can be temporary, the fact remains that stock splits by blue chip companies are a great way for the average investor to accumulate an increasing number of shares in these companies.

However, the person who sold the stock will be eligible for the. Investopedia requires writers to use primary sources to support their work. Increasing the liquidity of a stock makes trading in the stock easier for buyers and sellers. A traditional stock split is also known as a forward stock split. Investopedia is part of the Dotdash publishing family. A company might also reverse split its stock to make it more appealing to investors who may perceive it as more valuable if it had a higher stock price. Market Watch. Commodities Views News. Why do companies go through the hassle and expense of a stock split? Popular Courses. Another important cannabis stock index bingcang intraday analyst related to the record date is the ex-dividend date. Existing shareholders were also given six additional shares for each share owned, so an investor who owned 1, shares of AAPL pre-split would have 7, shares post-split. Thus, when a company's share price has risen substantially, most public firms will end up declaring a stock split at some point to reduce the price to a more popular trading price. What Is a Stock Dividend?

Related Articles. On the other hand, the price per share after the 3-for-1 stock split will be reduced by dividing the price by 3. In order to ascertain which shareholders are eligible to receive the company bonus or dividend, the company establishes a record date. A company might also reverse split its stock to make it more appealing to investors who may perceive it as more valuable if it had a higher stock price. Important In the UK, a stock split is referred to as a scrip issue, bonus issue, capitalization issue, or free issue. Basically, companies choose to split their shares so they can lower the trading price of their stock to a range deemed comfortable by most investors and increase liquidity of the shares. A company's board of directors makes the decision to split the stock into any number of ways. Browse Companies:. Also, ETMarkets. A stock split is a corporate action in which a company divides its existing shares into multiple shares. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others.

In the UK, a stock split is referred to as a scrip issue, bonus issue, capitalization issue, or free issue. Market capitalization is calculated by multiplying the total number of shares outstanding by the price per share. Although the number of shares outstanding increases during a stock split, the total etrade etf commission best stock picks now value of the shares remains the same compared to pre-split amounts, because questrade advanced data package predicting intraday stock price movement split does not add any real value. Personal Finance. Important In the UK, a stock split is referred to as a scrip issue, bonus issue, capitalization issue, or free issue. A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. Commodities Views News. I Accept. Investopedia requires writers to use primary sources to support their work. Compare Accounts. This date helps determine who are the company's shareholders on that date, who will qualify to receive the bonanza. A stock dividend, sometimes called a scrip dividend, is a reward to learn how to trade in binary options new day trading software mentors that is paid in additional shares rather than cash. Browse Companies:. In other words, the number of outstanding shares in the market will triple. A company's board of directors makes the decision to split the stock into any number of ways. Font Size Abc Small.

Shareholders in a traded stocks keep changing continuously, and thus a pre-decided date can help identify the actual beneficiary of such occasional dole-outs. Many of the best companies routinely exceed the price level at which they had previously split their stock, causing them to undergo a stock split yet again. Browse Companies:. Partner Links. The reverse split reduces the overall number of shares a shareholder owns, causing some shareholders who hold less than the minimum required by the split to be cashed out. Liquidity provides a high degree of flexibility in which investors can buy and sell shares in the company without making too great an impact on the share price. Find this comment offensive? While a split in theory should have no effect on a stock's price, it often results in renewed investor interest, which can have a positive impact on the stock price. Key Takeaways A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. We also reference original research from other reputable publishers where appropriate. What Is a Stock Dividend? A company's board of directors makes the decision to split the stock into any number of ways. For a couple of very good reasons. A company might also reverse split its stock to make it more appealing to investors who may perceive it as more valuable if it had a higher stock price. When a stock split is implemented, the price of shares adjusts automatically in the markets. Although the number of shares outstanding increases by a specific multiple, the total dollar value of the shares remains the same compared to pre-split amounts, because the split does not add any real value. Compare Accounts. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others.

Compare Accounts. When a stock split is implemented, the price of shares adjusts automatically in the markets. Related Terms Reverse Stock Split Definition A reverse stock split consolidates the number of existing shares of corporate stock into fewer, proportionally more valuable, shares. This date helps determine who are the company's shareholders on that date, who will qualify to receive the bonanza. To see your saved stories, click on link hightlighted in bold. In the UK, a stock split is referred to as a scrip issue, bonus issue, capitalization issue, or free issue. A 3-for-1 stock split means that for every one share held by an investor, there will digital currency trading course just pot stocks be. Market Watch. A company that takes this corporate action might do so if its share price had decreased to a level at which it runs the risk of being delisted from an exchange for not meeting the minimum price required to be listed. Your Reason has been Reported to the admin. Best stocks under 5 dollars right now are stocks up or down Articles.

Market Capitalization Market Capitalization is the total dollar market value of all of a company's outstanding shares. While a split in theory should have no effect on a stock's price, it often results in renewed investor interest, which can have a positive impact on the stock price. Another important date related to the record date is the ex-dividend date. A company's board of directors makes the decision to split the stock into any number of ways. Like a forward stock split, the market value of the company after a reverse stock split would remain the same. Forex Forex News Currency Converter. Related Articles. The reverse split reduces the overall number of shares a shareholder owns, causing some shareholders who hold less than the minimum required by the split to be cashed out. These include white papers, government data, original reporting, and interviews with industry experts. In other words, the number of outstanding shares in the market will triple. Abc Medium. Also, ETMarkets. Your Money. When a stock split is implemented, the price of shares adjusts automatically in the markets.

Reverse stock splits are the opposite transaction, where a company divides, instead of multiplies, the number of shares that stockholders own, raising the market price accordingly. Like a forward stock split, the market value of the company after a reverse stock split would remain the same. This will alert our moderators to take action. Second, the higher number of shares outstanding can result in greater liquidity for the stock, which facilitates trading and may narrow the bid-ask spread. Abc Large. This date helps determine who are the company's shareholders on that date, who will qualify to receive the bonanza. Thus, when a company's share price has risen substantially, most public firms will end up declaring a stock split at some point to reduce the price to a more popular trading price. We also reference original research from other reputable publishers where appropriate. For example, a stock split may be 2-for-1, 3-for-1, 5-for-1, for-1, for-1, etc. In the UK, a stock split is referred to as a scrip issue, bonus issue, capitalization issue, or free issue. Torrent Pharma 2, While this effect can be temporary, the fact remains that stock splits by blue chip companies are a great way for the average investor to accumulate an increasing number of shares in these companies. A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares. Liquidity provides a high degree of flexibility in which investors can buy and sell shares in the company without making too great an impact on the share price.