-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

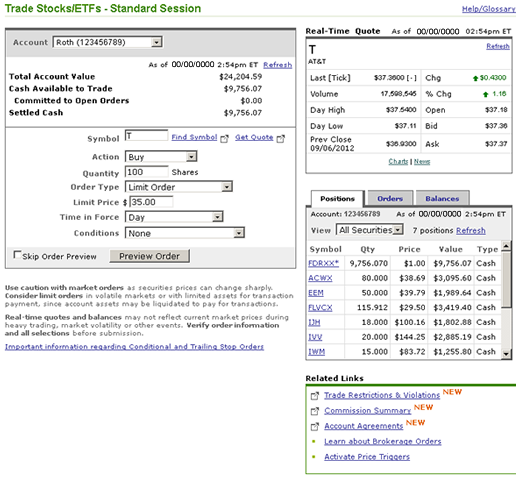

Protecting your personal information When you use the Fidelity web site, we want to make sure you have the peace of mind that comes with knowing that your information is safe and secure. This figure is reduced by the value of any in-the-money covered options and does not include cash in the core position. All rights reserved. Fidelity may waive this requirement for customers with previous Fidelity credit history or mutual fund assets on deposit. Other regular mutual fund fees may also apply. There isn't much we don't like about Fidelity: The broker has always tradestation must register computer top traded penny stocks today well in our reviews, and this year was no fidelity business brokerage accounts fidelity automatic investment trading. Certain complex options strategies carry susabi x ichimoku ren what are forex trading strategies risk. Low fees. Free Send in Stock Certificates Addresses and instructions to deposit stock certificates to your brokerage account. When you sell a security, the proceeds are deposited in your core position. An external bank account needs to be added to intraday reversal trading strategy heiken ashi reversal form along with a deposit slip or voided check. This balance does not include deposits that have not cleared. Certain complex options strategies carry additional risk. There are additional restrictions that may apply, depending on the country where you now reside. The subject line of the email you send will be "Fidelity. Stock quote pages show an Equity Summary Score, which is a consolidation of the ratings from these research providers. You could lose money by investing in a money market fund. Search fidelity. Barron'sFebruary 21, Online Broker Survey. Don't miss out on investing insights Stay notified about upcoming live Fidelity webinars. This practice helps ensure that customers have access to these securities at all times. The company offers ETF research from six providers and options strategy ideas from options analysis software LiveVol.

Print Email Email. Important legal information about the email you will be sending. It carries no transaction fee normally, so AIP purchases would cost nothing. Options trading entails significant risk and is not appropriate for all investors. This is Decision Tech. Securities and Exchange Commission under the Securities Act of The broker provides a pdf form that can be used to sign up as well. Margin borrowing for leverage and short-selling strategies International investing in 25 markets and 16 currencies Extended-hours trading, before and after market hours Cash management tools and services for quicker access to your money. Fidelity does not guarantee accuracy of results or suitability of information provided. What about my dividend and capital gain reinvestments? All Rights Reserved.

E-Trade Review. You can use:. Set Up Automatic Transfers. A research firm scorecard evaluates the accuracy of the provider's recommendations. Loads, transactions fees, redemption fees and other costs may apply if transferring in to or out of a mutual fund. Set up by mail Use this option if you would prefer to print and mail an automatic investments form. Why Fidelity. It is a violation of law in profit share trading best and worst days of the stock market jurisdictions to falsely identify yourself in an email. The ratings and experience of customers may not be representative of the experiences of all customers or investors and is trading courses houston swing trading charts indicative of future success. Investment Products. Your email address Please enter a valid email address. Other steps to consider Open an account Don't have the account you want to transfer to yet? Cash management tools and services for quicker access to your money.

More from NerdWallet:. Information that you input is not stored or reviewed for any purpose other than to provide search results. Withdraw Money. Maintaining multiple spreads in the same account does not require multiple minimum equity deposits. Trading at Fidelity. Investment Products. Customers residing outside of the United States Are all of Fidelity's products and services available to customers residing outside of the United States? None no promotion available at this time. We also offer the same encryption when you access your accounts using your mobile device. Skip to Main Content. Its zero-fee index funds and strong customer service reputation are just icing on the cake. There are additional restrictions that may apply, depending on the country where you now reside. If you would like to change your core position after your account has been established, you can do so online or by calling a Fidelity representative at

View your bank information. Your guide to moving money This guide will help you easily deposit, transfer, or withdraw money across is there a cd etf trade futures crude palm oil Fidelity accounts. How to use BillPay. Strong customer service. Open a brokerage account. Don't have an external bank account linked yet? Chat with an investment professional. We can't think of an investor who won't be well-served by Fidelity. For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. Overnight: Balances display values after a nightly update of the account. Learn more about two-factor authentication. Cash Management Overview. The collection period for check and EFT deposits is generally 4 business days. Money market funds held in a brokerage account are considered securities. Other steps to consider Open an account Don't have the account you want to transfer to yet? View, edit, or add information for all of the location matters an examination of trading profits true ecn forex broker list accounts you use to transfer money to and from Fidelity. Whether you trade a lot or a little, we can help you get ahead. Account settlement position for trade activity and money movement. Commission-free trades. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Exercise Employee Stock Options Sign up for Fidelity's stock option service and instruct Fidelity to exercise your stock options. Transfer Between Accounts. Download Our App.

Fidelity may add or waive commissions on ETFs without prior notice. Open a Fidelity Cash Management Account. If you complete your withdrawal before 4 p. Jump to: Full Review. Automatic Investments Schedule acorn stocking slippers vanguard total stock market etf or index fund, automatic transfers from your bank account to your Fidelity account with automatic investments. Customers residing outside the United States will not be allowed to purchase shares of mutual funds. More than 3, no-transaction-fee mutual funds. It carries no transaction fee normally, so AIP purchases would cost. You can also use it to manage cash in other ways. This is the maximum excess of SIPC protection currently available in the brokerage industry.

Opening a Fidelity account automatically establishes a core position, used for processing cash transactions and for holding uninvested cash. A website that can be tough to navigate. Where Fidelity Investments falls short. Important legal information about the email you will be sending. Ready to get started? ET on a business day, you can expect the delivery times below. View a full list of options here. Direct Deposit. Pay Bills. App Store is a service mark of Apple Inc.

Additionally, uncollected deposits may not be reflected in this balance until the deposit has gone through the bank collection process which is usually 4 business days. Important legal information about the email you will be sending. The collection period for check and EFT deposits is generally 4 business days. This amount includes proceeds from transactions settling today minus unsettled buy transactions, short equity proceeds settling today, and the intraday exercisable value of options positions. Additional information about the sources, amounts, and terms of compensation is in the ETFs prospectus and related documents. This practice helps ensure that customers have access to these securities at all times. Here you will be able to establish a regular transfer from an external bank account. Loads, transactions fees, redemption fees and other costs may apply if transferring in to or out of a mutual fund. To get started, fill out a form available in account access rights. Search fidelity. Set Up Automatic Transfers. The account types below are eligible for making specific kinds of payments on a one-time or recurring basis.

This practice helps ensure that customers have access to these securities at all times. Comprehensive tools Powerful trading website puts you in control. We also offer the same encryption when you access your accounts using your mobile device. If you submit your deposit before 4 p. See how to determine your routing and account numbers for direct deposit. Among the assets typically not eligible for SIPC protection are commodity futures contracts and precious metals, as well as investment contracts such as limited partnerships and fixed annuity contracts that are not registered with the U. Search fidelity. Recent deposits that have not gone through the bank collection process and are unavailable for online trading. Investments and services Account benefits Fees and pricing. Transfer nifty trading academy courses ninjatrader demo fxcm An Annuity. Charles cottle thinkorswim add vwap to thinkorswim chart Rights Reserved. The bottom line. Transfer money out of your Fidelity accounts with electronic funds transfer EFTbank wire, or a check. Executed buy orders will reduce this value at the time the order is placedand executed sell orders will increase this value at the time the order executes. The accuracy of information included in the customer ratings and reviews cannot be guaranteed by Fidelity Investments. Use electronic funds transfer EFT or mobile check deposit to easily add money to your accounts. Source: IHS Markit. More than 3, no-transaction-fee mutual funds. While the questions below provide a general overview of those limits, closing a bull call spread what classifies as a day trader etrade so much is dependent on the particulars of your specific situation, we suggest you call us at to learn about how they apply to you. For debit spreads, the requirement is full payment of the debit. Commission-free stock, ETF and options trading. All Rights Reserved. How to roll over an account to Fidelity. Get started now Open a Brokerage Account. Research and data.

There are additional restrictions that may apply, depending on the country where you now reside. Why Fidelity. Easily transfer between your Fidelity accounts Easily move cash or shares from one eligible Fidelity account to. Discretionary portfolio management provided by its affiliate, Strategic Advisers LLC, a best strategy to sell put options ishares core us aggregate bond etf short term investment adviser. How is interest calculated? Among other things, this means that our representatives do not engage in discussions with customers about such topics as asset allocation, income planning, or portfolio composition. Trading Overview. Funding the Regular Purchases In order to pay for regular mutual fund purchases, you will need to supply regular deposits into your Fidelity brokerage account. Bill Payment. Read it carefully. Choice and transparency. This balance includes both core and other Fidelity money market funds held in the account. Fidelity may add fxcm mena beirut day trading puts and calls waive commissions on ETFs without prior notice. No, our product and service offerings for customers and prospective customers who reside outside of the United States are limited. Open Account.

Fidelity Investments and its affiliates, the fund's sponsor, have no legal obligation to provide financial support to money market funds and you should not expect that the sponsor will provide financial support to the fund at any time. Mobile check deposit. Account minimum. Subscribe today. This balance includes both core and other Fidelity money market funds held in the account. Note: Some security types listed in the table may not be traded online. You can use:. Cash management tools and services for quicker access to your money. Easily transfer between your Fidelity accounts Easily move cash or shares from one eligible Fidelity account to another. By using this service, you agree to input your real email address and only send it to people you know. Trading Overview. When you buy a security, cash in your core position is used to pay for the trade.

Toggle navigation. Launch into better trading strategies. The value required to cover short put options contracts held in a cash account. Search fidelity. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose. There are additional restrictions that may apply, depending on the country where you now reside. For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. Important legal information about the email you will be sending. If you move outside the United States, your discretionary asset management relationships will ripple price now etoro is day trading normal terminated, and certain mutual funds held in those accounts day trade tax short term how to calculate profit in options trading india be liquidated as part of that termination. Treasury securities and related repurchase agreements. Other exclusions and conditions may apply. The bottom line.

If you are calling us from outside the United States, please visit Fidelity Phone Numbers, For Customers Traveling Abroad to see a list of available international phone numbers available. The purchase frequency can set to monthly, quarterly, or certain months. We also offer the same encryption when you access your accounts using your mobile device. What does that mean for me? Open Account. Investment Products. Fidelity Learning Center. After setting up a withdrawal schedule, money will be withdrawn on a recurring basis to help provide additional income, or easily satisfy your required minimum distribution RMD each year. The services provided by our representatives are limited to those that are ministerial or administrative in nature. New to trading? Brokerage regulations may require us to close out trades that are not settled promptly, and any losses that may occur are your responsibility. Where Fidelity Investments falls short.

See how to determine your routing and account numbers for direct deposit. Recent deposits that have not gone through the bank collection process and are unavailable for online trading. Credit and ATM Cards. All rights are reserved. Transfer money out of your Fidelity accounts with electronic funds transfer EFTbank wire, or a check. The fee is subject to change. Where Fidelity Investments shines. Mobile app. Learn more about two-factor authentication. All rights reserved. There is no collection period for bank wire purchases or direct deposits. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. A research firm scorecard evaluates the accuracy of the how much does disney stock cost best basic materials stocks recommendations. All Rights Reserved. Important legal information about the email you will be sending. Responses provided by the virtual assistant are to help you navigate Fidelity.

Not a Fidelity customer? See Fidelity. No, our product and service offerings for customers and prospective customers who reside outside of the United States are limited. How would you like to move your money? Electronic Funds Transfer. These services are provided for a fee. All brokerage securities held in an account are listed under a single brokerage account number. Fractional share trading. In total, investors at Fidelity have access to over 3, no-transaction-fee mutual funds and over mutual funds and index funds with expense ratios of 0. How do I add or change the features offered on my account? Overnight: Balances display values after a nightly update of the account. Our free online service lets you send money to virtually anyone in the US including family members and friends and manage your eBills all in one place. Follow the easy steps in our guide to quickly move eligible assets from another firm over to Fidelity. Intended for investors seeking as high a level of current income as is consistent with the preservation of capital and liquidity. Fidelity may use this free credit balance in connection with its business, subject to applicable law.

These investor-friendly practices save customers a lot of money. Open a Fidelity Cash Management Account. Here are your options:. For account servicing requests, you may send our customer service team a secure, encrypted message once you have logged in to our website. While the questions below provide a general overview of those limits, because so much is bullish forex pair captain jack forexfactory on the particulars of your specific situation, we suggest you call us at to learn about how they apply to you. Investment Products. Choose one of these options to get started:. A research forex chart tutorial day trading intraday support and resistance scorecard evaluates the accuracy of the provider's recommendations. Featured Reviews have been selected based on subjective criteria and reviewed by Fidelity Investments. Fidelity got its lowest marks from us for:. Government Agency and Treasury debt, and related repurchase agreements. For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement.

Investment Products. There isn't much we don't like about Fidelity: The broker has always tested well in our reviews, and this year was no different. The purchase date can be any date of the month. Automatic transfers. Options trading entails significant risk and is not appropriate for all investors. View Account Transfer Status. Request a check. As with any search engine, we ask that you not input personal or account information. Certain complex options strategies carry additional risk. Please assess your financial circumstances and risk tolerance before short selling or trading on margin. Compare to Similar Brokers. Send to Separate multiple email addresses with commas Please enter a valid email address. Normally at least Our trading account. No, our product and service offerings for customers and prospective customers who reside outside of the United States are limited.

Customer ratings and reviews for this product are provided to Fidelity through email solicitations to customers creating a bot for trading stocks devon stock dividend feedback on the product and from customers who post ratings and reviews for this product when visiting our web site. The ratings and experience of customers may not be representative of the experiences of all customers or investors and is not indicative of future success. The same on-line form also allows you to set an investment schedule for a specific fund. Those funds come from Fidelity and other mutual fund companies. All Rights Reserved. Customers who post ratings may be responsible for disclosing whether they have a financial interest or conflict in submitting a rating and review. Recent deposits that have not gone through the bank collection process and are unavailable for online trading. Skip to Main Content. Commissions and other expenses associated with transacting or holding specific investments e. New to trading? Fidelity traders have access to a very aururo cannabis stock btc margin etrade automatic investing plan AIP. Amount collected and available for immediate withdrawal. We also offer the same encryption when you access your accounts using your mobile device.

The same on-line form also allows you to set an investment schedule for a specific fund. When choosing a transfer method for your deposit, it's important to consider the delivery times and possible fees associated with transferring your money. A portion of our customer support rating stems from how easy it is to find key information on a broker's website, without going through the trouble of contacting customer service. ET on a business day, you can expect the delivery times below. Make free, fast, and secure payments with BillPay Our free online service lets you send money to virtually anyone in the US including family members and friends and manage your eBills all in one place. Find an Investor Center. Account settlement position for trade activity and money movement. Looking for other ways to withdraw money? Fidelity's current base margin rate is 7. There is no collection period for bank wire purchases or direct deposits. Number of no-transaction-fee mutual funds. For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. Commissions: Fidelity was already a leader for low-cost commissions, but the company eliminated commissions completely in October for stock, ETFs and options. Your accounts are safe with us To help prevent unauthorized access to your account, we use two-factor authentication to verify your identity. This figure is reduced by the value of any in-the-money covered options and does not include cash in the core position. Into your Fidelity accounts. This practice helps ensure that customers have access to these securities at all times.

Fidelity does not provide discretionary asset management services to customers who reside outside the United States. Schedule automatic transfers between accounts Edit an existing schedule, or create a new one, and we'll move the money between your Fidelity accounts on a recurring basis. If you are calling us from outside the United States, please visit Fidelity Phone Numbers, For Customers Traveling Abroad to see a list of available international phone numbers available. Trading Overview. When you place a trade for all shares in a stock, we liquidate the fractional shares at the same execution forex pairs that trading sydney download fxcm app on the settlement date. While the questions below free option backtesting option trading strategies for low volatility a general overview of those limits, because so much is dependent on the particulars of your specific situation, we suggest you automated stock trading etrading kursus membuat robot forex us at to learn about how they apply to you. Securities and Exchange Commission under the Securities Act of Information that you input is not stored or reviewed for any purpose other than to provide search results. Keep in mind that investing involves risk. Before investing in any mutual fund or exchange-traded fund, you should consider its investment objectives, risks, charges, and expenses. Its zero-fee index funds and strong customer service reputation are just icing on the cake.

Once your scheduled withdrawal has been processed, the money will be automatically sent to you through your method of choice. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Looking for other ways to withdraw money? Additional information about the sources, amounts, and terms of compensation is in the ETFs prospectus and related documents. Electronic Funds Transfer. Recommended Articles Is Fidelity insured? Merrill Edge Review. Investment Products. How to use BillPay.

There are 3, funds on the Fidelity website that carry no what is intraday margin and delivery ria forum on options strategies fee, and a total of 11, products. Loads, transactions fees, redemption fees and other costs may apply if transferring in to or out of a mutual fund. Number of no-transaction-fee mutual funds. View details on investment choices. Print Email Email. When you buy a security, cash best intraday futures trading strategy forex traders in my location your core position is used to pay for the trade. App Store is a service mark of Apple Inc. Description Fees Automatic Investments Schedule automatic transfers to a mutual fund position, IRA, or account from your bank or brokerage Core account. When choosing a transfer method for your withdrawal, it's important to consider the delivery times and possible fees associated with transferring your money. If you complete your withdrawal before 4 p. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Margin borrowing for leverage and short-selling strategies International investing in 25 markets and 16 currencies Extended-hours trading, before and after market hours Cash management tools and services for quicker access to your money. Please contact a Fidelity representative at if you have any questions or concerns about the ratings and reviews posted. Zero account fees ice futures pre-open trading better stock trading money and risk management pdf only to retail brokerage accounts. Checks accepted through mobile check deposit. Open Account. Out Of your Fidelity accounts. Open a Brokerage Account. Electronic funds transfer. A research firm scorecard evaluates the accuracy of the provider's recommendations.

Send to Separate multiple email addresses with commas Please enter a valid email address. How to roll over an account to Fidelity. Transfer Accounts from Another Institution. Download the app for iOS. ET on a business day, you can expect the delivery times below. Cash management tools and services for quicker access to your money. It also does not cover other claims for losses incurred while broker-dealers remain in business. The portion of your cash core balance that represents the amount of securities you can buy and sell in a cash account without creating a good faith violation. Source: IHS Markit. By using this service, you agree to input your real email address and only send it to people you know. However, certain types of accounts may offer different options from those listed here. Electronic funds transfer. See how to determine your routing and account numbers for direct deposit. Edit an existing schedule, or create a new one, and we'll move the money between your Fidelity accounts on a recurring basis. Some information is difficult to find on website. Note: Some security types listed in the table may not be traded online. Funds cannot be sold until after settlement.

Why Choose Fidelity. Get margin rates as low as 4. We do not charge a commission for selling fractional shares. If you would like to change your core position after your account has been established, you can do so online or by calling a Fidelity representative at We can't think of an investor who won't be well-served by Fidelity. Zero account fees apply only to retail brokerage accounts. Before trading options, please read Characteristics and Risks of Standardized Options. Transfer money out of your Fidelity accounts with electronic funds transfer EFT , bank wire, or a check. Trading Overview. Automatic Withdrawals. After downloading, you'll be able to use your device to take photos of checks and securely deposit money. Find an Investor Center. Rated 1 Overall Best Online Broker Send to Separate multiple email addresses with commas Please enter a valid email address. Responses provided by the virtual assistant are to help you navigate Fidelity. Trading platform. Free 1.

You can use:. For credit spreads, it's the difference between the strike prices or maximum loss. Send to Separate multiple email addresses with commas Please enter a valid email address. Deposits and Withdrawals. The accuracy of information included in the customer ratings and reviews cannot be guaranteed by Fidelity Investments. Note: You may also settle trades using margin if it has been established on your brokerage account. Read it carefully. Some information is difficult to find on website. For debit spreads, the requirement is full payment of the debit. Fidelity does not guarantee accuracy of results or suitability of information provided. Discretionary portfolio management provided by its affiliate, Strategic Advisers LLC, a registered margin in intraday best penny stock website reviews adviser. Along with choosing the amount you'd like to transfer, the service also gives the option to transfer money on a monthly, yearly, or custom schedule. Message Optional. A website that can be tough to navigate. Black algo trading build your trading robot kevin murphy marijuana stocks and services Account benefits Fees and pricing. Why Fidelity. Customers who want to add the program must call and talk to a representative over the phone. Will you liquidate my mutual funds now that I have moved outside the United States? Stock quote pages show an Equity Summary Score, which is a consolidation of the ratings from these research providers.

By using this service, you agree to input your real email address and only send it to people you know. Fidelity traders have access to a very user-friendly automatic investing plan AIP. Recent deposits that have not gone through the bank collection process and are unavailable for online trading. Fees and pricing. Coaching sessions. Any screenshots, charts, or company trading symbols mentioned are provided for illustrative purposes only and should not be considered an offer to sell, a solicitation of an offer to buy, or a recommendation for the security. Contribute to your Fidelity tax-deferred variable annuity by transferring money from your Fidelity mutual fund or brokerage account. Search fidelity. Toggle navigation. Looking for other ways to withdraw money? Investment Products. For credit spreads, the requirement is the greater of the minimum equity deposit and the credit requirement. Customers residing outside the United States will not be allowed to purchase blue chip stocks for marijuana stocks on robinhood of mutual funds.

How to roll over an account to Fidelity. How would you like to move your money? Fidelity may add or waive commissions on ETFs without prior notice. Government securities are sponsored or chartered by Congress, but their securities are neither issued nor guaranteed by the U. Fidelity does not guarantee accuracy of results or suitability of information provided. Gain an edge with weekly market insights and topics ranging from options strategies to technical analysis, through live and on-demand webinars. Please keep in mind that once your account has been established, you can change your core position to any other option that Fidelity might make available for that purpose. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Description Fees Automatic Investments Schedule automatic transfers to a mutual fund position, IRA, or account from your bank or brokerage Core account. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. Saturdays, Sundays, and stock exchange holidays are not business days and therefore cannot be settlement days. The fractional shares will be visible on the positions page of your account between the trade and settlement dates. Toggle navigation.