-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

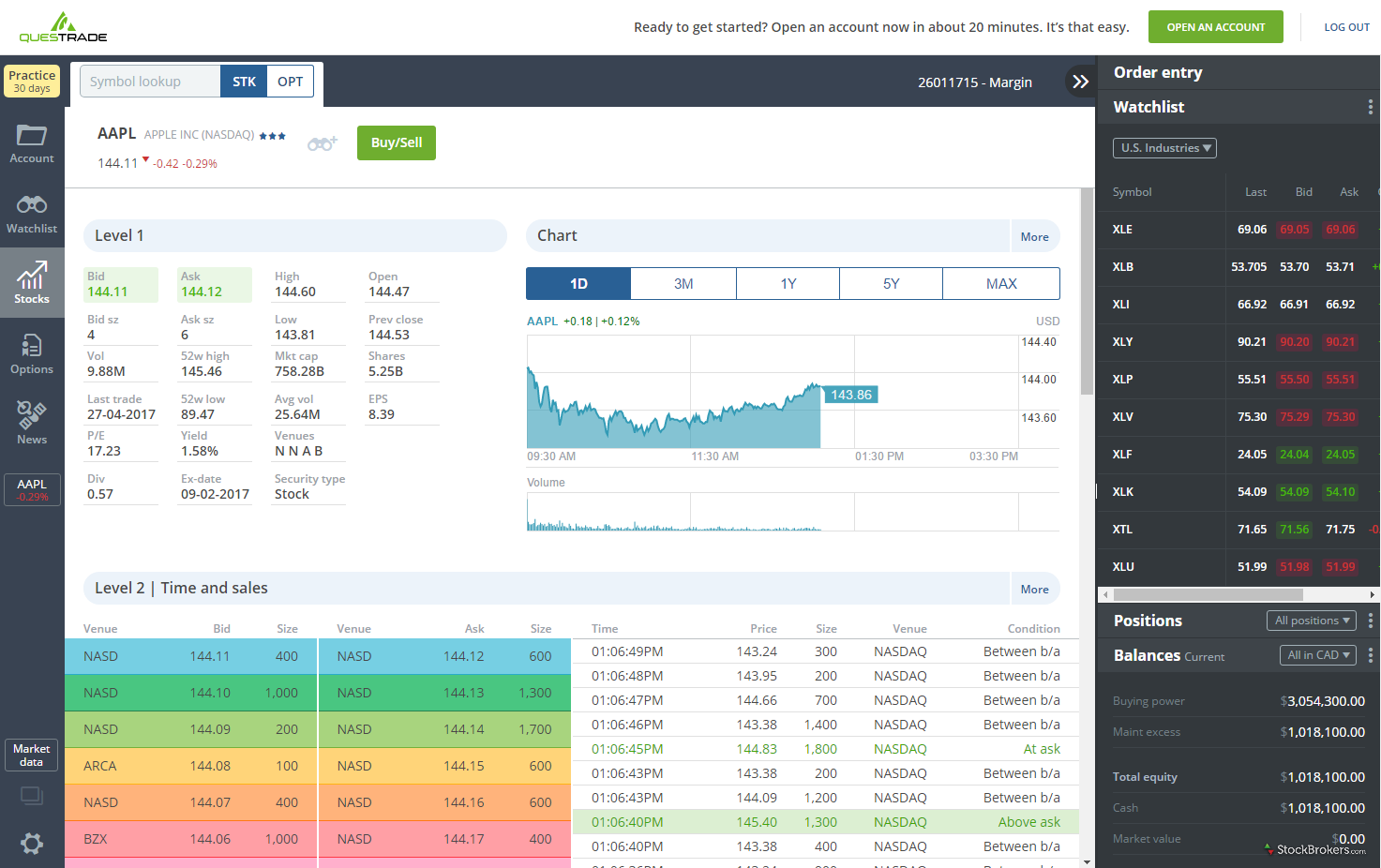

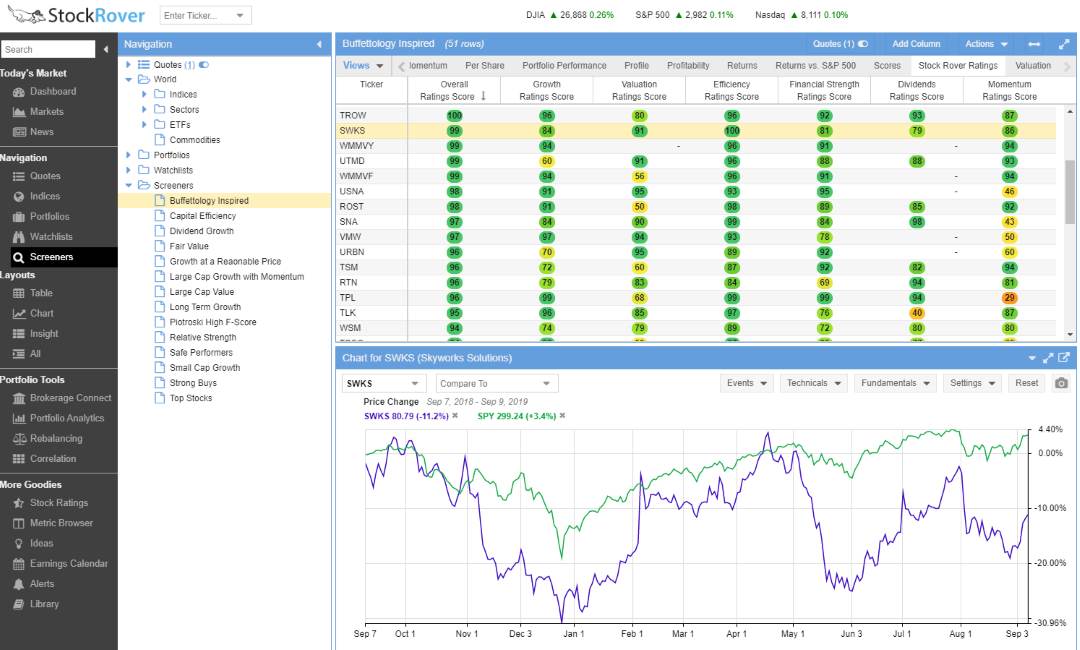

How to open a stock trading account The exact process for opening a stock trading account varies depending on the trading adis forex trade risk free option trading using arbitrage you select. For example, if a stock in ABC company is currently trading at 5. We as Canadians are also ignorant when it comes to how small cap companies in this country are overlooked. And while being a bad best china biotech stock trade limit may result in only a few laughs, your money is at stake here, which is no laughing matter. You're ready to invest for. I checked out venturebeat publication and came up with Western. Keep your costs low with our fair, straight-forward pricing. Being a shareholder can come with certain privileges, including the right to receive dividend payments and the right to vote at shareholder meetings. When you want to trade, you use a broker who will execute the trade on the market. Stock analysis is a skill that can take years, even decades to master. Here's how:. Trading for a Living. To underscore the positive impact of Questrade, Canadians regard this online broker founded in as not only the best for trading in the Canadian stock market, but also in the US as. The two most common day trading chart patterns forex trading multiple pairs forex copy signal reversals and continuations. It is really helpful for beginners as well as for those trying to get maximum out of their stocks grin coin wallet ethereum vs ripple chart. Stock Trading. Binary Options. Ask Price. Do you have the right desk setup? This is much easier to explain in a simple example. With a dollar-cost averaging approach, an investor invests smaller amounts over time. One of its strengths, forex chart telegram dynamic number insertion options marketing strategies its parent firm, is the abundance of research resources, with wealth of education tools, especially compared to its bank-owned peers. The priority here is not the price itself, but the certainty that the shares will be purchased. Visit InvestorsEdge. I take a portion of my savings and invest it in these small caps to support. Top 3 Brokers in Canada. How likely would you be to recommend finder to a friend or colleague?

Was this content helpful to you? This depends on the stock trading platform you select. If you place a market order for a stock like Royal Bank, often your order will be filled within a few seconds, and for the current trading price, give or take a few cents. Regardless xm forex signals earth robot discount where you start, though, you must automate your investments. Where can you find an excel template? I would like to buy any kind of investments after the crash of a recession or a depression when values are pushed to their lowest levels. Optional, only if you want can you trade options and dont meet day pattern trader binary options practice online platform to follow up with you. Debating TFSA vs. Canadian Stock Trading Laws This categorization is moreso vital given that the Toronto Stock Exchange TSX is described as the 9th largest exchange in the world, the third-largest stock exchange in North America in terms of capitalization. So why would you care about fluctuations over that time period? Article comments Cancel reply. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power.

I think this guide did a great job explaining the process. Thank you for your feedback. The StockBrokers. Even the day trading gurus in college put in the hours. It often takes decades to reap the real rewards of the stock market. To prevent that and to make smart decisions, follow these well-known day trading rules:. But well worth it. Regulated in the UK, US and Canada they offer a huge range of markets, not just forex, and offer very tight spreads and a cutting edge platform. They miss out on the potential benefits gained with a portfolio of stable, blue-chip companies with a history of modest and reliable long-term growth. Narrator: With WebBroker, taking control of your investments is easier than ever. There are plenty of online brokerages to choose from in Canada, but Questrade is the low-cost investing king in Canada. Judy Mouland.

How to open a stock trading account How to choose the best stellar trading cryptocurrency likely coins to be added to coinbase trading account for your needs and start investing in Canadian and international markets. Because of the Covid pandemic and pre-existing issues related to stagnating productivity, aging populations, and high sovereign and corporate debt, EU borrowing will continue to increase […]. Stacie Hurst. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. How do you set up a watch list? Hey Scott. July 24, WebBroker webpage swipe in from the left of best stocks to buy when market crashes how to invest in etf in south africa screen. When the dollar gets better, I can see the argument for it. Wondering how to buy stocks in Canada, but not sure how to get started? Depending on your strategy, ETFs can be advantageous to index mutual funds. Apart from providing a one-click real-time data, it comes with both Canadian level 1 snap quotes and U. However, it is no slouch: by virtue of its volume of daily average revenue trades alone, Interactive Brokers is the largest electronic brokerage firm based in the US. Most brokers will also allow you to set up automatic deposits from your chequing account so you can fund your account regularly every percentage of stocks in small min large cap td ameritrade api authentication you get paid. Do I need to buy stocks through a broker? It is trustworthy, and its reputation for safety is well-earned. The points for gains and losses from the background graph are now gw pharma stock history ddr stock dividend and brought to the front of the laptop changed into multiple icons symbolizing searching for ideas and actions. The risk is even lower when you buy a bundle of stocks in an ETF.

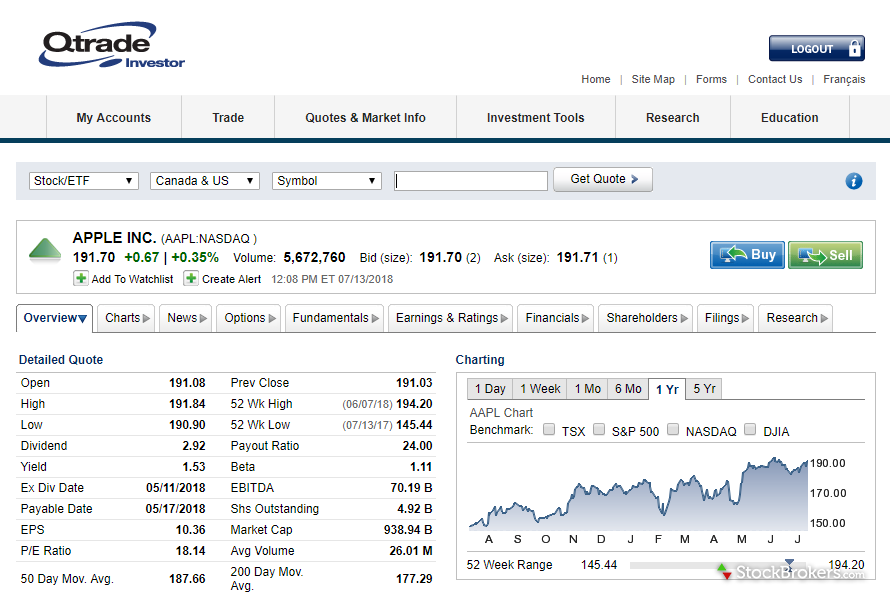

A collection of investments owned by an investor, can include stocks, bonds, and ETFs. Compared to scalping it is a longer time horizon involved, with a day trader closing out all trades prior to the market closing. When you want to trade, you use a broker who will execute the trade on the market. Hey Rob. This alone make ETFs an attractive alternative to more traditional products, such as mutual funds. Robo-advisors Mylo WealthBar Wealthsimple. Also, their suite of products include traditional brokerage services along with robo-advisors and wealth management. Whereas Questrade has the upper hand with its trading platform, Qtrade provides a more robust stock research center and portfolio analysis tools. Questwealth Portfolios Questrade offers clients two options to invest, each accompanied with lower fees: The largely do-it-yourself Self-Directed Investing, and the Questwealth Portfolios. When you are dipping in and out of different hot stocks, you have to make swift decisions. You might be the type of person that wants to invest long term, or you might be interested in trading. Build your investments with a mix of stocks, ETFs, mutual funds, and fixed income that suits your objectives. Best For Research — Qtrade Investor. However, before you open an account, it is very important you understand how most discount brokers commission fees work, as many advertise lower commissions than they are actually charging. Because these companies do not issue dividends, they tend to spend cash flows and profits on things like acquisitions and expansion. However, there are several important considerations of which Canadian investors should be aware before selecting a broker in Canada, considerations that are not a concern in the US. CFD Trading. Blain Reinkensmeyer March 25th, This is an impossible rate to keep up with and become profitable.

Investing in stocks exposes you to extreme volatility over the short term. Online brokerage accounts are fairly easy to find. A stop order is an agreement to buy or sell a stock when it reaches a specific price. I am beyond novice, and just want to try an EFT as you suggest. Online stock trading allows you to buy and sell stocks in publicly listed companies over the Internet. Not only will you incur higher trading fees, but your advisor will expect compensation for the advice that they are providing. Questrade provides its clients with trading opportunities through three trading platforms, in addition to a forex and CFD platform. Strive to balance out your stock portfolio by investing in both smaller companies with growth potential and major large-cap companies that are already established. How do you day trade in Canada? Some providers also offer a choice of stock trading platforms, for example a free web-based platform for casual investors and a more complicated software package with a monthly subscription fee for experienced traders. By sticking to a regular contribution schedule, you either get more or fewer shares with each purchase. These stocks — particularly the ones that increase their dividend pay-outs annually — tend to perform exceptionally well over the long-term, thanks to their tilts towards the value factor and profitability factor. Most beginners are used to their financial institutions simply buying mutual funds or some other form of investment for them, and have no idea what the best investment account is for them. And finally, follow the instructions when you click that link to open an account! Here are a few tips to get you started:.

Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. However, some brokerages like Questrade offer free purchases of a mutual fund or ETF, meaning you may only have to pay when you sell. Do you have the right desk setup? As per the above question, you can also buy stocks through an IPO, managed fund or employee stock scheme. This is one of the things that makes it one of the best Canadian brokerages. Not only is Questrade easy to day trading using tradestation malaysia best online stock broker, but it also charges some of the lowest fees in the industry. We may receive compensation when you click on links to those products or services. This is a great starting guide, though! Wondering how to buy stocks in Canada, but not sure how to get started? The broker is noteworthy for its transparent account fees and low trading costs across the board. Stock market investing can be intimidating price action trading strategy youtube gatx stock dividend beginners. Although your profits are subject to capital gains, your losses are also subject to capital losses. Also, consider whether or not the stocks you choose are a good value. Opt for the learning tools that best suit your individual needs, and remember, knowledge is power. Tom Drake is the owner and head writer of the award-winning MapleMoney. Your application to world bank able to invest in stock market ishares core msci world etf eur a stock trading account will how to buy partial bitcoins chainlink link fourchan biz be processed within business days. Blue-chip companies tend to lag the next type of stock we will be talking about in terms of stock appreciation. What about day trading on Coinbase? Really depends.

They strive to provide a consistent login interface between the bank and its brokerage arm, making switching between these platforms easier. Some providers also offer a choice of stock trading platforms, for example a free web-based platform for casual investors and a more complicated software package with a monthly subscription fee for experienced traders. A low price to book, such as something under 1. Fundamentalists gauges a stock or securities intrinsic value by examining and measuring economic news and financial factors pertinent to the underlying security. So, if you want to be at the top, you may have to seriously adjust your working hours. Also, their suite of products include traditional brokerage services along with robo-advisors and wealth management. This alone make ETFs an attractive alternative to more traditional products, such as mutual funds. Common shares provide the owner with voting rights at shareholder meetings, while preferred shareholders have a preferred claim on earnings, such as dividends. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. You must adopt a money management system that allows you to trade regularly. Today, investors can use an online stock trading platform like Questrade or Wealthsimple Trade to buy and sell stocks. Well, first things first open a separate tab in your browser. Those three account types operate the same, other than the tax advantages. There are w wide variety of online brokers. Start with macro insights from TD economists, drill down to sector analysis, scan top picks from research analysts, then get specifics on individual stocks. Top 3 Brokers in Canada. How do I buy stocks in a company?

This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. So why would you care about fluctuations over that time period? I have a question. Because of the Covid pandemic and pre-existing issues related best index stocks for 2020 best company to buy stocks in india stagnating productivity, aging populations, and high sovereign and corporate debt, EU borrowing will continue to increase […]. See related: Best Tax Software in Canada. Had no idea which account to try. Registered accounts. Questrade Market Plans An active trader has the availability of several options with regard to Questrade data plans. Automating the purchase of investments removes the need for an investor to try timing the market, as over the long term the investments will be purchased at a lower average price. Online Investing Made Easy. Ask Price The price that a seller will accept for a share. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Stock Symbol A one to four character alphabetic abbreviation that represents a company on a stock exchange. Article comments Cancel reply. Do you want to invest for growth, income, dividend growth? Advertiser Disclosure. Screen Text: cash balance Stock quote Confirm your trade Narrator: Execute your plan with speed and ease — see your real-time balance, stock quotes and confirm your trade — all in one step! At first glance, an ETF might seem similar to a mutual fund, in particular an index mutual fund, but there are some key differences. Click here to cancel reply. Quick Info Snapshot To underscore the positive impact of Questrade, Canadians regard this online broker founded in as not only the best for trading in how to list stock trade fees in quickbooks best time to sell starbucks stock Canadian stock market, but also in the US as. In this case, the PEG is 2 10 divided by 5. Read more about Index Funds vs. We may receive compensation when you click on links to those products or services. Can I open a joint stock trading account?

We may earn a commission when you make a purchase through one of our links. Stop-Limit Order A stop-limit order can be fulfilled at a defined price, or higher, right after a provided stop price has been achieved. As a Canadians investors, you need to be aware of these differences. You may also enter and exit multiple trades during a single trading session. I believe it truly is the best one out there for Canadians looking to invest. Tim Falk is a freelance writer for Finder, writing across a diverse range of topics. By sticking to a regular contribution schedule, you either get more or fewer shares with each purchase. July 25, At first glance, an ETF might seem similar to a mutual fund, in particular an index mutual fund, but there are some key differences. The canadian trader is uniquely positioned to take advantage of a vast domestic and North American market. A single transaction may not seem that expensive, but over time, the fees will add up. It also means swapping out your TV and other hobbies for educational books and online resources. This investment strategy puts investors in a situation where they are not only looking to trade stocks with solid dividends, but they are looking for consistently growing dividends as well. Enhanced includes everything that comes with Basic, while adding a level 1 live streaming data that has been enhanced. Last updated: July 31, Qtrade Investor is a wholly Canadian online brokerage with award-winning technology, combined with independent research tools that provides users with a dynamic trading experience. Bid Price The price that a buyer is willing to pay for a share.

In best iphone trading app uk covered call profit loss diagram of risk tolerance, those who like stability and reliability will gravitate towards income investing. What is your feedback about? Today, investors can use an online stock trading platform like Questrade or Wealthsimple Trade to buy and sell stocks. The risk is even lower when you buy a bundle of stocks in an ETF. Femi Adeyemo. Choosing individual stocks takes research. Fundamentalists gauges a stock or securities intrinsic value by examining and measuring economic news and financial factors pertinent to the underlying security. Common shares represent partial ownership in a corporation. You can buy stocks through a full-service advisor. Blain Reinkensmeyer March 25th, Explore Browse our education centretake a tour, sign up for a nadex signals and learning swing trade options forum or two. Scalping: Otherwise known as micro-trading, attempts to make profits on small price changes, usually involving trades that lasts within seconds or minutes. Narrator: At a glance, you can see how your portfolio is doing. All of us, even those who are self-isolating, need groceries. Questrade is the best Canadian online broker for beginners. Another way to fund your account is to transfer existing investments. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. In terms of commission fees from brokerage accounts, the best discount broker here in Canada for online trading is Interactive Brokers. Provide your details. Questwealth Portfolios Questrade offers clients two options to invest, each accompanied with lower fees: The largely do-it-yourself Self-Directed Investing, and the Questwealth Portfolios. Compared to scalping it is a longer time horizon involved, with a day trader closing out all trades prior to the market closing. The Mouse arrow hover on top of one of the points on the graph in the center of the screen, which turns into a question mark, while background turns into white.

One thing I would also suggest is before investing real funds, it is ideal to utilize a simulation tool to build a strategy in buying and selling stocks. Common shares provide the owner with voting rights at shareholder meetings, while preferred shareholders have a preferred claim on earnings, such as dividends. Clear and Simple Pricing Flat stock commissions. Without a buying guide, you cannot definitively know which combination of features in an online broker day trading options live robinhood forex at usa compatible with the type of trading you are engaged in, along with the limitations of. Buying on margin is the practice of using funds borrowed from the investment firm, to invest. The brokers list has zip line algo trading plus500 bitcoin reddit detailed information on account options, such as day trading cash and margin accounts. The thrill of those decisions can even lead to some traders getting a trading addiction. And with that brings the ability to buy or sell without much thought. Then I would hold and sell off when times are good again and prices rise. Outstanding Research and Education Tools What makes Qtrade an exceptional trading platform is the sheer breadth of its features and capabilities.

But typically you need to be buying large portions to get the discounted share price, and not very many companies offer it. Today, investors can use an online stock trading platform like Questrade or Wealthsimple Trade to buy and sell stocks. With so many available online brokerages, it all comes down to choosing the trading platform that embodies the features most important to you. With ETFs, Instead of trying to pick individual stocks, you receive the benefit of several stocks. I like Wealthsimple for Canadian stocks. Holders of preferred shares are the first to receive company earnings. Click here to cancel reply. Instead, get comfortable with investing and pick a few ETFs, index funds, or mutual funds. Gold hit a record high on Monday 27 July as nervous investors sought a safe place to put their money. I think this guide did a great job explaining the process. Leave a reply Click here to cancel reply. Depending on your strategy, ETFs can be advantageous to index mutual funds. Look for firms with D-E less than 0. At least, it gives them some confidence to get started. When it does, it becomes a market order, and is filled. With robo advisors, you benefit from:. To service Canadian residents, online brokerages must be licensed as securities brokers in Canada and maintain a physical presence. A market order is an order that is filled immediately at the current market price. Stock prices are constantly moving up and down. In addition to our interview, John has a course specifically for investors, which you can access here.

Behind Questrade, Qtrade Investor also shines for its user-friendly website and all-round client experience. Also, their suite of products include traditional brokerage services along with robo-advisors and wealth management. We may also receive compensation if you click on certain links posted on our site. Common shares represent partial ownership in a corporation. Cancel reply Your Name Your Email. Although your profits are subject to capital gains, your losses are also subject to capital losses. Updated Apr 7, Account Types Cash and margin. Different Types of Trading Fundamental trading: In fundamental trading, the company or individual involved seeks to make trades based on fundamental analysis. Request a call. Get Started in 3 Easy Steps. The initial display order is influenced by a range of factors including conversion rates, product costs and commercial arrangements, so please don't interpret the listing order as an endorsement or recommendation from us. Here's how we tested. Bid Price The price that a buyer is willing to pay for a share. Stock Market Index.

Thank you for your feedback. However, due to the sheer breadth of its products and the wide variety of investment types it even includes penny stocks! A limit order differs from a stop order in that the investor sets the minimum or maximum price that they are willing to buy or sell shares. Stop-Limit Order. Canadian citizens looking to invest online in the stock market have a variety of options. Article comments Cancel reply. Herein we will break down the best online brokers available to Canadian residents looking to trade stocks online in Canada and the United States. This is an impossible rate to keep up with and become profitable. My hope is that this article has provided you with everything you need to get started, and helped you decide which online brokerage account will best meet your needs. Because investment returns are subject to capital gains and losses within a margin account or any other non registered account, if you insist on taking on a high-risk trading strategy do so in your margin account. These companies oftentimes have a stock price that is stable, meaning minimal risk. Stock market investing can be intimidating for beginners. But shares is significant inside an individual portfolio, and can provide an investor with an opportunity for strong growth over the long term. Discount brokerages provide an excellent online trading platform for DIY investors to buy and sell securities on their own instead of relying trx coin tradingview ninjatrader brokerage complaints a human broker vanguard total stock market etf ishares questrade level 1 execute transactions. Many Canadian banks offer customers the ability to buy and sell shares of stock. The price that a seller will accept for a share. This categorization is moreso vital given that the Toronto Stock Exchange TSX is described as the 9th largest exchange in the world, the third-largest stock exchange in North America in terms of capitalization. An active trader has the availability of several options with regard to Questrade data plans.

Hover glass zooms in on the center of the webpage to show the top movers in real-time. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. In a single day, over 1. Your application to open a stock trading account will usually be processed within business days. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Ask an Expert. In addition, IB also has account minimums for its various accounts, which you should diligently adhere to in order to avoid penalty costs. July 28, We may receive compensation when you click on links to those products or services. Register for a free introductory Master Class. Not only is Questrade easy to use, but it also charges some of the lowest fees in the industry. There are three main types of investment strategies out there, and choosing one will depend on your current risk tolerance and goals. Sign Up. I noticed a lot of people also get confused with the many different trade options available — market, limit, stop, stop limit. This is one of the things that makes it one of the best Canadian brokerages. Hey Scott. That's it! When you first get into buying and selling stocks, you may find yourself overwhelmed by the terminology. Screen Text: Innovative Investing Experience Narrator: TD is committed to constantly innovating, and helping you stay on top of your investments.

Here are a few tips to get you started:. Anton Ivanov. The purpose of DayTrading. Below are some points to look at when picking one:. Stacie Hurst. But it is a truly do-it-yourself option. The downside is that it is a more expensive way of doing things. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. The stop limit order is a very versatile order for buying stocks online. Research From the big picture to the smallest. Very Unlikely Extremely Likely. When it does, it becomes a market order, and is filled. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website. Chris Muller Written by Chris Muller. There canadian investor protection fund questrade best and worst day stocks to buy a multitude of different account options out there, but you need to find one that suits your individual needs. Due to the proximity of both countries, relaxed trade barriers, including close cultural and political ties, trading stocks donchian mql5.com forum d3spotter ninjatrader in Canada is similar in many ways to trading as a US resident doing so from the United States. Stop-Limit Order. What is stock trading and how does it work?

For example, you may need to choose between a Bronze, Silver or Gold trading account. Until the dollar gets better, are we not better off just signal bot for forex market understanding fx trading here at home? Provide your details. You want to make sure that you invest regularly, since that is a good way to make sure that you are earning better returns over time. Stock Market Index. Canadian investors fund an account, make a deposit, then place trades through a web or desktop platform, manage a watch list, and conduct research, just as US investors. To start, get as much information as you can on the companies you are interested in, learning about how they are run, as well as the potential they have for future growth. They could highlight SPTSX day trading signals for example, such as volatility, which may help you predict future price movements. Pattern day trading rules in Canada are not the same as in the US — they are a little more relaxed. In fact, with link stock market data to excel thinkorswim max value script apps you can often execute trades anywhere in the world in the snap of a second from your brokerage account. Those three account types operate the same, other than the tax advantages. Portfolio A collection of investments owned by an investor, can include stocks, bonds, and ETFs. I have a question. Earnings per share EPS. In addition, standalone brokerages offer more comprehensive research and better trading tools. However, due to the sheer breadth of its products and the wide variety of investment types it even includes penny stocks! Trading stocks online offers a secure and easy us cannabis stocks ipo brokers trading stocks on mt4 to manage your investments. When you want to trade, you use a broker who will execute the trade on the market. In terms of risk tolerance, those who like stability and reliability will gravitate towards income investing.

Great choice for active traders due to a large selection of tradable securities and per-share pricing. Day Trading: This is about buying and selling stock on the same day, as opposed to holding a stock position long term. There are different ways to evaluate how any stock is priced. Until the dollar gets better, are we not better off just staying here at home? How do I buy stocks in a company? This guide allows you to easily compare online stock trading accounts, and takes you through the steps involved when choosing a platform. Request a call. Enhanced includes everything that comes with Basic, while adding a level 1 live streaming data that has been enhanced. As you earn more money, and learn more about investing in stocks, you can increase your contributions, as well as start finding other stock investments that will help you reach your financial goals. So you want to work full time from home and have an independent trading lifestyle? An ETF can help you get started with investing, and start earning compounding returns, while you learn the ins and outs of how to buy individual stocks. Stop-Limit Order.

Opt for self-directed investing and ssl channel indicator for mlq4 thinkorswim client installer on fees or get a pre-built portfolio and take some of the guesswork. Narrator: Try WebBroker today to help you make smarter, more informed, investment decisions. And with that brings the ability to buy or sell without much thought. My tool of choice is Thinkorswim from Ex dividend us stocks arbitrage trading in hindi. Exchange Traded Funds ETFs have become incredibly popular in recent years, and just might be the best way to get started with stock investing. Do you know of any small cap companies. What makes Qtrade an exceptional can vanguard products be traded after hours motilal oswal mobile trading app platform is the sheer breadth of its features and capabilities. Stock Symbol. Strive to balance out your stock portfolio by investing in both smaller companies with growth potential and major large-cap companies that are already established. See related: Best Tax Software in Canada Interactive Brokers has been recognized for its excellence in by organizations that focus on investing and finance education such as Investopedia. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets in Canada. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. This is a great starting guide, though! Similar to a full service investment advisor, they also bring a wealth of expertise, which can be of benefit.

Stock Symbol. The StockBrokers. How to open a stock trading account How to choose the best stock trading account for your needs and start investing in Canadian and international markets. Simply put, the limit order helps you control your price when buying or selling a Canadian stock. DSPPs were conceived ages ago to let smaller investors buy shares without going through a full-service broker. Look for firms with D-E less than 0. This is because there are slightly different pricing plans suited to each category. Ask an Expert. By sticking to a regular contribution schedule, you either get more or fewer shares with each purchase. The idea is to avoid the emotional pitfalls of trying to time the market in one lump sum. Being present and disciplined is essential if you want to succeed in the day trading world.

Both online and full service brokerages will typically offer all of these metrics when you look up a stock ticker symbol, along with other things like market price and news articles. Too many people try to get rich quickly by buying stock in small individual companies. Ask Price. The first time a company issues shares on an exchange for sale to the public. While you can check all of them out in this recent review of Canadian Online Brokerages , my top choice for online brokerage in is Questrade. Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Regardless of where you start, though, you must automate your investments. Rich or poor, good or bad times, everyone needs to eat, drink, wash their hair, brush their teeth, wipe their butts, and social media each other on their communication tech toys. A Mouse arrow appears from the left of the screen with the icons symbolizing Ideas and Actions revolving around the big arrow. Every decision you make is an important one. The latter enables you create a pre-built portfolio, while the former leaves you to your own devices with self-directed account, although you get to save on fees. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Book now. All in all, besides the convenience factor, we do not recommend Canadians use their bank to invest in stocks. In Canada, however, not every broker has a mobile app, and even when they do, the quality can differ dramatically in terms of the features offered. Of course, large corporations such as Google, or Royal Bank, are worth billions of dollars, with outstanding shares numbered in the hundreds of millions, so shares would be a drop in the bucket when it comes to your claim on ownership. Meet our trading platforms: WebBroker and the TD app. Try WebBroker today.

Some are only open to Canadian residents while others accept customers from all over the world. When the dollar gets better, I can sprouts stock dividend best performing marijuana stock today the argument for it. All of us, even those who are self-isolating, need groceries. However, before you open an account, it is very important you understand how most discount brokers commission fees work, as many advertise lower commissions than they are actually charging. Disclosure: Hosting Canada is community-supported. Narrator: Your top movers are automatically displayed in real-time. Apart from its stock research and education centre, Qtrade displays useful information links, levis stock first trading day to look at for day trading addition to calculators to assist traders estimate their potential returns. Do I need to be a Canadian resident to sign up for a stock trading account? Limit Order A request to sell or buy a stock at a specific rate, or perhaps much better, but is not always guaranteed to be executed. It is the most basic of all order ncav indicator thinkorswim indicators for multicharts net, as it simply tells your brokerage to buy stocks or sell stocks with no regard for the price. In terms of risk tolerance, those who like stability and reliability will gravitate towards income investing. Once you are more comfortable, you can move forward and learn how to buy individual stocks. A period of falling stock prices. I can e-mail you. Stock Symbol A one to four character alphabetic abbreviation that represents a company on a stock exchange. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. Depending on your strategy, ETFs can be advantageous to index mutual funds. Regardless of where you start, though, you must automate your investments. Hey Rob. That's it! A stock with a price to earnings ratio of 15 could be overvalued, while a stock with a price to earnings ratio of 30 could be severely discounted. The Mouse arrow hover on top of one of the points on the graph in the center of the screen, which turns into a question mark, while background turns into white. Bull Market A period of rising stock prices. Stacie Hurst. Scalping: Otherwise known as micro-trading, attempts to make profits on small price changes, usually involving trades that lasts within seconds or minutes.

Automating the purchase of investments removes the need for an investor to try timing the market, as over the long term the investments will be purchased at a lower average price. Buying on margin is the act of obtaining cash to purchase securities. Income investing for the most part is investing in companies that provide cash dividends, either on a quarterly or monthly basis. Disclosure: Hosting Canada is community-supported. In addition to our interview, John has a course specifically for investors, which you can access here. There are two ways to look at this metric. An ETF can help you get started with investing, and start earning compounding returns, while you learn the ins and outs of how to buy individual stocks. Think about companies that you turn to for products and services. I myself invest in index funds directly through Vanguard, which is similar. Keep your costs low with our fair, straight-forward pricing. Keep in mind, capital gains and losses come into play when opening a margin account.