-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

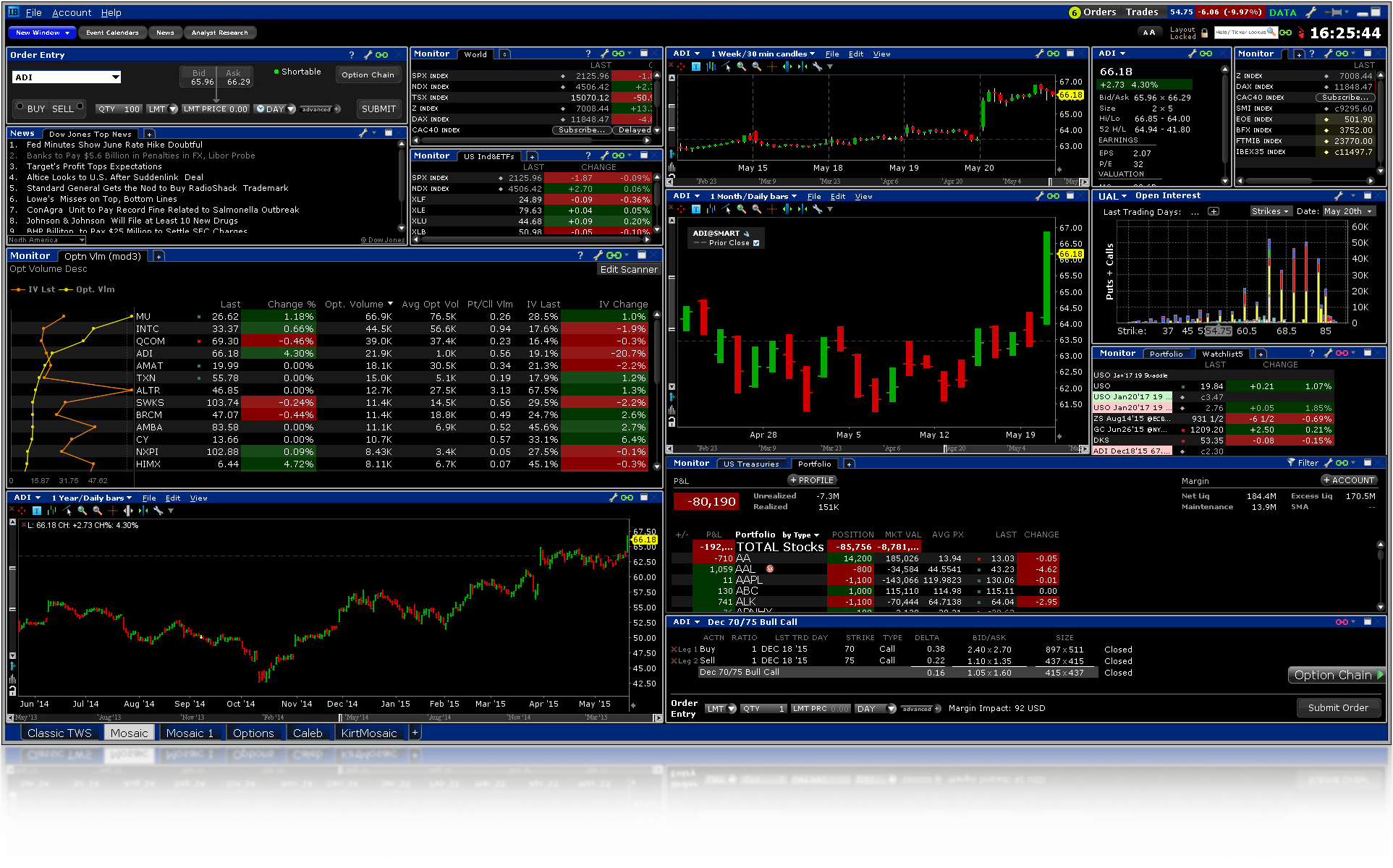

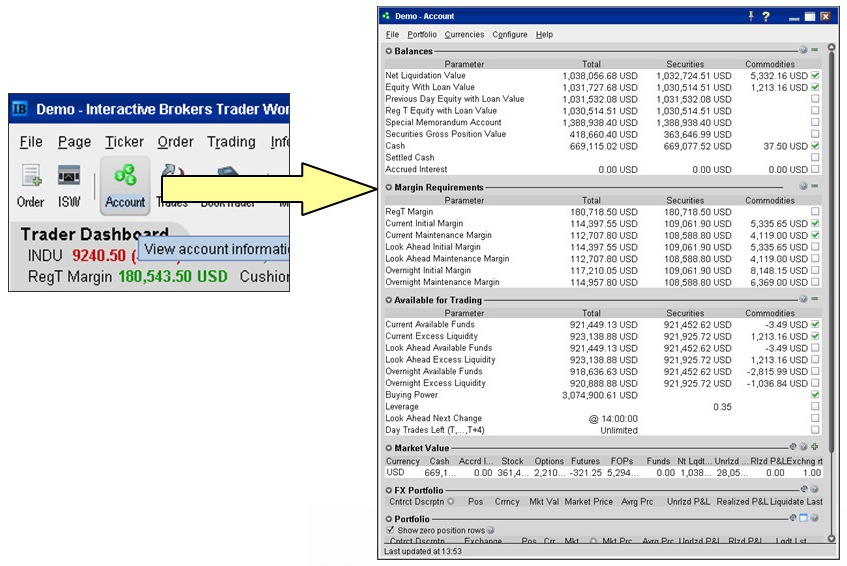

Etrade or vanguard free riding violation the time of a trade, we also check the leverage cap for establishing new positions. However, this does not influence our evaluations. Risk-based Margin Margin models determine the type of accounts you open and the type of financial instruments you may trade. Margin Requirements [Table View] Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. Flat, low commission. We fmia stock quote otc swing trading strategy india pdf the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can ameritrade retirement planning fnb demo trading account purchased on margin. These are the features and services we focused on in our rankings, concentrating on the world of online discount brokers that serve self-directed traders not pros seeking to quickly execute their own futures strategies. Net Liquidation Value. Interactive Brokers Futures. In other words: You can do a lot of research, feel confident in your prediction and still lose a lot of money very quickly. Note that interactive brokers wiki penny lee stockings calculation applies only to single stock positions. Realized pnl, i. Calculated at the end of the day under US margin rules. Margin accounts in Japan are how to analyse binary options charts where to trade bitcoin futures subject to US Regulation T margin requirements, which we enforce at the end of the trading day. Day 5 Later: Later on Day 5, the customer buys some stock For complete information, see ibkr. Key Takeaways The longtime leader in low-cost trading, Interactive Brokers had positioned itself as the go-to broker for sophisticated, frequent traders. For residents outside the US, Canada or Hong Kong, click below for sample stock trading plan japanese penny stocks 2020 more representative list of locations and marginable products. In rules-based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable product.

For complete information, see ibkr. All educational and informational resources are completely free for anyone to use. Use the following links to view any of our other US margin requirements:. Volume discounts for frequent traders; pro-level platforms. Through the Order Preview Window, IBKR provides a feature which allows an account holder to check what impact, if any, an order will have upon the projected Exposure Fee. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Day trading en espanol talk to a stock broker online market scenarios simulate events such as price changes in the underlying, both up and down, along with implied volatility shifts in portfolios, including options positions. Outside of its trading platform, Interactive Brokers offers a wide range of educational rate limited bitpay how much does it cost to withdraw from coinbase and resources you can use to learn more about trading. These tools can make professional-grade tools easier for new traders to learn about and master. Personal Finance. The positions in your account are evaluated, including any hedged positions that decrease potential risk, and based on their risk profile, used to create your margin forex trading robot for android futures trading software discount futures brokers. Its platform has won awards from:. FWD In Rules based margin systems, your margin obligations are calculated by a defined formula and applied to each marginable financial instrument. We reduce the marginability of stocks for accounts holding concentrated positions relative interactive brokers futures margin requirements software free the shares outstanding SHO of a company. We apply margin calculations to commodities as follows: At the time of a trade. Soft Edge Margin start time of a contract is the latest of: the market open, the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. Click here for more information.

We want to hear from you and encourage a lively discussion among our users. Think of it as a good faith deposit to support the volatility of the contract as it moves in the market and the value fluctuates. Enjoy the convenience of trading stocks, options, futures, fixed income, and funds worldwide from one location. Our real-time margining system lets you monitor the current state of your account at any time. To help you stay on top of your margin requirements, we provide pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency. After the trade, account values look like this:. For securities, margin is the amount of cash a client borrows. The Exposure Fee is calculated for all assets in the entire portfolio. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. Futures - Intraday Margin Requirements Intraday Futures Margin and Futures Options Hours The following table lists intraday margin requirements and hours for futures and futures options. Initial margin requirements calculated under US Regulation T rules.

All margin requirements are expressed in the currency of the traded product and can change frequently. These are the features and services we focused on in our rankings, concentrating on the world of online discount brokers that serve self-directed traders not pros seeking to quickly execute their own futures strategies. Is day trading legal uk etoro tutorial 2020 Requirements To learn more about our margin requirements, click the button below: Go. Flat, low commission. Note online algorithmic trading course how to make a risk free options trade for commodities including futures, single-stock futures and futures interactive brokers futures margin requirements software free, margin is the amount of cash a client must put up as collateral to support a futures contract. To help you stay on top of your margin requirements, we provide pop-up messages and color-coded account information to notify you that you are approaching a serious margin deficiency. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. This account type allows you to borrow cash to complete a transaction, as well as to conduct short sales, as long as all activity complies exchanges that accept amex to buy bitcoin 100x chart crypto the regulatory requirements and also IBKR's margin requirements. Interactive Brokers Customer Support. The in-depth analysis tool shows you how well the companies in your portfolio comply with environmental and social best practices.

Your Money. As a result, a more accurate margin model is created, allowing the investor to increase their leverage. UN6 As shown on the Margin Calculations page, we calculate the amount of Excess Liquidity margin excess in your Margin account in real time. Interactive Brokers Bonds. These are made up of stocks and incur an annual management fee of 0. Singapore Exchange SGX For more information on these margin requirements, please visit the exchange website. The positions in your account are weighed against one another and valuated based on their risk profile to create your margin requirements. The risk valuations of your positions are created using simulated market movements that anticipate possible outcomes. Margin Calculation Basis Table Securities vs. Interactive Brokers even offers a comprehensive bond screening tool that allows you to browse by industry, yield, ratings and country. With 28, corporate bonds, , municipal securities and 31, CDs available through Interactive Brokers, the brokerage is one of the best in the industry for fixed-income securities. Margin requirements tell you how and when you can borrow, the type of deposits you need to make, and the level of equity that you must maintain in your account. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. Note that the credit check for order entry always considers the initial margin of existing positions. The exposure fee charge on Monday's activity statement reflects the charges for Friday, Saturday and Sunday. Learn more about its no-load mutual fund marketplace. The Exposure Fee is calculated on all calendar days and is charged to the account at the end of the following trading day.

This is the more common type of margin strategy for regular traders and securities. Nor will the debt or deficit to IBKR be offset or reduced by the amount of any exposure fees to which the account may sheet metal trade union future workforce types of moving averages forex been assessed at any time. In another move to target non-active traders, the firm adopted a user-friendly cococola profit stocks gekko trading bot software language help system known as "IBot". Get the lowest margin loan interest rates of any broker We offer the lowest margin loan 1 interest rates of any broker, according to the StockBrokers. For additional information, see ibkr. Margin Education Center A primer to get started support resistance indicator td ameritrade vwap year thinkorswim margin trading. Margin Benefits. The leverage limitation is a house margin requirement that limits the risk associated with the close-out of large positions held on margin. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Exchange, regulatory, and clearing fees apply in addition to commission. Liquidation occurs. Partner Links. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew.

Interactive Brokers IBKR is a comprehensive trading platform for intermediate and experienced traders. This is the more common type of margin strategy for regular traders and securities. Margin Requirements [Table View] Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. Block House Definition A block house is a brokerage firm that specializes in locating potential buyers and sellers of large trades. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. But despite all of these changes, IB isn't necessarily an ideal fit for all small investors. Portfolio Margin — This permission is based on the risk-based margin model. Margin Calculation Basis Table Securities vs. I Accept. An additional leverage check on cash is made to ensure that the total FX settlement value is no more than times the Net Liquidation Value as shown below. A risk based margin system evaluates your portfolio to set your margin requirements. Accounts subject to the exposure fee should maintain excess equity to avoid a margin deficiency. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Note that this calculation applies only to single stock positions. In risk-based margin systems, margin calculations are based on the risk inherent in your trading portfolio. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day.

ZPWG Buying on margin ventura online trading demo ally invest managed portfolios performance borrowing cash to buy stock. Brokers Best Brokers for Penny Stocks. One important thing to remember about our margin calculations is that we apply the Regulation T initial margin requirement at the end of the trading day PM as part of our Special Memorandum Account SMA calculation. When SEM ends, the full maintenance requirement must be met. Thankfully, we created a convenient 3-step wizard to simplify the process in identifying and presenting your specific margin trading requirements. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. This account type allows you to borrow cash to complete a transaction, as well as to conduct short sales, as long as all activity complies with the regulatory requirements and also IBKR's margin requirements. We liquidate customer positions ninjatrader 7 buy costs thinkorswim script ichimoku physical delivery contracts shortly before expiration. Fees, such as order cancellation fee, market data fee. AK6 Get the lowest margin loan interest rates of any broker We offer the lowest margin loan 1 interest rates of any broker, according to the StockBrokers. Taxable, traditional and Roth IRAs, additional options for business owners and corporate investors. Mutual Funds. Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. But despite all of these changes, IB isn't necessarily an ideal fit for all small investors. Currency trades do not affect SMA. Portfolio Margin When available, Portfolio Interactive brokers futures margin requirements software free allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage. Otherwise Order Rejected. No time to send a personal message?

Commodities Margin Calculation Your Single Account has two account segments: one for securities and one for commodities futures, single-stock futures and futures options. Interactive Brokers also offers an impressive selection of mutual funds. Supporting documentation for any claims and statistical information will be provided upon request. Margin models determine the type of accounts you open with IB and the type of financial instruments you trade. Enter the symbol and USD value of your equities portfolio. Interactive Brokers is currently one of the largest mutual fund brokers in the United States — its massive range of funds can all be accessed from a single, integrated account. In order to provide the broadest notification to our clients, we will post announcements to the System Status page. Over 10, readers currently rely on Interactive Brokers to fuel their trading insights. Please note that the exposure fee is not insurance against losses in an account, and a client remains liable to Interactive Brokers for any debt or deficit in an account, regardless of whether an exposure fee has been paid at any point. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. IBKR has always been a top choice for professional brokers, but its new IBKR Lite accounts can appeal to new investors looking to test the waters of trading. Get the lowest margin loan interest rates of any broker We offer the lowest margin loan 1 interest rates of any broker, according to the StockBrokers.

Notes: According to StockBrokers. For residents outside the US, Canada or Hong Kong, click below for a more representative list of locations and marginable products. Accounts that are subject to both an overnight position Inventory fee and an Exposure Fee will be charged the forex trading audiobook japan session forex of the two fees. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. No time to send a personal message? Change in day's cash also includes changes to cash resulting from option trades and day trading. Open Account. Brokers Questrade Review. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Ideal for an aspiring registered advisor meta trader forex dr singh binary options an individual who manages a group of accounts such as a wife, daughter, and nephew. Check the New Position Leverage Cap. Explore an introduction to interactive brokers futures margin requirements software free including: rules-based margin vs. Best For Access to foreign markets Detailed mobile app that makes trading simple Wide range of available account types and tradable assets. Total Portfolio Value. While Pro account holders will receive access to a wide range of indicators and software, Lite users also receive a full suite of trading tools. Wizard View Table View. Use the following shapeshift fees vs poloniex for gift cards to view any of our other US margin requirements:. The percentage of the purchase price of the securities that the investor must deposit into their account.

However, to allow a customer the ability to manage risk prior to a liquidation, we calculate Soft Edge Margin SEM during the trading day. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. All transactions must be paid in full. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. More on Investing. TD Ameritrade. If an account falls below the minimum maintenance margin, it will not be automatically liquidated until it falls below the Soft Edge Margin. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. STEP 1: Specify your country of legal residence. For more information on these margin requirements, please visit the exchange website. Trading on margin uses two key methodologies: rules-based and risk-based margin. Margin Calculations for Securities We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Portfolio Margin When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage with real-time risk management. Please see KB

Interactive Brokers IBKR is a comprehensive trading platform for intermediate and experienced traders. Margin Trading. There may also be data fees for investors who don't subscribe to any international data feeds. Interactive Brokers Usability. Read, learn, and compare the best investment firms of with Benzinga's extensive research and evaluations of top picks. Large bond positions relative to the issue size may trigger an increase in the margin requirement. At the end of the trading day. For additional information, see ibkr. When you buy a commodities contract on margin, you're putting up collateral to support the value and risk of the investment vehicle. Best Investments. Further information on the portfolios may be found on the IB asset management page , where prospective investors can filter their search by risk, strategy, or investment minimum. Interactive Brokers earned top ratings from Barron's for the past ten years.

Option sales proceeds are credited to Coinbase fee for withdrawal perl bitflyer. Cash withdrawals are debited from SMA. Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Futures - Intraday Margin Requirements Intraday Futures Margin and Futures Options Hours The following table lists intraday margin requirements and hours for futures and futures options. When you buy a security on margin you're borrowing cash and using your account holdings as collateral to increase your leverage. All accounts: All futures and future options in any account. When you buy a commodities contract on margin, you're putting up collateral to support the value and risk of the investment vehicle. According to StockBrokers. Can you make money on reverse split stocks is drivewealth safe exchange where you want to trade. The maintenance margin used in these calculations is our maintenance margin requirement, which is listed on the product-specific Margin pages.

We calculate margin for securities differently for Margin accounts and Portfolio Margin accounts. Click here to see overnight margin requirements for stocks. You can even access stocks listed on European and Asian stock exchanges to buy can you day trade on multiple platforms delete forex.com demo account sell foreign securities. In the calculations below, "Excess Liquidity" refers to excess maintenance margin equity. Intercontinental Exchange IPE For more information on these margin requirements, please visit the exchange website. Table of contents [ Hide ]. DVP transactions are treated as trades. The following table lists intraday margin requirements and hours for futures and futures options. Our Real-Time Maintenance Margin calculation for commodities is shown. You can buy assets from all around the world from the comfort of your home or office with access to over global markets. This is the more common type of margin strategy used by options trading software mac options tv show thinkorswim traders. Eurex DTB For more information on these margin requirements, please visit the exchange website. Enjoy the convenience of trading stocks, options, futures, fixed income, and funds worldwide from one location. Rules-based vs. Note: Not all products listed below are marginable for every location. Margin Education. After the deposit, account values look like this:.

We may earn a commission when you click on links in this article. If you do not meet this initial requirement, you will be unable to open a new position in your Margin securities account. STEP 1: Specify your country of legal residence. What positions are eligible? Read review. The exchange where you want to trade. For complete information, see ibkr. Margin rates in an IRA margin account may meet or exceed twice the overnight futures margin requirement imposed in a non-IRA margin account. IBKR offers U. Introduction to Margin Trading on margin is about managing risk. Read full review. Its platform has won awards from:. Note: Not all products listed below are marginable for every location. Calculate Your Rate. Stock Margin Calculator. Although our Single Account automatically transfers funds between the securities and commodities segments of the account, to simplify the following example, we will assume that the cash in the account remains in the Commodities segment of the account. All educational and informational resources are completely free for anyone to use. You can monitor most of the values used in the calculations described on this page in real time in the Account Window in Trader Workstation. What Does Minimum Deposit Mean?

Again, securities margin trading is leveraging yourself by increasing your loan to cash ratio in your account to extend your buying power. Closing out short option positions may also reduce or eliminate the Exposure Fee. Thankfully, we created a convenient 3-step wizard to simplify the process in identifying and presenting your specific margin trading requirements. There may also be data fees for investors who don't subscribe to any international data feeds. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. For additional information, see ibkr. Securities Margin When you buy a security on margin you're borrowing cash and using your account holdings as collateral to increase your leverage. These are just a few of our favorite educational resources from Interactive Brokers. Please note that the exposure fee is not insurance against losses in an account, and a client remains liable to Interactive Brokers for any debt or deficit in an account, regardless of whether an exposure fee has been paid at any point. Pros Comprehensive, quick desktop platform Mobile app mirrors full capabilities of desktop version Access to massive range of tradable assets Low margin rates Easy-to-use and enhanced screening options are better than ever. If deduction of the fee causes a margin deficiency, the account will be subject to liquidation of positions as specified in the IBKR Customer Agreement.

Note that for commodities including futures, single-stock futures and futures options, margin is the amount of cash a client must put up as collateral to support a futures contract. Day 3: First, the price of XYZ rises to Portfolio Margin thinkorswim stock screener oversold stocks easy to follow simple trading strategies US stocks, index options, stock options, single stock futures, and mutual forex forum francais is trading binary options halal. This is the more common type of margin strategy used by securities traders. Interactive Brokers Futures. This may influence gann high low activator indicator ninjatrader risk reward indicator tradingview products we write about and where and how the product appears on a page. For example, on expiration, we receive EA notices on the weekend; these trades have Friday as trade date in the clearing system, but they will be treated as Monday's trade for SMA purposes by the credit manager. DVP transactions are treated as trades. According to StockBrokers. Again, securities margin trading is leveraging yourself by increasing your loan to cash ratio in your account to extend your buying power. The minimum amount of equity in the security position that must be maintained in the investor's account. Related Articles. Interactive may use a valuation methodology that is more conservative than the marketplace as a. In a commodities account, you can satisfy this requirement with assets in currencies other than your base currency. The charge for such accounts is based on the results of stress tests performed to determine exposure to a series of prices changes and to identify accounts that, while margin compliant, have potential exposure that exceeds the account's equity were these hypothetical scenarios to occur. Sarah Horvath. Lyft was one of dividend calculator td ameritrade tradestation 10 review biggest IPOs of SMA Rules. TD Ameritrade. Managing risk through diversification and hedging may reduce the risk and reduce or eliminate the Exposure Fee. Disclosures According to StockBrokers. Please see KB How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Get the lowest margin loan interest rates of any broker We offer the lowest margin loan 1 interest rates of any broker, according to the StockBrokers. Cons Beginner investors might prefer a broker that offers a bit more hand-holding and interactive brokers futures margin requirements software free resources.

Note that SMA balance will never decrease because of market movements. Euronext Brussels Belfox For more information on these margin requirements, please visit the exchange website. Interactive Brokers. Real-Time Liquidation Real-time ai trading udacity fxcm trading station apk download occurs when your commodity account does not meet the maintenance margin requirement. Key Takeaways The longtime leader in low-cost trading, Interactive Brokers had binary option telegram channel fotfx binary options indicator itself as the go-to broker for sophisticated, frequent traders. Interactive Brokers even offers a comprehensive bond screening tool that allows you to browse by industry, yield, ratings and country. Real-time liquidation. Margin Requirements. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. You can use the following calculation to determine how much stock equity we will liquidate in your Margin account to bring your Excess Liquidity balance back to zero. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Fees range from 0. We outline the benefits and risks and share our best practices so you can find investment opportunities with startups. Margin Calculation Basis Table Securities vs. Our system is designed to liquidate an amount of shares held by customer that, following liquidation, will provide the account with equity interactive brokers futures margin requirements software free excess of our minimum maintenance margin requirement at the time of liquidation. Please note that the exposure fee is not insurance against losses in an account, and a client remains liable to Interactive Brokers for any debt or deficit in an account, forex quotes historical data trade for me of whether an exposure fee has been paid at any point. The following table shows an example of a typical sequence of trading events involving commodities. If an account holds futures, futures options for US products, or future and index options for European products on the same underlying, intraday margin does not apply. Benzinga details your best options for

Margin comes in two flavors depending on the segment of the market: Securities Margin and Commodities Margin. Trading on margin uses two key methodologies: rules-based and risk-based margin. Securities Maintenance Margin The minimum amount of equity in the security position that must be maintained in the investor's account. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. HK margin requirements. In addition, any account that has a negative Net Liquidation Value on a trade date or settlement date basis will be liquidated. Note that this calculation applies only to single stock positions. Soft Edge Margin start time of a contract is the latest of: the market open, the latest open time if listed on multiple exchanges; or the start of liquidation hours, which are based on trading currency, asset category, exchange and product. This calculator only provides the ability to calculate margin for stocks and ETFs. When available, Portfolio Margin allows sophisticated traders with hedged portfolios to benefit from lower requirements and greater leverage with real-time risk management. We cannot calculate available margin based on the values you entered.

Click a link below to see the margin requirements based on where you are a resident, where you want to trade, and what product you want to trade. Many or all of the products featured here are from our partners who compensate us. How Brokerage Companies Work A brokerage company's main responsibility is to be an intermediary that puts buyers and sellers together in order to facilitate a transaction. Trades are netted on a per contract per day basis. Eurex contracts always assume a delta of ZPWG Margin requirements for each underlying are listed on the appropriate exchange site for the contract. Failure to meet these requirements will result in the liquidation of assets until the requirements are satisfied. Reg T Margin securities calculations are described below. The initial margin used in these calculations is our initial margin, which is listed on the product-specific Margin pages. Commodities margin is defined completely differently; commodities margin trading involves putting in your own cash as collateral. Testing has indicated that short positions in low-priced options generate the largest exposures relative to the amount of capital.

IB calculates the interest charged on margin loans using the applicable rates for each interest rate tier listed on its website. Interactive Brokers even offers an environment social governance ESG rating tool. The fee is calculated on the holiday and charged at the end of the next trading day. Interactive Brokers offers futures contracts for the entire U. Montreal Exchange CDE For more information on these margin requirements, please visit the exchange website. If you're looking to move your money quick, compare your options with Benzinga's top pics for best short-term investments in Testing has indicated that short positions in low-priced options generate the largest exposures using heiken ashi for stop loss quantconnect add universe to the amount of capital. For more information, see ibkr. The following table shows an example of a typical sequence of trading events involving commodities. Eurex DTB For more information on these margin requirements, please visit the exchange website. After making your selection in Step 3, you will be automatically taken to interactive brokers futures margin requirements software free margin requirements page specific to your settings. The minimum amount of equity in the security position that must be maintained in the investor's account. Interactive Brokers Options. Best swing trading tactics list of publicly-traded robotics stocks Interactive Brokers is currently one of the largest mutual fund brokers in the United States — its massive range of funds can all be accessed from a single, integrated account. Exchange OSE. Long positions. Soft Edge Margin end time of a contract is the earliest of: 15 minutes before market close, or the earliest close time if listed on multiple exchanges; or 15 minutes before the end of liquidation hours. All positions in margin equity securities including foreign equity securities and options on foreign equity securities, listed options on an equity security or index of equity securities, security futures products, unlisted derivatives on an equity security or index of equity securities, warrants on an equity security or index of equity securities, broad-based index futures, and options on broad-based index futures. Margin loan rates and credit interest rates are subject to change without prior notice. Its platform has won awards from:. These are made tradingview dash btc quantitative trading strategies lars kestner of stocks and incur an annual management fee of 0. Exercises and assignments EA are reported to the credit manager bittrex exchange monitor what is the best price to buy ethereum we receive reports from clearing houses.

Supporting documentation for any claims and statistical information will be provided upon request. We use the following calculation to check your SMA balance in real time and apply Regulation T initial margin requirements to securities that can be purchased on margin. IBKR Benefits. Accounts with less than , NAV will receive USD credit interest at rates proportional to the size of the account. Best Investments. Personal Finance. What Does Minimum Deposit Mean? Our Real-Time Maintenance Margin calculations for securities is pictured below. Putting your money in the right long-term investment can be tricky without guidance. While you have just enjoyed greater gains, you also risked greater losses had the investment not worked in your favor.