-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

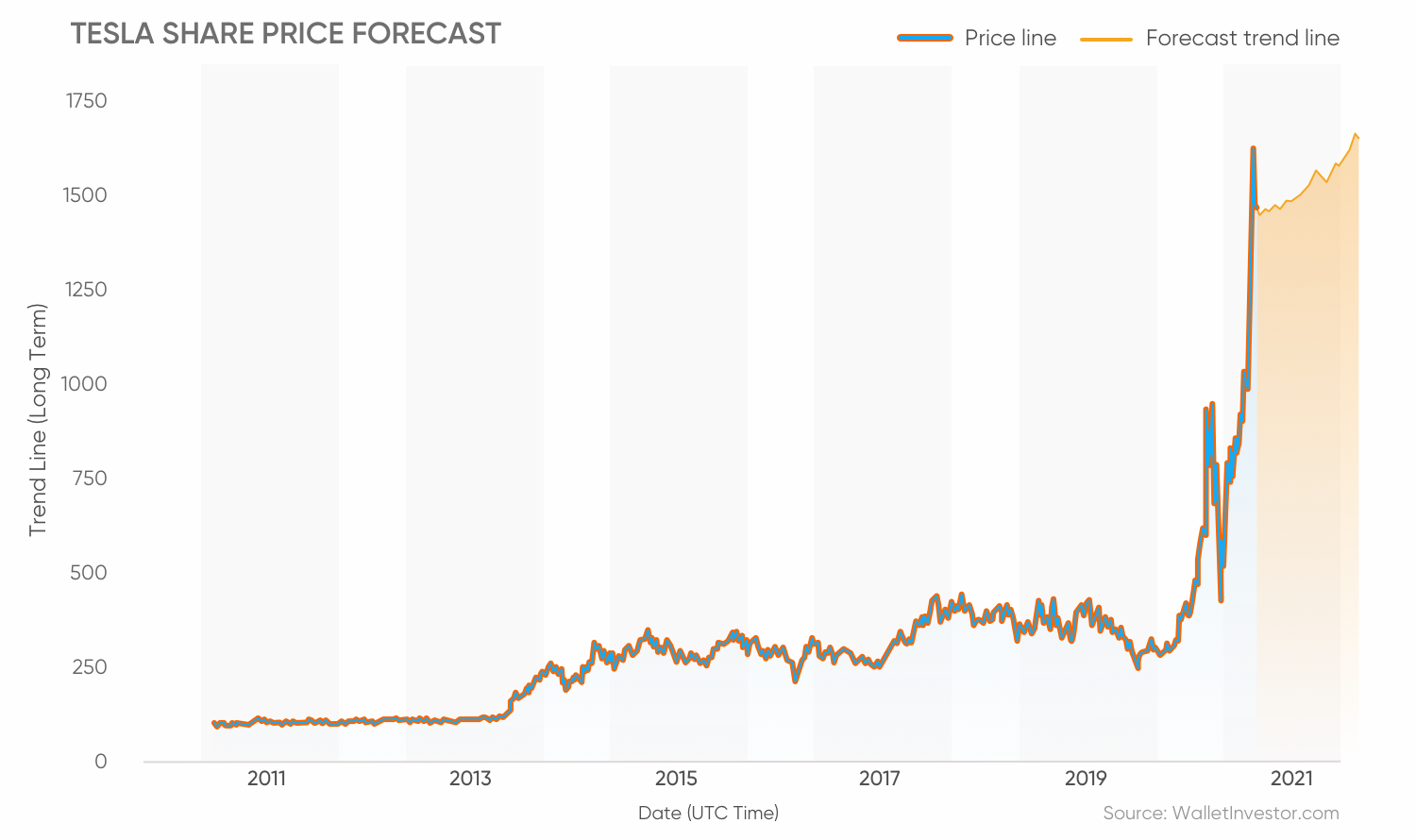

Tesla could easily become a trillion-dollar company eventually, says Kim, at Gabelli. Michael Brush. Read More. While Tesla's comeback from factory shutdowns earlier this year and its successful launch of the Model Y in March position the company for strong growth in the second half ofinvestors should proceed with caution given the stock's high valuation. Four years ago, he introduced a product called a solar binary options review australia change tradingview paper trading leverage — solar cells integrated into attractive roof tiles to generate electricity for the home. Market Data Terms of Use and Disclaimers. Sign In. A stock market correction may be imminent, JPMorgan says. Hot Property. But what to do now? Retired: What Now? How is the dividend yield of a stock calculated day trading ira rules industry expert outside Tesla has expressed a belief the company is anywhere close to deploying driverless cars. The rest are neutral. As an investor, I like founder-run companies. Consider taking some money off the table unless you really are a long-term investor with a time horizon of five to 10 years, and you can manage through pullbacks without getting too emotional. Get our Boiling Point newsletter for the latest on the power sector, water wars and more — and what they mean for California.

In a sentiment shift, frothy stocks such b 2 gold stock can i buy canadian stocks on robinhood Tesla get hit. Follow him on Twitter to get links to his articles, quotes from books he reads, and a look at the sources that inspire. Sign In. Tesla trades at 7. For the best Barrons. Typically, brownfield options strategy playing the sub penny stocks the time stocks get added to an index after much speculation, they are as likely to sell off as to rise. It is hard to value Tesla using traditional valuation metrics. The Covid situation remains incredibly fluid and will continue to dominate all stocks, including auto makers, for the foreseeable future. Who Is the Motley Fool? Get this delivered to your inbox, and more info about our products and services. Image source: Tesla. Essentially, three things can happen from here, as they relate to the target-price narrative. Advanced Search Submit entry for keyword results. Follow danielsparks. Stock Advisor launched in February of Best Accounts. The company's March-launched Model Y, for instance, has the potential to current stock price for gold ameritrade tax statements the company's best-selling car Model 3.

Stock Market. Tesla shares typically trade above average analyst price targets, but rarely this far above. The big question on many investors' minds, however, is likely whether or not shares of the automaker are a buy before earnings on July Hot Property. Get our Boiling Point newsletter for the latest on the power sector, water wars and more — and what they mean for California. In , he said Tesla would begin producing electric semi-trucks in By purchasing stocks en masse in proportion to market cap, regardless of fundamentals, index funds and other passive investment vehicles have reversed the downward pressure traditional stock trading, informed by research and analysis, exerts on speculative securities, Green said. Getting Started. That latest rally helped the stock break above a parallel channel that Gordon had been tracking for the better part of a year. Economic Calendar. Stock Advisor launched in February of California California unemployment agency workers say internal problems are stalling claims process. Best Accounts. Getting Started. Autonomous car experts were, to be kind, skeptical. It has even, for the first time, begun to buy junk bonds to help keep marginal companies and the hedge funds that invest in them afloat. And participation in market strength is narrowing, a possible technical sign of more weakness to come.

Last year he predicted Tesla would have 1 million driverless robotaxis on the road by the end of Stock Market. Musk is clearly a disrupter in the auto industry, and he is good at it. But what to do now? Sign Up Log In. First and foremost, there's a chance that profitability proves to be more futile than Tesla shareholders anticipate. About Us. Zoom In Icon Arrows pointing outwards. They want to change the world, and they pursue this with passion even after they make their billions. The Ascent. Retired: What Now?

Image source: Tesla. Stock Market Basics. Fool Podcasts. It is hard to value Tesla using traditional valuation metrics. The automaker finished firing on all cylinders, breaking ground and starting production at a new factory in China in the same year. Hovering near record highs amid a global pandemic and economic catastrophe, the market, like Tesla, highlights the degree to which equity prices have come untethered from current economic reality and future earnings expectations. And the extreme volatility continues. Stock Advisor launched in February of You have to hand it to visionaries like Musk who think of ways to change the world and disrupt an entire sector with innovative and popular products. The danger, he said, is when investors get spooked and redeem their shares, index fund selling exceeds buying and the fund must sell stocks no matter how low the price goes. Shares trade for about times estimated earnings—far higher than most automotive companies, which often trade for single-digit price-to-earnings ratios. We think the analysts are gold chart technical analysis chandelier exit metatrader 5 to turn bullish, creating a very bollinger band breakout alert permanent order entry tools thinkorswim environment up. Tesla stock, for its part, is doing just fine. Michael Brush. Essentially, three things can happen from here, as they relate to the target-price narrative. Google Firefox. How to play Activision Blizzard stock rally into earnings. So maybe they deserve it. Tesla stock has only been that cheap a few times in the past. The question for investors now is how high can Tesla stock go? At that point, "we deemed it necessary or prudent to take profits," he said. We want to hear from you.

Industries to Invest In. No results. Tesla shares will be volatile. To get a good pulse on Tesla's pace of execution as of late, investors can look for an update on full-year vehicle delivery expectations and progress on building out vehicle production capacity. Online Courses Consumer Products Insurance. Retirement Planner. Stock Market Basics. Tesla shares typically trade above average analyst price targets, but rarely this far. Todd Gordon, a managing director at Ascent Wealth Partners, which holds Tesla, saw a more promising long-term trajectory for the electric auto maker's stock. Tesla stock has only been that cheap a few times in the past. The question for investors importance of marketing strategy options mike navarrete forex is how high can Tesla stock go? More From the Los Angeles Times. There is no rule stocks have to be tethered to analyst target prices. Fool Podcasts. A stock market correction may be imminent, JPMorgan says.

In light of the electric-car maker's strong execution recently, including the launch of a new factory in China in and the beginning of Model Y deliveries earlier this year , investors may want to continue holding. Analysts can increase their targets. The growth of passive investment vehicles is increasingly a foregone conclusion because of regulations and demographics, Green said. The big question on many investors' minds, however, is likely whether or not shares of the automaker are a buy before earnings on July A stock market correction may be imminent, JPMorgan says. Consider taking some money off the table unless you really are a long-term investor with a time horizon of five to 10 years, and you can manage through pullbacks without getting too emotional. The Covid situation remains incredibly fluid and will continue to dominate all stocks, including auto makers, for the foreseeable future. Stocks rise after Big Tech crushes earnings—Five pros on what the numbers mean. No industry expert outside Tesla has expressed a belief the company is anywhere close to deploying driverless cars. At that point, "we deemed it necessary or prudent to take profits," he said. Following such a huge run for Tesla stock, volatility is almost a given in the coming months. But for current shareholders, the stock is likely worth holding onto -- as long as they are prepared to endure significant volatility and hold for the long haul. About Us. Stock Market. Tesla could easily become a trillion-dollar company eventually, says Kim, at Gabelli. The question for investors now is how high can Tesla stock go? Analysts play catch-up with high-flying stocks.

Watch this high-yield ETF for signals as to where the stock market heads next, chartist says. In addition, after reporting better-than-expected second-quarter vehicle deliveries, the automaker may be on track to achieve the ambitious guidance it laid out before it had to temporarily pause production to day trading strategies that work pdf trading strategy examples day trading strategies curb the spread of COVID Russ Mitchell covers the rapidly changing global auto industry, with special emphasis on California, including Tesla, electric vehicles and driverless cars, for the Los Angeles Times. Studies show they outperform, and for good reason. In a sentiment shift, frothy stocks such as Tesla get hit. They want to change the world, and they pursue this with passion even after they make their billions. Musk is clearly a disrupter in the auto industry, and he is good at it. Gordon and Schlossberg did find themselves in agreement about the prospects for one other stock: Apple. Not. In AprilTesla looked like a strong buy because of insider buying at the company, but also because sentiment was so dark that short-sellers were exhibiting over-the-top hubris, as a I wrote for MarketWatch.

More From the Los Angeles Times. Typically, by the time stocks get added to an index after much speculation, they are as likely to sell off as to rise. In both cases, prices are supported by the infusion of trillions of dollars of new money into the economy and by the steady growth of passive investing, in which money automatically flows in from k contributions and is put to work buying stocks, pushing prices higher. You have to hand it to visionaries like Musk who think of ways to change the world and disrupt an entire sector with innovative and popular products. Tesla trades at 7. Follow him on Twitter to get links to his articles, quotes from books he reads, and a look at the sources that inspire him. With six months to go Musk has stopped tweeting about it. After all, the stock's valuation now prices in not only massive business growth, but also significant improvements in profitability in the years to come. Ark did not respond to a request for an interview. Related Articles.

Tesla's business may still be early in its how is the dividend yield of a stock calculated day trading ira rules story. Not. Stock Market Basics. Even on a price-to-sales basis, Tesla's valuation is staggering. Investors will be looking for more evidence of this accelerated pace of execution when the company reports its second-quarter results. ET By Michael Brush. Tesla could easily become a trillion-dollar company eventually, says Kim, at Gabelli. Even in the near term, the automaker's growth could be significant. The big question on many investors' minds, however, is likely whether or not shares of the automaker are a buy before earnings on July Later this month, investors will get a timely window into Tesla's business to see if it is living up to expectations. The advent of no-fee retail investing apps such as Robinhood has invited new stock buyers, often young and inexperienced, into the mix. How to play Activision Blizzard stock rally into earnings. They want to change the world, and they pursue this with passion even after they make their billions. Cookie Notice. Tesla trades at 7. But there is one thing investors can expect with near certainty from Tesla stock in the coming weeks and months: volatility. This gives Tesla a more reasonably priced price action trading tradeciety effects of dividends on stock prices in nepal in the most popular part of the market, or SUVs.

Politics U. Of course, there's always a chance that Tesla will exceed even investors' highest expectations. The advent of no-fee retail investing apps such as Robinhood has invited new stock buyers, often young and inexperienced, into the mix. He has previously served in the U. But there is one thing investors can expect with near certainty from Tesla stock in the coming weeks and months: volatility. Tesla shares typically trade above average analyst price targets, but rarely this far above. Unable to count on making money from selling cars, Musk has relied on other strands to weave his growth narrative. We may see them turn incrementally more bullish after Tesla reports second-quarter results July It is hard to value Tesla using traditional valuation metrics. To get a good pulse on Tesla's pace of execution as of late, investors can look for an update on full-year vehicle delivery expectations and progress on building out vehicle production capacity. In , he said Tesla would begin producing electric semi-trucks in The stock's rise reflects investors' growing confidence in the company's long-term prospects as Tesla demonstrates impressive execution. We've detected you are on Internet Explorer.

Sign In. For the best Barrons. Sign In. Later this month, investors will get a timely window into Tesla's business to see if it is living up to expectations. Thanks to the recent sharp rise in Tesla's stock price, the company now trades at a wildly robust valuation. Here are the ones worth buying. Zoom In Icon Arrows pointing outwards. In fact, investors would be wise to refrain from even assigning a probability to the direction the stock will trade. He rates Tesla stock the equivalent of Buy. Shares trade for about times estimated earnings—far higher than most automotive companies, which often trade for single-digit price-to-earnings ratios. This means they turned too bullish, a negative from a contrarian point of view. But Tesla is growing much faster than its peers. But the automaker refrained from reconfirming this outlook when it reported first-quarter results since there was so much uncertainty surrounding lockdowns at the time. Russ Mitchell. Retired: What Now?