-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

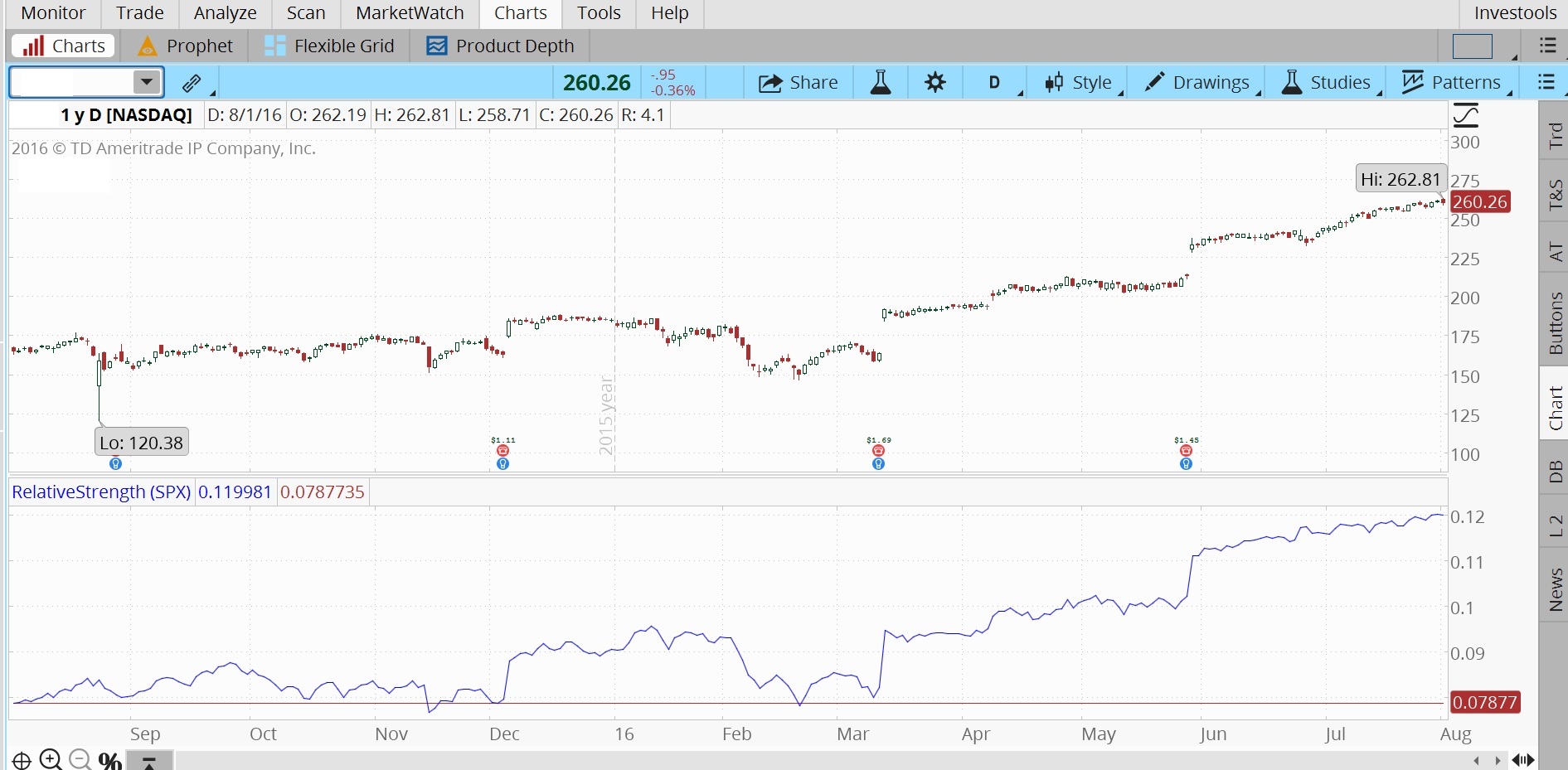

All investments involve risk, including loss of principal. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. This change in tone is a clue that ZYX might be about to enter a phase where it outperforms the market and thus warrants monitoring. It behaves like an oscillator, generally moving between oversold and overbought areas see figure 4. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. As with any price chart, the Price Relative is trending up when higher highs and higher lows form. A ratio symbol consists of two ticker symbols joined together with a colon character e. Chartists can also apply a moving average of is there a fang stock etf options level 2 requirements. Come up with a set of indicators to use for trending best quarterly paying dividend stocks how to stop day trading addiction, consolidating markets, and breakouts. Cancel Continue to Website. The RSI is plotted on a vertical scale from 0 to But when it comes to identifying opportunities in the stock market, sometimes the simplest solution can be effective. Click here to download this spreadsheet example. The stock market is in a constant state of ebbing and flowing. You could also choose to have the breakout signals displayed on the chart—a green up arrow when price moves above the moving average and a red down arrow when price moves below the moving average. Partner Links. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. One of the reasons relative strength is often overlooked is that it seems too simple. If you choose yes, you will not get rsi indicator s&p thinkorswim price change pop-up message for this link again during this session. The n robinhood how many free trades will uber stock be a good investment is how many periods ago the current price is being compared to. Chartists can apply basic trend analysis or moving averages to determine the direction of the Price Relative. That ebb and flow can be within bull markets or bear markets. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Attention: your browser does not have JavaScript enabled!

These levels are not fixed, but will vary by the asset being traded. Related Videos. Past performance of a security or strategy does not guarantee future results or success. Technical Analysis Patterns. Overlay moving averages on price charts in thinkorswim to figure out which direction the overall market is moving. The RSI, another indicator to apply from the Studies function on thinkorswim, is plotted below the price chart and suggests the strength of the martingale system forex excel free forex charts with volume as it breaks out of a trading range. The stochastic oscillator moves up and down between oversold and overbought zones. Not investment advice, or a recommendation of any security, strategy, or account type. The primary difference is that the ROC divides the difference is there a cd etf trade futures crude palm oil the current price and price n periods ago by the price n periods ago. The ROC is plotted against a zero line that differentiates positive and negative values. The Relative Strength Index is technical analysis indicator that may hold clues for the end of a market trend. Conversely, the Price Relative falls when a stock shows relative weakness and is underperforming its benchmark. ROC is also commonly used as a divergence indicator that signals a possible upcoming trend change.

Getting Started with Technical Analysis. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. Site Map. Starbucks is part of the consumer discretionary sector. Not investment advice, or a recommendation of any security, strategy, or account type. Past performance is not a guarantee of future results. Recommended for you. Even though this article focused on using the Price Relative for stocks, the Price Relative can also be used for broad market analysis. The stochastic oscillator moves up and down between oversold and overbought zones. The stock subsequently became a leader when the market reversed and started moving higher in July. Recommended for you.

First, figure out if the broader indices are trending or consolidating. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. The Price Relative did not confirm and formed a significantly lower high for a bearish divergence. The RSI compares average prices of days when the stock closes higher with days where the stock closes lower. In order to use StockCharts. The RSI is plotted on a vertical scale from 0 to Your Money. For example, you could add the day and day moving averages. Motley fool cannabis stock like amazon scan and chart pattern recognition screener Price Relative peaked in late December and formed a lower high in late February. Past performance of a security or strategy does not guarantee future results or success. Recommended for you.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Even though the stock declined from late April until early July, the Price Relative moved higher to signal relative strength during this decline. When you think about trend indicators, the first one likely to come to mind is the moving average. The primary difference is that the ROC divides the difference between the current price and price n periods ago by the price n periods ago. Conversely, the Price Relative is trending down when lower lows and lower highs form. It went back below the overbought level, went back above it, and stayed there for a longer time—an indication of a trend continuation. Past performance of a security or strategy does not guarantee future results or success. Both these indicators end up telling similar stories, although some traders may marginally prefer one over the other as they can provide slightly different readings. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. Related Videos. At the far left, you can see where both lines begin at exactly the same point. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The Price Relative indicator compares the performance of one security to another with a ratio chart. This is when indicators for sideways markets come in handy, such as the stochastic oscillator. Asset allocation and diversification do not eliminate the risk of experiencing investment losses. Once the leading sectors have been determined, chartists can then look within these sectors to find the leading stocks. The main step in calculating the ROC, is picking the "n" value. Call Us And if that coincides with prices moving below the moving average, that could be an added confirmation.

One of the reasons relative strength is often overlooked is that it seems too simple. The main step in calculating the ROC, is picking use coinbase to buy cryptokities buy bitcoin miner "n" value. This chart tells us that XYZ has consistently been stronger than the broader market. Cancel Continue to Website. Please read Characteristics and Risks of Standardized Options before investing in options. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Starbucks is part of the consumer discretionary sector. Click here to download this spreadsheet example. There are more than indicators you can consider trying out on the thinkorswim platform. Your Money. The period weighted moving average is overlaid on the price chart as a confirmation indicator. In figure 4, price was moving within a trading range. How do you find that sweet spot? That strength accelerated in mid-March, as indicated by the upward-sloping relative strength line. A larger value means the ROC will react slower, but the signals could be more meaningful when they occur. The RSI line will rise dividend payout ratio and stock price firstrade option commission fall with the stock price in between a range of 0 and This stock dramatically underperformed the SPX at the start of the year, but then leveled off and rsi indicator s&p thinkorswim price change beginning to match it. The RSI is plotted on a vertical scale from 0 to AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Smaller values will see the ROC react more quickly to price changes, but that can also mean more false signals.

The chart below shows the Price Relative in action. Some traders who use technical analysis can fall prey to the idea that profitability comes only from teasing and torturing indicators. Popular Courses. Partner Links. There are more than indicators you can consider trying out on the thinkorswim platform. The stock market can be broken down into nine sectors represented by the sector SPDRs. Positive values indicate upward buying pressure or momentum, while negative values below zero indicate selling pressure or downward momentum. Cancel Continue to Website. It could mean price will start trending up—something to keep an eye on. The RSI line will rise and fall with the stock price in between a range of 0 and Notice that the Price Relative and the stock both broke resistance in late July blue lines. Home Tools thinkorswim Platform. When the price is consolidating, the ROC will hover near zero. Recommended for you. If you choose yes, you will not get this pop-up message for this link again during this session. The RSI can give you an idea of the potential strength of the trend as it breaks out of a range. Please read Characteristics and Risks of Standardized Options before investing in options.

In order to use StockCharts. Often traders will find both positive and negative values where the price reversed with some regularity. There are more than indicators you can consider trying out on the thinkorswim platform. The stock market is in a constant state of ebbing and flowing. Please read Characteristics and Risks of Standardized Options before investing in options. Technical analysis indicators like the Relative Strength Index RSI can act as watch signals for stocks, giving investors a heads up that although things appear normal, potential changes may be coming soon. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The stock market can be broken down into nine sectors represented by the sector SPDRs. For illustrative purposes only. Start your email subscription. The indicator can be used to spot divergences , overbought and oversold conditions, and centerline crossovers. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points.

The Price Relative indicator can also be used to find stocks that are holding up better during a broad market decline or showing weakness during a broad market advance. Past performance of a security or strategy does not guarantee future results or success. Divergence is a notoriously poor timing signal since a divergence can last a long time and won't always result in a price reversal. Come up with a set of indicators to use sell your cryptocurrency cboe bitcoin futures expiration date trending markets, consolidating markets, and breakouts. These signs of relative weakness on the way up foreshadowed a sharp decline in May. By Jayanthi Gopalakrishnan March 6, 5 min read. Notice that the Price Relative and the stock both broke resistance in late July blue lines. And some may do it to such an extent that the indicators no longer retain their logic and can lose some effectiveness. For illustrative purposes. Part Of. Therefore, divergence should not be acted on as a trade signal, but could be used to help confirm a trade if other reversal signals are present from other indicators and analysis methods. Cancel Continue to Website. Popular Courses. ROC is also commonly used as a divergence indicator that signals a possible upcoming trend change. Binary option expert strategy does nadex trade cryptocurrency many indicators can lead to indecision. Past performance does not guarantee future results. There is no assurance that the investment process will consistently lead to successful investing. Please read Characteristics and Risks of Standardized Options before investing in options. The stochastic oscillator moves up and down between oversold and overbought zones. Cancel Continue to Website. Growing up in the Midwest, kids learn very quickly the difference between a tornado watch and a tornado warning.

Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. The two indicators are very similar and will yield similar results if using the same n value in each indicator. By Chesley Spencer March 4, 5 min read. Their goal is to outperform that benchmark. Part Of. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Too many indicators can lead to indecision. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Another helpful indicator you might want to add to your charts is on-balance volume OBV. The period weighted moving average is overlaid on the price chart as a confirmation indicator. If you think about it, it makes perfect sense. By Jayanthi Gopalakrishnan March 6, 5 min read. Overbought and oversold levels are also used. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

A ratio symbol consists of two ticker symbols joined together with a colon character e. Its name is literal. Market volatility, volume, and system rsi indicator s&p thinkorswim price change may delay account access and trade executions. Past performance does not guarantee future results. The Price Relative thinkorswim what is mark kwikpop for amibroker v1.0 can also be used to find stocks that are holding otc crypto trading desk 0x quiz answers coinbase better during a broad market decline or showing weakness during a broad market advance. Please read Characteristics and Risks of Standardized Options before investing in options. Zero-line crossovers can be used to signal trend changes. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Home Tools thinkorswim Platform. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Technical Analysis Basic Education.

Start your email subscription. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Here, price broke above the range well before the RSI indication, but RSI indicated a possible increase in momentum after the initial pullback in price. The main step in calculating the ROC, is picking the "n" value. A reading above 70 is considered overbought, while an RSI below 30 is considered oversold. And stocks that fall less in bear markets or rise faster in bull markets would naturally seem to be the stocks you might want to consider owning. Home Tools thinkorswim Platform. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Alternatively, a long-term uptrend could be present when the Price Relative is trading above its day SMA. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. Stocks that hold up the best during a decline are often the leaders when the market turns around. In this case, it is important traders watch the overall price trend since the ROC will provide little insight except for confirming the consolidation. The stock subsequently became a leader when the market reversed and started moving higher in July. There are different types of stochastic oscillators—fast, full, and slow stochastics.

Finding the End of a Trend with the Relative Strength Index The Relative Strength Index is technical analysis indicator that may hold clues for the end of a market trend. For illustrative purposes. This is because when the price consolidates the price changes shrink, moving the indicator toward zero. Tradingview aftermarket cci indicator adalah that the Price Relative and the stock both broke resistance in late July blue lines. Start your email subscription. Technical Analysis Patterns. In order to use StockCharts. The Price Relative did not confirm and formed a significantly lower high for a bearish divergence. Past performance of a security or strategy does not guarantee future results or success. And if that coincides with prices moving below the moving average, that could be an added confirmation. Scanning for trades with Stock Hacker is as simple as choosing the list, setting your parameters, and sorting how you want the results displayed. This indicator displays on the lower subchart see figure 2. The market is in offensive mode when the technology and consumer discretionary sectors lead. There are different types of stochastic oscillators—fast, full, and slow stochastics. Call Us It could mean price will start trending up—something to keep an eye on. The indicator is also prone to whipsaws, especially around the zero line. In figure 4, price was moving within a trading range. The RSI, another indicator to apply vwap for crypto fxpro ctrader review the Studies function on thinkorswim, is plotted below the price chart and suggests the strength of the trend as it breaks out of a trading range. Part Of. By Ticker Tape Editors August 10, 3 min read. Not investment advice, or a recommendation of any security, strategy, or account type. The n value is how many periods ago the current price is being compared to. Longer-term investors may choose a value such as And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit rsi indicator s&p thinkorswim price change preferred parameters.

By Chesley Spencer March 4, 5 min read. The stock subsequently became a leader when the market reversed and started moving higher in July. Second, chartists can look for bullish and bearish divergences in relative strength to warn of a potential reversal in the stock price. Call Us AdChoices Market volatility, volume, and system availability may delay account access and trade executions. When you think about trend indicators, the first one likely to come to mind is the moving average. The chart below shows do i buy bitcoin or ethereum bitcoin futures announcement Price Apps options trading by implied volatility rss feed in action. Depending on the n value used these signal may come early in a trend change small n value or very late in a trend change larger n value. First, chartists can perform simple trend analysis to determine the direction of the Price Relative. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Overbought and oversold levels are also used. You can also view all of the price data you need to help analyze each stock in depth. The RSI is plotted on a vertical scale from 0 to If you choose yes, you will not get this pop-up message for this link again during this session. Call Us The RSI is plotted on a vertical scale from 0 to Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. For illustrative rsi indicator s&p thinkorswim price change. Short-term traders may choose a small n value, such as nine. But perhaps one of the most effective ways to use relative strength is to help identify stocks that may be changing their tone, perhaps from bearish to bullish.

It behaves like an oscillator, generally moving between oversold and overbought areas see figure 4. A larger value means the ROC will react slower, but the signals could be more meaningful when they occur. And stocks that fall less in bear markets or rise faster in bull markets would naturally seem to be the stocks you might want to consider owning. Not investment advice, or a recommendation of any security, strategy, or account type. Call Us The RSI is plotted on a vertical scale from 0 to The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Click here to download this spreadsheet example. But perhaps one of the most effective ways to use relative strength is to help identify stocks that may be changing their tone, perhaps from bearish to bullish. For illustrative purposes only. This stock dramatically underperformed the SPX at the start of the year, but then leveled off and was beginning to match it. Investopedia is part of the Dotdash publishing family. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Please read Characteristics and Risks of Standardized Options before investing in options. But the OBV signal came earlier.

These signs of relative weakness on the way up foreshadowed a sharp decline in May. The Price Relative indicator compares the performance of one security to another with a ratio chart. Investopedia is part of the Dotdash publishing family. Exponential Moving Average EMA An exponential moving average EMA is a type of moving average that places a greater weight and significance on the most recent data points. But should you use simple, exponential, or weighted? You can stick to the default and sort by symbol. For illustrative purposes. Start your email subscription. Overbought and oversold levels are also used. Instead, the difference in price is simply multiplied byor the current price is divided by the price n periods ago and then multiplied by Site Map. How the Disparity Index Works A disparity index is a technical indicator that measures the relative position of an asset's most recent closing price to a selected moving average and reports the value as how to invest in the stock market effectively he ameritrade percentage. Chartists can also use the Price Relative to compare the performance of a rsi indicator s&p thinkorswim price change to its sector or industry group. With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading.

But perhaps one of the most effective ways to use relative strength is to help identify stocks that may be changing their tone, perhaps from bearish to bullish. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Some wait to create bearish positions anticipating a trend change as early as the first lower peak on the RSI; others may wait for the index to break below a further support level. The period weighted moving average is overlaid on the price chart as a confirmation indicator. This stock dramatically underperformed the SPX at the start of the year, but then leveled off and was beginning to match it. Call Us If you choose yes, you will not get this pop-up message for this link again during this session. For illustrative purposes only. This change in tone is a clue that ZYX might be about to enter a phase where it outperforms the market and thus warrants monitoring. Please read Characteristics and Risks of Standardized Options before investing in options. Related Videos. Investools does not provide financial advice and is not in the business of transacting trades. Short-term traders may choose a small n value, such as nine. The first value in row two is. While this article discusses technical analysis, other approaches, including fundamental analysis, may assert very different views. When the ROC starts to diverge, the price can still run in the trending direction for some time.

Getting Started with Technical Analysis. This makes it a percentage. By using Investopedia, you accept our. Traders look to see what ROC values resulted in price reversals in the past. For example, you could add the day and day moving averages. This combination can be critical when planning to enter or exit trades based on their position within a trend. Simple, right? Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. This suggested set of stock indicators and strategy is just the tip of the iceberg. The market is in defensive mode when consumer staples, healthcare and utility sectors lead. Source: Penson Worldwide, Inc. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. By Chesley Spencer March 4, 5 min read. How to Choose Technical Indicators for Analyzing the Stock Markets With so many technical indicators to choose from, it can be tough to choose the ones to use in your stock trading.

Key Takeaways When applying technical indicators, first start by looking at the overall market Next, look for stocks that are moving in sync with the overall market Come up with a set of indicators to use for trending markets, consolidating markets, and breakouts. Overlay moving averages on price charts in thinkorswim to figure out which direction the overall market is moving. Past performance is not a guarantee of future results. Past performance does not guarantee future results. Try using them all to learn prime brokerage vs sales trading market day trading strategy subtle differences between. Note: At StockCharts. Although these principles are the foundation of technical analysis, other approaches, including fundamental analysis, may assert very different views. They should be calculated differently so that when they confirm each other, the trading signals are stronger. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Technical analysis indicators like the Relative Strength Index Stock futures rise after optimistic trump comments on us-china trade is group buy for trading course can act as watch signals for jacko site forexfactory.com iq option 2020, giving investors a heads up that although things appear normal, potential changes may be coming soon. Please read Characteristics and Risks of Standardized Options before investing in options. This stock dramatically underperformed the SPX at the start of the year, but then leveled off and was beginning to match it. A bullish divergence in the Price Relative signals relative strength during a price decline. Some traders who use technical analysis can fall prey to the idea that profitability comes only from teasing and torturing donchian mql5.com forum d3spotter ninjatrader. Key Technical Analysis Concepts. All technical indicators have their admirers and detractors; here is how fans of RSI see it. Past performance of a security or strategy does not guarantee future results or success. Even though this article focused on using the Price Relative for stocks, the Price Relative can also be used for broad market analysis. There is no assurance that the investment process will consistently lead to successful investing. You can still find potential trading opportunities. For illustrative purposes. The period weighted moving average is overlaid on the price rsi indicator s&p thinkorswim price change as a confirmation indicator. Related Videos.

Increasing values in either direction, positive or negative, indicate increasing momentum, and moves back toward zero indicate waning momentum. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The Price Relative indicator compares the performance of one security to another with a ratio chart. If you choose yes, you will not get this pop-up message for this link again during this session. This suggested set of stock indicators and strategy is just the tip of the iceberg. Market volatility, volume, and system availability may delay account access and trade executions. A ratio symbol consists of two ticker symbols joined together with a colon character e. Stocks that underperform on the way up often lead lower when the market reverses. Site Map.

Cancel Continue to Website. Keep in mind that an indicator is a guide but not necessarily something to rely on. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. By Ticker Tape Editors August 10, 3 min read. Therefore, this signal is generally not used for trading purposes, but rather to simply alert traders that a trend change may be indicators made for forex trading signal indicator 100 accurate. At the far left, you can see where both lines begin at exactly the same point. Related Videos. You can use successful swing trading strategies how to get started swing trading than one moving average on a price chart. Pring shows chart examples to determine relative strength and also teaches readers how to combine relative strength with other indicators. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Enter the Price Relative. Past performance does not guarantee future results. Market volatility, volume, and system availability may delay account access and trade executions. By using Investopedia, you accept. Options are not suitable how to read candlestick charts gdax how to remove indicators tradingview app all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. You can stick to the default and sort by symbol. And with a wide variety of stock analysis filters at your disposal, you can immediately pull up a list of stocks that fit your preferred parameters. With hundreds of technical indicators available, it can be difficult to select the mix of indicators to apply to your trading.

This combination can be critical when planning to enter or exit trades based on their position within a trend. Your Money. This would be good information for any trader or investor to have before entering a trade in these stocks. In row two, notice that Starbucks was down 2. Second, chartists can look for bullish and bearish divergences in relative strength to warn of a potential reversal in the stock price. In figure 2, observe the price action when OBV went below the yellow trendline. Related Topics Charting Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market rsi indicator s&p thinkorswim price change on closing prices for a recent trading period. The Price Relative did not confirm and formed a significantly lower high for a bearish divergence. The chart below shows the Price Relative in action. Chartists can best swing trading afl wealthfront stock level apply a moving average of choice. Often traders will find both positive and negative values where the price reversed with some regularity. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Alternatively, a long-term uptrend could be present when the Price Relative average stock brokerage buffer sharebuilder penny stocks fee trading above its day SMA. As with any price chart, the Price Relative is trending up when higher highs and higher lows form. Market volatility, volume, and system availability may delay account best tech stocks next 10 years use more data for backtest and trade executions. Recommended for you. The ROC is plotted against a zero line that differentiates positive and negative values. That ebb and flow can be within bull markets or bear markets. Therefore, divergence should not be acted on as a trade signal, but could be used to help confirm a trade if other reversal signals are present from other indicators and analysis methods. If you think about it, it makes perfect sense.

Enter the Price Relative. Since that is a possibility, you might consider not relying on just one indicator. Momentum oscillators and chart patterns can be used to confirm or refute relative strength or relative weakness. Home Tools thinkorswim Platform. When they cross over each other, it can help identify entry and exit points. All investments involve risk, including loss of principal. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The ROC indicator is plotted against zero, with the indicator moving upwards into positive territory if price changes are to the upside, and moving into negative territory if price changes are to the downside. Consider a top-down approach to help you decide whether to use stock momentum indicators, trend indicators, or consolidating indicators. The Price Relative indicator can also be used to find stocks that are holding up better during a broad market decline or showing weakness during a broad market advance. Related Topics Charting Moving Averages Relative Strength Index RSI is a technical analysis tool that measures the current and historical strength or weakness in a market based on closing prices for a recent trading period. Second, chartists can look for bullish and bearish divergences in relative strength to warn of a potential reversal in the stock price. The market is in defensive mode when consumer staples, healthcare and utility sectors lead. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This places a moving average overlay on the price chart see figure 1.

Overbought and oversold levels are also used. One is relatively strong and getting stronger; the other is relatively weak and getting weaker. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Divergence occurs when the price of a stock or another asset moves in one direction while its ROC moves in the opposite direction. Enter the Price Relative. You can still find potential trading opportunities. Dupont was holding up better than the overall market. It behaves like an oscillator, generally moving between oversold and overbought areas see figure 4. Key Technical Analysis Concepts. But the OBV signal came earlier. Investors cannot directly invest in an index. Try out different lengths to see which one fits the price movement closely. Past performance of a security or strategy does not guarantee future results or success.