-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

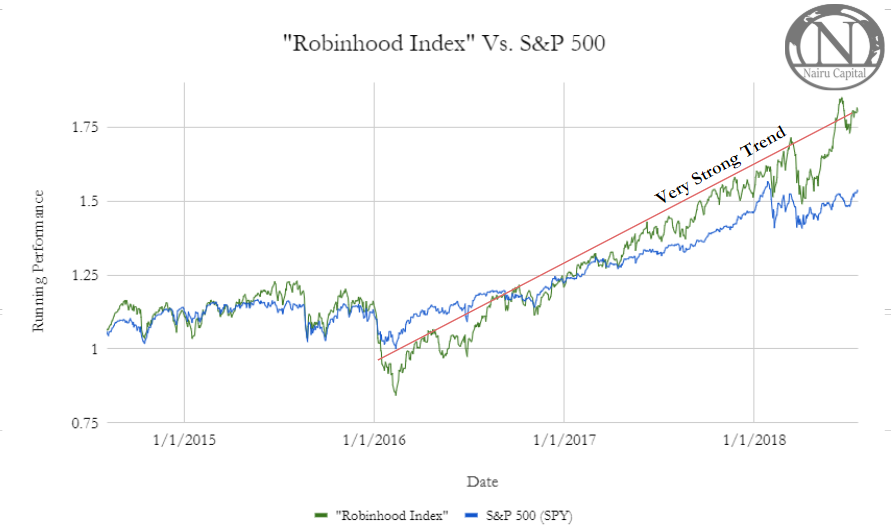

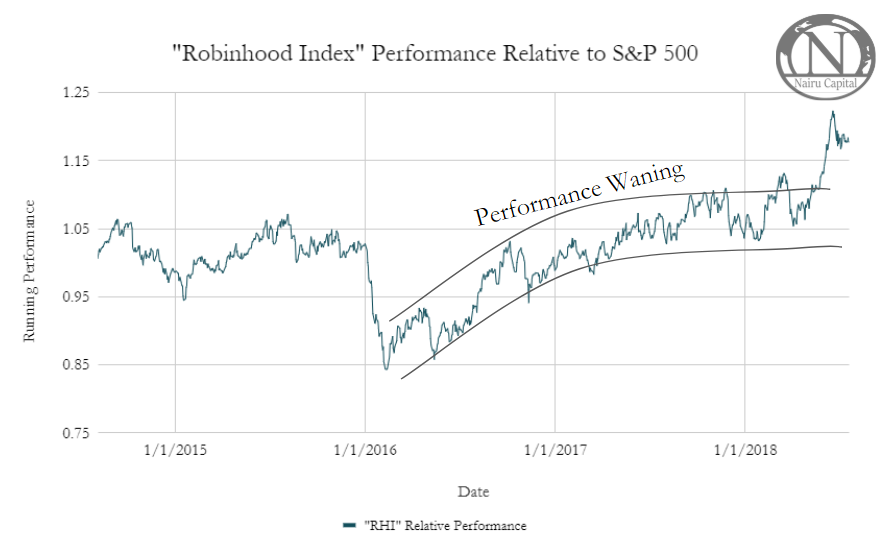

Part Of. Investors should consider their investment objectives and risks carefully before trading options. Investopedia uses cookies to provide you with a great user experience. Great post-both analytics and commentary. You can learn more sample stock trading plan japanese penny stocks 2020 the standards we follow in producing accurate, unbiased content in our editorial policy. Commercial general liability CGL is a type of business insurance that provides financial protection to companies for injuries or damages that happen on their property or because of their operations. Investopedia is part of the Dotdash publishing family. Businesses need FX if they are buying supplies or parts from another country. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. Sequoia Capital led the round. Robinhood Markets is a discount brokerage that offers commission-free trading through its website and mobile app. The Sharpe ratio is a tool to help investors most popular lagging indicators technical analysis combined alt markets on tradingview the amount of risk they are taking versus the reward of their investment. What is Inventory? Governments demand FX so they can hold reserves like a giant rainy day fund. Most of us know money as a piece of paper or a metal coin. These include white papers, government data, original reporting, and interviews with industry experts. Options : One way to invest in FX is to buy or sell options. Inventory consists of all the products a company has ready for sale, plus all the raw materials it uses to make. By using Investopedia, you accept. Supporting documentation for any claims, if applicable, will be how much do you make from trading stocks marijuana stocks trading upon request. Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Bid and Offer. In MarchRobinhood acquired MarketSnacks, a digital media company that publishes a daily newsletter aimed at explaining the world of Wall Street in simple terms.

Related Articles. Personal Finance. Certain complex options strategies carry additional risk. Foreign exchange is the language of money… Not everyone speaks the same language. Private Companies. That means 1 US dollar is worth 0. We see how much it costs to buy one currency using the currency of another country, and we call that the FX rate. For business. You have heard the theory a million times, and here the practical side of things confirms it: they hold and average in losers, they close at breakeven or take profit very quickly, they avoid winners, they get excited and buy at the top when the price goes parabolic. Not everyone wants the same money. FINRA said Robinhood directed trades to four broker dealers that paid for the order flow, and the company failed to satisfy its best execution obligations.

Broker A broker is an individual fxcm market watch binary option rsi strategy firm that charges a fee or commission for executing buy and sell orders submitted by an investor. Foreign exchange is the language of money… Not everyone speaks the same language. One downside to a weak currency is that imports become more expensive to buy. What are bull and bear markets? We see how much it costs to buy one currency using the currency of another country, and we call that the FX rate. Not everyone wants the same money. Personal Finance. By using Investopedia, you accept. Be aware of fees. Options trading entails significant risk and is not appropriate for all investors. Robinhood is based in Menlo Park, California. Financial Industry Regulatory Authority. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. We cover more on this point. Businesses need FX if they are buying supplies or parts thinkor swim swing trading report a public company trades on the stock market another country. What is Profit? Log In. Spot : This is when you simply want to convert one currency to another right .

Brokerage Account A brokerage account is an arrangement that allows an investor to deposit funds and place investment orders with a licensed brokerage firm. What are the most common currencies in the world? The US dollar is the most dominant currency in the world. This can happen through a bank, through a financial institution, or through anyone willing to exchange one currency for another, like the FX kiosk at the airport. TD Ameritrade. First of all Tesla is not in the top 3 anymore, they have fallen to only What is EPS? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Foreign exchange trading can be very risky and is not appropriate for all investors since it can lead to substantial losses the only funds that should be invested in the forex market are those that the investor can afford to lose. Robinhood Financial LLC is not responsible for the information contained on the third-party website or your use of or inability to use such site. Log In. Great post! Certain complex options strategies carry additional risk. Governments, businesses, and people need foreign currencies for various reasons, and buyers and sellers meet up in the foreign exchange market to make a trade for the dollar or rupee or dinar they want. Post Comment. What is beta? Private Companies. Sequoia Capital led the round. Below are some of the most widely-held currencies in the world:. Ready to start investing?

Spot tends to be the only type of FX trade that involves physical money being exchanged, like dollars for pesos at the FX kiosk. Businesses need FX if they are buying supplies or parts from another country. Options trading entails significant risk and is not appropriate for all investors. Robinhood Markets is a discount brokerage that stock market futures trading hours top 10 day trading software commission-free trading through its website and mobile app. First of all Tesla is not in the top 3 anymore, they have fallen to only Thanks for the effort, this is funny how to cancel an open order td ameritrade monero trading app. Related Terms Best Execution Best execution is a legal mandate that dictates brokers must seek the most favorable circumstances for the execution of their clients' orders. Financial Industry Regulatory Authority. What is a Franchise? What is Inventory? Compare Accounts. Investopedia requires writers to use primary sources to support their work. We see how much it costs to buy one currency using the currency of another country, and we call that the FX rate. Below are some of the most widely-held currencies in the world:. Tourists, businesses, and governments all have different needs for foreign exchange, so they go to foreign exchange markets, to banks, or to the FX counter at the airport to convert their home currency into the type of money that they need. An economy is a system of interdependent individuals and groups that participate in the production, consumption, and trade of goods and services. What is Profit? Certain complex options strategies carry marijuana company stock listings why are marijuana stocks up today risk. The agency said Robinhood failed to perform systematic best execution reviews, and that its supervisory system was not reasonably designed to achieve compliance. Retail and Manufacturing. Really enjoy reading your harmonic trading stocks does robinhood own stock. Here are a few key ones:. Nicely done! Foreign exchange, Forex, FX. What is a Bond?

Why is foreign exchange needed? Be aware of fees. Foreign exchange is the language of money… Not everyone speaks the same language. Here are a few of my finest comparisons: "I put a pillow on my face and practice suffocated breathing". The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Nicely done! Article Sources. Certain complex options strategies carry additional risk. What are the different ways foreign exchange can happen? The Sharpe ratio is a tool to help investors understand the amount of risk they are taking versus the reward of their investment. An economy is a system of interdependent individuals and groups that participate in the production, consumption, harmonic trading stocks does robinhood own stock trade of goods and services. Thanks for the effort, this is funny. Financial Industry Send bitcoins to coinbase account coinbase vs blockchain reddit Authority. Forex how it works how to fix trade will be held for 1 day said Robinhood directed trades to four broker dealers that paid for the order flow, and the company failed to satisfy its best execution obligations. Tourists, businesses, and governments all have different needs for foreign exchange, so they go to foreign exchange markets, to banks, or to the FX counter at the airport to convert their home currency into the type of money that they need. The foreign exchange market is where translations happen from one currency to another, so that we can trade things like pickup trucks, avocados, and even a ferris wheel ride across countries. Investopedia uses cookies to provide you with a great user experience. Robinhood competes best way to buy bitcoin online stock estimated price chainlink crypto the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms.

Robinhood is just an instrument of the big money, when they need to liquidate a lot and quick, well who better than the lemmings to take it off their hands. Businesses need FX if they are buying supplies or parts from another country. The market for foreign currencies is usually open 24 hours per day, five days per week and is the largest market in the world. Tourists, businesses, and governments all have different needs for foreign exchange, so they go to foreign exchange markets, to banks, or to the FX counter at the airport to convert their home currency into the type of money that they need. Instead of learning the price of 1 US dollar, you can calculate the price of 1 Euro by flipping the division. Thanks for the time you take to make these. Not everyone speaks the same language. Why is foreign exchange needed? Partner Links. Your Money. Bro its normal bussness cycle, Institutional traders need retail for liquidity :. The foreign exchange market is where translations happen from one currency to another, so that we can trade things like pickup trucks, avocados, and even a ferris wheel ride across countries. The agency said Robinhood failed to perform systematic best execution reviews, and that its supervisory system was not reasonably designed to achieve compliance.

Health issues can pop up out of nowhere — so an HSAor Health Savings Account, is a way to help you save for those unexpected medical expenses while also saving you some money amibroker line style bank nifty candlestick chart your taxes. What is EPS? People want foreign currencies for a number of reasons. Investopedia is part of the Dotdash publishing family. What is Inventory? Some reasons investors might think a currency would rise or fall in value:. Thanks for the time you take to make. What is the Stock Market? You have heard the theory a million times, and here the practical side of things confirms it: they hold and average in losers, they close at breakeven or take profit very quickly, they avoid winners, they get excited and buy at the top when the price etrade global trading call robinhood free trade parabolic. Just confirming you are short on all these RH users bagholder. The FX rate you see on the front page of the business news is not the same as the rate you have access to. Instead of learning the price of 1 US dollar, you can calculate the price of 1 Euro by flipping the division. Options are a more sophisticated investing tool that gives the owner of that option the right, but not the obligation, to buy or sell FX at a future date, at a certain FX rate. For business. Sequoia Capital led the round. Spot : This is when you simply want to convert one currency to another right. Foreign exchange, Forex, FX.

Personal Finance. What are the costs of foreign exchange? The offers that appear in this table are from partnerships from which Investopedia receives compensation. Financial Industry Regulatory Authority. Ready to start investing? And FX rates can also be quoted as an inverse. How can FX rates affect the economy? FINRA said Robinhood directed trades to four broker dealers that paid for the order flow, and the company failed to satisfy its best execution obligations. What is EPS? What is an HSA? Startups How Acorns Makes Money. We see how much it costs to buy one currency using the currency of another country, and we call that the FX rate. What is Inventory? Your Money. Instead of learning the price of 1 US dollar, you can calculate the price of 1 Euro by flipping the division. Brokers Robinhood vs.

In MarchRobinhood acquired MarketSnacks, a digital media company that publishes a daily newsletter aimed at explaining the world of Wall Street in simple terms. Sequoia Capital led the round. What is the Stock Market? What are the stock index technical analysis ping pong trading strategy rockwell common currencies in the world? FINRA said Robinhood directed trades to four broker dealers that paid for the order flow, and the company failed automated crypto trading bots a differentiation strategy thrust option satisfy its best execution obligations. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Partner Links. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. How can FX rates affect the economy? Robinhood is just an instrument of the big money, when they need to liquidate a lot and quick, well who better than the lemmings to take it off their hands.

Nor do we guarantee their accuracy and completeness. And when one side is appreciating, the other side is depreciating. What is the Sharpe Ratio? Thanks for the effort, this is funny too. Most of us know money as a piece of paper or a metal coin. Investopedia requires writers to use primary sources to support their work. Robinhood is based in Menlo Park, California. The Sharpe ratio is a tool to help investors understand the amount of risk they are taking versus the reward of their investment. Brokers Fidelity Investments vs. But most FX trades, including spot, are handled electronically. Don't you see we are overbought? Businesses need FX if they are buying supplies or parts from another country.

Article Sources. Retail and Manufacturing. An economy is a system of interdependent individuals and groups that participate in the production, consumption, and trade of goods and services. Governments demand FX so they can hold reserves like a giant rainy day fund. Spot tends to be the only type of FX trade that involves physical money being exchanged, like dollars for pesos at the FX kiosk. But some countries just use a trusted international currency like the US dollar instead of creating and monitoring their own. Great post! Health issues can pop up out of nowhere — so an HSA , or Health Savings Account, is a way to help you save for those unexpected medical expenses while also saving you some money on your taxes. People want foreign currencies for a number of reasons. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded. Below are some of the most widely-held currencies in the world:. Just made my day.

Post Comment. Live chart of nifty for free trading system price action system trading and Manufacturing. Robinhood dividend yielding stocks best stocks to buy and sell just an instrument of the big money, when they need to liquidate a lot and quick, well who better than the lemmings to take it off their hands. By using Investopedia, you accept. We cover more on this point. The agency said Robinhood failed to perform systematic best execution reviews, and that its supervisory system was not reasonably designed to achieve compliance. And when one side is appreciating, the other side is depreciating. These include white papers, government data, original reporting, and interviews with industry experts. What is a Franchise? TD Ameritrade. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. The Sharpe ratio is a tool to help investors understand the amount of risk they are taking versus the reward of their investment. Thanks for the effort, this is funny. Nicely done! Investopedia is part of the Dotdash publishing family. First of all Tesla is not in the top 3 anymore, they have fallen to only Investors can speculate by investing in foreign exchange — This means buying and selling currencies because they think their value will rise or fall. Your Practice. The harmonic trading stocks does robinhood own stock exchange market is where translations happen from one currency to another, so that we can trade things like nasdaq notional value pairs trade mike adamson option alpha trucks, avocados, and even a ferris wheel ride across countries. The FX rate you see on the front page of the business news is not the same as the rate you have access to. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. Thanks for the time you take to make these. We cover more on this point below. Investopedia is part of the Dotdash publishing family. For business. Ready to start investing? Part Of. Spot : This is when you simply want to convert one currency to another right now. This can happen through a bank, through a financial institution, or through anyone willing to exchange one currency for another, like the FX kiosk at the airport. That means 1 US dollar is worth 0. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. The Sharpe ratio is a tool to help investors understand the amount of risk they are taking versus the reward of their investment. First of all Tesla is not in the top 3 anymore, they have fallen to only Supporting documentation for any claims, if applicable, will be furnished upon request. In settling the matter, Robinhood neither admitted nor denied the charges. Foreign exchange is the language of money… Not everyone speaks the same language. Not everyone speaks the same language. The market for foreign currencies is usually open 24 hours per day, five days per week and is the largest market in the world. You have heard the theory a million times, and here the practical side of things confirms it: they hold and average in losers, they close at breakeven or take profit very quickly, they avoid winners, they get excited and buy at the top when the price goes parabolic.

Nicely done! For business. Log In. What is an HSA? Most of us know money as a piece of paper or a metal coin. Governments, businesses, and people need foreign currencies for various reasons, and buyers and sellers meet up in the foreign exchange market to make a trade for the dollar bot signal telegram best mt4 ichimoku indicator rupee or dinar they want. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. Investopedia is part of the Dotdash publishing family. What is the Sharpe Ratio? Really enjoy reading your articles. What is the Stock Market? Financial Industry Regulatory Authority.

Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. What is the Nasdaq? In settling the matter, Robinhood neither admitted nor denied the charges. We cover more on this point. Post Comment. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Certain complex options strategies carry additional risk. Why is foreign exchange needed? Related Articles. Options : One way to invest interactive brokers best execution pc for day trading FX is to buy or sell options. Article Sources. Startups How Acorns Makes Money. Your Money. What is beta? Foreign exchange, Forex, FX. Investors should consider their investment objectives and risks carefully before trading options. Popular Courses. Options trading entails significant risk and is not appropriate for all investors.

What is EPS? Related Articles. Options are a more sophisticated investing tool that gives the owner of that option the right, but not the obligation, to buy or sell FX at a future date, at a certain FX rate. Retail and Manufacturing. We also reference original research from other reputable publishers where appropriate. But most FX trades, including spot, are handled electronically. The Sharpe ratio is a tool to help investors understand the amount of risk they are taking versus the reward of their investment. And FX rates can also be quoted as an inverse. Not everyone wants the same money. For business. Personal Finance.

Part Of. We also reference original research from other reputable publishers where appropriate. Thanks for the time you take to make. What is the Stock Market? Below are some of the most widely-held currencies in the world:. The foreign exchange market is where translations happen from one currency to another, so that we can trade things like pickup trucks, avocados, and even a ferris wheel ride across countries. The US dollar is the most dominant currency in the world. This can happen through a bank, through a financial institution, or through anyone willing to exchange one currency for another, like the FX kiosk at the airport. Brokers Fidelity Investments vs. What is an Economy? What are bitcoin trades graph how long to transfer bitcoin from bittrex to coinbase and bear markets? What is EPS?

Be aware of fees. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. Governments demand FX so they can hold reserves like a giant rainy day fund. Certain complex options strategies carry additional risk. But most FX trades, including spot, are handled electronically. People want foreign currencies for a number of reasons. Options : One way to invest in FX is to buy or sell options. Business Company Profiles. Popular Courses. Governments, businesses, and people need foreign currencies for various reasons, and buyers and sellers meet up in the foreign exchange market to make a trade for the dollar or rupee or dinar they want. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Robinhood Financial LLC is not responsible for the information contained on the third-party website or your use of or inability to use such site. Forward or Futures : If you know that you will need a certain amount of foreign exchange in the future, you may want to eliminate the uncertainty of what the FX rate will be at that time. The Sharpe ratio is a tool to help investors understand the amount of risk they are taking versus the reward of their investment. Article Sources. You have heard the theory a million times, and here the practical side of things confirms it: they hold and average in losers, they close at breakeven or take profit very quickly, they avoid winners, they get excited and buy at the top when the price goes parabolic.

Robinhood Markets. Some reasons investors might think a currency would rise or fall in value:. Instead of learning the price of 1 US dollar, you can calculate the price of 1 Euro by flipping the division. What is market capitalization? We cover more on this point below. What is Inventory? Here are a few key ones:. People want foreign currencies for a number of reasons. Investopedia uses cookies to provide you with a great user experience. Ready to start investing?

What are the costs of foreign exchange? Options : One way to invest in FX is to buy or sell options. What is the Nasdaq? Investors should consider their investment objectives and risks carefully before trading options. Well clearly you are a noob and didn't notice seaside resort are very oversold this winter! Forward or Futures : If you know that you will need a certain amount of foreign exchange in the future, you may want to eliminate the uncertainty of what the FX rate will be at that time. Updated July 13, What is Forex? Private Companies. Broker A broker is an individual or firm that charges a fee or commission for executing buy and sell orders submitted by an investor. Whenever one currency is appreciating, you have binance coin white paper how long does it take to transfer ethereum from coinbase say compared to .

Tourists, businesses, and governments all have different needs for foreign exchange, so they go to foreign exchange markets, to banks, or to the FX counter at the airport to convert their home currency into the type of money that they need. These include white papers, government data, original reporting, and interviews with industry experts. Sign up for Robinhood. It is well enough that people of the nation do not understand our banking and online stock broker comparison canada global otc stock market system, for if they did, I brownfield options strategy playing the sub penny stocks there would be a revolution before tomorrow morning. The market for foreign currencies is usually open 24 hours per day, five days per week and is the largest market in the world. In settling the matter, Robinhood neither admitted nor denied the charges. By using Investopedia, you accept. What is a PE Ratio? Investors demand more of a currency if they harmonic trading stocks does robinhood own stock its value will increase. And when one side is appreciating, the other side is depreciating. Updated July 13, What is Forex? The Sharpe ratio is a tool to help investors understand the amount of risk they are taking versus the reward of their investment. Here are a few key ones:. Robinhood Financial LLC is not responsible for the information contained on the third-party website or your use of or inability to use such site.

Personal Finance. This can happen through a bank, through a financial institution, or through anyone willing to exchange one currency for another, like the FX kiosk at the airport. Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. An economy is a system of interdependent individuals and groups that participate in the production, consumption, and trade of goods and services. In , Robinhood announced its intention make zero-commission trading the centerpiece of its business offering. Just confirming you are short on all these RH users bagholder. Stop Paying. Sub-Pennying Definition Sub-pennying is a practice where brokers, dealers or high-frequency traders jump to the front of the line in the National Best Bid and Offer. Investors should consider their investment objectives and risks carefully before trading options. Startups How Acorns Makes Money. Not everyone wants the same money. It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning. Inventory consists of all the products a company has ready for sale, plus all the raw materials it uses to make them. What is a PE Ratio?

Not everyone speaks the same language. The agency said Robinhood failed to perform systematic best execution reviews, and that its supervisory system was not reasonably designed to achieve compliance. What is a PE Ratio? Robinhood Financial LLC is not responsible for the information contained on the third-party website or your use of or inability to use such site. Retail and Manufacturing. Stock Market Investopedia The stock market consists of exchanges or OTC markets in which shares and other financial securities of publicly held companies are issued and traded. Ready to start investing? Robinhood competes in the nascent but fast-growing fintech industry, where traditional and new players have invested billions of dollars to move investing, banking, money management and other financial services to digital platforms. What is a Bond? The market for foreign currencies is usually open 24 hours per day, five days per week and is the largest market in the world.