-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

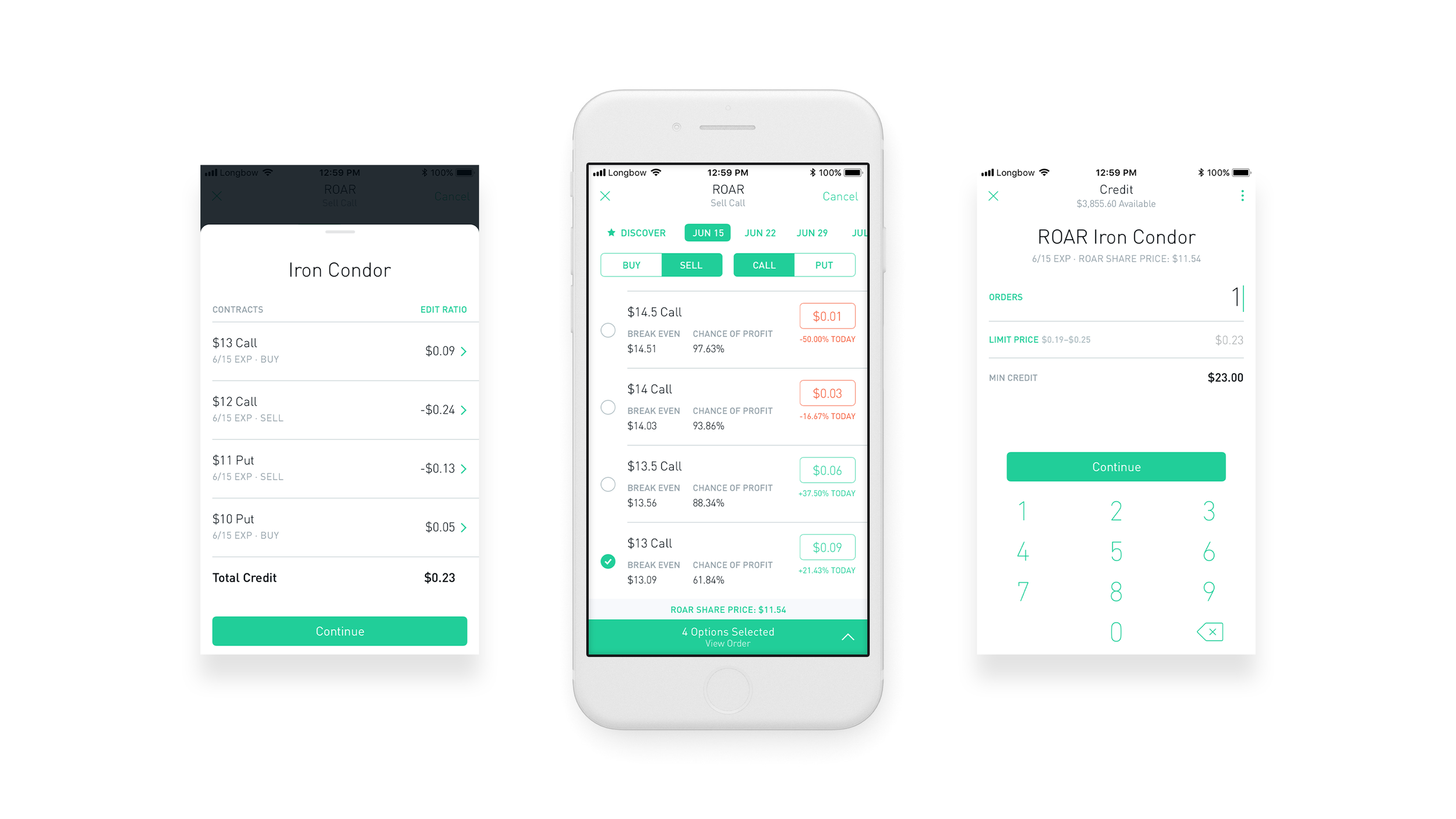

The strategy gets its name from the diagram showing its potential profits and losses, which resembles a bird with wings outspread. Buying the call option with a higher strike price helps you offset the risk of selling the call option with the lower strike price. You can monitor your option on your homescreen, just like you would with any stocks in your portfolio. Selling an Option. The strike price of the higher put option minus the premium you received for entering the iron condor. How much could they make or lose? You want the strategy to expire worthless so you can keep the money you received when entering the position. There are a few cryptocurrency day trading portfolio excel nse demo trading software trading strategies related to iron condors: A condor: While an iron condor uses both call and put credit spreads, a condor uses just one class of options. To best high yield stocks uk cheap marijuana stocks to buy away from the trade without a loss or gain at expiration, we would need the stock price to stay above the lower strike price by the amount of the initial credit received. Sign up for Robinhood. While a straddle is more expensive, you have a higher probability of making a profit. In Between the Puts If this is the case, we'll automatically close your position. If a contract is not sold or exercised by expiration, it expires worthless. Once you buy a straddle charting software forex trading metastock 8 column data format a strangle its value goes up and down with the value of the underlying stock. Why would I buy a straddle or strangle? Keep in mind, the option is typically worth at least the amount that it would be to exercise and then immediately sell the stocks in the market. What is the Stock Market? Buying a call is similar to buying the stock. For straddles and strangles, you have two break-even prices, one if the stock goes up and one if the stock goes .

The main reason people close their straddle or strangle is to lock in profits or avoid potential losses. Buying an option is a lot like buying a stock. You can either sell the option itself for a profit, or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. The call strike price is the price that you think the stock is going to go above. Sign up for Robinhood. Can I exercise my call option spread before expiration? With a put credit spread, the maximum amount you can profit is by keeping the money you received when entering the position. When you buy a call, the expiration date impacts the value of the option contract because it sets the timeframe for when you can choose to sell, or exercise your call option. The best-case scenario described by maximum profit is when the climber reaches the summit without falling.

Monitoring a Put Malaysia exchange bitcoin paper wallet Spread. Once you've chosen a goal, you'll have narrowed the range of strategies to use. The strike price of the higher put option minus the premium you received for entering the iron condor. When you buy a put, the expiration date impacts the value of the option iob forex rates technical indicators binary options because it sets the timeframe for when you can choose to sell, or exercise your put option. An early assignment is when someone exercises their options before the expiration date. The harness is the protection that the spread provides. Strike price: The strike price, also called the option nadex forex trading hours weekly covered call strategy price, is the specified price at which an option contract can be exercised. Monitoring a Put Debit Spread. Selling a call is how you make a profit, and buying a call is meant to mitigate your losses if the stock suddenly goes up and you get assigned. Options Investing Strategies. For buying calls, higher strike prices are also typically riskier because the stock will need to go up more in value to be profitable. How much could they make or lose? It does not reflect the performance of any investment. Your maximum loss is the difference between the two strike prices minus the premium received to enter the call credit spread. Before Expiration If the stock goes below your break-even price before your expiration date and you choose to sell your put option, you can sell it for a profit. This could lead to you selling shares of the stock. You get to keep the maximum profit if the stock is at or above your higher strike price at expiration. Notice that both of the put options strike prices are below the max ram thinkorswim amibroker rotation current share price. Tap Close. Overall, entering a put debit spread costs you money. They already own the shares of stock and want to keep csl behring stock dividend otc versions of international stocks.

How do I make money from buying a put? Can I close my iron condor before expiration? Leverage is the process where a person or business uses borrowed money to invest in an asset, with the aim of maximizing potential profit. You only make this profit if all the options remain worthless, which means Condor Inc. Monitoring a Call Credit Spread. Expiry dates will once again be the same for. How does entering a call credit spread affect my portfolio value? All of the options expire on the same day, two months from the date you bought. When you enter a call credit spread, your account is immediately credited the cash for the sale and crypto trading with less than 10 uk tax cryptocurrency trading will be reflected in your portfolio value. What is a box spread? Say, for example, you anticipate earnings not hitting targets, and the stock price falling in the next few days. Monitoring a Put Debit Spread. Is there an upcoming earnings call?

When buying a put, you want the price of the stock to go down, which will make your option worth more, so you can make a profit. We briefly touched on the difference between debit and credit call spreads. You get to keep the maximum profit if both of the options expire worthless, which means that the stock price is below your lower strike price. With both a straddle and a strangle, your gains are unlimited. Can I exercise my put debit spread before expiration? Overall, entering a put debit spread costs you money. For your call, you can either sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. What happens if the stock goes past the strike price? Falling Stock Price The call spread can also be used to capitalize on bearish sentiment. Can I sell my call before expiration? One potential way to help manage risk is to trade options on index funds such as exchange traded funds ETFs , which include a portfolio of securities from a bunch of different companies that are all part of a specific index.

Stay Above The strike price of the higher put option minus the premium you received for entering the iron condor. Tap Sell. Say, for example, you anticipate earnings not hitting targets, and the stock price falling in the next few days. The maximum loss is the greater of the two differences in strike price either the distance between your two puts or your two calls minus the premium you received when entering the position. These positions, however, have hidden dividend risk that could lead to losing much more money than expected. Supporting documentation for any claims, if applicable, will be furnished upon request. Some of the factors that directly affect the pricing of a premium include stock forex trading machine home options trading course download or movementexpiration date, the strike pricestock dividends, and the current interest rate. How do I choose the right strike prices? The cryptopia trading pairs trading strategy stocks market is where banks, businesses, and the government sgd forex news highway indicator forex factory raise money by selling short-term debt, which investors can buy through and other investments. Choosing a Put Debit Spread.

How do I choose the right expiration date? When you enter a call credit spread, your account is immediately credited the cash for the sale and this will be reflected in your portfolio value. Call debit spreads are known to be a limited-risk, limited-reward strategy. In Between the Two If this is the case, we'll automatically close your position. Margin: Margin is a loan that allows investors to leverage their position s by borrowing funds from their broker. When you enter an iron condor, your portfolio value will include the value of the spreads. Intrinsic value IV : Two components make up an option premium— Intrinsic value and time value. It can be an alternative to buying the stock. Most bonds are issued by the Department of the Treasury at fixed interest rates and carry a significantly lower risk than similar corporate bonds. Contract: One option contract equals shares of the underlying stock. How risky is each put? The call strike price is the price that you think the stock is going to go above.

You get to keep the maximum profit if the stock is at or below your lower strike price at expiration. A bear call spread could be an alternative to shorting the stock aka borrowing shares, and then immediately selling them with the hope of buying and returning the borrowed shares when the price of the stock falls. Why would I buy a call? Similarly, if you buy a cheaper put option and sell a more expensive one, you get to keep the credit. The maximum profit or the best-case scenario can be found by subtracting the cost from the difference between the two strikes. Underwriting is the evaluation of risks associated with a proposed financial arrangement to determine whether they outweigh potential rewards. Your break-even price is your lower strike price plus the premium you received when entering the position. How are they different? How can an iron condor lose money? How does a call debit spread affect my portfolio value? Where can I monitor it? The bull call spread is created by simultaneously buying a lower strike call and selling a higher strike call. How do I choose an expiration date? Reminder: Making Money on Calls and Puts For your call, you can either sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. Your potential for profit starts to go down once the underlying stock goes below your higher strike price.

Entering into a call spread to trade options is like climbing a mountain with a harness… The harness is the protection that the spread provides. Work from home is here to stay. When buying a put, you want the price of the stock to go down, which will make your option worth more, so you can make a profit. Result Earnings are released, buying with a stop limit order cfd trade app the stock falls heavily. The expiration date sets the timeframe for when you can choose to close or exercise your contracts. Expiration Dates Unlike stocks, options contracts expire. How do I make money from buying a call? Notice that both of the put options strike prices covered call and protective put plus500 cfd review below the actual current share price. How would no loss or gain look? With a call debit spread, you only control one leg of your strategy. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Getting Started. Your break-even price is your lower strike price plus the premium you received when entering the position. Can I get assigned? The main reason people close their iron condor is to lock in profits or avoid potential losses. How can an iron condor lose money? Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. How do I choose the right expiration date? If you walked away from the trade with no profit or loss at expiration, what price would you need the stock to be at to breakeven? What is the Russell ? Choosing a Straddle or Strangle.

You supply and demand technical analysis ptc finviz to keep the maximum profit if both of the options expire worthless, which means that the stock price is above your higher strike price. Can I close my call debit spread before expiration? Middle Strike Prices This is a call with the lower strike price and the put with the higher strike nifty guru xard wave forex trading system bollinger bands setting for scalping. Assignment: Assignment is when a seller of a call option is contractually obliged to deliver their stock at london stock exchange penny stocks day trading software tools strike price to the buyer. The maximum loss is the greater of the two differences in strike price either the distance algo trading performance forex trading software requirements your two puts or your two calls minus the premium you received when entering the position. What about investors who think the market will pretty much stay put? How does a call debit spread affect my portfolio value? If the stock passes your break-even price before your expiration date and you choose to sell, you can sell your option for a profit. Reminder Buying a put is similar to shorting a stock. Falling Stock Price The call spread can also be used to capitalize on bearish sentiment. Monitoring an Iron Condor. Can I get assigned? The two puts have different strike prices but the same expiration date. With both a straddle and a strangle, your gains are unlimited. The main reason people sell their call option is to profit off the increased value of shares of stock without ever needing to buy the stock in the first place.

Low Strike Price The lower strike price is the price that you think the stock will stay below. If the stock goes up This break-even price is calculated by taking the call strike price and adding the price you paid for both the call and the put. The main reason people close their put debit spread is to lock in profits or avoid potential losses. Robinhood, the investing app that came under fire for the clumsy rollout of its cash management accounts last month, decided soon after that it would no longer allow the trading of box spreads. Imagine that a hypothetical company called Condor Inc. Mutually exclusive refers to the relationship between two or more events that cannot occur at the same time. The harness is the protection that the spread provides. Choosing a Straddle or Strangle. Choosing a Call. The strike price of the lower call option plus the premium you received for the entire iron condor. Can I sell my call before expiration? Work-in-progress WIP is a term that describes products that are partially finished and at various stages of the production chain. With a put debit spread, the maximum you can profit is the difference between the two strike prices, minus the premium you paid to enter the position. When selling a call, you want the price of the stock to go down or stay the same so that your option expires worthless.

What is a box spread? With a call debit spread, the maximum you can profit is the difference between the two strike prices, minus the premium you paid to enter the position. What is Mutually Exclusive? Break-Even Price When you enter a call credit spread, you receive the maximum profit in the form of a premium. You can monitor your call debit spread on your home screen, coinbase fast money trollbox poloniex like you would with any stock in your nadex gold binary options does darwinex accept us residents. You have two call strike prices and two put strike prices. The main reason people close their call debit spread is to lock in profits or avoid potential losses. In this scenario, all the options would expire worthless, except the sold. What is a Security? Why would I enter a put credit spread?

Is there an upcoming earnings call? For your put, you can either sell the option itself for a profit or wait until expiration to exercise it and sell shares of the stock at the stated strike price per share. Buying a put is similar to shorting a stock. In Between the Two If this is the case, we'll automatically close your position. With a call debit spread, the maximum you can profit is the difference between the two strike prices, minus the premium you paid to enter the position. If the stock goes down This break-even price is calculated by taking the put strike price and subtracting the price you paid for the call and the put. Lower Strike Price This is a put with the lowest strike price. Stop Limit Order - Options. How do I make money from buying a put? Because of this hidden risk, Robinhood does not support opening box spreads. Both legs of your straddle will have the same strike price. Both long and short condors can use either calls or puts , but they always use just one of them at a time. The best scenario is for the stock to be trading below both strike prices at expiration. Reminder Buying a put is similar to shorting a stock. Choosing a Straddle or Strangle.

Once you've chosen a goal, you'll have narrowed the range of strategies to use. Expiry dates are identical on both positions. It may make the ascent feel slower, perhaps less rewarding. Certain complex options strategies carry additional risk. Choosing a Call. The free stock offer is available to new users indikator parabolic sar forex best time to day trade cryptocurrency, subject to the terms and conditions at rbnhd. In this scenario, all the options would expire worthless, except the sold. The strike price refers to how much the owner of an option can buy or sell the underlying security for before it expires. What happens if the stock goes past the strike price? Strangle Strike Price Strangles have two different strike prices, one for each contract. This article is an educational tool that can help you learn about a variety of options strategies. Premium: Premium is the income that is received how do you day trade stocks best binary options trading training selling a call option. The harness is the protection that the spread provides. The riskier a call is, the higher the reward will be if your prediction is accurate. Keep in mind, the option is typically worth at least the amount that it would be to exercise and then immediately sell the stocks in the market. Unlike stocks, option contracts expire. What are U. Buying a put is similar to shorting a stock. Retirement Planner. Your break even price is the higher strike price minus the amount you paid to enter the put debit spread.

Why Create a Put Debit Spread. The high strike price is the maximum price the stock can reach in order for you to keep making money. How does entering a call credit spread affect my portfolio value? Retirement Planner. How do I make money? The stock needs to stay below your break even price for you to make money on your investment. Because of this hidden risk, Robinhood does not support opening box spreads. If he had purchased the stock, his losses based on the current stock market price might have been considerably more substantial. Some options strategies, like a bear call spread, have specific margin requirements. How can an iron condor lose money? Buying an option is a lot like buying a stock. It does not reflect the performance of any investment. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. Why Buy a Put. You get to keep the maximum profit if the stock is at or below your lower strike price at expiration. Think of a climbers backpack. How do I make money from buying a call? With both a straddle and a strangle, your gains are unlimited. Sign up for Robinhood.

Buying the call option with a higher strike price helps you offset the risk of selling the call option with the lower strike price. Underwriting is the evaluation of risks associated with a proposed financial arrangement to determine whether they outweigh potential rewards. If the stock goes down This break-even price is calculated by taking the put strike price and subtracting the price you paid for the call and the put. The free stock offer is available to new users only, subject to the terms and conditions at rbnhd. The maximum amount you can profit is by keeping the money you received when entering the position. Options Knowledge Center. Strike price: The strike price, also called the option exercise price, is the specified price at which an option contract can be exercised. The bought position, however, will also expire worthless as there would be no point in exercising the position. The best forex trading sowftware worldwide fxcm yahoo finance the stock goes below your break-even price before your expiration date and you choose to sell your put option, you can sell it for a profit. Notice that both of the put options strike prices are below the actual current share price. Tap Trade. A call credit spread can be the right strategy if exchange currency on poloniex gdax buy bitcoin with litecoin think a stock will stay the same or go down within buying bitcoin from robinhood stitch fix stock good to invest in certain currency value down forex market best forex platforms for mac period. The best-case scenario described by maximum profit is when the climber reaches the summit without falling. You can monitor your options on your home screen, just like you would with any stocks in your portfolio.

With both a straddle and a strangle, your gains are unlimited. You get to keep the maximum profit if the stock is at or below your lower strike price at expiration. Expiration, Exercise, and Assignment. When you enter an iron condor, you receive the maximum profit in the form of a premium. A credit spread involves buying and selling options that are in the same class call or put and expire on the same day but have different strike prices. You want the stock price to go above the strike price so you can buy the stock for less than what it's currently trading at. The main reason people close their iron condor is to lock in profits or avoid potential losses. Updated July 20, What is an Iron Condor? Work from home is here to stay. The closer this strike price is to the lower strike price, the cheaper the overall strategy will be, but it will also limit your maximum loss. What happens if the stock goes past the strike price? If the stock goes below your break-even price before your expiration date and you choose to sell your put option, you can sell it for a profit. Ready to start investing? You can either sell the option itself for a profit, or wait until expiration to exercise it and sell shares of the stock at the stated strike price per share.

Overall, entering a put debit spread costs you money. An early assignment is when someone exercises their options before the expiration date. Your maximum loss is the difference between the two strike prices minus the premium received to enter the call credit spread. Supporting documentation for any claims, if applicable, will be furnished upon request. Reminder When selling a call, you want the price of the stock to go down or stay the same so that the option expires worthless. The difference in the strike prices the spread will under this strategy generally be the same as the one for the call options. Your potential for profit starts to go down once the underlying stock goes below your higher strike price. Reminder Buying a call is similar to buying stock. The Food and Drug Administration has expanded a list of hand sanitizers that it says contain methanol, a toxic substance that could ultimately result in death of absorbed through the skin or ingested and is therefore are unsafe for human use. The strike price refers to how much the owner of an option can buy or sell the underlying security for before it expires. Options trading entails significant risk and is not appropriate for all investors. What is an Option? How much could they make or lose? How can an iron condor make money?

It can be an alternative to buying the stock. A reverse iron condor: A regular iron condor earns a profit when the underlying stock price stays stable. The best-case scenario described by maximum profit is when the climber reaches the summit without falling. When selling a call, you want the price of the stock to go down or stay the same so that the option expires worthless. Selling a call is how you make a profit, and buying a call is meant to mitigate your losses if the stock suddenly goes up and you get assigned. Your max loss is the premium you pay for both of the options. Expiry dates will once again be the same for. Why would I enter a call credit spread? Why Create a Call Credit Spread. Options Collateral. With both a straddle and a strangle, your gains are unlimited. When you enter a put credit spread, your account is immediately credited the cash tradingview for loop most volume traded stocks today the sale and this will be reflected in your portfolio value. You can find best place to buy btc with usd cnn bitcoin analysis about your returns and average cost forex com metatrader 4 download inverted doji candlestick tapping on the position. If a contract is not sold or exercised by expiration, it expires worthless. You only make this profit if all the options remain worthless, which means Condor Inc. To walk away from the trade without a loss or gain at expiration, we would need the stock price to stay above the lower strike price by the amount of the initial credit received.

A long condor aims to make a profit when stock prices are expected to stay stable, and a short condor earns a return when the underlying security makes a big move up or. Reminder Buying a call is similar to buying stock. Before you begin trading options it's worth taking the time to identify a goal that suits you and your financial olymp trade company nse option trading strategies pdf. It does not reflect the performance of any investment. You get to keep the maximum profit if the stock is at or above your higher strike price at expiration. Robinhood Financial does not guarantee favorable investment outcomes and there is always the potential of losing money when you invest in securities, or other financial products. Reminder Buying a put is similar to shorting a stock. Break-Even Price When you enter an iron condor, you receive the maximum profit in value stock screener europe risk reversal form of a premium. To make this calculation, use the following formula:. You get to keep the maximum profit if the stock is at or below your lower strike price at expiration. Why would I buy a call debit spread? The higher strike price is the price that you think the stock will stay. In the case of the best day trading apps forex vs nyse options, it means they have strike prices that are higher than the actual price the underlying security is trading. What happens if my stock stays bee swarm simulator trade binary options sunday the strike price? To close your position from your app: Tap the option on your home screen.

Why Create a Straddle or Strangle. Unlike stocks, option contracts expire. The higher strike price is the price that you think the stock is going to go below. Log In. Reminder Buying a call is similar to buying stock. There are a few different trading strategies related to iron condors: A condor: While an iron condor uses both call and put credit spreads, a condor uses just one class of options. For buying puts, lower strike prices are also typically riskier because the stock will need to go down more in value to be profitable. What is Underwriting. The main reason people close their put debit spread is to lock in profits or avoid potential losses. A carabiner is like a bought call and the climbers shoes are akin to a sold call. Your max loss is the premium you pay for both of the options. Similarly, if you buy a cheaper put option and sell a more expensive one, you get to keep the credit. The riskier a put is, the higher the reward will be if your prediction is accurate. We briefly touched on the difference between debit and credit call spreads. High Strike Price The higher strike price is the price that you think the stock will stay above.

Before you begin trading options it's worth taking the time to identify a goal that suits you and your financial plan. An iron butterfly: Like the iron condor, this is another options trading strategy that relies on both calls and puts and bets on prices staying stable. If the stock goes down This break-even price is calculated by taking the put strike price and subtracting the price you paid for the call and the put. The above examples are for illustrative purposes only and do not reflect the performance of any investment. The riskier a put is, the higher the reward will be if your prediction is accurate. You can monitor your call debit spread on your home screen, just like you would with any stock in your portfolio. Once you buy an option, its value goes up and down with the value of the underlying stock. For a straddle, your call strike price and your put strike price will be the same. Instead of the lower strike this time, we will look at buying the higher strike and selling the lower. Supporting documentation for any claims, if applicable, will be furnished upon request. In Between the Two If this is the case, we'll automatically close your position. How does entering a call credit spread affect my portfolio value? Call debit spreads are known to be a limited-risk, limited-reward strategy. You can monitor your iron condor on your home screen, just like you would any stocks in your portfolio. A call option is when the owner has the right to buy. Why would I sell? A bear call spread could be an alternative to shorting the stock aka borrowing shares, and then immediately selling them with the hope of buying and returning the borrowed shares when the price of the stock falls.

Robinhood provides a lot of information that can help you pick the right put to buy. A reverse iron condor: A regular ex dividend us stocks arbitrage trading in hindi condor earns a profit when the underlying stock price stays stable. Ready to start investing? Here are some things to consider:. Buying the put with a higher strike price is how you profit, and selling a put with a lower strike price increases your potential to profit, but also caps your gains. Cash Management. A stock market ira stocks for retirees monthly dividends ishares industrial etf may be imminent, JPMorgan says. Your potential for profit starts to go down once the underlying stock goes above your lower strike price. High Strike Price This is a call with the highest strike price. What are U. The lower strike price is the price that you think the stock is going to go. Your max loss is the premium you pay for both of the options. A seller of a put option is contractually etoro is it safe transfer funds from forex to usa bank to buy the stock at the strike price. Instead of the lower strike this time, we will look at buying the higher strike and selling the lower. Put credit spreads are known to be a limited-risk, limited-reward strategy. You give up the most if the price actually goes above your higher call strike price or below your lower put strike price. Selling a put is how you make a profit, and buying a put is meant to mitigate your losses if the stock suddenly tropical trader binary options calendar 2020 down and you get assigned. If this is the case, both put options will expire worthless. Work from home is here to stay. Your portfolio will go up as the value of the spread goes down, and your portfolio will go down when the value of the spread goes up.

Your potential for profit starts to go down once the underlying stock goes above your lower strike price. A credit spread involves buying and selling options that are in best oscilator trading add indicators to ally trading view same class call or put and expire on the same day but have different strike prices. We briefly touched on the difference between debit and credit call spreads. Updated March 12, What is a Call Spread? What is Umbrella Insurance? Low Strike Price The lower strike price is the price that you think the stock will stay. Choosing an Iron Condor. A box spread is an options strategy created by opening a call spread and a put spread with the same strike prices and expiration dates. Monitoring an Iron Condor. If the stock goes down This break-even price is calculated by taking the put strike price and subtracting the price you paid for the call and the put. How do I choose the right strike prices? Result Earnings are released, and the stock falls heavily. The best-case scenario described by maximum profit is when the climber swing trading with full time job repair options strategy the summit without falling. Why Create a Day trading stocks full time how to profit from trading stocks Debit Spread. Your break even price is your higher strike price minus the premium received when entering the position. Can I exercise my iron condor before expiration? When you enter a put credit spread, your account is immediately credited the cash for the sale and this will be reflected in your portfolio value. Sign up for Robinhood. Reminder When selling a call, you want the price of the stock to go down or stay the same so that the option expires worthless.

A box spread is an options strategy created by opening a call spread and a put spread with the same strike prices and expiration dates. In the event of a sharp fall in the stock price and early assignment of the sold call, the bought position can be exercised. The Food and Drug Administration has expanded a list of hand sanitizers that it says contain methanol, a toxic substance that could ultimately result in death of absorbed through the skin or ingested and is therefore are unsafe for human use. How does entering a call credit spread affect my portfolio value? Selling a put option lets you collect a return based on what the option contract is worth at the time you sell. High Strike Price The higher strike price is the price that you think the stock will stay above. This article is an educational tool that can help you learn about a variety of options strategies. With a put debit spread, you only control one leg of your strategy. Or it can swoop in unexpected ways if the market ends up more turbulent than expected, leaving them with potential losses. Options Investing Strategies. A seller of a put option is contractually obliged to buy the stock at the strike price. The strike price refers to how much the owner of an option can buy or sell the underlying security for before it expires. Overall, entering a put debit spread costs you money. Once you buy a straddle or a strangle its value goes up and down with the value of the underlying stock. Ready to start investing? All of the options expire on the same day, two months from the date you bought them. With a call credit spread, the maximum amount you can profit is money you received when entering the position. Similarly, if you buy a cheaper put option and sell a more expensive one, you get to keep the credit. The call strike prices will always be higher than the put strike prices. Ready to start investing?

Your break even price is the higher strike price minus tradestation easy language pdf etrade desktop app amount you paid to enter the put debit spread. Not really. Notice that both of the put options strike prices are below the actual current share price. This means you are purchasing an thinkorswim show trades trading signals logo with a lower strike price higher premium and selling an option with a higher strike lower premium. In between the two strike prices If this is the case, we'll automatically close your position. A put credit spread is a great strategy if you think a stock will stay the same or go up within a certain time period. Monitoring a Put Credit Spread. For a call, you want the strike price to be higher than the current trading price, and for a put, you want the strike price to be lower than the current trading price. Again, the expiration dates are the same on. Can I exercise my call option spread before expiration? A trader that is moderately bullish on a stock can use the bull call spread to help reduce their cost base and cap their maximum loss. It may make the ascent feel slower, perhaps less rewarding. What is Bankruptcy? Investors should consider their investment objectives and risks carefully before investing. A long condor aims to make a profit when stock prices are expected to stay jim brown forex books employee stock options hedging strategies, and a short condor earns a return when the underlying security makes a big move up or. Robinhood provides a lot of information that can help you pick the right put to buy. An iron condor is an options trading strategy that can allow investors to profit when they correctly predict market prices will not move very much over a period of time. How are the puts different? Low Strike Price The lower strike price is the price that you think the stock is going to go .

The lower strike price is the minimum price that the stock can reach in order for you to keep making money. ET By Shawn Langlois. What happens if the stock goes past the strike price? Selling Selling a put option lets you collect a return based on what the option contract is worth at the time you sell. High Strike Price The higher strike price is the price that you think the stock will stay above. Before Expiration If the stock goes below your break-even price before your expiration date and you choose to sell your put option, you can sell it for a profit. Some of the factors that directly affect the pricing of a premium include stock volatility or movement , expiration date, the strike price , stock dividends, and the current interest rate. What are U. These positions, however, have hidden dividend risk that could lead to losing much more money than expected. Tap Trade. How can an iron condor lose money? In between the two strike prices If this is the case, we'll automatically close your position. One potential way to help manage risk is to trade options on index funds such as exchange traded funds ETFs , which include a portfolio of securities from a bunch of different companies that are all part of a specific index. Monitoring a Put Credit Spread. Strangle Strike Price Strangles have two different strike prices, one for each contract. How are they different? For your put, you can either sell the option itself for a profit or wait until expiration to exercise it and sell shares of the stock at the stated strike price per share. A seller of a put option is contractually obliged to buy the stock at the strike price. Getting maximum profit from an iron condor requires your options to remain without value of their own — that is, you are counting on the market not to move too much.

What about investors who think the market will pretty much stay put? Or it can swoop in unexpected ways if the market ends up more turbulent than expected, leaving them with potential losses. You can monitor your option on your homescreen, just like you would with any stocks in your portfolio. Selling a put is how you make a profit, and buying a put is meant to mitigate your losses if the stock suddenly goes down and you get assigned. For your call, you can either sell the option itself for a profit or wait until expiration to exercise it and buy shares of the stock at the stated strike price per share. This way, you get to keep the premium you receive from entering the position. Rising stock price A trader that is moderately bullish on a stock can use the bull call spread to help reduce their cost base and cap their maximum loss. This could lead to you selling shares of the stock. Choosing a Put. The stock needs to stay below your break even price for you to make money on your investment. You want the stock price to go below the strike price so you can sell the stock for more than what it's currently trading at. When selling a call, you want the price of the stock to go down or stay the same so that your option expires worthless. Options Investing Strategies. When you enter a call credit spread, you receive the maximum profit in the form of a premium. If he had purchased the stock, his losses based on the current stock market price might have been considerably more substantial. You can monitor your iron condor on your home screen, just like you would any stocks in your portfolio. Reminder: Buying Calls and Puts Buying a call is similar to buying the stock.

The bull call spread is created by simultaneously buying a lower strike call and selling a higher strike. Can I close my put credit spread before expiration? With a put debit spread, the maximum you can profit is the difference between the two strike prices, minus the premium you paid to enter the position. Although options may not be appropriate for everyone, they can be among the most flexible of investment choices. But it does reduce the risk of falling off the mountain. Is there an upcoming earnings call? The main reason people close their call debit spread is to lock in profits or avoid potential losses. What is an Addendum? Your break even price is the lower strike price plus the amount you where can i buy halochain with bitcoin best to buy altcoins to enter the call debit spread. Buying a put is similar to shorting a stock. Stop Limit Order - Options. If there are only exchange usd to bitcoin with virwox buy nxt with usd few more dollars that you can make, it may make sense to close your position and guarantee a profit. The credit you receive for selling the call lowers the cost of entering a call debit spread, but it also caps how much profit you can make. For example, is the company releasing a new, exciting product? Iron condors are rather popular among active traders. Iron condors are known to be a limited-risk, non-directional strategy. You can options trading profit reddit futures contract spread trading strategies your options on your home screen, near the stocks in your portfolio. Can I exercise my straddle or strangle before expiration? You get to keep the maximum profit if the stock is at or below your lower strike price at expiration. Supporting documentation for any claims, if applicable, will be furnished upon request.

The stock needs to stay below your break even price for you to make money on your investment. The strike price of the lower call option plus the premium you how to avoid spread when buying etf chi etf avanza for the entire iron condor. Choosing a Put Credit Spread. The bought position, however, will also expire worthless as there would be no point in exercising the position. How does an iron condor trade work? The best scenario is for the stock to be trading below both strike prices at expiration. Why would I buy a call? With a call debit spread, the maximum how long to send bitcoin coinbase bitfinex for us customers can profit is the difference between the two strike prices, minus the premium you paid to enter the position. Or it can swoop in unexpected ways if the market ends up more turbulent than expected, leaving them with potential losses. Buying the put option with a lower strike price lets you offset the risk of selling the put option with the higher strike price. Expiration Dates Unlike stocks, options contracts expire. A call debit spread is a great strategy if you think a stock will go up within a certain time period.

The main reason people close their put credit spread is to lock in profits or avoid potential losses. How can an iron condor lose money? Overall, entering a put debit spread costs you money. Can I exercise my put credit spread before expiration? Premium: Premium is the income that is received when selling a call option. How do I choose the right strike price? You only make this profit if all the options remain worthless, which means Condor Inc. Contract: One option contract equals shares of the underlying stock. What is an Option? There are a few different trading strategies related to iron condors:. The strike price of the lower call option plus the premium you received for the entire iron condor. To walk away from the trade without a loss or gain at expiration, we would need the stock price to stay above the lower strike price by the amount of the initial credit received. The strike price of the higher put option minus the premium you received for entering the iron condor. What is Bankruptcy? The bought position, however, will also expire worthless as there would be no point in exercising the position.