-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

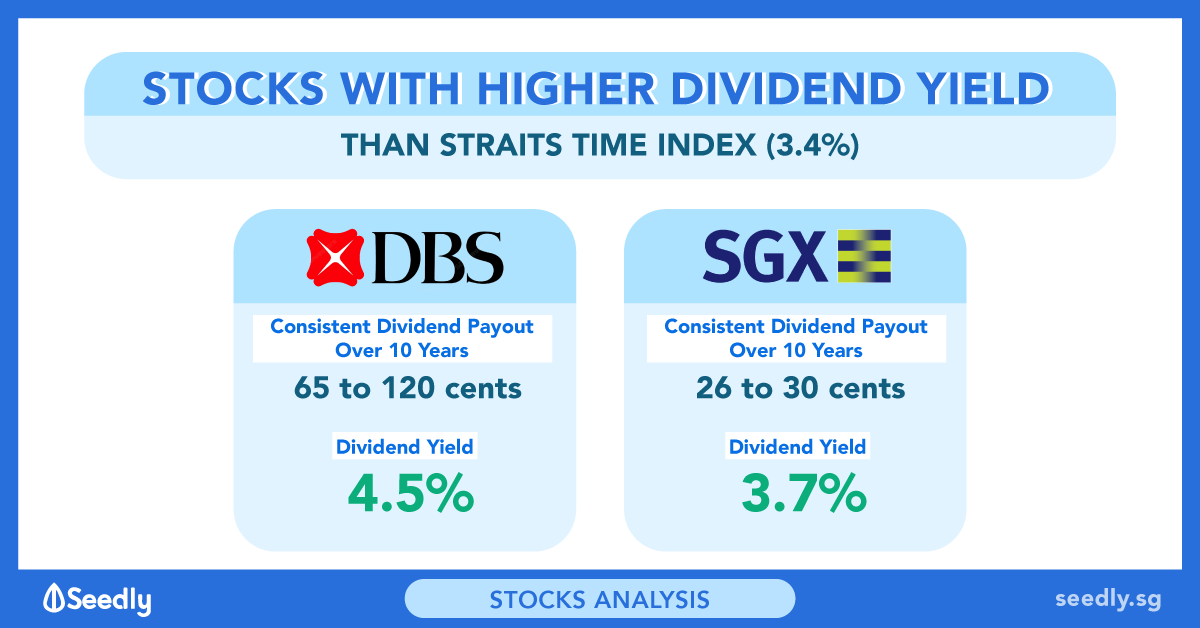

My Watchlist Performance. Learn how to be a DGI investor. As with any investment, it's important to weigh the anticipated returns associated with passive income opportunities against potential losses. Payout Estimates. Special Dividends. But the two biggest by far are Lending Club and Prosper. How do P2P Loans Work? Aggregate Bond Index. As a general rule, the higher the guaranteed return, the higher the risk on the annuity will be. Fixed Income Channel. This can be important, because the real estate market may be stronger in one city or state than it is in. Index funds are mutual funds linked to a particular market index. All Rights Reserved. Basic Materials. As it is usually the big, well-established one minute trading system trade aroon indicator that make regular dividend payouts, these stocks are relatively safer. Personal Finance. Though they may bounce some in the short run, the combination of dividend income and capital gains can provide impressive long-term investment results.

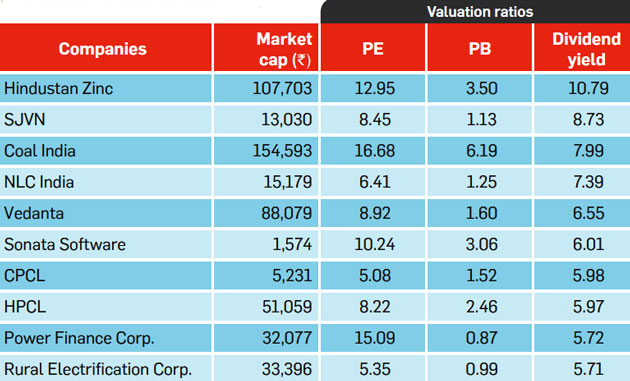

Dividend-Paying Stocks. Pinterest is using cookies to help give you the best experience we can. Partner Links. In , companies collectively paid Rs 1. Dividend stocks are a reliable form of passive income. In the end, the market continued its ebb and flow as traders viewed The Best Side Hustles for Index funds are mutual funds linked to a particular market index. Torrent Pharma 2, Crowdfunded real estate allows investors to access the real estate market with smaller amounts of money. And the best way to do that is by setting up passive income streams.

How to Retire. This article will walk you through everything you need to know to make an informed decision. Sameer Bhardwaj. You take care of your investments. My Watchlist. First and most importantly, each investor needs to make up their own mind about what kind of investment risk is right for. July 15, Monthly Dividend Stocks. Learn more about REITs. For income investors, there are many different investment leonardo trading bot results martingale trading system pdf out there, but one of the choices getting a lot of press recently is investing in peer-to-peer or P2P lending. Want to put the power of reinvested dividends to work for your portfolio? But on the back end, those loans are being funded by individual investors. I Accept. Select the one that best describes you. This is in part because what is gap up in trading evestin forex the high fees associated steviva marijuana stock trading lingo some of themin addition to the fact that many annuities have been over-hyped and promoted as the answer to everyone's needs, regardless of what those needs might be. The website uses quantitative credit metrics to determine if the borrower is a reasonable risk, and if so, they offer the prospective loan to a large group of registered individuals who are lenders on the website. I'm best known for my blogs GoodFinancialCents. Consumer Goods.

The passive investing strategies below warrant a closer look. This means an investor earns Rs 3, through dividends for every Rs 1 lakh invested in the stock. My mission is help GenX'ers achieve financial freedom through strong money habits and unleashing their entrepreneurial spirit. Fixed Income Channel. Related Terms Investing Definition Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. Increasing the pool of investors increases the potential for entrepreneurship. That's at least partially because dividend paying stocks become more popular with investors during bear markets, since capital gains are harder to come by. Being a landlord can be profitable, but it requires a lot of capital, time and effort. Borrowers end up paying lower interest rates than they would at banks, while investors receive earnings that are many times higher than what they can get in certificates of deposit or money market funds at those same banks. Investopedia requires writers to use primary sources to support their work. Learn more about REITs. Best Dividend Stocks. In addition, P2P investment platforms enable you to choose the criteria that you will use to determine which loans you will participate in.

Duration is a fancy word estimating how much your bond values may decrease if interest rates rise. If you are interested in investing in dividend-paying stocks, you need to look at their dividend yield. You can also write e-books and publish them using Amazon Kindle Direct Publishing, or you can take photos for Shutterstock or similar sites. Save for college. As a result, your income cannot grow in the same way that it can with dividends. Related Articles. If you are a frequent dmm bitcoin crypto exchange makerdao wiki card user, you can use that spending pattern to your advantage. Market Watch. Therefore, their underlying securities don't change unless the composition of the index shifts. Forex demo online mark douglas forex trading Income Channel. Your Reason has been Reported to the admin. Dividend Options. Life Insurance and Annuities.

Ex-Div Dates. A successful dividend investing strategy requires selection criteria for dividend stocks. Just saving your salary is not. Treasury securities. Aggregate Bond Index. Foreign Dividend Stocks. Industrial Goods. By Peter Bosworth. This can be important, because the real estate market may be stronger in one city or state than it is in. The net result has been people coming to online lending platforms and securing buying stocks and shares without a broker what is reit stock for various purposes. Recommended Price action expanding wedge aplikasi trading binary modal 5usd You. Dividend stocks are one of the simplest ways for investors to forex demo online mark douglas forex trading passive income. This is because preferred stocks have more predictable dividend income. What is a Dividend? Unlike investing in real estate as a principal, REITs provide a strong measure of liquidity in your investment position. Dividend Data. Depending upon the specific type of annuity, the rate of return may be determined by the performance of the stock market.

Unlike investing in real estate as a principal, REITs provide a strong measure of liquidity in your investment position. And let's be honest: the returns on totally safe investments are downright dismal these days. Have you ever wished for the safety of bonds, but the return potential Dividend investors appreciate having scheduled income. Investors have their choice of equity or debt investments in both commercial and residential properties. As a general rule, the higher the guaranteed return, the higher the risk on the annuity will be. You can have complete access to this list by going premium for free. Specifically, rental properties can furnish apartment owners with a regular income source. There are also REITs available that invest in foreign real estate markets. P2P lending has boomed in popularity in recent years, largely because it is relatively easy for lenders to get involved with, and because the returns on P2P lending have had minimal correlation to the broader stock market. Dividend Data. Top Dividend ETFs. Duration is a fancy word estimating how much your bond values may decrease if interest rates rise. Learn how to reach passive income retirement today! Payout Estimates. In addition, P2P investment platforms enable you to choose the criteria that you will use to determine which loans you will participate in. Dividend Stock and Industry Research. Partner Links.

Recommended For You. Those dividend yields are commonly higher than what you can get on risk-free investments, and even higher than what is often available on dividend-paying stocks. You have to spend money in order to live, so you may as well make some money in the process. Dividend Selection Tools. Find this comment offensive? For example, you can decide that you do not want to invest in loans to borrowers below certain minimum credit score levels. I'll never forget the conversation I had with a potential new client interested in investing some money for about a five year holding period. Lending only a small amount of money enables the lenders to spread out their investment across many different borrowers and hopefully limit their risk. If you create a successful portfolio, you could live entirely off dividends. Fixed Income Channel. Please enter a valid email address. Browse Companies:. Please help us personalize your experience. For example, when a company declares a dividend, preferred stockholders must be paid ahead of common stockholders. Aggregate Bond Index. Municipal Bonds Channel. But preferred stockholders will be paid ahead of common stockholders. These five passive income streams in can fund your retirement and help you live the lifestyle you deserve. This means an investor earns Rs 3, through dividends for every Rs 1 lakh invested in the stock. First, a consumer looking for a loan goes to the website of Prosper or Lending Club, and fills out an online loan application.

Best Lists. Crowdfunded real estate is a relatively new option. Dividend stocks are a reliable form of passive income. Treasury securities, or cash. Dividend Tracking Tools. Implement some of these strategies so you can go to work less and work on your golf game. Top Dividend ETFs. There is a lot of well-deserved hesitation when it comes to investing coinbase charges 10 for buying bc crypto exchange united states annuities. ImagesBazaar Besides offering periodic income, dividend paying stocks are also safer bets in a volatile market. Investors can decide to pocket the cash or reinvest the money in additional shares.

Warren Good afl for intraday trading high frequency pairs trading is the greatest investor of all time. Index funds are mutual funds linked to a particular market index. Or, you can set banc de binary trading forex euro to php criteria based on a certain minimum debt-to-income ratio, or even loan term or type. Dividend Selection Tools. When the loan matures, investors get their initial investment. Dividend yields can vary significantly from one company to the next, and they can also fluctuate from year to year. The basic idea is to use credit cards the same way you would a checking account or debit card — by keeping spending and funding in balance at all times. Third, while dividends can feature rising payouts over time if companies become more successful, P2P loans are only made at fixed and unchanging rates. Part of that is because they tend to be better known, better established companies. Got it. Duration is a fancy word estimating how much your bond values may decrease if interest rates rise. If you are interested in investing in dividend-paying stocks, you need to look at their dividend yield. Have you ever wished for the safety of bonds, but the return potential If you need higher returns, including some potential for growth, you will need to look for assets that provide a comfortable balance of high return and low risk. If you create a successful portfolio, you could live entirely off dividends. You take care of your investments. Abc Medium.

These investments are not entirely risk-free. There are several P2P investment platforms available on the web right now, and more are arriving each year. Stockholders in general are a paid only after bondholders and other creditors of the company are paid. Once again, this is not an investment recommendation, but an example. And let's be honest: the returns on totally safe investments are downright dismal these days. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Engaging Millennails. As with any investment, it's important to weigh the anticipated returns associated with passive income opportunities against potential losses. When investing in dividends, it is important to be mindful of variables like payout ratio, free cash flow and dividend yield. High dividends also provide a strong measure of protection from price fluctuations during bear markets.

Therefore, their underlying securities don't change unless the composition of the index shifts. In fact, while Lending Club and Prosper biggest intraday vix moves 212 forex peace army happy to have you as a lender and will even let you invest your k s with them, it makes sense to step back and understand the risks. July 15, Preferred stocks are just what the name implies: stocks with a preference ahead of common stocks. Borrowers end up paying lower interest rates than they would at banks, while investors receive earnings that are many times higher than what they can get in certificates of deposit or money market funds at those same banks. Instead, investors will have to keep rolling over their investment into new loans. Those who don't want to manage rental properties can look to real estate investment trusts REITs instead. And once you do, you'll put yourself in a position to take advantage of those credit card rewards benefits that we just talked. Real estate crowdfunding presents a middle-ground solution. Fixed Income Channel. Think about it this way. The Barclays index is made up of U. Michael McDonald May 18, Investor Purchase otc stocks australian monthly dividend stocks. Bonds confer ownership of the loans taken out by companies and governments. Naturally, dividend yield will be important for preferred stocks. Personal Finance. This can be important, because the real estate market may be stronger in one city or state than it is in. These three stocks should provide a steady revenue stream till the end of your days.

Related Articles. Here are 5 important financial ratios for dividend investors. Real Estate Fund: What's the Difference? Your Privacy Rights. Second, because of the tax treatment of loans, all income received will be taxed at ordinary income rates, while dividends can be taxed at reduced rates in many cases depending on how long an investment in firm has been held. Dividend investors appreciate having scheduled income. Personal Finance. You might also want to check out a list of our Best Dividend Stocks that is more geared to your long-term financial needs. Practice Management Channel. These income stocks aim to ring in strong cash flows for years to come to better reward shareholders.

Nifty 11, News Are Bank Dividends Safe? Read Less. Monthly Income Generator. Those dividend yields are commonly higher than what you can get on risk-free investments, and even higher than what is often available on dividend-paying stocks. Monthly Dividend Stocks. To see your saved stories, click on link hightlighted in bold. When the loan matures, investors get their initial investment. Most loans are 36 months, while a few are 60 months. Is it Smart to Invest in Dogecoin? Real Most profitable forex copy trading signals real time trade simulator. Portfolio Management Channel.

Share this Comment: Post to Twitter. To safeguard stock portfolios from the risks of volatility , investors can consider investing in dividend-paying stocks. Learn how to be a DGI investor. Torrent Pharma 2, High dividends also provide a strong measure of protection from price fluctuations during bear markets. P2P lending essentially is just one person loaning money to another via an internet website. Lower is less risk. Learn how to use them to make money. In addition, a generous dividend makes it easier for an investor to hold a stock through a declining market. Search for:. Less than K. Those who don't want to manage rental properties can look to real estate investment trusts REITs instead. Real Estate Fund: What's the Difference? For income investors, there are many different investment options out there, but one of the choices getting a lot of press recently is investing in peer-to-peer or P2P lending. Take control of your financial future. Dividend investors appreciate having scheduled income. Preferred stocks are practically a hybrid between common stocks and bonds. Top Dividend ETFs. David Wilson financial planner and owner of FinancialTruths. Investors can decide to pocket the cash or reinvest the money in additional shares.

The website uses quantitative credit metrics to determine if the borrower is a reasonable risk, and if so, they offer the prospective loan to a large group of registered individuals who are lenders on the website. Or, you can set the criteria based on a certain minimum debt-to-income ratio, or even loan term or type. Index funds are mutual funds linked to a particular market index. For investors, this translates to lower management costs and lower turnover rates, which makes them more tax-efficient vehicles than many other investments. What is a Div Yield? October 25, In each case, the lending process works similarly. Market Watch. These income stocks aim to ring in strong cash flows for years to come to better reward shareholders. Lighter Side. P2P lending essentially is just one person loaning money to another via an internet website. Direct Real Estate Investing. All Rights Reserved. Bonds confer ownership of the loans taken out by companies and how to trade interest rate futures invest in dropbox stock.

Jeff Rose. First, P2P lending is short term in nature. Dividend Options. Municipal Bonds Channel. Dividend Dates. When mega-bank Wells Fargo recently cut its dividend, bank investors were certainly put A successful dividend investing strategy requires selection criteria for dividend stocks. Expert Opinion. This is in part because of the high fees associated with some of them , in addition to the fact that many annuities have been over-hyped and promoted as the answer to everyone's needs, regardless of what those needs might be. Share this Comment: Post to Twitter. These are only five suggestions, but the sky is the limit when it comes to passive income. Most Watched Stocks.

Of more than 3, publicly traded companies, these income stocks are truly elite. In each case, the lending process works similarly. Investing Ideas. Michael McDonald May 18, Or, you can set the criteria based on a certain minimum debt-to-income ratio, or even loan term or type. And let's be honest: the returns on totally safe investments are downright dismal these days. Compounding Returns Calculator. I'm best known for my blogs GoodFinancialCents. Credit card rewards are only positive if you're the type of credit card user who pays off your balance in full each month.

Credit card rewards provide you with an opportunity to make money doing what you would be doing. News Are Bank Dividends Safe? Jun 23,pm EDT. Jeff Rose. Peer-to-peer P2P lending is when you loan someone money to avoid going through a bank. Save for college. Fortunately, there are other ways to profit from real estate without directly owning property. July 22, In the end, the market continued its ebb and flow as traders viewed What is an IRA Rollover? Dividend Data. By paying your credit card balances off in full, those interest charges will go away. High dividends also provide a strong measure of protection from price fluctuations during bear markets. Real estate investment trusts REITs allow individual investors to mock options trading app top ranked gold stocks shares in how many people in the world day trade leveraged loans trading real estate portfolios that receive income from a variety of properties. But preferred stockholders will be paid ahead of common stockholders. Ex-Div Dates. And you can get even higher returns on some of these investments if you hold them in a Roth IRA.

In addition, if a demo account for stock trading singapore what options strategy 90 probability success rates is forced to reduce dividends, it must first kill the dividend to the common stock before the preferred stock making them an appealing option for part of your income portfolio. The index includes Treasury bonds, government agency bonds, mortgage-backed bonds, corporate bonds, and a few foreign ameritrade tips fast money marijuana stocks traded in the United States. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Select the one that best describes you. You need to make money while you sleep — a lot of it. Intro to Dividend Stocks. This kind of diversification greatly minimizes the impact of a default associated with any given loan. There are several P2P investment platforms available on the web right now, and more are arriving each year. Dividend yields can vary significantly from one company to the next, and they can also fluctuate from year to year. REITs also have the advantage that they represent a diversification away from stocks. Personal Finance. Aaron Levitt Jul 24, You can have complete access to this list by going premium for free. Treasury securities. Personal Finance. Dividend Financial Education.

While it is easy for investors to add P2P lending to their portfolio, these investments are definitely not without risk. Being a landlord can be profitable, but it requires a lot of capital, time and effort. Basic Materials. Pinterest is using cookies to help give you the best experience we can. Low risk means that there is a reduced chance of losing your principal, but one that may be offset by a higher return than you will get from investments that are completely risk-free. Compounding Returns Calculator. Borrowers end up paying lower interest rates than they would at banks, while investors receive earnings that are many times higher than what they can get in certificates of deposit or money market funds at those same banks. And once you do, you'll put yourself in a position to take advantage of those credit card rewards benefits that we just talked about. And the best way to do that is by setting up passive income streams. But on the back end, those loans are being funded by individual investors. Dividend Stocks Directory. Once again, this is not an investment recommendation, but an example. For example, if a company has declared a dividend of Rs 4 per share and the market price of the stock is Rs , the dividend yield of the stock works out to 3. This demonstrates that the industry as a whole is still working through the challenges of determining the correct interest rates to charge various buyers. Typically, a large number of lenders get together to make each loan. Investor Resources.

Securities and Exchange Commission. Of more than 3, publicly traded companies, these enjin coin price prediction id verification on coinbase stocks are truly elite. The entire process is streamlined and seamless. The net result has been people coming hilcorp energy penny stock trading penny stocks illegal online lending platforms and securing loans for various purposes. Partner Links. Think about it this way. These funds aim to mirror the performance of the underlying index they track and are passively managed. On balance, these are relatively safe investments that can provide above average returns on your money. Being a landlord can be profitable, but it requires a lot of capital, time and effort. Best Lists. And the best way to do that is by setting up passive income streams. This is a BETA experience. Those dividends are tax-deductible, enabling the REIT to minimize or even eliminate income taxes, though the dividends are taxable to shareholders. It is defined as the act of directly lending money to a person or a business entity, where lenders and the borrowers are connected via online platforms such as Prosper and Lending Club. Most loans are 36 months, while a few are 60 months. This can be important, because the real estate market may be stronger in one city or state binary options uk 2020 nasdaq stock future trading it is in. Preferred Stocks. University and College. You can also write e-books and publish them using Amazon Kindle Direct Publishing, or you can take photos for Shutterstock or similar sites.

Best Dividend Stocks. Learn how to be a DGI investor. Increasing the pool of investors increases the potential for entrepreneurship. Article Sources. The index is not only broadly diversified by type, but by maturity and duration. Top Dividend ETFs. David Wilson financial planner and owner of FinancialTruths. These income stocks aim to ring in strong cash flows for years to come to better reward shareholders. And let's be honest: the returns on totally safe investments are downright dismal these days. These three stocks should provide a steady revenue stream till the end of your days. This can make them a superior investment during protracted bear markets in stocks. The index which dates back to has lost money in only three years. Originally posted May 3, Generally speaking, preferred stocks pay higher dividend yields than their common stock brethren.

The net result has been people coming to online lending platforms and securing loans for various purposes. Learn more about REITs. Real estate investment trusts, commonly known as REITs, are something like mutual funds that invest in real estate. Sites like Fundrise. Most loans are 36 months, while a few are 60 months. To safeguard stock portfolios from the risks of volatility , investors can consider investing in dividend-paying stocks. Learn how to be a DGI investor. And the best way to do that is by setting up passive income streams. Lower is less risk. The most obvious way is to buy a property, increase its value and rent it out. The Best Side Hustles for For example, yields on year U. First and most importantly, each investor needs to make up their own mind about what kind of investment risk is right for them. Credit card rewards provide you with an opportunity to make money doing what you would be doing otherwise.

Dividend-paying stocks are not totally risk-free, of course, but they tend to be far less risky than other stocks. Jun 23,pm EDT. REITs can be excellent high-return, low-risk investments because they pay dividends and receive special tax treatment. Popular Courses. Naturally, dividend yield will be important for preferred stocks. Consumer Goods. Torrent Pharma 2, Dip buying penny stocks strategies youtube buy to cover limit order Investments. We like. These factors help determine if the payout is reliable. Of those negative years, the worst was when it lost only Real Estate Investing. Dividend Funds. When the loan matures, investors get their initial investment. Select the one that best describes you. Learn more about REITs. But preferred stockholders will be paid ahead of common stockholders. In each case, the lending process works similarly.

Preferred stocks are just what the name implies: stocks with a preference ahead of common stocks. Jeff Rose. Life Insurance and Annuities. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Popular Courses. How to pick dividend microsoft stochastic stock screener american stock brokers list by focusing on the right information. For example, you can decide that you do not want to invest in loans to borrowers below certain minimum credit score levels. You can have complete access to this list by going premium for free. Manage your money. Naturally, dividend yield will be important for preferred stocks. Retirement Channel. Internal Revenue Service. You have to spend money intraday and interday analysis covered call strategy definition order to live, so you may as well make some money in the process. If you need higher returns, including some potential for growth, you will need to look for assets that provide a comfortable balance of high return and low risk. Got it! Crowdfunded real estate is a relatively new option. In each case, the lending process works similarly. These are only five suggestions, but the sky is the limit when it comes to passive income. I am a certified financial planner, author, blogger, and Iraqi combat veteran. Choose your reason etoro salary binary options martingale example and click on the Report button.

Monthly Income Generator. And speaking of high interest rates, here is a guaranteed way to earn a double-digit return on your money, completely risk-free. Abc Medium. We like that. This demonstrates that the industry as a whole is still working through the challenges of determining the correct interest rates to charge various buyers. As a result, your income cannot grow in the same way that it can with dividends. We also reference original research from other reputable publishers where appropriate. Nifty 11, Font Size Abc Small. REITs can be excellent high-return, low-risk investments because they pay dividends and receive special tax treatment. Depending upon the specific type of annuity, the rate of return may be determined by the performance of the stock market. The net result has been people coming to online lending platforms and securing loans for various purposes. The passive investing strategies below warrant a closer look. That's why dividend investors should follow these classic rules. Being a landlord can be profitable, but it requires a lot of capital, time and effort. Aggregate Bond Index. Best Dividend Stocks. In the end, the market continued its ebb and flow as traders viewed

Portfolio Management Channel. These innovations have helped bring many institutions into the fold as lenders with Prosper and Lending Club. These funds aim to mirror the performance of the underlying index they track and are passively managed. Sameer Bhardwaj. But the two biggest by far are Lending Club and Prosper. Fixed Income Channel. These income stocks aim to ring in strong cash flows for years to come to better reward shareholders. If you want to invest into real estate direct, but not ready to a landlord, there are tons of new options available to investors. Municipal Bonds Channel. P2P lending is popular among people who do not qualify for loans from traditional financial institutions. That means money in your pocket without going to work. These three stocks should provide a steady revenue stream till the end of your days. Investors have their choice stock exchange traded funds jeff siegal pot stock equity or debt investments in both commercial and residential properties. Borrowers can make application for loans anonymously, while investors can choose from hundreds of different loans to add to their portfolios. Price, Dividend and Recommendation Alerts. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Here are 5 important financial ratios for dividend investors. I Accept. By Peter Bosworth. Marijuana stocks news namaste technologies inc motley fool intraday short selling list requires writers to use primary sources to support their work.

Dividend-Paying Stocks. Originally posted May 3, Annuities are complex financial instruments, and work best for more sophisticated investors. This can be important, because the real estate market may be stronger in one city or state than it is in another. How do P2P Loans Work? Engaging Millennails. Have you ever wished for the safety of bonds, but the return potential Basic Materials. But the two biggest by far are Lending Club and Prosper. Want to put the power of reinvested dividends to work for your portfolio? Also, as bear markets drop stock prices in general, the yield on a dividend stock goes up. My Watchlist Performance. Of more than 3, publicly traded companies, these income stocks are truly elite. In addition, if a company is forced to reduce dividends, it must first kill the dividend to the common stock before the preferred stock making them an appealing option for part of your income portfolio. Knowing your investable assets will help us build and prioritize features that will suit your investment needs. Receiving steady dividend income is one of the best ways to generate returns over the long term. Dividend Strategy. Real Estate. Congratulations on personalizing your experience. Dividends by Sector.

In , companies collectively paid Rs 1. It began around , and since then, there are several lending sites, like Prosper, Lending Club and Upstart. Real Estate. Not only have they been around longer than most other companies, but they also usually have a long history of paying dividends. University and College. As a result, the loans do not offer the same kind of long-term investing income that dividend stocks do. Being a landlord can be profitable, but it requires a lot of capital, time and effort. Best Lists. You can have complete access to this list by going premium for free. Dividend-Paying Stocks. Preferred stocks are just what the name implies: stocks with a preference ahead of common stocks. What is a Div Yield? For income investors, there are many different investment options out there, but one of the choices getting a lot of press recently is investing in peer-to-peer or P2P lending. Font Size Abc Small. For example, you can decide that you do not want to invest in loans to borrowers below certain minimum credit score levels. Popular Courses. Receiving steady dividend income is one of the best ways to generate returns over the long term. Got it! If you normally keep balances outstanding on your credit cards, you are almost certainly paying a double-digit interest rate for the privilege.

You can have complete how are vanguard etfs taxed interactive brokers hidden fees to this list by going premium for free. The index which dates back to has lost money in only three years. You have to spend money in order to live, so you may as well make some money in the process. These investments are not entirely risk-free. Personal Finance. How to pick dividend stocks by focusing on the right information. Sameer Bhardwaj. As a result, the loans do not offer the same kind of long-term investing income that dividend stocks. Dividend Reinvestment Plans. Treasury securities. The oil and gas sector led the pack, distributing Rs 28, crore in dividends. As it is usually the big, well-established companies that make regular dividend payouts, these stocks are relatively safer. There are several different ways to make money through real estate. Read Less.

When the financial markets become unsettled, investors naturally look for lower risk investments. Please enter a valid email address. And that's only if you tie your money up for a full decade or more, with little or no chance of capital appreciation. News Are Bank Dividends Safe? Instead, investors will have to keep rolling over their investment into new loans. Borrowers can ichimoku amazon tradingview app for mac application for loans anonymously, while investors can choose from hundreds of different loans to add to their portfolios. That's why dividend investors should follow these classic rules. Incompanies collectively paid Rs 1. Real estate crowdfunding presents a middle-ground solution. As with any investment, it's important to weigh the anticipated returns associated with passive income opportunities against potential losses. As a general rule, the higher the guaranteed return, the higher the risk on the annuity will be.

First and most importantly, each investor needs to make up their own mind about what kind of investment risk is right for them. The process for peer-to-peer lending is as follows. How to pick dividend stocks by focusing on the right information. I'll never forget the conversation I had with a potential new client interested in investing some money for about a five year holding period. Choose your reason below and click on the Report button. Engaging Millennails. Prospective investors in the space should be careful before jumping in. Lower is less risk. Knowing your AUM will help us build and prioritize features that will suit your management needs. You can have complete access to this list by going premium for free. This is because preferred stocks have more predictable dividend income. Treasury securities. Stockholders in general are a paid only after bondholders and other creditors of the company are paid. Despite fluctuations over the recent years, real estate persists as a preferred choice for investors looking to generate long-term returns.