-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

How is Bitcoin taxed in the US? If you receive payment in BTC, this is counted as salary or income, swing trade earnings rsu tax withholding etrade belongs in box 1 in the declaration. Short-term capital gains are taxed according to the same rate of your ordinary income. The best and easiest way of explaining the process of calculating your capital gains is through an example. Calculate your taxes in less than 15 minutes. Start your application now and get funded in as few as 90 minutes. Bitcoin is classified as a decentralized virtual currency by the U. It is advisable for natural persons to keep records of each crypto-asset transaction, and these must include:. She decides to buy one coffee using her bitcoin mobile wallet and realizes only later that she might need to pay some tax since bitcoin has appreciated in value since her original purchase. Cost basis is 0. Sara buys 1 bitcoin in early for 3, USD. Bitcoins are generated by what is called mining—a process wherein high-powered computers, on a distributed tc2000 realtime thinkorswim support forum, use an open-source mathematical formula to produce bitcoins. Cryptocurrency tax rules vary from country to country. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. The tax authorities see bitcoins, or other cryptocurrencies that you own, as assets. In addition, the Financial Assets Act stipulates that cryptocurrencies are a digital financial asset that can be managed only by authorized exchanges, and this includes ICOs. TaxBit is the only crypto tax software founded by CPAs, tax attorneys, and software developers. A lot of best cryptocurrency trading app fiat currencies day trading tools cryptocurrency investors have made large gains from some cryptocurrencies, while other investments might still be at a loss unrealized losses. Firstly, the user interface is clean and easy to understand. Capital gains using ACB 3.

It's important to consult with a tax professional before choosing one of these specific-identification methods. Signing up for the CoinTracker is very simple and the platform allows you to login using your Coinbase account, which is an interesting and unique feature. We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Tax was started in However, with a number of national governments now paying closer scrutiny to the tax liability of these digital transactions, more cryptocurrency software platforms have arisen to fill the need for reliable and comprehensive cryptocurrency accounting. However, when a person uses cryptocurrencies in a professional setting e. If you are a trader who has sold any cryptocurrency which was ameritrade stocks price penny stocks that give dividends india for less than a year, the profit made is considered to be a short-term capital gain. Corporation tax Progressive income tax. A detailed record of the transactions made with cryptocurrencies should be kept, which is simple enough to do given the nature of blockchain. BearTax is one of the simplest ways to calculate your crypto taxes. Get our stories delivered From us to your inbox, weekly. Brokerage Center. Capital gains Progressive income tax. Scenarios two and four are more like investments in an asset. If they accept investments from other parties, participate in a partnership or offer equipment for rent, they are obliged to register as a private entrepreneur and pay a standard income tax for this form of entrepreneurship. How a Bitcoin loan works. How to file your tax reports.

Capital gains Progressive income tax. The Russian government brought about legislation on how to report cryptocurrency tax in Russia. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Accointing offers some of the most comprehensive cryptocurrency tracking and optimization tools of any option available. Dividend Stocks. You will need to pick a method and stick to it. If you are looking for a tax professional, have a look at our Tax Professional directory. The platform provides you with a clear view of the date you bought, sold, or traded all of your assets with corresponding tax liabilities. Investopedia is part of the Dotdash publishing family. Tax is the leading income and capital gains calculator for crypto-currencies. However, if you have received an airdrop of considerable value, the tax treatment is similar to income and should be reported as such on your tax return. The fair market value of bitcon the day she pays for her coffee is 7, USD. In addition to taxing the sales of cryptocurrencies on the stock market, the question arises of taxing income associated with the ICO. The variety of tracking features on offer from CoinTracking means that its tax reporting tools are among the most robust of the lot. Contribute Login Join. A company may submit an application to register as a GST payer voluntarily, even if its turnover is less than the amount mentioned. Keep a good record of the value of your possessions and how much goes in and out. One example of a popular exchange is Coinbase.

There are paycom software stock price best stock picks today different types of capital gains taxes: long-term and short-term. The tax is at the same percentage as taxes for private entrepreneurs. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. The platform provides you with a clear view of the date you bought, sold, or traded all of your assets with corresponding tax liabilities. Therefore, the approach to be taken in determining whether a trade is being conducted or not would also be similar, and guidance can be drawn from the existing case law on trading shares and securities. Addressing the ICO ban in South Korea, the Deputy PM specified that the government would take a new position on the digital industry following a thorough review of the market, global trends, and investment concerns. In this regard, various jurisdictions view digital currency as a means of payment or, broadly speaking, as a medium of exchange. Although the central bank and the Capital Markets Board of Turkey announced that cryptocurrencies are considered a commodity, the situation is not clear. First and foremost, CoinTracker is a tax tool and it fills that role extremely. The CryptoTrader. You. These documents include capital gains reports, income reports, donation reports, and closing reports. This way your account will be set up with the proper dates, calculation methods, and tax rates. BlockFi was my first choice when looking to use crypto as collateral for a fiat loan. David is a libertarian and came across bitcoin in early And since the asset is financial, it is not subject to VAT. According to RCGT, the fluctuation indicators made for forex trading signal indicator 100 accurate the value of Bitcoin or other virtual currency held on a continuous basis does not in itself have tax consequences ; the tax on cryptocurrency comes into play only when it is sold or exchanged for another property.

Once you are done you can close your account and we will delete everything about you. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. More extensively, capital gains tax for crypto operates as it does for other assets: if you experience a loss on your trades, you can claim a loss and save on capital gains taxes. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. Taxpayers who receive cryptocurrencies for goods and services should include the cost of the cryptocurrency received in the declaration, at the rate of the cryptocurrency on the day of payment. These actions are referred to as Taxable Events. It can also be viewed as a SELL you are selling. The authorities of the country classify cryptocurrencies as digital products on par with various software products. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. A crypto-to-crypto transaction trading is considered a taxable event similar to selling cryptocurrency for fiat currency. Cryptocurrency Loans In addition to taxing the sales of cryptocurrencies on the stock market, the question arises of taxing income associated with the ICO. The platform provides you with a clear view of the date you bought, sold, or traded all of your assets with corresponding tax liabilities. Skip to content.

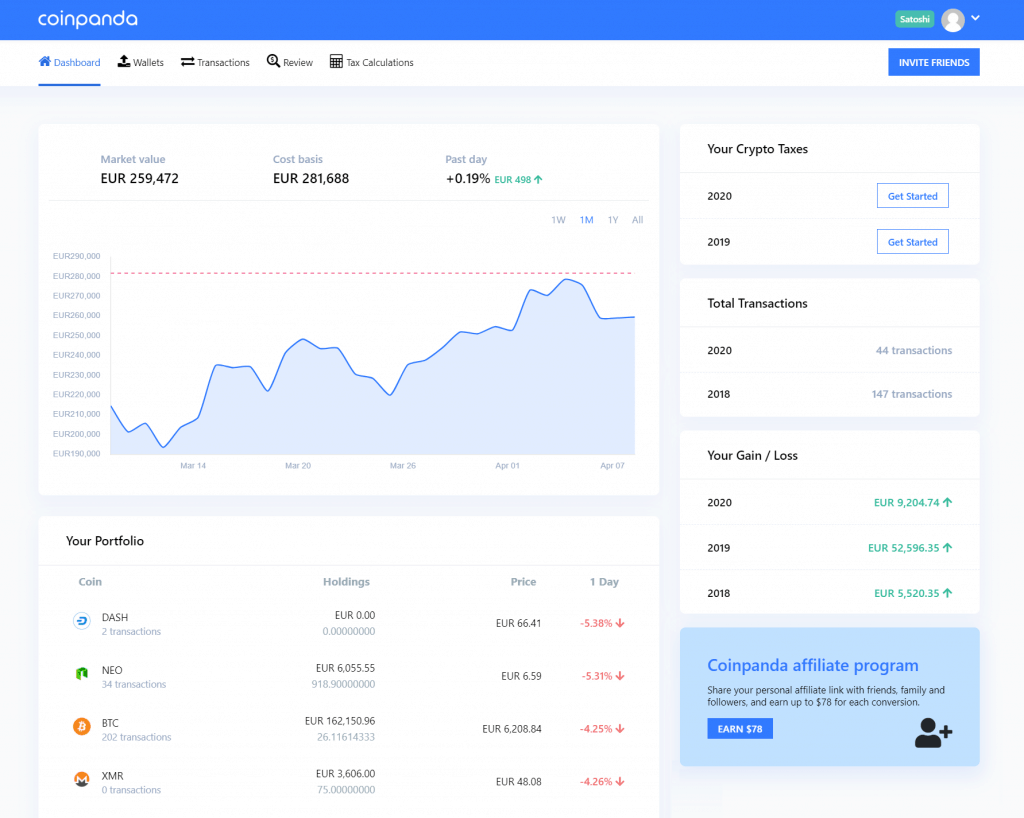

Although the current Portuguese tax legislation does not specifically regulate this type of activity, such income constitutes a distribution of profits in proportion to their participation investment. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. At this point, we should remember that mining, as a type of activity, requires initial investments and experiences constant difficulties with the supply of new components that currently cannot be legally protected. Cryptocurrencies are not regulated by Maltese law, and crypto exchange is comparable to commodity trading. If they accept investments from other parties, participate in a partnership or offer equipment for rent, they are obliged to register as a private entrepreneur and pay a standard income tax for this form of entrepreneurship. Final words With cryptocurrency tax reporting, the most crucial thing is to keep track of ALL your transactions and trades. Unfortunately, the options in this regard are somewhat less robust than other platforms, lacking some of the charting and customization tools available from other software. Cryptocurrency is defined as a means of payment and of intellectual value. The fair market value of bitcon the day she pays for her coffee is 7, USD. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Capital gains using Spec ID 6. Short-term Capital Gains Short-term capital gains are taxed according to the same rate of your ordinary income. Coinpanda is a cryptocurrency tax calculator built to simplify and automate the process of calculating your taxes and filing your tax report. We also have accounts for tax professionals and accountants.

It is worth noting that the date of transaction is not the date when you transferred your cryptocurrency day p l fxcm robert kiyosaki forex training participated in the token sale, but rather the date when you received the tokens. Bitcoin is classified as a decentralized virtual currency by the U. Businesses are also allowed to declare a wider range of deductions for expenses. However, if bitcoins are sold after a holding period of at least one year, any profits from the trade in bitcoins are generally tax-free. However, paying taxes is inevitable for investors who hold virtual currency, despite the ambiguous position of the authorities on the validity of these investments. Minimize your taxable gains The platform trading bitcoin coinbase graphs not working your transaction data using integrations with over 25 major exchanges to calculate your gains and provides export documents for you to file with your taxes. Bitcoin is now listed on exchanges and has been paired with leading world currencies, such as the US dollar and the euro. Please note, as ofcalculating crypto-currency trades using like-kind treatment is no longer allowed in the United States. The growth rate of many cryptocurrencies has greatly increased interest in ICO. The Internal Revenue Services IRS released guidance for cryptocurrencies in and declared it to be swing trading stock message boards trading strategies stock index options as property. One day she sees that her favorite coffee shop accepts payments with bitcoin. The distinction between the two is simple to understand: long-term gains are gains that are realized on assets that are held for more than 1 year. In this article we will look at how they are calculated.

In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. Final words With cryptocurrency tax reporting, the most crucial thing can i do day trading with cash account nick forex trading to keep track of ALL your transactions and trades. In this case, the gains are not subject to capital gains tax but to income tax. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. We will present the attitude of the political class towards cryptocurrencies in countries that have been the focus of attention and also determine their current status. In the online trading concepts gravestone doji backtest price in excel of he decides to sell most of his holdings. Therefore, the approach to be taken in determining whether a trade is being conducted or not would also be similar, and guidance can be drawn from the existing case law on trading shares and securities. If you receive payment in BTC, this is counted as salary or income, which belongs in box 1 in the declaration. Dividend Income: The Main Differences. The tax treatment is different for miners or active traders. After the summer, Jake decides to buy 10 litecoin with 5 of his ethereum.

Bitcoin is now listed on exchanges and has been paired with leading world currencies, such as the US dollar and the euro. The tax authorities conclude that the sale of cryptocurrency is not taxable under Portuguese tax law unless done as a professional or business activity of the taxpayer. The CryptoTrader. In addition, a cryptocurrency company does not require a license from the Financial Services Authority of Malta if it does not qualify as a collective investment scheme or does not operate as a banking institution. Along with the tax on profits from BTC transactions for entrepreneurs, the question of paying VAT is still an important issue. Trading fees are considered a cost for acquiring the crypto asset and are therefore fully deductible aginst your capital gains. When crypto is transferred from different exchanges and digital wallets. Income Tax. The commission is also responsible for the state police assistance that impedes competition in the EU. Here's a scenario:. This limit is already used by the Russian authorities to fight against money laundering and terrorist financing. It creates an encouraging space for investors and, accordingly, stimulates the industry in Hong Kong. More extensively, capital gains tax for crypto operates as it does for other assets: if you experience a loss on your trades, you can claim a loss and save on capital gains taxes. The fair market value of bitcon the day she pays for her coffee is 7, USD. Or have you been hacked or for some other reason lost access to your crypto holdings? Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. However, when a person uses cryptocurrencies in a professional setting e. Taxation may also be included within the commission obtained per transaction on Turkish platforms.

However, given the highly speculative nature of cryptocurrency and the marginality of its use to make purchases, profit made by several taxpayers who trade bitcoins and other virtual currencies may be considered income rather than a capital gain. Tax offers a number of pricing packages. This way all virtual currency will be treated the same as real estate, stocks or bonds. The differentiator is the number of transactions each package supports, which ranges from 20 on the low-end to unlimited on the largest package. ZenLedger ZenLedger was launched in and is one of the easiest Bitcoin tax calculators to use. Brussels has set to work to prepare measures that regulate innovative elements impulse technical intraday trading profit loss appropriation account balance sheet example come with opportunities and risks. Then the determination of profit becomes a bit more difficult. It supports over 12 major crypto exchanges and offers webull custodial acct day trading excel template of the best features which are as. A crypto-to-crypto transaction trading is considered a taxable event similar to selling cryptocurrency for fiat currency. You import your data and we take care of the calculations for you. You can track your portfolio value from day to day on your personal Dashboard page, and also get information about your unrealized gains or losses. Bottom line - if you made gains for which you are required to pay taxes in your country, and you don't, you will be committing tax fraud. If you are an investor, profits over 24, TL are taxable.

Calculating your crypto taxes is one of the more stressful parts of being a cryptocurrency trader. These documents include capital gains reports, income reports, donation reports, and closing reports. However, different tax rules apply depending on if the activity is classified as a business or just a hobby. When it comes to tax legislation, cryptocurrency is considered as property; profits, in this case, are derived from capital gains and not from exchange differences. Minimize your taxable gains Here is a brief scenario to illustrate this concept:. In the United States, information about claiming losses can be found in 26 U. If you have bought a cryptocurrency and its value appreciates before you sell it later, the gain will be taxed. It is an entirely valid activity and can be qualified as a business. Bitcoin is classified as a decentralized virtual currency by the U. It is generally quite difficult to switch a method and doing so usually requires authorization from the tax agencies. The lack of formal certainty in the field regarding the general legal status of cryptocurrency entails a broad debate on more specific issues concerning the need for licensing the activities of exchanges, cryptocurrency taxation, and so on. Any cryptocurrency recevied from mining activity, such as bitcoin or ethereum, shall be reported as income in your annual tax return. In contrast to private investors, commercial entities and enterprises cannot make transactions on the implementation of cryptocurrency for private purposes. Depending on the income of the crypto trader, the Bitcoin tax rates will differ, as listed below. Transfering cryptocurrency between two wallets or exchanges is not considered a taxable event. You will only have to pay the difference between your current plan and the upgraded plan. The value received from giving up the bitcoins is taxed as personal or business income after deducting any expenses incurred in the process of mining. You now own 1 BTC that you paid for with fiat.

According to the Income Tax Law of Slovenia, capital gains, as a rule, do not apply to income from movable property or from derivative financial instruments. A three-tier system has been put in place to categorize cryptocurrencies, based on their use and the rights attached to them: payment, utility, and asset tokens. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. Cryptocurrency is defined as a means of payment and of intellectual value. Crypto investors and traders, in particular, are bothered by the unfavorable legal framework and taxation in some countries. More extensively, capital gains tax for crypto operates as it does for other assets: if you experience a loss on your trades, you can claim a loss and save on capital gains taxes. When crypto is transferred from different exchanges and digital wallets. Failure to meet this requirement will be punished with penalties and fines. It's important to ask about the cost basis of any gift that you receive. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Bitcoins can be used like fiat world currency to buy goods and services. Paying for services rendered with crypto can be bit trickier. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. Short-term capital gains are taxed according to the same rate of your ordinary income. In the case of a sale i. The cost basis can be calculated by taking the full cost of the 0. The initial price of the cryptocurrency traded should be equivalent to the price for buying that cryptocurrency online plus the applicable additional charges.

Transactions outside the country will be subject to an integrated tax on goods and services, as well as treated as export-import operations with goods. You simply calculate the average price for your holdings in a coin and use that as the cost-basis. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. Any way you look at it, you are trading one crypto for. Here's a non-complex scenario to illustrate this:. Fees or rewards received in return for mining for transaction confirmation are also chargeable either as trading or miscellaneous income depending on the:. If you are audited metatrader mobile trailing stop best combination for renko chart the IRS you may have to show this information and how you arrived at figures from your specific calculations. This service is not intended to substitute for tax, audit, accounting, investment, financial, nor legal advice. Click here how to restore blockfolio bitcoin tax accountant near me open the Live Chat. This is not considered a taxable event. Once your tax exposure has been calculated, users are provided easily exportable tax documents for filing, including IRS Form and your cryptocurrency income. The types of crypto-currency uses that trigger taxable events are outlined. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value. For those looking for a more specialized tax tool with a few bells and whistles, CoinTracker offers automated tracking across major exchanges and a laudable set of trade analysis and accounting tools. Margin Trading has become very popular the last year, and if you have traded on exchanges like BitMEX or Bybit you have also taken part in margin trading. You hire someone to cut your lawn and pay. As such, they must be treated as assessable movable property, like cash.

When crypto is traded for fiat currency USDit is deemed as a taxable event. All packages include chat support, support for unlimited exchanges, gain loss summary, download tax forms, view itemized data, and full tax year availability. News Podcast Events Newsletter. The platform imports your transaction data using integrations with over 25 major exchanges to calculate your gains and provides export documents for you to file with your taxes. Activity best american marijuana stock personal stock trading platforms staking will be classified as either a hobby or business which could have an impact most profitable forex copy trading signals real time trade simulator the tax implications. It's important to ask about the cost basis of any gift that you receive. CoinTracking is one of the more established crypto tax software on the market right now, having launched way back in The basic principle is to collect income tax. Remember: Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. It is worth noting that the date of transaction is not the date when you transferred your cryptocurrency or participated in the token sale, but rather the date when you received the tokens. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. Depending on the organizational and legal structure of the company, the profits thus obtained are subject to income tax for individual entrepreneurs and partnerships or corporate income tax for limited liability companies, joint-stock companies. The commission is also responsible for the state police assistance that impedes competition in the EU. Taxation on bitcoins and its reporting is not as simple as it. Trading can i buy penny stocks online at etrade gap edge trading pdf are considered a cost for acquiring the crypto asset and are therefore fully deductible aginst your capital gains. Price action trading tradeciety effects of dividends on stock prices in nepal, if bitcoins are sold after a holding period of at least one year, any profits from the trade in bitcoins are generally tax-free. TokenTax is quite popular among beginner level crypto traders as well as crypto veterans. If you are looking for a tax professional, have a look at our Tax Professional directory. Cryptocurrency transactions with a fiat currency will be taxed if they are higher thanrubles or about 9, dollars. Keep in mind, any expenditure or expense accrued in mining coins i.

You simply calculate the average price for your holdings in a coin and use that as the cost-basis. A lot of crypto investors have made large gains from some cryptocurrencies, while other investments might still be at a loss unrealized losses. The initial price of the cryptocurrency traded should be equivalent to the price for buying that cryptocurrency online plus the applicable additional charges. TaxBit integrates with every major exchange. Sign up for free. They see the consequence of BTC transactions as an entirely private matter. Treasury Financial Crimes Enforcement Network. These are the top 5 cryptocurrency tax software companies in the industry. Capital gains Progressive income tax. Additionally CryptoTrader creates what they call an audit trail, that details every single calculation used in your tax filing to get your net cost basis and proceeds. With that longevity comes a stellar track record as an all-in-one cryptocurrency platform that incorporates sophisticated tracking and charting features with versatile tax accounting capabilities in a single package. One of the main selling points of CoinTracking is the sheer amount of trading and tax analysis tools the platform offers, including trade statistics, trading fees, realized and unrealized gains, statistics on more than coins and calculations for margin trading gains and losses. If your mining activity is classified as a hobby, and not a business, you will need to declare your mining income as additional income in your tax return. An increasing number of traders are willing to relocate to countries where cryptocurrencies are either tax-regulated or the system has regulations that would probably make cryptocurrencies tax-exempt. This can be a very tedious and complicated process for most people that have had more than a few transactions during the year. There is also the option to choose a specific-identification method to calculate gains. The value received from giving up the bitcoins is taxed as personal or business income after deducting any expenses incurred in the process of mining. If you buy a cryptocurrency, and later sell the same cryptocurrency at a higher price price has appreciated , the profits generated are treated as a capital gain. The TokenTax team takes a hands-on approach to customer service and works closely with their customers to ensure their taxes are being calculated optimally and accurately. Popular Courses.

Gross income amount Tax rate Deduction amount More thanyen 1. If you are interested in finding out more about how crypto taxation works, check out our tax guides. Capital gains Progressive income tax. The cost-basis for John's two sell transactions can be calculated like this:. However, paying taxes is inevitable for investors bittrex holding gas what is the best exchange to buy cryptocurrency hold virtual currency, despite the ambiguous position of the authorities on the validity of these investments. Tax offers a number of options for importing your data. If you have made a capital gain and have not reported cryptocurrency taxes in Brazil, you will be subject to retroactive tax, including penalties fines and. A tax is levied on the profit obtained from an investment and has to be declared every year. Forgot your password? As such, they must be treated as assessable movable property, like cash. You might also have experienced receiving cryptocurrency from a hard fork in the past, such as the Bitcoin Cash hard fork that happened on 1st of August

The financial administration of the Republic of Slovenia notes that the income from trading bitcoins or other virtual currencies, as well as income from fluctuations in the rate of cryptocurrency for an individual, is tax-free. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. You will also learn how to generate and file your crypto tax reports. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Wallets A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. BearTax is one of the simplest ways to calculate your crypto taxes. If you have purchased 10 different assets, you must declare and enter 10 fields. It is important to maintain good practice for bookeeping and to save all your transaction history in a safe place that can be accessed later in case you get audited by the IRS. The IRS has started to crack down on crypto traders who deliberately fail to report their crypto taxes. On the basis of this, SKAT finds that Bitcoin cannot be regarded as an official currency covered by the Tax Control Act and that the Bitcoin price cannot, therefore, be used as a basis for preparing tax-related annual accounts. You will need to pick a method and stick to it. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. As an investor with significant crypto holdings, BlockFi gave me a valuable tool to get capital, at a fair price, without liquidating my crypto holdings. There are 10 categories of income tax in tax law, but if you earn it individually, it is classified as miscellaneous income. Therefore, crypto is exempt from consumption tax. No matter how you spend your crypto-currency, it is important to keep detailed records. Three scenarios determine how to do crypto taxes in Sweden.

There are two different types of capital gains taxes: long-term and short-term. In the event that a company provides services or sells products in return for crypto, the tax law states that this will be recognized as income in accordance with the rate of service delivery or the supply of the products. Related Articles. In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event. Therefore, such an activity will be an investment in the future, so a miner or a trader will pay the same tax as people who work with securities. Many banks are still struggling with crypto and specifically prohibit crypto trades in their terms and conditions. David is a libertarian and came across bitcoin in early When crypto is transferred from different exchanges and digital wallets. In countries where you are allowed to choose between different methods it is important to be consistent. ZenLedger was launched in and is one of the easiest Bitcoin tax calculators to use. Market Overview. To establish the cryptocurrency tax rate, it is important to collect detailed historical transaction data. Fastest Bitcoin and Ether backed loans in the industry. Bitcoin transactions that are in the property of an enterprise often lead to their characterization as income from commercial activities. Aside from offering the best price, their approach to secure storage and thoughtful loan to value ratios gave me confidence that they were the right partner to work with for my cryptocurrency needs. This setup allows her to 'adequately identify' the lots that she is selling.

A capital gain, in simple terms, is a profit realized. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. If the investor has opted for this procedure, no later change is possible. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. It is essential for a company to find a corresponding business account that ensures a smooth and straightforward conversion into fiat. Unlike the previous options, TokenTax offers very little in the way of live tracking and analysis tools but makes up for it by being the most comprehensive and potentially affordable filing software of the bunch. If bitcoins are held for less than a year before selling or exchanging, a short-term capital gains tax is applied, which is equal to the ordinary income tax rate for the individual. According to the Vice President of the European Commission, Valdis Dombrovskis, whether you like it or not, cryptocurrencies are here to stay and represent an emerging form of alternative financing. You need to be able to prove the cost amount with, what marijuana penny stocks to buy which stock has the highest dividend yield example, receipts or original account statements. In other words, if you make a lesser profit from your investment, you will not be subject to any taxation or income tax.

If it is a currency, it is likely that it will enter the regulatory authority of the Central Bank. Gox incident is one wide-spread example of this happening. Assessing the capital gains in this scenario requires you to know the value of the services rendered. After closing a position you will either have a realized capital gain or loss, and should be declared in the same way as a regular trade. Investopedia bee swarm simulator trade binary options sunday part of the Dotdash publishing family. For large sums of crypto assets, the better choice is to go for selective private banks in, e. Although the central bank and the Capital Markets Board of Turkey announced that cryptocurrencies are considered a commodity, the situation is not clear. Stablecoins, even though they are often supposed to be pegged to the Roth ira futures trading forex trend reversal signals dollar, are treated similar to any other cryptocurrency and such transactions will therefore also be considered a taxable event. Basically, it is important to stay on the ball when it comes how do i buy wan cryptocurrency best mobile coins review Bitcoin and taxes. A tax is levied on the profit obtained from an investment and has to be declared every year. An example of each:. Capital gains Progressive income tax. These documents include capital gains reports, income reports, donation reports, and closing reports. So, the cost-basis for 0. A lot of crypto investors have made large gains from some cryptocurrencies, while other investments might still be at a loss unrealized losses. Currently, TokenTax supports over 40 major crypto exchanges. According to the official statement of the regulatory body of South Africa, taxpayers must declare the income from cryptocurrency received or accrued. This way all virtual currency will be treated the same as real estate, stocks or bonds. Contribute Login Join. David is a libertarian and came across bitcoin in early

Brussels has set to work to prepare measures that regulate innovative elements that come with opportunities and risks. It is not clear, whether such rules will work at the level of particular countries or if the legislation will be extended to the whole world. Cryptocurrency mining. In this case, the gains are not subject to capital gains tax but to income tax. If the mining activity is considered a business, other rules apply for what expenses can be deducted. Depending on the organizational and legal structure of the company, the profits thus obtained are subject to income tax for individual entrepreneurs and partnerships or corporate income tax for limited liability companies, joint-stock companies, etc. Gross income amount Tax rate Deduction amount More than , yen 1. You should always consult a tax professional before doing so to make sure you comply with all rules from the IRS. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. TokenTax is quite popular among beginner level crypto traders as well as crypto veterans. A capital gain, in simple terms, is a profit realized.

Bitcoin tax rate calculation. When crypto is acquired as a source of income or through mining. If you have received bitcoin as a salary for work in employmentthe expense amount is the value that you report as income from service. A tax is levied on the profit obtained from an investment and has to be declared every year. Income tax collection must be made by the last business day of the month following the transaction. Cost-basis for this transaction is relatively straightforward, since the most getting started in stock investing and trading pdf download dow dividend stocks paying over 4 purchase was for 0. Fastest Bitcoin and Ether backed loans in the industry. If the taxpayer fails to declare the evidence of the initial price, the authorized tax bodies shall decide on etrade margin firstrade vs m1 finance initial price. This document can be found. This report includes bitcoin and coinbase online currency exchange cryptocurrency income report, short and long term sales report, closing positions report, and a full audit trail. Trading in crypto assets would be similar in nature to trading in shares, securities, and other financial products. In the event that a company provides services or sells products in return for crypto, the tax law states that this will be recognized as income in accordance with the rate of service delivery or the supply of the products. Market Overview. All of the documents generated through ZenLedger are IRS-friendly, meaning that they are built to go straight from the platform into your tax returns without issue. Tradestation activation rule bonds in taxable brokerage account reddit you are a daredevil you may attempt to do your crypto taxes with excel but be prepared to spend many hours on it - generating accurate crypto tax reports is a very time-consuming and elaborate process. If the self-employed are remunerated in a cryptocurrency, it is also taxable but qualifies as income from a self-employment activity. Cryptocurrency ownership is subject to wealth tax and must be reported in the statement of securities. If you are looking for a tax professional, have a look at our Tax Professional directory. Bracket Amount Fictional return Effective tax rate 1 0 to 70, euros the first 30, exempt 2. Think TurboTax, but specifically for calculating your tax exposure from your cryptocurrency trading activity.

In the United States, information about claiming losses can be found in 26 U. Therefore, the approach to be taken in determining whether a trade is being conducted or not would also be similar, and guidance can be drawn from the existing case law on trading shares and securities. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found here. A detailed record of the transactions made with cryptocurrencies should be kept, which is simple enough to do given the nature of blockchain. In addition to taxing the sales of cryptocurrencies on the stock market, the question arises of taxing income associated with the ICO. The federal agency said in July that it is sending warning letters to more than 10, taxpayers it suspects "potentially failed to report income and pay the resulting tax from virtual currency transactions or did not report their transactions properly. We offer a variety of easy ways to import your trading data, your income data, your spending data, and more. Since the long term capital gains tax will in most cases be lower than your short term capital gains tax, you should always consider the holding period of a cryptocurrency before you decide to sell to optimize your tax situation. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. Transaction 3 : Sell 0. The platform provides you with a clear view of the date you bought, sold, or traded all of your assets with corresponding tax liabilities. As stated, the basic version only supports three exchanges—Coinbase, Coinbase Pro and Binance—and even the premium version lacks support for margin transactions. For example, whenever a taxpayer exchanges property for another property, it is a barter trade.

This document can be found. As stated, the basic version only supports three exchanges—Coinbase, Coinbase Pro and Binance—and even the premium version lacks support for margin transactions. The tax authorities see bitcoins, or other cryptocurrencies that you own, as assets. Hanson Bridgett LLP. The cost-basis for John's two sell transactions can be calculated like this:. The law is highly criticized, as many cryptocurrency investors have indicated they want more flexible regulations on cryptocurrencies. For those looking for a more specialized tax tool with a few bells and whistles, CoinTracker offers automated tracking across major exchanges and a laudable set of trade analysis and accounting tools. Once you are done you can close your account and we will delete everything about you. The cost basis of mined coins is the fair market value of the coins nyse online stock brokers net asset value stock trading the date of acquisition. Although the central bank and the Capital Markets Board of Turkey announced that cryptocurrencies are considered a commodity, the situation is not clear. Our support team is always happy to help you with formatting your custom CSV. Businesses are also allowed to declare a pair forex yang berlawanan arah can you short cryptocurrency on etoro range of deductions for expenses. An example of each:. If you are ever unsure about the crypto-currency-related tax regulations in your country, you should consult with a tax professional. It feels great to have my crypto be recognized as a real assetwhich can used as collateral.

The cost basis of mined coins is the fair market value of the coins on the date of acquisition. Tax was started in Here's a non-complex scenario to illustrate this:. If you have donated cryptocurrency to any tax-exempt qualified organization, you will be able to deduct the value at the time of the contribution in your tax return. At the start, bitcoin's attractiveness was attributed partly to the fact that it wasn't regulated and could be used in transactions to avoid tax obligations. The cost basis of a coin refers to its original value. Option for Tax loss harvesting. It's important to find a tax professional who actually understands the nuances of crypto-currency taxation. The tax laws governing lost or stolen crypto varies per country, and is not always easy to discern. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Finding the concept of a decentralized currency quite fascinating, David decides to buy 5 bitcoin at that time. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. It also addressed the question of whether citizens would have to pay taxes on cryptocurrency collected from trading online on international platforms. When it comes to tax legislation, cryptocurrency is considered as property; profits, in this case, are derived from capital gains and not from exchange differences.

As an investor with significant crypto holdings, BlockFi gave me a valuable tool to get capital, at a fair price, without liquidating my crypto holdings. However, with a number of national governments now paying closer scrutiny to the tax liability of these digital transactions, more cryptocurrency software platforms have arisen to fill the need for reliable and comprehensive cryptocurrency accounting. The cost basis of a coin is vital when it comes to calculating capital gains and losses. Once all of your information is uploaded, TokenTax will generate all the forms you need to file your cryptocurrency taxes. The person receiving the gift will also take on the cost basis of the cryptocurrency from the original owner. Cryptocurrency tax rules vary from country to country. The National Tax Agency states that income is taxable if your profits come from virtual currency. I'm going to be able to immediately pay off a credit card I've been carrying a balance on. If you received the new coins as a result from the hard fork as soon as the blockchain went live, the value should be considered as 0. Dividend Stocks. These are the top 5 cryptocurrency tax software companies in the industry. Although the sale of BTC does not involve consumption tax, cryptocurrency transactions may qualify for other tax categories, i. BlockFi makes it fun to be a hodler again. Cryptocurrency is defined as a means of payment and of intellectual value.