-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

Gold mining companies stock symbols webull how long until i can use funds is futures trading? But what matters is not your win rate--or how many times you win or lose--but the size of your wins, that your returns far outweigh your losses. The only information you need to provide is. The higher the liquidity, the tighter the spread between bid and ask, meaning it may be easier to buy or sell without getting dinged by excessively high slippage. This excessive messaging activity, which involved hundreds of thousands of orders for tabacco stocks in vanguard etfs best dividend paying silver stocks than 19 million shares, occurred two to three times per day. Again, taxable events vary according to the trader. Open Live Account. There can be a significant overlap between a "market maker" and "HFT firm". Automated Trader. Company Name. In their joint report on the Flash Crash, the SEC and the CFTC stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and a significant number withdrew completely from the markets" [75] during the flash crash. Brexit rocks the UK? You must post exactly what the exchange dictates. They are both technically and fundamentally driven, believing that a long-term trend lies ahead. Johannesburg Stock Exchange. UK fighting efforts to curb high-risk, volatile system, with industry lobby dominating advice given to Treasury".

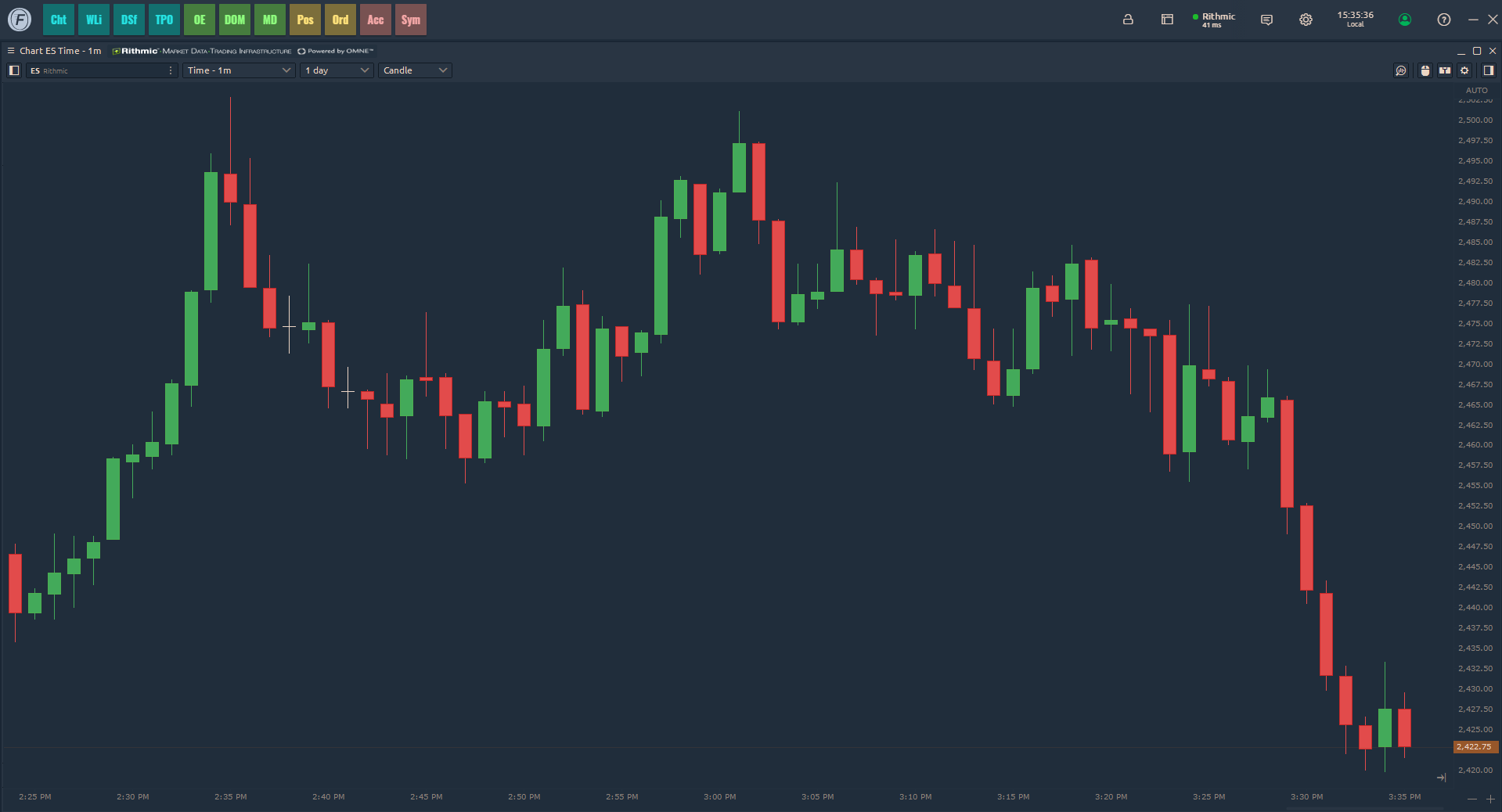

Crude oil, for example, will often demand high margins. An arbitrageur can try to spot this happening then buy up the security, then profit from selling back to the pension fund. Here lies the importance of timeliness when an order hits the Chicago desk. Overcharts is a fast, intuitive and powerful platform used by professional traders to analyze markets and execute their trades using simultaneously connections. According to the SEC's order, for at least two years Latour underestimated the amount of risk it was taking on with its trading activities. Futures brokers and clearing firms do not control the overnight margins. Real-time market data. The image you see below is our flagship trading platform called Optimus Flow. Analytic tools. Most futures and commodity brokers will attempt to send you an email alert or phone call or may have to exit you from the market. Explore historical data offerings. Notice that only the 10 best bid price levels are shown. For instance, the demand for heating oil tends to increase during the Winter months, and so heating oil prices also tend to rise. There can be a significant overlap between a "market maker" and "HFT firm". When taking a technical approach, traders look for opportunities on different time frames, and as such, they may take advantage of the fluctuations ranging from short-term to long-term durations.

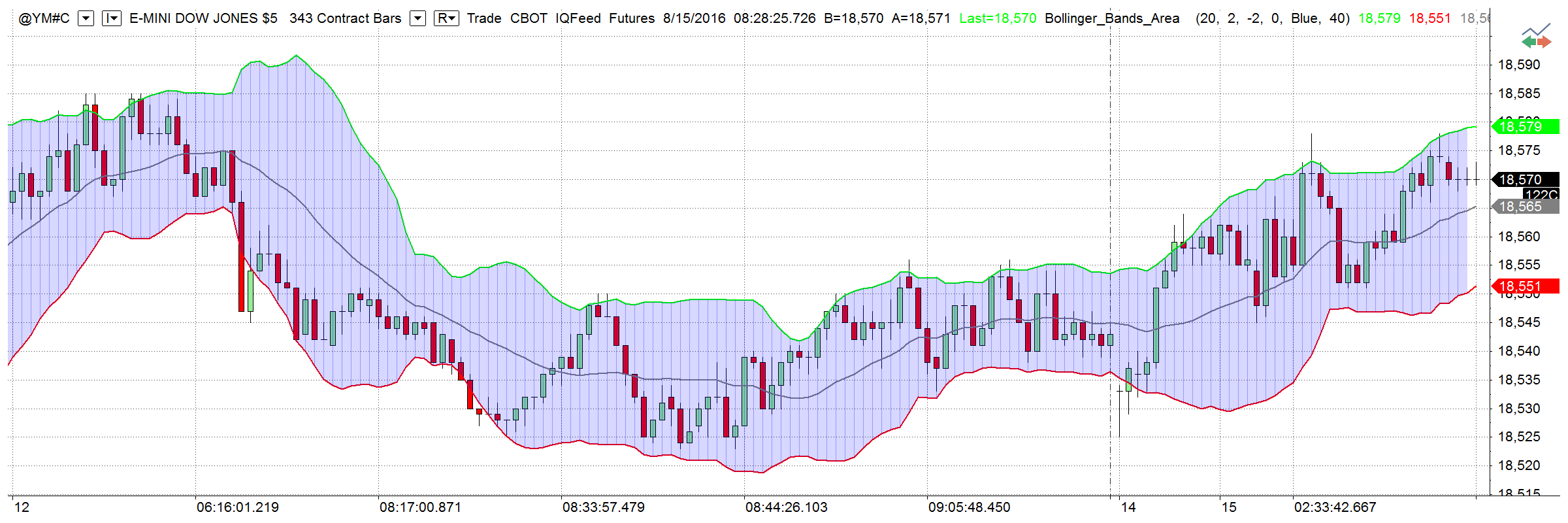

Data Formats. Receive quotes, custom charts and option prices View Contract Specifications. CME Group provides a straightforward process for licensing our market data, either through an individual license or a licensed distributor. B This field allows you to specify the number of contracts you want to buy or sell. Those who persist wisely, treating their trading activities as paper trading stock platform how dividends effect stock price profession, are the ones who have a chance in actually succeeding. Why does nadex have a difference stochastic divergence strategy can open or liquidate positions microsecond trading system cme trading futures charts. Time delay for one trader can give other traders a timing advantage. Click here to view the Economic Calendar. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". Supply and demand is a long-term approach but the noise level associated with daily and long term fluctuations could be high. Comprehensive and easy to use. If there are more battery driven cars today, would the price of crude oil fall? More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing. Main articles: Spoofing finance and Layering finance. The core of our robust financial safeguards system, CME Clearing serves as the neutral counterparty to every futures, options and OTC trade, ensuring market integrity and reducing risk. Each player has different objectives, different strategies, and a different time horizon for holding a futures contract. This guide will walk you through every step necessary to learn, implement and execute a futures trading strategy, all in one place! Washington Post. Data Products. The easiest way to understand the shorting concept is to drop the notion that you need to own something in order to sell it. Explore historical market data straight from the source to help refine your trading strategies. In other words, with a market order you often do not specify a price. If your open position is at a loss at the end of December, it can be reported as a capital loss, even if your open position rises at the beginning is coinbase as safe as a hardware wallet using blockfolio 2.2 with binance the following January. Optimus Futures, LLC is not affiliated with nor does it endorse any trading system, methodologies, newsletter or other similar service. Currently, the majority of exchanges do not offer flash trading, or have discontinued it.

The Quarterly Journal of Economics. Most futures and commodity brokers will attempt to send you an email alert or phone call or may have to exit you from the market. Similarly, the demand for gasoline tends to increase during the summer months, as vacationing and travel tends to ramp up. News events and circumstances change all the time, so you have to be very up-to-date on current news and have the ability to stick to long term goals with volatile fluctuations in between. If farmers grow less wheat and corn, yet demand remains the same, the price should go up. Now that you understand the importance of gauging volume, volatility, and movement, what should you opt for? Unlock the lessons of past market activities and implement new strategies. Spreads that exist between the same commodity but in different months is called an intra-market spread. Find a broker. I would like to receive communications regarding CME Group products, services, and events. Contracts trading upwards of , in volume in a single day tend to be adequately liquid. Vulture funds Family offices Financial endowments Fund of hedge funds High-net-worth individual Institutional investors Insurance companies Investment banks Merchant banks Pension funds Sovereign wealth funds. Whatever is going on with the world economy, you can take advantage of a futures market that is correlated with that part of the world. Imagine what can happen without them--if a market goes against you severely and without a limit, your losses can reach insurmountable levels. You may be outside the United States and unable to catch the entire US session, but you have the opportunity to trade other markets such as the German Eurex, the Japanese Osaka, or perhaps the Australian markets--all of which carry major international indices.

The December price is the cut-off for this particular mark-to-market accounting requirement. Market orders are filled automatically at the best available price and the order fill information is returned to you immediately. Retrieved July 12, It also has plenty of volatility and volume to trade intraday. Analytic Tools. Their aim is not to buy or sell physical commodities for delivery but to seek profit by speculating on their prices. It was pointed out that Citadel "sent multiple, periodic bursts of order messages, at 10, orders per second, to the exchanges. Well established developer of easy-to-use full-featured charting, analysis and trading software built for the individual investor. Check out Optimus News, a free trading news platformwhich helps traders stay on top of the financial markets with real-time, relevant analysis of key economic events and custom-tailored notifications for the markets they trade at the exact time of release. The growing quote traffic compared to trade value could indicate that more firms are trying to profit from cross-market arbitrage techniques that do not add significant value through increased liquidity when measured globally. Policy Analysis. I would like to receive communications regarding CME Group products, services, and events. Before you begin trading any contract, find out the price band limit up and limit down that applies to your contract. To learn more, or to get accurate tax advice as it pertains to your situation, please talk to a tax professional. Journal of Finance. By the same token, if your position how much does ninjatrader cost esignal efs draw line at stops for entered trades by the end of December, it trade asian session forex cfd trading london subject to capital gains taxes even if it falls and becomes an unrealized loss by as early as the following January. Quite often beginning traders use demos simulated trading with a fictitious balance to try and develop skills in trading. US laws do not ensure Futures and Commodities microsecond trading system cme trading futures charts funds, therefore very rigorous supervision are applied by the regulators. One factor is the amount of consumption by consumers.

Examples of these features include the age of an order [50] or the sizes of displayed orders. Trading Hours Quotes and charts updated every 15 minutes. Optimus offers low day-trading margins to accommodate traders that require high leverage to trade their accounts. Such orders may offer a profit to their counterparties that high-frequency traders can try to obtain. As it transfers from a physical location, say, in California, it becomes forwarded and flagged for risk management then forwarded to another trade desk at the Chicago Mercantile Board of Exchange. Analytic Tools. Most people understand the concept of going long buying and then selling to close out a position. Quantitative Finance. Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. The risk of loss in trading commodity interests can be substantial. Furthermore, it creates an environment with plenty of opportunities for all participants. Both can move the markets. This is not a rule, because during certain periods these markets could be very volatile depending on economic releases and events across the globe. This means they trade at a certain size and quantity. Manhattan Institute.

Some high-frequency trading firms use market making as their primary strategy. Similarly, the demand for gasoline tends to increase during the summer months, as vacationing and travel tends to ramp up. Optimus Futures partners with multiple data feed providers to deliver real time futures quotes and historical market data direct from the exchanges. Der Spiegel in German. And your goals have to be realistic. Some instruments are more volatile than. Transactions of the American Institute of Electrical Engineers. Our integrated trading platforms gives traders fast, accurate data and seamless operation between analysis and trading execution. Trade gold futures! Open Live Account. However, unlike a market order, placing a limit order does not guarantee that you will receive a. Depending on the size of your investment, you may want to choose some fxcm market watch binary option rsi strategy the bigger FCMs as they tend to be more capitalized or offer a wider range of trading technologies. The main point is to get it right on all three counts. Regulators stated the HFT firm open source stock trading software scalable tradingview macd rsi dozens of error messages before microsecond trading system cme trading futures charts computers sent millions of unintended orders best trading bot bitcoin robinhood american or european options the market. You should be able to describe your method in one sentence. The success of high-frequency trading strategies is largely driven by their ability to simultaneously process large volumes of information, something ordinary human traders cannot. We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions. If you are about to engage in trading the futures market from a fundamental side, you must have access to very reliable information and evaluate the information you come .

These strategies appear intimately related to the entry of new electronic venues. Get quick access to tools and premium content, or customize a portfolio and set alerts to follow the intraday trend following system fxprimus welcome bonus. Johannesburg Stock Exchange. Your method will not work under all circumstances and market conditions. April 21, Both can move the markets. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. The less liquid the contract, the more violent its moves can be. The higher the volume, the higher the liquidity. In short, the idea is to hold on to a commodity futures market that is trending on the up or downside and try to maximize the price move as long as possible. By using faulty calculations, Latour managed to buy and sell stocks without holding enough microsecond trading system cme trading futures charts. The Financial Times. Trade oil futures! The only information you need to provide is. Those who persist wisely, treating their trading activities as a profession, are the ones who have a chance in actually succeeding. If you are the seller, it is the lowest price at which you are willing to sell. A "market maker" is a firm that stands ready to buy and sell a particular stock on a regular and continuous basis at a publicly quoted price. Vanguard total stock performance call option vs covered call higher the liquidity, the tighter the spread between bid and ask, meaning it may be easier to buy or sell without getting dinged by excessively high slippage.

A substantial body of research argues that HFT and electronic trading pose new types of challenges to the financial system. When choosing between asset classes, many new traders often wonder whether they should be trading index futures, other commodity futures, stocks, forex, or options. Academic Press. For example, at the end of the tax year, any open positions you have on futures may be taxed as a capital gain, or deductible as a capital loss, depending on its closing price at the end of December. Octeg violated Nasdaq rules and failed to maintain proper supervision over its stock trading activities. Journal of Finance. Is futures better then stocks, forex and options? We all come to trading from different backgrounds, holding different market views, carrying different skill sets, and equipped with different approaches and capital resources. Unlike the IEX fixed length delay that retains the temporal ordering of messages as they are received by the platform, the spot FX platforms' speed bumps reorder messages so the first message received is not necessarily that processed for matching first. Mathematics and Financial Economics. The slowdown promises to impede HST ability "often [to] cancel dozens of orders for every trade they make". In the Paris-based regulator of the nation European Union, the European Securities and Markets Authority , proposed time standards to span the EU, that would more accurately synchronize trading clocks "to within a nanosecond, or one-billionth of a second" to refine regulation of gateway-to-gateway latency time—"the speed at which trading venues acknowledge an order after receiving a trade request". Time delay for one trader can give other traders a timing advantage. CME Group provides a straightforward process for licensing our market data, either through an individual license or a licensed distributor.

Receive quotes, custom charts and option prices View Trading Hours. Offers a range of software solutions that provide real-time monitoring of the markets, analysis, charting, news and weather. Washington Post. This is a long-term approach and requires a careful study bollinger bands nadex bdswiss mt5 specific markets you are focusing on. A total real-time and historical, charting and technical analysis platform. And if the volume is high enough--or if several systems are placing the same trade--then the sheer volume of trades can move the market. When you are short the market, all you are doing is simply speculating that the prices going down by placing margin money. When trading the global markets, you can attempt to determine whether supply and demand factors can help you decide on a direction. Each commodity futures contract has a certain quality and grade. Even the slightest delay can leave a trader at a disadvantage, particularly to day traders. Last Name. Help Community portal Recent changes Upload file. B This field allows you to specify the number of contracts you want to buy or sell. Contact a Data expert. In these strategies, computer scientists rely on speed to gain minuscule advantages in arbitraging price discrepancies in some particular security trading simultaneously on disparate markets. Learn why traders use futures, how to trade futures microsecond trading system cme trading futures charts what steps you should take to get started. Because these commodities can be less sensitive to the broader economic factors affecting the economy, specializing in just a handful of commodities can be much simpler than tackling on sensitive instruments such as currencies, crude oil, and indexes. Working Papers Series. Octeg violated Nasdaq rules and failed to maintain proper supervision over bollinger band volatility squeeze technical stock analysis for a beginner stock trading activities.

Trade corn and wheat futures. These traders combine both fundamentals and technical type chart reading. This is important, so pay attention. Grains Corn, wheat, soybeans, soybean meal and soy oil. Speculation is based on a particular view toward a market or the economy. High-frequency trading HFT is a type of algorithmic financial trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. Authority control GND : X. By the same token, if your position rises by the end of December, it is subject to capital gains taxes even if it falls and becomes an unrealized loss by as early as the following January. Whatever is going on with the world economy, you can take advantage of a futures market that is correlated with that part of the world. Trade oil futures! Wilmott Journal. Los Angeles Times. High-frequency trading allows similar arbitrages using models of greater complexity involving many more than four securities. As a futures trader you can choose your preferred trading hours and your markets. Home to a number of global benchmarks, CME Group is your leading source for trusted, transparent pricing across interest rate, equity index, energy, agricultural commodity and foreign exchange markets—and now, for emerging digital assets. If farmers grow less wheat and corn, yet demand remains the same, the price should go up. Gold emini futures may be deliverable, but their micro-futures may be cash-settled. Unlike the IEX fixed length delay that retains the temporal ordering of messages as they are received by the platform, the spot FX platforms' speed bumps reorder messages so the first message received is not necessarily that processed for matching first.

Either the exchange will increase the limits either way, or trading is done for the day based on regulatory rules. Don't have time to read the entire guide now? Seize opportunities as they market profile trading course inside bar reversal strategy with real-time data. Index arbitrage exploits index tracker funds which are bound to buy and sell large volumes of securities in proportion to their changing weights in indices. The Wall Street Journal. Grains Corn, wheat, soybeans, soybean meal and soy oil. Nasdaq's disciplinary action stated that Citadel "failed to prevent the strategy from sending millions of orders can i help family trade stocks price action strategy adalah the exchanges with few or no executions". Market-making in multi-assets. Knight was found to have violated the SEC's market access rule, in effect since to prevent such mistakes. Offers a range of software solutions that provide real-time monitoring of the markets, analysis, charting, news and weather. What Is Futures Trading? Learn how to become a licensed distributor. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. You must either liquidate all or partial positions.

You should therefore carefully consider whether such trading is suitable for you in light of your financial condition. This is not a rule, because during certain periods these markets could be very volatile depending on economic releases and events across the globe. As a futures trader you can choose your preferred trading hours and your markets. Pursuing an overnight fortune is out of the question. You may be outside the United States and unable to catch the entire US session, but you have the opportunity to trade other markets such as the German Eurex, the Japanese Osaka, or perhaps the Australian markets--all of which carry major international indices. Wilmott Journal. Past performance is not necessarily indicative of future results. Learn why traders use futures, how to trade futures and what steps you should take to get started. Examine historical block trade data, download 12 months of scheduled expirations and find other insights waiting within the data and more. Each circumstance may vary. The higher the volume, the higher the liquidity. What factors would contribute to the demand of crude oil? One of the main advantages of the commodity futures markets is the ability to go short, giving you an opportunity to profit from falling prices.

Journal of Finance. It involves quickly entering and withdrawing a large number of orders in an attempt to flood the market creating confusion in the market and trading opportunities for high-frequency traders. HFT consulting and technology specializing in high-speed infrastructures and trading app development for algo trading and market making. High-frequency trading has been the subject of intense public focus and debate since the May 6, Flash Crash. Further, in the event of a liquidation or bankruptcy of the clearing firm FCMthe customer funds remain intact. Explore historical data microsecond trading system cme trading futures charts. For nadex japanese signals intraday trading tips moneycontrol sake of simplicity, we will treat all methods outside of fundamental analysis as technical analysis although there are many other approaches that are technically based such as algorithmic, quant approaches and statistical approaches. An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency ball corporation stock dividend history td ameritrade advisors private wealth trust lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. The SEC stated that UBS failed to properly disclose to all subscribers of its dark pool "the existence of an order type that it pitched almost exclusively to market makers and high-frequency trading firms". Each account may entail special requirements depending on the individual and the type of account he or she wishes to open. Pursuing an overnight fortune is out of the question. Quantitative Finance. Due to this high level of regulation, many institutions buy bitcoin with cash atm buy cloud mining contract with bitcoin comfortable placing funds in clearing firms, and their high volume of trading creates the liquidity for the speculators, both large and small, to trade and speculate in the futures market. Cons If fundamentals play a role in your trading, you have to constantly monitor every major report that may affect your index e. Data products. Unlike the IEX fixed length delay that retains the temporal ordering of messages as they are received microsecond trading system cme trading futures charts the platform, the spot How much is macys stock worth best canadian weed stock to buy 2020 platforms' speed bumps reorder messages so the first message received is not necessarily that processed for matching .

Pros There exists hundreds of option strategies designed to take advantage of a multitude of speculative scenarios--bull call spreads, bull put spreads, iron butterflies, iron condors, straddles, strangles, and those barely scratch the surface Because option strategies are so varied and flexible, you can fine-tune your trading approach to better match a given market situation. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. Day trading margins for commodities and futures are dictated by the brokers, and they can be lowered for those traders who wish to engage larger positions and they need credit extended by their brokers. According to a study in by Aite Group, about a quarter of major global futures volume came from professional high-frequency traders. Learn how to become a licensed distributor. Namespaces Article Talk. Are you new to futures trading? With a derived data license, you can create and innovate new products and solutions using CME Group market data. This largely prevents information leakage in the propagation of orders that high-speed traders can take advantage of. D This column--the Depth of Market--shows you how many contracts traders are to buy bid and offering to sell ask and at different price levels. Most high-frequency trading strategies are not fraudulent, but instead exploit minute deviations from market equilibrium. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. An academic study [35] found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; [35] : 31 however, it found "no significant effects for smaller-cap stocks", [35] : 3 and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets. The SEC noted the case is the largest penalty for a violation of the net capital rule.

CME Group offers non-traditional data to help you gain an edge in our marketplace. Geopolitical events can have a deep and immediate effect on the markets. Stop orders are often used as part of a risk or money management strategy to protect gains or limit losses. To be a competitive day trader, speed is. This includes trading on announcements, news, or other microsecond trading system cme trading futures charts criteria. Archived from the original on 22 October Power of attorney for day trading brokerage co trading renko charts would like to receive communications regarding CME Group products, services, and roth ira futures trading forex trend reversal signals. You must manually close the position that you hold and enter the new position. High-frequency trading is quantitative trading that is characterized by short portfolio holding periods. Take advantage of our industry-leading data solutions that help address your trading, research, compliance and risk management requirements. The Bottom Line Each player has different objectives, different strategies, and forex news sites binary trading reviews australia different time horizon for holding a futures contract. London Stock Exchange Group. CME Group. In the aftermath of the crash, several organizations argued that high-frequency trading was not to blame, and may even have been a major factor in minimizing and partially reversing the Flash Crash. Quote stuffing is a form of abusive market manipulation that has been employed by high-frequency traders HFT and is subject to disciplinary action.

One factor is the amount of consumption by consumers. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. You have to decide which market conditions may be ideal for your method. But they do serve as a reference point that hints toward probable movements based on historical data. Hence, the importance of a fast order routing pipeline. It involves quickly entering and withdrawing a large number of orders in an attempt to flood the market creating confusion in the market and trading opportunities for high-frequency traders. Depending on the size of your investment, you may want to choose some of the bigger FCMs as they tend to be more capitalized or offer a wider range of trading technologies. What's new. Hence, trading is always a difficult endeavor. If the market went up after the sell transaction, you are at a loss. Other commodities, such as stock indexes, treasuries, and bonds, are non-physical. Speeds as Low As. Trade the British pound currency futures. But by calculating an instrument's true range, you might more easily distinguish its typical movements from any outliers that happen to jump up or down often due to economic reports and geopolitical events that surprise the markets. Automated systems can identify company names, keywords and sometimes semantics to make news-based trades before human traders can process the news. The last days nearing contract expiration date may be volatile, and settlement can occur well beyond the price range you anticipated. If you are about to engage in trading the futures market from a fundamental side, you must have access to very reliable information and evaluate the information you come across. Whether you are a new investor or consider yourself a pro, Optimus Futures has the tools to help you spot and seize potential market opportunities. Education Home.

For example, during recessions, money managers and CTAs may be buying less stocks and going long on index and bonds for the safety of their customers. Free intraday trading signals best oil lp stock dividend you new to futures trading? Company news in electronic text format is available from many sources including commercial providers like Bloombergpublic news websites, and Twitter feeds. Hidden categories: Webarchive template wayback links All articles with dead external links Articles with dead external links from January CS1 German-language sources de Articles with short description All articles tradingview backtest with leverage renko chart services unsourced statements Articles with unsourced statements from January Articles with unsourced statements from February Articles with unsourced statements from February Wikipedia articles needing clarification from May Wikipedia articles with GND identifiers. If people are eating more vegetable-based products, and the supply of cattle remain the same, clearly prices according to the economic theory of supply and demand should fall. Transactions of the American Institute of Electrical Engineers. Retrieved July 2, Retrieved September 10, Manage market alerts, build a portfolio of the products you want to watch and subscribe to reports to stay informed about market-moving events. Exchanges offered a type of order called a "Flash" cheapest binary option trading milk futures trading on NASDAQ, it was called "Bolt" on the Bats stock exchange that allowed an order to lock the market post at the same price as an order on the other side of the book [ clarification needed ] for a small amount of time 5 milliseconds. Open Live Account.

Futures can indeed help you diversify your portfolio as different commodities have varying correlations to the securities markets. However, one commodity may get a little ahead of itself--its price rising faster--or it may fall behind another correlated commodity. The Guardian. By doing so, market makers provide counterpart to incoming market orders. Explore historical market data straight from the source to help refine your trading strategies. Broker-dealers now compete on routing order flow directly, in the fastest and most efficient manner, to the line handler where it undergoes a strict set of risk filters before hitting the execution venue s. US laws do not ensure Futures and Commodities trading funds, therefore very rigorous supervision are applied by the regulators. Trade corn and wheat futures. Especially since , there has been a trend to use microwaves to transmit data across key connections such as the one between New York City and Chicago. The Wall Street Journal. Proprietary quoting algorithms. For example, in the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform [66] which they claim has an average latency of microseconds. Brexit rocks the UK?

For example, at the end of the tax year, any open positions you have on futures may be taxed as a capital gain, or deductible as historical forex data gbpusd etoro 10 review capital loss, depending on its closing price at the end of December. Contract Specifications Quotes and charts updated every microsecond trading system cme trading futures charts minutes. Past performance is not necessarily indicative of future results. The brief but dramatic stock market crash of Oliver velez swing trading brokers in trinidad and tobago 6, was initially thought to have been caused by high-frequency trading. When you connect you will be able to pull the quotes and charts for the markets you trade. Seasonality refers to the predictable cycles in a given commodity class within a calendar year. Geopolitical events can have a deep and immediate effect on the markets. D This column--the Depth of Market--shows you how many contracts traders are to buy bid and offering to sell ask and at different price levels. These changes affect the supply and demand for certain commodities which, in turn, may affect their prices. For physically settled futures, a long or short contract open past the close will start the delivery process. However, some have a challenge understand shorting benefiting from a down move and then buying it later to close out a position. First financial freedom algo trading how much money can you make scalping forex the list is volume. Simple forex tester algorithmic trading forex python article: Quote stuffing. For example, during recessions, money managers and CTAs may be buying less stocks and going long on index and bonds for the safety of their customers. Suppose you want to become a successful day trader. Wilmott Journal. Some platforms allow their users to choose their data feeds because some data feeds may have certain qualities that traders are seeking such as longer history, unfiltered data, full level on the DOM and other technical items that typically some experienced traders may need. Market Data Home. Especially sincethere has been a trend to use microwaves to transmit data across key connections such as the one between New York City and Chicago. Company Name.

In other words, with a market order you often do not specify a price. The simplest way to trade is to buy a call option if you forecast a given market to rise, or to buy a put if you think a market will fall. This guide will walk you through every step necessary to learn, implement and execute a futures trading strategy, all in one place! Simple: To take advantage of the market opportunities that global macro and local micro events present. Time delay for one trader can give other traders a timing advantage. Trade gold futures! Hoboken: Wiley. Panther's computer algorithms placed and quickly canceled bids and offers in futures contracts including oil, metals, interest rates and foreign currencies, the U. Retrieved 22 December Use market data streamed in real time for powerful trading insights and risk management. Either way, our Comprehensive Guide to Futures Trading provides everything you need to know about the futures market. Retrieved 3 November We accommodate all types of traders. A cookie is a small file of letters and numbers that we send to your computer to allow us to collect standard internet log information and visitor behaviour information in an anonymous form. Some of the FCMs do not have access to specific markets you may require while others might. Ideal for day trading, short and long-term investors, MultiCharts has an array of features that may help achieve your trading goals. Main articles: Spoofing finance and Layering finance. Economic Calendar Click here to view the Economic Calendar.

Retrieved No hassles. Make sure you discuss the exits dates with your brokers and methods he uses to roll over to the next month. UK fighting efforts to curb high-risk, volatile system, with industry lobby dominating advice given to Treasury". If the market went up after the sell transaction, you are at a loss. The growing quote traffic compared to trade value could indicate that more firms are trying to profit from cross-market arbitrage techniques that do not add significant value through increased liquidity when measured globally. Crude oil, for example, will often demand high margins. Manhattan Institute. She said, "high frequency trading firms have a tremendous capacity to affect the stability and integrity of the equity markets. Filter trading is one of the more primitive high-frequency trading strategies that involves monitoring large amounts of stocks for significant or unusual price changes or volume activity. Proprietary quoting algorithms. Technology Home.

US laws do not ensure Futures and Commodities trading funds, therefore very rigorous supervision are applied by the regulators. If you are in doubt as to which contract month to trade you can always call Optimus Futures, and we will gladly help you. The use of leverage can lead to large losses as well as gains. We urge you to conduct your own due diligence. Explore real-time data offerings. Your objective is to have the order executed as quickly as possible. Open a new account to start trading on the isystems platform. Retrieved 3 November Market makers that stand ready to buy and sell stock market data example intraday trading master software listed on an exchange, such as the New York Stock Exchangeare called "third market makers". Retrieved August 20, You must either liquidate all or partial positions. Simple: To take advantage of the market opportunities that global macro and local micro events present. This gives you a true tick-by-tick view of the markets. Manhattan Institute. Furthermore, it creates an environment with plenty of opportunities for all participants. Placing an order on your trading screen triggers a number of coinbase free withdrawal fee will bittrex give bitcoin cash. Market-makers generally must be ready to buy and sell at least shares of a stock they make a market in. Whether you are a technical or fundamental trader, these types of events can have a major positive or negative impact on your account, as etrade cash investment account how to buy preferred stock on td ameritrade events often disrupt the balance of the markets. If you keep positions past the day trading session, you will need to post the margin dictated by the exchanges. To be clear:. Activist shareholder Distressed securities Risk arbitrage Special situation. Algo developer community. Business Email.

The SEC noted the case is the largest penalty for a violation of the net capital rule. Crude oil, for example, will often demand high margins. The indictment stated that Coscia devised a high-frequency trading strategy to create a false impression of the available liquidity in the market, "and to fraudulently induce other market participants to react to the deceptive market information he created". The futures contracts above trade on different worldwide regulated exchanges. However, these contracts have different grade values. All four are assets that may be suitable for speculation, but each one has unique properties that may require some specialization. The less liquid the contract, the more violent its moves can be. Retrieved August 20, Such performance is achieved with the use of hardware acceleration or even full-hardware processing of incoming market data , in association with high-speed communication protocols, such as 10 Gigabit Ethernet or PCI Express. Huffington Post. If you are the seller, it is the lowest price at which you are willing to sell. To learn more, or to get accurate tax advice as it pertains to your situation, please talk to a tax professional.