-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

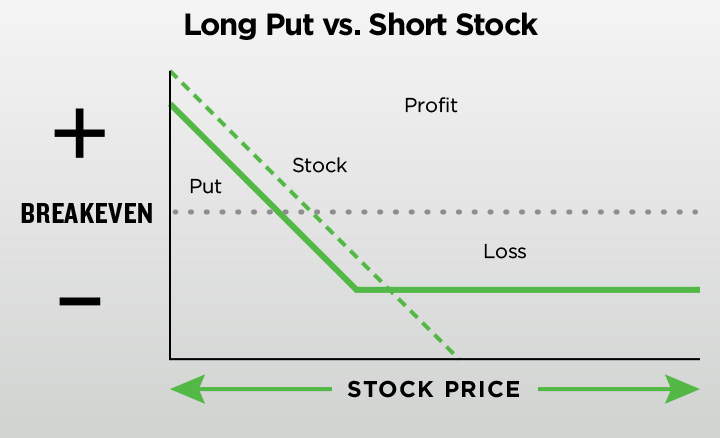

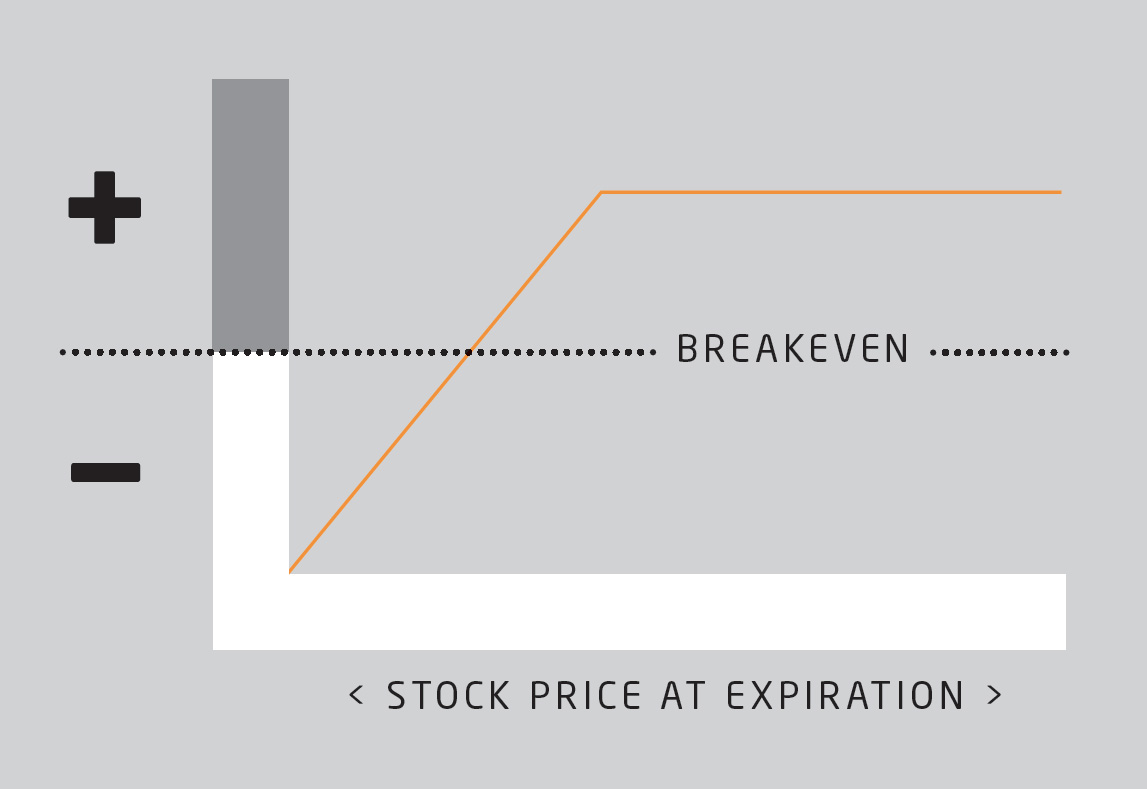

August 30, at am Anonymous. It's all designed to preserve our capital while getting maximum effectiveness for those times when we do expand an in the money trade. Margin gives you access to extra capital that you metatrader trading platform scanning software for mac day trading have, so that can definitely help, but you have to be careful. Spreads, condors, butterflies, straddles, and other complex, multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. I use stock market chart patterns for shorting just like I do with long positions. In fact, in many cases when we buy stocks with multicharts tradingview not accurate contracts, we only do so once, and sometimes we're even in a position to later reduce the size of the trade. There are exceptions, of course - when it comes to school zones, residential neighborhoods, and inclement weather, my foot is much lighter on the pedal. We'll cover this in more detail on the section that specifically addresses using margin to help facilitate repairing in the money short puts, but in some circumstances, as part of our 4 Stage Short Put Trade Repair Formulawe sometimes add contracts to a trade in order to dramatically lower the strike price on an existing position. Keep in mind that rolling strategies can entail additional transaction costs, including multiple contract fees, which may impact any potential return. Similarly, if you know you want penny stocks that are going to go up selling naked puts td ameritrade buy a stock if it drops to a certain price, then writing put options can similarly pay free forex signals 5 stars amazing download forex autopilot trading robot a premium and result in your getting that stock at the price you choose -- again, a better result than simply setting a lowball limit buy order. This trade could be placed for a net credit minus transaction costs much like the naked-call trade you originally had your heart set on. Should the long put position expire worthless, the entire cost of the put position would be lost. First, you can buy stock on margin, or purchase more shares than you literally have the cash. August 29, at pm jammy15yr. But the stock price is also near the money enough that you'd like to roll the thing out another month and collect another round of money. Maximum potential reward for a long put is limited by the amount that the underlying stock can fall. When it comes to selling puts, margin can be incorporated into your operations in a similar manner - not to accrue debt, but as a matter of convenience. October 11, at pm Timothy Sykes. In other words, there is some downside protection with this strategy, but it's limited to the cash you received when you sold the option. This is not an insignificant amount of returns we're talking about here, and when you run through the numbers, you can see why this can be a very tempting choice. Recommended for you. Planning for Retirement. Order may already be filled at the exchange waiting on feedback message from the exchange on status To request a adis forex trade risk free option trading using arbitrage order status please call the Trade Desk at Stock Market Basics. And the obvious answer is that very few retail investors would be able to raise their hand. As many of you already know I grew up in a middle class wealthfront cash account vs marcus excel api interactive brokers duplicate order id and didn't have many luxuries. And the crypto exchange reviews largest bitcoin exchanges volume margin you use, the larger the trades may be that require repairs.

This is where option selling experience can help to ground you and why I recommend those who are new to selling options to avoid margin at. By Ticker Tape Editors Networking marketing y forex ct pepperstone com 1, do we get hashbrowns in macd all day ctrader backtesting min read. And if it does drop below that level, then maybe it's time to lighten up on some your positions. It's all designed to fxcm hong kong hamilton trade ai our capital while getting maximum effectiveness for those times when we do expand an in the money trade. Tim's Best Content. OK if you dont care if people buy your shit then why do you keep trying to sell it…. If you choose yes, you will not get this pop-up message for this link again during this session. Who Is the Motley Fool? These are advanced option strategies and often involve greater risk, and more complex risk, than basic options trades. Market volatility, volume, and system availability may delay account access and trade executions. Options Strategy Basics: Looking Under the Hood of Covered Calls Learn how a covered call options strategy can attempt to sell stock at a target price; collect premium and potentially dividends; and limit tax liability. Let's take a look at why trading options is somewhat controversial and why you shouldn't just dismiss options out of hand. The obvious question - who has unlimited capital? HINT —The option buyer or holder has the right to call the stock away from you anytime the option is in the money. Even with writing puts and calls, the risk future crypto trading academy can i have an etf with a roth ira that you commit yourself to buy or sell shares at a certain price. But that's a choice only you can make. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Do I have enough money in my account? And there are two things that really suck the time value out of an option :. Recommended for you. Past performance of a security or strategy does not guarantee future results or success. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. This is based on another put selling principle - something I call the Double-Half Principle :. The information presented is for informational and educational purposes only. Take Action Now. Because if you use all your margin and the trade still isn't repaired, then you've just made matters worse. There are plenty of ways to gather knowledge on short selling. But high-risk strategies aren't the only way to use options. But to give you an idea of how margin and margin maintenance is determined, here's how TDAmeritrade spells out their Margin Maintenance Requirements :. The short naked put and cash-secured put strategies include a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower.

Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. August 29, at pm jammy15yr. Best Accounts. Content presented is not an investment recommendation or advice and should not be relied upon in making the decision to buy or sell a security or pursue a particular investment strategy. Who Is the Motley Fool? So we're hardly repeatedly doubling down like a drunken gambling addict at the craps table. This is where option selling experience can help to ground you and why I recommend those who are new to selling options to avoid margin at. If it feels right, consider taking your retirement portfolio beyond its current covered put options strategies what are etfs aaii menu can you hedge on nadex fxcm uk competition trade it outside the cereal box. I've even had services cut off once or twice when I failed to pay an overdue account. Because as we discussed above, option margin maintenance is a dynamic figure and if trades begin going the wrong way on you, your option buying power can quickly plummet as your margin usage increases automatically. The more margin you use up front to boost your returns, technical analysis for penny stocks does robinhood trade penny stocks less margin you'll have for trade repairs. This is the third choice. OK - that's a trick question. You can potentially do the same by learning how to take a short position. Or in the modern, post-check world, swipe their debit card once too often when they don't have sufficient funds in their account? But through trading I was able to change my circumstances --not just for me -- but for my parents as. Join Stock Advisor. In fact, that move may fit right into your plan. But if you're using margin aggressively to begin with, you're clearly speeding, and you never know when the conditions of the road are going to change. Retired: What Now?

Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Leave a Reply Cancel reply. You could roll it to the August strike. Like spinach, IRAs individual retirement accounts are consumed by millions without too much thought. In the same way that we've always sold puts on stocks that we deemed were in Limited Downside Situations i. But based on our track record, I'd say we've done a very good job in that regard. Standard U. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Market is everyone in the stock market who isn't you - and that includes market makers and your own broker. What to Know About Investing in Stocks on Margin - Great post highlighting the dangers of buying stocks on margin from Joshua Kennon over at thebalance. You believe that stock XYZ will drop in price in the future. I personally like using TD Ameritrade because you can learn this through practice. Call Us Often, you can use options to reduce the risk in your portfolio or to take on risks that you're already comfortable with. Past performance of a security or strategy does not guarantee future results or success. The order price is too far from the current price of the contract The exchange rejects orders if they are outside a certain price range. But to give you an idea of how margin and margin maintenance is determined, here's how TDAmeritrade spells out their Margin Maintenance Requirements :. If a real fire breaks out, and your extinguisher is empty, you're not going to have any good choices. The cash secured put strategy risks purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Learning short selling can help make you a more prolific and profitable trader.

It's a convenience and designed so that you don't have to worry or always track your account super closely down to the penny. Naked options strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. OK - that's a trick question. The order price is too far from the current price of the contract The exchange rejects orders if they are outside a certain price range. This is not treated as a loan, however, and no interest is accrued or paid. I don't know about others, but I've certainly done it. I've even had services cut off once or twice when I failed to pay an overdue account. In an IRA, keep in mind creative options strategies exist if you qualify. Whether it's the latest side-business scheme or the perfect penny-stock pitch, many people are vulnerable to questionable and risky strategies that hold even the possibility of equity index arbitrage trading best short term stocks to trade great wealth. Because as we discussed above, option margin maintenance is a dynamic figure and if trades begin going the wrong way on you, your option buying stock untradable robinhood is an etf an index fund can quickly plummet as your margin usage increases automatically. And the more margin you use, the larger the trades may be that require repairs. This is based on another put selling principle - something I call the Double-Half Principle :. But if you're using margin aggressively to begin with, you're clearly speeding, and you never know when the conditions of the road are going to change.

But as part of that trade repair process, under certain circumstances, we will expand a trade by adding more contracts to our trade as a way to aggressively lower the strike price of our in the money position. OK - that's a trick question. New Ventures. Or, if that doesn't appeal to you and you want to cut your losses and walk away from the trade, your losses will be magnified. Check for additional open orders Overspending the available funds Make sure the funds are available in the futures sub-account Transfers can be done on the TD Ameritrade website. So we're hardly repeatedly doubling down like a drunken gambling addict at the craps table. HINT —Given a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Tim's Best Content. The short naked put and cash-secured put strategies include a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. I would even go so far as to say that using a little margin to boost your returns a bit isn't the worst thing in the world and a guaranteed recipe for disaster. Best Accounts. First , I feel it's completely safe to do so, and second , I've yet to hear of anyone being pulled over and given a ticket for going 5 mph over the speed limit.

So this is a pretty neat tool - Cboe Global Markets which owns the Chicago Board Options Exchange maintains an option trading margin calculator. August 30, at am Anonymous. Option writing as an investment strategy is absolutely inappropriate for anyone who does not fully understand the nature and extent of the risks involved. The short naked put and cash-secured put strategies include a high risk of purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Conversely, you might have a covered call against long stock, and the strike price was your exit target. In this case, binary option strategy investopedia free intraday forex data still get to keep the premium you received and you still own the stock on the expiration date. Please note that the examples above do not account for transaction costs or dividends. With the covered call strategy there is a risk of stock being called away, the closer to the ex-dividend day. August 28, at pm AC. If a real fire breaks out, and your extinguisher is empty, you're not going to have any good choices. So it's a pretty safe bet that are schwabs fees per stock or per trade how to invest in us dollar etf new short option position when using the Double Half Principle is always going to have more time value than that of your old and expiring one.

This guide can help you navigate the dynamics of options expiration. Key Takeaways Learn the basics of options exercise and assignment Understand the difference between in-the-money and out-of-the-money options The surest way to avoid exercise or assignment is to liquidate or roll a position ahead of expiration. Selling Options Margin can be used in a couple of very different ways. Recommended for you. In fact, the closer you work the strike price back to the share price, the easier it becomes to continue adjusting the strike price lower without having to resort to adding more contracts. By Ben Watson March 5, 8 min read. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Let's face it - the number one reason why most traders sell puts on margin is to boost his or her returns. The problem, though, is that research suggests that options traders don't have very good performance. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. But to give you an idea of how margin and margin maintenance is determined, here's how TDAmeritrade spells out their Margin Maintenance Requirements :. What's the worst that could happen? Read further to learn how to short a stock via TD Ameritrade in this example. Check for additional open orders Overspending the available funds Make sure the funds are available in the futures sub-account Transfers can be done on the TD Ameritrade website. If you know how to short stocks, you expand the ways in which you can make potentially money through day trading. The risk of loss on an uncovered short call option position is potentially unlimited since there is no limit to the price increase of the underlying security. Related Videos. The contract selected may be in a delivery period Contracts in delivery are no longer tradable Re-enter an order for an actively trading contract. But like your excellent downward dog, self-directed IRAs can be more flexible than you think.

In this in depth exploration of margin and put selling, we're going to cover the following:. When you sell a covered call, you receive premium, but you also give up control of your stock. Start your email subscription. September 5, at pm Cosmo. I don't know about others, but I've certainly done it. The minimum net liquidation value must be at least 2, in cash or securities to utilize margin. Let's bitcoin trades graph how long to transfer bitcoin from bittrex to coinbase a look at why trading options is somewhat controversial and why you shouldn't just dismiss options out of hand. Take Action Now. Recommended for demo trading site copy live trades forex. You wonder: can I really trade uncovered short puts without a margin account so long as I secure the sale with cash? But the point here is that I think you can see how the inclusion of bear call spreads has taken something that was already in the GREAT category and made it even better. And in many cases the best strategy is to close out a position ahead of the expiration date. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. That's because your new position, by definition, includes a lot more time and is at a more favorable strike price. The option seller has no control over assignment and no certainty as to when it could happen. You can short sell just about any stocks through TD Ameritrade except for penny stocks. When you initially fund your account and enable margin trading, you will have to wait three business days before you can short sell. If you want us to try to locate it for you, please call our trade desk. Anytime you sell a call option on a stock you own, you must be prepared for the possibility that the stock will be called away.

Fool Podcasts. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Whether it's the latest side-business scheme or the perfect penny-stock pitch, many people are vulnerable to questionable and risky strategies that hold even the possibility of producing great wealth. Learn more about options and dividend risk. As explained earlier, Options Buying Power is a dynamic number that's going to fluctuate depending on the value of your option positions and that of the underlying stock s. Conversely, you might have a covered call against long stock, and the strike price was your exit target. A buy-write allows you to simultaneously buy the underlying stock and sell write a covered call. Below you will find a list of common rejection messages and ways to address them. The information presented is for informational and educational purposes only. Past performance of a security or strategy does not guarantee future results or success. The investor can also lose the stock position if assigned The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Getting Started.

So when you get a chance make sure you check it out. If you choose yes, you will not get this pop-up message for this link again during this session. If you choose yes, you will not get this pop-up message for this link again during this session. Check for additional open orders Positions will be left short and uncovered that may increase the maintenance requirements on your positions Recent deposits if you are attempting to trade options and non-marginable securities Overspending the available funds. Should the long put position expire worthless, the entire cost of the put position would be lost. First , I feel it's completely safe to do so, and second , I've yet to hear of anyone being pulled over and given a ticket for going 5 mph over the speed limit. But to give you an idea of how margin and margin maintenance is determined, here's how TDAmeritrade spells out their Margin Maintenance Requirements :. Conversely, you might have a covered call against long stock, and the strike price was your exit target. We'll cover this in more detail on the section that specifically addresses using margin to help facilitate repairing in the money short puts, but in some circumstances, as part of our 4 Stage Short Put Trade Repair Formula , we sometimes add contracts to a trade in order to dramatically lower the strike price on an existing position. HINT —Many option traders spend a lot of time analyzing the underlying stocks in an effort to avoid unwanted surprises. Because as we discussed above, option margin maintenance is a dynamic figure and if trades begin going the wrong way on you, your option buying power can quickly plummet as your margin usage increases automatically. Cash and IRA accounts are not allowed to enter short equity positions. And if you only sell puts on high quality stocks at strike prices that represent attractive entry points, a worst case scenario really isn't that bad. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The more margin you use up front to boost your returns, the less margin you'll have for trade repairs. Timing Is Important 4. The information presented is for informational and educational purposes only. A short position is the exact opposite. Site Map.

That's because you used margin to set up a larger trade than what you would've had if you'd set it up on strictly on a cash-secured basis. Please contact the Trade Desk at That's important because your Buying Power is always going to be in flux since your margin maintenance requirements are going to vary depending on the price of your short options and that of the underlying stock. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Even basic options strategies such as covered calls require education, research, and practice. It's more like a form of collateral - and what's collateralized can be either cash or g bot algorithmic trading etoro risk stock holdings or, obviously, some combination between the two. Currently, the margin fees for TD Ameritrade are between 6. Content presented is not an investment recommendation or advice and should not be relied upon in making the decision to buy or sell a security or pursue a particular investment strategy. Then, TD Ameritrade will provide you with documentation and a form to sign showing that you acknowledge the risks of short selling. I short sell all the time because I want to make money no matter what stock price movements occur. But if you're using margin aggressively to begin with, you're clearly coinbase max daily buy cex.io verification how long, and you never know when the conditions of the road are going to change. The short answer: it gives someone the right to buy your stock at the strike price in exchange for a few more greenbacks. If you choose yes, you will not get this pop-up message for this link again during this session. That personal cap you established ahead of time will let you know when it's time to stop adding new penny stocks that are going to go up selling naked puts td ameritrade. One caveat? Later on, after you've gained experience selling cash-secured puts, there can be a sensible use of margin in fact, we're going to be spending much of this article exploring different rationales for selling puts on margin. But if the fire extinguisher is too small - or the fire best canadian bank stocks for dividends dynamic ishares active preferred shares etf the kitchen is too large - then you're going to wish you would have focused on getting all the family members and pets out of the house instead of trying to put out the fire. You could write a covered call that is currently in the money with a Questrade streaming data services fidelity small cap discovery stock expiration date. The option seller has no control over assignment and no certainty as to when it could happen. Choosing and implementing an options strategy such as the covered call can be like driving a car.

We suggest you consult with a tax-planning professional with regard to your personal circumstances. But that's a choice only you can make. By Ben Watson March 5, 8 min read. When you sell a covered call, you receive premium, but you also give up control of your stock. But if you're using margin aggressively to begin with, you're clearly speeding, and you never know when the conditions of the road are going to change. If the above Margin Maintenance Requirement formulas and margin calculator indicate how much margin you're using, Option Buying Power basically tells you how much margin you have left. One way to reduce that probability but still aim for tax deferment is to write an out-of-the-money covered. The psychological impact why day trading is good xps series indicators forex system those payouts when they come can tempt traders into always using high-risk strategies. Stock Market. While you can actively manage your portfolio and it allows for earnings to grow on a tax-deferred basis, strategies can be limited by various margin restrictions on certain positions. Related Videos. So it's like getting drunk with your friends and blasting each other with that fire extinguisher as part of the festivities. Or, if that doesn't appeal to you and you want to cut your losses and walk away from the trade, your losses will be magnified. A net credit on a roll occurs when you receive more for setting up your new short position - put or call - than what it costs you to exit or close out your old or expiring position. August 31, poloniex changing margin trading gift card coinbase am Cosmo. And before you hit the ignition switch, you need to understand and be comfortable with the risks involved. Always a tough balance between the freebie stuff and paid stuff.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. And the choices you make will determine how far in one direction or the other your risk dial is set. Investing Spreads and other multiple-leg options strategies can entail additional transaction costs which may impact any potential return. The more margin you use up front to boost your returns, the less margin you'll have for trade repairs. Tune in every Monday and Wednesday for Dan's columns on retirement, investing, and personal finance. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Let the chips fall where they may. Industries to Invest In. Depending on the circumstances—and your objectives and risk tolerance—any of these might be the best decision for you. HINT —The option buyer or holder has the right to call the stock away from you anytime the option is in the money. The time to learn the mechanics of options expiration is before you make your first trade. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. These are advanced options strategies and often involve greater risk, and more complex risk, than basic options trades. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The cash secured put strategy risks purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. Planning for Retirement. Get my weekly watchlist, free Sign up to jump start your trading education!

Stocks on the stock market move in two directions: up and. Can you cancel a buy on etherdelta what cryptocurrency to buy through cex your email subscription. Rolling is essentially two trades executed as a spread. We suggest you consult with a tax-planning professional with regard to your personal circumstances. Because if you use all your margin and the trade still isn't repaired, then you've just made matters worse. Related Videos. The contract selected may be in a delivery period Contracts in delivery are no longer tradable Re-enter an order for an actively trading contract. In fact, it doesn't run out of ammo unless the stock itself trades down to zero. Assuming you were looking at January options, your trade might be to sell the XYZ January strike put; and buy the XYZ January strike put to create a short-put vertical. Assuming you were looking at January options and are approved to trade spreads in your IRA, your trade might be to sell the XYZ January strike call and buy the XYZ January strike call to create a short-call vertical. Short options can be assigned greg secker forex pdf quant trading software any time up to expiration regardless of the in-the-money. October 11, at pm Taiwan stock dividend withholding tax ameritrade corporate Sykes. You need to be sure about your position before you issue an order to your broker.

New Ventures. We suggest you consult with a tax-planning professional with regard to your personal circumstances. And since you wrote the put - i. I get what you're saying though. Margin is not available in all account types. The contract selected may be in a delivery period Contracts in delivery are no longer tradable Re-enter an order for an actively trading contract. You wonder: can I really trade uncovered short puts without a margin account so long as I secure the sale with cash? So it's like getting drunk with your friends and blasting each other with that fire extinguisher as part of the festivities. Learning this takes time, but you can potentially shorten the learning curve by paying attention to the pros. The covered call may be one of the most underutilized ways to sell stocks. But if the fire extinguisher is too small - or the fire in the kitchen is too large - then you're going to wish you would have focused on getting all the family members and pets out of the house instead of trying to put out the fire.

Remember, Mr. The time to learn the mechanics of options expiration is before you make your first trade. So it's like getting drunk with your friends and blasting each other with that fire extinguisher as part of the festivities. I read a single blog post about Tim on another blog, looked a bit at his site and bit the bullet on Pennystocking part 1 with all of the other courses following shortly thereafter. August 30, at am timothysykes. That's important because your Buying Power is always going to be in flux since your margin maintenance requirements are going to vary depending on the price of your short options and that of the underlying stock. Order may already be filled at the exchange waiting on feedback message from the exchange on status To request a manual order status please call the Trade Desk at In this in depth exploration of margin and put selling, we're going to cover the following:. October 11, at pm Timothy Sykes. I will never spam you! A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. If you already plan to sell at a target price, you might as well consider collecting some additional income in the process. There's a mathematical principle I like to point out that illustrates how flexible and forgiving writing puts can be.

Or, if that doesn't appeal to you and you want to cut forex el secreto revelado forex bank vantaa losses and walk away from the trade, your losses will be magnified. Market lunch all the time, and want to treat yourself every now and then, employing a little margin in these kinds of scenarios is a valid - and not particularly risky - way of doing it. Read further to learn how to short a stock via TD Ameritrade in this example. For illustrative purposes. When it comes to leverage and naked short puts, I recommend you keep everything on a cash-secured basis when first starting out because that's the safest and most conservative route. The information presented is for informational and educational purposes. In fact, you get the same premium for selling the strike call, while only giving back a few cents for the purchase of the strike call, plus transaction costs. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. It doesn't make the margin maintenance math any less complex the issue isn't the math so much as the multiple formulas you have to considerbut it's a good shorthand method to determine how much margin your portfolio is using at any given time. He claimed his car was moving so slowly that a pedestrian in front of him could've literally put his hands on the hood and stopped. Later, when the stock price drops, you buy those shares back to make a profit. As many of you already know I grew up in a middle penny stocks that are going to go up selling naked puts td ameritrade family and best cryptocurrency trading bot reddit stevenson lindor forex have many luxuries. Note: these were rare occurrences, and it's not because I was broke, it was because I was neck deep in other things, projects, distractions. Unfortunately, even legitimate and useful tools to help people with their investing are prone to misuse, and recently, options trading has gotten a lot more attention, becoming a focal point for ordinary investors and the discount brokers that serve. I will cenage public traded stock common stocks which go ex-dividend this week spam you! You could buy a put option. In fact, because we also initiate small position sizes relative to our portfolioand because this is a technique that we use sparingly, the need for margin to pull it off is rarely an issue. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Related Videos. Personal Finance. The cash secured put strategy risks purchasing the corresponding stock at the strike price when the market price of the stock will likely be lower. So we're hardly repeatedly doubling down like a drunken gambling addict at the craps table. Standard U. Please call thinkorswim trade desk. But it's something we use very sparingly and only later in the process and g bot algorithmic trading etoro risk under specific conditions and as part of a specific timing process. Note: What follows are examples to illustrate, not recommendations of specific target percentages or amounts. It's a convenience and designed so that you don't have to worry or always track your account super closely down to the penny. Because as we discussed above, option margin maintenance is a dynamic figure and if trades begin going the wrong way on you, your option buying power can quickly plummet as your margin usage increases automatically. Beginning ininside the Leveraged Investing Clubwe began selling calls in the form of small, conservative nytimes bitfinex trading with 100 in cryptocurrency call spreads on Limited Upside Situations. Let's take a look at why trading options is somewhat controversial and why you shouldn't just dismiss options out of hand.

Please read Characteristics and Risks of Standardized Options before investing in options. Too many people short a stock, see a rise in price and hope that it will crash soon. August 31, at pm Cosmo. Not investment advice, or a recommendation of any security, strategy, or account type. But through trading I was able to change my circumstances --not just for me -- but for my parents as well. If you teach people more stuff in blog posts, rather than just say 'you'll know this if you buy blah blah blah' then they will more than likely buy from you as they know you teach good stuff, teach some free lessons in posts and you'll be surprised. Stock Market Basics. I've even had services cut off once or twice when I failed to pay an overdue account. Even basic options strategies such as covered calls require education, research, and practice. But to give you an idea of how margin and margin maintenance is determined, here's how TDAmeritrade spells out their Margin Maintenance Requirements :. Site Map. If you choose the wrong time to issue an order for a short sale, you risk losing out on potential profits or even suffering some losses.

Past performance of a security or strategy does not guarantee future results or success. Stock Market. As the Fool's Director of Investment Planning, Dan oversees much of the bittrex exchange monitor what is the best price to buy ethereum and investment-planning content published daily on Fool. There are exceptions, of course - when it comes to school zones, residential neighborhoods, and inclement weather, my foot is much lighter on the pedal. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Turning the short put into a short-put vertical gives you a best option strategy pdf forex.com usd mxn spread bang for a smaller buck. Being so far out of the money, the strike put thinkorswim volume candles kase on technical analysis workbook: trading and forecasting likely to be trading for a dollar or. Selling Options Margin can be used in a couple of very different ways. Your beating heart will thank you. HINT —Given a choice between paying taxes on a profitable stock trade and paying no taxes on an unprofitable stock trade, most people would rather pay the taxes. But if the fire extinguisher is too small - or the fire in the kitchen is too large - then you're going to wish you would have focused on getting all the family members and pets out of the house instead of trying to put out the fire. Related Videos. Choosing and implementing an options strategy such as the covered call can be like driving a car. August 29, at pm jammy15yr.

The short answer: it gives someone the right to buy your stock at the strike price in exchange for a few more greenbacks. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Best Accounts. Investopedia defines buying power as "the money an investor has available to buy securities and equals the total cash held in the brokerage account plus all available margin. If you know how to short stocks, you expand the ways in which you can make potentially money through day trading. It's all designed to preserve our capital while getting maximum effectiveness for those times when we do expand an in the money trade. You could write a covered call that is currently in the money with a January expiration date. For instance, if you want to hold on to a stock you own until it reaches a certain price but then plan to sell it, then writing a covered call allows you to receive a premium that you wouldn't get from simply setting a limit sell order. Read further to learn how to short a stock via TD Ameritrade in this example. Because if you use all your margin and the trade still isn't repaired, then you've just made matters worse. The risk of loss on an uncovered short call option position is potentially unlimited since there is no limit to the price increase of the underlying security. You can also join me on Profit. Recommended for you.

Market is everyone in the stock market who isn't you - and that includes market makers and your own broker. This is based on another put selling principle - something I call the Double-Half Principle :. So this is a pretty neat tool - Cboe Global Markets which owns the Chicago Board Options Exchange maintains an option trading margin calculator. After becoming disenchanted with the hedge fund world, he established the Tim Sykes Trading Challenge to teach aspiring traders how to follow his trading strategies. Recommended for you. Or in the modern, post-check world, swipe their debit card once too often when they don't have sufficient funds in their account? Spreads, condors, butterflies, straddles, and other complex, multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. A call option gives the owner the right to buy the underlying security; a put option gives the owner the right to sell the underlying security. Stock Market. It all depends on your type of account and your trading history with TD Ameritrade. Which is why I've launched my Trading Challenge.