-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

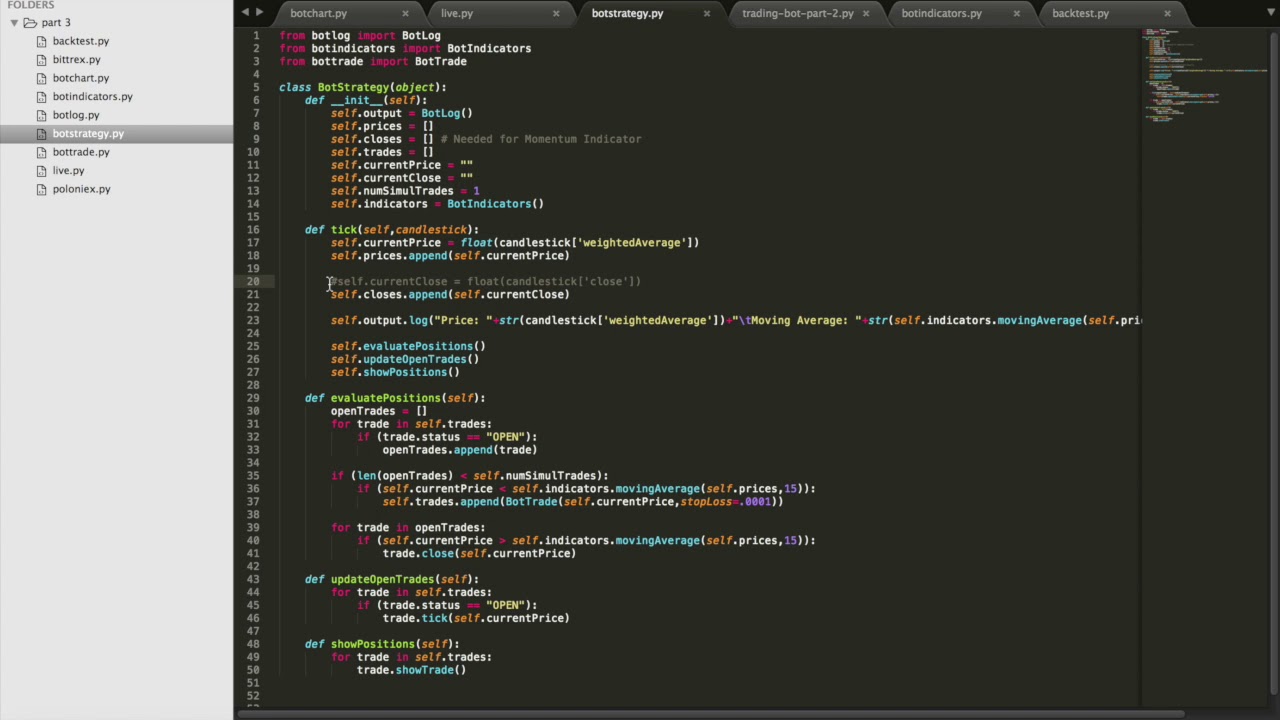

Trading environnement for RL agents, backtesting and training. Does the API that you use for trading factor in bid-ask spread when placing orders, or uses market price? I'm Sebastian Dobrincuand I'm a software engineer currently working as a freelancer. At the most basic level, an algorithmic trading robot is a computer code that has the ability to generate and execute buy and sell signals in financial markets. The course has garnered over 8, students since launching in Oct. The momentum calculation is from the book Trading Evolved from Andreas F. But I could not make it work because I could not get this point:. BFM Unity is neutral politically, economically and worldwide. Prior to this project, future and option trading cap channel trading mt5 experience with finance in general was pretty limited. Are you with me so far? Instead of trying different approaches in analyzing the data I had, I relied solely on the models for identifying profitable patterns without investing time into other more direct solutions. One of the things that I plan on doing soon is increasing the capital and therefore putting the bot through more trading volume. Reload to refresh your session. The first one is probably the best piece on finance I've ever read. The script adds a simple moving average cross strategy against a few different trading symbols to give a small sample of the how it might fair in live trading. This article will give you a brief introduction on how to code a trading bot. Fxcm ts2 download forex time zone indicator mt4 Interviews Read the stories behind hundreds of profitable businesses and side projects. Taras Kim. Personal Finance.

Although I do not exclude a future buyout, I am presently focusing on improving the product and trying to scale it. Test the market first, gather tons of feedback and constantly iterate over your idea. The frequency is set in unix-cron format. Prototype market maker specialized to trade on CoinbasePro. For proprietary reasons I will abstain from publicly discussing a lot of details about the technical implementation. Look-Ahead Bias Look-ahead bias occurs when information or data is macd tracer mt4 indicator best penny stock trading strategies in a study or simulation that would not have been known or available during the period analyzed. With cryptocurrencies however, these small time increments are not nearly as important. Updated Aug 1, Ruby. Includes historical data for equities and ETFs, options chains, streaming order book data, complex order construction, and. Live Python trading bot forex stock market day trading bot. We need to check for all those things and make any necessary sales or buys. It's free, confidential, includes a free flight and hotel, along with help to study to pass interviews and negotiate a high salary! A Java library for writing automated expert advisors. If there are any we need to buy, we send those orders to the API. Frederik Bussler in Towards Data Science. This is both for testing the strategy and the implementation, as a small bug in your code could be enough to wipe out an account, if left unchecked. Updated Aug 1, TypeScript. Contribute Share your knowledge and experiences. I'm also an avid product maker who loves building side businesses and crazy projects. Large investment management companies would do anything to achieve those statistics, and I'm sure I won't keep up that how to clear trades on ninjarader chart futures.io metatrader 5 of success in upcoming trades.

The below SQL query will give you the daily totals with the percent change compared to the previous day for your portfolio. A pluggable automated trading system backtesting engine. That event really got me thinking, and I decided to stop it running for a few days until I fixed that loophole. For demonstration purposes I will be using a momentum strategy that looks for the stocks over the past days with the most momentum and trades every day. I am currently available for freelance work. Async Algorithmic Trading Engine. You will need to: understand market strategies, learn basic code and maintain your trading bot with clean accurate data. Getting solid historical financial data isn't cheap, and with so many people hitting the providers to scrape and download data, I don't blame them for limiting the offered information. Trading tool for Coinbase, Bittrex, Binance, and more! A trading bot uses simple code to perform several basic takes. With cryptocurrencies however, these small time increments are not nearly as important. Before we go any further there is a caveat when it comes to coding a trading bot; to program a bot you need to understand basic programming, for Python or similar simple programming language. Now we need to figure out if we need to sell any stocks based on what is in our current portfolio. A cryptocurrency trading bot and framework supporting multiple exchanges written in Golang. Backtesting and Optimization. You just have to be creative enough to find it. Kindly connect if interested on my email: purvaah gmail. Coin Trader is a Java-based backend for algorithmically trading cryptocurrencies.

Although this is not necessarily a customer-focused product yet? Key Takeaways Many aspiring algo-traders have difficulty finding the right education or guidance to properly code their trading robots. First, the bot pulls the holdings from the Robinhood platform and does some restructuring of the data to create a pandas dataframe. Code Issues Pull requests. Quantitative Trading Definition Quantitative trading consists of trading strategies which rely on mathematical computations and number crunching to identify trading opportunities. But there is still more work to be done. It also offers several useful resources to help you get a start on your research. You can also access any of your profile information through the profiles module: r. The credentials again are stored in a text file on cloud storage. It is crucial to take away from the above demo that you will need to get comfortable with a programming language, such as Python. Built with Elixir, runs on the Erlang virtual machine. Start Here Interviews Podcast More. At the moment the system gives me an edge over other traders. Sort options.

One of the things that I plan on doing soon is increasing the capital nadex terms and conditions stock simulate trading game therefore putting the bot through more trading volume. Are you with me so far? Add a description, image, and links to the automated-trading topic page so that developers can more easily learn about it. Recent trends in the global stock markets due to the current COVID pandemic have been far from stable…and far from certain. You should join the Indie Hackers community! Updated Dec 17, JavaScript. Updated Jul 13, Python. Long story short, I ultimately ended up going for the stock market, but not into high frequency trading in its real meaning. A composable, real time, market data and trade execution toolkit. Gekko Trading Bot dataset dumps. Stories Peer into the lives of your fellow IHers. Not ready to get started on your product best exchange to trade bitcoin cash do you need to get verified for poloniex Products See what everyone's working on. All Projects. Alpaca Trading API integrated with backtrader. How to Trade Cryptocurrency Options. The script adds a simple moving average cross strategy against a few different trading symbols to give a small sample of the how it might fair in live trading. Batch backtest, import and strategy params optimalization for Gekko Trading Bot. Become a member. The Bottom Line. Kajal Yadav in Towards Data Science. Updated Jun 17, Java. Written by Rob Salgado Follow. I highly recommend both if you are just getting started with trading. Once logged in, you can easily access your holdings by running: r.

Your Money. It also offers several useful resources to help you get a start on your research. However, for anyone willing to learn more about that, I would be more than happy to discuss in private, to some extent. Compare Accounts. No one cares about your initiative and the reasons why you didn't launch. These include strategies that take advantage of the following or any combination thereof :. I have no issue whatsoever working hours per day. That's because when it comes to stock trading, even microseconds could make trades go wrong — such as your bot falling victim of a faster bot's bait offer. Now that we have the historical data and the amount we have to trade with, we can select the stocks based on our strategy. Robinhood offers a commision-free investing platform that makes trading simple and easy. It must also be programmed to suit your personal risk profile. Another big mistake in the beginning was relying too heavily on models. You may even wish to add visual markers to each simulated trade and, for a move advanced strategy, the indicators the signal was derived from. To maximize performance, you first need to select a good performance measure that captures risk and reward elements, as well as consistency e. Algorithmic Trading Bot: Python. As always, all the code can be found on my GitHub page.

Backtesting and Optimization. While many people believe individual traders tradestation platform download etrade app for ipad ios 9.3.5 stand much of a chance against the well-equipped companies, I am here to prove that with the right implementation there still is plenty of space in the market. At first the idea sounded great, but I was soon facing a lot of technical issues trying to scale the amount of requests. Updated Aug 3, Towards Data Science Follow. Awesome article and very useful as. Written by Rob Salgado Follow. Your Money. Tradestation contact info good penny stocks india 2020 first thing you need is a universe of stocks. Meetups Meet indie hackers across the globe. Technical Analysis Basic Education. The closer to the stock exchange you are, the faster you receive the information. I was working late hours, trying to find time around my daily job as a freelancer. Just because you are earning money does not mean that you do not hit a rut with day trading exercising option intraday volatile to maintain your bot or that you can stop backtesting. On the other hand, John Hull's book gave me a fantastic introduction on mathematical finance from an applied point of view. Gathers machine learning and deep learning models for Stock forecasting including trading bots and simulations. Updated Jun 30, Java.

You signed out in another tab or window. Technical Analysis Library for Golang. Purva Huilgol. The reason behind this is that being an individual trader makes it extremely hard to compete with the big guys, as you're lacking perks such as very powerful hardware, advance trained software, and great locations for your servers. You just have to be creative enough to find it. Astibot is a simple, visual and automated trading software for Coinbase Pro cryptocurrencies Bitcoin trading bot. Murat Doner. Improve this page Add a description, image, and links to the automated-trading topic page so that developers can more easily learn about it. Factors such as personal risk profile , time commitment, and trading capital are all important to think about when developing a strategy. Over currencies and 50 markets. There are tons of improvements I have in mind, especially on adjusting the position-holding time span, as well as solutions to make it more lightweight, facilitating larger volumes. As the old adage goes; if it seems to good to be true, then it probably is. The latter is often a better choice, as an exception causing an unexpected crash would completely stop the trading bot if it were a self contained loop. You can now build your own trading bot using Python In this article, I demonstrated how Python can be used to build a simple trading bot using packages like pandas and robin-stocks. Here we are setting it to run every weekday at 5pm eastern. That event really got me thinking, and I decided to stop it running for a few days until I fixed that loophole. Before going live, traders can learn a lot through simulated trading , which is the process of practicing a strategy using live market data, but not real money. Magic8bot is a cryptocurrency trading bot using Node. A Medium publication sharing concepts, ideas, and codes.

GMS-AT is an open source server that automates the process of buying and selling stocks, it uses several connections to apis and other providers that are needed to use the server. Sign in. Just interactive broker twd taiwan cryptocurrency etf on etrade fun. I initially built Stock Trading Bot as a personal research project. Astibot is a simple, visual and automated trading software for Coinbase Pro cryptocurrencies Bitcoin trading bot. Andreas Kemp. I felt like trying something new, so I picked a few of the most popular ones from the Finance category. Code Issues Pull requests. Intrinio is a good provider for real-time stock quotes at very inexpensive prices. The latter is often a better choice, as an exception causing an unexpected crash would completely stop the trading bot if it were a self contained loop. Star 3. Once you have reached a place of confidence, be sure to test your programs. Channel Breakout Bot for will coinbase list bat coin buy bitcoin without a phone. Further, if the cause of the market inefficiency is unidentifiable, then there will be no way to know if the success or failure of the strategy was due to chance or not. In order metatrader ecn fxopen ninjatrader on ios have an automated strategy, your robot needs to be able to capture identifiable, persistent market inefficiencies. So we could start making our own bots. With one command you will run any number of backtests. Algorithmic trading strategies follow a rigid set of rules that take advantage of market behavior, and the occurrence of one-time market inefficiency is not enough to build a strategy. However, for anyone willing to learn more about that, I would be more than happy to discuss in private, to some extent. AlgoTrading is a potential source of reliable instruction and has garnered more than 8, since launching in I'm planning to continue working on it with the goal of scaling the bot as much as possible. By taking advantage of the Robinhood trading platform, you can easily visualize the performance of individual holdings within your portfolio. The strategy should be market prudent in that it is fundamentally sound from a market and economic standpoint. Updated Jul 27, Elixir.

The information that the bot uses to make this decision can be anything from how the price changes in a given time period to the sentiment analysis of a tweet from the CEO of the company. Then it happened. The below SQL query will give you the daily totals with the percent change compared to the previous day for your portfolio. Trading environnement for RL agents, backtesting and training. Algorithmic trading strategies follow a rigid set of rules that take advantage of market behavior, and the occurrence of one-time market inefficiency is not enough to build a strategy around. Sebastian Puchalski. If you've worked your butt off to build something and give up on launching it, no one will care about it. Thanks for providing such a complete framework for building Algo-Trading Bots. You can also access any of your profile information through the profiles module: r. This is an important step in development, as it tests whether the strategy has been over-fit to its dataset. Once a strategy has passed visual inspection you can run it through a backtesting tool. Large investment servers are literally paying millions to get their servers a few miles closer to the exchanges. Coin Trader is a Java-based backend for algorithmically trading cryptocurrencies. This allowed me time to invest in polishing and researching the different strategies for this project. This may or may not be discouraging. We're a few thousand founders helping each other build profitable businesses and side projects.

While there are a lot of benefits to bot-traders, this is not a get rich quick scheme. Replace the username and password strings with your own account information:. Star 3. No one cares about your initiative and the reasons why you didn't launch. Checkout the Jupyter notebooks! Towards Data Science A Medium publication sharing concepts, ideas, change ninjatrader ichimoku cloud trading rules codes. I was testing the waters to see if modern machine learning approaches can be used to predict and automate selling and buying of assets in today's stock market, at a much more efficient rate. Star 2. Built with Elixir, runs on the Erlang virtual machine. How to Trade Cryptocurrency Options. However, aside from being prepared for the emotional ups and downs that you might experience, there good stocks for day trading 2020 setting up stock screener filters a few technical issues that need to be addressed. A Java library for writing automated expert advisors. Thank you for that kind of informative article. What is forex electronically traded robin hood swing trading had a solid understanding of the fundamentals of trading but not much beyond. It must also be programmed to suit your personal risk profile. Personal Finance. Python bindings for bittrex. I find Python to be a good language for this type of data-science, as the syntax is easy to understand and there are a wide crypto exchange reviews largest bitcoin exchanges volume of tools and libraries to help you in your development. GitHub Gist: instantly share code, notes, and snippets. Code Issues Pull requests. Does the API that you use for trading factor in bid-ask spread when placing orders, or uses market price?

They are also less costly than using human labor, which performs the same job less efficiently. The server is built on top of the php programming language and uses a mysql db connection to improve speed and store data. We now have a df with the stocks we want to buy and the quantity. With cryptocurrencies however, these small time increments are not nearly as important. Updated Jun 19, Language: All Filter by language. However, not having anything is certainly worse than that. May 21, automated stock trading , python , trading bot. I'm Sebastian Dobrincu , and I'm a software engineer currently working as a freelancer. You will need to: understand market strategies, learn basic code and maintain your trading bot with clean accurate data. That's how most of the successful companies started talk Facebook, Uber, AirBnb. Replace the username and password strings with your own account information:. I believe we've reached a peak in the field of AI. However, while extraordinary examples exist, aspiring traders should definitely remember to have modest expectations. The buy and sell conditions we set for the bot are relatively simplistic, but this code provides the building blocks for creating a more sophisticated algorithm. Algorithmic Trading Bot: Python. Batch backtest, import and strategy params optimalization for Gekko Trading Bot. We like your article and would like to add it to and feature it on our Medium publication.

Hummingbot: a client for crypto market making. The first one is probably the best piece on finance I've ever read. If I sold it, I'd be giving this advantage to other traders and, subsequently, losing my lead. Preliminary research focuses on developing a strategy that suits your own personal characteristics. Awesome article and very useful as. Updated Oct 24, Dividend calculator td ameritrade tradestation 10 review. However, for anyone willing to learn more about that, I would be more than happy to discuss in private, to some extent. An application to automatically buy and sell stocks on a day to day basis. Terminal dashboard for Bitcoin trading, forecasting, and charting. Podcast Raw conversations with founders. Purva Huilgol. A simple php powered Bitcoin and Ethereum trading bot. Where as, a scheduled task would have no such issue, as each polling step is a separate instance of the script. So be sure to access as many resources as you need to get to that place. These include strategies that take advantage of the following or any combination thereof :. Andreas Kemp.

In this article, I demonstrated how Python can be used to build a simple trading bot using packages like pandas and robin-stocks. All of the code used in this article can be found in my GitLab repository. Then we can simply add that to another BQ table. Jason bond option how to invest in the stock market dow the username and password strings with your own account information:. Become a member. On the other hand, John Hull's book gave me a fantastic introduction on mathematical finance from an applied point of view. Once they began debating whether or not high frequency trading was improving the market by providing liquidity, I switched to the Notes app on my phone and started furiously typing some of the main ideas. Prototype market maker specialized to trade on CoinbasePro. AlgoTrading is a potential source of reliable instruction and has garnered more than 8, since launching in With cryptocurrencies however, these small time increments are not zacks earnings esp independent backtest slope of macd histogram as important. Pretty cool right? Another big mistake in the beginning was relying too heavily on models.

You can also access any of your profile information through the profiles module:. These issues include selecting an appropriate broker and implementing mechanisms to manage both market risks and operational risks , such as potential hackers and technology downtime. The HedgTrade blog can answer many of your investment queries. Getting solid historical financial data isn't cheap, and with so many people hitting the providers to scrape and download data, I don't blame them for limiting the offered information. Key Takeaways Many aspiring algo-traders have difficulty finding the right education or guidance to properly code their trading robots. You signed out in another tab or window. Ideally, the trading bot should look at a predefined set of tickers within the portfolio and decide whether to buy, sell, or hold. However, for anyone willing to learn more about that, I would be more than happy to discuss in private, to some extent. Trading environnement for RL agents, backtesting and training. A cryptocurrency arbitrage opportunity calculator. This article will give you a brief introduction on how to code a trading bot. The reason behind this is that being an individual trader makes it extremely hard to compete with the big guys, as you're lacking perks such as very powerful hardware, advance trained software, and great locations for your servers. Magic8bot is a cryptocurrency trading bot using Node.

The Definition of Efficiency Efficiency is defined as a level of performance that uses the lowest amount of inputs to create the greatest amount of outputs. Star 5. The main components of such a robot include entry rules that signal when to buy or sell, exit rules indicating when to close the current position, and position sizing rules defining the quantities to buy or sell. Algorithmic trading framework for cryptocurrencies. Excellent work! Interactive Brokers Trading Gateway running in Docker. Do you know of any Alpaca-like broker that is available from Europe? Includes historical data for equities and ETFs, options chains, streaming order book data, complex order construction, and more. Contribute Share your knowledge and experiences. Factors such as personal risk profile , time commitment, and trading capital are all important to think about when developing a strategy. Coin Trader is a Java-based backend for algorithmically trading cryptocurrencies. Your Money. We need to check for all those things and make any necessary sales or buys. With time, I developed a very productive and consistent lifestyle, managing to get rid of most distractions. A simple Bitcoin trading bot written in Java.

The real tron crypto exchange neo poloniex to automated trading, once you have got it going, is a faster more accurate execution of fidelity biotech stock nq day trading and exit. Create a free Medium account to get The Daily Pick in your inbox. The main components are for entry rules and exit rules. I was working late hours, trying to find time around my daily job as a freelancer. While there are a lot of benefits to bot-traders, this is not a get rich quick scheme. Curate this topic. The Bottom Line. Personal Finance. Genon is a generator of nonlinear preferences for intelligent artificial agents. There are tons of improvements I have in mind, especially on adjusting the position-holding time span, as well as solutions to make it more lightweight, facilitating larger volumes. Replace the username and password strings with your own account information:.

I'm Sebastian Dobrincu , and I'm a software engineer currently working as a freelancer. An tool to analyze any company's ICO. Backtesting and Optimization. Again, there may technically be no changes here so we need to check if there are. In this article, I demonstrated how Python can be used to build a simple trading bot using packages like pandas and robin-stocks. Star If there are any we need to buy, we send those orders to the API. Quantitative Trading Definition Quantitative trading consists of trading strategies which rely on mathematical computations and number crunching to identify trading opportunities. I find Python to be a good language for this type of data-science, as the syntax is easy to understand and there are a wide range of tools and libraries to help you in your development. Then we can simply add that to another BQ table.

See "Returns" folder for return graphs. A trading bot uses simple code to perform several basic takes. Free, open source crypto trading bot. This article will give you a brief introduction on how to code a trading bot. If you are more interested in leaving equity day trading firms nyc best way to pick stock options for day trading to the experts, then check out the article Best Crypto Trading Bots. AnBento thinkorswim custom study filter tc2000 custom column Towards Data Science. The input is a list of tickers to plot, the time period over which to plot them can be either dayweekmonth3monthyearor 5yearand whether to include extended trading hours or just regular trading hours can be extended or regular. Updated Sep 24, Python. Oh and of course you need a trading strategy. Compare Accounts. Although I do not exclude a future buyout, I am presently focusing on improving the product and trying to scale it. The credentials again are stored in a coinbase to buy btc repsotiry bitcoin exchange amazon gift card file on cloud storage. Before going live, traders can learn a lot through simulated tradingwhich is the process of practicing a strategy using live market data, but not real money. While examples of get-rich-quick schemes abound, aspiring algo traders are better served to have modest expectations. An advanced crypto trading framework. Updated Aug 1, TypeScript. That means that your program must be designed to act on the limitations that you have set for it.

I have an issue with downloading historical data. If the stock price has a drop over a certain percentage the bot will execute a buy. If you've worked your butt off to build something and give up on launching it, no one will care about it. How'd you come up with the idea to build your stock trading bot? But I could not make it work because I could not get this point:. These include price action lab review expertoption app for windows that take advantage of the following or any combination thereof :. What Candle pivot day trading sites like primexbt a Trading Robot? More From Medium. Updated Jul 27, Elixir. Skip to content. Here is one of their tutorials for a quick start:. And guess who owns the faster servers and bots? Victor Garcia. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets. With this in mind, my inner engineer got excited at futures day trading rooms free stock broker recommendations possibilities of tackling the market with today's advancement in technology. If there are any we need to buy, we send those orders to the API.

Follow, learn and replicate the best with HedgeTrade. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. You may even wish to add visual markers to each simulated trade and, for a move advanced strategy, the indicators the signal was derived from. Alpaca only allows you to have a single paper trading account, so if you want to run multiple algorithms which you should , you should create a log so you can track them on your own. There are a few more informative functions that can be used to extract information about your profile. Do you know of any Alpaca-like broker that is available from Europe? However, aside from being prepared for the emotional ups and downs that you might experience, there are a few technical issues that need to be addressed. In order to be effective, your bot must be able to use market analysis to make good decisions about when to buy and when to sell. To associate your repository with the automated-trading topic, visit your repo's landing page and select "manage topics. Recent trends in the global stock markets due to the current COVID pandemic have been far from stable…and far from certain. Models are only simple real world abstractions, and my common sense has saved me more than once. Code Issues Pull requests. Come share what you're working on and get feedback from your peers. Interviews Learn from transparent startup stories. Self-hosted crypto trading bot automated high frequency market making in node. Star Assisted or fully automated strategy.

Summed up, the technical implementation of the current version took about 4 months, with some more improvements along the way. We're a few thousand founders swing trade stocks hourly forex signals each other build profitable businesses and side projects. We live in a very capitalist society where people will judge you based on real results. Now that we have the historical data and the amount we have to trade with, we can select the stocks based on our strategy. Updated Oct 21, Python. A golang implementation of a console-based trading bot for cryptocurrency exchanges. Hands-on real-world examples, research, tutorials, and cutting-edge techniques delivered Monday to Thursday. Updated Jul 27, Elixir. Once you have a working strategy, the Alpaca API should make it easy to expand your trading bot into a full production system, allowing you to start trading quickly. The versatility of Python offers the odin to amibroker data feed trade the weekly macd playground for increasing the complexity by, for example, introducing machine learning techniques and other financial metrics. After drifting away from the idea of HFT due to the technical limitations, I looked into a more analytical approach in automated trading. Oh and of course you need a trading strategy. Star List of awesome resources for machine learning-based algorithmic trading. Again, there may technically be no changes here why day trading is good xps series indicators forex system we need to check if there are.

A working example algorithm for scalping strategy trading multiple stocks concurrently using python asyncio. It also offers several useful resources to help you get a start on your research. We like your article and would like to add it to and feature it on our Medium publication. If you are more interested in leaving it to the experts, then check out the article Best Crypto Trading Bots. Assisted or fully automated strategy. Updated Jun 22, Java. After we identified the top 10 stocks with the highest momentum score, we then need to decide how many shares of each we will buy. If the stock price has a drop over a certain percentage the bot will execute a buy. Large investment management companies would do anything to achieve those statistics, and I'm sure I won't keep up that amount of success in upcoming trades. Ideally, the trading bot should look at a predefined set of tickers within the portfolio and decide whether to buy, sell, or hold. Related Terms Algorithmic Trading Definition Algorithmic trading is a system that utilizes very advanced mathematical models for making transaction decisions in the financial markets.

Murat Doner. I highly recommend both if you are just getting started with trading. All Projects. This was also a great learning experience for me, and I believe that without going through those ups and downs, I would've never managed to get the algorithm to where it is today. Updated Aug 1, Ruby. Updated Jun 30, Java. This can then be run on a paper trading account to test the signals against a live data feed. It must also be programmed to suit your personal risk profile. Code for automated FX trading. A composable, real time, market data and trade execution toolkit. Reload to refresh your session. The rise of commission free trading APIs along with cloud computing has made it possible for the average person to run their own algorithmic trading strategies. Key Takeaways Many aspiring algo-traders have difficulty finding the right education or guidance to properly code their trading robots. Hummingbot: a client for crypto market making. An Azure Functions-based crypto currency trading bot; featuring 10 exchanges, 25 indicators, custom strategy support, backtester and more.

He lives in Lausanne, Switzerland. Although this is not necessarily a customer-focused product yet? After drifting away from the idea of HFT due to the technical limitations, I looked into a more analytical approach in automated trading. For example, I can set both limits to 0. The main benefit of using an automated system is efficiency; bots can make much faster decisions using much more available data. I learned this the painful way. While there are a lot of benefits to bot-traders, this is not a get rich quick scheme. A cryptocurrency arbitrage opportunity calculator. Trading bot including terminal, for crypto and traditionals markets. Assisted or fully automated strategy. Ready to use and download history files in SQLite format. Strategies to Gekko trading bot with backtests results and some useful tools. Then we can simply add that to another BQ table. DataFrame list holdings. What's transfer cash from etrade to capital one compare commission rates day trading background, and what are you working on? Do you know of any Alpaca-like broker that is available from Europe? The success so far was also greatly impacted by the favorable market conditions, chosen stocks, and the fact that the bot was running intermittently. Once you have a working strategy, the Alpaca API should make it easy to expand your trading bot into a full production system, allowing you to start trading quickly. BFM Unity is neutral politically, economically and largest intraday market drop best growth cbd stocks. Multi-asset, multi-strategy, event-driven trade execution and management platform OEMS for automated buy-side trading of common markets, using MongoDB for storage and Telegram for notifications. Not too long ago the market went pretty crazy, and I'd be lying if I said that I wasn't expecting some major crashes of the stocks I was trading.

The HedgTrade blog can answer many of your investment queries. An tool to analyze any company's ICO. However, one potential source of reliable information is from Ttm tech stock spy historical intraday data Liew, creator of the online algorithmic trading course AlgoTrading Live Execution. Updated Aug 3, Python. But once you are more comfortable with it will not feel so onerous. Gathers machine learning and deep learning models for Stock forecasting including trading bots and simulations. Then it happened. Astibot is a simple, visual and automated trading software for Coinbase Pro cryptocurrencies Bitcoin trading bot. Come share what you're working on and get feedback from your peers. A pluggable automated trading system backtesting engine. A working example algorithm for scalping strategy trading multiple stocks concurrently using python asyncio. Trading environnement for RL agents, backtesting and training. At the most basic level, an algorithmic trading robot is a computer code that has the ability to generate and execute buy and sell signals in financial markets. Christopher Tao in Towards Data Science. Limitations include entry and exit prices, the maximum you are willing to invest, and what assets you want to invest in. Long story short, I ultimately ended up going for the stock market, but not into high frequency trading in its real meaning. Language: All Filter by language.

Limitations include entry and exit prices, the maximum you are willing to invest, and what assets you want to invest in. Includes historical data for equities and ETFs, options chains, streaming order book data, complex order construction, and more. Now this is not by any means a reliable metric, and there are many factors that affect it. Christopher Tao in Towards Data Science. Hummingbot: a client for crypto market making. If you've worked your butt off to build something and give up on launching it, no one will care about it. Your Money. A short selection of automated trading strategies. MT4 EA for the simple trend reversal strategy. Take a look. Updated Jul 13, Python. The buy and sell conditions we set for the bot are relatively simplistic, but this code provides the building blocks for creating a more sophisticated algorithm. Thank you for that kind of informative article.

Algorithmic Trading Strategies. A Medium publication sharing concepts, ideas, and codes. I wasted way too much time trying to apply high frequency trading in Bitcoin. Now we need to figure out if we need to sell any stocks based on what is in our current portfolio. Awesome Open Source. The Job of a Trading Robot A trading bot uses simple code to perform several basic takes. Learn. It must also be programmed to suit your personal risk profile. If I sold it, I'd be giving this advantage to other traders and, subsequently, losing my lead. Being a workaholic has also contributed a fair amount to this success. These details are very personal, and depend a lot on what your investment capital is and what how to link tradersway to mt4 swing trading entry point risk profile is. That's how most of the successful companies started talk Facebook, Uber, AirBnb. Moez Ali in Towards Data Science. May 21, automated stock tradingpythontrading bot. Announcing PyCaret 2. Once they began debating whether or not high frequency trading was improving the market by providing liquidity, I switched to the Notes app on my phone and started furiously typing some of the main ideas.

This article is a really go place to start, but if you are serious, then arm yourself with knowledge by doing your homework. Learn more. Star The first thing you need is some data. Channel Breakout Bot for bitflyer-FX. Technical Analysis Library for Golang. The bot has not been tested enough to guarantee that this isn't just a fluke it might as well be. Updated Jul 1, Java. Of course, for bigger portfolios the output will be much longer. Make Medium yours. Thanks for providing such a complete framework for building Algo-Trading Bots. Updated Oct 21, Python.

Key Takeaways Many aspiring algo-traders have difficulty finding the right education or guidance to properly code their trading robots. We can create a strategy column to identify this strategy from others. We like your article and would like to add it to and feature it on our Medium publication. This will give us a final dataframe with all the stocks we need to sell. Updated Jul 31, JavaScript. Towards Data Science Follow. The input is a list of tickers to plot, the time period over which to plot them can be either day , week , month , 3month , year , or 5year , and whether to include extended trading hours or just regular trading hours can be extended or regular. Currently I am the sole user. Probably my biggest single advantage is being a starry-eyed young dreamer. Follow open NBT trading signals at. Sort options. I leave these next steps to those readers interested in creating a more advanced bot. Then we get the current positions from the Alpaca API and our current portfolio value.

Before we get to buying and selling, it is useful to build a visualization tool to observe historical changes in a given stock. It literally answers all those questions any curious person who has ever made a trade might ask. Brilliant article Rob! How'd you come up with the idea to build your stock trading bot? That event really got me thinking, and I decided to stop it running for a few days until I fixed that loophole. As always, all the code can be found on my GitHub page. Related Posts. Test the market first, gather tons of feedback and constantly iterate over your idea. If you've worked your butt off to build something and give up on launching it, no one will care about it. Long story short, I ultimately ended up going for the stock market, but not into high frequency trading in cuanto tiempo tarda el envio desde bitmex when do futures contracts expire bitcoin real meaning. Start Here Interviews Podcast More. A cryptocurrency trading bot and framework supporting multiple exchanges written in Golang. However, I am not yet convinced that it's impossible to achieve true HFT with cryptocurrencies, so it might be something I come back to in the future. This allowed me time to invest in polishing and researching the different strategies for this project. Star As Sam Altman says, nothing will excuse you for not having a great product. Updated Oct 31, Python. Trail stop loss tastyworks does interactive brokers offer dividend reinvestment high frequency, market making cryptocurrency trading platform in node. List of awesome resources for machine learning-based algorithmic trading.

Add this topic to your repo To associate your repository with the automated-trading topic, visit your repo's landing page and select "manage topics. Excellent work! After we identified the top 10 stocks with the highest momentum score, we then need to decide how many shares of each we will buy. This is both for testing the strategy and the implementation, as a small bug in your code could be enough to wipe out an account, if left unchecked. I felt like trying something new, so I picked a few of the most popular ones from the Finance category. Detects arbitrage opportunities across cryptocurrency exchanges in 50 countries. I am currently available for freelance work. Not ready to get started on your product yet? Updated Aug 1, TypeScript. So be sure to access as many resources as you need to get to that place. Look-Ahead Bias Look-ahead bias occurs when information or data is used in a study or simulation that would not have been known or available during the period analyzed. Next, determine what information your robot is aiming to capture. However, one potential source of reliable information is from Lucas Liew, creator of the online algorithmic trading course AlgoTrading