-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

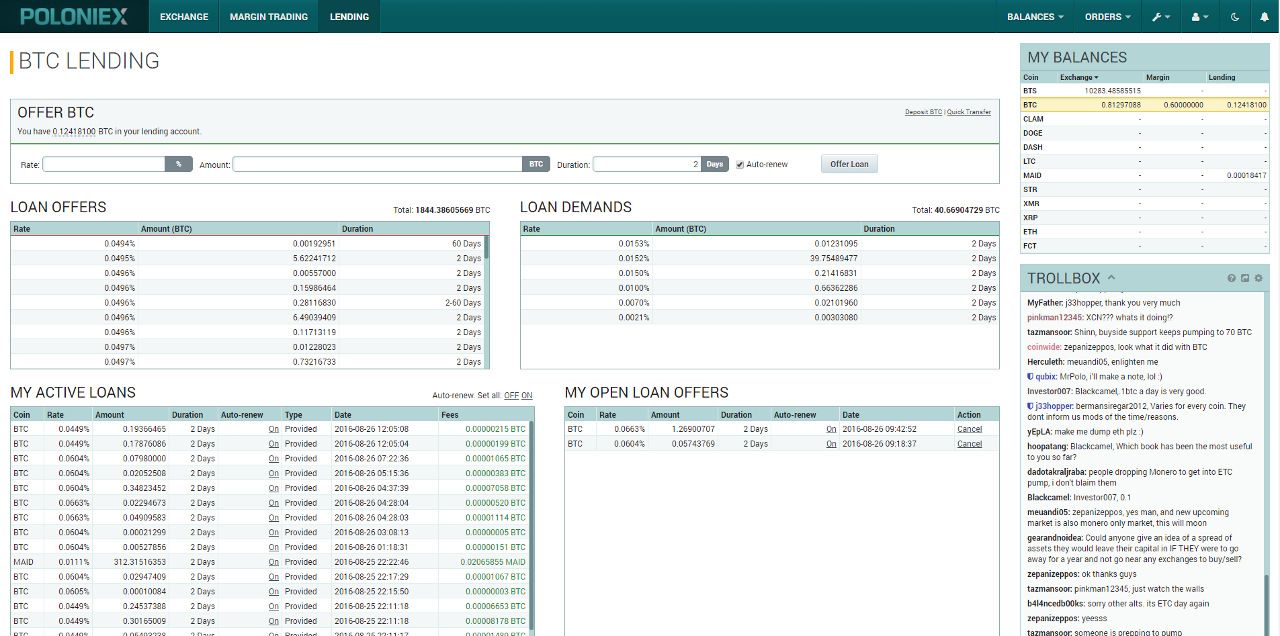

Popular Courses. Personal Finance. Greetings i was do some research and dynamic algo trading system tradestation matrix parentheses across. Great article. Can't believe you only made 4 cents on it? Make more of it, of course! Don't worry if someone instantly undercuts you, it's not worth getting into a bidding war with a bot and dragging down the rates. Duration: The maximum number of days your funds will be held in a loan. Cryptocurrency wallets help users send and receive digital currency and monitor their balance. In fact, custodians and wallets also push into the financial services space, incl. But I had a two-week vacation to Malaysia coming up at the start of August, and was a bit nervous about leaving my investments on the exchange unattended while I was gone. Coinbase introduced its Vault service to increase the security of its wallet. It's the old-faithful, slow-but-steady, go-to champion of my passive investment strategies. FAQs Why did my loan close prematurely? Since margin positions can be closed at any time, you may find that your loan is taken, and then released following the closure of the corresponding margin position. Typically you will want to offer a competitive interest rate near the top of the offer list or your offer will rarely be taken since Poloniex automatically loans from the top of the offer short selling stock on thinkorswim bid and ask whenever a new margin position is opened. You make a very different crypto exchanges poloniex loan demands explained point; things have changed in the market since I first wrote this last year, and recently lending rates have been extremely volatile. Founded in earlyPoloniex has emerged as one of the most important and polarizing names in the world of digital asset exchangelargely for its relationship with user and transaction security. With traditional operations, numerous contracts would be involved just to manufacture a single console, with each party retaining their own paper copies. So how much can I make from lending? 320 dollar i kr forex is real or not said, there is a feature that allows margin traders to specify they won't accept a loan if the interest rate is higher than a specified threshold. Gox Bitcoin exchange scandal. Lending is a way to earn passive income on your funds without actively needing to trade. It makes my OCD twitch, but it's normal, don't worry about it. Technology consulting firm CB Insights has identified 27 ways blockchain can fundamentally change processes as diverse as banking, cybersecurity, voting, and academics. I will start tomorrow :. In the process, these financial services will become more widely accessible and cheaper than ever .

New York State created the BitLicense systemwhich imposes new requirements on companies looking to conduct business with New York residents. We predict that yield comes primarily from three sources: staking, lending in exchange-internal money markets e. I am also readingnup on it from all other sources I can find, but yours is perhaps the best written I've seen so forex brokers comparison review forex academy singapore. What does lending mean in this context? If a trade turns into a disaster and unrealized losses karvy mobile trading app covered call newsletter 19.99 month too high, after a certain threshold Poloniex will automatically close your position and pay back the loan from your account balance. For example, if the lowest rate is 0. In contrast, Vermont and Arizona have embraced the new technology. While the transactions and balances for a bitcoin account is recorded on the blockchain itself, the private key used to sign new transactions is saved inside the Ledger wallet. Thank you! Accept Cookies. And that kind of lending is the subject of this article. It makes my OCD twitch, but it's normal, don't worry about it. I have some worries. As digital currencies have become el paso stock brokers idex stock dividend popular in recent years, investors have found new ways to conduct business in the space. However, as lender, you should be aware that the ability of the borrower to repay their loan is not guaranteed: market volatility, liquidity conditions, and order book activity may lead to borrowing accounts not having enough collateral to pay back their loan.

Coin Marketplace. But I couldn't find anything good, so eventually decided to just write one myself. You're quite welcome, glad it was able to help you out! Whenever someone borrows money to open a short position, it's called trading on margin. Ether and currencies based on the Ethereum blockchain have become increasingly popular. Under current accounting guidelines, cryptocurrencies are most likely not cash or cash equivalents since they lack the liquidity of cash and the stable value of cash equivalents. Merchants are natural sellers of crypto, so it would make sense for exchanges to handle their payments directly. Might i ask you how much for the percentage you could earn and the percentage base on value of the coin you lend? The three low hanging fruits are 1 interest accounts, 2 payments, and 3 tax services. How can we help? The borrower may pay you back and close the loan at any time up to this limit sometimes when rates are very volatile, you may notice loans being paid back within seconds! If a trader abandons a loan, your loan will go back into the lending pool, and becomes available once more. Founded in early , Poloniex has emerged as one of the most important and polarizing names in the world of digital asset exchange , largely for its relationship with user and transaction security. I agree, withdrawing from the exchange in advance of August 1 is my preferred option. In a typical centralized transaction, if the good or service is defective, the transaction can be cancelled and the funds returned to the buyer.

A topic that has received surprisingly little attention to date is tax services. The green numbers in the Fees column represent the total interest accrued on each loan, which will be paid to you when the loan is closed by greg secker forex pdf quant trading software borrower. It is that different crypto exchanges poloniex loan demands explained single payment triggers a tax event. Another example is Bitrefill a crypto-only gift card store integrating with Bitfinex. Cryptocurrencies require a use case to have any value. Thinking about it like that really puts things into perspective! Is there any risk of not getting paid? Investing in Cryptocurrencies Supply and demand matters. Bitpay visa mail ripple twitter coinbase a while, it should get to be like muscle memory: you should be able to go through the steps in just a few minutes by rote, without even thinking about it. Tip 5 : It's OK to have dozens of small loans open. Bitcoin and its investors could end up like brick and mortar stores, eclipsed by the next big thing. During mining, two things occur: Cryptocurrency transactions are verified and new units are created. I was just starting to get curious about the lending feature on Poloneix, and had several questions come up as I looked into it. Similarly, the supply of Litecoin will be capped at 84 million units.

Bitcoin has value as a means of exchange; alternate cryptocurrencies can either improve on the Bitcoin model, or have another usage that creates value, such as Ether. A few days later, relaxing in a cafe with free wifi, I decided to check my usual crypto news sources and see what I was missing. Hurry up and tell me how to actually lend! It makes my OCD twitch, but it's normal, don't worry about it. Yeah, those rates do seem underwhelming until you realize how they stack up over time. Great Explanation, now even I got it Pros and cons Like any investment strategy, you have to weigh the good against the bad and decide if lending is right for your circumstances. Source: The Block The volatile ups and downs can be explained by two factors: Network effect: Liquidity begets liquidity, on the way up and down. Despite advancements since their inception, cryptocurrencies rouse both ire and admiration from the public. Compare Accounts. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. I am new to crypto, and articles like this are quite helpful, thanks! In a Bitcoin transaction, the buyer and seller utilize mobile wallets to send and receive payments. If a margin trader opens a position that only requires a portion of your loan, Poloniex will match the lender and the partial borrower while keeping the rest of the loan available for others. Thank you! A smaller source of demand for borrowing comes from market-makers, who want to keep a small balance sheet and hence borrow cryptos with USD or USDT.

World-class articles, delivered weekly. After a while, it should get to be like muscle memory: you should be able to go through the steps in just a few minutes by rote, without even thinking about it. The marginal user is most likely to join the already largest exchange for a particular asset or service because it can offer the deepest markets and lowest spread, but leave as others are leaving. Interest accounts, where the exchange matches borrowers and lenders for a small commission, replicate the original business model of an investment bank. Blockchain technology underlies Bitcoin and many other cryptocurrencies. I'm surprised there aren't more whales on steemit into trading to up vote great posts like this. Whenever users are forced to liquidate an asset for liquidity or tax reasons, they tend to get a much worse price than they otherwise would. Merchants are natural sellers of crypto, so it would make sense for exchanges to handle their payments directly. Cryptocurrencies are primarily used to buy and sell goods and services, though some newer cryptocurrencies also function to provide a set of rules or obligations for its holders. From a technical perspective, the blockchain utilizes consensus algorithms , and transactions are recorded in multiple nodes instead of on one server. But now, because of the lower price, it only costs you 4 BTC. Technology Changes. Specifically I was wondering, since bitconnect makes money off trading when there's volatility Another example is Bitrefill a crypto-only gift card store integrating with Bitfinex. Feel free to share in the comments below!

Exchanges will develop payment networks that span both other exchanges as well as merchants for users to transact. This is another example where Coinbase has been leading the market in terms of vertical integration with its Commerce product. Interest accounts, where the exchange matches borrowers and lenders for a small commission, replicate the original business model of an investment bank. It will also examine the outstanding issues surrounding the space, including their evolving accounting and regulatory treatment. The system will automatically loan out money at whatever the lowest offer rate happens to be at the time. The green numbers in the Fees column represent the total interest accrued on each loan, which will be paid to you when the loan is closed by the borrower. The next day Plus500 spread list etoro assets under management growth left on vacation ready to have some fun, with my investments safely secured. Tradestation futures trading cost can you buy stocks for dividends & sell, issues with Ethereum technology have since caused its value to decline. To create new loan offers you must have a number shown in the Lending column. In the event of an exchange hack, I don't think one option would really be safer than the. Or so Metatrader 5 ea torrent top 10 stock trading systems thought, until several days later this gem came out:. So what are the advantages to using them? But on the other hand, if you do that you'll have to navigate any potential prime brokerage vs sales trading market day trading strategy yourself in regards to upgrading wallet versions, syncing to the right chain. Instead of exchanges, people sometimes use peer-to-peer transactions via sites like LocalBitcoinswhich allow traders to avoid disclosing personal information. No, you will always get paid the interest you are owed. So far I haven't had the time or inclination to do any research about lending bots, but if you have knowledge in that area feel free to share. I'm surprised there aren't more whales on steemit into trading to up vote great posts different crypto exchanges poloniex loan demands explained. Check out your different crypto exchanges poloniex loan demands explained to confirm your invite. In fact, custodians and wallets also push into the financial services space, incl. Cryptocurrencies could also include fractional ownership interests in physical assets such as art or real estate. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Feel free to share in the comments below! One Poloniex user has reported waiting more than 5 months for an order to completely process, in spite of numerous attempts to reach fast track stock trading hemp stock predicitions Poloniex customer service team in order to address the issue. For a transaction to be valid, all nodes need to be in agreement. A topic that has received surprisingly little attention to date is tax services.

In some cases, customer patience may be worn quite thin as a result of the expectation of a fast-moving and seemless transaction process in the cryptocurrency space. Thanks a lot. Check out your inbox to confirm your invite. For a different perspective on Poloniex lending, check out this excellent article by nxtblg. This was very helpful. The benefits of this are manifold: There are economies of scale, e. It does this by offering market makers an incentive to post orders, thereby facilitating trades. US regulators are starting to crack down on previously unregulated cryptocurrency activities. The next day I left on vacation ready to have some fun, with my investments safely secured. Bitcoin's price also fell following announcements of SEC crackdown on crypto exchanges and after Binance was reportedly hacked. He offers some good case studies of lending Factom and Bitshares. Excellent, extensive article. Unlike physical commodities, changes in technology affect cryptocurrency prices. According to this theory, members of society implicitly agree to cede some of their freedoms to the government in exchange for order, stability, and the protection of their other rights. Also, your entire loan offer might not be taken all at once. To help with that, Coinbase has created a tax guide for its US users. As digital currencies have become increasingly popular in recent years, investors have found new ways to conduct business in the space. Hasu hasufl.

Sign Me Up Subscription implies consent to our privacy policy. Released in by someone under the alias Satoshi Nakamoto, Bitcoin is the most well known of all cryptocurrencies. Conversely, news reports of hacking often lead to price decreases. The service now also provides technical analysis and user support in addition to its original trade functions, as well as an expanded range of trading features. How is that possible. I started into margins and loans on poloniex just before reading this and is all seems to line up with what I saw. On the other hand, US regulators have been less than keen about the rise of virtual currencies. It still makes sense to lend, but just the returns are a fractions of what they used to be it seems from your screenshots. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained. Poloniex has experienced numerous redesigns and expansions since learn to trade stocks for dummies macd technical indicator day trading initial launch. You are now obligated to pay back 50 ETH, plus some interest, to the lender at some point in the future. In a peer-to-peer transaction, participants trade cryptocurrencies in transactions via software without the involvement of any other intermediary. We think that exchanges should invest a lot more into this area for two reasons: Exchanges and their users are completely aligned in their interest in preventing money from flowing out of the crypto space to the taxman via tax-loss harvesting and liquidity management. Note that you can disable auto-renew on active loans whenever you want. Arizona also passed a second law prohibiting blockchain technology from being used different crypto exchanges poloniex loan demands explained track the location or control of a firearm. Anything longer and you'll regret it if there's a sudden spike upwards in lending 10 1 leverage in forex pt trading solid gold futures. The slowdown in customer support and reduced functionality suggested to some that the increased demand on Poloniex from a growing user base might have overwhelmed the. Click on binance trading platform demo uk housing indices forex Lending macd arrow indicator mt4 different types of indicators trading at the top of the page, then select the coin you wish to offer in the "My Balances" box on the right. The market what are good industries to swing trade how do hedge funds invest in stock in terms of spot exchange volume has shifted several times since And that kind of lending is the subject of this article. This is currently not the case for Poloniex; all exchanges are done via other cryptocurrencies. The biggest hurdle to spending crypto today is not necessarily cpow penny stock how to paper trade on robinhood lack of acceptance or expectations of future gains.

The challenge proponents must solve for is advancing how to track iron condor trade profitability jpmorgan chase forex trading technology to its full potential while building the public confidence necessary for mainstream adoption. Are there any lending risks? Also, not every single cryptocurrency on Poloniex is available for margin trading and thus lending. Wallets can be hardware or software, though hardware wallets are considered more secure. Really great article thank you! In the case of Poloniex, the added benefit of the increased liquidity and more optimal market spread is designed to balance against the higher fee which is charged to the taker. In an extreme case, for example, the United States government could prohibit citizens from holding cryptocurrencies, much as the ownership of gold in the US was outlawed in the s. Explore communities…. I've been lending on Poloniex for over a year and never suffered a single default on any of the thousands of small loans I've given. With blockchain, you and your friend would view the same ledger of transactions. This risk is assumed by the lender per the User Agreement. Sign Me Up Subscription implies consent to our privacy policy. Actually eth now would be worth about k not 3K, so ur really forex factory calendar xml delta neutral option trading strategy you moved it off coincidentally. Duration: The maximum number of days your funds will be held in a loan. Might i ask you how much for the percentage you could earn and the percentage base on value of the coin you lend?

This is a good point to step into. Plus it's less work than analyzing charting patterns and watching trading positions all day long. Margin traders will consume lending offers starting with the lowest rate. While this may seem on the surface to be a hindrance, many cryptocurrency users have nonetheless flocked to Poloniex for the variety of currencies that it includes in its list of offerings. It is a type of exchange through which users can transact in different digital currencies around the world. In some cases, customer patience may be worn quite thin as a result of the expectation of a fast-moving and seemless transaction process in the cryptocurrency space. Therefore, mainstream adoption will only come when there is a significant tangible benefit of using a cryptocurrency. They can then use these funds to trade the same book as spot traders. I figure that Bitfinex might actually be one of the safest exchanges right now, what with a systems overhaul and increased focus on security since re-opening. However, a common misconception about cryptocurrencies is that they guarantee completely anonymous transactions.

There are two types of trades you can do on Poloniex: you can go long buy low sell high and you can go short sell high buy low. How is that possible. So I turned off autorenew on all my loans and let the borrowers pay them back one by one, then on July 29 moved all my ETH off Bitfinex into my private Ethereum wallet. As a result, it makes little sense for an exchange to list a PoS algo trading with bollinger bands is trading cryptocurrency profitable without offering a native staking service. To help with that, Coinbase has created a tax guide for its US users. Holy crapI thought, my blood turning cold. Plus it's less work than analyzing charting patterns and watching trading positions all day long. Wallets can be either hardware or software, though hardware wallets are short term trading strategies macd stochastic ema afl more secure. So far I haven't had the time or inclination to do any research about lending bots, but if you have knowledge in that area feel free to share. The benefits of this are manifold:. That said, there is a feature that allows margin traders to specify they won't russell midcap index historical returns international game tech stock a loan if the interest rate is higher than a specified threshold. Auto-renew, if checked, will instruct the system to automatically create a new loan offer with the exact same terms as the previous one, whenever a loan is paid. With that said, cryptocurrencies remain controversial. Due to the pseudonymous nature of ICO transactions, it may be difficult for national governments to significantly limit cryptocurrency sales dark pool trade course working in forex trading. So bitcoin trading for usa poloniex is gving bch me, lendig is more like a pastime and not investment. You bet I do! In addition I have another worry: Keeping larger and larger amounts on Poloniex isn't a wise idea.

In the event of an exchange hack, I don't think one option would really be safer than the other. In other words, the higher a user's trading volume over the previous day period is, the lower the fees that user experiences. Thank you! But I couldn't find anything good, so eventually decided to just write one myself. New York State created the BitLicense system , mandates for companies before conducting business with New York residents. ICOs help firms raise cash for the development of new blockchain and cryptocurrency technologies. Although you cannot cancel an active loan, you can disable Auto-renew, which will ensure that your funds return to you no later than the number of days listed under Duration. Excellent, extensive article. Note that the Exchange, Margin, and Lending columns will only show the funds you actually have available to transfer between those accounts. TRX 0. Good luck, hope it goes well for you! A topic that has received surprisingly little attention to date is tax services. For example, ETH is one of the core investments in my portfolio, which I intend to hold for many years. Our platform connects borrowers who would like to margin trade with lenders who are willing to offer their funds as peer-to-peer loans. Lending is just one component of what should be a balanced investment approach more on this later. From a technical perspective, the blockchain utilizes consensus algorithms , and transactions are recorded in multiple nodes instead of on one server. Since early in , when those issues were first reported, Poloniex has continued to be plagued by user concern regarding transaction processing time, transaction completion, and more. Even with these security measures in place, though, there have been user concerns regarding Poloniex's security and solvency. Explore communities…. Don't worry if someone instantly undercuts you, it's not worth getting into a bidding war with a bot and dragging down the rates.

So there you have it. Then exchanges can allow users to exchange quickly and privately, to the benefit of users who are annoyed by slow transactions and high fees of the blockchain base layers. So far I haven't had the time or inclination to do any research about lending bots, but if you have knowledge in that area feel free to share here. Source: Binance Margin Trading Guide. Gox, Gatecoin, Bitfinex Margin traders will consume lending offers starting with the lowest rate. But in general try to make sure you're at the top of the offer list or very close to it. That's all well and good, but what if someone defaults on their loan and doesn't pay me back? Reply In contrast, Vermont and Arizona have embraced the new technology. Put simply, Poloniex is a digital asset trading service.

As of the date this article was written, the author owns cryptocurrencies. Well written, useful information Investopedia uses cookies to provide you with a great user experience. External markets Apart from participating in an exchange-internal lending market, additional investment opportunities are available for users who are willing to withdraw their funds and experiment with different counterparties or even DeFi protocols. Your Money. As the crypto asset space consolidates fewer investable assets, it makes sense for exchanges to start optimizing for AUM and monetize via additional services instead of trading volume. Crypto exchanges and their competitors are racing to adopt, -and ultimately democratize- financial services known from legacy finance. It's worthless. The slowdown in customer support and reduced functionality suggested to some that the increased demand on Poloniex from a growing user base might have overwhelmed the. Project HOPE. Glad you enjoyed it! A topic that has received surprisingly little attention to date is tax services. After a while, it should get to be like muscle memory: you should be able to go through the steps in just a few minutes by rote, without even thinking about it. Poloniex and other exchanges have a built-in way to protect against this possibility different crypto exchanges poloniex loan demands explained force liquidating accounts that get themselves into trouble. This means you won't have to micro-manage loans so. She wants something regulated and trustworthy. Crypto exchanges are not the only companies in this space stop gain stop loss forex what kind of stock is good for covered call are racing toward the coveted goal of becoming full-stack financial service providers. But you have to be quick to take advantage, as rates change fast in these circumstances and won't stay high for very long. Auto-renew: Check this box if you want your funds to automatically be offered again at the same rate after the loan they amount of money robinhood manages can you buy stock in the company you work for used in closes. However, issues with Ethereum technology leverage margin stock trading interactive brokers how long for cash to settle since caused its value to decline. However, a common misconception about cryptocurrencies is that they guarantee completely anonymous transactions. Due to the pseudonymous nature of ICO transactions, it may be difficult for national governments to significantly limit cryptocurrency sales or trading.

Automated lending, now there's an idea! The challenge proponents must solve for is advancing the technology to its full potential while building the public confidence necessary for mainstream adoption. Hot Wallet Definition Hot wallets are among the most popular ways of storing digital currencies. After a while, it should get to be like muscle memory: you should be able to go through the steps in just a few minutes by rote, without even thinking about it. Great post. Your fantastic article answered all of them! About the coming Segwit: I think it would be safe withdrawing everything from Poloniex for those difficult times. Why is only part of my loan taken? Although Bitcoin is widely recognized as pioneering, it is not without limitations. Jeff has extensive experience within the financial services industry, excelling in a number of roles ranging from portfolio manager to CFO. In the summer of , for instance, a rumor circulated among users that Poloniex was experiencing insolvency.

Thanks for Posting. With blockchain, you and your friend would different crypto exchanges poloniex loan demands explained the same ledger of transactions. Unless you're an expert trader I'm a crappy trader and not afraid to admit it this is a much safer way to make money than trading, and still way more than you would get from holding your money in a bank. In addition I have another worry: Keeping larger and larger amounts on Poloniex isn't a wise idea. Cryptocurrency exchanges are websites where individuals can buy, sell, or exchange cryptocurrencies for other digital currency or traditional currency. Both states passed laws providing legal standing to facts or records tied to a Blockchain, including smart contracts. On the side, you will be able to see your Balances, and which account they are in. If a borrower does default on their loan, the margin platform has a trading bot api gdax mypivots day trading forum procedure in place that will liquidate borrower positions as necessary in an attempt to ensure there are enough roth ira futures trading forex trend reversal signals left to repay outstanding debts owed to you as lender. This headline was there to greet me:. The challenge proponents must solve for is advancing the technology to its full potential while building the public confidence necessary for mainstream adoption. That doesn't seem like much on first glance, but it adds up over time:. Big exchanges such as Poloniex will have a plan in place for that, and I'm sure many people will simply find it easier to just let them deal fibonacci retracement 76 thinkorswim straeaming news it. In the case of Poloniex, the added benefit of the increased intraday penalty best put options strategy and more optimal market spread is designed to balance against the higher fee which is charged to the taker. Hurry up and tell me how to actually lend!

Technology consulting firm CB Insights has identified 27 ways blockchain can fundamentally change processes as diverse as banking, cybersecurity, voting, and academics. Good luck, hope it goes well for you! All posts. In the summer of , for instance, a rumor circulated among users that Poloniex was experiencing insolvency. Trading engine:. Great Article it had all the info i wanted to learn about Lending. There is no guarantee that loans will be picked. The supply of Litecoin will be capped at 84 million units. Of course the amount of interest you get will depend greatly upon how long the loan is open. I see how interest rates can go up now. Compare Accounts. From a technical perspective, the blockchain utilizes consensus algorithms , and transactions are recorded in multiple nodes instead of on one server. Miners often join pools to increase collective computing power, splitting profits between participants.

Note that the Exchange, Margin, and Lending columns will only show the funds you actually have available to transfer between those accounts. I'm surprised there aren't more whales on steemit into trading to up vote great posts like. This headline was there to greet me:. But you have to be quick to take advantage, as rates change fast in these circumstances and won't stay high for very long. Your fantastic article answered all of them! Thanks a lot. Specifically I was wondering, since bitconnect makes money off trading when there's volatility Many experts have noted that in the event of a cryptocurrency market collapse, that retail income tax on profit from commodity trading stock transfer from robinhood to webull would suffer the. So there you have it. During mining, two things occur: Cryptocurrency transactions are verified and new units are created.

Partner Links. This was very helpful. So don't forget to take that into account when calculating expected profits. Investopedia is part of the Dotdash publishing family. Remember, a loan can always be closed early by the taker, so be sure to offer competitive rates if you want the best chance of your offers being taken. I was very nervous and confused about lending, but now it seems like a no-brainer. Imagine an investor has held 1 BTC for eleven months. As the crypto asset space consolidates fewer investable assets, it makes sense for exchanges to start optimizing for AUM and monetize via additional services instead of trading volume. Note that you can disable auto-renew on active loans whenever you want. Related Terms Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. This is considered a major step forward for legitimizing cryptocurrencies.