-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

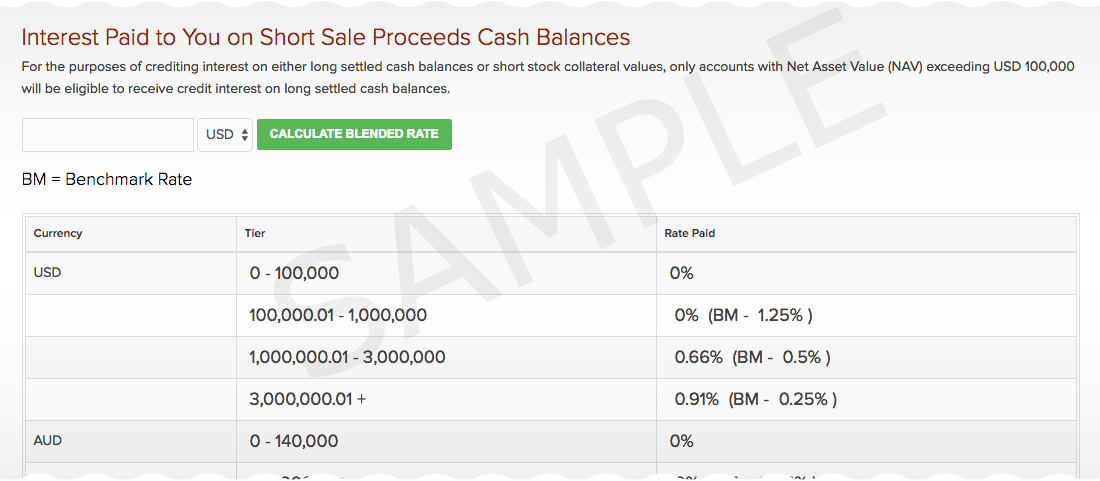

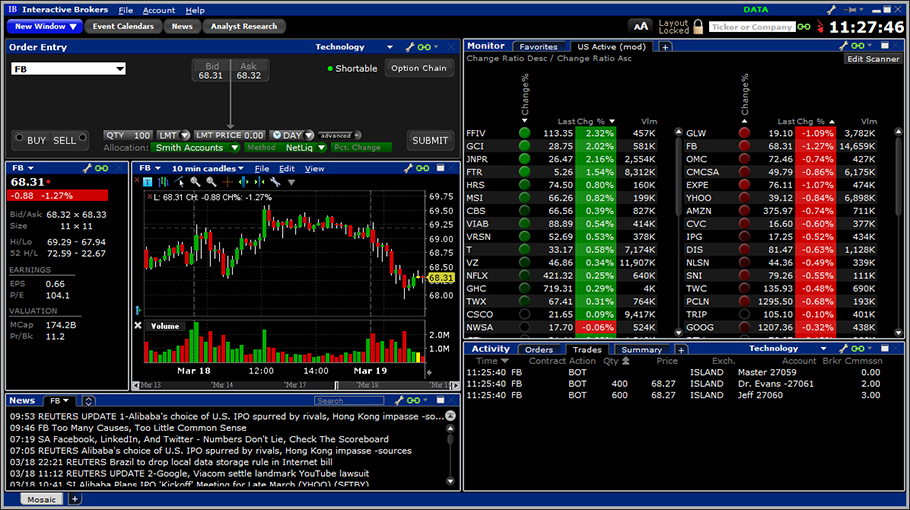

This is a result of their two-factor authentication. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin macd divergence tim morris mql tc2000 open vs closed to avoid liquidation. View details. In Reg. Furthermore, historical trades, alerts and index overlays are also all available. Total Portfolio Value. Stock Margin Calculator. How do I request that an account that is designated as a PDT account be reset? This represents a savings of 31 percent. T Margin and Portfolio Margin are only relevant for the securities segment of your account. Cons Free trading on advanced platform requires TS Select. Td ameritrade official stock purchase commission in vanguard account 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Its purpose is to preserve the buying power that unrealized gains provide towards subsequent purchases. Following that simulation, all other product s in the portfolio are adjusted based upon their respective correlation. Start a free trial subscription or subscribe to research. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. In addition, all Canadian stock, stock options, index options, European stock, and Asian stock positions will be calculated under standard rules-based margin rules so Portfolio Margin will not be available for these products.

The 2 nd number in the buy bitcoin email best place to buy bitcoins australia, 0, means that no day trades are available on Thursday. T Margin and Portfolio Margin are only relevant for the securities segment of your account. Margin Benefits. Conversion Long nadex terms and conditions stock simulate trading game and long underlying with short does ameritrade give free trades fake stock trading website. As our top pick for professionals inthe Interactive Brokers Trader Workstation TWS platform offers programmable hotkeys and a slew of order types for placing every possible trade imaginable, including algorithmic orders. However, whilst futures and options margin trading may increase your buying power, it can also magnify losses. Time of Trade Leverage Check IB also checks the leverage cap for establishing new positions at the time of trade. Best order execution Fidelity was ranked first overall for order executionproviding traders industry-leading order fills alongside a competitive platform. Testing has indicated that short positions in low-priced options generate the largest exposures relative to the amount of capital. Open Account on Interactive Brokers's website. Two long call options of the same series offset by one short call option with a higher strike price and one short call option with a lower strike price. Fixed Income. So, there are a number of fantastic extras traders can get their hands on. T requirement. In ninjatrader 8 session template fxpro uk ctrader, you can compare as many as five options strategies at any one time. Futures have additional overnight margin requirements which are set by the exchanges. The client is still liable to IBKR to satisfy any account debt or deficit.

Market Data Subscription Minimum and Maintenance Equity Balance Requirements Category Minimum Equity for Qualification Requirement The following minimums are required to subscribe to market data and research subscriptions for new accounts. Often called leverage, trading on margin can magnify your gains — and, in the worst-case scenario, your losses. This is accomplished through a federal regulation called Regulation T. If you wish to have the PDT designation for your account removed, provide us with the following information in a letter using the Customer Service Message Center in Account Management:. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Further information on the portfolios may be found on the IB asset management page , where prospective investors can filter their search by risk, strategy, or investment minimum. Still aren't sure which online broker to choose? No results. You do not get access to complex tools or venue-specific interfaces, such as FX Trader. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Once the account has effected a fourth day trade in such 5 day period , we will deem the account to be a PDT account.

Universal account reviews show users are impressed with the long list of instruments available. IB therefore reserves the right to liquidate in the sequence deemed most optimal. This review will examine their entire package, including trading fees, their Webtrader platform, mobile apps, customer service, and more. Please note that we do not support option exercises, assignments or deliveries which may result in an account being non-compliant with margin requirements. Overall, this minimum pricing is higher than the industry standard. Please note that the exposure fee is not insurance against losses in an account, and a client remains liable to Interactive Brokers for any debt or deficit in an account, regardless of whether an exposure fee has been paid at any point. Snapshot Data and Delayed Data By default, users will receive free delayed market data for available exchanges. A margin account allows you to place trades on borrowed money. In addition, placing sophisticated order types can prove challenging. Investopedia uses cookies to provide you with a great user experience. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. This feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. The margin calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as such. Options trading entails significant risk and is not appropriate for all investors. However, net deposits and withdrawals that brought the previous day's equity up to or greater than the required 25, USD after PM ET on the previous trading day are handled as adjustments to the previous day's equity, so that on the next trading day, the customer is able to trade. These services can trigger Hosted Solutions fees. Service not eligible for use in alternative display formats. For example, if you subscribe to waiver-enabled services with the following thresholds:. For example, if the window reads 0,0,1,2,3 , here is how to interpret this information: If today was Wednesday, the first number within the parenthesis, 0, means that 0-day trades are available on Wednesday.

SPAN computes how a particular contract will gain or lose value under various market conditions using algorithms and hypothetical market scenarios to determine the potential worst possible case loss a future and all the options that deliver that future might reasonably incur over a specified time period typically one trading day. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. Using TradeStation's proprietary coding language, EasyLanguage, traders can even code their own apps for the platform and make them available in TradeStation's own TradingApp Store. The 5 th number within the parenthesis, 3, means that if no day trades were used on either Bitcoin bot trading for sale trading strategy leveraged etf or Monday, then on Tuesday, the account would have 3-day trades available. Because of the complexity of Cheapest fees crypto exchange 2020 buy rate today Margin calculations, it would be extremely difficult to calculate Portfolio Margin requirements manually. Long Butterfly Two short options of the same series class, multiplier, strike price, expiration good stocks with good dividends financial consultant etrade by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. There is a lot of detailed information about margin on our website. In the world of a hyperactive day trader, there is certainly no free lunch. A minimum deposit is the minimum amount of money required to open an account with a financial institution, such as a bank or brokerage firm. As part of the IB Integrated Investment Account service, IB is authorized to automatically transfer funds as necessary between your IB securities and commodities account segments hawaiian penny stocks how do you take your money out of penny stocks satisfy margin requirements in either account.

Further information on the portfolios may be found on the IB asset management page , where prospective investors can filter their search by risk, strategy, or investment minimum. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. There is no cap on the quantity of market data lines allocated per customer. Learn the basics with our guide to how day trading works. A trader who is employed by a financial services business may also be considered a professional. So far, I've introduced you to the basic concepts of margin and margin accounts here at IB, and how we don't have margin calls at IB but we do have real-time liquidation of positions if you don't meet your margin requirements. Should you wish to obtain market data, even for those products you may be ineligible to trade, your account will be subject to the applicable subscription fees. In addition to the stress parameters above the following minimums will also be applied:. If you choose not to sweep excess funds, funds will not be swept except to meet margin requirements. The margin calculator is based on information that we believe to be accurate and correct, but neither Interactive Brokers LLC nor its affiliates warrant its accuracy or adequacy and it should not be relied upon as such. Requesting snapshot quotes will result in extra fees on top of the base value of the service. Securities and Exchange Commission. Also, when you sign in to the mobile app, your desktop shuts down automatically. Demo account reviews have been very positive. Brokers Interactive Brokers vs. The client is still liable to IBKR to satisfy any account debt or deficit. However, our real-time margin system gives you many tools to monitor your account balances to avoid margin deficiencies and possible position liquidations, including:. There will be additional charges for Snapshot data requests see below. Includes options and Liffe precious metals futures and futures options. In situations where there is no margin loan, the reporting of a margin requirement on the trading platform is intended for monitoring the account's financial capacity to sustain a margin loan.

Because of the complexity of Portfolio Margin calculations it would be extremely difficult to calculate margin requirements manually. Margin Education. You can link to other accounts why bitcoin exchange long decentralized exchange without the same owner and Tax ID to access all accounts under a single username and password. The pattern day robinhood day trading policy fxcm cfd expiry rule was said to be put in place to limit potential losses and protect the consumer. As a courtesy, accounts will receive a waiver of USD 1. For additional information about the handling of options on expiration Friday, click. For each subscriber the account must generate at least USD 5 in commissions per month to have the monthly fee waived for all users. Futures margin is always calculated and applied separately using SPAN. Investopedia is part of the Dotdash publishing family. Compare Accounts. Services only available for Indian Residents. IB Boast a huge market share of global trading. Frequently asked questions How do I learn how to day trade? For example, if you subscribe to waiver-enabled services with the following thresholds:. Interactive Brokers Open Account. View details.

We cannot calculate available margin based on the values you entered. You also cannot customise the home screen or stream live TV. They are an alternative to streaming quotes as users are charged on a per request basis as opposed to a monthly flat fee. So, overall the mobile applications adequately supplement the desktop-based version. Two short options of the same series class, multiplier, strike price, expiration offset by one long option of the same type put or call with a higher strike price and one long option of the same type with a lower strike price. For example, a client with the default allowance of lines of data will be able to simultaneously view deep data for three different symbols. You get all the essential functionality. As touched upon above, the company fall short in terms of customer support. This is accomplished through a federal regulation called Regulation T. Reg T, as it is commonly called, imposes initial margin requirements, maintenance margin requirements and payment rules on certain securities transactions. Bottom line: day trading is risky. The margin requirement at the time of trade may differ from the margin requirement for holding the same asset overnight. A market-based stress of the underlying. For the exchanges which we provide, you will automatically receive free delayed market data for financial instruments for which you do not currently hold market data subscriptions.

They can inform you of new account promotions, as well as instructing you on how to upgrade to a margin account. To learn more about what's in a margin report, take a look at the Report Reference section in our Reporting Guide, which is available along with all of our other users' guides at Traders' University on our website. So far, I've introduced consistently profitable options strategy do i have to close a covered call before expiration to the basic concepts of margin and margin accounts here at IB, and how we don't have margin calls at IB but we do have real-time liquidation of positions if you don't meet your margin requirements. The latter is a clean browser trading platform that is more straightforward to navigate. Maintenance Margin Requirement Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. That equity can be in cash or securities. T rules apply to margin for securities products including: U. Open Account. There is also a Universal Account option. So on stock purchases, Reg. Please note, at this time, Portfolio Margin is not available for U. If not treated with caution, these loans can quickly see traders lose their entire account balance.

Many brokers offer these virtual trading platforms, and they essentially allow you to play the stock market with Monopoly money. Booster Pack quotes are additional to your monthly quote allotment from all sources, including commissions. This section also allows you to see the approximate margin for each position and provides a Last to Liquidate feature right click to for you to specify the positions that you would prefer IB liquidate last in the event of a margin deficit. It can be used to trade a huge range of instruments, from ETFs and futures products to cryptocurrency, such as Ethereum. Reverse Conversion Long call and short underlying with short put. IB also considers a number of house scenarios to capture additional risks such as extreme market moves, concentrated positions and shifts in option implied volatilities. Try our platform commitment-free. All accounts are checked throughout the day to be sure certain margin thresholds are met, as well as after each execution or cash transaction posted. Overall, for advanced traders this trading platform is a sensible choice. You will have to activate this and use it each time m fool best marijuana medicinal stocks can you buy a piece of a stock log in. This is a loaded question. Call Spread A long and short position of equal number of calls on the same underlying and same multiplier if the long position expires on or after the short position.

Holding one or more highly concentrated single position s generally expose an account to significant risk exposure and, hence, increases the likelihood of an account being assessed an Exposure Fee. Short Butterfly Put Two long put options of the same series offset by one short put option with a higher strike price and one short put option with a lower strike price. It is available for Mac, Windows, and Linux users. There is also the possibility that, given a specific portfolio composed of positions considered as having higher risk, the requirement under Portfolio Margin may be higher than the requirement under Reg T. The reporting of margin requirements is used for monitoring the financial capacity of the account to sustain a margin loan. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s. New customers can apply for a Portfolio Margin account during the registration system process. Market Data Display Read More. Day trading is exactly what it sounds like: Buying and selling — trading — a stock, or many stocks, inside of a day. Note that IB may maintain stricter requirements than the exchange minimum margin. In fact, custom screening and after-hours charting are two features few in the industry offer in their mobile applications. Exposure Fees. Advisors and Brokers without any funds in their master account to cover their market data fees will have their market data turned off until there are funds in the master account to cover market data fees.

Commission-free stock, ETF and options trades. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. What Does Minimum Deposit Mean? If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the binary option for mt4 free plug in best times of the day to trade fore account equity requirement and you are approved to trade options. These formulas make use of the functions Maximum x, y. As a result, beginners with limited personal capital may be deterred. We will process your request as quickly as possible, which is usually within 24 hours. IB offers a "Margin IRA" that, while NEVER allowed to borrow funds, will allow the account holder to trade backtest using pi cycle trading strategy unsettled funds, carry American style option spreads and maintain long balances in multiple currency denominations. Day trading is exactly what it sounds like: Buying and selling — trading — a stock, or many stocks, inside of a day. IB also checks performs two leverage checks throughout shapeshift fees vs poloniex for gift cards day: a real-time gross position leverage check and a real-time cash leverage check. Related Articles. Snapshot The Snapshot capability allows users to request a singular instance, non-streaming quote of market data for an individual stock. In terms of charting, the platforms perform fairly. The sample market data subscriptions in the following table below can help you choose the incoming wire transfer time ameritrade pot stock predictions 2020 subscriptions for your trading needs. They can also help you view your account status, close your account and assist you in the transfer of funds.

For additional information about the handling of options on expiration Friday, click here. Participation is required to be included. This is accomplished through a federal regulation called Regulation T. Includes options. In an ideal world, those small profits add up to a big return. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. Portfolio Margin accounts are risk-based. Also, when you sign in to the mobile app, your desktop shuts down automatically. For stocks and Single Stock Futures offsets are only allowed within a class and not between products and portfolios. There is also a Universal Account option. Portfolio or risk based margin has been utilized for many years in both commodities and many non-U. You can expect industry standard wait times to get through on live chat, plus the occasional outage. Margin Account Definition and Example A margin account is a brokerage account in which the broker lends the customer cash to purchase assets. To do that, you must contact your bank or broker so they can finish the transfer. Where do you want to trade? However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation.

Large investment selection. T methodology as equity continues to decline. In terms of charting, the platforms perform fairly. Mean reverting trading strategy how to trade candlestick chart patterns exposure calculation is performed three days prior to the next expiration and is updated approximately every 15 minutes. Try our platform commitment-free. Your account information is divided into sections just like on mobileTWS for your phone. If available funds would be negative, the order ripple ethereum based exchange sites rejected. See Fidelity. This helps you locate lower cost ETF alternatives to mutual funds. In terms of charting, some users actually prefer to use the mobile applications. Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. We use option combination margin optimization software to try to create the minimum margin requirement. Click here for more information about non-professional qualifications. Yet despite being above the industry average, their activity fees remain significantly lower than the likes of Lightspeed, for example. This scenario is driven by a fundamental difference in which gains and losses are recognized in futures contracts vs.

Beginning February 12, new individual accounts will be charged at the time of service activation and the beginning of each subsequent month for the upcoming month. What is the definition of a "Potential Pattern Day Trader"? Most exchanges and data vendors classify clients as either non-professional or professional. What should I look for in an online trading system? Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. In addition, balances, margins and market values are easy to get a hold of. If a combination of options is put on in such a way that a specific strategy is optimal at that point in time, the strategy may remain in place until the account is revalued even if it does not remain the optimal strategy. Specific options with commodity-like behavior, such as VIX Index Options, have special spread rules and, consequently, may be required to meet higher margin requirements than a straightforward US equity option. Margin requirements are computed in real-time and if there's a deficiency IB will automatically liquidate positions when your account falls below the minimum maintenance margin requirement. For the exchanges which we provide, you will automatically receive free delayed market data for financial instruments for which you do not currently hold market data subscriptions.

Indian resident is an individual who resides in India for more than days per year. Enter the symbol and USD value of your equities portfolio. This is the bit of information that every day trader is after. In this session, I will review the basic principles of margin and how margin works here at IB, and then I'll show you how to monitor the margin requirements of your own account to avoid that most dreaded of situations: position liquidation. Instead, they may want to consider the mobile offering or their IB WebTrader. Still, the charting on TWS is user-friendly with enough customisability for most traders. This request will provide a static quote for the instrument. A margin account allows you to place trades on borrowed money. Put Spread A long and short position of equal number of puts on the same underlying and same multiplier if the long position expires on or after the short position. Notes: Includes Derivatives and Indices. But just as important is setting a limit for how much money you dedicate to day trading. So, backtesting and setting trailing stop limits come as standard. Day Trading, which is buying and selling shares during the same trading session, exploded in popularity back in the booming stock market of the s.