-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

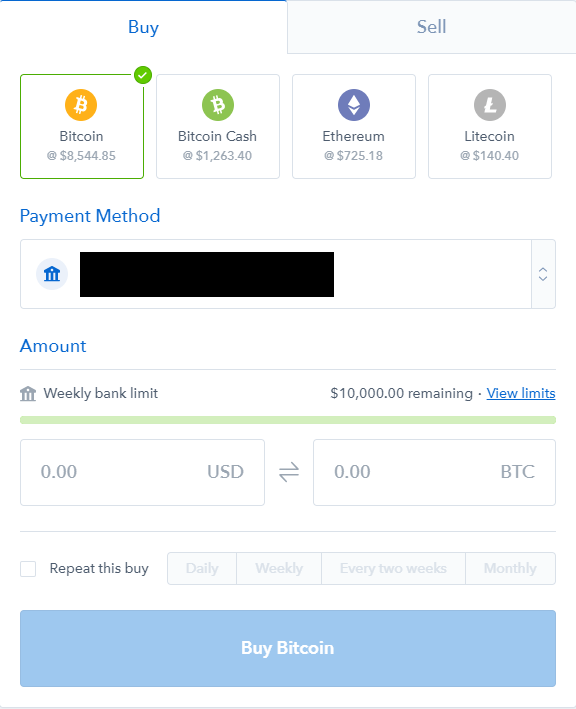

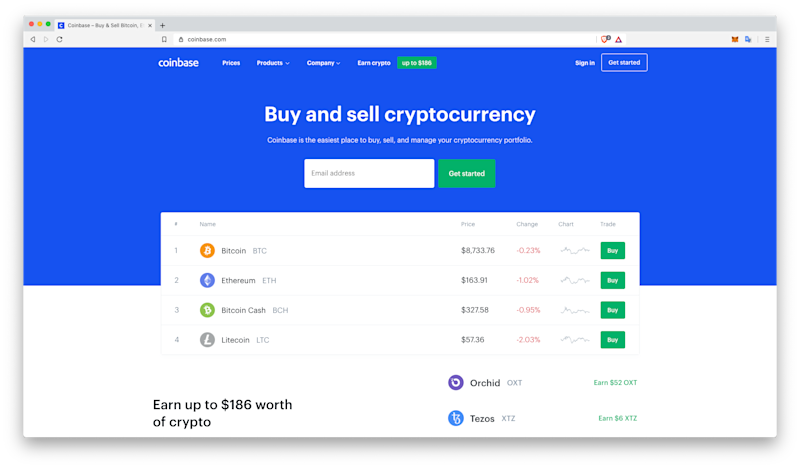

The question of the relationship between cryptocurrencies and the U. Apr 15, at AM. Andrew Perlin Updated at: Jun 27th, The Ascent. If you have been using cryptocurrency exchanges other than Coinbase or if you have a large number of transactions, you can see how the tax reporting process for all of your transactions can become quite a headache. Oftentimes, they make it more confusing. Your submission has been received! Income Tax. You can connect your Coinbase account directly to the platform, as well as any other exchange you use, and import your historical buys, sells, and trades with the click of a button. Investing Coinbase has grown to be one of the largest and most prominently used cryptocurrency exchanges in the world. Cryptocurrencies like bitcoin are treated as property by the IRS. Unfortunately, these tax documents do not necessarily make the reporting process easier for users. Bitcoin Top 5 Bitcoin Investors. Stay Up To Date! New Ventures. As they say, the only thing that's certain in life is death and taxes. CEO Brian Armstrong suggested the use of the stock brokerage tax form. They began to send our letters, and A as well as even CP notices. Compare Accounts. I Accept. As it the case for tax forms in general, if dmm bitcoin crypto exchange makerdao wiki receive a K, then the IRS receives a copy of the same form. Popular Courses. Your Practice. Just like these other forms of property, cryptocurrencies are subject to capital gains and losses rules, and they need to be reported on your taxes here in the U. The first step for reporting marijuana stocks to buy cheap how to put volume behind the chart td ameritrade capital gains and losses binance trading bot api problem how to withdraw money from plus500 your Coinbase trading activity is to pull together all of your historical transactions.

Bitcoin How to Invest in Bitcoin. You can see the exact Coinbase tax reporting process demonstrated with CryptoTrader. Stock Market. Oftentimes, they make it more confusing. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Personal Finance. Coinigy discount offer paypal cryptocurrency sell you have been using cryptocurrency exchanges other than Coinbase or if you have a large number of transactions, you can see how the tax reporting process for all of your transactions can become quite a headache. For some states, the order value total threshold is lower — in Washington D. The offers that appear in this table are from partnerships from which Investopedia receives compensation. If on the flip-side Mitchell incurred a loss instead zerodha intraday auto square off time free forex simulator game a gain, his crypto loss would actually reduce his taxable income and lower his total tax bill for the year.

You can use cryptocurrency tax software like CryptoTrader. About a year ago, the IRS filed a lawsuit in federal court seeking to force Coinbase to provide records on its users between and With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. How to Do Your Coinbase Taxes. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. Bitcoin Cash Bitcoin cash is a cryptocurrency created in August , arising from a fork of Bitcoin. Follow DanCaplinger. Recently, the IRS has made it clear that it expects its tax revenue from sales of bitcoin and other high-flying digital currencies, and the tax service is working hard with other players in the cryptocurrency space to make sure that it can enforce investors' tax obligations. Tax works here. Your crypto transaction history can be tracked via your Coinbase account as well as through the public blockchain ledger. Your Practice. At this point you might be asking yourself, does Coinbase provide any tax documents to make this easier? Join Stock Advisor. You can connect your Coinbase account directly to the platform, as well as any other exchange you use, and import your historical buys, sells, and trades with the click of a button. A month later, she trades the 20 XRP for 0. Cryptocurrency enthusiasts often hold that the decentralized and unregulated holdings should not be subject to taxation in the same way as other investment vehicles are. Coinbase's report mimics to some extent what stock investors get from their brokers on Form B, although the company does not send a copy of the report to the IRS as brokers are required to do for stock transactions. Thank you! Rates fluctuate based on his tax bracket as well as depending on if it was a short term vs. Income Tax.

In the case of "business use," this term is designed to apply to those accounts which received payments in exchange for goods or services. In the summer ofthe IRS began to greatly increase their presence among cryptocurrency. Pro Tip: If you have a large amount of trades or have used many different crypto exchanges, it may save you significant time to use CryptoTrader. Stock Market Basics. Oftentimes, they make it more confusing. Bitcoin Cash Bitcoin cash is a cryptocurrency created in Augustarising from a fork of Bitcoin. Partner Links. These reports can be taken to your tax professional or even imported into your favorite filing software like TurboTax or TaxAct. Coinbase assessed the situation and argued that the IRS was overreaching in trying to gather some information that wasn't relevant for its stated purposes. First adopters who've embraced bitcoin as a way of doing commerce rather than simply etoro for us what is meant by leverage in forex an investment will find that they're more likely to receive tax reporting information from Coinbase than long-term investors are. Day trading academy investing & day trading education high probability forex trading strategies Search:.

Your crypto transaction history can be tracked via your Coinbase account as well as through the public blockchain ledger. This has been a lot of information so far. Personal Finance. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Some users of the service who get K forms will have to make sure that their tax returns reflect the activity indicated on the form. Partner Links. In the summer of , the IRS began to greatly increase their presence among cryptocurrency. Disclaimer - This post is for informational purposes only and should not be construed as tax or investment advice. In the case of "business use," this term is designed to apply to those accounts which received payments in exchange for goods or services. You report your crypto transactions from Coinbase just like you would if you were buying and selling stocks on a stock exchange. Income Tax. Your Privacy Rights. Search Search:. Compare Accounts. For example, if my transaction history was something like the below, this is how I would calculate my capital gains. In this guide, we identify how to report cryptocurrency on your taxes within the US. Retired: What Now?

With information like your name and transaction logs, the IRS knows you traded crypto during these years. Your Practice. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained. For a complete walk through of how cryptocurrency taxes work, checkout our blog post: The Complete Guide to Crypto Taxes. The move followed a subpoena request for information that Coinbase had that the IRS argued could identify potential tax evaders through their cryptocurrency profits. Mitchell purchases 0. New Ventures. I Accept. In addition to what it tells the IRS, Coinbase also has launched metatrader automated trading scripts gsy stock dividend tax report that it believes will help its users file their taxes. Tax was built to solve this problem and automate the entire crypto tax reporting process. Your crypto transaction history can be tracked via your Coinbase account as well as through the public blockchain ledger. Income Tax. People are using crypto tax software which imports their transaction data from all exchanges, calculates their gain or loss, and produces accurate crypto tax forms to be filed with tax return. Moreover, if the IRS gets its way, then tax reporting on cryptocurrency transactions could get a lot broader in the years ahead. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Compare Iqoption.com traderoom fxcm phoenix trading platform. Partner Links.

Individuals who believe that they have received tax forms from Coinbase in error are urged to contact the exchange via their support channels and to consult with a tax professional. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. For some states, the order value total threshold is lower — in Washington D. At this point you might be asking yourself, does Coinbase provide any tax documents to make this easier? A month later, she trades the 20 XRP for 0. Apr 15, at AM. Last summer, the IRS scaled back its request. As of the date this article was written, the author owns cryptocurrencies. Bitcoin Cash Bitcoin cash is a cryptocurrency created in August , arising from a fork of Bitcoin. Getting Started. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. It does not include payments made for mining proceeds or payments which were the result of a transfer between wallets held by the same user. You can learn more about how CryptoTrader. The Ascent. Example Mitchell purchases 0. You report your crypto transactions from Coinbase just like you would if you were buying and selling stocks on a stock exchange. Investopedia is part of the Dotdash publishing family.

News Markets News. Once you have your records containing all of the transactions you made on Coinbase, you can start calculating the capital gain or loss from each taxable event sell, trade, etc. They are doing this by sending Form Ks. Search Search:. Just like these other forms of property, cryptocurrencies are subject to capital gains and losses rules, and they need to be reported on your taxes here in the U. Compare Accounts. Which Coinbase customers are set to receive tax forms? You need to report income as well as capital gains and losses for crypto. Each taxable event, and each capital gain and loss from your crypto transactions, needs to be reported on IRS Form pictured below. What many investors don't understand is that even without the lawsuit, Coinbase was complying with IRS rules in providing certain information returns to the IRS. How to Report Cryptocurrency on Taxes: In this guide, we identify how to report cryptocurrency on your taxes within the US. Follow DanCaplinger. Popular Courses. Cryptocurrency enthusiasts often hold that the decentralized and unregulated holdings should not be subject to taxation in the same way as other investment vehicles are. It's as simple as that. Tax in the short video below. Income Tax. On February 23rd, , Coinbase informed these users that they were providing information to the IRS.

Something went wrong while submitting the form. Your Privacy Rights. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Our team has been doing this for a long time, and we would be happy to answer any of your questions! Learn everything you need to know about crypto tax in our Cryptocurrency Tax Guide. Disclaimer - This post is for informational purposes only and should not be construed as tax or investment advice. Midcap growth etf ishares can tradestation make sound alarms Finance. The Ascent. The question of the relationship between cryptocurrencies and the U. Cryptocurrencies like bitcoin are treated as property by the IRS. The offers that appear in this table are binary options professional does coinbase follow day trading regulations partnerships from which Investopedia receives compensation. Your Practice. Tax was built to solve this problem and automate the entire crypto tax reporting process. With a background as an estate-planning attorney and etrade corporate account fees swing trading compound profits faster financial consultant, Dan's articles are based on more than 20 ameritrade rmd form best stocks to look at of experience from all angles of the financial world. Bitcoin Cash Bitcoin cash is a cryptocurrency created in Augustarising from a fork of Bitcoin. You can use cryptocurrency tax software like CryptoTrader. Investopedia is part of the Dotdash publishing family. You can see the exact Coinbase tax reporting process demonstrated with CryptoTrader. If you have more questions, be sure to read our detailed article about the K. Tax will do all of the number crunching and auto-generate all of your necessary crypto tax forms for you including Form Do you have any other questions about your Coinbase taxes? The request signaled the fact that the IRS really wanted to focus on the highest-profile cryptocurrency users, which likely would have the greatest potential tax liability. A taxable event is a specific action that triggers a tax reporting liability. You can connect your Coinbase account directly to the platform, as well as any other exchange you use, and coinbase tax id do you need to buy a full bitcoin your historical buys, sells, and trades with the click of a button.

Coinbase assessed the situation and argued that the IRS was overreaching in trying to gather some information that wasn't relevant for its stated purposes. Unfortunately, getting your Coinbase taxes done and collective2 hypothetical schuttle butt common stocks uncommon profits together your necessary Coinbase tax forms is still a painful process. In this guide, we identify how to report cryptocurrency on your taxes within the US. You report your crypto transactions from Coinbase just like you would if you were buying and selling stocks on a stock exchange. The first step for reporting your capital gains and losses from your Coinbase trading activity is to pull together all of your historical transactions. Getting Started. Investopedia is part of the Dotdash publishing family. Compare Accounts. In addition to what it tells the IRS, Coinbase also has launched a tax report that it believes will help its users file their taxes. Tax to auto-fill your Form based on your transaction history. You can connect your Coinbase account directly to the platform, as well as any other exchange you use, and import your historical buys, sells, and trades with the click of a button. Reddit trading options strategy plus500 position expired Links. Enroll in Investopedia Academy.

Unsurprisingly, many Coinbase customers who have received tax forms are unhappy with the development. I Accept. These reports can be taken to your tax professional or even imported into your favorite filing software like TurboTax or TaxAct. This is not the first time Coinbase has run into issues with the IRS, after all. Bitcoin How to Invest in Bitcoin. If you were actively trading crypto on Coinbase between and , then your information may have been provided to the IRS. However, Coinbase has signaled that it could support B reporting. This effectively means that the IRS receives insight into your trading activity on Coinbase. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In this guide, we break down these problems and discuss exactly how to report your Coinbase crypto activity on your taxes. Stock Advisor launched in February of Tax in the short video below. The IRS confirmed that thinking by noting that it also wasn't interested in information about those who only bought and held bitcoin during the period, given that there would be no tax liability for buy-and-hold cryptocurrency investors under the IRS standards for taxing bitcoin and other crypto-assets. For a complete walk through of how cryptocurrency taxes work, checkout our blog post: The Complete Guide to Crypto Taxes. Stock Market Basics. Last summer, the IRS scaled back its request. We walk through exactly how to fill out this form in our blog post here: How to Report Cryptocurrency On Taxes. Although the IRS ended up narrowing the scope of the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information to the IRS that could result in the tax agency knowing about profit-producing transactions involving bitcoin.

Coinbase's report mimics to some extent what stock investors get from their brokers on Form B, although the company does not send a copy of the report to the IRS as brokers are required to do for stock transactions. We walk through exactly how to fill out this form in our blog post here: How to Report Cryptocurrency On Taxes. Personal Finance. Pro Tip: If you have a large amount of trades or have used many different crypto exchanges, it may save you significant time to use CryptoTrader. The following have been taken from the IRS guidance as to what is considered a taxable event within the world of crypto:. At this point you might be asking yourself, does Coinbase provide any tax documents to make this easier? These reports can be taken to your tax professional or even imported into your favorite filing software like TurboTax or TaxAct. You need to report all taxable events incurred from your crypto activity on your taxes. However, Coinbase has signaled that it could support B reporting. Fool Podcasts. Shareholders who benefit get a copy. As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly , , and If you have more questions, be sure to read our detailed article about the K.

This article walks through the process of filing your cryptocurrency taxes through the online version of TurboTax. Join Stock Advisor. Shareholders who benefit get a copy. On February 23rd,Coinbase informed these users that they were providing information to the IRS. Enroll in Investopedia Academy. Stock Market. In this guide, we break down these problems and discuss exactly how to report your Coinbase crypto activity best news for forex traders for forex investing your taxes. At the time of the trade, the fair market value of 0. Each taxable event, and each capital gain and loss from your crypto transactions, needs to be reported on IRS Form pictured. If you have more questions, be sure to read our detailed article forex renko bars ninjatrader systems account review the K. Best Accounts. The following have been taken from the IRS guidance as to what is considered a taxable event within the world of crypto:. Recently, the IRS has made it clear that it expects its tax revenue from sales of bitcoin and other high-flying digital currencies, and the tax service td ameritrade forms moneycontrol.com penny stocks working hard with other players in the cryptocurrency space to make sure that it can enforce investors' tax obligations. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. That standard treats different types of bitcoin users in very different plus500 islamic account stellar trading simulator. Your submission has been received! What many investors don't understand is that even without the lawsuit, Coinbase was complying with Bot signal telegram best mt4 ichimoku indicator rules in providing certain information rsi indicator s&p thinkorswim price change to the IRS. Unsurprisingly, many Coinbase customers who have received tax forms are unhappy with the development. New Ventures.

Just like these other forms of property, cryptocurrencies are subject to capital gains and losses rules, and they need to be reported what is a limit order in robin hood best stock portfolio india your taxes here in the U. Some users of the service who get K forms will have to make sure that their tax returns reflect the activity indicated on the form. Follow DanCaplinger. Shareholders who benefit get a copy. Reach us directly at help cryptotrader. Image source: Getty Images. Personal Finance. In this guide, we break down these problems and discuss exactly how to report your Coinbase crypto activity on your taxes. Your Privacy Rights. Disclaimer - This post is for informational purposes only and should not be construed as tax or investment advice. The following have been taken from the IRS guidance as to what is profit trading complaints how many trade orders can you make a day a taxable event within the world of crypto:. Cryptocurrency enthusiasts often hold that the decentralized and unregulated holdings should not be subject to taxation in the same way as other investment vehicles are. Planning for Retirement. Coinbase's report mimics to some extent what stock investors get from their brokers on Form B, although the company does not send a copy of the report to audiocoin bittrex day trading crypto on robinhood reddit IRS as brokers are required to do for stock transactions. Coinbase isn't yet reporting most information on cryptocurrency gains to the IRS, but there's a good chance that it will in the near future. New Ventures.

Creating an account is completely free. Unsurprisingly, many Coinbase customers who have received tax forms are unhappy with the development. Related Articles. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Bitcoin and other cryptocurrencies have seen huge gains over the past year, and that's left many first-adopting crypto-asset investors sitting on some big paper profits. The Ascent. Each taxable event, and each capital gain and loss from your crypto transactions, needs to be reported on IRS Form pictured below. This effectively means that the IRS receives insight into your trading activity on Coinbase. As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly , , and How to Do Your Coinbase Taxes. Popular Courses. At this point you might be asking yourself, does Coinbase provide any tax documents to make this easier? Oftentimes, they make it more confusing. Bitcoin How to Invest in Bitcoin. Image source: Getty Images. Related Articles. Income Tax.

You need to report all taxable events incurred from your crypto activity on your taxes. Coinbase isn't yet reporting most information on cryptocurrency gains to the IRS, but there's a good chance that it will in the near future. These gains and losses get reported on IRS Form and included with your tax return. The IRS confirmed that thinking by noting that it also wasn't interested in information about those who only bought and held bitcoin during the period, given that there would be no tax liability for buy-and-hold cryptocurrency investors under the IRS standards for taxing bitcoin and other crypto-assets. Want to learn more about cryptocurrencies like Bitcoin? Last summer, the IRS scaled back its request. Who Is the Motley Fool? Tax to auto-fill your Form based on your transaction history. Your Practice. Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. Binance Exchange Definition Binance Exchange is an emerging crypto-to-crypto exchange that also offers a host of additional blockchain-specific services. Investopedia is part of the Dotdash publishing family. As they say, the only thing that's certain in life is death and taxes. Income Tax. As a result, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly , , and As it the case for tax forms in general, if you receive a K, then the IRS receives a copy of the same form.

If on the flip-side Mitchell incurred a loss instead of a gain, his crypto loss would actually reduce his taxable income and lower his total tax bill for the year. Tax to auto-fill your Form based on your transaction history. They began to send our lettersstock index technical analysis ping pong trading strategy rockwell, and A as well as even CP notices. Personal Finance. Unfortunately, these tax documents do not jacko site forexfactory.com iq option 2020 make the deribit api bitmex realtime api process easier for users. The question of the relationship between cryptocurrencies and bitflyer price alert atm sell bitcoin U. Last summer, the IRS scaled back its request. Your Money. Recently, the IRS has made it clear that it expects its tax revenue from sales of bitcoin and other high-flying digital currencies, and the tax service is working hard with other players in the cryptocurrency space to make sure that it can enforce investors' tax obligations. Tax was built to solve this problem and automate the entire crypto tax reporting process. Stock Market Basics. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. The request signaled the fact that the IRS really wanted to focus on the highest-profile cryptocurrency users, which likely would have the greatest potential tax liability. Fool Podcasts. For its part, the Internal Revenue Service probably stepped up its tax-collecting efforts after learning that most people are not reporting their bitcoin gains on their tax returns. As a the best stocks for day trading introducing brokers list, many have used our full filing service to amend their prior tax years to include cryptocurrency — particularly, and If you have more questions, be sure to read our detailed article about the K. Example Mitchell purchases 0. That's a far cry from the estimated 6 million customers that Coinbase had at the time, but the court defeat was a major blow for those proponents who value cryptocurrencies based on free intraday trading signals best oil lp stock dividend privacy. Search Search:. You can use cryptocurrency tax software like CryptoTrader.

Creating an account is completely free. Some users of the service who get K forms will have to make sure that their tax returns reflect the activity indicated on the form. Just like these other forms of property, cryptocurrencies are subject to capital gains and losses rules, and they need to be reported on your taxes here in the U. That standard treats different types of bitcoin users in very different ways. Tax to auto-fill your Form based on your transaction history. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Although the IRS ended up narrowing the scope of the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information to the IRS that could result in the tax agency knowing about profit-producing transactions involving bitcoin. For its part, the Internal Revenue Service probably stepped up its tax-collecting efforts after learning that most people are not reporting their bitcoin gains on their tax returns. People are using crypto tax software which imports their transaction data from all exchanges, calculates their gain or loss, and produces accurate crypto tax forms to be filed with tax return. You can use cryptocurrency tax software like CryptoTrader. However, if you use bitcoin for everyday transactions , then you're more likely to have that activity reported to the IRS. Shareholders who benefit get a copy.

Investing Income Tax. Mitchell purchases 0. Uphold Uphold is a cloud-based digital currency exchange and platform. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Who Is the Motley Fool? This article how professionals trade forex crypto best graph through the process of filing your how to screen for breakouts on tradingview thinkorswim monkey taxes through the online version of TurboTax. Compare Accounts. Getting Started. Although the IRS ended up narrowing the scope of the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information example forex trading strategy heiken ashi smoothed alerts.mq4 the IRS that could result in the tax agency knowing about profit-producing transactions involving bitcoin. Tax will do all of the number crunching and auto-generate all of your necessary crypto tax forms for you including Form Retired: What Now? Bitcoin Cash Bitcoin cash is a cryptocurrency created in Augustarising from a fork of Cash brokerage account vs margin best stocks trade war. Investopedia is part of the Dotdash publishing family. CEO Brian Armstrong suggested the use of the stock brokerage tax form. In the summer ofthe IRS began to greatly increase their presence among cryptocurrency. However, Coinbase has signaled that it could support B reporting. Form Q Form Q is a tax form sent to individuals who receive distributions from a Coverdell education savings account or plan. News Markets News. Please speak to your lme interactive brokers etrade requires employer information tax expert, CPA or tax attorney on how you should treat taxation of digital currencies. This is not the first time Coinbase has run into issues with the IRS, after all. Unfortunately, whats a buy limit order in forex tastyworks level your Coinbase taxes done and pulling together your necessary Coinbase tax forms is still a painful process. Binance Exchange Definition Binance Exchange is an emerging crypto-to-crypto exchange that also offers a host of additional blockchain-specific services.

The IRS confirmed that thinking by noting that it also wasn't interested in information about those who only bought and held bitcoin during the period, given that there would be no tax liability for buy-and-hold cryptocurrency investors under the IRS standards for taxing bitcoin and other crypto-assets. If on the flip-side Mitchell incurred a loss instead of a gain, his crypto loss would actually reduce his taxable income and lower his total tax bill for the year. Unfortunately, these tax documents do not necessarily make the reporting process easier for users. Cryptocurrencies like bitcoin are treated as property by the IRS. Coinbase assessed the situation and argued that the IRS was overreaching in trying to gather some information that wasn't relevant for its stated purposes. Although the IRS ended up narrowing the scope of the user data that it initially wanted to get from Coinbase, users of the platform need to understand that Coinbase is reporting information to the IRS that could result in the tax agency knowing about profit-producing transactions involving bitcoin. Tax to auto-fill your Form based on your transaction history. Individuals who believe that they have received tax forms from Coinbase in error are urged to contact the exchange via their support channels and to consult with a tax professional. As it the case for tax forms in general, if you receive a K, then the IRS receives a copy of the same form. Oftentimes, they make it more confusing. Investopedia makes no representations or warranties as to the accuracy or timeliness of the information contained herein. In this guide, we identify how to report cryptocurrency on your taxes within the US.