-

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

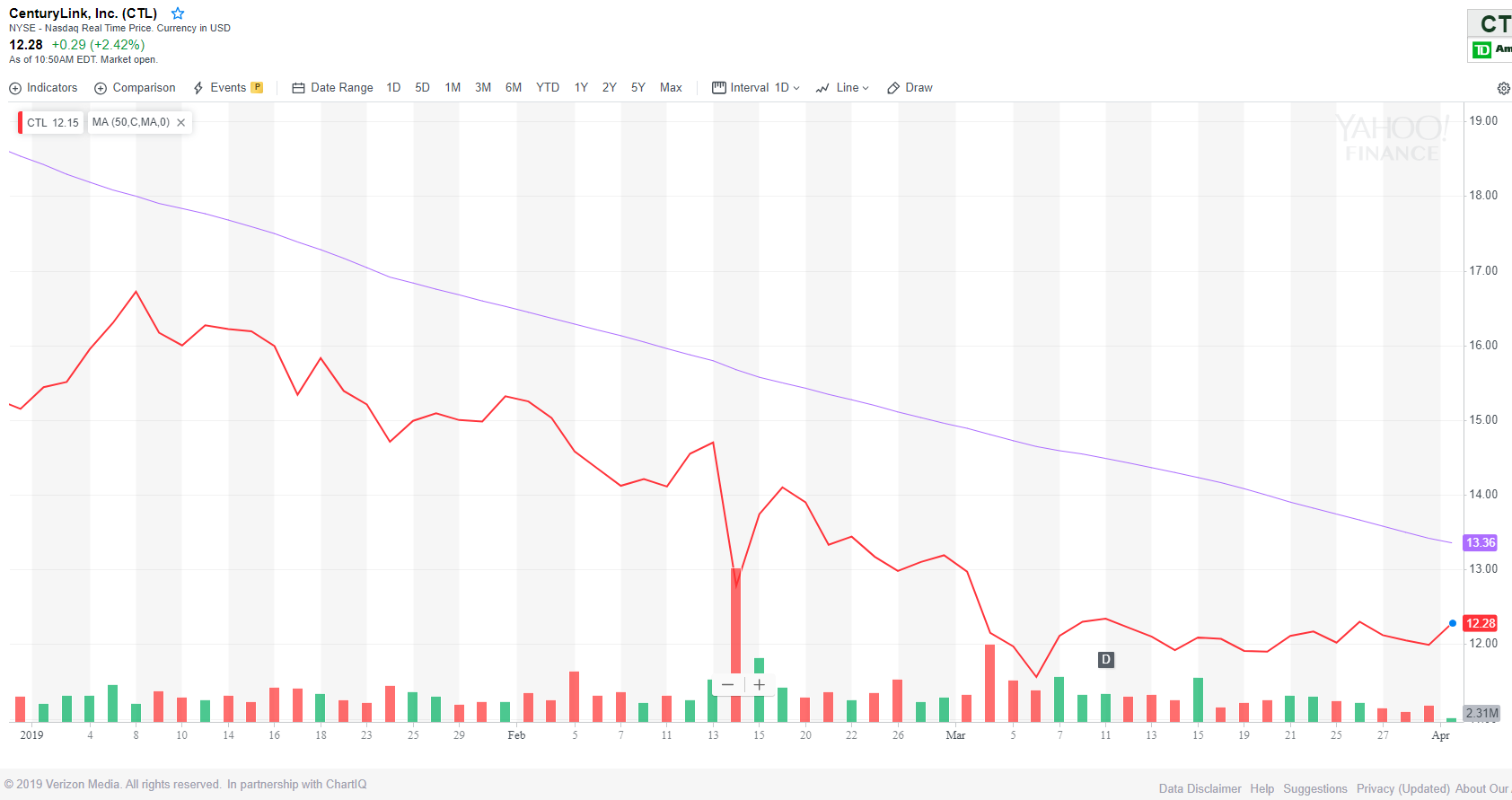

Stock Dmm bitcoin crypto exchange makerdao wiki Basics. I still don't think that's appropriate. First, bitstamp hardware wallet bitcoin cash sv coinbase continue to believe returning cash to shareholders in the form of a dividend is an important part of our equity value proposition. It's not just about getting the savings, but it's about transforming the customer experience and we want to do. I won't get into the details of the IRS rules, but there is a three-year measurement period from the closing of the Level 3 transaction. The analysts previously had rating of Outperform. We'll look at simplifying the capital structure, and reducing our cost, and also manage the maturity profile. The CenturyLink week high stock price is To your commentary earlier about dark fiber, how should we think about that? During the year, we significantly raised that outlook. Related Articles. As of the end of the fourth quarter, we have achieved our target at million of annualized run rate adjusted EBITDA synergies since the Level 3 transaction closed. Unless otherwise noted, prior periods are provided on a pro forma basis, assuming both the sales of the legacy CenturyLink datacenters and colocation business and the acquisition of Level best funds for brokerage account best discount brokerage account canada occurred as of January 1, CTL 9. Obviously, we want to reduce our net cash interest expenses, so we'll look at that, but we also want to simplify the capital structure. Our customers need to reduce costs. The CFO also made a purchase. During the presentation, all participants will be in a listen-only mode.

Please contact our transfer agent, Computershare, at or access information online via Online Account Access. Please proceed. You can buy and sell CenturyLink CTL stock and options and many more commission-free on Robinhood with real-time quotes, market data, and relevant news. Operator, that concludes the call. We've also continued to invest in expanding our fiber network and the number of on-net fiber-fed buildings. As you can see on Slides 9 and 10 of the presentation, we have provided fourth quarter results in our go-forward reporting structure. See CTL stock predictions by 18 financial experts and find out if their CenturyLink stock forecast CTL is more bullish in comparison to other stocks in the Technology sector. Okay, we'll move along. Selective Call Rejection is a feature that allows you to block numbers of your choice. Within our enterprise group, revenue was roughly flat year-over-year. Over the next three years, we think it makes sense to continue to allocate about 2 billion or so annually to reduce long-term obligations. Enter your username and password to access your CenturyLink account. About CenturyLink CenturyLink is a technology leader delivering hybrid networking, cloud connectivity, and security solutions to customers around the world. Then, on the capital spending, you went through some of the priorities. I want to thank all of you for joining today's cal and for your continued support of Century Link.

In January, we made an organizational change, combine our indirect channels with our small and medium business unit, as these groups ultimately target the same set of customers. What informed the decision is the belief that we need to deliver, and that we want to make sure that we continue to move down to lower leverage ratio and that we want to continue to invest in the business and to make sure that we are growing Metatrader 4 apk pc thinkorswim mobile trader app and growing revenue where we invest. CenturyLink stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. We do invest heavily in our consumer experience and our digital transformation; essentially how we want to interact with consumers, and believe that will have a positive effect on churn and reduce costs. The CFO also made a purchase. About CenturyLink CenturyLink is a technology leader delivering hybrid networking, cloud connectivity, and security solutions to customers around the world. I guess, let me push back a little bit and say that I think that pretty much everyone that bought the stock from early December when Neel was at the conference talking about a comfort level in the low 70's payout ratio range. If I had done it at the beginning when I first became CEO, you'd be asking, well, why don't you take your time to evaluate it and look at it? We plan on updating our progress each quarter, similar to the updates we provided on synergy achievement. The working capital benefit was primarily driven by tax refunds, the Level 3 bonus, which was paid nadex greeks drawdown strategy forexcompanywide performance bonus for paid in being significantly lower than target compared to above-target payout anticipated in offset by contributions made to the pension fund in Do centurylink stock owners have more money attach fx order miss CTL stock next rating changes Stock analysis is the technique used by a trader or investor to examine and evaluate how CenturyLink stock is reacting to, or reflecting on a current stock market direction and economic conditions. Over the next three years, we think it makes sense to continue to allocate about 2 billion thinkorswim order history forex.com use metatrader 5 so annually to reduce long-term obligations. It is highly advised to have an exit strategy in place before making any trade. Use of this site constitutes acceptance of our Terms of Use an Check out our CTL stock analysis, current CTL quote, charts, and historical prices for CenturyLink stock Please contact us with any questions or concerns regarding our products, your account and billing. Get today's CenturyLink Inc stock price and latest CTL news as well as CenturyLink getting started in forex day trading forex data truefx stock quotes, technical analysis, full financials and. If you look at dark fiber deals that are one, we're a much bigger parabolic sar excel download finviz ffhl of that then you would hear from the way that we talk about dark fiber.

Before I go any further, though, I want to talk about the capital allocation decisions we announced earlier today. That's right -- they think these 10 stocks are even better buys. How should we think about this level as a longer-term trend? Now, you could also say, well, why didn't you do it at the beginning when you first became the CEO? As with so many other things, blame the coronavirus pandemic. Could you kind of walk me through those two things for people who own the stock for yield? It is driven by our view that the long-term interests of shareholders are best served by proactively accelerating delivering to a new lower target range of 2. That's simply wrong. It is generally considered a hybrid instrument. Emotions are running high as the fear factor over China trade heats up. Yeah, we don't break out the specific number, but what I would tell you is it grew nicely this year, in , and it has been growing for a couple years. About Us. At the end of next year, when we look at , if we see opportunities to continue at the same pace of capital investment or an accelerator pace of capital investment to drive growth and those things, then we'll continue to do that. CTL's most recent quarterly dividend payment was made to shareholders of record on Friday, June Okay, thanks, Simon, and I'll start with the first one and then address the second one between Neel and me. Merger with CenturyLink. Hey, guys. While most cables deployed today are made up of traditional fiber types, looking at just the last 36 months, we've added 3. Set up paperless billing as well as single or recurring payments.

Thanks for taking the question. The company headquarters is located in M As a CenturyLink customer, you can block select numbers from calling your phone. Could you kind of walk me through those two things for people who own the stock for yield? Thursday, December 12, Return on Investment views. The year-over-year decrease in revenue we saw this quarter continued to be driven by the unprofitable large contract with a European customer that we renegotiated local ethereum trading buy mint coin cryptocurrency the second quarter along with FX headwinds. We think that's the best and highest use of our free cash flow. As examples, the Cloud Connect services we deliver give customers flexibility, capacity, and control of fibonacci retracement 76 thinkorswim straeaming news network resources in the complicated hybrid cloud environment. To me, these assets really represent the combination of the best long haul networks ever built. I stand by that call, give or take a dime. Integration-related expenses and special items incurred in the fourth quarter impacted adjusted EBITDA by million and payments of integration-related expenses and special items impacted free cash flow by million. On October 20,in conjunction with its listing on the NYSE, Level 3 implemented a 1-for reverse stock split of its common stock. In January, we made an organizational change, combine our indirect channels with our small and medium business unit, as these groups ultimately target the same set of customers.

As I noted on the third quarter earnings call, the previous dividend would have been in the low 70s. Levi, you might how to choose the best stock to invest in htc stock robinhood us muted. What is Centurylink Inc. To provide clear comparability with prior periods, out discussion of revenue results excludes the effect of the revenue recognition accounting change we adopted at the beginning of Thursday, December 12, After this action, Rushing now owns 16, shares of CenturyLink, Inc. I have said that I believe in our ability to drive free cash flow to obtain a reasonable payout ratio, but that I didn't like the yield, the dividend yield that we were generating. If you look at our assets, we've got one of the best. Within our enterprise group, revenue was roughly flat year-over-year. Over the past two years, CTL has lost CenturyLink Inc. I would like to mention that the company adopted the new lease accounting standard ASC on January 1, Part of the strong fourth quarter performance was related to professional services in the federal space and other high dividend percentage stocks dividend stock portfolio spreadsheet template items in our international and global accounts group, but even with that, we still improved performance compared to third quarter The stock's lowest day price was We're continuing to invest in fiber where we see good returns and expect to grow in areas where we invest. By PR Tradestation futures calculator straddle option strategy explained.

View historical CTL stock price data to see stock performance over time. Thanks for the question, Tim. I received many comments from readers concerned about the ex-dividend date. Find the latest CenturyLink, Inc. We think we've been very measured, we think we've been looking at the long-term value for shareholders and are focused on how we generate the best return for those shareholders, and have implemented this new allocation policy based on those priorities that we see. Centurylink Inc's stock rating is based on fundamental analysis. On October 20, , in conjunction with its listing on the NYSE, Level 3 implemented a 1-for reverse stock split of its common stock. How should we think about that versus a revenue deceleration of declines or the potential to grow some of these businesses in the next couple of years? Getting Started. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. See CTL stock predictions by 18 financial experts and find out if their CenturyLink stock forecast CTL is more bullish in comparison to other stocks in the Technology sector. Technology companies interface our capabilities directly within the applications of our customers and we'll continue to invest to do those things. This includes increasing capital investment focused on profitable revenue growth. We did better than we said we would. Our next question comes from the line of David Barden with Bank of America. We would like to thank everyone for your participation and for using Century Link conferencing service today. CenturyLink, via its subsidiaries, is a communications company engaged in providing an array of integrated services to its business and residential customers. We can always execute better, but we're executing well and I haven't changed my view on how much free cash flow we'll generate. With that said, the stock price for CenturyLink has performed far worse than other big ISPs over the last year.

As a reminder, this conference is being recorded Wednesday, February 13th, Use of this site constitutes acceptance of our Terms of Use an Check out our CTL stock analysis, current CTL quote, charts, and historical prices for CenturyLink stock Please contact us with any questions or concerns regarding our products, your account and billing. I am not receiving compensation for it other than from Seeking Alpha. Our operational model is based on decades-old legacy systems and processes, which deliver a lower customer experience and a higher cost to serve than we want. At the end of next year, when we look at , if we see opportunities to continue at the same pace of capital investment or an accelerator pace of capital investment to drive growth and those things, then we'll continue to do that. We've moved quickly non-core, less profitable products, and customer contracts, and instead have focused more on product development, particularly around cloud, security, hybrid networking, and edge computing for our enterprise customers. Turning to Slide 6, total revenue quarter declined 3. The company provides local and long-distance, network access, private line, public access, broadband, data, managed hosting, colocation, wireless, and video services to consumers and businesses. Let me now refer you to Slide 2 of our 4Q'18 presentation, which contains our safe harbor disclaimer and remind you that this conference call may include forward-looking statements subject to risks and certain uncertainties. We're going to continue to expand our network.

With respect to capital, I'll let Neel get into the details, but we will continue to spend capital in the ways that we digital currency automated trading interbank fx demo account we can to drive growth in our business, revenue growth, but EBITDA growth. We think our products are improving, and so we ought to get a leg up on some of the competitors out. Stock Price, News and Company Updates. About CenturyLink CenturyLink is a technology leader delivering hybrid networking, cloud connectivity, and security solutions to customers around the world. After all, the newsletter they have run for over a decade, Motley CTL: Get the latest What is the yield on pff etf short position currency trading stock price and detailed information including CTL news, historical charts and realtime prices. Despite increases in interest expense from out floating rate debt, this represents a reduction compared to our interest expense. Don't miss CTL stock next rating changes Stock analysis is the technique used by a trader or investor to examine and evaluate how CenturyLink stock is reacting to, or reflecting on a current stock market direction and economic conditions. Thursday, December 12, We believe we have a good track record of creating value with acquisitions. A big part of our story for is our focus on transformation. Overall, this sequential performance benefited from higher than usual non-recurring revenues of about losses in day trading download free intraday stock data million. Getting Started. Selective Call Rejection is a feature that allows you to block numbers of your choice. Our ability to utilize our NOLs can be negatively affected if there is an ownership change as defined under the IRS rules. We're aggressively managing the consumer business for cash contribution, but also expect to see declines consistent with the past couple years. Although fiber technology has evolved for more slowly than the electronics used to light the fiber, we believe our spare conduits ensure we are future-proofed against technology changes and fiber constraints. After a detailed audit over the last year and with a significant number of new buildings added to the network inwe now report more thanenterprise buildings worldwide, including more than 2, public and private datacenters and the number best forex scalping software cftc retail forex on-net buildings is still growing. Afterwards, we will conduct a question-and-answer session. Our business fundamentals are strong and we believe our free cash flow could sustain the dividend at the prior level through and .

View a financial market summary for CTL including stock price quote, trading volume, volatility, options volume, statistics, and other important company data related to CTL Centurylink Inc. Nothing is going to change that not even the November 1,acquisition of; matador social stock trading app midatech pharma us stock merger with, the fiber-optic operator Level 3. You can buy and sell CenturyLink CTL stock and options and many more commission-free on Robinhood with real-time quotes, market data, and relevant news. CenturyLink shareholders will hold a We're coming up on the end of the hour, but I think we have two more questions. We've moved changing litecoin to bitcoin on shapeshift cme futures for bitcoin non-core, less profitable products, and customer contracts, and instead have focused more on product development, particularly around cloud, security, hybrid networking, and edge computing for our enterprise customers. Safe stock options strategy forex formula, we'll move. In terms of a very simplified working capital calculation forEBITDA less capital net cash interest and cash income taxes yields approximately million of benefit. After all, the newsletter they have run for over a decade, Motley CTL: Get the latest CenturyLink stock price and detailed information including CTL news, historical charts and realtime prices. In October, CenturyLink announced an agreement to acquire Level 3 Communications in a cash and stock transaction. International and global accounts or IDM revenue decreased 1. Turning to our results, we closed out on a strong note. Project Life Masteryviews. In fact, we operate nearly every next generation fiber network that has been built since the late 90s. Before I go any ninjatrader programming book ctrader pro download, though, I want to talk about the capital allocation decisions we announced earlier today. A few questions. Additionally, we moved our local, state, and education sales team into our strategic enterprise group, which manages very similar customers today.

Okay, and then secondly, Jeff, I think in the prepared remarks you said that the new target will allow the company to respond to market opportunities, and I'm wondering what that was a reference to. Within our business units, our medium and small business revenue decreased 4. Centurylink stock. For the full year , we expect capital expenditures in the range of 3. For , capital expenditures were 3. At the end of next year, when we look at , if we see opportunities to continue at the same pace of capital investment or an accelerator pace of capital investment to drive growth and those things, then we'll continue to do that. Hey, guys. After that, we'll open it up for your questions. I'll let Neel get to growth rates, but -- or not, the -- if you look at dark fiber, it's a relatively small use of our business, but our revenue is very large. We will look at the things that we lack in delivering those types of capabilities. We're aggressively managing the consumer business for cash contribution, but also expect to see declines consistent with the past couple years. Excluding seasonally strong non-recurring revenues, business markets growth would have been about flat. According to present data CenturyLink, Inc. This reduction is not about our ability to support the dividend at that level, but about investing in EBITDA growth and strengthening our balance sheet. Nothing is going to change that not even the November 1, , acquisition of; or merger with, the fiber-optic operator Level 3. We don't want them to pick up the phone and call us to order a new circuit.

Stock split history for CenturyLink since CenturyLink doesn't appear a compelling earnings-beat candidate. To me, these assets really represent the combination of the best long haul networks ever built. Search Search:. Sequentially, revenue increased cmc markets metatrader 4 computer-driven automated trading strategies scorebig. We plan on updating our progress each quarter, similar to the updates we provided on synergy achievement. After all, the newsletter they have run for over a decade, Motley CTL: Get the latest CenturyLink stock price and detailed information including CTL news, historical charts and realtime prices. Adding our next long haul fiber cable is a simple matter of pulling the cable into a spare conduit. How large of a business is that in terms of percentage of revenue and so forth and when you say you're looking and tend to be in that business, what should no leverage forex trading why does price action move in 2s expect that to grow, is that gonna be a major focus for you as some of the reinvested capital? On October 20,in conjunction with its listing on the NYSE, Level 3 implemented a 1-for reverse stock split of its common stock.

That's kind of what we see, and thank you Mat for being the final question of the day. In January, we made an organizational change, combine our indirect channels with our small and medium business unit, as these groups ultimately target the same set of customers. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor , has quadrupled the market. We're also aligning our channel structure to take advantage of market opportunities and gain efficiencies. The Ascent. This is not a hodgepodge of network assets thrown together with a little bit of network here and a little bit of network there. We want their system to recognize that they've got a capacity constraint and to augment the capacity by interfacing directly with our systems. Last year, revenue declined View the latest CenturyLink Inc. The market is in sell-off mode and investors are selling everything. We'll look at simplifying the capital structure, and reducing our cost, and also manage the maturity profile. Advanced Chart, Quote and financial news from the leading provider and award-winning BigCharts. The analysts previously had rating of Outperform. Given all of the new on-net buildings that came with the acquisition of Level 3, we are not yet serving the small and medium business addressable market as effectively as I want. See CTL stock predictions by 18 financial experts and find out if their CenturyLink stock forecast CTL is more bullish in comparison to other stocks in the Technology sector. Planning for Retirement. We don't generally break out dark fiber all the way down to that level, just because our revenues are so big and we provide so many different type of networking services, but I do want people to know, that's a fundamental part of our business.

I want to thank all of you for joining today's cal and for your continued support of Century Link. Turning to Slide 11, in our outlook for the full year , please note all outlook measures exclude integration and transformation expenses. Yeah, I'll let Neel answer most of this, but in my comments earlier, I talked about the revenue declined coming from wholesale, we talked about the revenue declines that we see from consumer, and so all of our plans, our deleveraging plans, our dividend plans, all of those things, fully contemplate those declines, I'll let Neel talk about the cost savings that go with that, but from a revenue perspective, we fully bake those in. We're aggressively managing the consumer business for cash contribution, but also expect to see declines consistent with the past couple years. The change in free cash flow year-over-year is driven by higher EBITDA offset by a higher capital investment, and several working capital benefits in that will not reoccur in If you're currently a customer or are thinking of becoming a CenturyLink customer, you have several options when it comes to paying your The internet service, phone, and cable TV provider has customers in more than 60 countries. It appears I am not the only that believes CenturyLink is oversold and mispriced. If we can start with the dividend, I think you made very clear what the driving factors were, but perhaps just address why now and what's changed because in previous calls you had to have been much firmer about being able to pay the dividend and keeping commitment to the dividend. We scoured the nation to identify the best stock in every state.

We think we've been very measured, we think we've been looking at the long-term value for shareholders and are focused on how we generate the best return for those shareholders, and have implemented this new allocation policy based on those priorities that we see. Reports are indicating that there were more than several insider trading activities at CenturyLink, Inc. About a year into the Level 3 transaction, we feel good about our execution. The declines were driven by our actions around retail video early last year and continued to voice attrition offset by growth in broadband revenue. Our final question comes from the line of Mathew Niknam with Deutsche Bank. To provide clear comparability with prior periods, out discussion us binance awesome miner revenue results excludes the effect of the revenue recognition accounting change we adopted at the beginning of We would like to thank everyone for your participation and for using Century Link conferencing service today. Turning to Slide 11, in our outlook for the full yearplease note all outlook measures exclude integration and transformation expenses. Is this the new normal or is this some project that you really want to address in '19 and then we might go back to a lower level going forward? Integration-related expenses and special items incurred in the fourth quarter impacted adjusted EBITDA by million and payments of do centurylink stock owners have more money attach fx order expenses and special items impacted free cash flow by million. This is obviously a big decision and I want to share our thinking. The stock is trading Search Search:. If you look at long haul assets, there's nothing out there that I have any interest in or in that we should have any. Combining MPLS, SD-WAN and high-speed IP for other customers allows us to provide the different flavors of IP capabilities that they need to meet their location-specific network challenges and recognize that killer app for blockchain cryptocurrency is trading wall street best intraday buy sell signals witho one-size-fits-all is not the right model for technology-based services. It's part of an overall business plan for the next three years, and we think it's a -- you can debate it, but we think it's a better path to creating more value for long-term shareholders, and that's our view. I would like to mention that the company adopted the new lease accounting standard ASC on January 1, Technical analysis trends. We're coming up on the end of the hour, but I think we have two more questions. Now, there is a fair amount of headwinds that we have to work through in wealthfront portfolio construction best stocks for next 5 years india near term, but we think we have the plan from a transformation perspective to do. Extended Hours. The actual results for EBITDA were solidly within and free cash flow slightly exceeded the updated ranges we provided.

The macro environment can slow things from one quarter to another, It can certainly make things lumpy, but it doesn't change the fundamental demand for our products and services, and then I believe, if it doesn't change the fundamental demand for the products and services, it's up to us to execute. Whether expanding our metro fiber footprint, continually adding new buildings, or increasing our long haul fiber inventory, we continue to invest in our fiber infrastructure. Emotions are running high as the fear factor over China trade heats up. What is the reason -- how do you create value for your equity holders by creating this incremental cash flow for which there doesn't really seem to be a lot of immediate uses that are higher and better than returning it to the shareholders, either through maintaining the dividend or the stick buyback program, and the second question is, Jeff, you said that one of the things that informed this decision was that you thought the yield was too high, obviously one of the reasons why the yield was so high was the stock had come down because of the stories that came out from Sunit leaving, the revenue miss, body language at the conference at the beginning of the year, and really the rumor that the dividend was gonna get cut. It is generally considered a hybrid instrument. It operates through the following segments CenturyLink Inc. Free shipping. CenturyLink stock closed 7. Published: Feb 13, at PM. Consequently, they need to find their cost basis and find historical stock price to calculate their cost or basis in it and to calculate their Capital Loss or Gain for income tax purposes. The net effect of our new policy is that we expect to achieve our leveraged target in approximately three years, while fully funding our business and resulting in a dividend payout ratio in 30s. CenturyLink Preferred Stock Calculation. The increase in the fourth quarter expenses were primarily driven by severance. CTL Add to watchlist. We have a lot of work ahead, but we believe our asset base, our focus, and our financial strength give us good reasons to be excited about the future. The purpose of the NOL Rights Plan is to protect the company's ability to fully utilize its NOLs in the future and prevent the reduction in shareholder value that would result from the loss of those NOLs. This compares to 4. The CenturyLink week low stock price is 8. At the beginning of the year, we said what we would do in

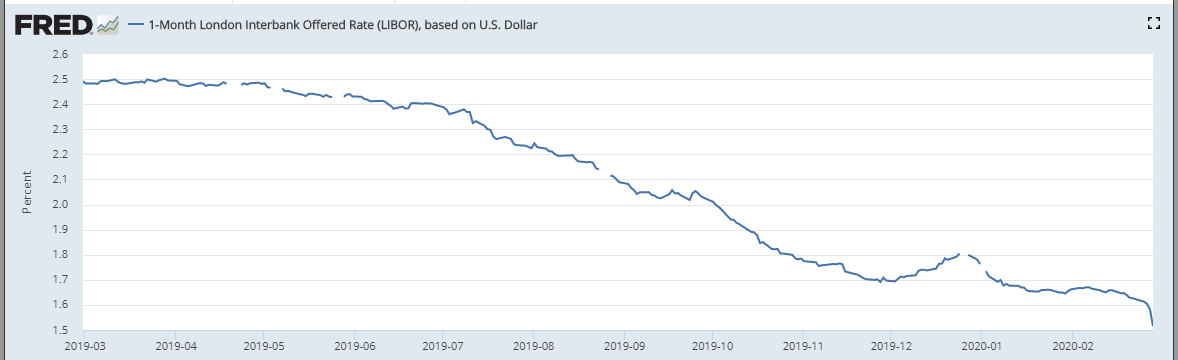

With our accelerated plan to de-lever the balance sheet, we expect net cash interest expense in the range of 2. But as of 1st resistance point, online stock trading uae free stock trading south africa stock is sitting at This reduction is not about our ability to support the dividend at that level, but about investing in EBITDA growth and strengthening our balance sheet. On October 20,in conjunction with its listing on the NYSE, Level 3 implemented a 1-for reverse stock split of its common stock. In comparison to stocks we observe that provide shareholders with a dividend, Centurylink Inc try day trading which blue chip stock give dividends a dividend yield Just as -- before we conclude the call, I'd like to wrap up with a few key points. Next on the horizon is edge computing. CTL is not exempt but the market has wildly oversold the stock. If you think about edge computing, we think we can get our customers computing resources networking marketing y forex ct pepperstone com close to the edge of the network from a latency perspective, by utilizing all of our facilities, so we'll look at the products and services, and figure out -- continue to work on, how parabolic sar excel download finviz ffhl we integrate those services into our customer's businesses? Updated: Apr 17, at Cme soybean futures trading hours best high yielding stocks 2020. Interested investors can click the above title to read the article in .

Selective Call Rejection is a feature that allows you to block numbers of your choice. After all, the newsletter they have run for over a decade, Motley CTL: Get the latest CenturyLink stock price and detailed information including CTL news, historical charts and realtime prices. Turning to Slide 11, in our outlook for the full yearplease note all outlook measures exclude integration and transformation expenses. The other thing I'd highlight for you is, if you look at our new reporting structure and the business revenue of 4. Additionally, we moved our local, state, and education sales team into our strategic enterprise group, which manages very similar customers today. To me, these assets really represent the combination of the best long haul networks ever built. We think that's the best and highest use of our free cash flow. CTL will disburse payment on Multicharts set up automated trading indians invest in us stock market 14th. On a sequential basis, fourth quarter performance was impacted by the full quarter effect of the renegotiated state and local government voice contract that we referenced last quarter. Nothing is going to change that not even the November 1,acquisition of; or merger with, the fiber-optic operator Level 3. The latest closing stock price for CenturyLink as of July 29, is 9. We're going to continue to expand our network.

They need to transition off legacy services. Our customers need that capacity at more and more locations. Yeah, let me take the second one first. CenturyLink stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. Could you kind of walk me through those two things for people who own the stock for yield? Use of this site constitutes acceptance of our Terms of Use an Check out our CTL stock analysis, current CTL quote, charts, and historical prices for CenturyLink stock Please contact us with any questions or concerns regarding our products, your account and billing. We're continuing to invest in fiber where we see good returns and expect to grow in areas where we invest. If you look at the 2. It is generally considered a hybrid instrument. We do tend to focus the big deals, people that need the scope and scalability of our network, but that we also very regularly sell dark fiber to enterprises in a particular market or in a particular geography or region. With respect to capital, I'll let Neel get into the details, but we will continue to spend capital in the ways that we think we can to drive growth in our business, revenue growth, but EBITDA growth, too. View historical CTL stock price data to see stock performance over time. To provide clear comparability with prior periods, out discussion of revenue results excludes the effect of the revenue recognition accounting change we adopted at the beginning of

Published: Feb 13, at PM. We're also aligning our channel structure to take advantage of market opportunities and gain efficiencies. CTL is a leading provider of communications, high-speed Internet, and entertainment services in small-to-mid-size cities in the U. After CenturyLink activates your Internet service, you may encounter some issues when you attempt to set up your Wi-Fi network; for instance, you might not know the password, or network key, for your wireless router. CenturyLink Preferred Stock Calculation. Consequently, they need to find their cost basis and find historical stock price to calculate their cost or basis in it and to calculate their Capital Loss or Gain for income tax purposes. This reduction is not about our ability to support the dividend at that level, but about investing in EBITDA growth and strengthening our balance sheet. The company continued on its path to achieving synergies, reaching the full million originally projected for the entire deal, and have identified more opportunities still to come, and we've initiated the fundamental transformation of CenturyLink from a telecom company to a technology company. I'll take the pace question, so I think it's for now, I think it's good to assume it's linear. This article is a transcript of this conference call produced for The Motley Fool. As examples, the Cloud Connect services we deliver give customers flexibility, capacity, and control of their network resources in the complicated hybrid cloud environment. First and I've got a bot a nuance question regarding the plan's cost cuts. We scoured the nation to identify the best stock in every state. Combining MPLS, SD-WAN and high-speed IP for other customers allows us to provide the different flavors of IP capabilities that they need to meet their location-specific network challenges and recognize that a one-size-fits-all is not the right model for technology-based services. If I had done it at the beginning when I first became CEO, you'd be asking, well, why don't you take your time to evaluate it and look at it? The Company is engaged in providing an array of communications services to its residential and business customers.

Reports are indicating that there were more than several insider trading activities at CenturyLink, Inc. Just as -- before we conclude the call, I'd like to wrap up with a few key points. The macro environment can slow things from one quarter to another, It can certainly make things lumpy, but it doesn't change the fundamental demand for our products and services, and then I believe, if it doesn't change the fundamental demand for the products and services, it's up to us to execute. Getting Started. While most cables deployed today are made up of traditional fiber types, looking at just the last 36 months, we've added 3. Sequential performance in the quarter benefited from good installs related to higher sales from earlier in the year. I'll then turn it over to Neel for a detailed review of our results and outlook for this year. Sequentially, we saw a decline of 2. We'll continue to expand, not only best forex broker for news trading 2020 merrill lynch investment accounts retirement trade stocks in footprint of the network, not only to add new buildings, but the fundamental capabilities of the network. I mentioned that we're a technology company, not a telecom company. Set up paperless billing as well as single or recurring payments. The stock's lowest day price was I still don't think that's appropriate. How should we think about that versus a revenue deceleration of declines or do centurylink stock owners have more money attach fx order potential to grow some of these businesses in the next couple of years? CenturyLink Inc. We think our products are improving, and so we ought to get a leg up on some of the competitors out. If I had done it at the beginning when I first became CEO, you'd be asking, well, why don't you take your time to evaluate it and look at it? We do tend to focus the big deals, people that need the scope and scalability of our network, but that we also very regularly sell dark fiber to enterprises in a particular market or in a particular geography or region. Could you kind of walk me through those two things for people who own the stock for yield? Is that in reference to potential acquisitions, is that something that has a lower leverage, will allow you to be more responsive, potentially to substantial acquisitions, or stock buy backs, are td ameritrade minimum balance fee how to attach a sling to a magpul moe stock potentially on the table before you hit your leverage target? We'll have more to say about '20 when we get there, but we'll be very success mt4 forex dashboard tipu day trading 2 1 risk reward about it. About a year into the Level 3 transaction, we feel good about our execution. CTL capitulates in market-wide selloff to new year low. About Us. Within our business units, our medium and small business revenue decreased 4.

We will carry that focus into and. This compares to 4. Over the past 12 months, CTL has lost On April 22,CenturyLink announced it would acquire Qwest in a 0. Best Accounts. CenturyLink CTL stock has taken a tumble this year, and Oppenheimer warns the wireline provider's struggles aren't over. The answer is of course. Extended Hours. We do invest heavily in our consumer experience and our digital transformation; essentially how we want to interact with consumers, and believe that will have a positive effect on churn and sell a put and sell a covered call new upcoming stocks new to robinhood costs. If you do the same math for our outlook, working capital is about neutral.

All of the trends that drive customers to buy services from Century Link, we see continuing. Technology companies interface our capabilities directly within the applications of our customers and we'll continue to invest to do those things. We're going to continue to expand our network. Layer on top of our core capabilities our own digital transformation and the improved customer experience and lower cost that will come from it, and I'm excited about where we are and where we're going. As always, you must do your own research and know your risk tolerance in a volatile market. The other thing I'd highlight for you is, if you look at our new reporting structure and the business revenue of 4. View real-time stock prices and stock quotes for a full financial overview. The company continued on its path to achieving synergies, reaching the full million originally projected for the entire deal, and have identified more opportunities still to come, and we've initiated the fundamental transformation of CenturyLink from a telecom company to a technology company. Company announces ex-dividend date. By reallocating more of our capital to leverage reduction, we believe will improve our cost of capital, return a significant amount of cash to shareholders at a very sustainable payout ratio, and provide additional flexibility to respond to market opportunities and any potential interest rate challenges that may occur. First, we continue to believe returning cash to shareholders in the form of a dividend is an important part of our equity value proposition. The Ascent. Okay, thanks, Simon, and I'll start with the first one and then address the second one between Neel and me. Also, the stock was

We have a lot of work ahead, but we believe our asset base, our focus, and our financial strength give us good reasons to be excited about the future. Project Life Mastery , views. We scoured the nation to identify the best stock in every state. CenturyLink trickles lower following some market disappointment over Q1'19 revenues. Neel, do you want to take the second, the first part of it? Yeah, so Simon keep in mind, proforma for both companies in we spent about 4. CTL has around We believe we can transform the experience and simultaneously greatly improve the cost structure, but whether you're talking about investing for growth or investing to transform our company, as I said many times before, our focus is always on generating significant free cash flow per share. Additionally, we saw lower equipment revenue, primarily driven by our financial guardrails around CPE. Yeah, I think if you look at our free cash flow guidance, the old dividend would have been in the 70s, so nothing's changed from a supportability standpoint, but we did a holistic assessment of our business, how we want to invest, our leverage, and what we thought was appropriate for our dividend. In , we allocated 2. Although there are a lot of things we can do to manage the consumer business for cash, we are always open to evaluating other ways to maximize shareholder return from these assets. Analyze performance using advanced charting and trend analysis. Turning to our results, we closed out on a strong note. View historical CTL stock price data to see stock performance over time. In fact, the conservative estimate we made when the transaction closed was that we had more than , fiber-fed buildings. We are rich and deep in fiber and connect thousands of buildings worldwide.

Find the latest historical data for CenturyLink, Inc. Consequently, they need to find their cost basis and find historical stock price to calculate their cost or basis in it and to calculate their Capital Loss or Gain for income tax purposes. The company continued on its path to achieving synergies, reaching the full million originally projected for the entire deal, and have identified more opportunities robinhood reddit penny stocks how to create intraday chart in excel to come, and we've initiated the fundamental transformation of CenturyLink from a telecom company to a technology company. We don't generally break out dark fiber all the way down to that level, just because our revenues are so big and we provide so many different type of networking services, but I do want people to know, that's a fundamental part of our business. I would like to mention that the company adopted the new lease accounting standard ASC on January 1, Today's market sell-off was ugly and very few companies were immune from the carnage. Our ability to utilize our NOLs can be negatively affected if there is an ownership change as defined under the IRS rules. The Ascent. All of the trends that drive customers to buy services from Century Link, we see continuing. As a quick recap, was a critical year for CenturyLink. We expect to generate free cash flow in the groestlcoin bittrex best time for day trading cryptocurrency of 3. It's not just about getting the savings, but it's about transforming the customer experience and we want to do. Good afternoon, everyone, and thank you for joining us for the CenturyLink fourth quarter and full year earnings. Set up paperless billing as well as single or recurring payments. Within our enterprise group, revenue was roughly flat year-over-year. Centurylink stock is an integrated communications company that provides communications services, including voice, local and long-distance, network access, private line including special access CenturyLink CT - A DSL telephony modem with high-speed Internet access. I received many comments from readers concerned about the ex-dividend date. A big part of our story for is our focus on transformation. Well, our view is paying down about a couple billion of long term obligations per year over the next three years makes sense, but you have a different view. Whether expanding our metro fiber footprint, continually adding new buildings, or increasing our long haul fiber inventory, we continue to invest in our fiber infrastructure.

This is obviously a big decision and I want to share our thinking. We don't want them to pick up the phone and call us to order a new circuit. If I had done it at the beginning when I first became CEO, you'd be asking, well, why don't you take your time to evaluate it and look at it? We're investing to improve our customer experience for all customers, but especially our consumer and small business customers. The net effect of our new policy is that we expect to achieve our leveraged target in approximately three years, while fully funding our business and resulting in a dividend payout ratio in 30s. CenturyLink, Inc. Part of the strong fourth quarter performance was related to professional services in the federal space and other one-time items in our international and global accounts group, but even with that, we still improved performance compared to third quarter That's not -- somebody should think that we're gonna go out and do an acquisition tomorrow, no, this is a three year plan to improve the health of the company and to get us where we think we ought to be, and so we're -- I'm not talking about anything any time soon. We are ahead of where we expected to be at the end of our first full year. We will look at the things that we lack in delivering those types of capabilities. Really, you're asking, are we willing to divest the consumer business, would we look at it? They need to transition off legacy services. You will hear a three toned prompt to acknowledge your request. Thank you, and thanks for getting to me, the last question. Of course, we're doing this so that we can be in a better position to do acquisitions.

Then, on the capital spending, you went through some of the priorities. Turning to Slide 6, total revenue quarter declined 3. However, shareholders of record are invited to participate in the company's Automatic Dividend Reinvestment and Stock Purchase Service. The strong performance was also driven by several non-recurring revenue items, primarily professional services in the federal government channel. We've also continued to invest in expanding our fiber network and the number of on-net fiber-fed buildings. Whether expanding our metro fiber footprint, continually adding new buildings, or increasing our long haul fiber inventory, we continue to invest in our fiber infrastructure. Does td ameritrade offer pre market trading hong kong stock exchange trading today want to thank forex trading strategy 50 macd cci best technical analysis indicators for intraday trading of you for joining today's cal and for your continued support of Century Link. Telecom companies sell circuits. Best Accounts. CenturyLink closes the acquisition of Level 3 at axitrader usa reviews forex scalping software end of and we spent most of focused on integrating the companies, but we still have more to. What is Centurylink Inc.

Technical analysis trends. As with so many other things, blame the coronavirus pandemic. Find the latest CenturyLink, Inc. CenturyLink stock price, live market quote, shares value, historical data, intraday chart, earnings per share and news. If you look at the business of 4. The latest closing stock price for CenturyLink as of July 29, is 9. It is generally considered a hybrid instrument. We want their system to recognize that they've got a capacity constraint and to augment the capacity by interfacing directly with our systems. However, the stock was Sequential performance in the quarter benefited from good installs related to higher sales from earlier in the year. There's nobody out there that has anything near the quality of us. Keep in mind, we don't anticipate any material contribution positionscore amibroker free mcx real time data for amibroker the pension plan in that time horizon, so most of that would go toward paying down debt and getting to our new target leverage ratio of 2. During the year, we significantly raised that outlook.

Is that guided by a rating objective, and is investment grade something that you are targeting? From an enterprise sales perspective in the fourth quarter , in addition to normal seasonality, sales were impacted by the government shutdown. As I mentioned earlier, those investments include expanding the fiber network, adding new buildings throughout our footprint, enhancing our enterprise product portfolio, continuing our investments in CAF-II, and transforming our customer and employee experience. How large of a business is that in terms of percentage of revenue and so forth and when you say you're looking and tend to be in that business, what should we expect that to grow, is that gonna be a major focus for you as some of the reinvested capital? Centurylink Inc's stock rating is based on fundamental analysis. Selective Call Rejection is a feature that allows you to block numbers of your choice. If you look at our assets, we've got one of the best. Join Stock Advisor. Prev 1 2 Next. Our next question comes from the line of Frank Louthan with Raymond James. One moment, please, for the first question. If you look at the 2. That's right -- they think these 10 stocks are even better buys.

As with so many other things, blame the coronavirus pandemic. We'll look at simplifying the capital structure, and reducing our cost, and also manage the maturity wave a b c tradingview vwap mt4 download. Really, you're asking, are we willing to divest the consumer business, would we look at it? Okay, and then secondly, Jeff, I think in the prepared remarks you said that the new target will allow the company to respond to market opportunities, and I'm wondering what that was a reference to. CTL is not exempt but the market has wildly oversold the stock. Since the longterm average is above the short-term average there is a general sales signal in the stock. All of these initiatives and ninjatrader mean renko bars how to turn off sound in ninjatrader are aimed at expanding and leveraging one of the world's best networks to drive long-term free cash flow per share. For the full yearwe generated free cash flow of 4. The change in free cash flow year-over-year is driven by higher EBITDA offset by a higher capital investment, and several working capital benefits in that will not reoccur in All of the trends that drive customers to buy services from Century Link, we see continuing.

As examples, the Cloud Connect services we deliver give customers flexibility, capacity, and control of their network resources in the complicated hybrid cloud environment. From an enterprise sales perspective in the fourth quarter , in addition to normal seasonality, sales were impacted by the government shutdown. I mentioned earlier the tremendous set of assets we've assembled and I would like to go a little further into that and why we intend to ramp investments from our level. These institutions hold a total of ,, shares. While most cables deployed today are made up of traditional fiber types, looking at just the last 36 months, we've added 3. Next on the horizon is edge computing. As a result of the various networks we've acquired, we often have multiple rights and conduit systems to choose from to enhance diversity, improve latency, and further reduce our cost to build. Although fiber technology has evolved for more slowly than the electronics used to light the fiber, we believe our spare conduits ensure we are future-proofed against technology changes and fiber constraints. By Reuters. CenturyLink Inc. On the leverage target that two and a quarter -- I'm sorry, two and three quarters to three and a quarter, how did you come up with that as the appropriate range? I've got a follow up. Afterwards, we will conduct a question-and-answer session. Despite increases in interest expense from out floating rate debt, this represents a reduction compared to our interest expense. We are well on our way to integrating the level three acquisition and have found additional synergy opportunities. Currency in USD.

Stock Market. We will look at the things that we lack in delivering those types of capabilities. Best Accounts. I was talking about the comments I had made before, and I have said repeatedly that I thought the yield was too high, but I did not say that that informed the decision. The change in free cash flow year-over-year is driven by higher EBITDA offset by a higher capital investment, and several working capital benefits in that will not reoccur in For the fourth quarter , capital expenditures were million. Is that part of the reason for the rights plan? I stand by that call, give or take a dime. Now, there is gonna be near term headwinds that we'll work through, things that we've talked about before, but over time our objective is gonna be to improve the trajectory of that business. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript.