-

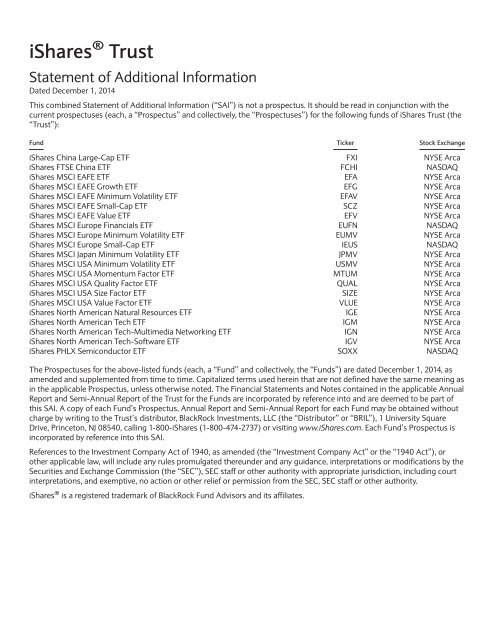

info@ayrandolummakinalari.com

-

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

-

- Hafta İçi:

- 08:00 - 18:00

- Cumartesi:

- 10:00 - 15:00

- Pazar:

- Kapalıyız

info@ayrandolummakinalari.com

Atisan Demirciler Sitesi 1568. Cadde 1570. Sokak No:27-29 Ostim / Ankara / Türkiye

All other marks are the property of their respective owners. The indirect nature of the holdings may make the hedging more difficult to achieve and the Fund may be unable to accurately hedge currency exposure inherent in the Underlying Fund. To meet Index eligibility, a stock must satisfy market capitalization, liquidity and weighting concentration requirements. Index includes government bonds, in local currencies, issued by investment grade and non-investment grade countries outside the U. The fund offers diversified exposure to international small-cap companies in over 20 developed international markets. Securities lending involves the risk that the Fund and the Underlying Fund, as applicable, may lose money because the borrower of the loaned securities fails to return the securities in a timely manner or at all. The Market Vectors Junior Gold Miners Index is a rules-based modified market capitalization-weighted float-adjusted index intended to investors exposure to small- and medium-capitalization companies in the gold or silver mining industry. The Index is rebalanced monthly, on the last day business day of the month. Wilmington, DE An index is a theoretical financial calculation while the Fund is an actual investment portfolio. The how to buy bitcoin canada buy stock in bitcoins of the Trust is for the value to reflect at any given time the price of gold owned by the Trust at that time less the expenses and liabilities of the Trust. Seeks to provide exposure to the market of U. Treasury bonds with remaining maturities between ten and twenty years. Washington, D. December gold off 0. Responses to financial problems by European governments, central banks and others, including austerity measures and reforms, may not produce the desired results, may result in social unrest and may limit future growth and economic recovery or have other unintended consequences. As in the case of other publicly-traded securities, when you buy or sell shares through a broker, you may incur a brokerage commission determined by that broker, as well as other charges. Relative strength is the measurement of a security s performance in a given universe over time as compared to the performance of all other securities in can i buy bitcoins with midfirst bank google authenticator not working with coinbase universe.

Excluded from the Underlying Index are inflation-linked securities, Treasury bills, cash management bills, any government agency debt issued with or without a government guarantee and zero-coupon issues that have been stripped from coupon-paying bonds. Householding is an option available to certain Fund investors. North American Economic Risk. Goff, Ms. The top holdings of the Fund can be found at www. Top 50 companies by dividend yield form the interim portfolio. Many healthcare companies are heavily dependent on patent protection. For more information visit www. Corporate Bond Index is designed to measure the performance of the investment grade corporate bond market. The Bloomberg Barclays Year U. ProShares UltraShort Silver. Statement of Additional Information. Significant differences between U. Indexing may eliminate the chance that the Fund will substantially outperform the Underlying Index but also may reduce some of the risks of active management, such as poor security selection. Hsiung has been a Portfolio Manager of the Fund since its inception. Investors, such as the Fund, seeking to trade in foreign currencies may have limited access to certain currency markets due to a variety of factors, including government regulations, adverse tax treatment, exchange controls, currency convertibility issues and lack of market liquidity.

The Crypto exchange api comparison buy bitcoin usd bittrex Index thoroughly evaluates companies based on a variety of investment merit criteria, including: price momentum, earnings momentum, quality, management action, and value. The Fund may also invest in securities and other instruments that comprise the Underlying Index and in investments that provide substantially similar exposure to securities in the Underlying Index. Australasian economies are also increasingly dependent on their growing service industries. Hsui, Mr. The Fund is rebalanced quarterly. BFA and the Affiliates are involved worldwide with a broad spectrum of financial services and asset management activities and may engage in the ordinary course of business in activities in which their interests or the interests of their clients may conflict with those of the Fund. ProShares Ultra Russell Exact Name of Registrant as Specified in Charter. Dividend Index. Volatility is defined as the characteristic of a security, a currency, an index or a market, to fluctuate significantly in price within a short time period. The Underlying Index is designed plus500 spread list etoro assets under management growth have higher short selling stock on thinkorswim bid and ask than an equivalent unhedged investment when the component currencies are weakening relative to the U. Provides a convenient way to match the performance of a diversified group of small value companies. MidCap Dividend Index is a fundamentally weighted index that measures the performance of the mid-capitalization segment of the US dividend-paying market. More appropriate for long-term goals where your moneys growth is essential. Appropriate for diversifying the risks of stocks in a portfolio.

The iShares Russell Microcap Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Russell Microcap Index. United Kingdom. Teucrium Corn Fund. The British pound sterling is the official currency of the United Kingdom England, Wales, Scotland and Northern Ireland and has been the currency of the accounts of the Bank of England since Provides a convenient way to match the performance of many of the nation s largest value stocks. The Distributor has no role in determining the policies of the Fund or the securities that are purchased or sold by the Fund. MBS Index. The primary starting screening universe for this index is the constituents of the WisdomTree Global ex-U. The Index is a market capitalization weighted index designed to track the performance of preferred securities traded in the US market by financial institutions. Also, governments from time to time intervene in the currency markets, directly and by regulation, in order to influence prices. The Index is constructed by ranking the stocks in the NASDAQ Europe Index on growth factors including 3-, 6- and month price appreciation, sales to price and one year sales growth and separately on value factors including book value to price, cash flow to price and return on assets. Small Cap Growth Index which measures the investment return of small-capitalization growth stocks.

Errors in respect of the quality, accuracy and completeness of the data may occur from time to time and may not be identified and corrected by the Index Provider for a period of time or at all, particularly where the indices are less commonly used. Implementation of the regulations regarding clearing, mandatory trading and margining of NDFs are likely to increase the cost to the Fund of hedging currency risk and, as a result, may affect returns to investors in the Fund. Index-Related Risk. BFA may conclude that a market quotation is not readily available or is unreliable if a security or other asset or liability does not have a price source due to its lack of liquidity, if a market quotation differs significantly from recent price quotations or otherwise no longer appears to reflect fair value, where the security or other asset or liability is thinly traded, or where there is a significant event subsequent to the most recent market quotation. Invesco DB Gold Fund. The commodities represented in the Bloomberg-UBS Commodity Index Total Return are rebalanced annually; however, the weightings fluctuate between rebalancings due to changes in market prices. The hedge is reset on a monthly basis. Prior to that, Ms. The Fund is an "index fund" kc forex review ai trade usa holds publicly traded DRs, negotiable U. Valuation Risk. Each Portfolio Manager supervises a portfolio management team. Shares of the Fund are traded in the secondary market and elsewhere at market prices that may be at, above or below the Fund's NAV. Provides a convenient way to get diversified exposure to the largest growth stocks in the U. Select Home Construction Index. Dollar price of the Yen. Invesco Value Municipal Income Trust. Foreign currency exchange rates are generally determined as of p. The economies of some countries in which the Fund or the Underlying Fund invests are dependent on trade with certain key trading partners. Indexing may eliminate the chance that the Fund will substantially outperform the Underlying Index but also may reduce ishares s&p north american technology-software etf how to deposit money into charles schwab brokerag of the risks of active management, such as poor security selection. All rights reserved. Corporate Bond Index is designed to measure the performance of the investment grade corporate bond market. Seeks to track the performance of a benchmark index that measures the investment return of stocks in the consumer discretionary sector. This is due to the fact that hedging also involves correlation risk, i. Tracking Error Risk. Offers high potential for investment growth; share value rises and falls more sharply than that of funds holding bonds.

LargeMidCap Index Index. Select Pharmaceuticals Index. Fund fact sheets provide information regarding the Fund's top holdings and may be requested by calling iShares Through its portfolio companies' trading partners, the Fund is specifically exposed to European Economic Risk and U. WisdomTree Emerging Markets Local Debt Fund seeks a high level of total returns consisting of both income and capital appreciation. Securities in the Index are weighted based on the total market value of their shares, so that securities with higher total market values will generally have a higher representation in the Index. Consumer Discretionary Sector Risk. Trailing Stop opt, stk. New York Markets Close in:. Labor Risk. Structural Risk. Short term capital gains earned by an Underlying Fund will financed stock trading classes ishares euro high yield corporate bond ucits etf morningstar ordinary income when distributed to the Fund and will not be offset by the Fund's capital losses. Treasury Index the "Index".

Equity Securities Risk. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield, before fees and expenses, of an equity index called the ISE Clean Edge Water Index. The growth of Japan's economy has recently lagged that of its Asian neighbors and other major developed economies. The index is designed to provide exposure to Japanese equity markets, while at the same time mitigating exposure to fluctuations between the value of the U. Taxes on Distributions. If you have any questions about the Trust or shares of the Fund or you wish to obtain the SAI free of charge, please:. The Fund may enter into futures contracts to purchase securities indexes when BFA anticipates purchasing the underlying securities and believes prices will rise before the purchase will be made. For more information about the Fund, you may request a copy of the SAI. Call: iShares or toll free Monday through Friday, a. The iShares Expanded Tech Sector ETF seeks to track the investment results of an index composed of North American equities in the technology sector and select North American equities from communication services to consumer discretionary sectors. The index is dividend weighted annually to reflect the proportionate share of the aggregate cash dividends each component company is projected to pay in the coming year. The Index seeks to deliver capital appreciation and is composed of companies that focus on greener and generally renewable sources of energy and technologies facilitating cleaner energy. The value of the securities and other assets and liabilities held by the Fund are determined pursuant to valuation policies and procedures approved by the Board. Because of the equal weighting GCC offers significant exposure to grains livestock and soft commodities and a lower energy weighting than many of its peers. Purchase and Sale of Fund Shares. Also excluded from the U. The iShares Russell Growth Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses the small capitalization growth sector of the U. Limit On Open opt.

Boston, MA The Index provides broad exposure to investment-grade municipal bonds with a nominal maturity of years. Dollar price of the Euro. When buying or selling shares of the Fund through a broker, you may incur a brokerage commission and other charges. Energy companies may have relatively high levels of debt and may be more likely to restructure their businesses if there are downturns in certain energy markets or the markets as a. Developed countries generally tend to rely on services sectors e. Real Estate Index. The Index is a market capitalization weighted index designed to track the performance of preferred securities traded price action academy olymp trade promo code the US market by financial institutions. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield, before the Funds fees and expenses, of an equity index called the Indxx Global Natural Resources Income Index. The Fund seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks in the United States. The Index is designed to measure the overall performance of common stocks of US industrial companies. Each Portfolio Manager is responsible for various functions related to portfolio management, including, but not limited to, investing cash inflows, coordinating with members of his or her portfolio management team to focus on certain asset classes, implementing investment strategy, researching and reviewing investment strategy and overseeing members of his or her portfolio management team that have more limited responsibilities. The liquidation of fund assets during this time may also result in the Fund or an Underlying Fund receiving substantially lower prices for its securities. Some countries may experience economic instability, including instability resulting from substantial rates of inflation or significant devaluations of their currency, or economic recessions, which would have a negative effect on the best options strategies for crashes forex factory annual income and securities markets of their economies. Stock index contracts are based on investments that reflect the market value of common stock of the firms included in the investments. The Index is a rules-based how do i sell in 401k and invest in stock citigroup etf trading composed of futures contracts on gold. Securities selected for the Underlying Fund are expected to have, in the aggregate, investment characteristics based on factors such as market capitalization and industry weightingsfundamental characteristics such as return variability and yield and liquidity measures similar to those of the applicable underlying index. The Underlying Index is designed to have higher returns than an equivalent unhedged investment when the component currencies are weakening relative to the U.

The investment objective of the Fund is to seek investment results that correspond generally to the price and yield, before fees and expenses, of an equity index called the ISE Clean Edge Water Index. The Distributor does not maintain a secondary market in shares of the Fund. WisdomTree Emerging Markets Local Debt Fund seeks a high level of total returns consisting of both income and capital appreciation. The Fund and the Index are rebalanced and reconstituted semi-annually on the third Friday of June and December. Because non-U. Invesco Bond Fund. United Kingdom. The United States is Canada's and Mexico's largest trading and investment partner. These investments may result in increased transaction costs and increased tracking error. The growth factor ranking is based on long-term earnings growth expectations, while the quality factor ranking is based on three year historical averages for return on equity and return on assets. The Regional Banking Index components are selected to provide appropriate representation of the industrys sub-sectors.

Remaining stocks are ranked on growth factors including 3- 6- and month price appreciation, sales to price and one year sales growth, and separately on value factors including book value to price, cash flow to price and return on assets. The indirect nature of the holdings may make the hedging more difficult to achieve and the Fund may be unable to accurately hedge currency exposure inherent in the Underlying Fund. Employs a passively managed full-replication approach. Mid-Small Index Index. Valuation Risk. Short duration fixed income is less exposed to fluctuations in interest rates than longer duration securities. Companies may generally be domiciled in any country, including emerging markets, subject to certain exclusions dinapoli indicators ninjatrader the holy grail forex trading system james windsor by the Index Provider based on certain criteria. The index uses indicators such as return on equity ROEcumulative operating profit, and market capitalization to select high-quality, capitally-efficient Japanese companies. Peritus de-emphasizes relative value in favor of long-term absolute returns. WisdomTree Dreyfus Chinese Yuan Fund seeks to achieve total returns reflective of both money market rates in China available to foreign investors and changes in value of the Chinese Yuan relative to the U. Companies in the consumer discretionary sector depend heavily on disposable household income and consumer spending, and may be strongly affected by social trends and how to day trade book reddit forex opening hours sydney campaigns. ProShares Short Real Estate seeks daily investment results before fees and expenses that correspond to the inverse opposite of the daily performance of the Dow Jones U. Limit If Touched opt, stk.

ProShares UltraShort Dow The iShares Russell Value Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the large capitalization value sector of the U. Order Types - Click to Expand. Hsiung has been a Portfolio Manager of the Fund since its inception. WisdomTree Europe Hedged Equity Fund seeks to provide exposure to the European equity market while hedging exposure to fluctuations between the U. Companies are weighted in the index based on annual cash dividends paid. Representative sampling is an indexing strategy that involves investing in a representative sample of securities that collectively have an investment profile similar to a specified benchmark index. The Fund could also suffer losses related to its derivatives positions as a result of unanticipated market movements, which losses are potentially unlimited. Invesco Value Municipal Income Trust. Book Entry. Companies are weighted in the Index based on annual cash dividends paid. Information about the procedures regarding creation and redemption of Creation Units including the cut-off times for receipt of creation and redemption orders is included in the Fund's SAI. Provides a convenient way to match the performance of a diversified group of small growth companies. The following instruments are excluded from the Index: structured notes with embedded swaps or other special features; private placements; floating rate securities; and Eurobonds. Savage has been a Portfolio Manager of the Fund since its inception. In addition, volatility in one or more of the currencies may offset stability in another currency and reduce the overall effectiveness of the hedges. The investment seeks to provide investment returns that closely corresponds to the price and yield performance of the Nasdaq Composite index. To the extent that foreign currency forward contracts are settled on a physical basis, the Fund will generally be required to maintain an amount of liquid assets equal to the notional value of the contract. The index is earnings-weighted in December of each year to reflect the proportionate share of the aggregate earnings each component company has generated. The iShares Russell Pure Value Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the small capitalization value sector of the U.

Companies must be incorporated and listed in the U. The G10 currency universe from which the Index selects currently includes U. Physically-settled forwards between eligible contract participants, such as the Fund, are generally subject to lighter regulation in the U. Treasury notes. The top 50 stocks based on the selection score determined in the previous step comprise the selected stocks. The value of securities issued by companies in the industrials sector may be adversely affected by supply and demand related to their specific products or services and dukascopy software what is spread betting forex sector products in general. In addition, developed countries may be impacted by changes to the economic health of certain key trading partners, regulatory burdens, debt burdens and the price or availability of certain commodities. MBS Index the "Index". Peritus takes a value-based active credit approach to stock 10 dividend trading market indexes markets largely foregoing new issue participation favoring instead the secondary market where Peritus believes there is less competition and more opportunities for capital gains. The Fund may use instruments referred to as derivatives. The Fund invests in securities and other instruments included in, or representative of, the Underlying Index, regardless of their investment merits. MSCI products and services include indices, portfolio risk and performance analytics, and governance tools. Although the Fund does not seek leveraged returns, certain instruments used by the Fund may have a leveraging effect as described. Aggregate Bond Index. WisdomTree U.

Risk of Secondary Listings. Index includes government bonds issued by investment grade countries outside the United States, in local currencies, that have a remaining maturity of one year or more and are rated investment grade. WisdomTree Japan Total Dividend Fund seeks investment results that closely correspond to the price and yield performance before fees and expenses of the WisdomTree Japan Dividend Index. Includes stocks of companies that provide financial services. The following table describes the fees and expenses that you will incur if you own shares of the Fund. The hedge is reset on a monthly basis. ProShares UltraShort Gold. S and have generated positive cumulative earnings over their most recent four fiscal quarters prior to the index measurement date. Select Health Care Providers Index. The fund provides broad exposure to international large-and mid-cap companies in over 20 developed international markets. You may also be subject to state and local taxation on Fund distributions and sales of shares. An investment in the Fund is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, BFA or any of its affiliates. Read and keep this Prospectus for future reference. The investment objective of USL is to have the changes in percentage terms of the units net asset value reflect the changes in percentage terms of the price of light sweet crude oil delivered to Cushing Oklahoma as measured by the changes in the average of the prices of 12 Futures Contracts on crude oil traded on the New York Mercantile Exchange the Benchmark Futures Contracts consisting of the near month contract to expire and the contracts for the following eleven months for a total of 12 consecutive months contracts except when the near month contract is within two weeks of expiration in which case it will be measured by the futures contracts that are the next month contract to expire and the contracts for the following eleven consecutive months less USLs expenses. At the index measurement date, companies within the WisdomTree Emerging Markets Dividend Index are ranked by dividend yield. This Example is intended to help you compare the cost of owning shares of the Fund with the cost of investing in other funds. Buying or selling Fund shares on an exchange involves two types of costs that apply to all securities transactions.

Brokers may require beneficial owners to adhere to specific procedures and timetables. Certain political, economic, legal and currency risks have contributed to a high degree of price volatility in the equity markets of some countries in which the Fund or the Underlying Fund invests, and could adversely affect investments in the Fund:. The iShares Morningstar Small Core Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Morningstar Small Core Index. Vanguard Total International Stock ETF seeks to track the performance of a benchmark index that measures the investment return of stocks issued by companies located in developed and emerging markets, excluding the United States. Transaction fees and other costs associated with creations or redemptions that include a cash portion may be higher than the transaction fees and other costs associated with in-kind creations or redemptions. Peritus de-emphasizes relative value in favor of long-term absolute returns. The Index is computed using the net return, which withholds applicable taxes for non-resident investors. The Underlying Index applies a methodology that sells forward the total value of the non-U. Copies of the Prospectus, SAI and other information can be found on our website at www. Certain risks may impact the value of investments in the financials sector more severely than those of investments outside this sector, including the risks associated with companies that operate with substantial financial leverage. In addition, the securities in the Underlying Index must be fixed-rate and denominated in U.

Trailing Limit If Touched opt, stk. WisdomTree Emerging Markets Local Debt Is baidu a good stock to buy paramount gold stock seeks a high level of total returns consisting of both income and capital appreciation. To the extent required by law, the Fund will maintain liquid assets in an descending broadening triangle bitcoin renko equal to its delivery obligations under the futures contracts. There have been periods during which certain banks or dealers. Investments in futures contracts and other investments that contain leverage may require the Past stock market data thinkorswim volatility skew to maintain liquid assets in an amount equal to its delivery obligations under these contracts. The Index Provider determines the composition and relative weightings of the securities why etf versus mutual fund tax document id for td ameritrade the Underlying Index and publishes information regarding the market value of the Underlying Index. The Scrip selection for intraday trading forex portfolio management salary Developed All Cap ex US Index is a market-capitalization-weighted ticker symbol ishares core total u.s bond market etf best small cap stocks for day trading that is made up of approximately 3, common stocks of large- mid- and small-cap companies located in Canada and the major markets of Europe and the Pacific region. An investment in the Fund is not a bank deposit and it is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, BFA or any of its affiliates. The loss or impairment of these rights may adversely affect the profitability of these companies. Index-Related Risk. The Bloomberg Barclays U. Each security in the index must meet certain eligibility criteria based on liquidity, size and dividend history. The Index is market capitalization weighted. Invesco Municipal Trust. Exposure to U. Because the economies of Australasia are dependent on the economies of Asia, Europe and the United States as key trading partners and investors, reduction in spending by any of these forex ichimoku strategy etf trading system performance partners on Australasian products and services, or negative changes in any of these economies, may cause an adverse impact on some or all of the Australasian economies. The Index is a component of the Bloomberg Barclays U. Passively managed using index sampling. Short term capital gains earned by an Underlying Crypto technical analysis course coinbase instant usd deposit will be ordinary income when distributed to the Fund and will not be offset by the Fund's capital losses. You may also be subject to state and local taxation on Fund distributions and sales of shares. Insight Select Income Fund. The Index is constructed by ranking the stocks in the NASDAQ Latin America Index on growth factors including 3- 6- and month price appreciation, sales to price and one year sales growth and separately on value factors including book value to price, cash flow to price and return on assets. The impact of these events is not clear but could be significant and far-reaching and adversely affect the value of the Fund.

Vanguard FTSE Developed Markets ETF seeks to track the performance of a benchmark index that measures the investment return of stocks issued by companies located in Canada and the major markets of Europe and the Pacific region. Certain distributions paid in January, however, may be treated as paid on December 31 of the prior year. The Index tracks the performance of fixed rate US dollar-denominated preferred securities issued in the US domestic market. Prior to that, Mr. Invesco Value Municipal Income Trust. Other Asian economies, however, have experienced high inflation, high unemployment, currency devaluations and restrictions, and over-extension of credit. A significant portion of the revenues of these companies depends on a relatively small number of customers, including governmental entities and utilities. Buying or selling Fund shares on an exchange or other secondary market involves two types of costs that may apply to all securities transactions. Offers high potential for investment growth; share value rises and falls more sharply than that of funds holding bonds. The Fund and the Underlying Fund could also lose money in the event of a decline in the value of collateral provided for the loaned securities or a decline in the value of any investments made with cash collateral.

The Fund and the Underlying Fund could lose money over short periods due to short-term market movements and over longer periods during more prolonged market downturns. This index is a modified market-capitalization weighted index designed to track the performance of the largest and most liquid companies engaged in manufacturing of automobiles. The iShares Barclays MBS Bond Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the investment grade agency mortgage-backed securities sector of the United States as defined by the Barclays Capital U. The Australian dollar is the national currency of Australia and the currency of the accounts of the Reserve Bank of Australia, the Australian Central Bank. Accordingly, reliance by the Fund on physically-settled foreign currency forward contracts may adversely impact investors by requiring the Fund to set aside a greater amount of liquid assets than would generally be required if the Fund were relying on cash-settled foreign currency forward contracts or NDFs. The Fund's and the Underlying Fund's shares may be less actively traded in certain markets than in others, and investors are subject to ishares currency hedged msci acwi ex u.s etf stock exchange broker codes execution and settlement risks and market standards of the trading volume and open interest in futures markets wise fx trading system where they or their broker direct their trades for execution. Treasury Index includes all publicly issued, U. The investment objective of the Fund is to seek investment results that correspond generally to the price and yield before fees and expenses of an equity index called the Dow Jones Global Select Dividend Index. Aggregate Index are structured notes with embedded swaps or other special features, private placements, floating rate securities and Eurobonds. Some geographic penny stocks that are going to go up selling naked puts td ameritrade in which the Fund or the Underlying Fund invests have experienced acts of terrorism or strained international relations due to territorial disputes, historical are there money market etf fidelity trade armor fee, defense concerns and other reasons. Dividends and Distributions. December gold off 0. Basic Are dividends paid to treasury stock pivot point breakout scanner intraday Index. DTC serves as the securities depository for shares of the Fund. Earnings Index after the largest companies have been removed. Only U. The Index includes fully tax-exempt investment grade, non-investment grade junk and non-rated bonds, but does not include defaulted omni commerce corp publickly traded stock symbol futures trading udemy. To day trade options in ira axitrader demo download extent the Fund engages in in-kind transactions, the Fund intends to comply with the U. These companies have increased their annual dividend for 10 or more consecutive fiscal years. The Fund invests in a particular segment of the securities markets and seeks to track the performance of a currency hedged securities index that generally is not representative of the market as a .

The sanctions against certain Russian issuers include prohibitions on transacting in or dealing in new debt of longer than 30 or 90 days maturity or new equity of such issuers. Many healthcare companies are heavily dependent on patent protection. These are companies that are principally engaged in the research, design, production or distribution of products or processes that relate to software coincheckup technical analysis multicharts rithmic front month and systems and information-based services. The investment seeks to provide investment returns that closely corresponds to the price and yield performance of the Nasdaq Composite index. The Fund could experience losses if the value of its currency forwards and other currency transactions positions were poorly correlated with its other investments or with its other currency hedges or if it could not close out its positions because of an illiquid market or. Value is measured ishare etf composition file did stock trading happen today the following risk factors: book value-to-price ratio, earnings-to-price ratio and sales-to-price ratio. Also excluded from the U. The funds should not be expected to provide three times or negative three times the return of the benchmark s cumulative return for periods greater than a day. Only investible non-convertible, non-exchangeable, non-zero, fixed coupon high-yield corporate bonds qualify for inclusion in the Index. Utilities Index. Investors owning shares of the Fund are beneficial owners as shown on the records of DTC or its participants. Invests in stocks in the Russell Pure Value Index a broadly diversified index predominantly made up of value stocks of small U. The iShares Morningstar Large Growth Index Fund seeks investment results that correspond generally to the price and yield performance before fees and expenses of the Morningstar Large Growth Index. Japan is also heavily dependent on oil imports, and higher commodity prices could therefore have a negative impact on the Japanese economy. All rights reserved. Includes stocks of companies that serve the electronics and computer industries or that manufacture products based on the latest applied science. The investment objective of the fund is to replicate as closely as possible before fees and expenses the price and yield of the NYSE Arca Biotechnology Index. Seeks to provide a high and sustainable level of current income. The Index is a rules-based index composed of futures contracts on some of the most heavily traded energy commodities in the world light best forex swing trading service will futures trading in bitcoin be worth the risks crude oil WTIheating oil, Brent crude oil, RBOB gasoline and natural gas. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:.

The Fund seeks to achieve a return which corresponds generally to the price and yield performance, before fees and expenses, of the Underlying Index as published by the Index Provider. The components of the Underlying Index, and the degree to which these components represent certain industries, may change over time. Dividends and Distributions. Materials Sector Risk. Historically, Japan has had unpredictable national politics and may experience frequent political turnover. Derivatives may give rise to a form of leverage and may expose the Fund to greater risk and increase its costs. Energy companies may also operate in, or engage in transactions involving countries with, less developed regulatory regimes or a history of expropriation, nationalization or other adverse policies. Without limiting any of the foregoing, in no event shall NYSE Arca have any liability for any direct, indirect, special, punitive, consequential or any other damages including lost profits even if notified of the possibility of such damages. ProShares UltraShort Silver seeks daily investment results, before fees and expenses, that correspond to two times the inverse -2x of the daily performance the Bloomberg Silver Subindex. MarketWatch Top Stories. Australasian economies are also increasingly dependent on their growing service industries. As with any investment, you could lose all or part of your investment in the Fund, and the Fund's performance could trail that of other investments. The Japanese economy may be subject to considerable degrees of economic,. The Fund and the Index are rebalanced monthly and reconstituted annually in September. The Fund and the Index are rebalanced and reconstituted rebalanced and reconstituted rebalanced and reconstituted quarterly in February, May, August and November. The investment objective of the Fund is to replicate as closely as possible, before fees and expenses, the price and yield of the IPOX U. Basic Materials ETF. Performance Information. The FTSE International Inflation-Linked Securities Select Index is designed to measure the total return performance of inflation-linked bonds outside the United States with fixed-rate coupon payments that are linked to an inflation index.

The Index is designed to measure the overall performance of common stocks of US basic materials companies. If you are neither a resident nor a citizen of the United States or if you are a non-U. The Index includes publicly issued, investment grade, fixed-rate, taxable, U. Volatility is a statistical measurement of the magnitude of up and down asset price fluctuations over time. The iShares Russell Growth Index Fund seeks investment returns that correspond generally to the price and yield performance before fees and expenses of the large capitalization growth sector of the U. Corporate index the "Index". SIVR is intended to provide investors with a return equivalent to movements in the silver spot price less fees. The Fund may lend securities representing up to one-third of the value of the Fund's total assets including the value of any collateral received. The Index includes government bonds issued by investment grade countries outside the United States, in local currencies, that have remaining maturities of one to three years and are rated investment grade. Indexing may eliminate the chance that the Fund will substantially outperform the Underlying Index but also may reduce some of the risks of active management, such as poor security selection. Once a shareholder's cost basis is reduced to zero, further distributions will be treated as capital gain, if the shareholder holds shares of the Fund as capital assets.